アジア太平洋地域のセラミック膜市場、材質別(アルミナ、酸化ジルコニウム、チタニア、シリカ、その他)、用途別(水・廃水処理、食品・飲料、医薬品、バイオテクノロジー、その他)、技術別(限外濾過、精密濾過、ナノ濾過、その他) - 2030年までの業界動向と予測。

アジア太平洋地域のセラミック膜市場の分析と洞察

水・廃水処理、食品・飲料、製薬、バイオテクノロジー業界からのセラミック膜の需要増加は、アジア太平洋地域のセラミック膜市場の重要な推進力となっています。ろ過プロセスにおける膜の持続可能性、品質、効率性への重点が高まっており、セラミック膜市場の成長が促進されると予想されます。

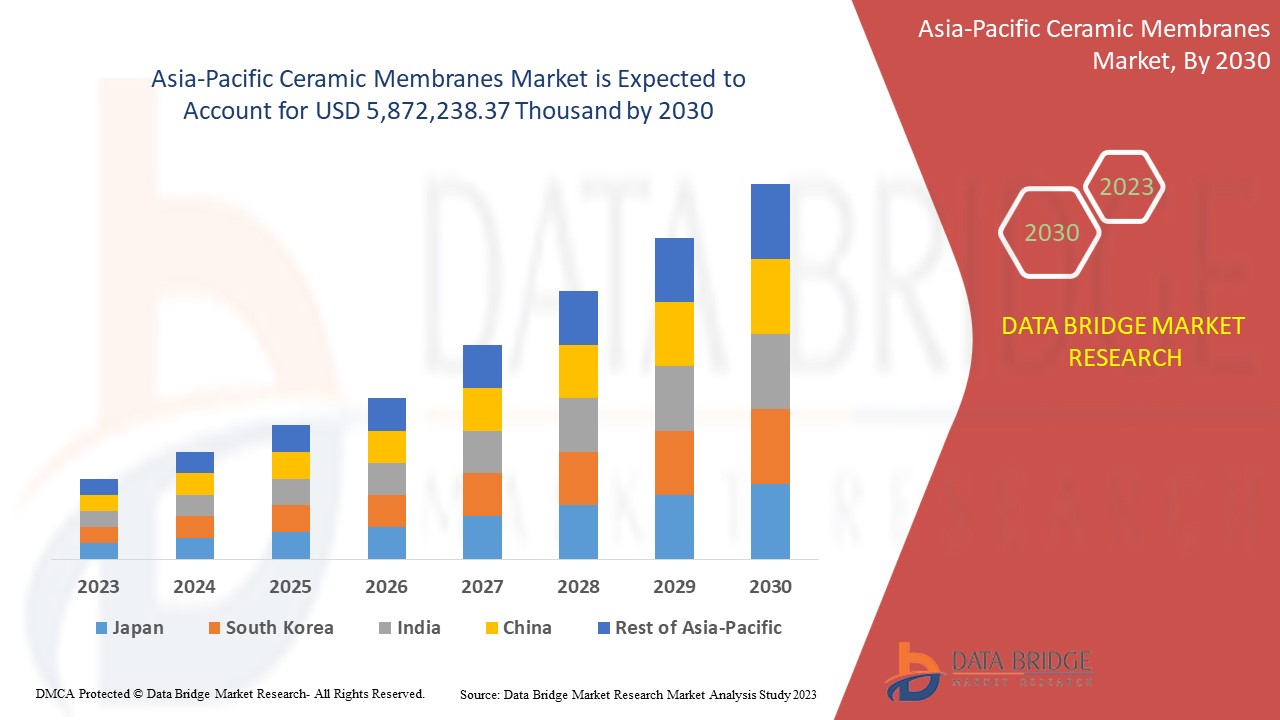

セラミック膜市場は、2023年から2030年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に12.8%のCAGRで成長し、2030年までに5,872,238.37千米ドルに達すると予測しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

材質別(アルミナ、酸化ジルコニウム、チタニア、シリカ、その他)、用途別(水・廃水処理、食品・飲料、医薬品、バイオテクノロジー、その他)、技術別(限外濾過、精密濾過、ナノ濾過、その他)。 |

|

対象国 |

中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋諸国、 |

|

対象となる市場プレーヤー |

TAMI Industries、atech Innovations gmbh、GEA Group Aktiengesellschaft、Nanostone、LiqTech Holding A/S、Qua Group LLC、TORAY INDUSTRIES, INC.、SIVA Unit.、METAWATER. CO., LTD.、KERAFOL Ceramic Films GmbH & Co. KG、Aquatech International LLC.、Paul Rauschert GmbH & Co. KG.、HYDRASYST、Membratec SA、Mantec Filtration。 |

市場の定義

セラミック膜は無機材料から製造される人工膜です。セラミック膜は濾過や液体処理などの産業に応用されています。セラミック膜が使用される産業の大半は、食品・飲料、医薬品、バイオテクノロジー、水・廃水処理などです。市場の成長要因には、医薬品、水・廃水処理産業からの需要増加が含まれます。

セラミック膜市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 食品・飲料業界からのセラミック膜の需要増加

食品および飲料は、ろ過特性や抗菌作用などのさまざまな利点があるため、セラミック膜が適用される最大の産業の 1 つです。さらに、高い分離効率と優れた化学的安定性により、セラミック膜は食品および飲料業界にとってますます不可欠なものとなっています。

セラミック膜はポリマー膜の限界を克服できます。このため、食品および飲料業界、特に乳製品メーカーのほとんどが、他の膜サービスよりもセラミック膜の適用に移行しています。品質向上のために標準的なメーカーでセラミック膜の必要性が時間とともに高まっています。

さらに、セラミック膜が使用される技術的用途には、甘味料の濃縮と精製、濃縮乳タンパク質、および分離乳タンパク質が含まれます。セラミック膜クロスフローろ過は、水性製品を精製するためにいくつかの業界で使用されています。たとえば、ワイン、ビール、果物や野菜のジュースの生産です。乳製品産業におけるアミノ酸生産と乳酸生産における細胞分離も今日では技術的に進歩しており、セラミック膜もこれらの分野で使用されています。

高い需要に応えるため、食品・飲料業界は成長し、生産を急速に拡大しています。この上昇傾向の中で、これらの業界でのセラミック膜の需要も増加しており、今後数年間でセラミック膜の市場を牽引すると予想されています。したがって、さまざまな独自の要因により、食品・飲料業界からのセラミック膜の需要が増加しており、アジア太平洋地域のセラミック膜市場の需要と売上を牽引すると予想されます。

- 浄水産業におけるセラミック膜の需要増加

人口の急速な増加と廃水量の増加により、浄水および廃水処理サービスの必要性が高まっています。セラミック膜は、浄水プロセスにおける主要な用途の 1 つです。高い機械的強度、耐薬品性温度など、いくつかの利点を持つセラミック膜は、水処理および廃水処理に使用されます。

水処理におけるセラミック膜の用途範囲には、都市用水および廃水処理、産業廃水処理が含まれます。油性および繊維産業の廃水、印刷および染色廃水などの産業廃水は、定期的に処理する必要があります。アジア太平洋市場では水処理産業の工業化が進むにつれて、セラミック膜の需要も増加しており、将来的にはアジア太平洋のセラミック膜市場を牽引する可能性があります。セラミック膜が使用できる水処理分野の例としては、油田注入水、製紙産業水、埋立地浸出水、パーム油廃水、二酸化チタン廃水などがあります。

水処理と浄化のニーズが高まるにつれて、セラミック膜の需要と用途も増加しています。この上昇傾向は、今後の市場の成長を促進すると予想されています。したがって、浄水および水処理業界からの需要の増加により、今後数年間でアジア太平洋地域のセラミック膜市場が成長すると予想されます。

機会

- さまざまな産業におけるセラミック膜の応用

セラミック膜は、幅広い業界で適用されています。セラミック膜技術のさまざまな用途により、用途は多岐にわたります。繊維、食品、飲料、化学、製紙などのさまざまな業界で、ろ過などにセラミック膜が使用されています。製薬業界は、セラミック膜技術の重要な消費者の 1 つです。抗菌作用と抗微生物作用があるため、セラミック膜はさまざまな衛生目的で使用されています。

さらに、セラミック膜を使用して液体からあらゆる種類の特定の物質を分離する効率は、食品および飲料業界で使用されています。このため、セラミック膜は食品、飲料、および製薬業界で需要が高まっています。持続可能な目標を満たすための水処理のニーズが高まっていることは、廃水処理におけるセラミック膜の幅広い用途により、アジア太平洋地域のセラミック膜市場にチャンスを生み出しています。

- セラミック膜科学における技術的進歩

テクノロジーは、古い方法を更新し、品質の向上とコスト削減を実現したセラミック技術を製造する新しい方法を発見するという点で、アジア太平洋地域のセラミック膜市場に大きな影響を与えています。この分野での継続的なイノベーションとその増加傾向により、アジア太平洋地域のセラミック膜市場は近い将来に急激な成長に直面する可能性があります。医薬品、バイオテクノロジー、水処理技術などのすべての分野では、セラミック技術の進歩が不可欠です。セラミック膜技術には、脆さ、延性の低さなど、いくつかの制限があります。ただし、研究者と科学界は、制限を克服するために懸命に取り組んでいます。たとえば、都市の廃水処理には、フラットセラミック膜技術が使用されています。そのため、アジア太平洋地域のセラミック膜市場にチャンスが生まれています。このように、科学技術の最近の進歩は、セラミック膜市場の成長を常にサポートしています。

制約/課題

- セラミック膜の製造には高額な投資が必要

One of the restraints that affect the growth of the Asia-Pacific ceramic membranes market is its production cost. The investment cost associated with manufacturing ceramic membranes is higher than other similar types of membranes. Water treatment plants need membranes systems to filter waste water contaminant particles. However, when it comes to ceramic membranes installation, the number of full-pledged installation in water treatment industries is really low. Hence, the cost associated with the installation or manufacturing of ceramic membranes may restrict the growth of the Asia-Pacific ceramic membranes market.

- Performance issues due to the brittleness of ceramic membranes

Ceramic membranes consist of small porous substrates which are providing support to the thin dense membranes. In spite of having several beneficial factors such as chemical and thermal stability, these membranes can have subcritical cracks. It has been observed that in particular sensitivity, the ceramic membranes act as a very brittle component, and the growth of cracks within it can increase. Due to differences in thermal expansion, the ceramic membranes can act as a very brittle substance. Moreover, along with the brittleness, the ceramic membranes has negligible ductility, tensile strength, and other related concerns. Hence, this major drawback can restrain the market of Asia-Pacific ceramic membranes from growing in upcoming years.

Recent Development

- In October 2022, METAWATER CO., LTD. Announced their new order received from PWNT, Netherlands. This order is regarding ceramic membranes for Hampton Loade water treatment works in the United Kingdom. After completion, it will be the world's largest ceramic membranes water treatment plant. This announcement will create more customer attention and brand value for the company.

- In September 2022, Nanostone ceramic ultrafiltration membranes technology achieved Regulation 31 approval in UK for use in drinking water treatment in the UK. It helps to improve the quality of the drinking water. This approval helps the company to showcase better standards among the competitors.

Ceramic Membranes Market Scope

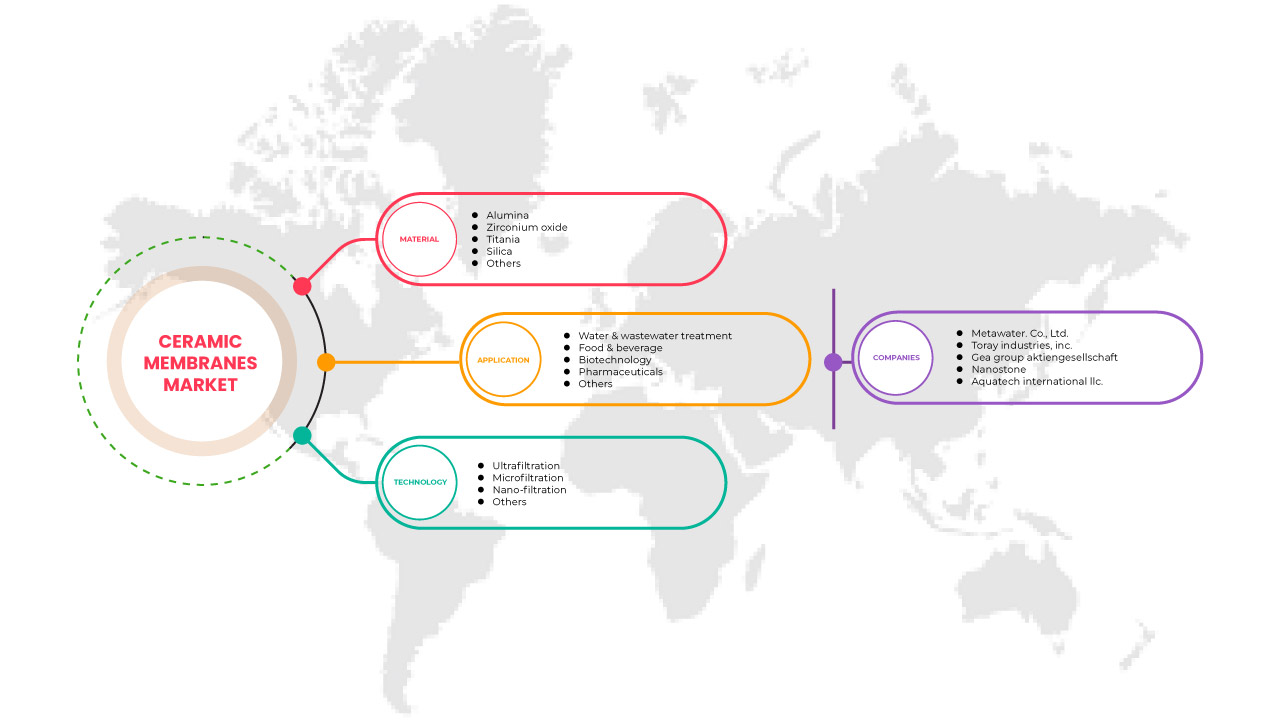

The ceramic membranes market is categorized based on material, application and technology. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Material

- ALUMINA

- ZIRCONIUM OXIDE

- TITANIA

- SILICA

- OTHERS

On the basis of material, the ceramic membranes market is classified into alumina, zirconium oxide, titania, silica, and others.

Application

- WATER & WASTEWATER TREATMENT

- FOOD & BEVERAGE

- BIOTECHNOLOGY

- PHARMACEUTICALS

- OTHERS

On the basis of application, the ceramic membranes market is classified into water & wastewater treatment, food & beverage, biotechnology, pharmaceuticals, and others.

Technology

- ULTRAFILTRATION

- MICROFILTRATION

- NANO-FILTRATION

- OTHERS

技術に基づいて、セラミック膜市場は限外濾過、精密濾過、ナノ濾過などに分類されます。

セラミック膜市場の地域分析/洞察

セラミック膜市場は、材料、用途、技術に基づいて分類されています。

セラミック膜市場レポートで取り上げられている国は、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域 (APAC) です。

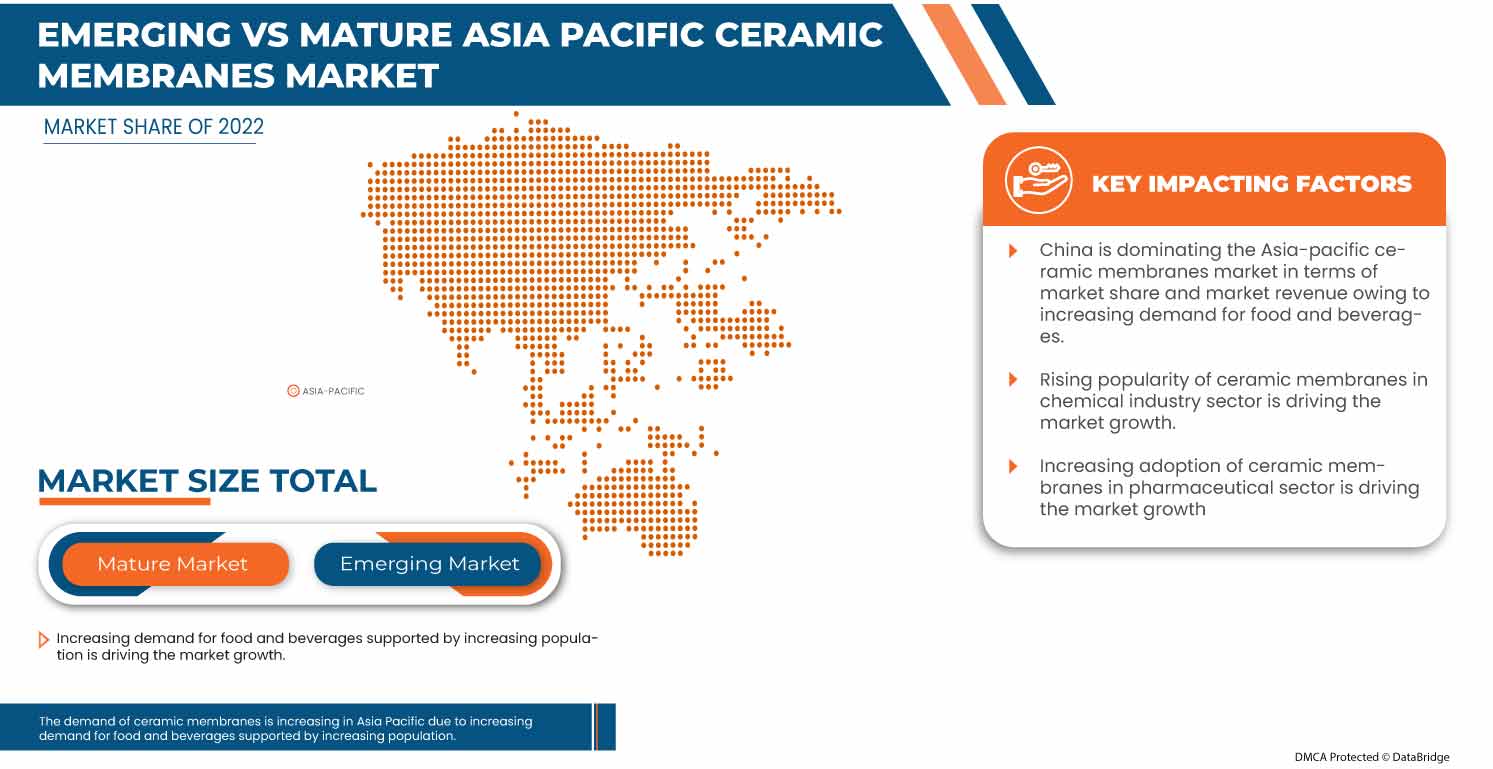

アジア太平洋地域は、持続可能性、品質、労働者の安全に対する重視の高まりにより、セラミック膜市場を支配すると予想されています。水および廃水処理、食品および飲料、製薬、バイオテクノロジー業界からのセラミック膜の需要の増加により、中国がアジア太平洋地域で優位に立っています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。データポイントの下流および上流のバリューチェーン分析、技術動向、ポーターの 5 つの力の分析、およびケーススタディは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、アジア太平洋ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮されます。

競争環境とセラミック膜市場シェア分析

セラミック膜市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、製品のライフライン曲線などがあります。提供されている上記のデータ ポイントは、セラミック膜市場に関連する会社の焦点にのみ関連しています。

市場で活動している主要な市場プレーヤーには、TAMI Industries、atech Innovations gmbh、GEA Group Aktiengesellschaft、Nanostone、LiqTech Holding A/S、Qua Group LLC、TORAY INDUSTRIES, INC.、SIVA Unit.、METAWATER. CO., LTD.、KERAFOL Ceramic Films GmbH & Co. KG、Aquatech International LLC.、Paul Rauschert GmbH & Co. KG.、HYDRASYST、Membratec SA、Mantec Filtration などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC CERAMIC MEMBRANE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 CERAMIC MEMBRANE MATERIAL LIFE LINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 IMPORT-EXPORT DATA

2.15 SECONDARY SOURCES

2.16 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 VENDOR SELECTION CRITERIA

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT'S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 IMPORT EXPORT SCENARIO

4.6 PRODUCTION CONSUMPTION ANALYSIS- ASIA PACIFIC CERAMIC MEMBRANE MARKET

4.7 RAW MATERIAL SOURCING ANALYSIS

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR CERAMIC MEMBRANES FROM THE FOOD AND BEVERAGES INDUSTRIES

5.1.2 RISING DEMAND FOR CERAMIC MEMBRANES FROM WATER PURIFICATION INDUSTRIES

5.1.3 INCREASING DEMAND FOR CERAMIC MEMBRANES FROM PHARMACEUTICAL INDUSTRIES

5.2 RESTRAINTS

5.2.1 HIGH-COST INVESTMENT FOR MANUFACTURING CERAMIC MEMBRANES

5.2.2 PERFORMANCE ISSUES DUE TO THE BRITTLENESS OF CERAMIC MEMBRANES

5.3 OPPORTUNITIES

5.3.1 APPLICATIONS OF CERAMIC MEMBRANES IN DIFFERENT INDUSTRIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN CERAMIC MEMBRANE SCIENCE

5.4 CHALLENGES

5.4.1 AVAILABILITY OF ALTERNATIVES SUCH AS POLYMERIC MEMBRANES

6 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 ALUMINA

6.3 ZIRCONIUM OXIDE

6.4 TITANIA

6.5 SILICA

6.6 OTHERS

7 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 WATER & WASTEWATER TREATMENT

7.3 FOOD & BEVERAGE

7.4 PHARMACEUTICALS

7.5 BIOTECHNOLOGY

7.6 OTHERS

8 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 ULTRAFILTERATION

8.3 MICROFILTERATION

8.4 NANO-FILTERATION

8.5 OTHERS

9 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 JAPAN

9.1.3 SOUTH KOREA

9.1.4 INDIA

9.1.5 THAILAND

9.1.6 SINGAPORE

9.1.7 INDONESIA

9.1.8 AUSTRALIA & NEW ZEALAND

9.1.9 PHILIPPINES

9.1.10 MALAYSIA

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC CERAMIC MEMBRANES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.2 ANNOUNCEMENTS

10.3 DEVELOPMENT

10.4 PROJECT

10.5 TECHNOLOGY

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 METAWATER. CO., LTD.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 SWOT

12.1.6 RECENT DEVELOPMENT

12.2 TORAY INDUSTRIES, INC. (2022)

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 SWOT

12.2.6 RECENT DEVELOPMENTS

12.3 GEA GROUP AKTIENGESELLSCHAFT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 SWOT

12.3.6 RECENT DEVELOPMENTS

12.4 NANOSTONE

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 AQUATECH INTERNATIONAL LLC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENTS

12.6 A-TECH INNOVATION GMBH

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 HYDRASYST

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 KERAFOL CERAMIC FILMS GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 LIQTECH HOLDING A/S (2022)

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 SWOT

12.9.5 RECENT DEVELOPMENTS

12.1 MANTEC FILTRATION

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT UPDATES

12.11 MEMBRATEC SA

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 PAUL RAUSCHERT GMBH & CO.KG

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 QUA GROUP LLC.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATES

12.14 SIVA UNIT

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 SWOT

12.14.4 RECENT UPDATES

12.15 TAMI INDUSTRIES

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF CERAMIC WARES FOR LABORATORY, CHEMICAL OR OTHER TECHNICAL USES, PORCELAIN OR CHINA (EXCLUDING REFRACTORY CERAMIC GOODS, ELECTRICAL DEVICES, INSULATORS AND OTHER ELECTRICAL INSULATING FITTINGS); HS CODE – 690911 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CERAMIC WARES FOR LABORATORY, CHEMICAL OR OTHER TECHNICAL USES, PORCELAIN OR CHINA (EXCLUDING REFRACTORY CERAMIC GOODS, ELECTRICAL DEVICES, INSULATORS AND OTHER ELECTRICAL INSULATING FITTINGS); HS CODE – 690911 (USD THOUSAND)

TABLE 3 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC ALUMINA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA PACIFIC ZIRCONIUM OXIDE IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC TITANIA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA PACIFIC SILICA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC WATER & WASTEWATER TREATMENT IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA PACIFIC FOOD & BEVERAGE IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC PHARMACEUTICALS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA PACIFIC BIOTECHNOLOGY IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC ULTRAFILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC MICROFILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC NANO-FILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 22 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (PRICE)

TABLE 23 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 25 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 26 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 28 CHINA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 29 CHINA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 30 CHINA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 31 CHINA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 JAPAN CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 34 JAPAN CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 35 JAPAN CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 36 JAPAN CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 37 JAPAN CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 38 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 39 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 40 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 41 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 SOUTH KOREA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 43 INDIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 44 INDIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 45 INDIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 46 INDIA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 47 INDIA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 48 THAILAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 49 THAILAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 50 THAILAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 51 THAILAND CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 THAILAND CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 53 SINGAPORE CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 54 SINGAPORE CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 55 SINGAPORE CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 56 SINGAPORE CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 57 SINGAPORE CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 58 INDONESIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 59 INDONESIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 60 INDONESIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 61 INDONESIA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 62 INDONESIA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 63 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 64 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 65 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 66 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 67 AUSTRALIA & NEW ZEALAND CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 68 PHILIPPINES CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 69 PHILIPPINES CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 70 PHILIPPINES CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 71 PHILIPPINES CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 72 PHILIPPINES CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 73 MALAYSIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 74 MALAYSIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 75 MALAYSIA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 76 MALAYSIA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 77 MALAYSIA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 78 REST OF ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 79 REST OF ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 80 REST OF ASIA-PACIFIC CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

図表一覧

FIGURE 1 ASIA PACIFIC CERAMIC MEMBRANE MARKET

FIGURE 2 ASIA PACIFIC CERAMIC MEMBRANE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CERAMIC MEMBRANE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CERAMIC MEMBRANE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CERAMIC MEMBRANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CERAMIC MEMBRANE MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC CERAMIC MEMBRANE MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC LIFE LINE CURVE

FIGURE 9 ASIA PACIFIC CERAMIC MEMBRANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 ASIA PACIFIC CERAMIC MEMBRANE MARKET: DBMR MARKET POSITION GRID

FIGURE 11 ASIA PACIFIC CERAMIC MEMBRANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 ASIA PACIFIC CERAMIC MEMBRANE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 ASIA PACIFIC CERAMIC MEMBRANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 ASIA PACIFIC CERAMIC MEMBRANE MARKET: SEGMENTATION

FIGURE 15 GROWING DEMAND FOR CERAMIC MEMBRANES ACROSS VARIOUS INDUSTRIES IS EXPECTED TO DRIVE ASIA PACIFIC CERAMIC MEMBRANE MARKET IN THE FORECAST PERIOD

FIGURE 16 ALUMINA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CERAMIC MEMBRANE MARKET IN 2023 & 2030

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC CERAMIC MEMBRANES MARKET

FIGURE 19 ASIA PACIFIC CERAMIC MEMBRANE MARKET: BY MATERIAL, 2022

FIGURE 20 ASIA PACIFIC CERAMIC MEMBRANE MARKET: BY APPLICATION, 2022

TABLE 10 ASIA PACIFIC WATER & WASTEWATER TREATMENT IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

FIGURE 21 ASIA PACIFIC CERAMIC MEMBRANE MARKET: BY TECHNOLOGY, 2022

FIGURE 22 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: SNAPSHOT (2022)

FIGURE 23 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: BY COUNTRY (2022)

FIGURE 24 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 ASIA-PACIFIC CERAMIC MEMBRANE MARKET: BY MATERIAL (2023 & 2030)

FIGURE 27 ASIA PACIFIC CERAMIC MEMBRANES MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。