アジア太平洋地域のタンパク質加水分解物市場、タイプ別(牛乳、肉、海産物、植物、卵、その他)、供給源別(動物、植物、微生物)、形態別(液体、粉末)、プロセス別(酵素加水分解、酸加水分解)、用途別(動物飼料、乳児栄養、臨床栄養、スポーツ栄養、栄養補助食品、その他)、国別(日本、中国、韓国、インド、シンガポール、タイ、インドネシア、マレーシア、フィリピン、オーストラリア、ニュージーランド、その他のアジア太平洋地域)業界動向および2029年までの市場予測。

市場分析と洞察:アジア太平洋地域のタンパク質加水分解物市場

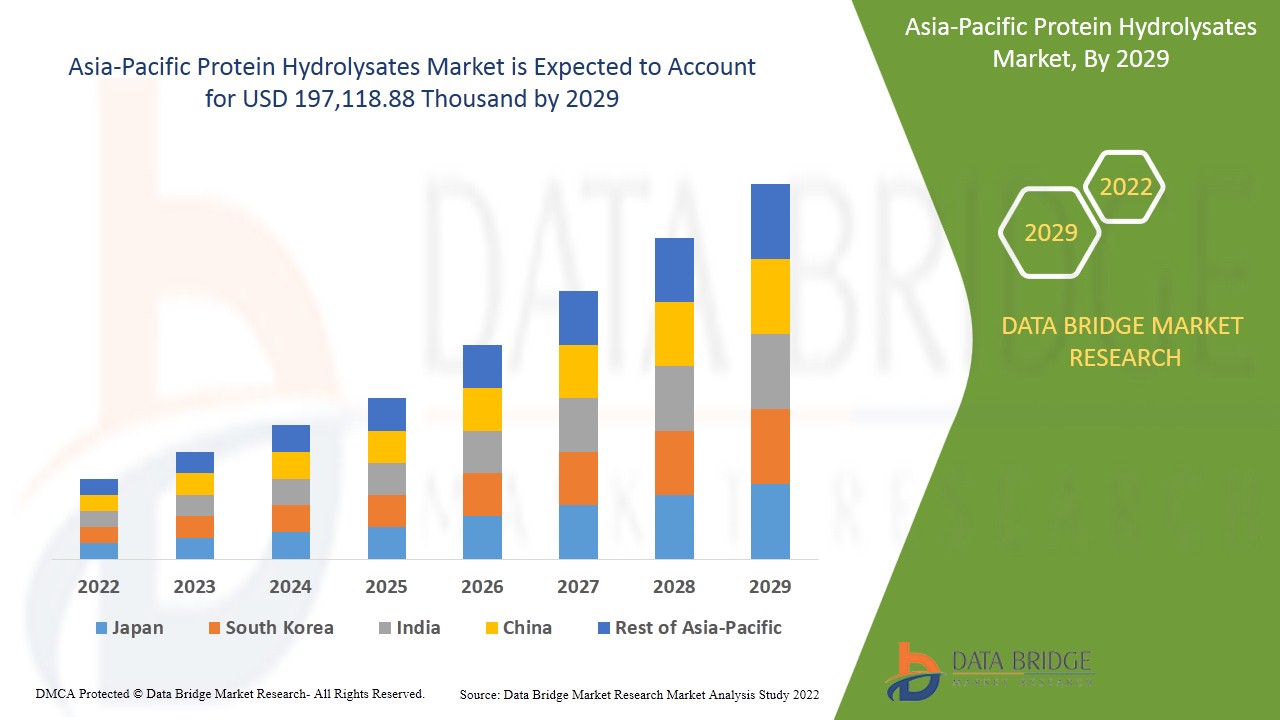

タンパク質加水分解物市場は、2022年から2029年の予測期間に市場成長を遂げると予想されています。データブリッジ市場調査は、市場は2022年から2029年の予測期間に6.1%のCAGRで成長し、2029年までに1億9,711万8,880米ドルに達すると分析しています。乳児およびスポーツ栄養のための体重管理製品に対する大きな需要が、市場の成長を後押しすると予想されています。

タンパク質加水分解物は、精製されたタンパク質源からタンパク質分解酵素を添加し、続いて精製手順を行うことで生成されます。各タンパク質加水分解物は、異なる鎖長のペプチドと遊離アミノ酸の複雑な混合物であり、加水分解度と呼ばれる全体的な値で定義できます。これは、スタータータンパク質で切断されたペプチド結合の割合です。このような調製物は、その構成アミノ酸において元の材料と同等の栄養価を提供し、特別な食事や通常の食品タンパク質を摂取できない患者の栄養補給および水分補給として使用されます。これは、体が完全なタンパク質よりも急速にアミノ酸を吸収するのを助けるなど、多くの健康上の利点を提供し、したがって栄養素の供給を最大化し、食品および飲料業界でさまざまな用途があります。タンパク質加水分解物の用途は、スポーツ医学で特に使用されています。タンパク質加水分解物に含まれるアミノ酸は、完全なタンパク質よりも体に吸収されやすく、筋肉への栄養素の供給を増やすためです。また、バイオテクノロジー業界では、細胞培養を補うために使用されています。

さまざまな地域での乳児用調合乳の需要の急増が、タンパク質加水分解物市場の成長を後押ししています。タンパク質加水分解物を含む調合乳の摂取は、乳児が簡単に消化できるため、牛乳調合乳よりも有益であると考えられており、乳製品ベースの製品がアジア太平洋地域のタンパク質加水分解物市場の成長を促進すると大いに期待されています。

乳児およびスポーツ栄養のための体重管理製品に対する大きな需要と、機能性食品および栄養食品の消費につながる消費者の健康意識の高まりが、アジア太平洋地域のタンパク質加水分解物市場の原動力となっています。ただし、分離物などの代替品が利用可能になることで、市場の成長が抑制されると予想されます。

世界中でビーガン人口が増加することで、将来的にアジア太平洋地域のタンパク質加水分解物市場が成長する機会がもたらされる可能性があります。

加水分解タンパク質の加工コストが高いため、近い将来、アジア太平洋地域のタンパク質加水分解物市場の成長が阻害されると予想されます。

このアジア太平洋タンパク質加水分解物市場レポートでは、市場シェア、新開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点からの機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、収益への影響ソリューションを作成し、希望する目標を達成できるようお手伝いします。

アジア太平洋地域のタンパク質加水分解物市場の範囲と市場規模

タンパク質加水分解物市場は、タイプ、ソース、形態、プロセス、および用途に基づいて 5 つの主要なセグメントに分割されています。セグメント間の成長は、ニッチな成長分野と市場にアプローチするための戦略を分析し、コア アプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

- タイプに基づいて、アジア太平洋地域のタンパク質加水分解物市場は、牛乳、肉、海産物、植物、卵、その他に分類されます。2022年には、乳児栄養業界での使用の増加により、牛乳タンパク質加水分解物セグメントが優勢になると予想されます。

- アジア太平洋地域のタンパク質加水分解物市場は、原料に基づいて動物、植物、微生物に分類されます。2022年には、動物由来原料には他の原料に比べてタンパク質含有量が多いため、動物セグメントがアジア太平洋地域のタンパク質加水分解物市場を支配すると予想されます。

- 形態に基づいて、アジア太平洋地域のタンパク質加水分解物市場は液体と粉末に分類されます。2022年には、栄養補助食品、乳児栄養、スポーツ栄養など、さまざまな用途での需要の増加により、粉末タンパク質加水分解物セグメントがアジア太平洋地域のタンパク質加水分解物市場で優位になると予想されます。

- プロセスに基づいて、アジア太平洋地域のタンパク質加水分解物市場は、酵素加水分解と酸加水分解に分類されます。2022年には、経費を節約するのに役立つコスト削減技術により、酵素加水分解がアジア太平洋地域のタンパク質加水分解物市場を支配すると予想されます。

- 用途に基づいて、アジア太平洋地域のタンパク質加水分解物市場は、動物飼料、乳児栄養、臨床栄養、スポーツ栄養、栄養補助食品、その他に分類されます。2022年には、栄養補助食品セグメントが心臓病を予防し、認知能力を向上させるため、アジア太平洋地域のタンパク質加水分解物市場を支配すると予想されます。

タンパク質加水分解物市場の国別分析

タンパク質加水分解物市場は、タイプ、ソース、形態、プロセス、および用途に基づいて 5 つの主要なセグメントに分類されます。

アジア太平洋地域のタンパク質加水分解物市場レポートで取り上げられている国は、日本、中国、韓国、インド、シンガポール、タイ、インドネシア、マレーシア、フィリピン、オーストラリア、ニュージーランド、その他のアジア太平洋地域です。

中国、インド、日本などの国々は、タンパク質加水分解物市場における人口消費をリードしています。同時に、これらの国々は、地元および地域の需要を満たすために生産能力を増強しています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

環状オレフィン共重合体(COC)などのポリマー製造における材料選択肢の増加

アジア太平洋地域のタンパク質加水分解物市場では、タンパク質加水分解物市場向けのさまざまな種類の製品のインストールベースの各国の成長、ライフライン曲線を使用した技術の影響、乳児用調合乳の規制シナリオの変更とそれらがタンパク質加水分解物市場に与える影響に関する詳細な市場分析も提供されます。データは、2011年から2020年までの履歴期間で利用できます。

競争環境とタンパク質加水分解物の市場シェア分析

アジア太平洋地域のタンパク質加水分解物市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、アジア太平洋地域でのプレゼンス、生産拠点と施設、会社の強みと弱み、製品の発売、臨床試験パイプライン、ブランド分析、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線が含まれます。上記のデータ ポイントは、タンパク質加水分解物市場に関連する会社の焦点にのみ関連しています。

このレポートで取り上げられている主要企業には、Novozymes、BRF Global、Azelis、Kemin Industries Inc.、Bioiberica SAU、Bio-marine Ingredients Ireland、ZXCHEM USA INC.、New Alliance Dye Chem Pvt. Ltd.、Titan Biotech、Janatha Fish Meals & Oil Products、NAN Group.、SUBONEYO Chemicals Pharmaceuticals P Limited、SAMPI、その他の国内企業およびアジア太平洋地域の企業などがあります。DBMR のアナリストは、競争力を理解し、各競合他社の競合分析を個別に提供します。

例えば、

- 2021年10月、当社の社会的投資を戦略的に指揮する民間団体であるBRF研究所は、Our Part for the Whole Fundの公示の3回目の選定を完了しました。このイニシアチブには370件を超える応募があり、その中から50件が選ばれ、雇用と収入の創出、健康と緊急時の行動、食品安全、社会保障に焦点を当てたさまざまな分野で総額180万レアルの投資が行われました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC PROTEIN HYDROLYSATES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT DEMAND IN WEIGHT MANAGEMENT PRODUCTS FOR INFANT AND SPORTS NUTRITION

5.1.2 INCREASING HEALTH AWARENESS AMONG CONSUMERS LEADING TO CONSUMPTION OF FUNCTIONAL AND NUTRITIONAL FOODS

5.1.3 RISING DEMAND ACROSS A DIVERSE RANGE OF APPLICATIONS

5.1.4 INCREASED USAGE OF FISH PROTEIN HYDROLYSATE IN AQUAFEED

5.2 RESTRAINTS

5.2.1 HEALTH ISSUES RELATED TO HIGH AND LONG TERM CONSUMPTION OF PROTEIN-BASED DIET

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.2.3 AVAILABILITY OF ALTERNATIVES SUCH AS ISOLATES AND CONCENTRATES

5.3 OPPORTUNITIES

5.3.1 INCREASING VEGAN POPULATION ACROSS THE GLOBE

5.3.2 HIGH DEMAND FOR ORGANIC FOOD INGREDIENTS

5.4 CHALLENGES

5.4.1 HIGH PRODUCTION COST OF HYDROLYZED PROTEIN

5.4.2 LACK OF AWARENESS IN DEVELOPING COUNTRIES

6 COVID-19 IMPACT ON ASIA PACIFIC PROTEIN HYDROLYSATES MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON ASIA PACIFIC PROTEIN HYDROLYSATES MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST ASIA PACIFIC PROTEIN HYDROLYSATES MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY TYPE

7.1 OVERVIEW

7.2 MILK

7.2.1 MILK, BY TYPE

7.2.1.1 WHEY

7.2.1.2 CASEIN

7.3 MEAT

7.3.1 MEAT, BY TYPE

7.3.1.1 BOVINE

7.3.1.2 POULTRY

7.3.1.3 SWINE

7.4 PLANT

7.4.1 PLANT, BY TYPE

7.4.1.1 SOY

7.4.1.2 WHEAT

7.4.1.3 OTHERS

7.5 EGGS

7.6 MARINE

7.6.1 MARINE, BY TYPE

7.6.1.1 FISH

7.6.1.1.1 FISH, BY TYPE

7.6.1.1.1.1 TUNA

7.6.1.1.1.2 SALMON

7.6.1.1.1.3 OTHERS

7.6.1.2 ALGAE

7.7 OTHERS

8 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ANIMALS

8.3 PLANTS

8.4 MICROBES

9 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY FORM

9.1 OVERVIEW

9.2 POWDER

9.3 LIQUID

10 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY PROCESS

10.1 OVERVIEW

10.2 ENZYMATIC HYDROLYSIS

10.3 ACID HYDROLYSIS

11 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIETARY SUPPLEMENTS

11.3 INFANT NUTRITION

11.4 SPORTS NUTRITION

11.5 ANIMAL FEED

11.6 CLINICAL NUTRITION

11.7 OTHERS

12 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA & NEW ZEALAND

12.1.6 INDONESIA

12.1.7 SINGAPORE

12.1.8 MALAYSIA

12.1.9 THAILAND

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

13.4 NEW PRODUCT DEVELOPMENTS

13.5 PARTNERSHIPS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 BRF ASIA PACIFIC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 NOVOZYMES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 AZELIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 SCANBIO MARINE GROUP AS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATE

15.5 BIOIBERICA S.A.U

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT UPDATES

15.6 KEMIN INDUSTRIES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATES

15.7 COPALIS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATES

15.8 BIO-MARINE INGREDIENTS IRELAND

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 JANATHA FISH MEAL & OIL PRODUCTS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 NAN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 NEW ALLIANCE DYE CHEM PVT. LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 SAMPI

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 SUBONEYO CHEMICAL PHARMACEUTICALS P LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATE

15.14 TITAN BIOTECH

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 ZXCHEM USA INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE - 350400 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PEPTONES AND THEIR DERIVATIVES; OTHER ALBUMINOUS SUBSTANCES AND THEIR DERIVATIVES; HS CODE – 350400 (USD THOUSAND)

TABLE 3 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 5 ASIA PACIFIC MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC MILK IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 7 ASIA PACIFIC MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC MEAT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 10 ASIA PACIFIC MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC PLANT IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 13 ASIA PACIFIC PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC EGGS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 16 ASIA PACIFIC MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC MARINE IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (TONNE)

TABLE 18 ASIA PACIFIC MARINE IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC FISH IN PROTEIN HYDROLYSATESMARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC OTHERS IN PROTEIN HYDROLYSATESMARKET, BY REGION, 2020-2029 (TONNE)

TABLE 22 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC ANIMALS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC PLANTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC MICROBES IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC POWDER IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC LIQUID IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC ENZYMATIC HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC ACID HYDROLYSIS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC DIETARY SUPPLEMENTS IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC INFANT NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC SPORTS NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC ANIMAL FEED IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA PACIFIC CLINICAL NUTRITION IN PROTEIN HYDROLYSATES MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY COUNTRY,2020-2029 (TONNE)

TABLE 41 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 43 ASIA-PACIFIC MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 CHINA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 CHINA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 54 CHINA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CHINA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 CHINA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 CHINA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 60 CHINA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 62 CHINA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 INDIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 INDIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 65 INDIA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 INDIA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 INDIA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 INDIA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 INDIA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 71 INDIA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 INDIA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 73 INDIA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 JAPAN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 JAPAN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 76 JAPAN MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 JAPAN MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 JAPAN MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 JAPAN FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 JAPAN PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 JAPAN PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 82 JAPAN PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 JAPAN PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 84 JAPAN PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH KOREA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 SOUTH KOREA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 87 SOUTH KOREA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 SOUTH KOREA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 SOUTH KOREA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 SOUTH KOREA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 SOUTH KOREA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 SOUTH KOREA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 93 SOUTH KOREA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 94 SOUTH KOREA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 95 SOUTH KOREA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 AUSTRALIA & NEW ZEALAND PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 AUSTRALIA & NEW ZEALAND PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 98 AUSTRALIA & NEW ZEALAND MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 AUSTRALIA & NEW ZEALAND MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 AUSTRALIA & NEW ZEALAND MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 AUSTRALIA & NEW ZEALAND FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 AUSTRALIA & NEW ZEALAND PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 AUSTRALIA & NEW ZEALAND PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 104 AUSTRALIA & NEW ZEALAND PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 AUSTRALIA & NEW ZEALAND PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 106 AUSTRALIA & NEW ZEALAND PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 INDONESIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 INDONESIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 109 INDONESIA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 INDONESIA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 INDONESIA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 INDONESIA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 INDONESIA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 INDONESIA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 115 INDONESIA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 116 INDONESIA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 117 INDONESIA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 118 SINGAPORE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 SINGAPORE PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 120 SINGAPORE MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 SINGAPORE MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 SINGAPORE MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 SINGAPORE FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 SINGAPORE PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 SINGAPORE PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 126 SINGAPORE PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 127 SINGAPORE PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 128 SINGAPORE PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 MALAYSIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 MALAYSIA PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 131 MALAYSIA MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 MALAYSIA MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 MALAYSIA MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 MALAYSIA FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 MALAYSIA PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 MALAYSIA PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 137 MALAYSIA PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 138 MALAYSIA PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 139 MALAYSIA PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 140 THAILAND PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 THAILAND PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 142 THAILAND MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 THAILAND MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 THAILAND MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 THAILAND FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 THAILAND PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 THAILAND PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 148 THAILAND PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 149 THAILAND PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 150 THAILAND PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 PHILIPPINES PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 152 PHILIPPINES PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

TABLE 153 PHILIPPINES MILK IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 PHILIPPINES MEAT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 PHILIPPINES MARINE IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 PHILIPPINES FISH IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 PHILIPPINES PLANT IN PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 PHILIPPINES PROTEIN HYDROLYSATES MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 159 PHILIPPINES PROTEIN HYDROLYSATES MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 160 PHILIPPINES PROTEIN HYDROLYSATES MARKET, BY PROCESS, 2020-2029 (USD THOUSAND)

TABLE 161 PHILIPPINES PROTEIN HYDROLYSATES MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 162 REST OF ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 REST OF ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET, BY TYPE, 2020-2029 (TONNE)

図表一覧

FIGURE 1 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC PROTEIN HYDROLYSATES MARKET, WHILE ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASED DEMAND FOR INFANT NUTRITION AND SPORTS NUTRITION IS EXPECTED TO DRIVE THE ASIA PACIFIC PROTEIN HYDROLYSATES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PROTEIN HYDROLYSATES MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC PROTEIN HYDROLYSATES MARKET

FIGURE 18 WORLD CAPTURE FISHERIES FROM 1950 TO 2018

FIGURE 19 ASIA PACIFIC PROTEIN HYDROLYSATES, BY TYPE, 2021

FIGURE 20 ASIA PACIFIC PROTEIN HYDROLYSATES, BY SOURCE, 2021

FIGURE 21 ASIA PACIFIC PROTEIN HYDROLYSATES, BY FORM, 2021

FIGURE 22 ASIA PACIFIC PROTEIN HYDROLYSATES, BY PROCESS, 2021

FIGURE 23 ASIA PACIFIC PROTEIN HYDROLYSATES, BY APPLICATION, 2021

FIGURE 24 RETAIL SALES VALUE OF COSMETICS BY WHOLESALE AND RETAIL COMPANIES IN CHINA FROM 2010 TO 2020

FIGURE 25 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET : SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET : BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET : BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET : BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC PROTEIN HYDROLYSATES MARKET : BY TYPE (2022-2029)

FIGURE 30 ASIA PACIFIC PROTEIN HYDROLYSATES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。