ヘルスケアサービスへの意識の高まりは、ベトナムの高齢者介護市場を大きく牽引しています。人口の高齢化に伴い、高齢者とその家族の間では、高齢者特有のニーズに合わせた専門的なヘルスケアサービスの重要性に対する理解が深まっています。この意識の高まりは、政府の健康教育推進、医療インフラの拡充、そして高齢者ケアに力を入れるNGOの影響によって推進されています。慢性疾患、予防ケア、長期治療の選択肢に関する情報の入手しやすさが高まったことで、家族は専門的なケアサービスを求めるようになり、高齢者介護施設、在宅ヘルスケアサービス、リハビリテーションセンターへの需要が高まっています。さらに、こうした意識の高まりは、高齢者介護施設への入居に伴う偏見を軽減し、高齢化社会における専門的なヘルスケア支援への文化的変化に貢献しています。その結果、質の高いケアを求める人々の数が大幅に増加し、ベトナムの高齢者介護市場の成長を牽引しています。

完全なレポートは https://www.databridgemarketresearch.com/reports/vietnam-elderly-care-marketでご覧いただけます。

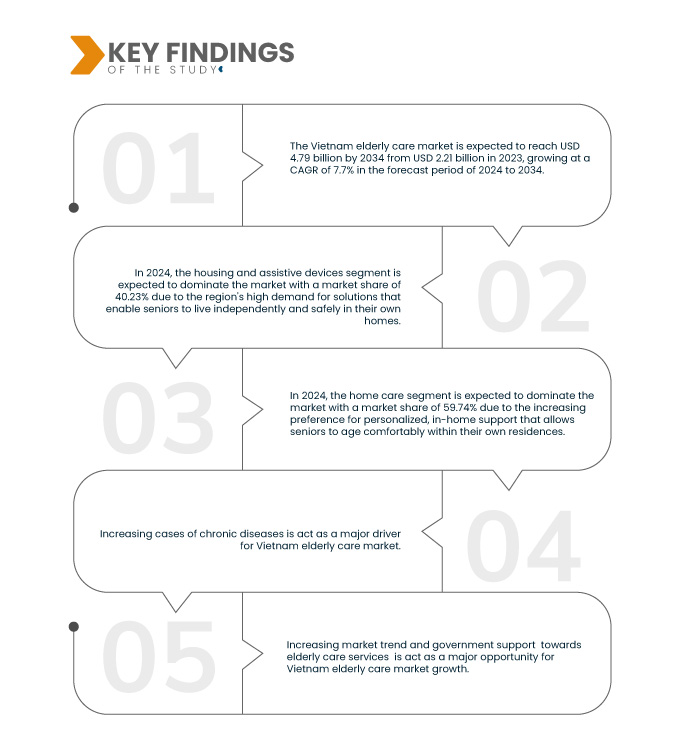

データブリッジマーケットリサーチは、ベトナムの高齢者介護市場は、 2024年から2034年の予測期間中に年平均成長率7.7%で成長し、2023年の22億1,000万米ドルから2031年には47億9,000万米ドルに達すると予測しています。

研究の主な結果

- 高齢化人口の増加

ベトナムにおける老年人口の増加は、高齢者介護サービスの発展を大きく牽引しています。高齢者数の増加に伴い、高齢者のニーズに合わせた包括的かつ専門的なケアへの需要が高まっています。こうした人口動態の変化は、医療、日常生活支援、社会支援など、高齢化のさまざまな側面に対応できる強固な支援システムの必要性を浮き彫りにしています。高齢人口の増加は、高齢者が必要なケアとケアを受けられるようにするための革新的なソリューションとインフラの緊急性を浮き彫りにしています。さらに、高齢者(60歳以上)の割合は世界中で増加しています。老年人口はより多くの健康問題を抱えており、在宅医療は患者により良い治療を提供するためのサービスを提供しています。このように、老年人口の増加は高齢者介護市場の成長を後押ししています。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024~2034年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016~2021年にカスタマイズ可能)

|

定量単位

|

収益(10億米ドル)

|

対象セグメント

|

製品タイプ(住宅および補助器具、医薬品)、サービス(在宅ケア、施設ケア、成人デイケア)、用途(心臓病、呼吸器、糖尿病、骨粗鬆症、神経系、がん、腎臓病、関節炎、その他)

|

対象国

|

ベトナム

|

対象となる市場プレーヤー

|

Care Connect Vietnam (ベトナム)、Hio Care (ベトナム)、Philips (オランダ、アムステルダム)、Medtronic (アイルランド、ダブリン)、Vinmec International Hospital (ベトナム、ハノイ)、Phonak (スイス、シュテファ)、Signia Vietnam (WS Audiology の一部、デンマーク、リンゲに本社を置く)、Saigon Healthcare (ベトナム、ホーチミン市) など。

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要企業などの市場シナリオに関する洞察に加えて、専門家による詳細な分析、地理的に表された企業別の生産量と生産能力、販売業者とパートナーのネットワークレイアウト、詳細かつ最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。

|

セグメント分析

ベトナムの高齢者介護市場は、製品の種類、サービス、用途に基づいて3つの主要なセグメントに分割されています。

- 製品タイプに基づいて、市場は住宅および補助装置と医薬品に分類されます。

2024年には、住宅および補助機器分野がベトナムの高齢者介護 市場を支配すると予想されている。

2024年には、高齢者が自宅で自立して安全に生活できるようにするソリューションに対する地域の需要が高いため、住宅および支援機器セグメントが40.23%の市場シェアで市場を支配すると予想されています。

サービスに基づいて、市場は在宅ケア、施設ケア、成人デイケアに分類されます。

2024年には、在宅介護分野がベトナムの高齢者介護 市場を支配すると予想されている。

2024年には、高齢者が自宅で快適に老後を過ごせるように、パーソナライズされた在宅サポートへの関心が高まっているため、在宅ケア分野が59.74%の市場シェアで市場を支配すると予想されています。

用途別に見ると、市場は心臓疾患、呼吸器疾患、糖尿病、骨粗鬆症、神経疾患、がん、腎臓疾患、関節炎、その他に分類されています。2024年には、心臓疾患分野が市場シェア24.42%で市場を席巻すると予想されています。

主要プレーヤー

データブリッジマーケットリサーチは、 この市場における主要な市場プレーヤーとして、フィリップス(アムステルダム、オランダ)、メドトロニック(ダブリン、アイルランド)、ヴィンメック国際病院(ハノイ、ベトナム)、ケアコネクトベトナム(ベトナム)、フォナック - ソノバブランド(スイス)を分析しています。

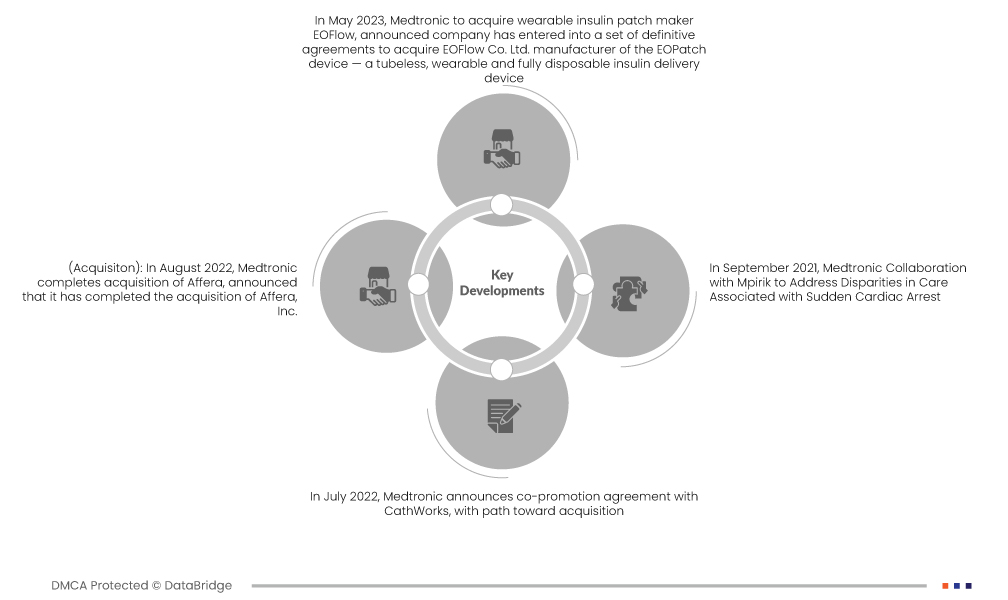

市場開発

- メドトロニックは2023年5月、ウェアラブルインスリンパッチメーカーのEOFlow社を買収すると発表しました。同社は、チューブレスでウェアラブル、かつ完全に使い捨てのインスリン注入デバイスであるEOPatchデバイスを製造するEOFlow社を買収するための一連の正式契約を締結しました。EOFlow社に加え、メドトロニックの食事検出技術アルゴリズムと次世代持続血糖モニター(CGM)が加わることで、より多くの糖尿病患者のニーズに対応できる能力が拡大すると期待されます。

- 2022年8月、メドトロニックはアフェラ社の買収を完了し、アフェラ社の買収を完了したことを発表しました。この買収により、同社の心臓アブレーションポートフォリオが拡大し、差別化された完全に統合された診断、焦点パルスフィールド、および高周波アブレーションソリューションを含む初の心臓マッピングおよびナビゲーションプラットフォームが含まれるようになります。

- 2022年7月、メドトロニックは買収に向けた道筋を定めたキャスワークスとの共同プロモーション契約を発表しました。同社は、イスラエルのケファル・サヴァに本社を置く非上場企業であるキャスワークスと戦略的パートナーシップ契約を締結したことを発表しました。キャスワークスは、冠動脈疾患(CAD)の診断と治療の変革を目指しています。

- 2021年9月、メドトロニックはMpirik社と提携し、突然の心停止に伴うケアの格差是正に取り組みました。Mpirik社と共同で、突然の心停止(SCA)の予防に関するケアの格差是正に向けたパイロットプログラムを発表しました。SCAは心臓の電気システムの障害によって引き起こされ、数分以内に除細動処置を受けなければ致命的となる可能性があります。

ベトナムの高齢者介護市場の詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/vietnam-elderly-care-market