業界が3Dプリントの革新的な機能を採用するにつれて、この革新的な製造プロセスの多様な要件を満たすことができる材料の需要が急増しています。3Dの汎用性 印刷積層造形法としても知られる 3D プリンティングは、航空宇宙、ヘルスケア、自動車、消費財などの業界で幅広く利用されており、ラピッドプロトタイピング、カスタマイズされた生産、複雑なデザインの製造にこの技術が採用されています。3D プリント材料の需要に寄与している要因は、複雑で高度にカスタマイズされた部品を製造できるこの技術の能力です。従来の製造方法は、業界がより複雑で精密に設計された部品を求めているため、それほど効率的でも迅速でもありません。3D プリンティングは、幾何学的に複雑な構造を効率よく作成できるようにすることで、このギャップに対処します。これには、プラスチックや金属からセラミックや複合材料に至るまで、さまざまな用途に合わせた幅広い材料が必要です。特定の業界のニーズを満たすことができる多様な材料の需要は、このように 3D プリンティング技術の汎用性によって推進されています。

完全なレポートにアクセスするには、https://www.databridgemarketresearch.com/reports/europe-3d-printing-materials-market

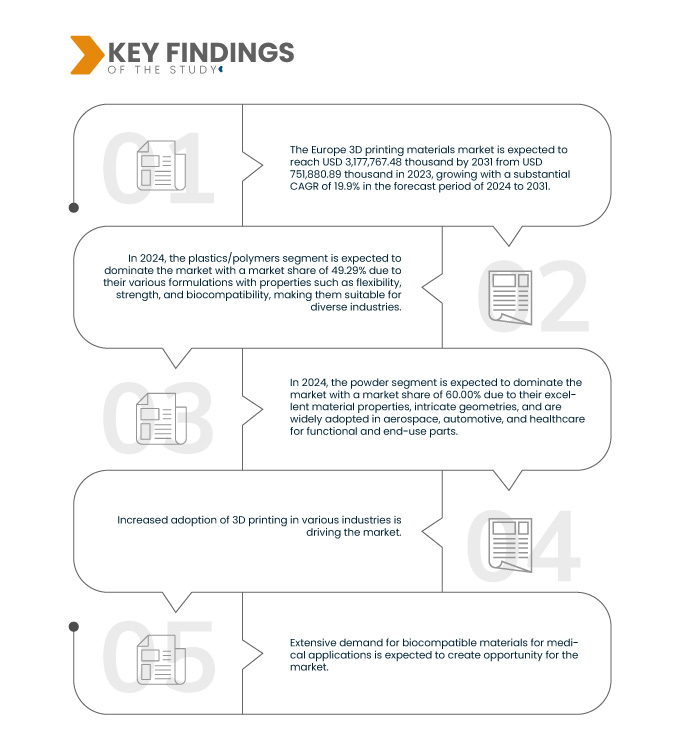

データブリッジマーケットリサーチは、 ヨーロッパの3Dプリント材料市場 2023年の751,880.89米ドルから2031年には3,177,767.48米ドルに達し、2024年から2031年の予測期間に19.9%の大幅なCAGRで成長すると予想されています。

研究の主な結果

3Dプリント技術のアクセス性と手頃な価格の拡大

3Dプリントの採用の急増により、さまざまな用途に適したさまざまな材料の需要が高まっています。ポリマーや金属から 陶芸 複合材料は現在、3D プリントのアプリケーションやテクノロジーに不可欠なものとなっています。これらのテクノロジーの利用しやすさが向上したことで、ユーザー ベースが多様化し、それぞれに独自の材料要件が課せられるようになりました。3D プリントの利用しやすさと手頃な価格により、材料開発のイノベーションも促進されました。研究者やメーカーは、多様なアプリケーションの進化するニーズに対応する特殊材料の作成に投資しています。これにより、強度、柔軟性、耐熱性などの特性を強化した高度な材料が登場しました。これにより、3D プリント材料の対象市場が拡大し、材料消費量が増加しました。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2024年から2031年

|

|

基準年

|

2023

|

|

歴史的な年

|

2022 (2016~2021年にカスタマイズ可能)

|

|

定量単位

|

収益(千米ドル)

|

|

対象セグメント

|

タイプ(プラスチック/ポリマー、金属、セラミック、その他)、形状(粉末、フィラメント、液体)、技術(熱溶解積層法(FDM)、選択的レーザー焼結法(SLS)、光造形法(SLA)、直接金属レーザー焼結法(DMLS)、大面積積層造形法(BAAM)、ワイヤアーク積層造形法(WAAM)、カラージェット、その他)、最終用途(工業製造、自動車、 航空宇宙 防衛、ヘルスケア、消費財、エレクトロニクス、教育、建設、その他)

|

|

対象国

|

ドイツ、イタリア、イギリス、フランス、スペイン、トルコ、ロシア、スイス、ベルギー、オランダ、ルクセンブルク、その他のヨーロッパ諸国

|

|

対象となる市場プレーヤー

|

Formlabs(米国)、EOS(ドイツ)、ENVISIONTEC US LLC(米国)、American Elements(米国)、Höganäs AB(スウェーデン)、UltiMaker(オランダ)、Carbon, Inc.(米国)、KRAIBURG TPE GmbH & Co. KG(ドイツ)、Covestro AG(ドイツ)、Markforged, Inc.(米国)、Stratasys(米国)、ExOne(米国)、Arkema(フランス)、3D Systems, Inc.(日本)、Evonik Industries AG(ドイツ)、Materialise(ベルギー)、BASF SE(ドイツ)、Solvay(ベルギー)、Sandvik AB(スウェーデン)など

|

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、詳細な専門家の分析、地理的に表された企業別の生産と生産能力、販売代理店とパートナーのネットワークレイアウト、詳細で最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。

|

セグメント分析

ヨーロッパの 3D プリント材料市場は、タイプ、形状、技術、最終用途に基づいて 4 つの主要なセグメントに分割されています。

- タイプ別に見ると、ヨーロッパの3Dプリント材料市場は、プラスチック/ポリマー、金属、セラミック、その他に分類されます。

2024年には、プラスチック/ポリマーセグメントがヨーロッパの3Dプリント材料市場を支配すると予想されています。

2024年には、柔軟性、強度、生体適合性などの特性を備えたさまざまな配合により、さまざまな業界に適したプラスチック/ポリマーセグメントが49.29%の市場シェアで市場を支配すると予想されています。

- 形態に基づいて、ヨーロッパの3Dプリント材料市場は粉末、フィラメント、液体に分類されます。

2024年には、粉末セグメントがヨーロッパの3Dプリント材料市場を支配すると予想されています。

2024年には、粉末ベースのプロセスが優れた材料特性と複雑な形状を提供し、航空宇宙、自動車、ヘルスケアの機能部品や最終用途部品に広く採用されているため、粉末セグメントが60.00%の市場シェアで市場を支配すると予想されています。

- 技術に基づいて、ヨーロッパの3Dプリント材料市場は、熱溶解積層法(FDM)、選択的レーザー焼結法(SLS)、ステレオリソグラフィー(SLA)、直接金属レーザー焼結法(DMLS)、大面積積層造形法(BAAM)、ワイヤアーク積層造形法(WAAM)、カラージェットなどに分割されています。2024年には、熱溶解積層法(FDM)セグメントが35.95%の市場シェアで市場を支配すると予想されています。

- 最終用途に基づいて、ヨーロッパの3Dプリント材料市場は、工業製造、自動車、航空宇宙、 防衛、ヘルスケア、消費財、電子機器、教育、建設など。2024年には、産業製造部門が市場シェア21.13%で市場を支配すると予想されています。

主要プレーヤー

Data Bridge Market Research は、ヨーロッパの 3D プリント材料市場の主要企業として、Stratasys (米国)、EOS (ドイツ)、3D Systems, Inc. (日本)、BASF SE (ドイツ)、Materialise (ベルギー) を分析しています。

市場動向

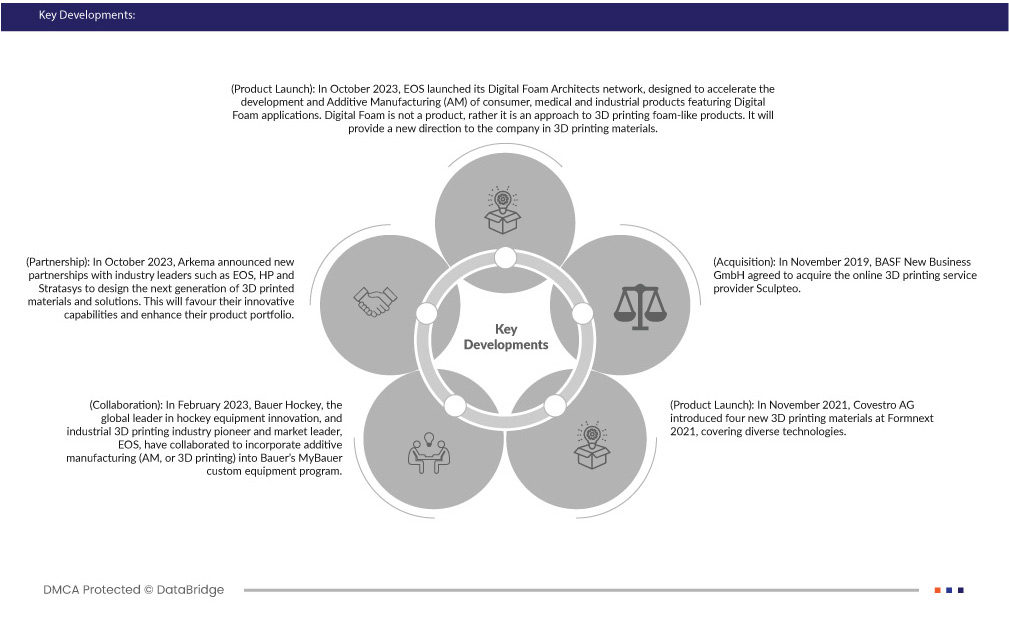

- 2023年10月、EOSはデジタルフォームアーキテクトネットワークを立ち上げました。これは、デジタルフォームアプリケーションを搭載した消費者向け、医療用、産業用製品の開発と積層造形(AM)を加速するように設計されています。デジタルフォームは製品ではなく、フォームのような製品を3Dプリントするためのアプローチです。これは、3Dプリント材料における会社に新たな方向性を提供します。

- 2023年10月、アルケマはEOS、HP、ストラタシスなどの業界リーダーと新たな提携を結び、次世代の3Dプリント材料とソリューションを設計すると発表しました。これにより、アルケマの革新的能力が強化され、製品ポートフォリオが強化されます。

- 2023年2月、ホッケー用具の革新におけるヨーロッパのリーダーであるバウアーホッケーと、産業用3Dプリント業界の先駆者であり市場リーダーであるEOSが協力し、バウアーのMyBauerカスタム機器プログラムに積層造形(AM、または3Dプリント)を組み込むことになりました。EOSとポリマー印刷に対する特許取得済みのデジタルフォームアプローチは、バウアーに明確な優位性をもたらしました。これにより、ヨーロッパの3Dプリント材料市場におけるEOSの市場プレゼンスが強化されます。

- 2021年11月、コベストロAGはFormnext 2021で、多様な技術を網羅した4つの新しい3Dプリント材料を発表しました。その中には、高温材料のFDMプリント用の可溶性サポート材であるAddigy FPC SOL1 HTがあり、簡単に除去でき、持続性があります。SLS用のArnitel AM3001(P)は、エネルギーリターンの高い柔らかい材料で、玩具安全基準に準拠した3Dプリントに成功しました。コベストロはまた、反発性、後処理のしやすさ、高い再利用率で知られるTPUパウダーAddigy PPU 86AW6のSLSおよびHSSバージョンも発売しました。これらの追加により、今年初めのDSMの積層製造事業の買収に続き、コベストロの3Dプリント用ポリマーの選択肢が広がります。

- 2019年11月、BASF New Business GmbHはオンライン3DプリントサービスプロバイダーのSculpteoを買収することに合意しました。この契約は2019年11月14日に締結され、関係当局の規制承認を待って今後数週間以内に発効する予定です。パリとサンフランシスコに拠点を置くフランスの3Dプリント専門企業の買収により、BASF New Business GmbHの完全子会社であるBASF 3D Printing Solutions GmbHは、新しい産業用3Dプリント材料をより迅速に販売および確立できるようになり、BASFの生産能力が強化されました。

地域分析

地理的に見ると、ヨーロッパの 3D プリント材料市場に含まれる国は、ドイツ、イタリア、イギリス、フランス、スペイン、トルコ、ロシア、スイス、ベルギー、オランダ、ルクセンブルク、およびその他のヨーロッパ諸国です。

Data Bridge Market Research の分析によると:

ドイツ と推定される 支配的で ヨーロッパの3Dプリント材料市場で最も急成長している国

ドイツ 国内で 3D プリント技術へのアクセス性と手頃な価格が拡大しているため、この市場で支配的かつ最も急速に成長している郡になると推定されています。

ヨーロッパの3Dプリント材料市場レポートの詳細については、ここをクリックしてください。https://www.databridgemarketresearch.com/reports/europe-3d-printing-materials-market