アジア太平洋地域の皮革製品市場、皮革の種類別(フルグレインレザー、スプリットグレインレザー、トップグレインレザー、本革、合成皮革、合成皮革)、製品別(履物、ハンドバッグ、アパレル、旅行カバン、財布、ベルトなど)、グレード別(高級・中級)、流通チャネル別(専門店、企業フランチャイズ店、電子商取引、スーパーマーケット/ハイパーマーケットなど)業界動向と2030年までの予測。

アジア太平洋地域の皮革製品市場の分析と洞察

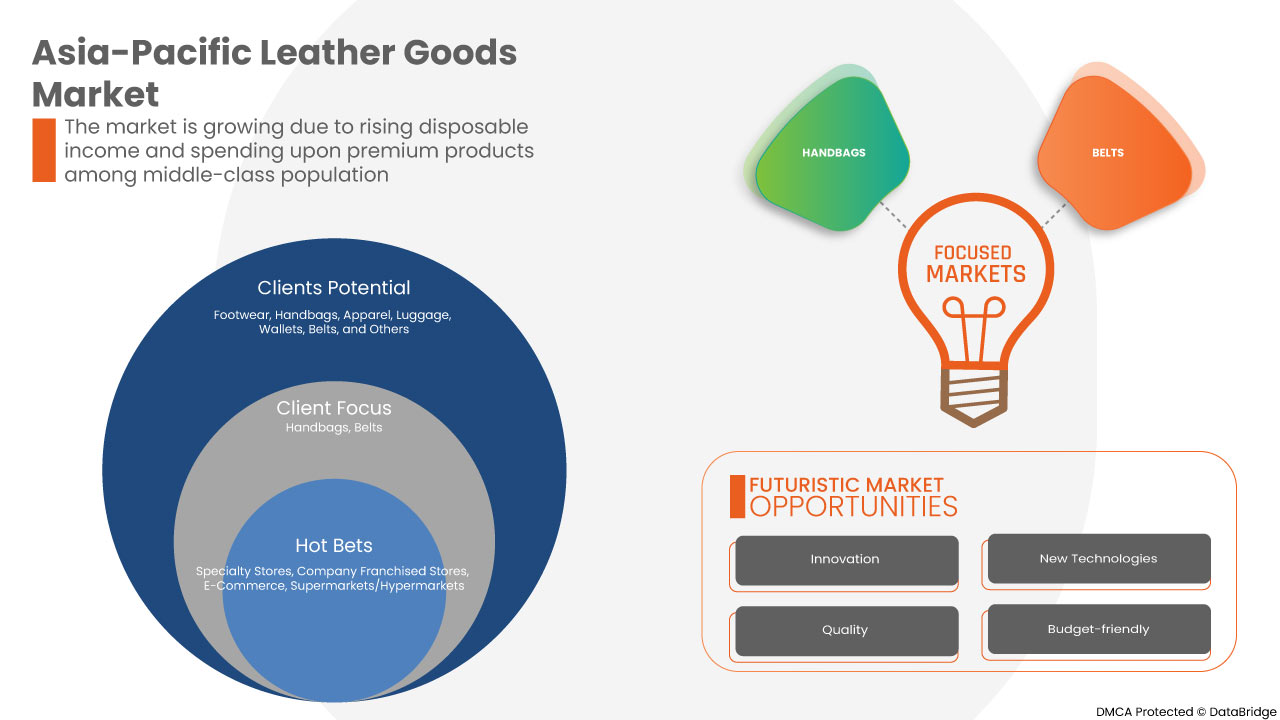

新しい機能やデザインを備えた皮革製品の革新の増加とバイオベースの皮革の導入は、アジア太平洋の皮革製品市場にチャンスをもたらすと予想されています。しかし、皮革製品の製造における非倫理的な慣行の有害な影響、およびスキル、技術、中間投入物、加工設備の不足に関する意識の高まりは、市場の成長を阻むと予測されています。原材料の入手のしやすさ、プラスチック皮革などの合成代替品の入手のしやすさ、および皮革製品の低価格での入手のしやすさは、市場の成長を抑制する要因の一部です。

アジア太平洋地域の皮革製品市場レポートでは、市場シェア、新しい展開、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

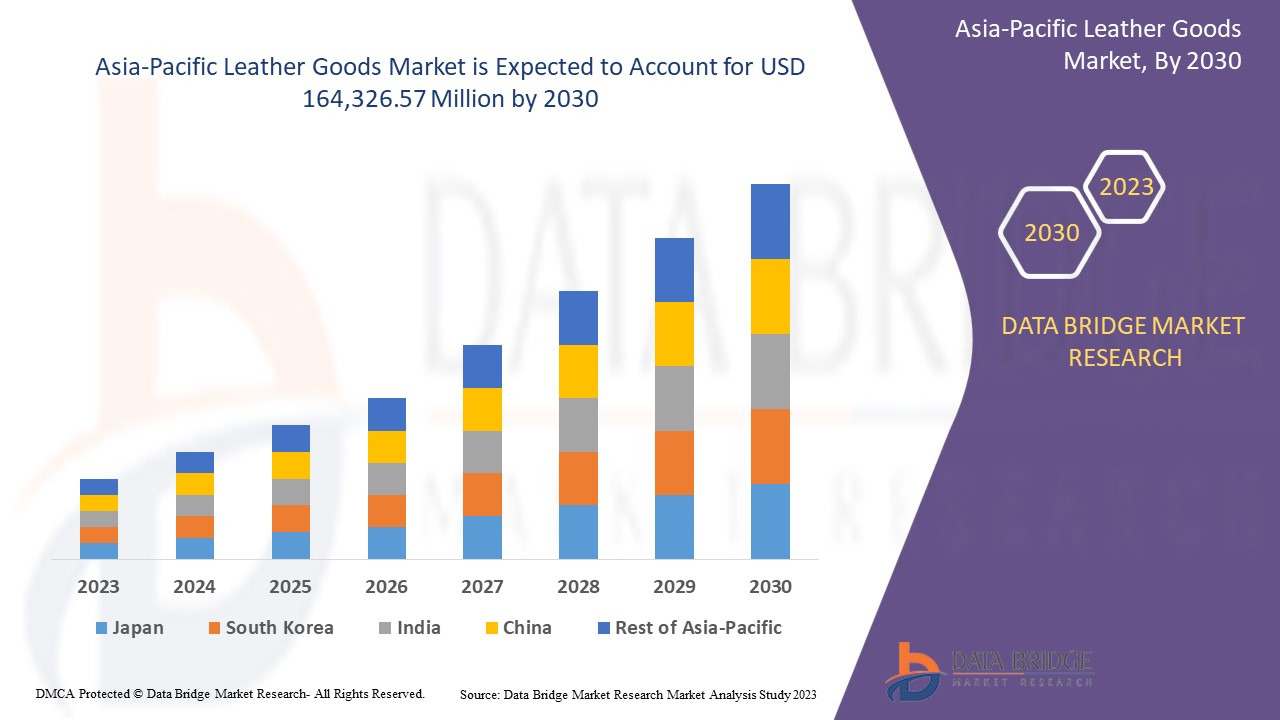

アジア太平洋地域の皮革製品市場は、2023年から2030年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に7.3%のCAGRで成長し、2030年までに164,326.57百万米ドルに達すると分析しています。市場の成長を牽引する主な要因は、急速に拡大しているファッション業界であり、これにより、高品質、プレミアム、高級皮革製品に対する消費者の需要が大幅に増加しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020~2015年にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

革の種類(フルグレインレザー、スプリットグレインレザー、トップグレインレザー、本革、合成皮革、合成皮革)、製品(履物、ハンドバッグ、アパレル、旅行カバン、財布、ベルトなど)、グレード(高級および中級)、流通チャネル(専門店、企業フランチャイズ店、電子商取引、スーパーマーケット/ハイパーマーケットなど)別。 |

|

対象国 |

日本、中国、韓国、インド、シンガポール、タイ、インドネシア、マレーシア、フィリピン、オーストラリア、ニュージーランド、その他のアジア太平洋諸国。 |

|

対象となる市場プレーヤー |

TBL Licensing LLC(VF Corporation の子会社)、CAPRI HOLDINGS LIMITED、Hermès、KERING、PRADA SPA、Kiton、Woodland Leathers、American Leather、Aero Leather Clothing、JOHNSTON & MURPHY(Genesco の子会社)、NAPPA DORI など。 |

市場の定義

皮革製品は、皮革で作られた製品です。衣類、履物、バッグ、手袋など、さまざまな製品があります。防塵性、耐火性、耐久性などの皮革の特性により、皮革製品は他の資源よりも好まれています。衣料品生産における皮革の需要の増加が市場の成長を牽引しています。

アジア太平洋地域の皮革製品市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 高級で高品質な高級皮革製品の需要増加

急速に拡大するファッション業界により、高品質、高級、高級な皮革製品に対する消費者の需要が大幅に増加しました。顧客は美的感覚を重視し、ファッション ステートメントを演出するために高級な製品を求めています。さらに、米国、フランス、中国などの主要市場でデザイナーやブランドの服が人気を集めていることと相まって、富裕層 (HNWI) の数が増え、高級皮革製品の需要が高まっています。皮革製品は高級で、多くの場合、高額です。

- 低コストで耐久性の高い合成皮革製品

合成皮革はフェイクレザーとも呼ばれ、本革よりも安価で、動物に優しく、事実上すべての色で生産でき、高光沢仕上げを特徴とするように製造でき、湿った布で簡単に掃除でき、メンテナンスがほとんど必要なく、本革ほど簡単には割れず、紫外線による色あせに強く、本革の匂いがないため、予測期間中に需要が見込まれます。フェイクレザーは人工製品であり、非常に耐久性があります。最近では、フェイクレザーは通常、本革よりも丈夫です。市場では、合皮、ナウガハイド、ビーガンレザー、樹皮布、コルク、艶出し綿、リサイクルPETポリエステルなどの人工皮革が販売されています。合皮は、人工皮革の衣類を作るのによく使用されます。プラスチックで作られており、本革よりも安価で軽量です。合皮で作られた製品は、さまざまな色で入手できます。革に使用されるもう1つの素材は、動物の皮膚に似たナウガハイドです。合成皮革が提供するこれらすべての要素と利点により、市場の成長が促進されると予想されます。

- 快適でトレンディな高級皮革製品のアパレル、履物、アクセサリーの需要の高まり

皮革製品には、手袋、バッグ、履物、時計、家具など、さまざまな製品があります。衣料品の生産における皮革の需要の増加は、市場の成長にプラスの影響を与える可能性のある主要な推進要因の 1 つです。さらに、皮革製品の耐火性、防塵性、ひび割れ防止性、耐久性などの皮革の特別な特性は、他のリソースや素材よりも好まれることが多く、市場の需要と売上の増加に貢献しています。

機会

- 新しい機能やデザインを備えた革製品の革新の増加

消費者の行動は過去 10 年間で大きく変化しました。特にファッション製品の開発とマーケティングにおいて、古い技術がより多く活用されるようになったため、企業は製品の多様性で顧客のニーズを満たす新しい可能性を手に入れています。革新的な製品を開発し、製品に独自性と価値を付加するには、実行可能な技術による新しい表面仕上げと装飾の開発が必要です。

ライフスタイルが日々急速に進化し、変化し、可処分所得も増加しているため、消費者はファッショナブルな製品を好む傾向にあります。消費者は可処分所得に基づいて生活水準を向上させ、よりファッショナブルな製品を消費しています。そのため、このような消費者の傾向は、市場で活動する市場プレーヤーにとってチャンスを生み出すことになります。

- バイオバイアスレザーの導入

バイオベースの皮革製造プロセスは、生態系に悪影響を及ぼしません。亜麻綿や綿繊維などの天然繊維とトウモロコシ、ヤシ、大豆などを組み合わせた合成皮革は、バイオベースの皮革の出現によりアジア太平洋地域の皮革製品市場で競争力のある市場シェアを獲得するためにメーカーが注力すべき分野です。これとは別に、パイナップルの葉は、新しい合成皮革製品「ピナテックス」の製造に実際に使用されています。これらのパイナップルの葉は、弾力性と強度に優れた繊維で、製造プロセスでの使用に最適です。

制約/課題

- 安価な皮革製品の入手可能性と世界的な皮革製品の不足

The high cost of natural leather is a factor that has driven the need for natural leather replacements. The low quality of leather and the shortage of leather all over the world are bottlenecks for the leather goods industry. Some kinds of leather goods available in the market have low costs. It will also hamper the supply and demand for good quality leather products and their price. Moreover, the worldwide shortage of leather goods and raw materials, such as genuine leather, is driving up the price of these products. As a result, European buyers are looking for low-cost suppliers who can produce leather from exotic animals like pythons and alligators. These factors are restraining market growth. Also, the low availability of raw materials, the availability of synthetic alternatives such as plastic leather, and the availability of leather goods at low cost are some factors restraining market growth.

- Strict governmental regulations on the production and use of natural leather

Stringent government regulations in regions such as Europe and the U.S., among others, are closing various tanneries and leather processing units. These governments have enforced regulations regarding leather use, which will act as a restraint for market growth in the coming years. Government policies have made new synthetic alternatives, such as plastic leather, available in the market.

- Lack of skills, technology, intermediate inputs and processing equipment

The scarcity of home universities that offers leather technology degrees contributes to this situation. This has created a skill gap that needs to be the priority in the leather sector development. The lack of professionals and inadequate training centers to train technicians and operators required in the sector are the causes of the prevailing situation. The lack of technology, skill, and intermediate is a challenge for the leather goods market as these features help to produce high-quality leather goods. The quality of leather goods is most important for the industry to grow.

Recent Development

- In August 2017, the Swiss luxury brand, Bally, launched its first flagship store in India in a joint-venture partnership with Reliance Brands Limited. This store includes women's and men's shoes, accessories, and premium leather goods.

Asia-Pacific Leather Goods Market Scope

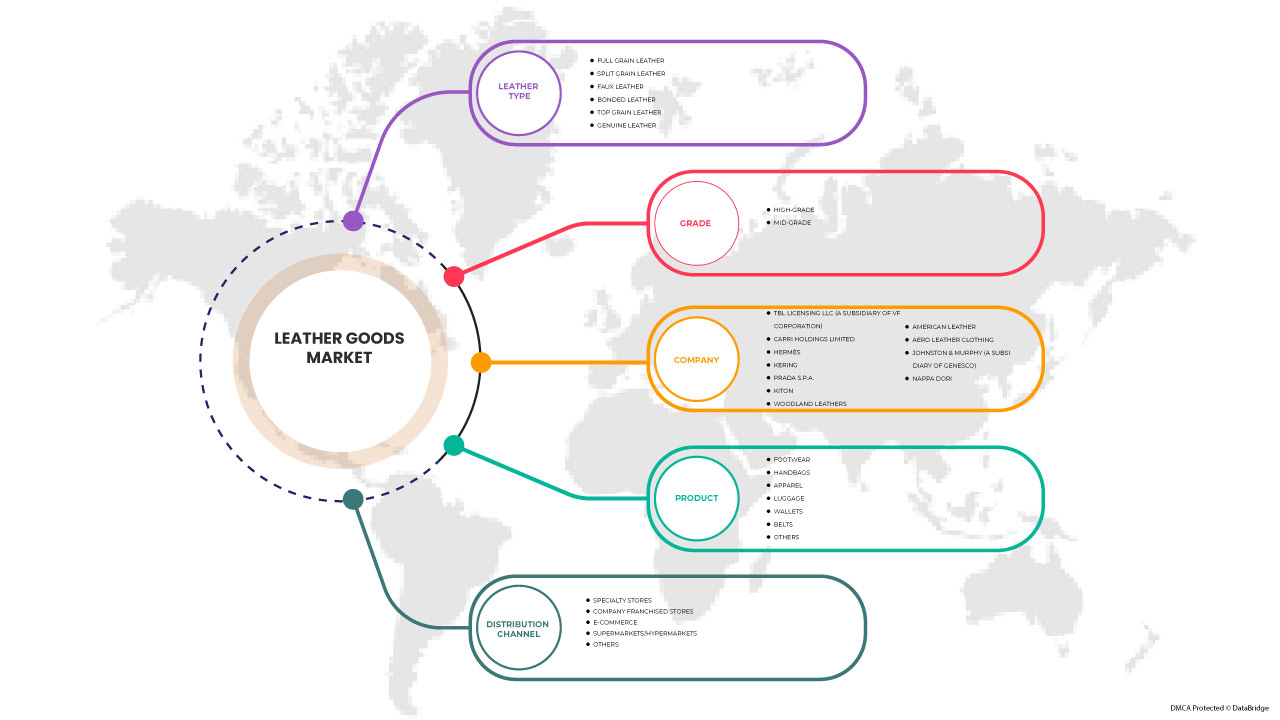

The Asia-Pacific leather goods market is categorized into four notable segments based on leather type, product, grade, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Leather Type

- Full Grain Leather

- Split Grain Leather

- Faux Leather

- Bonded Leather

- Top Grain Leather

Based on leather type, the market is segmented into full grain leather, split grain leather, top grain leather, genuine leather, faux leather, bonded leather, and others.

Product

- Footwear

- Handbags

- 衣服

- 荷物

- ウォレット

- ベルト

- その他

製品に基づいて、市場は履物、ハンドバッグ、アパレル、荷物、財布、ベルト、その他に分類されます。

学年

- 高級

- 中級

グレードに基づいて、市場は高級と中級に分類されます。

流通チャネル

- 専門店

- 会社フランチャイズ店

- 電子商取引

- スーパーマーケット/ハイパーマーケット

- その他

流通チャネルに基づいて、市場は専門店、企業フランチャイズ店、電子商取引、スーパーマーケット/ハイパーマーケット、その他に分類されます。

アジア太平洋地域の皮革製品市場 地域分析/洞察

アジア太平洋地域の皮革製品市場は、皮革の種類、製品、グレード、流通チャネルに基づいて分類されています。

アジア太平洋地域の皮革製品市場は、日本、中国、韓国、インド、シンガポール、タイ、インドネシア、マレーシア、フィリピン、オーストラリア、ニュージーランド、その他のアジア太平洋諸国で構成されています。この地域における皮革製品の優れた特徴と特性に対する認識が高まっているため、中国は市場シェアと市場収益の面でアジア太平洋地域の皮革製品市場を支配しています。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。データポイントの下流および上流のバリューチェーン分析、技術動向、ポーターの 5 つの力の分析、およびケーススタディは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮されます。

競争環境とアジア太平洋地域の皮革製品市場シェア分析

アジア太平洋の皮革製品市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、および技術ライフライン曲線が含まれます。提供された上記のデータ ポイントは、アジア太平洋の皮革製品市場に関連する会社の焦点にのみ関連しています。

アジア太平洋地域の皮革製品市場で事業を展開している著名な企業としては、TBL Licensing LLC(VF Corporation の子会社)、CAPRI HOLDINGS LIMITED、Hermès、KERING、PRADA SPA、Kiton、American Leather、Aero Leather Clothing、JOHNSTON & MURPHY(Genesco の子会社)、NAPPA DORI などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC LEATHER GOODS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN THE DEMAND FOR COMFORTABLE, TRENDY, FANCY LEATHER APPAREL, FOOTWEAR, AND ACCESSORIES

5.1.2 INCREASE IN THE DEMAND FOR PREMIUM AND HIGH-QUALITY LUXURY LEATHER PRODUCTS

5.1.3 LOW-COST AND HEAVY-DUTY CONSTRUCTION OF SYNTHETIC LEATHER PRODUCTS

5.1.4 RISE IN THE EXPENDITURE ON HOME FURNISHING AND RENOVATION

5.2 RESTRAINTS

5.2.1 THE AVAILABILITY OF CHEAPER LEATHER GOODS AND THE SHORTAGE OF LEATHER GOODS WORLDWIDE

5.2.2 STRICT GOVERNMENTAL REGULATIONS ON THE PRODUCTION AND USE OF NATURAL LEATHER

5.3 OPPORTUNITIES

5.3.1 INCREASE IN INNOVATION IN LEATHER GOODS WITH NEW FEATURES AND DESIGNS

5.3.2 INTRODUCTION OF BIO-BIASED LEATHER

5.4 CHALLENGES

5.4.1 RISE IN THE AWARENESS REGARDING THE DETRIMENTAL EFFECTS OF UNETHICAL PRACTICES IN THE PRODUCTION OF LEATHER GOODS

5.4.2 LACK OF SKILLS, TECHNOLOGY, INTERMEDIATE INPUTS, AND PROCESSING EQUIPMENT

6 ASIA PACIFIC LEATHER GOODS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 FOOTWEAR

6.2.1 FOOTWEAR, BY TYPE

6.2.1.1 BOOTS

6.2.1.2 FORMAL SHOES

6.2.1.3 LOAFERS

6.2.1.4 BALLERINAS

6.2.1.5 SANDALS

6.2.1.6 OTHERS

6.3 HANDBAGS

6.3.1 HANDBAGS, BY TYPE

6.3.1.1 SLING BAG

6.3.1.2 CLUTCHES

6.3.1.3 SATCHEL BAG

6.3.1.4 TOTE BAGS

6.3.1.5 WRISTLET BAG

6.3.1.6 OTHERS

6.4 APPAREL

6.4.1 APPAREL, BY TYPE

6.4.1.1 JACKET

6.4.1.2 CAPS

6.4.1.3 SUIT

6.4.1.4 WAISTCOAT

6.4.1.5 SHIRTS

6.4.1.6 OTHERS

6.5 LUGGAGE

6.5.1 LUGGAGE, BY TYPE

6.5.1.1 TRAVEL BAGS

6.5.1.2 BUSINESS BAGS

6.5.1.3 DUFFEL BAGS

6.5.1.4 SUITCASE & BRIEFCASE

6.5.1.5 ROLLABLE LUGGAGE

6.5.1.6 OTHERS

6.6 WALLETS

6.7 BELTS

6.8 OTHERS

7 ASIA PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE

7.1 OVERVIEW

7.2 FULL GRAIN LEATHER

7.3 SPLIT GRAIN LEATHER

7.4 TOP GRAIN LEATHER

7.5 GENUINE LEATHER

7.6 FAUX LEATHER

7.7 BONDED LEATHER

8 ASIA PACIFIC LEATHER GOODS MARKET, BY GRADE

8.1 OVERVIEW

8.2 HIGH-GRADE

8.3 MID-GRADE

9 ASIA PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 SPECIALTY STORES

9.3 COMPANY FRANCHISED STORES

9.4 E-COMMERCE

9.5 SUPERMARKETS/HYPERMARKETS

9.6 OTHERS

10 ASIA PACIFIC LEATHER GOODS MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 AUSTRALIA & NEW ZEALAND

10.1.6 SINGAPORE

10.1.7 THAILAND

10.1.8 INDONESIA

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 EVENT

11.3 ACQUISITION

11.4 AWARD

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 KERING

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 PRADA S.P.A.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 CAPRI HOLDINGS LIMITED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 HERMÈS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 TBL LICENSING LLC (A SUBSIDIARY OF VF CORPORATION)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AERO LEATHER CLOTHING

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMERICAN LEATHER

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 JOHNSTON & MURPHY (A SUBSIDIARY OF GENESCO)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 KITON

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 NAPPA DORI

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 WOODLAND LEATHERS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF TRUNKS, SUITCASES, VANITY CASES, EXECUTIVE CASES, BRIEFCASES, SCHOOL SATCHELS, SPECTACLE CASES, AND OTHER GOODS PRODUCED USING LEATHER AND SIMILAR MATERIALS; HS CODE – 4202 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TRUNKS, SUITCASES, VANITY CASES, EXECUTIVE CASES, BRIEFCASES, SCHOOL SATCHELS, SPECTACLE CASES, AND OTHER GOODS PRODUCED USING LEATHER AND SIMILAR MATERIALS; HS CODE – 4202 (USD THOUSAND)

TABLE 3 ASIA PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 ASIA PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC APPAREL IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 ASIA PACIFIC APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 ASIA PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC WALLETS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 ASIA PACIFIC BELTS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC OTHERS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 ASIA PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC FULL GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA PACIFIC SPLIT GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC TOP GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 ASIA PACIFIC GENUINE LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC FAUX LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 ASIA PACIFIC BONDED LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 23 ASIA PACIFIC HIGH-GRADE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC MID-GRADE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 ASIA PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC SPECIALTY STORES IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 ASIA PACIFIC COMPANY FRANCHISED STORES IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC E-COMMERCE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 ASIA PACIFIC SUPERMARKETS/HYPERMARKETS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC LEATHER GOODS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 40 CHINA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 41 CHINA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 CHINA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 CHINA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CHINA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 47 CHINA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 48 INDIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 INDIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 INDIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 INDIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 INDIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 INDIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 54 INDIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 55 INDIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 JAPAN LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 57 JAPAN FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 JAPAN HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 JAPAN APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 JAPAN LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 JAPAN LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 62 JAPAN LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 63 JAPAN LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 64 SOUTH KOREA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 SOUTH KOREA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SOUTH KOREA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SOUTH KOREA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 SOUTH KOREA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 SOUTH KOREA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 70 SOUTH KOREA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 71 SOUTH KOREA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA & NEW ZEALAND FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA & NEW ZEALAND HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 AUSTRALIA & NEW ZEALAND APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 AUSTRALIA & NEW ZEALAND LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 78 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 79 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 80 SINGAPORE LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 SINGAPORE FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 SINGAPORE HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 SINGAPORE APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 SINGAPORE LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 SINGAPORE LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 86 SINGAPORE LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 87 SINGAPORE LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 88 THAILAND LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 89 THAILAND FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 THAILAND HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 THAILAND APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 THAILAND LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 THAILAND LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 94 THAILAND LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 95 THAILAND LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 96 INDONESIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 97 INDONESIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 INDONESIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 INDONESIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 INDONESIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 INDONESIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 102 INDONESIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 103 INDONESIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 104 MALAYSIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 105 MALAYSIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 MALAYSIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MALAYSIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 MALAYSIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 MALAYSIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 110 MALAYSIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 111 MALAYSIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 PHILIPPINES LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 PHILIPPINES FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 PHILIPPINES HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 PHILIPPINES APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 PHILIPPINES LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 PHILIPPINES LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 118 PHILIPPINES LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 119 PHILIPPINES LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC LEATHER GOODS MARKET

FIGURE 2 ASIA PACIFIC LEATHER GOODS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC LEATHER GOODS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC LEATHER GOODS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC LEATHER GOODS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC LEATHER GOODS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC LEATHER GOODS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC LEATHER GOODS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC LEATHER GOODS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC LEATHER GOODS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA PACIFIC LEATHER GOODS MARKET: SEGMENTATION

FIGURE 13 RISING DEMAND FOR COMFORTABLE, TRENDY, AND FANCY LEATHER APPAREL, FOOTWEAR, AND ACCESSORIES IS EXPECTED TO DRIVE THE ASIA PACIFIC LEATHER GOODS MARKET IN THE FORECAST PERIOD

FIGURE 14 FOOTWEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC LEATHER GOODS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC LEATHER GOODS MARKET

FIGURE 16 ASIA PACIFIC LEATHER GOODS MARKET: BY PRODUCT, 2022

FIGURE 17 ASIA PACIFIC LEATHER GOODS MARKET: BY LEATHER TYPE, 2022

FIGURE 18 ASIA PACIFIC LEATHER GOODS MARKET: BY GRADE, 2022

FIGURE 19 ASIA PACIFIC LEATHER GOODS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 ASIA-PACIFIC LEATHER GOODS MARKET: SNAPSHOT (2022)

FIGURE 21 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2022)

FIGURE 22 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 ASIA-PACIFIC LEATHER GOODS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 25 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。