アジア太平洋地域の屈折矯正手術機器市場

Market Size in USD Billion

CAGR :

%

USD

316.16 Million

USD

654.98 Million

2021

2029

USD

316.16 Million

USD

654.98 Million

2021

2029

| 2022 –2029 | |

| USD 316.16 Million | |

| USD 654.98 Million | |

|

|

|

アジア太平洋地域の屈折矯正手術機器市場、製品タイプ別(レーザー、有水晶体眼内レンズ(IOL)、収差計/波面収差測定、手術器具および付属品、屈折矯正手術キット、瞳孔径計、エピケラトーム、マイクロケラトーム、熱角膜形成術、輪部弛緩切開キットなど)、手術タイプ別(LASIK(レーザー角膜切開術、光屈折角膜切除術(PRK)、有水晶体眼内レンズ(IOL)、乱視角膜切開術(AK)、自動ラメラ角膜形成術(ALK)、角膜内リング(INTACS)、レーザー熱角膜形成術(LTK)、導電性角膜形成術(CK)、放射状角膜切開術(RK)など)、用途別(近視(近視)、遠視(遠視、乱視、老眼)、エンドユーザー (病院、専門クリニック、外来手術センターなど)、流通チャネル (直接入札、サードパーティの販売代理店など) 業界の動向と 2029 年までの予測。

市場の定義と洞察

屈折矯正手術装置は、近視、遠視、老眼、乱視などの屈折異常を改善または矯正するために使用されます。これらの装置には、エキシマレーザー、YAGレーザー、マイクロケラトーム、フェムト秒レーザーなどがあります。屈折矯正手術により、眼鏡やコンタクトレンズへの依存度が大幅に軽減されます。市場では、視力障害の治療にさまざまな屈折矯正装置が使用されています。

屈折異常は、角膜または眼球の形状が不適切であるために発生します。屈折矯正手術には、高度なレーザー、レーシック治療、光屈折角膜切除術、有水晶体眼内レンズやトーリック眼内レンズなどのさまざまなレンズなど、さまざまな屈折矯正手術装置を使用して眼球または角膜の形状を変更することが含まれます。

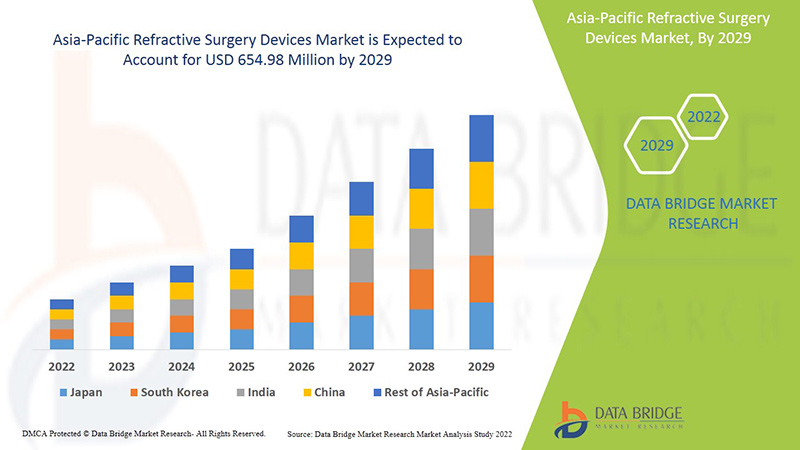

屈折矯正手術装置市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に9.8%のCAGRで成長し、2021年の3億1,616万米ドルから2029年には6億5,498万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ別 (レーザー、有水晶体眼内レンズ (IOL)、収差計/波面収差測定器、手術器具および付属品、屈折矯正手術キット、瞳孔径計、エピケラトーム、マイクロケラトーム、サーモケラトプラスティ、輪部弛緩切開キットなど)、手術タイプ別 (LASIK (レーザー角膜切削術、フォトレフラクティブ角膜切除術 (PRK)、有水晶体眼内レンズ (IOL)、乱視角膜切開術 (AK)、自動ラメラ角膜形成術 (ALK)、角膜内リング (INTACS)、レーザーサーマル角膜形成術 (LTK)、導電性角膜形成術 (CK)、放射状角膜切開術 (RK) など)、用途別 (近視 (近視)、遠視 (遠視)、乱視および老眼)、エンドユーザー(病院、専門クリニック、外来手術センターなど)、流通チャネル (直接入札、サードパーティの販売業者など) |

|

対象国 |

中国、日本、インド、韓国、オーストラリア、シンガポール、タイ、マレーシア、インドネシア、フィリピン、ベトナム、その他のアジア太平洋諸国 |

|

対象となる市場プレーヤー |

Tracey Technologies、Bausch + Lomb Incorporated、BD、STAAR SURGICAL、SCHWIND eye-tech-solutions、Hoya Surgical Optics、Johnson & Johnson Services、Inc.、Ophtec BV、Glaukos Corporation、Amplitude Laser、Reichert、Inc.、NIDEK CO.、LTD.、Ziemer Ophthalmic Systems、ROWIAK GmbH、Moria、LENSAR、Inc.、Topcon Canada Inc.(Topcon Corporation の子会社)、Aaren Scientific Inc.、Rayner Intraocular Lenses Limited.、iVIS Technologies、Alcon など |

屈折矯正手術機器市場の市場動向には以下が含まれます。

ドライバー

- 技術進歩の増加

ヘルスケア分野における技術開発の加速は、ここ数年で飛躍的に増加しています。屈折矯正手術装置の技術の進歩は、病気の治療中に痛みがなく、合併症のない治療をサポートします。さらに、さまざまな屈折矯正手術装置の革新とアップグレードは、病気の診断を正確かつ迅速に行うのに役立ちます。屈折矯正手術装置の革新は、病気の治療中に技術ベースの治療ツールの費用対効果も高めます。

例えば、

- Contoura Vision Indiaによると、Contoura Vision手術は眼鏡除去における最新の高度な眼科手術であることがわかりました。これは眼科手術における最も安全な技術的進歩の1つであり、眼鏡の度数を矯正するだけでなく、角膜の不規則性にも効果があります。

- 眼科レーザーセンター組織によると、2017年5月、Visumaxフェムト秒レーザー技術は最も先進的な屈折矯正手術の1つであることが判明しました。この技術は、目の視覚障害を治療することができます。

レーザー可変スポットスキャンの進歩など、さまざまな屈折矯正手術機器の技術的進歩の増加は、屈折矯正手術機器市場を牽引すると予想されます。したがって、屈折矯正手術機器の革新と技術的進歩の拡大は、予測期間中に市場の成長を促進すると予想されます。

- 医療費の増加

過去 10 年間、患者への医療サービス向上のため、医療費は大幅に増加しました。米国は最大の医療市場であり、過去数年間で医療費総額が大幅に増加しました。支出増加の根本的な目的は、適切で手頃な価格の高品質の屈折矯正手術機器を提供することです。先進国と発展途上国における国民の健康を促進し、医療上の緊急事態に対処するため、それぞれの政府機関と医療組織が医療費の加速化に取り組んでいます。

例えば、

- 保健省によると、米国の医療費は2020年に9.7%増加して4.1兆ドルに達し、これは2019年よりもはるかに高い伸び率である。

- 英国政府によると、2020年に政府は、最新の技術を使用してNHS(国民保健サービス)全体の診断ケアをデジタル化し、進歩させるために、約2億5000万ポンド(約3億ドル)を提供しました。この資金は、健康状態をできるだけ早く検出し、治療を開始するためのNHS診断サービスの技術的改善に特に割り当てられています。

- インド政府による国家保健ミッションの一環として、全国無料診断サービスイニシアチブが展開されました。これは、包括的で質の高い医療を一か所で無料で提供するために重要でした。インド政府によるこのイニシアチブにより、いくつかの州が公衆衛生施設での診断の利用可能性を確保するためのいくつかのモデルを試みてきました。

医療費の増加は、医療部門の成長だけでなく、経済成長にも有益です。これは、新しい診断テストや新しい手術ツールの開発に大きな影響を与えます。したがって、医療費の巨額は市場の成長にとって好ましい要因です。

機会

- レーシック手術の実績

レーシックの成功率やレーシックの結果はよく理解されており、視力と患者の満足度を調べた何千もの臨床研究が行われています。最近の研究では、患者の 99 パーセントが 20/40 以上の視力を達成し、90 パーセント以上が 20/20 以上の視力を達成していると報告されています。さらに、レーシックの患者満足度は前例のない 96 パーセントで、選択的処置の中で最も高い数値です。

例えば、

- 2016年に白内障屈折手術ジャーナルに掲載された研究によると、LASIKの患者満足度は96%であることが判明した。

記事「LASIK:メリットとリスクを知る」2018年

- アメリカ白内障屈折手術学会元会長のエリック・ドネンフェルド医師は、28年間のキャリアで約85,000件の手術を行った。

- マーケットスコープによると、1999年にFDAが初めて承認して以来、約1,000万人のアメリカ人がレーシック手術を受けている。毎年約70万件のレーシック手術が行われていますが、これは2000年のピーク時の140万件からは減少しています。

今後、世界中でレーシック手術の成功件数が増加し、製品開発、製品登録、製品発売が促進されることが予想されます。そのため、今後数年間は屈折矯正手術機器市場が拡大すると予想されます。

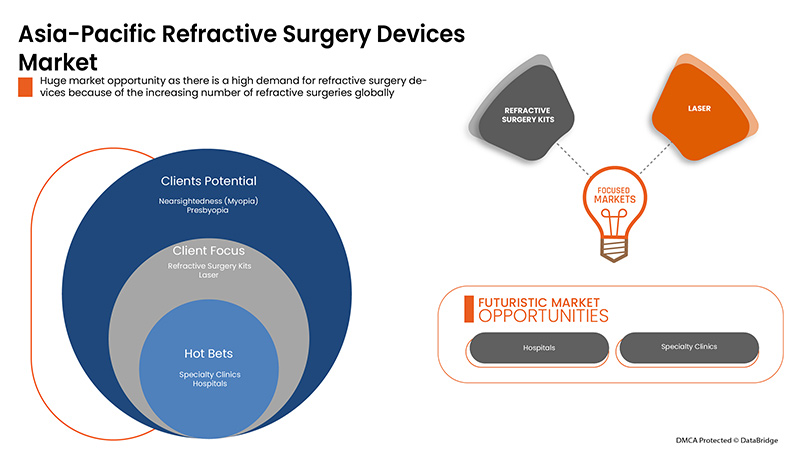

- 市場参加者による戦略的取り組み

世界中で屈折異常の負担が増加したことにより、屈折矯正手術機器市場への需要が高まっています。主な目的は、革新的な製品と手術方法の開発により健康管理を改善し、便利なアプリケーションで質の高いケアを提供することです。屈折矯正手術機器市場の主要企業は、製品の発売、買収などを含む戦略的イニシアチブを講じており、屈折矯正手術機器市場をリードし、より多くの機会を創出することが期待されています。

例えば、

- 2021年6月、Glaukos Corporationはオーストラリアの医薬品管理局(TGA)からPRESERFLO MicroShuntの規制承認を取得しました。PRESERFLO MicroShuntは、最大許容薬物療法であるにもかかわらず眼圧(IOP)が制御不能な原発開放隅角緑内障患者の眼のIOPを下げることを目的としており、緑内障の進行により手術が必要になります。

- 2021年6月:Bausch & Lomb Incorporatedは、情報技術サービス業界の企業であるLochanと契約を締結しました。これらの企業は、Bausch & Lomb IncorporatedのeyeTELLIGENCE臨床意思決定支援ソフトウェアの次世代を開発することを目指していました。eyeTELLIGENCEの既存のクラウドベースのインフラストラクチャを活用することで、このソフトウェアは、外科医が白内障、網膜、屈折矯正手術のすべての要素を簡単に組み合わせて、全体的な診療効率を高めることができるように開発されます。

- 2021年3月、NIDEKはRT-6100インテリジェント屈折計とTS-610卓上屈折計のオプション制御ソフトウェアであるRT-6100 CB for Windowsを発表しました。このソフトウェアは、患者とオペレーターの個別の要件に適応します。さらに、このソフトウェアは、社会的距離の要件を満たす屈折を可能にします。

屈折矯正手術機器市場における大手企業による多くの戦略的製品の発売と買収は、世界中の企業にチャンスをもたらしました。これらの戦略により、企業は市場での足跡を強化することができます。したがって、戦略的イニシアチブは、市場プレーヤーが市場での収益成長を加速するための絶好の機会であると予測されます。

課題/制約

- 処置の利点に関する認識と人々の信頼の欠如

多くの国では、一般の人々は屈折矯正手術や、近視、乱視、老眼などの屈折異常に対するそのさまざまな利点を認識していません。人々は手術が深刻な副作用につながるのではないかと恐れており、市場に大きな課題をもたらすことが予想されます。

例えば、

- According to the study by the National Institute of Health (NIH) 2021, it stated that people refused to undergo surgery because they were worried about its complications and lacked information regarding the procedure. Moreover, the study showed that 82.5% of participants were unaware that refractive surgery could enhance their visual acuity due to the lack of awareness

- According to the study by the International Journal of Medicine in Developing Countries in 2019, it was stated that-

- 32.2% of the total participants thought that refractive surgery was dangerous and 9.5% thought that it causes advanced complications

- Also, the study from India showed that 64% of participants did not know that refractive surgery was able to improve their vision

The lack of awareness regarding the benefits of refractive surgery and people's fear of surgery complications is expected to create a great challenge for the market growth.

- Lack of healthcare facilities for eye treatment

The poverty-stricken population in low- and middle-income countries suffer more from blindness and ophthalmic disorders than the wealthier population. The advancement and strategic plans taken in developed countries are not equally initiated in low-income countries. Many low-income countries usually rely on community health workers, physician assistants, and cataract surgeons for their initial primary eye care. Ophthalmology in low-income countries (LIC) is very challenging due to its complexities such as tropical climates, frail electric grids, poor road and water infrastructure, limited diagnostic capability, and limited treatment options.

For instance,

- As per the article, "Innovative Diagnostic Tools for Ophthalmology in Low-Income Countries," the 2020 report states that the prevalence of blindness and ocular disorders in high-income countries is 0.3 per 1,000 people, but in low-income countries, the estimation is 1.5 per 1,000. This shows the unmet need for ophthalmology care in low-income countries

Another major problem in low-income countries is the lack of awareness among people regarding ocular pain and other disorders. Many research studies report the high requirement of low-income countries for eye health care, and their unmet needs are still gaining attention among many health care organizations.

For instance,

- In 2014, the British Journal of Ophthalmology reported that the vision 2020 plan initiated by the government is still far from achieved due to the lack of initiatives taken targeting middle and low-income countries

Hence, the poor healthcare facility for eye treatments in low and middle-income countries are considered the greatest challenge to the growth of the refractive surgery devices market.

Post COVID-19 Impact on Refractive Surgery Devices Market

The COVID-19 has affected the market. Lockdowns and isolation during pandemics restricted the movement of the masses. As a result surgeries date and times were delayed. Hence, the pandemic has negatively affected this market

Recent Development

- In July 2021, Johnson & Johnson Vision launched the VERITAS Vision System, next-generation phacoemulsification (phaco) system. This system is developed to look after three important areas: surgeon efficiency, patient safety, and comfort. This has increased the company's product portfolio

Refractive Surgery Devices Market Scope

Refractive surgery devices market is segmented into product type, surgery type, application, end user, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Laser

- Phakic Intraocular Lens (IOL)

- Aberrometers / Wavefront Aberrometry

- Surgical Instruments & Accessories

- Refractive Surgery Kits

- Pupillary Diameter Meters

- Epikeratomes

- Microkeratomes

- Thermokeratoplasty

- Limbal Relaxing Incision Kits

- Others

On the basis of product type, the refractive surgery devices market is segmented into a laser, phakic intraocular lens (IOL), aberrometer/wavefront aberrometry, surgical instruments & accessories, refractive surgery kits, pupillary diameter meters, epikeratomes, microkeratomes, thermokeratoplasty, limbal relaxing incision kits, and others.

Surgery Type

- Lasik (Laser In-Situ Keratomileusis)

- Photorefractive Keratectomy (PRK)

- Phakic Intraocular Lenses (IOL)

- Astigmatic Keratotomy (AK)

- Automated Lamellar Keratoplasty (ALK)

- Intracorneal Ring (INTACS)

- Laser Thermal Keratoplasty (LTK)

- Conductive Keratoplasty (CK)

- Radial Keratotomy (RK)

- Others

On the basis of surgery type, the refractive surgery devices market is segmented into LASIK (laser in-situ keratomileusis), photorefractive keratectomy (PRK), phakic intraocular lenses (IOL), astigmatic keratotomy (AK), automated lamellar keratoplasty (ALK), intracorneal ring (INTACS), laser thermal keratoplasty (LTK), conductive keratoplasty (CK), radial keratotomy (RK), and others.

Application

- Nearsightedness (Myopia)

- Farsightedness (Hyperopia)

- Astigmatism

- Presbyopia

On the basis of application, the refractive surgery devices market is segmented into nearsightedness (myopia), farsightedness (hyperopia), astigmatism, and presbyopia.

End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

On the basis of end user, the refractive surgery devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others.

Distribution Channel

- Direct Tender

- Third Party Distributors

- Others

On the basis of distribution channel, the refractive surgery devices market is segmented into direct tender, third party distributors, and others.

Refractive Surgery Devices Market Regional Analysis/Insights

The refractive surgery devices market is analysed and market size insights and trends are provided by country, product type, surgery type, application, end user, and distribution channel as referenced above.

The countries covered in the refractive surgery devices market report are the China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Vietnam, Rest of Asia-Pacific.

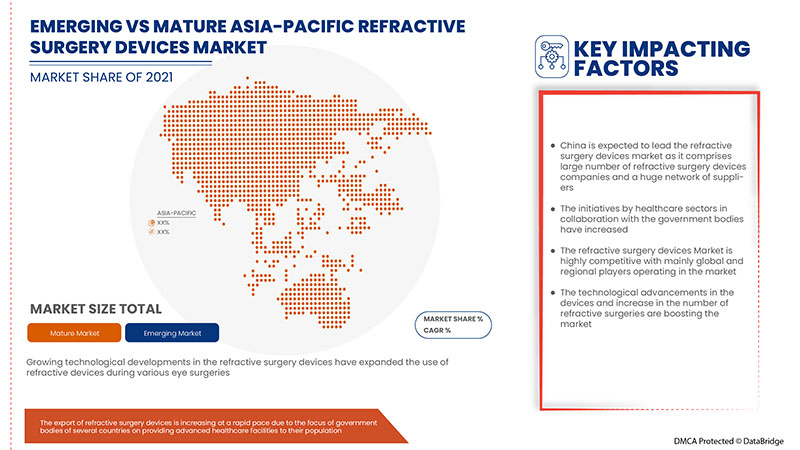

China dominates the refractive surgery devices market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period due to increase in the number of refractive surgeries in the region and technological advancements.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Refractive Surgery Devices Market Share Analysis

The refractive surgery devices market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on refractive surgery devices market.

Some of the major companies dealing in the refractive surgery devices market are Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (A subsidiary of Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, among others.

Research Methodology

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、世界対地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合ったデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場、製品ベース分析などを含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社を必要なだけ追加できます。必要な形式とデータ スタイルでデータを追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクトブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: REGULATIONS

4.3.1 REGULATION IN THE U.S.

4.3.2 REGULATIONS IN EUROPE

4.3.3 REGULATIONS IN SINGAPORE

4.3.4 REGULATIONS IN AUSTRALIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TECHNOLOGICAL ADVANCEMENT

5.1.2 RISE IN HEALTHCARE EXPENDITURE

5.1.3 INCREASE IN POPULATION WITH MACULAR DEGENERATION

5.1.4 RISE IN ADOPTION OF MINIMALLY INVASIVE SURGERIES

5.2 RESTRAINTS

5.2.1 STRINGENT RULES AND REGULATIONS

5.2.2 HIGH COST ASSOCIATED WITH REFRACTIVE SURGERY DEVICES

5.2.3 SIDE EFFECTS OF SURGERY

5.3 OPPORTUNITIES

5.3.1 ACHIEVEMENTS IN LASIK SURGERIES

5.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.3 INCREASING GERIATRIC POPULATION

5.3.4 EXCESSIVE USAGE OF DIGITAL DEVICES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 LACK OF HEALTHCARE FACILITIES FOR EYE TREATMENT

6 COVID-19 IMPACT ON ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY

6.4 STRATEGIC DECISIONS BY MANUFACTURERS

6.5 CONCLUSION

7 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LASER

7.2.1 EXCIMER LASERS

7.2.2 FEMTOSECOND LASER/ULTRASHORT PULSE LASER

7.2.3 OTHERS

7.3 PHAKIC INTRAOCULAR LENS (IOL)

7.4 ABERROMETERS / WAVEFRONT ABERROMETRY

7.5 SURGICAL INSTRUMENTS & ACCESSORIES

7.6 REFRACTIVE SURGERY KITS

7.7 PUPILLARY DIAMETER METERS

7.8 EPIKERATOMES

7.9 MICROKERATOMES

7.1 THERMOKERATOPLASTY

7.11 LIMBAL RELAXING INCISION KITS

7.12 OTHERS

8 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 LASIK (LASER IN-SITU KERATOMILEUSIS)

8.3 PHOTOREFRACTIVE KERATECTOMY (PRK)

8.4 PHAKIC INTRAOCULAR LENSES (IOL)

8.5 ASTIGMATIC KERATOTOMY (AK)

8.6 AUTOMATED LAMELLAR KERATOPLASTY (ALK)

8.7 INTRACORNEAL RING (INTACS)

8.8 LASER THERMAL KERATOPLASTY (LTK)

8.9 CONDUCTIVE KERATOPLASTY (CK)

8.1 RADIAL KERATOTOMY (RK)

8.11 OTHERS

9 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEARSIGHTEDNESS (MYOPIA)

9.3 FARSIGHTEDNESS (HYPEROPIA)

9.4 PRESBYOPIA

9.5 ASTIGMATISM

10 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 VIETNAM

12.1.12 REST OF ASIA-PACIFIC

13 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 JOHNSON AND JOHNSON SERVICES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.1.5.1 PRODUCT LAUNCH

15.2 ALCON INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.5.1 ACQUISITION

15.2.5.2 PRODUCT LAUNCH

15.3 STAAR SURGICAL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAUSCH + LOMB INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 ACQUISITION

15.4.5.2 CE APPROVAL

15.5 TOPCON CANADA INC., (A SUBSIDIARY OF TOPCON CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PARTNERSHIP

15.5.5.2 ACQUISITION

15.6 AAREN SCIENTIFIC INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMPLITUDE LASER

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 PARTNERSHIP

15.8 BD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.8.4.1 CONFERENCE

15.8.4.2 PRODUCT LAUNCH

15.9 GLAUKOS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 PRODUCT LAUNCH

15.9.4.2 ACQUISITION

15.1 HOYA SURGICAL OPTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 CONFERENCE

15.11 IVIS TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LENSAR INC. (A SUBSDIARY OF PDL BIOPHARMA, INC.)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MORIA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NIDEK CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 WEBSITE LAUNCH

15.15 OPHTEC BV

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 PRODUCT LAUNCH

15.16 RAYNER INTRAOCULAR LENSES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.16.3.1 NEW DISTRIBUTION UNIT

15.16.3.2 ACQUISITION

15.16.3.3 ACQUISITION

15.17 REICHERT, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 CONFERENCE

15.18 ROWIAK GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 R&D FACILITY

15.19 SCHWIND EYE-TECH-SOLUTIONS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRACEY TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 R&D FACILITY

15.21 ZIEMER OPHTHALMIC SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 AGREEMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PHAKIC INTRAOCULAR LENS (IOL) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ABBEROMETERS/WAFEFRONT ABERROMETRY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SURGICAL INSTRUMENT & ACCESSORIES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC REFRACTIVE SURGERY KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC PUPILLARY DIAMETER METERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC EPIKERATOMES IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MICROKERATOMES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC THERMOKERATOPLASTY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC LIMBAL RELAXING INCISION KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC LASIK (LASER IN-SITU KERATOMILEUSIS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PHOTOREFRACTIVE KERATECTOMY (PRK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC PHAKIC INTRAOCULAR LENSES (IOL) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ASTIGMATIC KERATOTOMY (AK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC AUTOMATED LAMELLAR KERATOPLASTY (ALK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC INTRACORNEAL RING (INTACS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC LASER THERMAL KERATOPLASTY (LTK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CONDUCTIVE KERATOPLASTY (CK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC RADIAL KERATOTOMY (RK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC NEARSIGHTEDNESS (MYOPIA) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC FARSIGHTEDNESS (HYPEROPIA) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC PRESBYOPIA IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC ASTIGMATISM IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC HOSPITALS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC SPECIALTY CLINICS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC AMBULATORY SURGICAL CENTERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC DIRECT TENDER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 INDIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH KOREA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 AUSTRALIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SINGAPORE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 THAILAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 MALAYSIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 INDONESIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 PHILIPPINES LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 103 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 VIETNAM LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 109 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 REST OF ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN THE REFRACTIVE SURGERY DEVICES ARE EXPECTED TO DRIVE THE ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET

FIGURE 15 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2021

FIGURE 20 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2021

FIGURE 24 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2021

FIGURE 28 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。