アジア太平洋地域の食用油市場

Market Size in USD Billion

CAGR :

%

| 2022 –2029 | |

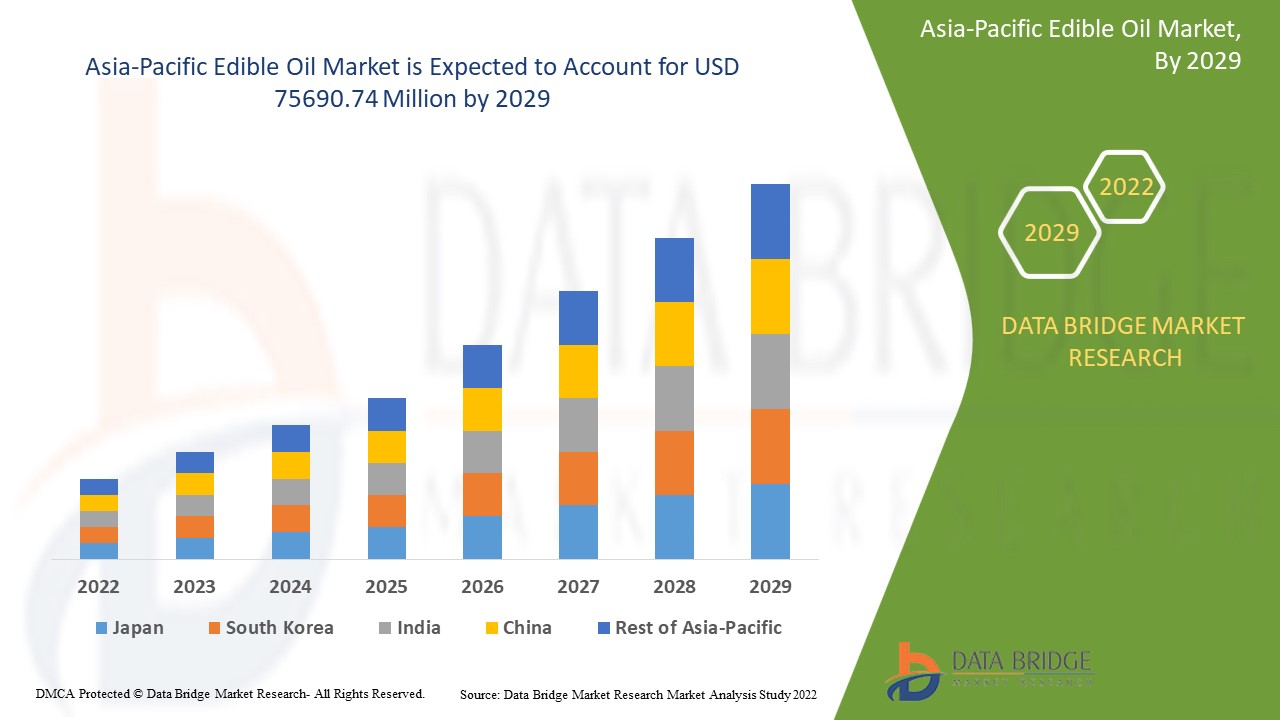

| USD 40,292.54 Million | |

| USD 75,690.74 Million | |

|

|

|

>アジア太平洋地域の食用油市場、タイプ別(パーム油、大豆油、菜種油、ひまわり油ピーナッツ油、特殊ブレンド油、オリーブ油、コーン油、亜麻仁油、アボカド油、クルミ油、カボチャ種子油、グレープシード油、その他)、パッケージタイプ(ブリキ容器、HDPE(高密度ポリエチレン)容器、PVC(ポリ塩化ビニル)ボトル、PET(ポリエチレンテレフタレート)ボトル、ガラス瓶、半硬質容器、フレキシブルプラスチックポーチ、その他)、流通チャネル(直接、間接)、エンドユーザー(国内、産業、食品サービス、その他)– 2029年までの業界動向と予測

市場分析と規模

食用油は、世界中の食品および飲料業界で重要な位置を占めています。レストラン、カフェテリア、ホテルなどで何百万人もの人々が毎日食用油を消費しています。メーカーは、消費者により健康的な選択肢を提供するために、食用油の開発に取り組んでいます。

アジア太平洋地域の食用油市場は、2021年に402億9,254万米ドルと評価され、2022年から2029年の予測期間中に8.20%のCAGRを記録し、2029年には7億5,690万米ドルに達すると予想されています。家庭用の消費量が多いため、国内が最大のエンドユーザーセグメントを占めています。市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、データブリッジ市場調査チームがまとめた市場レポートには、詳細な専門家分析、輸入/輸出分析、価格分析、生産消費分析、特許分析、消費者行動も含まれています。

市場の定義

食用油とは、植物、野菜、種子から抽出される液体を指します。このタイプの油には、脂肪酸、抗酸化物質、リン脂質などが含まれています。食用油は、人間や食品加工業界で広く消費されています。この油は、脂肪、カロリー、コレステロールが低いことで知られています。

レポートの範囲と市場セグメンテーション

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2014 - 2019 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

タイプ(パーム油、大豆油、菜種油、ひまわり油、落花生油、特殊ブレンド油、オリーブ油、コーン油、亜麻仁油、アボカド油、クルミ油、カボチャ種子油、グレープシード油、その他)、パッケージタイプ(ブリキ容器、HDPE(高密度ポリエチレン)容器、PVC(ポリ塩化ビニル)ボトル、PET(ポリエチレンテレフタレート)ボトル、ガラス瓶、半硬質容器、フレキシブルプラスチックパウチ、その他)、流通チャネル(直接、間接)、エンドユーザー(家庭用、産業用、食品サービス用、その他) |

|

対象国 |

Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC) |

|

Market Players Covered |

Bunge Limited (US), ADM (US), Cargill, Incorporated (US), ACH Food Companies, Inc. (US), Adani Group (India), SALAD OILS INTERNATIONAL CORPORATION (US), American Vegetable Oils, Inc. (US), BORGES INTERNATIONAL GROUP, S.L. (Spain), Hebany Group (UAE), NGO CHEW HONG EDIBLE OIL PTE LTD (Singapore), TITAN OILS Inc., (Canada) Ragasa - Derechos Reservados (Mexico), SOVENA (Thailand), and Sunora Foods (Canada), among others |

|

Market Opportunities |

|

Asia-Pacific Edible Oil Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Inclination towards Healthy Lifestyle

The increase in the consumer preference for dietary improvements acts as one of the major factors driving the growth of edible oil market. The rise in trend of leading a healthy lifestyle among all age groups shifting to healthy and innovative approach have a positive impact on the industry.

- Prevalence of Obesity

The increase in the prevalence of obesity among population further influences the market. People reaching out to dieticians and nutritionists providing customized diet plans with the aim of losing weight helps in the market growth.

- Awareness Regarding Healthy Lifestyle

The rise in the awareness regarding the importance of leading a healthy lifestyle, accelerate the market growth. The prevalence of various chronic diseases, such as diabetes, and cardiovascular diseases, among others is encouraging people to adopt edible oil.

- Increase in Demand for Functional Foods

The increase in the functional food products further influence the market growth. Also, increase in consumers seeking healthy and sustainable food options along with growing number of sports and gym enthusiasts assist in the expansion of the market.

Additionally, change in lifestyle, increase in the disposable income and rise in awareness regarding the benefits of the nutrition plan positively affect the edible oil market.

Opportunities

Furthermore, rise in demand for clean edible oil products extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, research and development activities will further expand the market.

Restraints/Challenges

On the other hand, high cost associated with the products and limited availability of raw materials are expected to obstruct market growth. Also, use of artificial/synthetic ingredients in various applications resulting in health hazards and lack of consistency in regulations are projected to challenge the edible oil market in the forecast period of 2022-2029.

This edible oil market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on edible oil market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Asia-Pacific Edible Oil Market

COVID-19 had a negative impact on several industries. However, edible oil market witnessed a significant growth during this period. During the lockdown imposed by the government for restricting the spread of the coronavirus disease, most of the population took keen interest in adopting health diets. People are adopting health supplements to increase their immunity with the increasing health complications. The rise in the emphasis on good health is going to keep increasing the growth of the market in the post pandemic scenario.

Recent Developments

- In April 2020, Adani Group’s subsidiary Adani Wilmar partnered with Swiggy based in India for delivery of food products including oil products to customers due to the national lockdown because of COVID-19 pandemic. This partnership has helped the company to reach its customer base to offer its products and earn revenue.

Asia-Pacific Edible Oil Market Scope and Market Size

The edible oil market is segmented on the basis of type, package type, distribution channel and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Palm Oil

- Soybean Oil

- Rapeseed Oil

- Sunflower Oil

- Peanut Oil

- Specialty Blended Oil

- Olive Oil

- Corn Oil

- Flaxseed Oil

- Avocado Oil

- Walnut Oil

- Pumpkin Seed Oil

- Grapeseed Oil

- Others

Package Type

- Tinplate Containers

- HDPE (High Density Polyethylene) Containers

- PVC (Poly Vinyl Chloride) Bottles

- PET (Polyethylene Terephthalate) Bottles

- Glass Bottles, Semi – Rigid Containers

- Flexible Plastic Pouches

- Others

Distribution Channel

- Direct

- Indirect

End User

- Domestics

- Industrial

- Food Services

- Others

Asia-Pacific Edible Oil Market Regional Analysis/Insights

The edible oil market is analysed and market size insights and trends are provided by country, type, package type, distribution channel and end user as referenced above.

The countries covered in the edible oil market report are Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC).

アジア太平洋地域の食用油市場では、中国が農業、特に油糧種子の生産の成長により、最大の市場を独占しています。インドとインドネシアも、その好ましい環境により油糧種子生産の人気の拠点として知られており、市場を独占し、大幅な成長率で成長すると予想されています。ロックダウンや輸送制限などの政府による制限により、COVID-19の蔓延が市場に影響を与える可能性があります。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、グローバル ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境とアジア太平洋食用油市場シェア分析

食用油市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、食用油市場に関連する会社の焦点にのみ関連しています。

食用油市場で活動している主要企業には、

- バンジ・リミテッド(米国)

- ADM(米国)

- カーギル社(米国)

- ACHフードカンパニーズ(米国)

- アダニグループ(インド)

- サラダオイルインターナショナルコーポレーション(米国)

- アメリカン・ベジタブル・オイルズ社(米国)

- BORGES INTERNATIONAL GROUP, SL(スペイン)

- ヘバニーグループ(UAE)

- NGO CHEW HONG EDIBLE OIL PTE LTD (シンガポール)

- TITAN OILS Inc.(カナダ

- ラガサ - デレチョス保護区 (メキシコ)

- ソベナ(タイ)

- サンオラフーズ(カナダ)

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC EDIBLE OIL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 ASIA-PACIFIC EDIBLE OIL MARKET: LIST OF SUBSTITUTES

6 ASIA-PACIFIC EDIBLE OIL MARKET: MARKETING STRATEGIES

7 ASIA-PACIFIC EDIBLE OIL MARKET: REGULATORY FRAMEWORK

7.1 LABELLING REQUIREMENTS (NORTH AMERICA)

7.2 DOSAGE RECOMMENDATIONS IN DIFFERENT PET ANIMALS

7.3 EDIBLE OILS CERTIFICATIONS

7.3.1 ORGANIC:

7.3.2 AGMARK CERTIFICATION

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 EASY AVAILABILITY OF RAW MATERIALS

8.1.2 HEALTH BENEFITS ASSOCIATED WITH EDIBLE OILS

8.1.3 INCREASING DEMAND FOR FORTIFIED EDIBLE OILS

8.1.4 OIL PACKAGING INNOVATIONS

8.1.5 INCREASING DEMAND FOR ORGANIC EDIBLE OIL PRODUCTS

8.2 RESTRAINTS

8.2.1 INTERNATIONAL PRICES OF OILSEEDS AND VEGETABLE OILS

8.2.2 ADULTERATION IN EDIBLE OILS

8.2.3 OBESITY AND EDIBLE OILS

8.3 OPPORTUNITIES

8.3.1 INTRODUCTION OF CLEAN LABELLED EDIBLE OIL PRODUCTS

8.3.2 PREMIUM EDIBLE OIL PRODUCTS

8.3.3 E-COMMERCE CONTINUES TO CREATE OPPORTUNITIES

8.4 CHALLENGES

8.4.1 INCREASING COMPETITION

8.4.2 HEALTH ISSUES ASSOCIATED WITH THE CONSUMPTION OF EDIBLE OILS

9 COVID-19 IMPACT ON THE GLOBAL EDIBLE OIL MARKET IN FOOD & BEVERAGE INDUSTRY

10 ASIA-PACIFIC EDIBLE OIL MARKET, BY TYPE

10.1 OVERVIEW

10.2 PALM OIL

10.3 OLIVE OIL

10.4 SOYBEAN OIL

10.5 SUNFLOWER OIL

10.6 SPECIALTY BLENDED OIL

10.7 CORN OIL

10.8 RAPESEED OIL

10.9 FLAXSEED OIL

10.1 AVOCADO OIL

10.11 PUMPKIN SEED OIL

10.12 WALNUT OIL

10.13 PEANUT OIL

10.14 GRAPESEED OIL

10.15 OTHER

11 ASIA-PACIFIC EDIBLE OIL MARKET, BY PACKAGE TYPE

11.1 OVERVIEW

11.2 TIN PLATE CONTAINERS

11.3 GLASS BOTTLES

11.4 SEMI - RIGID CONTAINERS

11.5 HDPP (HIGH DENSITY POLYETHYLENE CONTAINERS) CONTAINERS

11.6 PET (POLYETHYLENE PTERAPTHALATE) BOTTLES

11.7 PVC (POLY VINYL CHLORIDE) BOTTLES

11.8 FLEXIBLE PLASTIC POUCHES

11.9 OTHERS

12 ASIA-PACIFIC EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

12.3.1 GROCERY STORE

12.3.2 SUPERMARKETS/HYPERMARKETS

12.3.3 CONVENIENCE STORES

12.3.4 SPECIALTY STORES

12.3.5 E-COMMERCE

12.3.6 OTHERS

13 ASIA-PACIFIC EDIBLE OIL MARKET, BY END USER

13.1 OVERVIEW

13.2 DOMESTIC

13.3 FOOD SERVICE

13.3.1 RESTAURANTS

13.3.2 CANTEENS

13.3.3 OTHERS

13.4 INDUSTRIAL

13.5 OTHERS

14 ASIA-PACIFIC EDIBLE OIL MARKET, BY COUNTRIES

14.1 OVERVIEW

14.2 ASIA-PACIFIC

14.2.1 CHINA

14.2.2 INDIA

14.2.3 INDONESIA

14.2.4 MALAYSIA

14.2.5 THAILAND

14.2.6 PHILIPPINES

14.2.7 JAPAN

14.2.8 VIETNAM

14.2.9 SOUTH KOREA

14.2.10 SINGAPORE

14.2.11 AUSTRALIA

14.2.12 NEW ZEALAND

14.2.13 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC EDIBLE OIL MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 SWOT

17 COMPANY PROFILE

17.1 ADANI GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 VENDOR SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 BUNGE LIMITED

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 VENDOR SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 ADM

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 VENDOR SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CARGILL, INCORPORATED.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 VENDOR SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 AJANTA SOYA LIMITED

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 HEBANY GROUP

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 NGO CHEW HONG EDIBLE OIL PTE LTD’S (A SUBSIDIARY OF MEWAH GROUP)

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 OLYMPIC OILS LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 RUCHI SOYA INDUSTRIES LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 SOVENA

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

LIST OF TABLES

TABLE 1 APPROXIMATE FAT CONTENT OF MAJOR EDIBLE OILS

TABLE 2 ASIA-PACIFIC EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 3 ASIA-PACIFIC EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 4 ASIA-PACIFIC EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 5 ASIA-PACIFIC INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 6 ASIA-PACIFIC EDIBLE OIL MARKET, BY END USER, 2018– 2027 (USD MILLION )

TABLE 7 ASIA PACIFIC FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 8 ASIA-PACIFIC EDIBLE OIL MARKET,BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 9 ASIA-PACIFIC EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 10 ASIA-PACIFIC EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 11 ASIA-PACIFIC EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 12 ASIA-PACIFIC INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 13 ASIA-PACIFIC EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 14 ASIA-PACIFIC FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 15 CHINA EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 16 CHINA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 17 CHINA EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 18 CHINAINDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 19 CHINA EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 20 CHINAFOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 21 INDIA EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 22 INDIA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 23 INDIA EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 24 INDIA INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 25 INDIA EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 26 INDIA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 27 INDONESIA EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 INDONESIA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 29 INDONESIA EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 30 INDONESIA INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 31 INDONESIA EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 32 INDONESIA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 33 MALAYSIA EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 34 MALAYSIA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 35 MALAYSIA EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 36 MALAYSIA INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 37 MALAYSIA EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 38 MALAYSIA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 39 THAILAND EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 40 THAILAND EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 41 THAILAND EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 42 THAILAND INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 43 THAILAND EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 44 THAILAND FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 45 PHILIPPINES EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 46 PHILIPPINES EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 47 PHILIPPINES EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 48 PHILIPPINES INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 49 PHILIPPINES EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 50 PHILIPPINES FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 51 JAPAN EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 52 JAPAN EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 53 JAPAN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 54 JAPAN INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 55 JAPAN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 56 JAPAN FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 57 VIETNAM EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 VIETNAM EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 59 VIETNAM EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 60 VIETNAM INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 61 VIETNAM EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 62 VIETNAM FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 63 SOUTH KOREA EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 64 SOUTH KOREA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 65 SOUTH KOREA EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 66 SOUTH KOREA INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 67 SOUTH KOREA EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 68 SOUTH KOREA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 69 SINGAPORE EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 70 SINGAPORE EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 71 SINGAPORE EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 72 SINGAPORE INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 73 SINGAPORE EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 74 SINGAPORE FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 75 AUSTRALIA EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 76 AUSTRALIA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 77 AUSTRALIA EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 78 AUSTRALIA INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 79 AUSTRALIA EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 80 AUSTRALIA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 81 NEW ZEALAND EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 82 NEW ZEALAND EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 83 NEW ZEALAND EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 84 NEW ZEALAND INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 85 NEW ZEALAND EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 86 NEW ZEALAND FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 87 REST OF ASIA-PACIFIC EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

図表一覧

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC EDIBLE OIL MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC EDIBLE OIL MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC EDIBLE OIL MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC EDIBLE OIL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC EDIBLE OIL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC EDIBLE OIL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC EDIBLE OIL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC EDIBLE OIL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC EDIBLE OIL MARKET: SEGMENTATION

FIGURE 10 EASY AVAILABILITY OF RAW MATERIALS AND DEMAND FOR ORGANIC EDIBLE OILS PRODUCTS ARE DRIVING THE ASIA-PACIFIC EDIBLE OIL MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 PALM OIL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC EDIBLE OIL MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC EDIBLE OIL MARKET

FIGURE 13 INTERNATIONAL PRICES OF VEGETABLE OILS

FIGURE 14 ASIA-PACIFIC EDIBLE OIL MARKET, BY TYPE, 2019

FIGURE 15 ASIA-PACIFIC EDIBLE OIL MARKET, BY PACKAGE TYPE, 2019

FIGURE 16 ASIA-PACIFIC EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2019

FIGURE 17 ASIA-PACIFIC EDIBLE OIL MARKET, BY END USER, 2019

FIGURE 18 FIGURE 23………………………… PACIFIC EDIBLE OIL MARKET: COMPANY SHARE 2019 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。