ストーマ装置は、ストーマの形成を通じて、大腸、回腸、膀胱などの外科的に迂回された生物学的システムからの廃棄物の収集を管理するように設計された人工医療機器です。結腸ストーマ、尿路ストーマ、回腸ストーマの 3 つのタイプに分類されます。これらの装置は、安全な取り付け、臭気制御、快適性のための特殊なコンポーネントを備えており、先天性欠損、膀胱がん、炎症性腸疾患、憩室炎、肥満、その他の病状を持つ人々が活動的で機能的な生活を送れるようにします。

完全なレポートにアクセスするにはhttps://www.databridgemarketresearch.com/reports/global-ostomy-devices-market

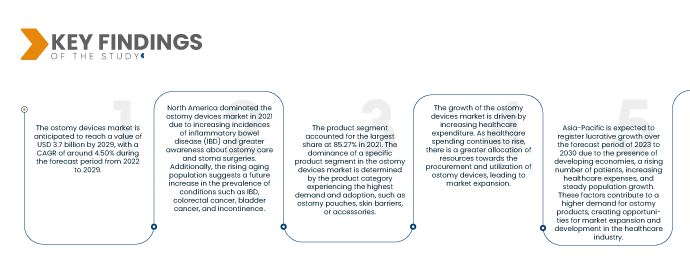

データブリッジマーケットリサーチの分析によると、 ストーマ器具市場 2021年のストーマ装置の市場規模は26億100万米ドルで、2029年までに37億米ドルに達すると予想されており、2022年から2029年の予測期間中に4.50%のCAGRを記録します。市場におけるストーマ装置の需要は技術の進歩によって推進されており、より快適で効率的な製品の開発につながり、患者の満足度を高め、ストーマ装置の採用を増加させます。

研究の主な結果

ストーマドレナージバッグの使用増加が市場の成長率を押し上げると予想される

ストーマ用排泄バッグの使用増加により、ストーマ用器具市場は成長を遂げています。これらのバッグは、ストーマを持つ人の排泄物を収集するための便利で効果的なソリューションを提供します。炎症性腸疾患、膀胱がん、大腸がんなどの病気の罹患率の上昇と高齢化人口の増加により、ストーマ用製品の需要が高まっています。このストーマ用排泄バッグの使用増加は、ストーマ用器具部門の市場成長の重要な原動力です。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2022年から2029年

|

|

基準年

|

2021

|

|

歴史的な年

|

2020 (2014~2019年にカスタマイズ可能)

|

|

定量単位

|

売上高(10億米ドル)、販売数量(個数)、価格(米ドル)

|

|

対象セグメント

|

製品(バッグ、アクセサリー)、手術タイプ(回腸造瘻ドレナージバッグ、結腸造瘻ドレナージバッグ、尿路造瘻ドレナージバッグ)、皮膚バリアの形状(平面および凸面)、システムタイプ(ワンピースシステム、ツーピースシステム)、エンドユーザー(外来手術センター、病院、在宅ケアなど)

|

|

対象国

|

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国、アジア太平洋地域 (APAC) では中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米。

|

|

対象となる市場プレーヤー

|

コロプラスト社(米国)、ホリスター社(米国)、コンバテックグループ社(英国)、ソルツヘルスケア社(英国)、ビー・ブラウン社(ドイツ)、3M社(米国)、アルケア社(日本)、フレキシケアグループ社(英国)、ヘンケルアドヒーシブテクノロジーズインディア社(ドイツ)、マーレンマニュファクチャリング&デベロップメント社(米国)、ニューホープラボラトリーズ社(米国)、オックスメッドインターナショナル社(ドイツ)、スミス・ネフュー社(英国)、トルボットグループ社(米国)、ウェランドメディカル社(英国)

|

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制枠組みも含まれています。

|

セグメント分析:

ストーマ装置市場は、製品、手術の種類、皮膚バリアの形状、システムの種類、およびエンドユーザーに基づいて分類されています。

- システムの種類に基づいて、ストーマ装置市場は、ワンピースシステムとツーピースシステムに分割されます。世界のストーマ装置市場におけるツーピースシステムセグメントは、柔軟性、メンテナンスの容易さ、快適性の向上などの利点により、2022年から2029年の予測期間に7.6%のCAGRで成長しています。

2022年には、2ピースシステムセグメントが世界のストーマデバイス市場のシステムタイプセグメントを支配します。

世界のストーマ装置市場におけるツーピースシステムセグメントは、柔軟性、メンテナンスの容易さ、快適性の向上などの利点により、2022年から2029年の予測期間に7.6%のCAGRで成長すると予想されています。

- 製品に基づいて、ストーマ装置市場はバッグと付属品に分類されます。付属品セグメントは、廃棄物の収集と管理における重要な役割により、2022年から2029年の予測期間に5.4%のCAGRで製品セグメントを支配します。

- 手術の種類に基づいて、ストーマ装置市場は、回腸ストーマ排液バッグ、結腸ストーマ排液バッグ、尿路ストーマ排液バッグに分類されます。世界のストーマ装置市場における結腸ストーマ排液バッグ部門は、需要が高く、結腸ストーマを持つ人々の排泄物の管理に不可欠な役割を果たすため、2022年から2029年の予測期間に7.4%のCAGRで成長しています。これらの特殊なバッグは、結腸ストーマからの排泄物を効果的に収集および処分できるため、ストーマ装置市場での優位性に貢献しています。

- 皮膚バリアの形状に基づいて、世界のストーマ器具市場は、平面型と凸型に分類されます。平面型セグメントは、その広範な採用と汎用性により、2022年から2029年の予測期間に世界のストーマ器具市場を支配します。平面型ストーマ器具は薄型設計と安全なフィット感を提供し、ストーマを持つ人々に快適さと目立たなさを提供し、市場での優位性につながっています。

- エンドユーザーに基づいて、ストーマ装置市場は外来手術センター、病院、在宅ケア、その他に区分されます。自宅で快適にストーマケアを選択する患者が増えているため、2022年から2029年の予測期間では在宅ケアセグメントがエンドユーザーセグメントをCAGR 7.5%で支配します。在宅ケアは利便性、独立性、費用対効果を提供し、ストーマ装置市場におけるこのセグメントの優位性を推進します。

2022年には在宅ケア分野が市場を席巻するだろう。 エンドユーザー 世界のストーマ器具市場の

2022年には、自宅で快適にストーマケアを受けたいというニーズが高まっているため、在宅ケア部門が世界のストーマ機器市場のエンドユーザー部門で主流を占めることになります。在宅ケアにより、ストーマを持つ人は自分の状態を管理しながら、自立性、プライバシー、利便性を維持することができます。さらに、病院や臨床環境に比べてコストを節約できます。

主要プレーヤー

データブリッジマーケットリサーチは、オストミー機器市場における主要なオストミー機器市場プレーヤーとして、コロプラスト社(米国)、ホリスター社(米国)、コンバテックグループ社(英国)、ソルツヘルスケア社(英国)、B.ブラウン社(ドイツ)、3M社(米国)を挙げています。

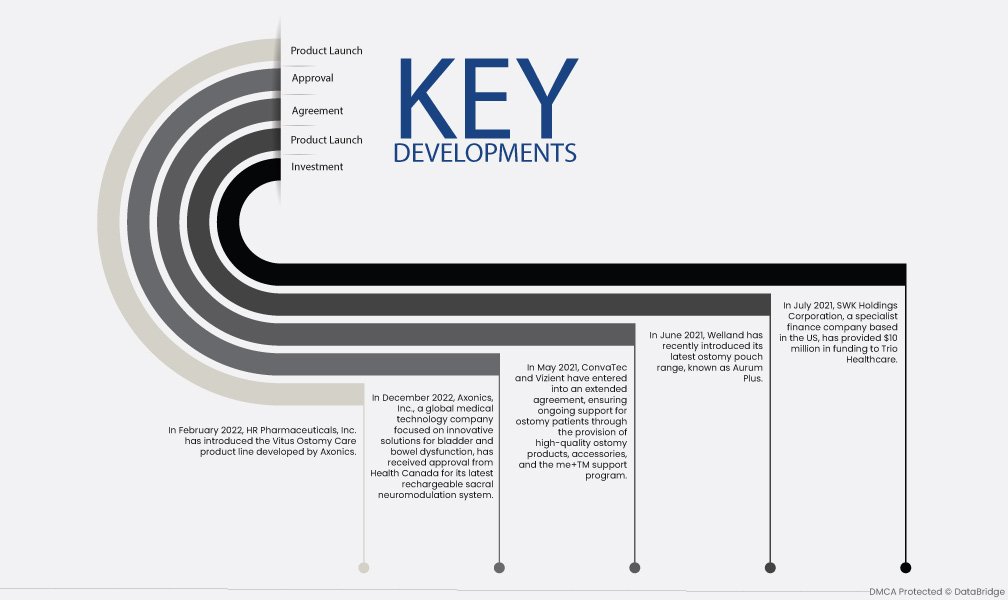

市場開拓

- 2021年7月、米国に拠点を置く専門金融会社であるSWKホールディングス・コーポレーションは、トリオ・ヘルスケアに1,000万ドルの資金を提供しました。この投資は、トリオの研究開発および製造チームの事業拡大に役立ちます。その目的は、ストーマケアを必要とする人々に役立つトリオのGeniiストーマバッグを世界中で広く発売することです。

- 2021 年 6 月、ウェランドは最新のストーマ パウチ シリーズ「Aurum Plus」を発表しました。これらの新しいパウチは、閉鎖型、排泄型、尿路ストーマ用サイズがあり、ストーマを持つ人々に多様な選択肢を提供します。Aurum Plus は、ストーマを持つ人々に、快適性と自信を高め、特定のニーズを満たす幅広い選択肢を提供するソリューションとして考案されました。

- 2021 年 5 月、コンバテックと Vizient は契約延長を締結し、高品質のストーマ製品、付属品、me+TM サポート プログラムの提供を通じて、ストーマ患者への継続的なサポートを確保しました。このコラボレーションは、ストーマ患者にケア全体を通じて包括的なケアを提供することを目指しており、ストーマを持つ人々の多様なニーズを満たすというコンバテックの取り組みを強調しています。

- 2022年12月、膀胱および腸の機能不全に対する革新的なソリューションに注力する世界的な医療技術企業であるAxonics, Inc.は、カナダ保健省から最新の充電式仙骨神経調節システムの承認を取得しました。この第4世代のシステムは、これらの症状の治療のための高度な製品の開発と商品化に向けた同社の取り組みにおいて重要なマイルストーンとなります。

- 2022 年 2 月、HR Pharmaceuticals, Inc. は、Axonics が開発した Vitus Ostomy Care 製品ラインを導入しました。この包括的なストーマ アクセサリ シリーズは、ストーマと皮膚の保護を強化し、安全でしっかりとした密閉を保証するように特別に設計されています。Vitus Ostomy Care の導入は、ストーマを持つ人々のニーズを満たし、全体的な快適さと健康に貢献する高度なソリューションを提供するという HR Pharmaceuticals の取り組みを反映しています。

地域分析

地理的に見ると、ストーマ装置市場レポートでカバーされている国は、北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国、アジア太平洋地域 (APAC) では中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米です。

Data Bridge Market Research の分析によると:

北米は、 ストーマ器具市場 予測期間2022年~2029年

2023年には、炎症性腸疾患(IBD)の発生率の増加と、ストーマケアおよびストーマ手術に対する意識の高まりにより、北米がストーマ器具市場を支配しました。さらに、人口の高齢化により、IBD、大腸がん、膀胱がん、失禁などの病気の有病率が将来的に上昇することが予想されます。これらの要因により、ストーマ製品の需要が高まり、ストーマ器具市場の成長が促進され、この分野でのイノベーションが促進されます。

アジア太平洋地域は、ストーマ器具市場において最も急速に成長する地域であると推定されている。 予測期間2022年~2029年

アジア太平洋地域は、市場拡大の機会とストーマ器具へのアクセス向上をもたらす発展途上国の存在により、予測期間中に成長すると予想されています。さまざまな病状によりストーマケアを必要とする患者数の増加が、市場の需要を牽引しています。さらに、医療費の増加と世界人口の着実な増加が、ストーマ器具の全体的な成長と市場の可能性に貢献しています。

詳細については、 ストーマ器具市場 レポートはこちらをクリックしてください – https://www.databridgemarketresearch.com/reports/global-ostomy-devices-market