アジア太平洋地域の針生検市場、針の種類別(トレフィン生検針、クリマ胸骨針、サラ針吸引針、ジャムシディ針など)、人間工学(鋭利、鈍角、クインケ、チバ、フランシーンなど)、手順(細針吸引生検、コア針生検、真空補助生検、画像誘導生検)、サンプル部位(筋肉、骨、その他の臓器)、実用性(使い捨ておよび再利用可能)、用途(腫瘍、感染症、炎症など)– 2029年までの業界動向と予測。

アジア太平洋地域の針生検市場の分析と規模

針生検市場は、予測期間中に大幅な成長が見込まれています。針生検市場の拡大は、世界中の癌症例の発生率と正比例しています。これにより、針生検の受け入れが増加し、市場が発展します。急速なイノベーションと技術の進歩が針生検市場に影響を与え、手術中および手術後の患者の快適性を向上させ、外傷を軽減するための製品開発が進行中です。この市場は需要が最も高く、予測期間中に大幅な成長が見込まれています。

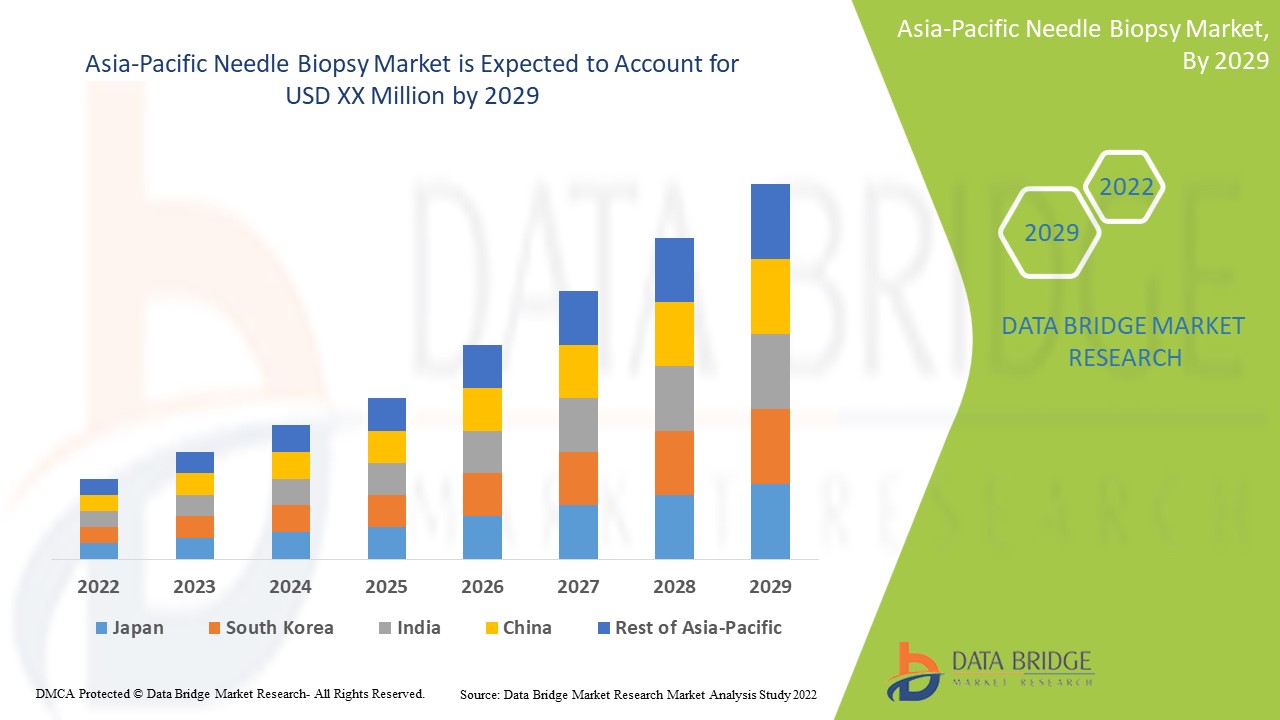

Data Bridge Market Researchは、2022~2029年の予測期間における針生検市場の成長率を分析しています。市場規模は2021年に1億8,000万米ドルと評価されました。市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、Data Bridge Market Researchチームがまとめた市場レポートには、詳細な専門家分析、患者疫学、パイプライン分析、価格分析、規制枠組みも含まれています。

アジア太平洋地域の針生検市場の範囲とセグメンテーション

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2014 - 2019 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

針の種類 (トレフィン生検針、クリマ胸骨針、サラ針吸引針、ジャムシディ針など)、人間工学 (鋭利、鈍角、クインケ、チバ、フランシーンなど)、手順 (細針吸引生検、コア針生検、吸引補助生検、画像誘導生検)、サンプル部位 (筋肉、骨、その他の臓器)、有用性 (使い捨ておよび再利用可能)、用途 (腫瘍、感染症、炎症など) |

|

対象国 |

日本、中国、韓国、インド、オーストラリア、シンガポール、タイ、マレーシア、インドネシア、フィリピン、その他のアジア太平洋諸国 |

|

対象となる市場プレーヤー |

Boston Scientific Corporation(米国)、Hologic, Inc.(米国)、ST. STONE MEDICAL DEVICES PVT. LTD(インド)、AprioMed AB(スウェーデン)、Amecath(エジプト)、Cardinal Health(米国)、BD(米国)、Merit Medical Systems(米国)、Swastik Enterprise(インド)、B. Braun SE(ドイツ) |

|

市場機会 |

|

市場の定義

針生検は、画像誘導または超音波検査で、特に腫瘍の検査や診断のために人体から細胞サンプルを採取するために使用されます。一般的な針生検手順には、細針吸引生検とコア針生検があります。針生検は、異常なしこりがある場合、または画像スキャンで体内に異常が見られる場合に行われます。針生検は内科医にとって非常に重要になってきており、予測期間中に大幅な成長が見込まれています。

針生検市場の動向

ドライバー

- がん患者の増加

がん症例の発生は、針生検市場の世界的な拡大に直接寄与しています。WHO によると、2030 年には、がんによる死亡者数は世界中で 130 億人に達すると予想されています。世界中でがん症例が急増しているため、生検を受ける患者数も増加すると予想されます。その結果、針ベースの生検ガンの採用が増加し、市場の成長が促進されます。

- 高齢者人口の増加

研究者によると、がんは加齢に伴う病気だと考えられています。いくつかの研究によると、50歳以上の人は子宮頸がん、乳がん、前立腺がんになりやすいそうです。予測期間中、これが市場を押し上げると予想されます。

機会

- 臨床研究と償還

針生検のいくつかの高度な技術革新、有望な臨床研究、およびより優れた償還ポリシーにより、2022年から2029年にかけて針生検市場に大きな成長の機会がもたらされると予想されます。

- 先進技術

針生検市場における人工知能などの技術の導入は、同市場の成長機会を生み出している。例えば、米国に拠点を置くAIゲノムビジネスであるFreenomeは、2018年10月に、AIを活用して体内のがんの早期警告兆候を検出する血液検査の開発に取り組んでいると発表した。同社は2018年10月に、機械学習を応用して大腸がんを早期に検出するための研究開発の予備的証拠を発表した。

制約/課題

- 熟練した専門家の不足

これらのシステムを使用できない有資格者の不足により、予測期間中のアジア太平洋地域の針生検市場の成長が抑制される可能性があります。

- 高コスト

これらの治療プロセスのコストが高いため、病気の発生率が高いにもかかわらず、針生検市場の成長が妨げられる可能性があります。

このアジア太平洋の針生検市場レポートでは、最近の新しい開発、貿易規制、輸出入分析、生産分析、バリュー チェーンの最適化、市場シェア、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会の分析、市場規制の変更、戦略的市場成長分析、市場規模、カテゴリ市場の成長、アプリケーションのニッチと優位性、製品の承認、製品の発売、地理的拡大、市場における技術革新などの詳細が提供されます。アジア太平洋の針生検市場に関する詳細情報を取得するには、アナリスト ブリーフについて Data Bridge Market Research にお問い合わせください。当社のチームが、市場の成長を達成するための情報に基づいた市場決定を行うお手伝いをします。

COVID-19がアジア太平洋地域の針生検市場に与える影響

COVID-19は、実質的にすべてのセクターに影響を及ぼした重大な公衆衛生危機を引き起こしており、その長期的な影響は予測期間中の業界の成長に影響を及ぼすと予想されます。

パンデミック後の時代では、がんの有病率は現在の状況とは無関係であるため、針生検市場の急増が大いに期待されています。また、病院や研究機関ではCOVID-19感染例が減少しているため、がん症例への注目が再び高まるでしょう。

最近の動向

- 2021年1月、Hologic, Inc.はSOMATEX Medical Technologies GmbHを6,400万米ドルで買収しました。これは、乳がん治療のためのさまざまな新しいソリューションを提供することを目指しています。Hologic, Inc.は、乳がんマーカーのポートフォリオを拡大することができます。

アジア太平洋地域の針生検市場の展望

アジア太平洋地域の針生検市場は、針の種類、手順、サンプル採取場所、用途に基づいてセグメント化されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

針の種類

- トレフィン生検針

- クリマ胸骨針

- サラー針吸引針

- ジャムシディニードル

- その他

手順

- 穿刺吸引細胞診

- コア針生検

- 吸引補助生検

- 画像誘導生検

サンプルサイト

- 筋肉

- 骨

- その他の臓器

応用

- 腫瘍

- 感染

- 炎症

- その他

アジア太平洋地域の針生検市場の地域分析/洞察

アジア太平洋地域の針生検市場が分析され、上記の針の種類、手順、サンプル採取部位、用途別に市場規模の洞察と傾向が提供されます。

アジア太平洋地域の針生検市場に含まれる主要国は、日本、中国、韓国、インド、オーストラリア、シンガポール、タイ、マレーシア、インドネシア、フィリピン、その他のアジア太平洋地域です。

中国ではがん治療に対する意識が高く、針生検に対する償還シナリオも有利であるため、アジア太平洋地域の針生検市場は中国が主導すると予想されています。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える国内市場における個別の市場影響要因と規制の変更についても説明しています。また、国別データの予測分析を提供しながら、グローバルブランドの存在と入手可能性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されています。

競争環境とアジア太平洋地域の針生検市場シェア分析

アジア太平洋の針生検市場の競争状況は、競合他社ごとに詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。提供されている上記のデータ ポイントは、アジア太平洋の針生検市場に関連する会社の焦点にのみ関連しています。

アジア太平洋地域の針生検市場で活動している主要企業は次のとおりです。

- ボストン・サイエンティフィック・コーポレーション(米国)

- ホロジック社(米国)

- ST. STONE MEDICAL DEVICES PVT. LTD (インド)

- アプリオメッドAB(米国)

- アメカス(エジプト)

- カーディナルヘルス(米国)

- BD(米国)

- メリットメディカルシステムズ(米国)

- スワスティックエンタープライズ(インド)

- B.ブラウンSE(ドイツ)

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of THE Asia-Pacific needle biopsy market

- Currency and pricing

- LIMITATIONs

- MARKETS COVERED

- Asia-Pacific needle biopsy market: SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- MULTIVARIATE MODELLING

- end user LIFELINE CURVE

- DBMR MARKET POSITION GRID

- VENDOR SHARE ANALYSIS

- MARKET procedure COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Asia-Pacific needle biopsy market: regulations

- REGULATIONS IN CHINA

- MEDICAL DEVICE INSTRUCTIONS FOR LABELLING IN CHINA:

- REGULATIONS IN JAPAN

- REGUALTION IN INDIA

- Market Overview

- drivers

- INCREASED PREVALENCE OF BREAST AND LUNG CANCER

- SURGE IN DEMAND FOR MINIMALLY INVASIVE SURGERIES

- GOVERNMENT INITIATIVES TO SPREAD AWARENESS ABOUT LUNG AND BREAST CANCER

- TECHNOLOGICAL ADVANCEMENT IN NEEDLE BIOPSY

- RESTRAINTS

- RISING COST OF THE NEEDLE BIOPSY

- RAPID DEVELOPMENT OF ULTRASENSITIVE IMAGING TECHNOLOGIES SUCH AS MAGNETIC RESONANCE IMAGING

- RISK OF INFECTION RELATED TO BIOPSY PROCEDURES

- COMPLEXITY IN NEEDLE BIOPSY

- OPPORTUNITIES

- STRATEGIC INITIATIVEs BY THE MARKET PLAYERS

- RISE IN HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME

- INCREASE IN RESEARCH AND DEVELOPMENT ACTIVITIES

- HUGE MARKET POTENTIAL IN DEVELOPING COUNTRIES

- CHALLENGES

- STRINGENT RULES AND REGULATIONS

- rise in competition between market players

- limitations or complications of needle biopsy

- Impact of COVID-19 Pandemic on the Asia-Pacific needle biopsy market

- Price Impact

- Asia-pacific needle biopsy market, By needle type

- overview

- trephine biopsy needles

- reusable

- disposable

- salah needle aspiration needle

- klima sternal needle

- jamshidi needle

- others

- Asia-Pacific needle biopsy market, By ergonomics

- overview

- sharp

- blunt

- chiba

- franseen

- quincke

- others

- Asia-Pacific needle biopsy market, By PROCEDURE

- overview

- fine-needle aspiration biopsy

- core needle biopsy

- image-guided biopsy

- vacuum assisted biopsy

- Asia-Pacific needle biopsy market, By sample site

- overview

- bones

- muscles

- other organs

- BREAST

- liver

- lungs

- others

- Asia-Pacific needle biopsy market, By utility

- overview

- disposable

- reusable

- Asia-Pacific needle biopsy market, By application

- overview

- tumor

- carcinoma

- sarcoma

- blastoma

- germ cell tumor

- others

- infection

- INFLAMMATION

- others

- Asia-Pacific needle biopsy market, By end user

- overview

- hospitals

- diagnostic centers

- biopsy labs

- Ambulatory surgical centers

- Academic and research organization

- others

- Asia-Pacific needle biopsy market, By distribution channel

- overview

- direct tender

- retail sales

- ASIA-PACIFIC NEEDLE BIOPSY MARKET, BY COUNTRY

- China

- India

- Japan

- AUSTRALIA

- South Korea

- Singapore

- Malaysia

- thailand

- indonesia

- philippines

- Rest of Asia-Pacific

- company share analysis: Asia-Pacific

- boston scientific corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- HOLOGIC, INC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- product portfolio

- RECENT DEVELOPMENTS

- BD

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- B. BRAUN MELSUNGEN AG

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- product Portfolio

- RECENT DEVELOPMENTs

- cook

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- amecath

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- APRIOMED, AB

- COMPANY SNAPSHOT

- product portfolio

- RECENT DEVELOPMENT

- ARGON MEDICAL

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Cardinal Health

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HAKKO CO., LTD.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- merit medical systems

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ST. STONE MEDICAL DEVICES PVT. LTD.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

表のリスト

TABLE 1 Asia-Pacific needle biopsy market, By needle type, 2019-2028 (USD million)

TABLE 2 ASIA-PACIFIC trephine biopsy needles in needle biopsy market, By needle type, 2019-2028 (USD million)

TABLE 3 Asia-Pacific needle biopsy market, By ergonomics, 2019-2028 (USD million)

TABLE 4 Asia-Pacific needle biopsy market, By procedure, 2019-2028 (USD million)

TABLE 5 Asia-Pacific needle biopsy market, By sample site, 2019-2028 (USD million)

TABLE 6 ASIA-PACIFIC other organs IN needle biopsy market, By sample site, 2019-2028 (USD million)

TABLE 7 Asia-Pacific needle biopsy market, By utility, 2019-2028 (USD million)

TABLE 8 Asia-Pacific needle biopsy market, By application, 2019-2028 (USD million)

TABLE 9 ASIA-PACIFIC tumor in needle biopsy market, By application, 2019-2028 (USD million)

TABLE 10 Asia-Pacific needle biopsy market, By end user, 2019-2028 (USD million)

TABLE 11 Asia-Pacific needle biopsy market, By distribution channel, 2019-2028 (USD million)

TABLE 12 Asia-Pacific needle biopsy MARKET, By COUNTRY, 2021-2028 (USD million)

TABLE 13 Asia-Pacific Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 14 Asia-Pacific trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 15 asia-Pacific Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 16 Asia-Pacific Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 17 Asia-Pacific Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 18 Asia-Pacific other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 19 Asia-Pacific Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 20 Asia-Pacific Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 21 Asia-Pacific tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 22 Asia-Pacific Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 23 Asia-Pacific Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 24 China Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 25 China trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 26 China Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 27 China Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 28 china Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 29 china other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 30 China Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 31 China Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 32 China tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 33 China Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 34 China Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 35 India Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 36 India trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 37 India Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 38 India Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 39 India Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 40 India other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 41 India Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 42 India Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 43 India tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 44 India Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 45 India Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 46 Japan Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 47 Japan trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 48 Japan Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 49 Japan Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 50 Japan Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 51 Japan other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 52 Japan Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 53 Japan Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 54 Japan tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 55 Japan Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 56 Japan Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 57 Australia Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 58 Australia trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 59 Australia Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 60 Australia Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 61 Australia Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 62 Australia other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 63 Australia Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 64 Australia Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 65 Australia tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 66 Australia Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 67 Australia Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 68 South Korea Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 69 South Korea trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 70 South Korea Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 71 South Korea Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 72 South Korea Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 73 South Korea other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 74 South Korea Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 75 South Korea Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 76 South Korea tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 77 South Korea Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 78 South Korea Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 79 Singapore Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 80 Singapore trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 81 Singapore Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 82 Singapore Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 83 Singapore Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 84 Singapore other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 85 Singapore Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 86 Singapore Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 87 Singapore tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 88 Singapore Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 89 Singapore Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 90 Malaysia Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 91 Malaysia trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 92 Malaysia Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 93 Malaysia Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 94 Malaysia Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 95 Malaysia other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 96 Malaysia Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 97 Malaysia Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 98 Malaysia tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 99 Malaysia Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 100 Malaysia Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 101 Thailand Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 102 Thailand trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 103 Thailand Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 104 Thailand Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 105 Thailand Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 106 Thailand other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 107 Thailand Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 108 Thailand Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 109 Thailand tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 110 Thailand Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 111 Thailand Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 112 Indonesia Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 113 Indonesia trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 114 Indonesia Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 115 Indonesia Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 116 Indonesia Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 117 Indonesia other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 118 Indonesia Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 119 Indonesia Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 120 Indonesia tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 121 Indonesia Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 122 Indonesia Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 123 Philippines Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 124 Philippines trephine biopsy needles in Needle biopsy Market, By needle type, 2019-2028 (USD Million)

TABLE 125 Philippines Needle biopsy Market, By ergonomics, 2019-2028 (USD Million)

TABLE 126 Philippines Needle biopsy Market, By procedure, 2019-2028 (USD Million)

TABLE 127 Philippines Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 128 Philippines other organs in Needle biopsy Market, By sample site, 2019-2028 (USD Million)

TABLE 129 Philippines Needle biopsy Market, By utility, 2019-2028 (USD Million)

TABLE 130 Philippines Needle biopsy Market, By application, 2019-2028 (USD Million)

TABLE 131 Philippines tumor in Needle biopsy Market, By application, 2019-2028(USD Million)

TABLE 132 Philippines Needle biopsy Market, By End User, 2019-2028 (USD Million)

TABLE 133 Philippines Needle biopsy Market, By distribution channel, 2019-2028 (USD Million)

TABLE 134 rest of asia-pacific Needle biopsy Market, By needle type, 2019-2028 (USD Million)

図表一覧

FIGURE 1 Asia-Pacific needle biopsy market: segmentation

FIGURE 2 Asia-Pacific needle biopsy market: data triangulation

FIGURE 3 ASIA-PACIFIC NEEDLE BIOPSY MARKET: DROC ANALYSIS

FIGURE 4 Asia-Pacific needle biopsy market: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 Asia-Pacific needle biopsy market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Asia-Pacific needle biopsy market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Asia-Pacific needle biopsy market: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC NEEDLE BIOPSY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 Asia-Pacific needle biopsy market: MARKET procedure OVERAGE GRID

FIGURE 10 ASIA-PACIFIC NEEDLE BIOPSY MARKET: SEGMENTATION

FIGURE 11 rising prevalence of breast and lung cancer, INCREASE in demand of minimally invasive surgeries, and presence of healthcare reimbursement is expected to drive the Asia-Pacific needle biopsy market in the forecast period of 2021 to 2028

FIGURE 12 TREPHINE BIOPSY NEEDLE SEGMENT is expected to account for the largest share of the Asia-Pacific needle biopsy market in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPRTUNITIES AND CHALLENGES OF ASIA-PACIFIC NEEDLE BIOPSY MARKET

FIGURE 14 COMPARISON OF PREVALENCE OF BREAST CANCER IN EUROPE, INDIA AND IN THE U.S.

FIGURE 15 PREVALENCE OF LUNG CANCER IN VARIOUS COUNTRIES, WITH HUNGARY BEING THE HIGHEST PREVALENCE RATE IN WOMEN AND MEN

FIGURE 16 Asia-Pacific needle biopsy market: By needle type, 2020

FIGURE 17 Asia-Pacific needle biopsy market: By needle type, 2021-2028 (USD million)

FIGURE 18 Asia-Pacific needle biopsy market: By needle type, CAGR (2021-2028)

FIGURE 19 Asia-Pacific needle biopsy market: By needle type, LIFELINE CURVE

FIGURE 20 Asia-Pacific needle biopsy market: By ERGONOMICS, 2020

FIGURE 21 Asia-Pacific needle biopsy market: By ERGONOMICS, 2021-2028 (USD million)

FIGURE 22 Asia-Pacific needle biopsy market: By ERGONOMICS, CAGR (2021-2028)

FIGURE 23 Asia-Pacific needle biopsy market: By ERGONOMICS, LIFELINE CURVE

FIGURE 24 Asia-Pacific needle biopsy market: By procedure, 2020

FIGURE 25 Asia-Pacific needle biopsy market: By procedure, 2021-2028 (USD million)

FIGURE 26 Asia-Pacific needle biopsy market: By procedure, CAGR (2021-2028)

FIGURE 27 Asia-Pacific needle biopsy market: By procedure, LIFELINE CURVE

FIGURE 28 Asia-Pacific needle biopsy market: By sample site, 2020

FIGURE 29 Asia-Pacific needle biopsy market: By sample site, 2021-2028 (USD million)

FIGURE 30 Asia-Pacific needle biopsy market: By sample site, CAGR (2021-2028)

FIGURE 31 Asia-Pacific needle biopsy market: By sample site, LIFELINE CURVE

FIGURE 32 Asia-Pacific needle biopsy market: By utility, 2020

FIGURE 33 Asia-Pacific needle biopsy market: By utility, 2021-2028 (USD million)

FIGURE 34 Asia-Pacific needle biopsy market: By utility, CAGR (2021-2028)

FIGURE 35 Asia-Pacific needle biopsy market: By utility, LIFELINE CURVE

FIGURE 36 Asia-Pacific needle biopsy market: By application, 2020

FIGURE 37 Asia-Pacific needle biopsy market: By application, 2021-2028 (USD million)

FIGURE 38 Asia-Pacific needle biopsy market: By application, CAGR (2021-2028)

FIGURE 39 Asia-Pacific needle biopsy market: By application, LIFELINE CURVE

FIGURE 40 Asia-Pacific needle biopsy market: By end user, 2020

FIGURE 41 Asia-Pacific needle biopsy market: By end user, 2021-2028 (USD million)

FIGURE 42 Asia-Pacific needle biopsy market: By end user, CAGR (2021-2028)

FIGURE 43 Asia-Pacific needle biopsy market: By end user, LIFELINE CURVE

FIGURE 44 Asia-Pacific needle biopsy market: By distribution channel, 2020

FIGURE 45 Asia-Pacific needle biopsy market: By distribution channel, 2021-2028 (USD million)

FIGURE 46 Asia-Pacific needle biopsy market: By distribution channel, CAGR (2021-2028)

FIGURE 47 Asia-Pacific needle biopsy market: By distribution channel, LIFELINE CURVE

FIGURE 48 Asia-Pacific needle biopsy MARKET: SNAPSHOT (2020)

FIGURE 49 Asia-Pacific needle biopsy MARKET: BY COUNTRY (2020)

FIGURE 50 Asia-Pacific needle biopsy MARKET: BY COUNTRY (2021 & 2028)

FIGURE 51 Asia-Pacific needle biopsy MARKET: BY COUNTRY (2020 & 2028)

FIGURE 52 Asia-Pacific needle biopsy MARKET: BY needle type (2021-2028)

FIGURE 53 Asia-Pacific needle biopsy market: company share 2020 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。