欧州の安静時心電計(ECG)市場は、心血管疾患の罹患率増加に牽引され、大幅な拡大を遂げています。心血管疾患は依然として欧州大陸における主要な死亡原因となっています。高齢化、早期診断への意識の高まり、そして高血圧や糖尿病といった慢性疾患の増加により、ECG機器などの高度な診断ツールへの需要が高まっています。簡便性と信頼性で知られる安静時ECGは、長期的な医療費の削減と患者の転帰改善に不可欠な早期発見において重要な役割を果たしています。

ワイヤレス、デジタル、ポータブルな心電図機器などの技術革新は、診断精度と患者の快適性を向上させ、医療環境を変革しています。さらに、人工知能(AI)との統合により、より迅速な分析とより正確な結果が可能になり、医師と患者の双方にとって魅力的なものとなっています。しかしながら、医療機器に関する厳格なEU規制をはじめとする規制上の課題、そしてデータのプライバシーとセキュリティに関する懸念が、市場の成長を阻んでいます。EU政府の取り組みに支えられたデジタルヘルスケアへの移行は、この市場における新たな投資とイノベーションの道を開くことが期待されます。

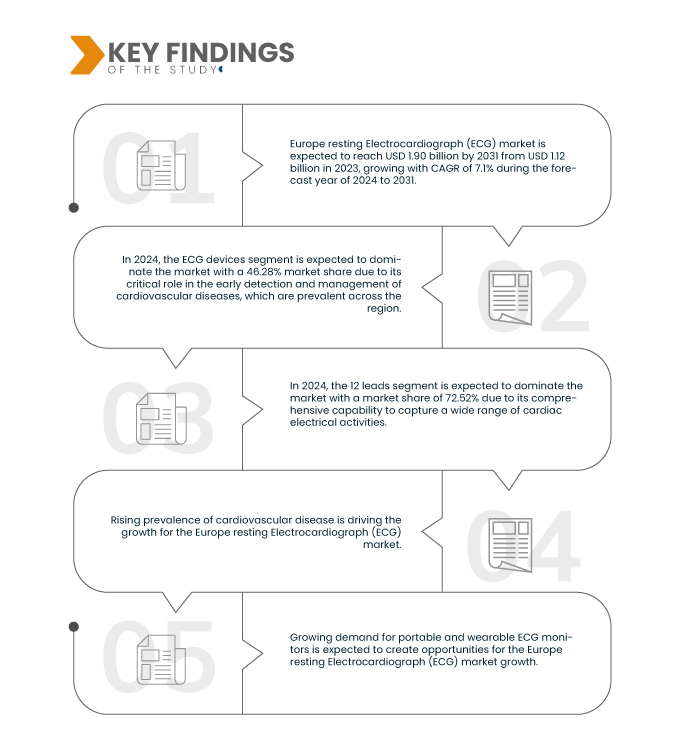

データブリッジマーケットリサーチは、欧州の安静時心電計(ECG)市場は、2024年から2031年の予測期間中に7.1%のCAGRで成長し、2023年の11億2,000万米ドルから2031年には19億米ドルに達すると予測しています。

研究の主な結果

心電図における技術の進歩

心電図(ECG)における技術革新は、これらの診断機器の精度、効率、そして使いやすさを向上させるため、欧州の安静時心電計市場の成長を牽引する重要な要因となっています。デジタルECGシステム、心臓信号を解釈するための高度なアルゴリズム、クラウドベースのデータ管理といった技術革新は、従来のECGの実践を変革し、心臓疾患のより正確かつタイムリーな診断を可能にしています。さらに、人工知能(AI)と機械学習をECG分析に統合することで、医療従事者はより確実に異常を検出できるようになり、人為的ミスの可能性を低減し、患者の転帰を改善します。

さらに、ポータブルおよびウェアラブルECGデバイスの登場により、心臓モニタリングがより身近なものとなり、遠隔での患者モニタリングと早期介入が容易になりました。医療システムが遠隔医療やリモートケアソリューションを重視するようになるにつれ、機能性と利便性を兼ね備えた先進的なECGデバイスの需要が高まっています。これらの進歩は、臨床現場におけるワークフローを合理化するだけでなく、患者が心臓の健康管理に積極的に関わる力を与え、医療提供者が心臓血管ケアのための最先端ソリューションの導入を模索する中で、市場を牽引することになります。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024~2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016~2021年にカスタマイズ可能)

|

定量単位

|

収益(10億米ドル)

|

対象セグメント

|

製品(ECGデバイス、モニター、ソフトウェアとサービス、埋め込み型ループレコーダー、モバイル心臓遠隔測定装置)、リード数(12リード、15リード、18リード、その他)、テクノロジー(デジタルとアナログ)、モダリティ(固定式とモバイル式)、デバイスサイズ(大、中、小)、接続性(有線と無線)、操作モード(自動、半自動、手動)、エンドユーザー(病院、専門クリニック、外来手術センター、在宅ケア環境、その他)

|

対象国

|

ドイツ、イギリス、フランス、イタリア、スペイン、ロシア、トルコ、ベルギー、オランダ、スイス、ポーランド、チェコ共和国、スロバキア、その他のヨーロッパ諸国

|

対象となる市場プレーヤー

|

GE Healthcare(米国)、Koninklijke Philips NV(オランダ)、Baxter(米国)、SCHILLER AG(スイス)、Cardioline SPA(イタリア)、EDAN Instruments, Inc.(中国)、FUKUDA DENSHI(日本)、Personal MedSystems GmbH(ドイツ)、VYAIRE MEDICAL, INC.(米国)、Innomed Medical Inc.(ハンガリー)、Norav Medical(米国)、OSI Systems, Inc.(Spacelabs Healthcare)(米国)、Lepu Medical Technology(Beijing)Co., Ltd.(中国)、Dawei medical(中国)、Gima SPA(イタリア)、Zimmer Benelux BV(ドイツ)、AMEDTEC Medizintechnik Aue GmbH(ドイツ)、BTL(インド)、Contec Medical Systems Co., Ltd(中国)など

|

レポートで取り上げられているデータポイント

|

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。

|

セグメント分析

ヨーロッパの安静時心電図計 (ECG) 市場は、製品、リード数、テクノロジー、モダリティ、デバイス サイズ、接続性、操作モード、およびエンド ユーザーに基づいて、いくつかの主要なセグメントに分類されています。

- 製品に基づいて、ヨーロッパの安静時心電計(ECG)市場は、ECGデバイス、モニター、ソフトウェアとサービス、埋め込み型ループレコーダー、モバイル心臓テレメトリーデバイスに分類されます。

2024年には、ECGデバイスセグメントがヨーロッパの安静時心電計(ECG)市場を支配すると予想されています。

2024年には、地域全体で蔓延している心血管疾患の早期発見と管理における重要な役割により、ECGデバイスセグメントが46.28%の市場シェアで市場を支配すると予想されています。

- ヨーロッパの安静時心電図(ECG)市場は、リード数に基づいて、12リード、15リード、18リード、その他に分類されます。

2024年には、12リードセグメントがヨーロッパの安静時心電計(ECG)市場を支配すると予想されています。

2024年には、広範囲の心臓の電気活動を捉える包括的な能力により、12リードセグメントが72.52%の市場シェアで市場を支配すると予想されています。

- 欧州の安静時心電計(ECG)市場は、技術に基づいてデジタルとアナログに区分されています。2024年には、デジタルセグメントが77.87%の市場シェアで市場を独占すると予想されています。

- 欧州の安静時心電計(ECG)市場は、モダリティに基づいて固定式と携帯式に分類されます。2024年には、固定式が市場シェア70.72%で市場を独占すると予想されています。

- 欧州の安静時心電計(ECG)市場は、機器サイズに基づいて、大型、中型、小型に分類されています。2024年には、大型セグメントが60.91%の市場シェアを獲得し、市場を独占すると予想されています。

- 欧州の安静時心電計(ECG)市場は、接続性に基づいて有線と無線に分類されます。2024年には、有線セグメントが63.28%の市場シェアで市場を独占すると予想されています。

- 欧州の安静時心電計(ECG)市場は、動作モードに基づいて、自動、半自動、手動に分類されます。2024年には、自動セグメントが71.51%の市場シェアで市場を独占すると予想されています。

- 欧州の安静時心電計(ECG)市場は、エンドユーザー別に、病院、専門クリニック、外来手術センター、在宅ケア施設、その他に分類されています。2024年には、病院セグメントが35.05%の市場シェアで市場を席巻すると予想されています。

主要プレーヤー

Data Bridge Market Research は、GE Healthcare (米国)、Koninklijke Philips NV (オランダ)、Baxter (米国)、SCHILLER AG (スイス)、Cardioline SPA (イタリア) など、ヨーロッパの安静時心電計 (ECG) 市場の主要企業として以下の企業を分析しています。

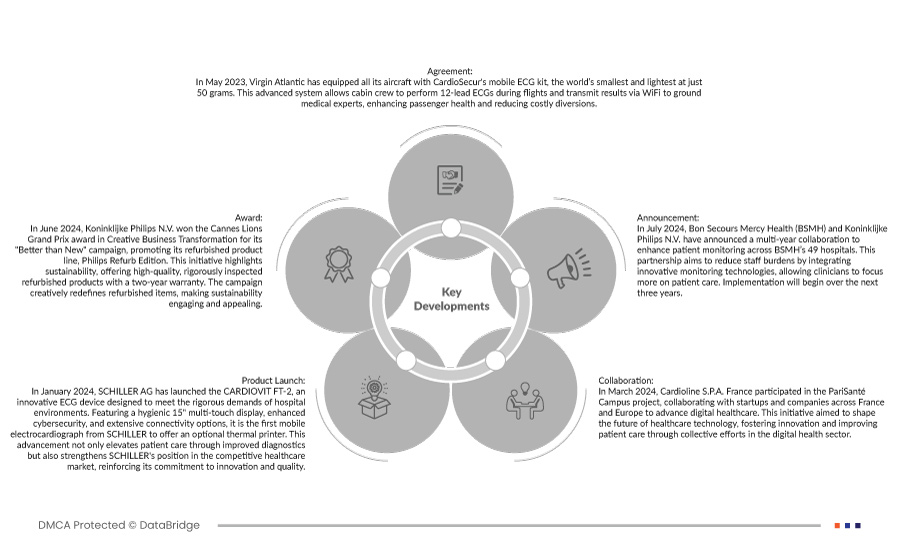

市場動向

- 2024年7月、ボン・セクール・マーシー・ヘルス(BSMH)とコーニンクレッカ・フィリップスNVは、BSMH傘下の49病院における患者モニタリングを強化するため、複数年にわたる提携を発表しました。この提携は、革新的なモニタリング技術を統合することでスタッフの負担を軽減し、医師が患者ケアに集中できるようにすることを目的としています。実装は今後3年間で開始されます。

- SCHILLER AGは2024年1月、病院環境の厳しい要求に応えるよう設計された革新的な心電図装置「CARDIOVIT FT-2」を発売しました。衛生的な15インチマルチタッチディスプレイ、強化されたサイバーセキュリティ、そして幅広い接続オプションを備えた本製品は、SCHILLER社初のモバイル心電計として、オプションでサーマルプリンターを搭載可能です。この進歩は、診断精度の向上による患者ケアの向上だけでなく、競争の激しいヘルスケア市場におけるSCHILLER社の地位を強化し、イノベーションと品質へのコミットメントをさらに強化します。

- 2024年3月、Cardioline SPA Franceは、フランスおよびヨーロッパのスタートアップ企業や企業と連携し、デジタルヘルスケアを推進するPariSanté Campusプロジェクトに参加しました。この取り組みは、デジタルヘルス分野における共同の取り組みを通じて、ヘルスケアテクノロジーの未来を形作り、イノベーションを促進し、患者ケアを向上させることを目指しています。

- 2022年5月、フクダ電子は米国のお客様向けにウェブサイトを開設し、製品サポートへの即時アクセスを可能にしました。このサイトでは、製品情報、チュートリアルビデオ、マニュアル、ニュースなどを掲載し、ユーザーエクスペリエンスを向上させ、デバイスの使用を最適化するための支援を提供しています。

- 2023年5月、ヴァージン・アトランティック航空はCardioSecur社と提携し、機内安全性の向上を目指し、全便に世界最小のモバイル心電図キットを導入しました。このシステムにより、客室乗務員は12誘導心電図を記録し、結果を地上医療サービスに送信できます。これにより、重要なフィードバックが得られ、心血管イベントによるフライトの迂回の必要性が軽減されます。

ヨーロッパの安静時心電計(ECG)市場の詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/europe-resting-electrocardiograph-ecg-market