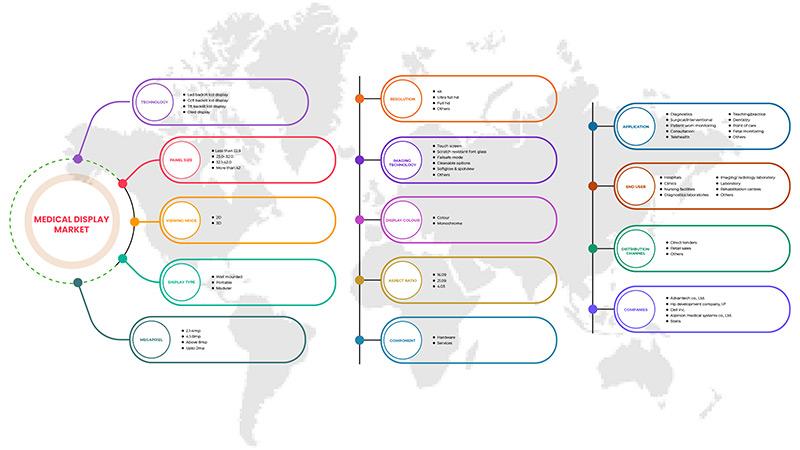

アジア太平洋地域の医療用ディスプレイ市場、技術別(LEDバックライトLCDディスプレイ、CCFLバックライトLCDディスプレイ、TFT LCDディスプレイ、OLEDディスプレイ)、パネルサイズ(22.9インチ未満のパネル、23.0~32.0インチのパネル、27.0~41.9インチのパネル、42インチ以上のパネル)、表示モード(2Dおよび3D)、メガピクセル(最大2MP、2.1~4MP、4.1~8MP、8MP以上)、解像度(4K、ウルトラフルHD、フルHDなど)、ディスプレイタイプ(壁掛け、ポータブル、モジュラー)、イメージング技術(タッチスクリーン、傷に強いフォントガラス、フェイルセーフモード、洗浄可能なオプション、ソフトグローおよびスポットビューなど)、ディスプレイカラー(カラー、モノクロ)、アスペクト比(16.09、21.09、4.03)、コンポーネント(ハードウェアおよびサービス)、アプリケーション(相談、診断、外科/介入、遠隔医療、教育/診療、胎児モニタリング、歯科、ポイントオブケア、患者装着型モニタリングなど) エンドユーザー (病院、診療所、介護施設、診断研究所、画像/放射線研究所、研究所、リハビリテーションセンターなど)、流通チャネル (直接入札、小売販売など) - 2029 年までの業界動向と予測。

アジア太平洋地域の医療用ディスプレイ市場の分析と洞察

医療用ディスプレイ市場の成長の主な理由は、術後の痛みの軽減、手術および術後の重大な合併症の減少、入院期間の短縮、回復時間の短縮、瘢痕の減少、免疫システムへのストレスの軽減、切開の小ささなど、さまざまな利点による低侵襲治療 (MIT) の需要の高まりです。また、一部の手術では手術時間の短縮とコストの削減も実現しています。

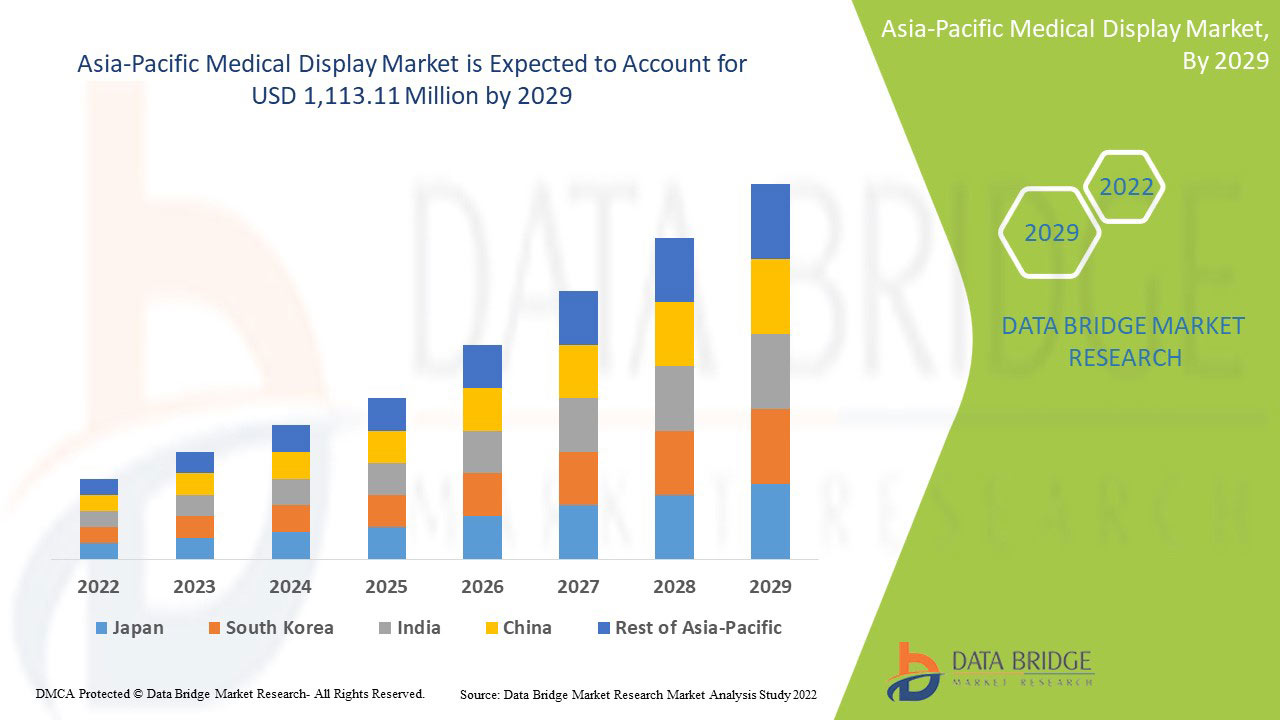

Data Bridge Market Research の分析によると、医療用ディスプレイ市場は、予測期間中に 6.2% の CAGR で成長し、2029 年までに 11 億 1,311 万米ドルに達すると予想されています。高度な医療用ディスプレイと画像サービスに対する世界的な需要の高まりにより、テクノロジーが市場で最大のセグメントを占めています。この市場レポートでは、価格分析、特許分析、技術の進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

テクノロジー別 (LED バックライト LCD ディスプレイ、CCFL バックライト LCD ディスプレイ、TFT LCD ディスプレイ、OLED ディスプレイ)、パネル サイズ別 (22.9 インチ未満のパネル、23.0 ~ 32.0 インチのパネル、27.0 ~ 41.9 インチのパネル、42 インチ以上のパネル)、表示モード別 (2D および3D )、メガピクセル別 (最大 2MP、2.1 ~ 4MP、4.1 ~ 8MP、8MP 以上)、解像度別 (4K、ウルトラ フル HD、フル HD など)、ディスプレイ タイプ別 (壁掛け、ポータブル、モジュラー)、イメージング テクノロジー別 (タッチ スクリーン、傷に強いフォント ガラス、フェイルセーフ モード、クリーニング可能なオプション、ソフトグローおよびスポットビューなど)、ディスプレイ カラー別 (カラー、モノクロ)、アスペクト比別 (16.09、21.09、4.03)、コンポーネント別 (ハードウェアおよびサービス)、アプリケーション別 (相談、診断、外科/介入、遠隔医療、教育/診療、胎児モニタリング、歯科、ポイントオブケア、患者装着型モニタリングなど)、エンドユーザー(病院、診療所、介護施設、診断ラボ、画像/放射線ラボ、研究所、リハビリテーションセンターなど)、流通チャネル(直接入札、小売販売など) |

|

対象国 |

中国、日本、インド、オーストラリア、韓国、シンガポール、タイ、マレーシア、インドネシア、フィリピン、その他のアジア太平洋諸国 |

|

対象となる市場プレーヤー |

BenQ、ALPINION MEDICAL SYSTEMS Co., Ltd、Nanjing Jusha Commercial &Trading Co,Ltd、COJE CO.,LTD.、Axiomtek Co., Ltd.、Dell Inc.、HP Development Company, LP、Reshin、Onyx Healthcare Inc.、Teguar Computers.、Shenzhen Beacon Display Technology Co., Ltd.、Rein Medical、STERIS.、Barco.、Hisense.、Sony Corporation、Advantech Co., Ltd.、LG Electronics.、Sharp NEC Display Solutions、Koninklijke Philips NV、EIZO INC.、Novanta Inc.、FSN Medical Technologies.、Quest、Ampronix.、Siemens Healthcare GmbH、Panasonic Corporation など。 |

医療用ディスプレイ市場の定義

医療用ディスプレイは、医療用画像処理の高度な要求を満たすモニターです。通常、特別な画像強化技術が採用されており、ディスプレイの寿命全体にわたって一貫した明るさ、ノイズのない画像、人間工学に基づいた読み取り、医療におけるデジタル画像および通信 (DICOM) やその他の医療規格への自動準拠が保証されます。

医療用画像技術の発展により、強力な診断ツールが提供され、外傷や内部の問題を非侵襲的に評価できるようになり、かつてないほど早期に病気を検出できるようになり、ヘルスケアが進歩しました。医療用画像には、一般向けディスプレイよりも医療用ディスプレイが好まれます。その理由は単純です。医療用ディスプレイは、画質、医療規制、品質保証に関する規定の要件を満たしているからです。

医療用ディスプレイ機器の将来は、人工知能 (AI) とデータ分析の発展にかかっています。医療機器は、医師がこれまでにないほど医療をパーソナライズできるようにすることで、疾病管理を進化させています。これらのテクノロジーは、個々の患者に関する驚くべき洞察をリアルタイムで提供します。

Medical Display Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- The Growing Trend Towards Minimally Invasive Treatment

The main reasons for the growth of the Asia-Pacific medical display market is the rising demand for minimally invasive treatments (MIT) due to multiple benefits such as less post-operative pain, fewer operative, and major post-operative complications, shortened hospital stay, faster recovery times, less scarring, less stress on the immune system, smaller incision, and for some procedures it reduced operating time and reduced costs as well.

Minimal invasive surgery is an excellent approach for diagnosing and treating a wide range of thoracic disorders that previously required sternotomy or open thoracotomy. The prevalence of chronic diseases requiring surgery has increased worldwide. Due to the many advantages of minimally invasive treatment, many patients prefer it. In addition, vascular and endovascular surgeries, neurological and spinal surgeries, orthopedic trauma care, and cardiac surgeries are performed in hybrid operating rooms. This feature allows hospitals to perform advanced surgical operations, which increases the demand for medical displays. In addition, increasing healthcare costs and the number of pathology and radiology laboratories drive the demand for medical monitors.

Minimally invasive surgery allows surgeons to use modern technology and advanced surgical techniques to operate on the human body in a less harmful way. This is expected to boost the demand for minimally invasive surgeries.

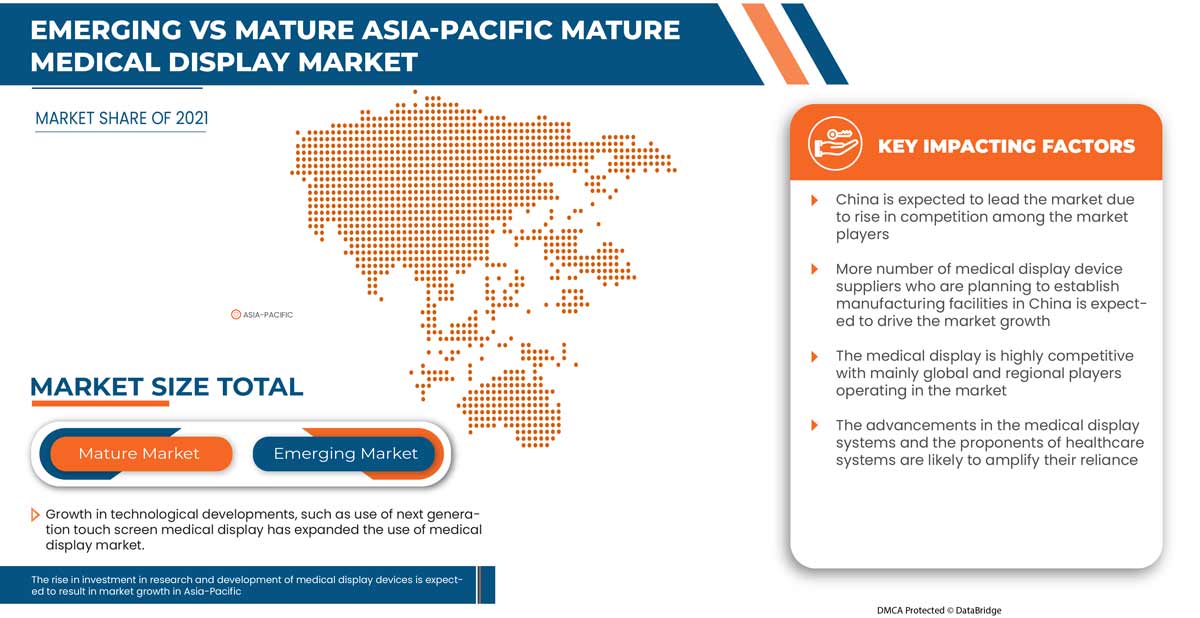

- Growing Healthcare Infrastructure

Governments and non-profit organizations in several countries mainly focus on developing health infrastructure to minimize disease burden and provide better health services. In addition, the adoption of technologically advanced medical devices, screens, monitors, and various other devices has increased. All such factors are likely to create favorable opportunities for market growth during the forecast period. In addition, heavy investments by key players in innovative product launches and updated features in the coming years can also boost the market.

Moreover, the increasing demand for cost-effective healthcare services, increasing demand for technical solutions, increasing high mobility of information, increasing government initiatives and incentives, and increasing funding for high-quality medical displays in hospitals and research centers are expected to drive these healthcare facilities in the market. Medical software infrastructure has formed the basis for recent advances in medical displays, digital medical libraries, and management information systems. These factors are expected to drive the growth of the Asia-Pacific medical display market.

Opportunity

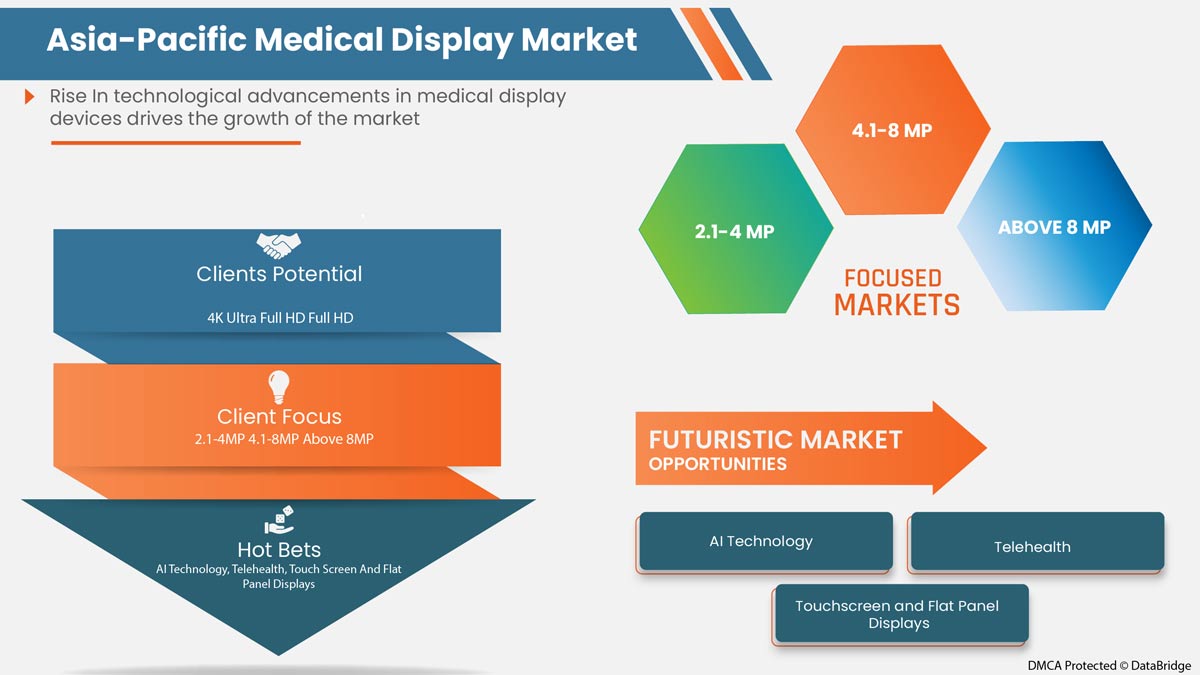

- Technological Advancements In Medical Display Instruments

As the market-focus drive toward the production of orally deliverable dosage forms, there is a constant struggle to develop appropriate formulations of new molecules that allow oral administration and, simultaneously, ensure the drug has optimal bioavailability in patients. To overcome this, pharmaceutical excipient manufacturers are developing easier products and reducing development time and cost. The development of medical display technologies has changed the healthcare industry, providing diagnostic tools, telehealth, providing support for non-invasive treatment, allowing diseases to be assessed and allowing the diseases to be detected earlier.

The launch of technological developments in medical display devices is enhancing the efficiency of the medical display and increasing the ease of using medical display devices. The surge in technological applications in medical display devices would result in less workforce and swift diagnosis and recovery of diseases. In the future, artificial intelligence technology will replace the medical display market. This factor is expected to act as an opportunity for Asia-Pacific medical display market growth in the forecast period.

Restraint/Challenges

- High Costs Of Medical Display Devices

The high cost of display devices and the high implementation is the major factor restraining market growth, specifically in countries where the reimbursement scenario is poor. Most healthcare facilities in developing countries, such as hospitals and diagnostic centers, cannot afford these devices due to the high installation and maintenance costs and due to the high cost of these medical equipment’s and low financial resources, healthcare facilities in emerging countries are reluctant to invest in new technologically advanced systems. These factors can hamper the digitalization in healthcare facilities and impact the adoption of advanced technologies for diagnosis and analysis.

The advancement in technology leading to the development of advanced and innovative display devices escalates the cost of the devices. Thus, the high cost of display devices is expected to restrain the market's growth.

Recent Developments

- In June 2022, EIZO Corporation launched RadiForce MX243W – a 24.1-inch 2.3 megapixel (1920 x 1200 pixels) monitor. The 24.1-inch 2.3 megapixels (1920 x 1200 pixels) monitor has been designed for careful monitoring and diagnosis of complete physiology of patient system in clinics and hospitals. The launch resulted in the addition of a new medical device to the portfolio and offered exceptional market purity

- In May 2021, Barco launched the Nio Fusion 12MP medical display. The product launch resulted in an enhanced product portfolio and a rise in sales and expansion of medical display product line across North America and Europe

Asia-Pacific Medical Display Market Scope

Asia-Pacific medical display market is categorized into thirteen notable segments which are based on technology, panel size, viewing mode, megapixel, resolution, display type, imaging technology, display color, aspect ratio, component, application, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY TECHNOLOGY

- LED-BACKLIT LCD DISPLAY

- CCFL-BACKLIT LCD DISPLAY

- TFT LCD DISPLAY

- OLED DISPLAY

On the basis of technology, the medical display market is segmented into LED-backlit LCD display, CCFL-backlit LCD display, TFT LCD display and OLED display.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY PANEL SIZE

- UNDER 22.9 INCH PANELS

- 23.0-26.9 INCH PANELS

- 27.0-41.9 INCH PANELS

- ABOVE 42 INCH PANELS

On the basis of panel size, the medical display market is segmented into under 22.9" inch panels, 23.0"- 32.0" inch panels, 27.0-41.9 inch panels and above 42 inch panels.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY VIEWING MODE

- 2D

- 3D

On the basis of viewing mode, the medical display market is segmented into 2D and 3D.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY MEGAPIXEL

- UP TO 2MP

- 2.1–4MP

- 4.1–8MP

- ABOVE 8MP

On the basis of megapixel, the medical display market is segmented into UP TO 2MP, 2.1–4MP, 4.1–8MP and above 8MP.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY RESOLUTION

- FULL HD

- ULTRA FULL HD

- 4K

- OTHERS

On the basis of resolution, the medical display market is segmented into full HD, ultra-full HD, 4K, and others.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY TYPE

- WALL MOUNTED

- PORTABLE

- MODULAR

On the basis of display type, the medical display market is segmented into wall mounted, portable and modular.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY

- TOUCH SCREEN

- SCRATCH RESISTANT FONT GLASS

- FAILSAFE MODE

- CLEANABLE OPTIONS

- SOFTGLOW & SPOTVIEW

- OTHERS

On the basis of imaging technology, the medical display market is segmented into touch screen, scratch resistant font glass, failsafe mode, cleanable options, softglow & spotview and others.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY COLOR

- COLOR

- MONOCHROME

On the basis of display color, the medical display market is segmented into color and monochrome.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY ASPECT RATIO

- 16:09

- 21:09

- 4:03

On the basis of aspect ratio, the medical display market is segmented into 16:09, 21:09 and 4:03.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY COMPONENT

- HARDWARE

- SERVICES

On the basis of component, the medical display market is segmented into hardware and services.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY APPLICATION

- DIAGNOSTICS

- SURGICAL/INTERVENTIONAL

- PATIENT WORN MONITORING

- CONSULTATION

- TELEHEALTH

- TEACHING/PRACTICE

- DENTISTRY

- POINT OF CARE

- FETAL MONITORING

- OTHERS

On the basis of application, the medical display market is segmented into consultation, diagnostic, surgical/interventional, telehealth, teaching / practice, fetal monitoring, dentistry, point of care, patient-worn monitoring and others.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY END USER

- HOSPITALS

- BY TECHNOLOGY

- CLINICS

- NURSING FACILITIES

- DIAGNOSTIC LABORATORIES

- IMAGING/RADIOLOGY LAB

- LABORATORY

- REHABILITATION CENTERS

- OTHERS

On the basis of end user, the medical display market is segmented into hospitals, clinics, nursing facilities, diagnostic laboratories, imaging/radiology lab, laboratory, rehabilitation centers and others.

ASIA-PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the medical display market is segmented into direct tender, retail sales and others.

Medical Display Market Regional Analysis/Insights

The medical display market is analyzed and market size information is provided technology, panel size, viewing mode, megapixel, resolution, display type, imaging technology, display color, aspect ratio, component, application, end user and distribution channel.

The countries covered in this market report are China, Japan, India, Australia, South Korea, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific.

China dominates the Asia-Pacific region due to rapidly growing healthcare market coupled with rise in medical display production.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Medical Display Market Share Analysis

The medical display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the medical display market.

市場で活動している主要企業には、BenQ、ALPINION MEDICAL SYSTEMS Co., Ltd、Nanjing Jusha Commercial &Trading Co,Ltd、COJE CO.,LTD.、Axiomtek Co., Ltd.、Dell Inc.、HP Development Company, LP、Reshin、Onyx Healthcare Inc.、Teguar Computers.、Shenzhen Beacon Display Technology Co., Ltd.、Rein Medical、STERIS.、Barco.、Hisense.、Sony Corporation、Advantech Co., Ltd.、LG Electronics.、Sharp NEC Display Solutions、Koninklijke Philips NV、EIZO INC.、Novanta Inc.、FSN Medical Technologies.、Quest、Ampronix.、Siemens Healthcare GmbH、Panasonic Corporation などがあります。

調査方法: 医療用ディスプレイ市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、アジア太平洋と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MEDICAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGYLIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 TECHNOLOGICAL LANDSCAPE IN THE ASIA PACIFIC MEDICAL DISPLAY MARKET

3.3.1 ORGANIC LIGHT EMITTING DIODE (OLED)

3.3.2 LIGHT EMITTING DIODE (LED), TECHNOLOGY

3.3.3 LIQUID CRYSTAL DISPLAY (LCD)

4 VALUE CHAIN ANALYSIS: ASIA PACIFIC MEDICAL DISPLAY MARKET

5 ASIA PACIFIC MEDICAL DISPLAY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING TREND TOWARDS MINIMALLY INVASIVE TREATMENT

6.1.2 GROWING HEALTHCARE INFRASTRUCTURE

6.1.3 SURGE IN THE NUMBER OF DIAGNOSTIC IMAGING CENTERS

6.2 RESTRAINTS

6.2.1 INCREASE IN USE OF REFURBISHED MEDICAL DISPLAYS

6.2.2 MEDICAL COMMUNITY HAS ATTEMPTED TO TAKE ADVANTAGE

6.2.3 HIGH COSTS OF MEDICAL DISPLAY DEVICES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DISPLAY INSTRUMENTS

6.3.3 RISING DISPOSABLE INCOME

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 STRINGENT REGULATIONS

7 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LED BACKLIT LCD DISPLAY

7.3 CCFL BACKLIT LCD DISPLAY

7.4 TFT BACKLIT LCD DISPLAY

7.5 OLED DISPLAY

7.5.1 AMOLED

7.5.2 PMOLED

8 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 LESS THAN 22.9

8.2.1 LED BACKLIT LCD DISPLAY

8.2.2 CCFL BACKLIT LCD DISPLAY

8.2.3 TFT BACKLIT LCD DISPLAY

8.2.4 OLED DISPLAY

8.3 23.0- 32.0

8.3.1 LED BACKLIT LCD DISPLAY

8.3.2 CCFL BACKLIT LCD DISPLAY

8.3.3 TFT BACKLIT LCD DISPLAY

8.3.4 OLED DISPLAY

8.4 32.1-42.0

8.4.1 LED BACKLIT LCD DISPLAY

8.4.2 CCFL BACKLIT LCD DISPLAY

8.4.3 TFT BACKLIT LCD DISPLAY

8.4.4 OLED DISPLAY

8.5 MORE THAN 42

8.5.1 LED BACKLIT LCD DISPLAY

8.5.2 CCFL BACKLIT LCD DISPLAY

8.5.3 TFT BACKLIT LCD DISPLAY

8.5.4 OLED DISPLAY

9 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY VIEWING MODE

9.1 OVERVIEW

9.2 2D

9.3 3D

10 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY MEGAPIXEL

10.1 OVERVIEW

10.2 2.1-4MP

10.3 4.1-8MP

10.4 ABOVE 8MP

10.5 UPTO 2MP

11 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY RESOLUTION

11.1 OVERVIEW

11.2 4K

11.3 ULTRA FULL HD

11.4 FULL HD

11.5 OTHERS

12 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY TYPE

12.1 OVERVIEW

12.2 WALL MOUNTED

12.3 PORTABLE

12.4 MODULAR

13 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY COLOR

13.1 OVERVIEW

13.2 COLOR

13.2.1 LED BACKLIT LCD DISPLAY

13.2.2 CCFL BACKLIT LCD DISPLAY

13.2.3 TFT BACKLIT LCD DISPLAY

13.2.4 OLED DISPLAY

13.3 MONOCHROME

13.3.1 LED BACKLIT LCD DISPLAY

13.3.2 CCFL BACKLIT LCD DISPLAY

13.3.3 TFT BACKLIT LCD DISPLAY

13.3.4 OLED DISPLAY

14 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY COMPONENT

14.1 OVERVIEW

14.2 HARDWARE

14.2.1 ACCESSORIES

14.2.2 SENSORS

14.2.3 PANELS

14.2.4 OTHERS

14.3 SERVICES

14.3.1 CONSULTING

14.3.2 INSTALLATION

14.3.3 AFTER-SALE SERVICES

15 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 DIAGNOSTICS

15.2.1 BY TYPE

15.2.1.1 GENERAL RADIOLOGY

15.2.1.2 MAMMOGRAPHY

15.2.1.3 DIGITAL PATHOLOGY

15.2.1.4 MULTI-MODALITY

15.2.2 BY PANEL SIZE

15.2.2.1 LESS THAN 22.9

15.2.2.2 23.0- 32.0

15.2.2.3 32.1-42.0

15.2.2.4 MORE THAN 42

15.3 SURGICAL/INTERVENTIONAL

15.3.1 BY TYPE

15.3.1.1 CARDIOVASCULAR

15.3.1.2 ONCOLOGY

15.3.1.3 NEUROLOGY

15.3.1.4 OPHTHALMOLOGY

15.3.1.5 OTHERS

15.3.2 BY PANEL SIZE

15.3.2.1 LESS THAN 22.9

15.3.2.2 23.0- 32.0

15.3.2.3 32.1-42.0

15.3.2.4 MORE THAN 42

15.4 PATIENT WORN MONITORING

15.5 CONSULTATION

15.6 TELEHEALTH

15.6.1 BY PANEL SIZE

15.6.1.1 LESS THAN 22.9

15.6.1.2 23.0- 32.0

15.6.1.3 32.1-42.0

15.6.1.4 MORE THAN 42

15.7 TEACHING/PRACTICE

15.7.1 BY PANEL SIZE

15.7.1.1 LESS THAN 22.9

15.7.1.2 23.0- 32.0

15.7.1.3 32.1-42.0

15.7.1.4 MORE THAN 42

15.8 DENTISTRY

15.8.1 BY PANEL SIZE

15.8.1.1 LESS THAN 22.9

15.8.1.2 23.0- 32.0

15.8.1.3 32.1-42.0

15.8.1.4 MORE THAN 42

15.9 POINT OF CARE

15.9.1 BY PANEL SIZE

15.9.1.1 LESS THAN 22.9

15.9.1.2 23.0- 32.0

15.9.1.3 32.1-42.0

15.9.1.4 MORE THAN 42

15.1 FETAL MONITORING

15.10.1 BY PANEL SIZE

15.10.1.1 LESS THAN 22.9

15.10.1.2 23.0- 32.0

15.10.1.3 32.1-42.0

15.10.1.4 MORE THAN 42

15.11 OTHERS

16 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 BY AREA

16.2.1.1 OPERATING ROOM

16.2.1.2 SURGERY UNIT

16.2.1.3 OTHERS

16.2.2 BY TECHNOLOGY

16.2.2.1 LED BACKLIT LCD DISPLAY

16.2.2.2 CCFL BACKLIT LCD DISPLAY

16.2.2.3 TFT BACKLIT LCD DISPLAY

16.2.2.4 OLED DISPLAY

16.2.3 CLINICS

16.2.3.1 LED BACKLIT LCD DISPLAY

16.2.3.2 CCFL BACKLIT LCD DISPLAY

16.2.3.3 TFT BACKLIT LCD DISPLAY

16.2.3.4 OLED DISPLAY

16.2.4 NURSING FACILITIES

16.2.4.1 LED BACKLIT LCD DISPLAY

16.2.4.2 CCFL BACKLIT LCD DISPLAY

16.2.4.3 TFT BACKLIT LCD DISPLAY

16.2.4.4 OLED DISPLAY

16.2.5 DIAGNOSTIC LABORATORIES

16.2.5.1 LED BACKLIT LCD DISPLAY

16.2.5.2 CCFL BACKLIT LCD DISPLAY

16.2.5.3 TFT BACKLIT LCD DISPLAY

16.2.5.4 OLED DISPLAY

16.3 IMAGING/ RADIOLOGY LABORATORY

16.3.1 LABORATORY

16.3.1.1 LED BACKLIT LCD DISPLAY

16.3.1.2 CCFL BACKLIT LCD DISPLAY

16.3.1.3 TFT BACKLIT LCD DISPLAY

16.3.1.4 OLED DISPLAY

16.3.2 REHABILITATION CENTERS

16.3.2.1 LED BACKLIT LCD DISPLAY

16.3.2.2 CCFL BACKLIT LCD DISPLAY

16.3.2.3 TFT BACKLIT LCD DISPLAY

16.3.2.4 OLED DISPLAY

16.4 OTHERS

17 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY

17.1 OVERVIEW

17.2 TOUCH SCREEN

17.3 SCRATCH RESISTANT FONT GLASS

17.4 FAILSAFE MODE

17.5 CLEANABLE OPTIONS

17.6 SOFTGLOW & SPOTVIEW

17.7 OTHERS

18 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY ASPECT RATIO

18.1 OVERVIEW

18.2 12/30/1899 4:09:00 PM

18.3 12/30/1899 9:09:00 PM

18.4 12/30/1899 4:03:00 AM

19 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDERS

19.3 RETAIL SALES

19.4 OTHERS

20 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY GEOGRAPHY

20.1 ASIA-PACIFIC

20.1.1 CHINA

20.1.2 JAPAN

20.1.3 SOUTH KOREA

20.1.4 INDIA

20.1.5 AUSTRALIA

20.1.6 SINGAPORE

20.1.7 THAILAND

20.1.8 MALAYSIA

20.1.9 INDONESIA

20.1.10 PHILIPPINES

20.1.11 REST OF ASIA-PACIFIC

21 ASIA PACIFIC MEDICAL DISPLAY MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 ADVANTECH CO., LTD

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 COMPANY SHARE ANALYSIS

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 HP DEVELOPMENT COMPANY, L.P

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 COMPANY SHARE ANALYSIS

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENT

23.3 DELL INC.

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 COMPANY SHARE ANALYSIS

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 ALPINION MEDICAL SYSTEMS CO., LTD

23.4.1 COMPANY SNAPSHOT

23.4.2 COMPANY SHARE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 STERIS

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 COMPANY SHARE ANALYSIS

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENT

23.6 AMPRONIX

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENT

23.7 AXIOMTEK CO., LTD.

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 BARCO

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 BENQ

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENTS

23.1 COJE CO., LTD.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENTS

23.11 EIZO INC (2021)

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENT

23.12 FSN MEDICAL TECHNOLOGIES.

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 HISENSE MEDICAL EQUIPMENT CO, LTD (A SUBSIDIARY OF HISENSE GROUP)

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENT

23.14 KONINKLIJKE PHILIPS N.V.( 2021)

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENT

23.15 LG DISPLAY CO., LTD.

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENT

23.16 NANJING JUSHA COMMERCIAL &TRADING CO,LTD

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 NOVANTA INC. (2021)

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 ONYX HEALTHCARE INC. (SUBSIDIARY OF AAEON TECHNOLOGY INC.)

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 PANASONIC HOLDINGS CORPORATION

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 RECENT DEVELOPMENT

23.2 QUEST MEDICAL, INC. (A SUBSIDIARY OF ATRION CORPORATION)

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 REIN MEDICAL GMBH

23.21.1 COMPANY SNAPSHOT

23.21.2 PRODUCT PORTFOLIO

23.21.3 RECENT DEVELOPMENTS

23.22 SHARP NEC DISPLAY SOLUTIONS ( 2021)

23.22.1 COMPANY SNAPSHOT

23.22.2 PRODUCT PORTFOLIO

23.22.3 RECENT DEVELOPMENTS

23.23 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

23.23.1 COMPANY SNAPSHOT

23.23.2 PRODUCT PORTFOLIO

23.23.3 RECENT DEVELOPMENT

23.24 SHENZHEN JLD DISPLAY EXPERT CO., LTD

23.24.1 COMPANY SNAPSHOT

23.24.2 PRODUCT PORTFOLIO

23.24.3 RECENT DEVELOPMENTS

23.25 SIEMENS HEALTHCARE GMBH

23.25.1 COMPANY SNAPSHOT

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENT

23.26 SONY GROUP CORPORATION

23.26.1 COMPANY SNAPSHOT

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENT

23.27 TEGUAR COMPUTERS

23.27.1 COMPANY SNAPSHOT

23.27.2 PRODUCT PORTFOLIO

23.27.3 RECENT DEVELOPMENTS

24 QUESTIONNAIRE

25 RELATED REPORTS

表のリスト

TABLE 1 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC LED BACKLIT LCD DISPLAY MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC CCFL BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC TFT BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC OLED DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC OLED DISPLAY TYPE IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC 32.1-42.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC 32.1-40.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY VIEWING MODE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC 2D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC 3D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY MEGAPIXEL, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC 2.1-4MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC 4.1-8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC ABOVE 8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC UPTO 2MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY RESOLUTION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC 4K IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ULTRA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC WALL MOUNTED IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PORTABLE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC MODULAR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISPLAY COLOR, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC COLOR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC COLOR IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC MONOCHROME IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC MONOCHROME IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC HARDWARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC HARDWARE IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC SERVICES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC SERVICES IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC PATIENT WORN MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC CONSULTATION IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC TELEHEALTH IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC TELEHEALTH IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC DENTISTRY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC DENTISTRY IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC POINT OF CARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC POINT OF CARE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC HOSPITALS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC HOSPITALS IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC BY AREA IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC BY TECHNOLOGY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC CLINICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC CLINICS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC IMAGING/ RADIOLOGY LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC LABORATORY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 ASIA PACIFIC REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 ASIA PACIFIC REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 ASIA PACIFIC TOUCH SCREEN IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 ASIA PACIFIC SCRATCH RESISTANT FONT GLASS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 ASIA PACIFIC FAILSAFE MODE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 ASIA PACIFIC CLEANABLE OPTIONS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 ASIA PACIFIC SOFTGLOW & SPOTVIEW IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 89 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY ASPECT RATIO, 2020-2029 (USD MILLION)

TABLE 90 ASIA PACIFIC 16:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 91 ASIA PACIFIC 21:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 ASIA PACIFIC 4:03 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 93 ASIA PACIFIC MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 ASIA PACIFIC DIRECT TENDERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 95 ASIA PACIFIC RETAIL SALES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 ASIA PACIFIC OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC MEDICAL DISPLAYMARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MEDICAL DISPLAYMARKET : DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MEDICAL DISPLAYMARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MEDICAL DISPLAYMARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MEDICAL DISPLAYMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MEDICAL DISPLAYMARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA PACIFIC MEDICAL DISPLAYMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA PACIFIC MEDICAL DISPLAYMARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC MEDICAL DISPLAYMARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC MEDICAL DISPLAYMARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC MEDICAL DISPLAY MARKET: SEGMENTATION

FIGURE 12 RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS IN MEDICAL DISPLAYIS DRIVING THE ASIA PACIFIC MEDICAL DISPLAYMARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 TECHNOLOGYSEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MEDICAL DISPLAYMARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC MEDICAL DISPLAY MARKET

FIGURE 15 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2021

FIGURE 16 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2021

FIGURE 20 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY PANEL SIZE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2021

FIGURE 24 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY VIEWING MODE, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2021

FIGURE 28 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY MEGAPIXEL, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, 2021

FIGURE 32 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY RESOLUTION, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2021

FIGURE 36 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, LIFELINE CURVE

FIGURE 39 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2021

FIGURE 40 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2022-2029 (USD MILLION)

FIGURE 41 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, CAGR (2022-2029)

FIGURE 42 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, LIFELINE CURVE

FIGURE 43 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, 2021

FIGURE 44 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 45 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, CAGR (2022-2029)

FIGURE 46 ASIA PACIFIC MEDICAL DISPLAY MARKET : BY COMPONENT, LIFELINE CURVE

FIGURE 47 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, 2021

FIGURE 48 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 49 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 50 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 51 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, 2021

FIGURE 52 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 53 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 54 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY END USER, LIFELINE CURVE

FIGURE 55 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2021

FIGURE 56 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 57 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, CAGR (2022-2029)

FIGURE 58 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, LIFELINE CURVE

FIGURE 59 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2021

FIGURE 60 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2022-2029 (USD MILLION)

FIGURE 61 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, CAGR (2022-2029)

FIGURE 62 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY ASPECT RATIO, LIFELINE CURVE

FIGURE 63 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 64 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 65 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 66 ASIA PACIFIC MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 67 ASIA-PACIFIC MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 68 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 69 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 70 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 71 ASIA-PACIFIC MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 72 ASIA PACIFIC MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。