2009年以降、金融機関はデジタル技術の統合とフィンテック化により、デジタル化への変革を遂げてきました。デジタル変革は、金融プロセスの自動化、サービスの向上、効率化をもたらしました。インターネットサービスは、こうした金融機関の変革において大きな要因となっています。人々が基本的な利用方法としてインターネットサービスに慣れてきたことで、金融サービスはこれらの要素を活用しています。企業はデジタル融資プラットフォームなど、金融サービスのためのデジタルプラットフォームを開発していますが、これらのプラットフォームはインターネットの普及なしには効果を発揮しません。インターネットサービスの普及拡大は、アフリカのデジタル融資プラットフォーム市場を活性化させるでしょう。

完全なレポートは https://www.databridgemarketresearch.com/reports/africa-digital-lending-platform-marketでご覧いただけます。

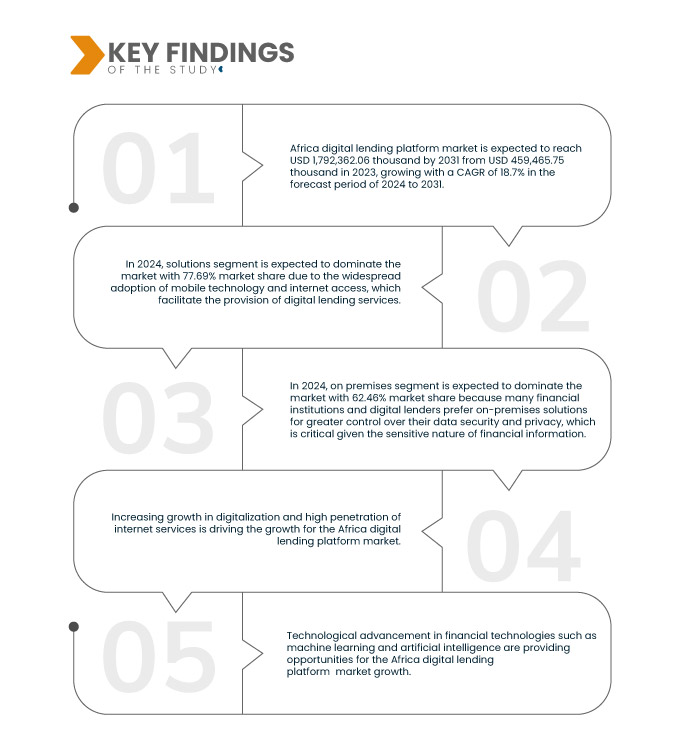

データブリッジマーケットリサーチの分析によると、アフリカのデジタル融資プラットフォーム市場は、2024年から2031年の予測期間に18.7%のCAGRで成長し、2023年の459,465.75米ドルから2031年には1,792,362.06米ドルに達すると予想されています。

研究の主な結果

金融サービスにおけるスマートフォンの増加

スマートフォンは、近距離無線通信(NFC)決済、クイックレスポンス(QR)コード決済、インターネット決済、キャリア決済、モバイルバンキングといった技術を導入することで、金融サービス市場に革命をもたらしました。スマートフォンへのオンラインバンキングの導入に伴い、アフリカの人々の間でスマートフォンの利用率が高いことから、金融サービスはスマートフォンで利用できるデジタルプラットフォームの開発の必要性を認識しました。こうしたスマートフォンの普及は、アフリカのデジタル融資プラットフォーム市場の大きな成長を生み出しています。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016~2021年にカスタマイズ可能)

|

定量単位

|

収益(千米ドル)

|

対象セグメント

|

コンポーネント (ソリューションとサービス)、導入モデル (オンプレミスとクラウド)、ローン金額 (7,000 米ドル未満、7,001 米ドルから 20,000 米ドル、20,001 米ドル超)、サブスクリプション タイプ (無料と有料)、ローンの種類 (自動車ローン、中小企業向け金融ローン、個人ローン、住宅ローン、耐久消費財、その他)、タイプ (企業と消費者)、業種 (銀行、金融サービス、保険会社、P2P (ピアツーピア) 貸し手、信用組合、貯蓄貸付組合、住宅ローン)

|

対象国

|

南アフリカ、ナイジェリア、ケニア、エジプト、ウガンダ、タンザニア、エチオピア、コンゴ民主共和国、スーダン、その他のアフリカ諸国

|

対象となる市場プレーヤー

|

Branch International(米国)、Tala(米国)、OPay Digital Services Limited(ナイジェリア)、Carbon(ナイジェリア)、FairMoney(ナイジェリア)、Aella(ナイジェリア)、FINT Technology Africa Ltd.(ナイジェリア)、Lendable(ロンドン)、Palmcredit(ナイジェリア)、Renmoney Microfinance Bank Limited(ナイジェリア)、JUMO(アフリカ)、PesaZone(アフリカ)、Backbase(オランダ)、Fawry Banking and Payment Technology Services(エジプト)、Kashway(ケニア)、XCreditplus(ナイジェリア)、Okash(ケニア)、iPesa(ケニア)、Pesapro Ltd.(ケニア)、M-KOPA(ケニア)など

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、専門家による詳細な分析、輸入/輸出分析、価格分析、生産消費分析、乳棒分析が含まれています。

|

セグメント分析

アフリカのデジタル融資プラットフォーム市場は、コンポーネント、展開モデル、融資額、サブスクリプションタイプ、融資タイプ、タイプ、垂直に基づいて、7 つの主要なセグメントに分類されています。

- コンポーネントに基づいて、アフリカのデジタル融資プラットフォーム市場はソリューションとサービスに分類されます。

2024年には、ソリューション セグメントがアフリカのデジタル融資プラットフォーム市場を独占するだろう。

2024年には、モバイルテクノロジーとインターネットアクセスの普及によりデジタル融資サービスの提供が容易になり、ソリューションセグメントが市場シェア77.69%で市場を支配することになります。

- 導入モデルに基づいて、アフリカのデジタル融資プラットフォーム市場はオンプレミスとクラウドに分類されます。

2024年にはオンプレミスセグメントがアフリカのデジタル融資プラットフォーム市場を独占するだろう

2024 年には、オンプレミス セグメントが 62.46% の市場シェアで市場を支配すると予想されています。これは、多くの金融機関やデジタル融資機関が、金融情報の機密性を考慮すると重要な、データ セキュリティとプライバシーのより厳格な管理のためにオンプレミス ソリューションを好むためです。

- アフリカのデジタル融資プラットフォーム市場は、融資額規模に基づいて、7,000米ドル未満、7,001米ドル~20,000米ドル、20,001米ドル超の3つに分類されています。2024年には、7,000米ドル未満のセグメントが市場シェア43.15%で市場を席巻すると予想されています。

- アフリカのデジタル融資プラットフォーム市場は、サブスクリプションの種類に基づいて、無料と有料に区分されています。2024年には、無料セグメントが60.61%の市場シェアで市場を独占すると予想されています。

- アフリカのデジタル融資プラットフォーム市場は、融資の種類に基づいて、自動車ローン、中小企業向け融資、個人向け融資、住宅ローン、耐久消費財、その他に分類されています。2024年には、自動車ローンが市場シェア33.10%で市場を席巻すると予想されています。

- 市場はタイプ別にビジネス向けと消費者向けに分類されます。2024年には、ビジネス向けがアフリカのデジタル融資プラットフォーム市場において64.69%の市場シェアを占めると予想されています。

- アフリカのデジタル融資プラットフォーム市場は、業種別に見ると、銀行、金融サービス、保険会社、P2P(ピアツーピア)融資業者、信用組合、貯蓄貸付組合、住宅ローンに分類されます。2024年には、銀行セグメントが32.03%の市場シェアで市場を席巻すると予想されています。

主要プレーヤー

データブリッジマーケットリサーチは、アフリカのデジタル融資プラットフォーム市場で事業を展開する主要企業として、Branch International Financial Servid(米国)、Tala(米国)、OPay Digital Services Limited(ナイジェリア)、Carbon(ナイジェリア)、FairMoney(ナイジェリア)、Aella(ナイジェリア)、FINT Technology Africa, Ltd(ナイジェリア)、Lendable(ロンドン)、Palmcredit(ナイジェリア)、Renmoney Microfinance Bank Limited(ナイジェリア)、JUMO(アフリカ)、PesaZone(アフリカ)、Backbase(オランダ)、Fawry Banking and Payment Techno(エジプト)、Kashway(ケニア)、XCreditplus(ケニア)、Okash(ケニア)を分析しています。

市場開発

- 2023年12月、M-KOPAはガーナに進出し、1,000万米ドル相当のデジタルクレジットを提供します。市場プレゼンスの強化により、金融包摂とデジタルインクルージョンが促進され、西アフリカ全体の成長と顧客への影響が強化されます。

- 2023年7月、M-KOPAはババジデ・デュロショラ氏をナイジェリア事業の拡大責任者に任命しました。彼の市場参入と資産ファイナンスにおける成功経験は、アフリカ最大の経済大国ナイジェリアにおけるM-KOPAの成長戦略と合致しています。

- 2022年3月、ブランチ・インターナショナルはケニアのセンチュリー・マイクロファイナンス銀行の過半数株式を取得し、マイクロファイナンス銀行セクターへの進出を果たしました。この戦略的な動きにより、ブランチ・インターナショナルは預金受入サービスとデジタル融資の提供能力を拡大し、個人および中小企業へのサポートを強化します。ケニアの優れたモバイルテクノロジー環境を活用し、ブランチ・インターナショナルは地域全体の金融包摂性とアクセス性の向上を目指します。

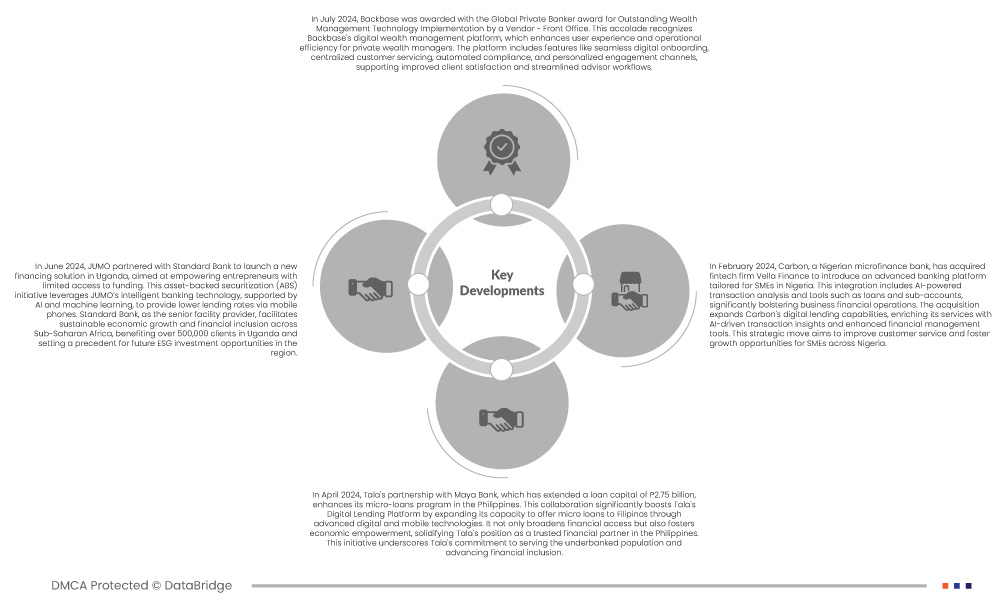

- 2024年4月、タラ銀行はマヤ銀行と提携し、27億5000万ペソの融資資本を供与することで、フィリピンにおけるマイクロローン・プログラムを強化します。この提携により、タラ銀行のデジタル融資プラットフォームは、先進的なデジタル技術とモバイル技術を駆使してフィリピン国民へのマイクロローン提供能力を拡大し、大幅に強化されます。これは金融アクセスの拡大だけでなく、経済的エンパワーメントを促進し、フィリピンにおける信頼できる金融パートナーとしてのタラ銀行の地位を確固たるものにします。この取り組みは、銀行口座を持たない人々へのサービス提供と金融包摂の推進に対するタラ銀行のコミットメントを強調するものです。

- 2024年5月、Talaはフィンテックにおける影響力のある存在として再び表彰され、Forbesの「Fintech 50」リストに8年連続で選出され、CNBCの「Disruptor 50」リストにも5年連続で選出されました。この選出は、Talaがパーソナライズされた金融サービスを世界中で提供するリーダーシップを改めて証明し、その評判とリーチをさらに強化するものです。また、Talaがデジタル融資プラットフォームの強化において継続的にイノベーションを推進し、世界中のサービスが行き届いていない人々への金融サービスのアクセス性と効率性を向上させていることも浮き彫りにしています。

地域分析

地理的に見ると、アフリカのデジタル融資プラットフォーム市場レポートで取り上げられている国は、南アフリカ、ナイジェリア、ケニア、エジプト、ウガンダ、タンザニア、エチオピア、コンゴ民主共和国、スーダン、およびその他のアフリカ諸国です。

Data Bridge Market Researchの分析によると:

南アフリカは、アフリカのデジタル融資プラットフォーム市場で優位に立ち、最も急速に成長する国になると予想されています。

南アフリカは、高度な金融インフラ、高いモバイル普及率、そして整備された規制環境を背景に、市場を牽引すると予想されています。同国の堅調な銀行セクターとテクノロジーに精通した国民は、デジタル融資プラットフォームが繁栄するための肥沃な土壌を形成しています。さらに、フィンテック系スタートアップ企業にとって有利な規制と政府の支援体制により、南アフリカはデジタル融資イノベーションの拠点としての地位を確立し、国内外のプレーヤーを市場に惹きつけています。

アフリカのデジタル融資プラットフォーム市場レポートの詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/africa-digital-lending-platform-market