世界の検査情報管理システム (LIMS) 市場は、いくつかのプラス要因に牽引され、堅調な成長を遂げています。効率的なデータ管理とワークフロー自動化のために検査室で LIMS の採用が進むと、運用効率とデータの整合性が向上します。データの統合と標準化に重点を置くことで、シームレスなコラボレーションとデータ共有が可能になります。クラウドベースのソリューションやモバイル アプリケーションなどの技術の進歩により、アクセシビリティとスケーラビリティが向上します。データ セキュリティとプライバシーへの注目が高まり、データ分析とビジネス インテリジェンスに対する需要も高まっているため、市場の好調な軌道がさらに推進されています。

完全なレポートにアクセスする:https://www.databridgemarketresearch.com/reports/global-hospital-laboratory-information-management-systems-market

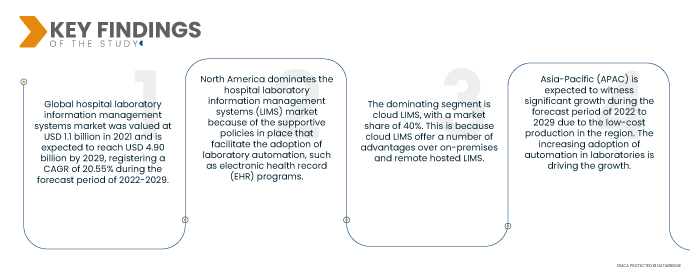

データブリッジマーケットリサーチの分析によると、 病院検査情報管理システム (LIMS) 市場 2022年には20億7000万米ドルに成長し、2023年から2030年の予測期間中に9.80%のCAGRで2030年までに43億7000万米ドルに達すると予想されています。ラボデータの量と複雑さが増すにつれて、データの統合と標準化がますます重要になっています。LIMSソリューションは、ラボデータを統合、整理、標準化する機能を提供し、複数の部門や関係者間でシームレスなデータ共有とコラボレーションを可能にし、市場の成長を促進します。

研究の主な結果

ラボ自動化の需要は高まっており、 市場の成長率を牽引すると予想される

研究開発ラボ、特に製薬およびバイオテクノロジーラボにおけるラボの自動化とイノベーションの需要の高まりが、ラボ情報システム (LIS) の推進力となっています。さらに、ラボ情報ソリューションの高精度と効率性の結果が、ラボ情報市場を前進させています。プロのヘルスケア IT サービス プロバイダーである Astrix Technologies LLC が実施した 2020 年の調査によると、LIMS ユーザーの 61% が手動操作の排除から恩恵を受け、57% がサンプル管理アプローチを改善し、46% がラボ環境内での生産性の大幅な向上を確認しました。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2022年から2029年

|

|

基準年

|

2021

|

|

歴史的な年

|

2020 (2014~2019年にカスタマイズ可能)

|

|

定量単位

|

売上高(10億米ドル)、販売数量(個数)、価格(米ドル)

|

|

対象セグメント

|

製品 (デバイス、ソフトウェア、サービス)、タイプ (ワイヤレス ヘルス、M-health、テレヘルス、EHR/EMR など)、エンド ユーザー (病院、在宅ケア施設、診療所、外来手術センターなど)

|

|

対象国

|

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、ヨーロッパではその他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、中東およびアフリカ (MEA) の一部としてその他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、南米のその他の地域

|

|

対象となる市場プレーヤー

|

Medtronic(アイルランド)、Boston Scientific Corporation(米国)、NEVRO CORP(米国)、Cyberonics, Inc.(米国)、Inspire Medical Systems, Inc.(米国)、SPR Therapeutics(米国)、ALEVA NEUROTHERAPEUTICS SA(スイス)、Bioness Inc.(米国)、ReShape Lifesciences, Inc.(米国)、LivaNova PLC(英国)、NeuroPace, Inc.(米国)、Synapse Biomedical Inc.(米国)、Soterix Medical Inc.(米国)、Accellent Technologies, Inc.(米国)、Abbott(米国)、Bioventus(米国)、Soterix Medical Inc.(米国)、Integer Holdings Corporation(米国)

|

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、詳細な専門家分析、患者の疫学、パイプライン分析、価格分析、規制枠組みが含まれています。

|

セグメント分析:

病院検査情報管理システム市場は、タイプ、コンポーネント、展開モデル、業界に基づいて分類されています。

- タイプに基づいて、病院検査情報管理システム市場は、広範囲にわたる LIMS と業界固有の LIMS に分類されます。

幅広いタイプのLIMSセグメントが病院の検査情報管理システムを支配している 市場

支配的なセグメントはブロードベース LIMS で、市場シェアは 60% です。これは、ブロードベース LIMS が病院、診療所、研究機関など、さまざまな研究室環境で使用できるように設計されているためです。ブロードベース LIMS は幅広い機能と性能を備えており、特定の研究室の特定のニーズに合わせてカスタマイズできます。

- コンポーネントに基づいて、病院検査情報管理システム市場はソフトウェアとサービスに分かれています。支配的なセグメントはソフトウェアで、市場シェアは 80% です。これは、ソフトウェアが LIMS の最も重要なコンポーネントであるためです。ソフトウェアは、検査室で生成されたすべてのデータを保存および管理する役割を担い、検査室スタッフがそのデータを分析および解釈するために必要なツールを提供します。

- 導入モデルに基づいて、病院の検査情報管理システム市場は、オンプレミス LIMS、リモート ホスト LIMS、クラウド LIMS に分類されます。支配的なセグメントはクラウド LIMS で、市場シェアは 40% です。これは、クラウド LIMS がオンプレミスやリモート ホスト LIMS に比べて多くの利点を提供するためです。クラウド LIMS は、より拡張性と信頼性が高く、管理と更新も簡単です。

- 業界別に見ると、病院検査情報管理システム市場は、ライフサイエンス、石油化学製油所および石油・ガス、食品・飲料・農業、化学、環境試験研究所、およびその他の業界に分類されます。

在宅ケア設定の業界セグメントは、病院の検査情報管理システムを支配している。 市場

最も大きなセグメントはライフサイエンスで、市場シェアは 35% です。これは、ライフサイエンス研究室が最も複雑で要求の厳しい研究室環境の 1 つであるためです。ライフサイエンス研究室では、幅広いデータ タイプを処理でき、他の研究室システムと簡単に統合できる LIMS が必要です。

主要プレーヤー

Data Bridge Market Research は、以下の企業を主要な市場プレーヤーとして認識しています:Medtronic (アイルランド)、Boston Scientific Corporation (米国)、NEVRO CORP (米国)、Cyberonics, Inc. (米国)、Inspire Medical Systems, Inc. (米国)、SPR Therapeutics (米国)、ALEVA NEUROTHERAPEUTICS SA (スイス)、Bioness Inc. (米国)、ReShape Lifesciences, Inc. (米国)、LivaNova PLC (英国)、NeuroPace, Inc. (米国)、Synapse Biomedical Inc. (米国)、Soterix Medical Inc. (米国)、Accellent Technologies, Inc. (米国)、Abbott (米国)、Bioventus (米国)、Soterix Medical Inc. (米国)、Integer Holdings Corporation (米国)。

市場開拓

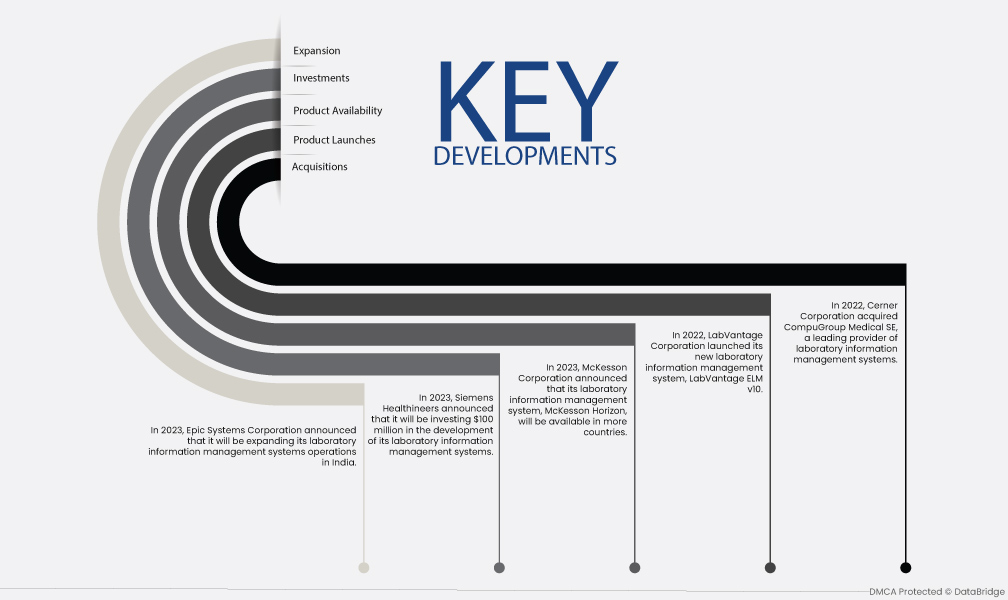

- 2022 年、Cerner Corporation は、検査情報管理システムの大手プロバイダーである CompuGroup Medical SE を買収しました。この買収により、Cerner は検査情報管理システムとサービスのポートフォリオを拡大することができます。

- 2022 年、LabVantage Corporation は新しいラボ情報管理システムである LabVantage ELM v10 をリリースしました。この新しいシステムは、データ統合の改善、自動化の向上、セキュリティの強化など、数多くの新機能と機能を提供します。

- 2023 年、McKesson Corporation は、同社のラボ情報管理システムである McKesson Horizon をさらに多くの国で利用可能にすると発表しました。McKesson Horizon システムは、リモート アクセス、モバイル デバイスのサポート、データ分析など、さまざまな機能と機能を提供するクラウドベースのラボ情報管理システムです。

- 2023年、シーメンス ヘルスシナーズは、検査情報管理システムの開発に1億ドルを投資すると発表しました。この投資は、シーメンスの検査情報管理システムの新機能や機能の開発、および販売とマーケティング活動の拡大に使用されます。

- 2023年、Epic Systems Corporationはインドでの検査情報管理システム事業を拡大すると発表しました。この拡大により、Epicはインドでの検査情報管理システムに対する需要の高まりに対応できるようになります。

地域分析

地理的に、市場レポートでカバーされている国は、北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米です。

Data Bridge Market Research の分析によると:

北米は病院の検査情報管理システムの主要地域である 予測期間2022~2029年の市場

北米は、電子医療記録 (EHR) プログラムなどの検査自動化の導入を促進する支援政策があるため、病院検査情報管理システム市場を独占しています。EHR プログラムは患者データの集中リポジトリを提供し、検査ワークフローを自動化して検査業務の効率を向上させることができます。さらに、北米には確立された医療インフラと高い一人当たり所得があり、この地域での LIMS の需要に貢献しています。

アジア太平洋地域 最も急速に成長している地域であると推定されています 病院検査情報管理システム 市場 予測期間2022-2029年

アジア太平洋地域(APAC)は、同地域での低コスト生産により、2022年から2029年の予測期間中に大幅な成長が見込まれています。研究室での自動化の導入の増加と患者データ統合の需要の高まりも、APACの市場の成長を牽引しています。

デジタルヘルスモニタリングデバイスの詳細については 市場 レポートはこちらをクリックしてください – https://www.databridgemarketresearch.com/reports/global-hospital-laboratory-information-management-systems-market