アジア太平洋地域のゴム解こう剤市場、製品別(ジベンズアミドジフェニルジスルフィド(DBD)、ペンタクロロチオフェノール、亜鉛ペンタクロロチオフェネート、アリールメルカプタン、メルカプトベンゾチアゾール、その他)、用途別(天然ゴム、合成ゴム)、最終用途別(タイヤ、非タイヤ) - 2030年までの業界動向と予測。

アジア太平洋地域のゴム解こう剤市場の分析と洞察

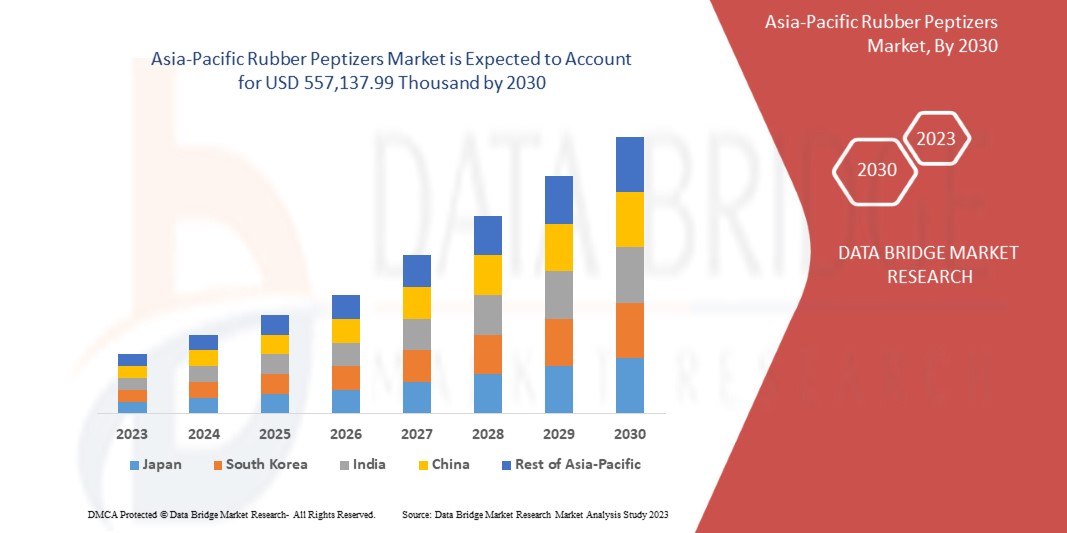

アジア太平洋地域のゴム解膠剤市場は、2023年から2030年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に5.1%のCAGRで成長し、2030年までに557,137.99千米ドルに達すると分析しています。ゴム解膠剤市場の成長を牽引する主な要因は、ゴム添加剤の粘度が高いため需要が増加し、さまざまな業界での採用が増えていることです。

アジア太平洋地域のゴムペプタイザー市場レポートでは、市場シェアの詳細、新しい開発、国内および現地の市場プレーヤーの影響について説明し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品の発売、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、収益に影響を与えるソリューションを作成し、希望する目標を達成できるようお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

製品別(ジベンズアミドジフェニルジスルフィド(DBD)、ペンタクロロチオフェノール、亜鉛ペンタクロロチオフェネート、アリールメルカプタン、メルカプトベンゾチアゾール、その他)、用途別(天然ゴム、合成ゴム)、最終用途別(タイヤ、非タイヤ) |

|

対象国 |

中国、日本、韓国、インド、シンガポール、タイ、インドネシア、マレーシア、フィリピン、オーストラリア、ニュージーランド、その他アジア太平洋地域 |

|

対象となる市場プレーヤー |

Struktol Company of America, LLC、LANXESS、Thomas Swan & Co. Ltd.、Shandong Stair Chemical & Technology Co., Ltd.、DONGEUN CO., LTD、Zhengzhou Double Vigour Chemical Product Co., ltd.、Taizhou Huangyan Donghai Chemical Co., Ltd.、Acmechem、HENAN CONNECT RUBBER CHEMICAL LIMITED、Kettlitz-Chemie GmbH & Co. KG、および King Industries, Inc. |

市場の定義

ペプタイザーは酸化触媒またはラジカル受容体として機能し、基本的にエラストマーの初期混合中に形成されたフリーラジカルを除去します。これによりポリマーの再結合が防止され、結果としてポリマーの分子量が低下し、化合物の粘度が低下します。このポリマーの軟化により、配合物に含まれるさまざまな配合材料を組み込むことができます。ペプタイザーの例には、ペンタクロロチオフェノール、フェニルヒドラジン、特定のジフェニルスルフィド、キシリルメルカプタンがあります。各ペプタイザーは、最大の効率を得るために化合物に最適な量で配合されます。ペプタイザーは、天然ゴムの素練りに使用され、その処理が最適化されます。ペプタイザーは、分子鎖を分解することでポリマーの分子量を低下させます。天然ゴムや合成ゴムなど、タイヤ産業やその他のゴム産業のさまざまな用途でゴムペプタイザーの使用が増えると、世界中で需要が増加すると予想されます。

アジア太平洋地域のゴム解こう剤市場の動向

ドライバー

- ゴム製品の製造におけるゴム解こう剤の使用増加

自動車、化学、医療などの産業による天然ゴムの使用の増加は、アジア太平洋レベルでのペプタイザーの範囲の拡大を促進すると予想されます。天然ゴムと比較して、合成ゴムはより耐摩耗性があります。この利点により、合成ゴムはゴム製ガスケットやシールでますます使用されています。ゴムペプタイザーは、天然ゴムの加工を最適化するために、素練りに使用されます。このゴム添加剤は、不良品がほとんどまたはまったくないゴム製品の製造において品質を保証します。充填剤の良好な分散と完全な可塑性を達成するには、特殊な化学物質が必要です。処理されていない天然ゴムは非常に硬いです。この場合、加工を最適化するために、天然ゴムの素練りにペプタイザーが使用されます。ゴム添加剤であるペプタイザーの使用は、広い温度範囲で素練りを加速します。

- 優れた粘度のため、様々な業界で採用されています

ペプタイザーは酸化触媒またはラジカル受容体として機能し、エラストマーの初期混合中に形成されたフリーラジカルを本質的に除去します。これによりポリマーの再結合が防止され、結果としてポリマーの分子量が低下し、コンパウンドの粘度が低下します。ペプタイザーは天然ゴムの素練りに使用され、その加工が最適化されます。分子鎖を分解することでポリマーの分子量を低下させます。ゴムの機械的素練りとは対照的に、化学ペプタイザーは素練り時間を短縮し、エネルギー消費量を低減するため、コンパウンディングの生産性が向上します。

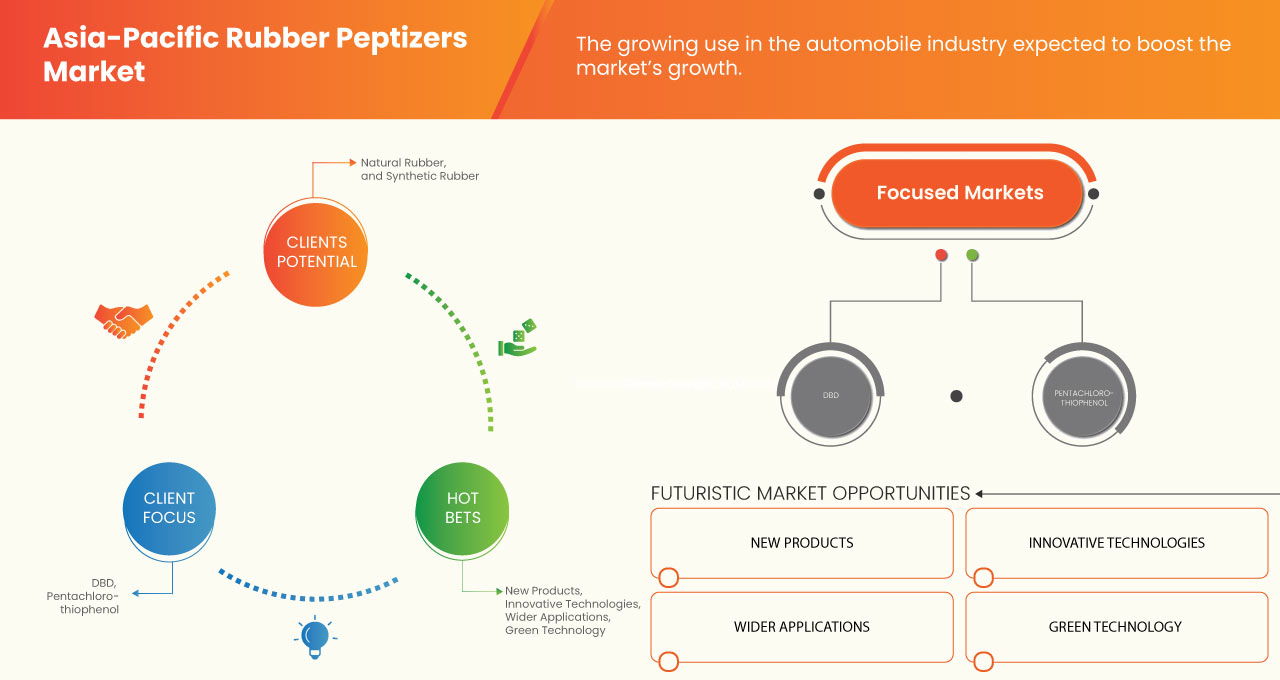

- 自動車産業における応用の増加

The rapid growth of the automotive business has created a rise in demand for rubber additives within the production of tires as different rubber products improve resistance to sunlight, ozone, heat, and mechanical stress tires. Rubber additives are used for the improvement of rubber strength and performance of rubber. The demand for rubber additives for non-tire applications boosts market growth.

Opportunities

- ADOPTION OF GREEN TECHNOLOGY IN RUBBER MANUFACTURING

The adoption of green technology in rubber manufacturing has opened many ways for rubber peptizers, also as for the processing of natural rubber peptizers is one of the main compounds. The reduction of molecular weight and properties of natural rubber, such as viscosity, tensile strength, and compression strength, also decreased. Mastication is done for natural rubber only. Mastication can be done chemically (using peptizers). Chemical mastication of natural rubber results in chain session, lower molecular weight, border molecular weight distribution, and an increased number of free chain ends. Peptizers are chemicals that use for chemical mastication. There are two types of peptizers. Those are physical and chemical peptizers. Physical peptizers are lubricants that reduce internal viscosity and do not reduce molecular weight. Chemical peptizers are oxidation catalysts or radical acceptors.

- INCREASING USE OF RUBBER PEPTIZERS IN THE CONSTRUCTION SECTOR

The construction sector is one of the important markets for rubber chemical additives. A wide variety of rubber chemical additives is used in producing multiple components and ingredients for the construction sector, such as rubber tiles, gaskets, seals, and pipes, among others. The construction sector displays outstanding growth globally with increasing investments and construction activities. Compounding is the materials science of modifying a rubber or elastomer, or a blend of polymers and other materials to optimize properties to meet a given service application or set of performance parameters. Compounding is a complex multidisciplinary science necessitating knowledge of materials physics, organic and polymer chemistry, inorganic chemistry, and chemical reaction kinetics.

Restraints/Challenges

- EMISSION OF HAZARDOUS GASSES AND POLLUTANTS

Hazards caused by the industries on our environment come primarily in the form of air, water and noise pollution. There are a number of industries producing different synthetic and non-synthetic products, among which rubber industries play the role of giant backbone. The rubber manufacturing industry not only produces rubber goods as the prime product but indeed produces a massive amount of air, noise and water pollution as their by-products. A lot of volatile organic matter and other particulates are present in the air in the unit place and the facility. Also, different chemicals are used during manufacturing processes that are discharged as effluent into the environment. So the study was carried out to assess the air and noise quality of the workplace and Wastewater characteristics so that necessary measures can be taken to protect workers from occupational exposure.

- IMPOSITION OF STRINGENT GOVERNMENT REGULATIONS

Rubber chemical additives are associated with adverse impacts on human health, which has been a challenge in the market. This might hamper the market's growth during the forecast period. Various governing bodies such as Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) and the Environmental Protection Agency (EPA) strictly monitor the use of chemical additives in the preparation of rubber. The strict regulations on the use of rubber chemicals are likely to hamper the demand for rubber chemicals in the market. Since most of them are dumped into water bodies, the processing chemicals used for rubber are harmful to the atmosphere and marine life.

Asia-Pacific Rubber Peptizers Market Scope

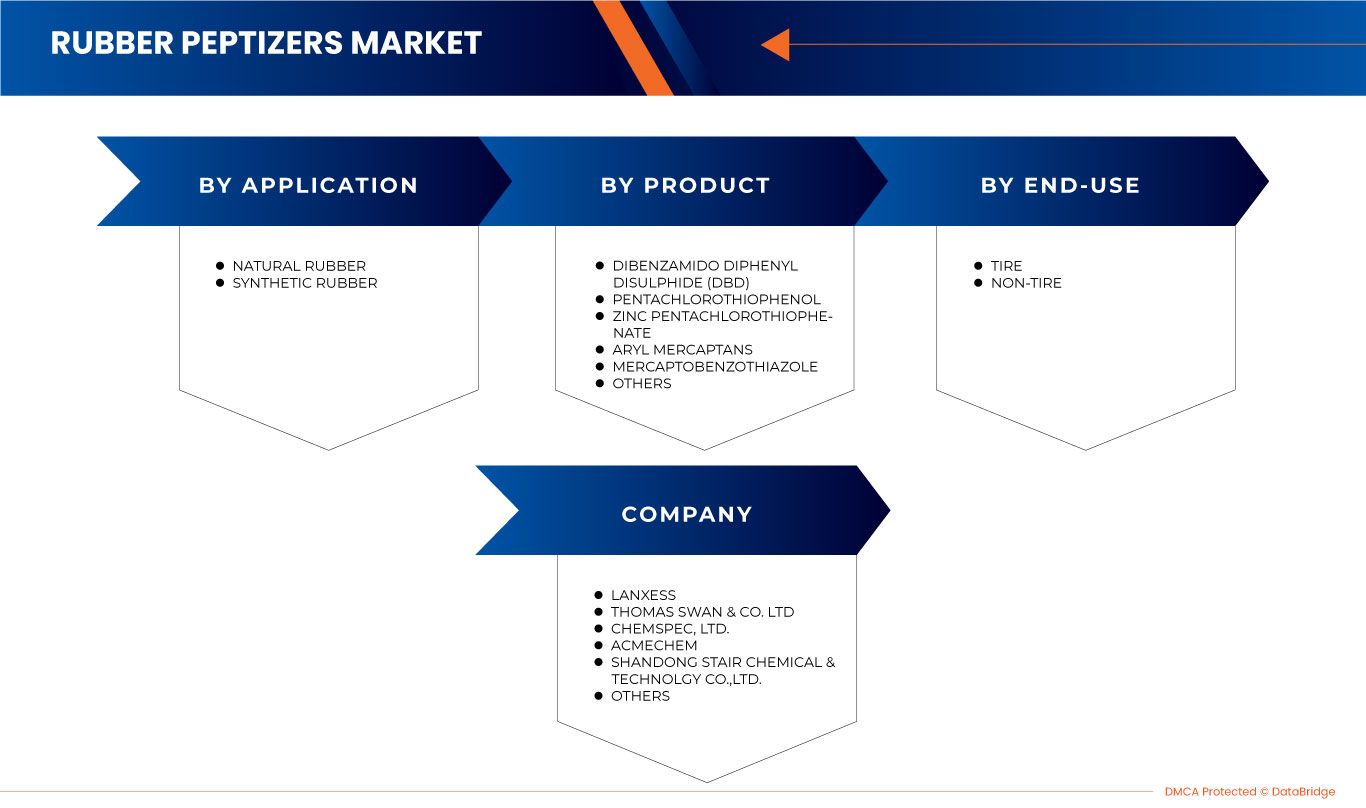

The Asia-Pacific rubber peptizers market is categorized based on product, application and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Dibenzamido Diphenyl Disulphide (DBD)

- Pentachlorothiophenol

- Zinc Pentachlorothiophenate

- Aryl Mercaptans

- Mercaptobenzothiazole

- Others

Based on product, the Asia-Pacific rubber peptizers market is classified into dibenzamido diphenyl disulphide (DBD), pentachlorothiophenol, zinc pentachlorothiophenate, aryl mercaptans, mercaptobenzothiazole, others.

Application

- Natural Rubber

- Synthetic Rubber

Based on application, the Asia-Pacific rubber peptizers market is classified into natural rubber and synthetic rubber.

End-Use

- Tire

- Non-Tire

Based on the end-use, the Asia-Pacific rubber peptizers market is classified into tire and non-tire.

Asia-Pacific Rubber Peptizers Market Regional Analysis/Insights

The Asia-Pacific rubber peptizers market is segmented on the basis of product, application and end-use.

The countries in the Asia-Pacific Machined seals market are China, Japan, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the Rest of Asia-Pacific.

中国は、自動車産業における用途の需要増加により、市場シェアと市場収益の面でアジア太平洋地域のゴム解こう剤市場を支配しています。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。データポイントの下流および上流のバリューチェーン分析、技術動向、ポーターの 5 つの力の分析、およびケーススタディは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮されます。

競争環境とアジア太平洋地域のゴム解こう剤市場シェア分析

アジア太平洋地域のゴムペプタイザー市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータポイントは、アジア太平洋地域のゴムペプタイザー市場に関連する企業の焦点にのみ関連しています。

アジア太平洋地域のゴム解こう剤市場で活動している主な企業としては、Struktol Company of America, LLC、LANXESS、Thomas Swan & Co. Ltd.、Shandong Stair Chemical & Technology Co., Ltd.、DONGEUN CO., LTD、Zhengzhou Double Vigour Chemical Product Co., ltd.、Taizhou Huangyan Donghai Chemical Co., Ltd.、Acmechem、HENAN CONNECT RUBBER CHEMICAL LIMITED、Kettlitz-Chemie GmbH & Co. KG、King Industries, Inc. などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC RUBBER PEPTIZERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING AND PACKING

4.4.3 MARKETING AND DISTRIBUTION

4.4.4 END USERS

4.5 PRICE INDEX

4.6 PRODUCTION AND CONSUMPTION ANALYSIS

4.7 PRODUCTION CAPACITY OVERVIEW

4.8 RAW MATERIAL PRODUCTION COVERAGE

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING THE USE OF RUBBER PEPTIZERS IN THE MANUFACTURING OF RUBBER PRODUCTS

5.1.2 ADOPTED BY THE VARIOUS INDUSTRIES BECAUSE OF SIGNIFICANT VISCOSITY

5.1.3 INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY

5.2 RESTRAINTS

5.2.1 EMISSION OF HAZARDOUS GASSES AND POLLUTANTS

5.2.2 IMPOSITION OF STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 ADOPTION OF GREEN TECHNOLOGY IN RUBBER MANUFACTURING

5.3.2 INCREASING USE OF RUBBER PEPTIZERS IN THE CONSTRUCTION SECTOR

5.4 CHALLENGES

5.4.1 DISRUPTIONS IN THE SUPPLY CHAIN

5.4.2 FLUCTUATING PRICE OF RAW MATERIALS.

6 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DIBENZAMIDO DIPHENYL DISULPHIDE (DBD)

6.3 PENTACHLOROTHIOPHENOL

6.4 MERCAPTOBENZOTHIAZOLE

6.5 ARYL MERCAPTANS

6.6 ZINC PENTACHLOROTHIOPHENATE

6.7 OTHERS

7 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 NATURAL RUBBER

7.3 SYNTHETIC RUBBER

7.3.1 SYNTHETIC RUBBER, BY CATEGORY

7.3.1.1 STYRENE-BUTADIENE RUBBER (SBR)

7.3.1.2 ACRYLONITRILE-BUTADIENE RUBBER (NBR)

7.3.1.3 POLYBUTADIENE RUBBER (BR)

7.3.1.4 BUTYL RUBBER (IIR)

7.3.1.5 OTHERS

8 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY END-USE

8.1 OVERVIEW

8.2 NON-TIRE

8.3 TIRE

9 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 MALAYSIA

9.1.4 INDONESIA

9.1.5 THAILAND

9.1.6 SINGAPORE

9.1.7 PHILIPPINES

9.1.8 AUSTRALIA & NEW ZEALAND

9.1.9 JAPAN

9.1.10 SOUTH KOREA

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC RUBBER PEPTIZERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.2 CERTIFICATION

10.3 ACHIEVEMENT

10.4 LAUNCH

10.5 EVENT

10.6 INVESTMENT

10.7 COMMITMENT

10.8 ACQUISITION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LANXESS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 THOMAS SWAN & CO. LTD

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 CHEMSPEC LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 ACMECHEM

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 SHANDONG STAIR CHEMICAL & TECHNOLOGY CO., LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 AKROCHEM CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 DONGEUN CO., LTD

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 HENAN CONNECT RUBBER CHEMICAL LIMITED

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 KETTLITZ-CHEMIE GMBH & CO. KG

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 KING INDUSTRIES, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 STRUKTOL COMPANY OF AMERICA, LLC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 TAIZHOU HUANGYAN DONGHAI CHEMICAL CO., LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 ZHENGZHOU DOUBLE VIGOUR CHEMICAL PRODUCT CO., LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

表のリスト

TABLE 1 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (PRICE/KG)

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 5 ASIA PACIFIC DIBENZAMIDO DIPHENYL DISULPHIDE (DBD) IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC PENTACHLOROTHIOPHENOL IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA PACIFIC MERCAPTOBENZOTHIAZOLE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC ARYL MERCAPTANS IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA PACIFIC ZINC PENTACHLOROTHIOPHENATE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC OTHERS IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC NATURAL RUBBER IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA PACIFIC SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC NON-TIRE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC TIRE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC RUBBER PEPTIZERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC RUBBER PEPTIZERS MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 20 ASIA-PACIFIC RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 22 ASIA-PACIFIC RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 25 CHINA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 26 CHINA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 27 CHINA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 CHINA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 29 CHINA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 30 INDIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 INDIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 32 INDIA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 INDIA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 34 INDIA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 35 MALAYSIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 MALAYSIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 37 MALAYSIA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 38 MALAYSIA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 39 MALAYSIA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 40 INDONESIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 41 INDONESIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 42 INDONESIA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 INDONESIA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 44 INDONESIA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 45 THAILAND RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 THAILAND RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 47 THAILAND RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 48 THAILAND SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 49 THAILAND RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 50 SINGAPORE RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 SINGAPORE RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 52 SINGAPORE RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 SINGAPORE SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 54 SINGAPORE RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 55 PHILIPPINES RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 56 PHILIPPINES RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 57 PHILIPPINES RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 58 PHILIPPINES SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 59 PHILIPPINES RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 60 AUSTRALIA & NEW ZEALAND RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 61 AUSTRALIA & NEW ZEALAND RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 62 AUSTRALIA & NEW ZEALAND RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 63 AUSTRALIA & NEW ZEALAND SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 64 AUSTRALIA & NEW ZEALAND RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 65 JAPAN RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 JAPAN RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 67 JAPAN RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 68 JAPAN SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 69 JAPAN RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 70 SOUTH KOREA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 71 SOUTH KOREA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 72 SOUTH KOREA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH KOREA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH KOREA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 75 REST OF ASIA-PACIFIC RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 REST OF ASIA-PACIFIC RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

図表一覧

FIGURE 1 ASIA PACIFIC RUBBER PEPTIZERS MARKET

FIGURE 2 ASIA PACIFIC RUBBER PEPTIZERS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC RUBBER PEPTIZERS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC RUBBER PEPTIZERS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC RUBBER PEPTIZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC RUBBER PEPTIZERS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC RUBBER PEPTIZERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC RUBBER PEPTIZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC RUBBER PEPTIZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC RUBBER PEPTIZERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC RUBBER PEPTIZERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC RUBBER PEPTIZERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC RUBBER PEPTIZERS MARKET: SEGMENTATION

FIGURE 14 INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY ARE EXPECTED TO DRIVE THE ASIA PACIFIC RUBBER PEPTIZERS MARKET IN THE FORECAST PERIOD

FIGURE 15 DIBENZAMIDO DIPHENYL DISULPHIDE (DBD) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC RUBBER PEPTIZERS MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN ANALYSIS – ASIA PACIFIC RUBBER PEPTIZERS MARKET

FIGURE 17 ASIA PACIFIC RUBBER PEPTIZERS MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (TONS)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC RUBBER PEPTIZERS MARKET

FIGURE 19 ASIA PACIFIC RUBBER PEPTIZERS MARKET: BY PRODUCT, 2022

FIGURE 20 ASIA PACIFIC RUBBER PEPTIZERS MARKET: BY APPLICATION, 2022

FIGURE 21 ASIA PACIFIC RUBBER PEPTIZERS MARKET: BY END-USE, 2022

FIGURE 22 ASIA-PACIFIC RUBBER PEPTIZERS MARKET: SNAPSHOT (2022)

FIGURE 23 ASIA-PACIFIC RUBBER PEPTIZERS MARKET: BY COUNTRY (2022)

FIGURE 24 ASIA-PACIFIC RUBBER PEPTIZERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 ASIA-PACIFIC RUBBER PEPTIZERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 ASIA-PACIFIC RUBBER PEPTIZERS MARKET: BY PRODUCT (2023-2030)

FIGURE 27 ASIA PACIFIC RUBBER PEPTIZERS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。