Saudi Arabia Warehousing Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

9,314.17 Million

USD

13,214.96 Million

2022

2030

USD

9,314.17 Million

USD

13,214.96 Million

2022

2030

| 2023 –2030 | |

| USD 9,314.17 Million | |

| USD 13,214.96 Million | |

|

|

|

Saudi Arabia Warehousing Market, By Component (Hardware/System, Software, and Services), Function (Inventory Control and Management, Asset Tracking, Yard & Dock Management, Order Fulfilment, and Workforce & Task (Process) Management, Shipping, Predictive Maintenance, and Others), Type (Insource Warehousing and Outsource Warehousing), Size (Small, Medium, and Large), Ownership (Public Warehouses, Private Warehouses, Bonded Warehouses, and Consolidated Warehouse), Warehousing Storage Nature (Ambient Warehousing (Around 80°F), Air Conditioned (56°F and 75°F), Refrigerated (33°F and 55°F), and Cold/Frozen (Of or Below 32°F)), WMS Tier Type (Advanced WMS, Basic WMS, and Intermediate WMS), End User (Retail and E-Commerce, Transportation and Logistics, Automotive, Healthcare, Food and Beverages, Electrical and Electronics, Chemical, Agriculture, Energy and Utilities, and Others) - Industry Trends and Forecast to 2030.

Saudi Arabia Warehousing Market Analysis and Insights

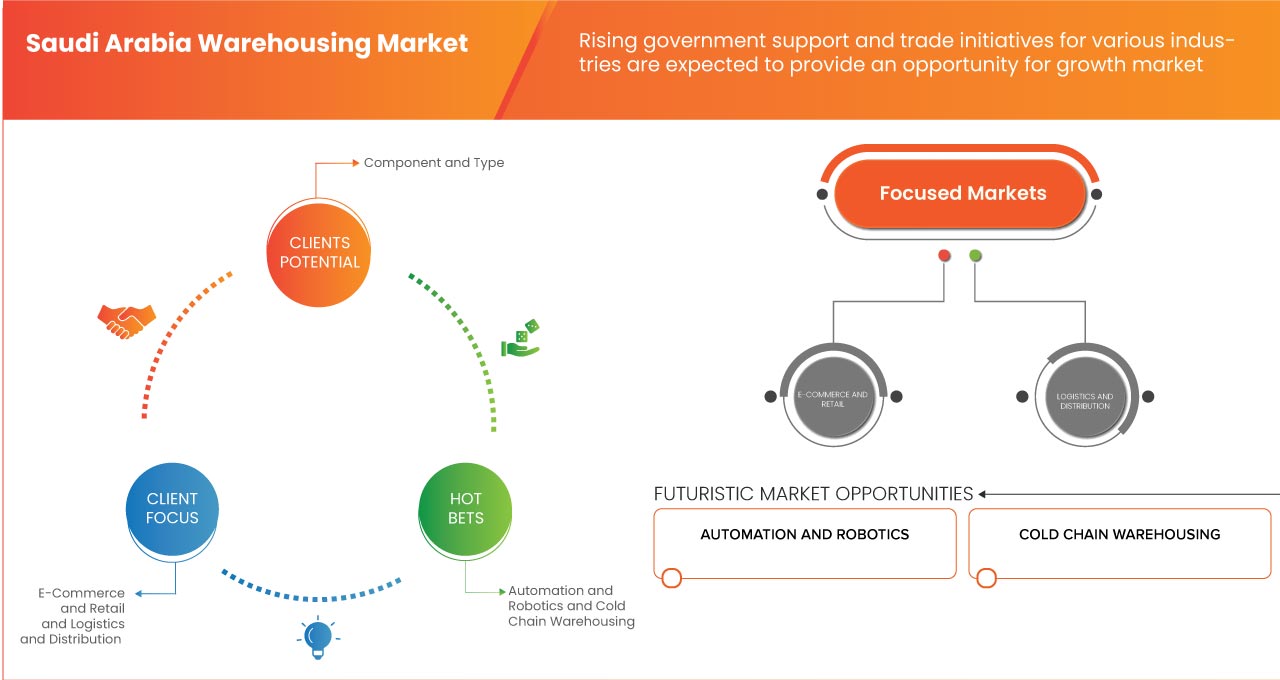

Saudi Arabia is becoming a hub for regional trade and a key player in global supply chain networks as the largest economy in the Middle East. The warehousing industry in the kingdom is witnessing rapid development, with a surge in demand for modern, technologically advanced storage facilities that can meet the requirements of diverse industries. The growth of e-commerce, along with the government's focus on economic diversification and investments in infrastructure, is driving the need for efficient and strategically located warehousing solutions. With its strategic geographic location and ambitious Vision 2030 plan, Saudi Arabia warehousing market is poised for continued expansion and innovation to meet the evolving demands of the modern business landscape. The market is experiencing significant growth and transformation in response to the country's expanding logistics and e-commerce sectors.

Data Bridge Market Research analyzes that the Saudi Arabia warehousing market is expected to reach USD 13,214.96 million by 2030 from USD 9,314.17 million in 2022, growing with a substantial CAGR of 4.5% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015- 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Componente (hardware/sistema, software y servicios), función (control y gestión de inventario, seguimiento de activos, gestión de patios y muelles, cumplimiento de pedidos y gestión de mano de obra y tareas (procesos), envío, mantenimiento predictivo y otros), tipo (almacenamiento interno y almacenamiento externo), tamaño (pequeño, mediano y grande), propiedad (almacenes públicos, almacenes privados, almacenes aduaneros y almacén consolidado), naturaleza del almacenamiento (almacenamiento a temperatura ambiente (alrededor de 80 °F), aire acondicionado (56 °F y 75 °F), refrigerado (33 °F y 55 °F) y frío/congelado (de o por debajo de 32 °F)), tipo de nivel de WMS (WMS avanzado, WMS básico y WMS intermedio), usuario final (venta minorista y comercio electrónico, transporte y logística, automoción, atención médica, alimentos y bebidas, electricidad y electrónica, química , agricultura, energía y servicios públicos, y Otros) |

|

País cubierto |

Arabia Saudita |

|

Actores del mercado cubiertos |

Kuehne+Nagel, CEVA Logistics, YBA KANOO, GAC, Tamer Logistics, Almajdouie Logistics, DB Schenker, Wared Logistics, Aramex, MLS, SMSA Express Transportation Company Ltd., Binzagr, DHL, HALA, Sign Logistics, LSC Warehousing & Logistics Company, Agility, Aiduk, Takhzeen, fourwinds-ksa, Camels Party Logistics, BAFCO, SA TALKE Ltd., LogiPoint y United Group |

Definición de mercado

El almacenamiento se refiere a la industria y la infraestructura relacionadas con el almacenamiento, la gestión y la distribución de bienes y productos dentro del Reino de Arabia Saudita. Este mercado abarca una amplia gama de servicios e instalaciones que desempeñan un papel crucial en la cadena de suministro y la logística de varias industrias. El almacenamiento comprende una red de instalaciones de almacenamiento, centros de distribución y servicios logísticos dedicados al almacenamiento, la manipulación y el movimiento eficientes y seguros de bienes y productos. Estas instalaciones pueden variar en tamaño y especialización, y atienden a industrias como la fabricación, el comercio minorista, el comercio electrónico, la agricultura y más.

Dinámica del mercado de almacenamiento en Arabia Saudita

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- El sector del comercio electrónico está en auge en Arabia Saudita

El floreciente sector del comercio electrónico en Arabia Saudita es un poderoso impulsor del crecimiento y la expansión del mercado. Existe una mayor demanda de instalaciones de almacenamiento y distribución eficientes para respaldar las operaciones de comercio electrónico debido al rápido aumento de las compras en línea y las preferencias cambiantes de los consumidores. Los almacenes desempeñan un papel fundamental para garantizar el cumplimiento oportuno de los pedidos, la gestión del inventario y la entrega sin inconvenientes de los productos a los compradores en línea, mejorando así la experiencia general del cliente.

- Creciente expansión del sector manufacturero

El crecimiento de la industria manufacturera en Arabia Saudita está desempeñando un papel importante en el mercado de almacenamiento. Las fábricas e industrias están produciendo bienes, por lo que necesitan lugares para almacenarlos. Los almacenes son como grandes espacios de almacenamiento donde las empresas guardan sus productos antes de enviarlos a las tiendas o a los clientes. Además, como la fabricación está en aumento en Arabia Saudita, también lo está la demanda de almacenes porque brindan una forma segura y organizada de almacenar todo lo que se fabrica. Esta tendencia está impulsando el mercado de almacenamiento en Arabia Saudita y creando oportunidades para las empresas que brindan servicios de almacenamiento.

Restricción

- Altos costos de instalación de terrenos y almacenes

Los altos costos de instalación de terrenos y almacenes representan una importante limitación para el crecimiento del mercado. Los gastos asociados con la adquisición de terrenos adecuados y la construcción de almacenes pueden ser una barrera importante para las empresas que buscan establecerse o expandir su presencia en el país. Estos costos abarcan los precios de los terrenos, los materiales de construcción, la mano de obra y el cumplimiento de las regulaciones locales, que en conjunto contribuyen a la carga financiera general.

Oportunidad

- Aumento del apoyo gubernamental y de las iniciativas comerciales para diversas industrias

El creciente apoyo y las iniciativas relacionadas con el comercio por parte del gobierno presentan una oportunidad significativa para el crecimiento del mercado. Estas medidas fomentan un entorno empresarial más favorable, atrayendo a una amplia gama de industrias a la región. Se espera que la demanda de instalaciones de almacenamiento modernas aumente a medida que varios sectores expandan sus operaciones, lo que ofrece una perspectiva prometedora para el desarrollo y la expansión de la industria.

Desafío

- Escasez de mano de obra calificada

Un factor importante que se espera que dificulte el crecimiento del mercado es la escasez de mano de obra calificada. Existe una creciente demanda de trabajadores con habilidades especializadas en áreas como la gestión de almacenes, la logística y la operación de sistemas avanzados de automatización y tecnología a medida que la industria continúa creciendo y evolucionando. Sin embargo, la disponibilidad de esa mano de obra calificada sigue siendo limitada en el mercado, lo que genera dificultades de contratación y un aumento de los costos laborales.

Acontecimientos recientes

- En mayo de 2023, Tamer Logistics alcanzó un hito importante al ganar el premio a la empresa de logística más inspiradora del año en los premios TLME Inspiration Awards 2023. Este prestigioso reconocimiento no solo celebró su capacidad de adaptación e innovación en una industria que cambia rápidamente, sino que también reforzó su posición como un verdadero líder en bienes de consumo masivo, atención médica, cosméticos y logística de terceros dentro del Reino de Arabia Saudita. Este premio sirvió como testimonio de su compromiso con la excelencia y destacó su papel en la redefinición de la cadena de suministro y la logística, lo que en última instancia contribuyó a mejorar la reputación y el liderazgo en la industria.

- En septiembre de 2021, MLS obtuvo un rol exclusivo como proveedor exclusivo de servicios posventa para Hyundai y Nissan en Arabia Saudita. Esta asociación estratégica no solo ha reforzado la presencia de Mosanada en el mercado, sino que también le ha permitido ofrecer servicios integrales y especializados a una amplia gama de clientes, lo que ha contribuido al crecimiento de los ingresos y ha mejorado su reputación como proveedor de confianza en el sector automotriz.

Alcance del mercado de almacenamiento en Arabia Saudita

El mercado de almacenamiento de Arabia Saudita está segmentado en ocho segmentos notables según el componente, la función, el tipo, el tamaño, la propiedad y la naturaleza del almacenamiento, el tipo de nivel de WMS y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Componente

- Hardware/Sistema

- Software

- Servicios

Según el componente, el mercado se segmenta en hardware/sistema, software y servicios.

Función

- Control y gestión de inventarios

- Seguimiento de activos

- Seguimiento de equipos y vehículos

- Gestión de patios y muelles

- Cumplimiento de pedidos

- Gestión de tareas (procesos) y personal

- Envío

- Mantenimiento predictivo

- Otros

Sobre la base de la función, el mercado está segmentado en control y gestión de inventario, seguimiento de activos, gestión de patios y muelles, cumplimiento de pedidos, gestión de fuerza laboral y tareas (procesos), envío, mantenimiento predictivo y otros.

Tipo

- Almacenamiento interno

- Subcontratación de almacenamiento

Según el tipo, el mercado se segmenta en almacenamiento interno y almacenamiento externo.

Tamaño

- Pequeño

- Medio

- Grande

En función del tamaño, el mercado se segmenta en pequeño, mediano y grande.

Propiedad

- Almacenes públicos

- Almacenes privados

- Almacenes aduaneros

- Almacén consolidado

En función de la propiedad, el mercado se segmenta en almacenes públicos, almacenes privados, almacenes aduaneros y almacenes consolidados.

Almacenamiento Almacenamiento Naturaleza

- Almacenamiento a temperatura ambiente (alrededor de 80 °F)

- Aire acondicionado (56°F y 75°F)

- Refrigerado (33°F y 55°F)

- Frío/congelado (a 32 °F o menos)

En función de la naturaleza del almacenamiento, el mercado se segmenta en almacenamiento a temperatura ambiente (alrededor de 80 °F), con aire acondicionado (56 °F y 75 °F), refrigerado (33 °F y 55 °F) y frío/congelado (de 32 °F o menos).

Tipo de nivel de WMS

- WMS avanzado

- WMS básico

- WMS intermedio

Según el tipo de nivel de WMS, el mercado se segmenta en WMS avanzado, WMS básico y WMS intermedio.

Usuario final

- Comercio minorista y comercio electrónico

- Transporte y Logística

- Automotor

- Cuidado de la salud

- Alimentos y bebidas

- Electricidad y electrónica

- Agricultura

- Energía y servicios públicos

- Otros

Sobre la base del usuario final, el mercado está segmentado en comercio minorista y comercio electrónico, transporte y logística, automotriz, atención médica, alimentos y bebidas, electricidad y electrónica, química, agricultura, energía y servicios públicos, y otros.

Análisis y perspectivas del mercado de almacenamiento de Arabia Saudita

Se analiza el mercado de almacenamiento de Arabia Saudita y se proporciona información sobre el tamaño del mercado por componente, función, tipo, tamaño, propiedad y naturaleza del almacenamiento, tipo de nivel de WMS y usuario final.

En cuanto a la ciudad, el mercado está segmentado en Yeda, Riad, Dammam, Al Khobar y el resto de Arabia Saudita. Riad, la capital de Arabia Saudita, domina el mercado de almacenamiento en Arabia Saudita. Su dominio se debe a su ubicación central, lo que la convierte en un centro estratégico para la distribución de bienes en todo el país. Además, el próspero entorno empresarial de Riad, en línea con la iniciativa Visión 2030 del gobierno, ha atraído una inversión significativa en infraestructura logística y de almacenamiento, lo que refuerza aún más su posición como líder del mercado de almacenamiento en el reino.

La sección de ciudades del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas del país y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la cuota de mercado del almacenamiento en Arabia Saudita

El panorama competitivo del mercado de almacenamiento de Arabia Saudita proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, la amplitud y la variedad de productos, el dominio de las aplicaciones y la curva de vida útil del tipo de producto. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado.

Algunos de los principales actores del mercado que operan en el mercado de almacenamiento de Arabia Saudita son Kuehne+Nagel, CEVA Logistics, YBA KANOO, GAC, Tamer Logistics, Almajdouie Logistics, DB Schenker, Wared Logistics, Aramex, MLS, SMSA Express Transportation Company Ltd., Binzagr, DHL, HALA, Sign Logistics, LSC Warehousing & Logistics Company, Agility, Aiduk, Takhzeen, fourwinds-ksa, Camels Party Logistics, BAFCO, SA TALKE Ltd., LogiPoint y United Group, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 END USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE ANALYSIS

4.2 COMPANY COMPARATIVE ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 TECHNOLOGICAL TRENDS

4.5 KEY STRATEGIC INITIATIVES

4.6 CASE STUDY 1

4.6.1 PROBLEM STATEMENT

4.6.2 BACKGROUND

4.6.3 SOLUTION

4.7 CASE STUDY 2

4.7.1 PROBLEM STATEMENT

4.7.2 SOLUTION

4.8 LIST OF THE TOP WAREHOUSING COMPANIES AS PER SQM

4.9 PATENT ANALYSIS

4.9.1 IMAGE-BASED INSPECTION AND AUTOMATED INVENTORY AND SUPPLY CHAIN MANAGEMENT OF WELL EQUIPMENT

4.9.2 OPTIMIZED TASK GENERATION AND SCHEDULING OF AUTOMATED GUIDED CARTS USING OVERHEAD SENSOR SYSTEMS

4.9.3 SYSTEM AND METHOD FOR WORKFLOW MANAGEMENT

4.9.4 RETURN ORDERING SYSTEM AND METHOD

4.9.5 RETAIL SHELF SUPPLY MONITORING SYSTEM

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING EXPANSION OF THE MANUFACTURING SECTOR

5.1.2 SURGING GROWTH OF THE LOGISTICS SECTOR

5.1.3 TECHNOLOGICAL ADVANCEMENT IN WAREHOUSING

5.2 RESTRAINTS

5.2.1 HIGH LAND AND WAREHOUSE SETUP COST

5.2.2 COMPLEXITY TO OPERATE A WAREHOUSING BUSINESS IN SAUDI ARABIA

5.3 OPPORTUNITIES

5.3.1 RISING GOVERNMENT SUPPORT AND TRADE INITIATIVES FOR VARIOUS INDUSTRIES

5.3.2 SURGING GROWTH OF SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN SAUDI ARABIA

5.3.3 INCREASING PARTNERSHIP AND COLLABORATION AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 INCREASING GEOPOLITICAL TENSIONS AND GLOBAL ECONOMIC SLOWDOWN

5.4.2 SKILLED LABOR SHORTAGE

5.4.3 CHALLENGING CLIMATIC CONDITIONS

6 SAUDI ARABIA WAREHOUSING MARKET, BY TYPE

6.1 OVERVIEW

6.2 INSOURCE WAREHOUSING

6.3 OUTSOURCE WAREHOUSING

7 SAUDI ARABIA WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

7.1 OVERVIEW

7.2 PUBLIC WAREHOUSES

7.3 PRIVATE WAREHOUSES

7.4 BONDED WAREHOUSES

7.5 CONSOLIDATED WAREHOUSES

8 SAUDI ARABIA WAREHOUSING MARKET, BY SIZE

8.1 OVERVIEW

8.2 SMALL

8.2.1 SMALL SCALE DISTRIBUTION CENTERS

8.2.2 MICRO WAREHOUSES

8.3 MEDIUM

8.3.1 REGIONAL WAREHOUSES

8.3.2 CROSS DOCKING FACILITIES

8.4 LARGE

8.4.1 NATIONAL DISTRIBUTION CENTERS

8.4.2 MEGA WAREHOUSES

9 SAUDI ARABIA WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE

9.1 OVERVIEW

9.2 AMBIENT WAREHOUSING (AROUND 80°F)

9.2.1 BY PRODUCT TYPE

9.2.1.1 FOOD & BEVERAGES

9.2.1.1.1 BY TYPE

9.2.1.1.1.1 BREADS AND CEREALS

9.2.1.1.1.2 SAUCES AND CONDIMENTS

9.2.1.1.1.3 TEA AND COFFEE

9.2.1.1.1.4 BISCUITS AND CAKES

9.2.1.1.1.5 PASTA AND RICE

9.2.1.1.1.6 OTHERS

9.2.1.2 ELECTRONICS

9.2.1.3 PAPER PRODUCTS

9.2.1.4 PHARMACEUTICALS

9.2.1.5 COSMETICS

9.2.1.6 OTHERS

9.3 AIR CONDITIONED (56°F AND 75°F)

9.3.1 BY PRODUCT TYPE

9.3.1.1 FOOD

9.3.1.1.1 BY TYPE

9.3.1.1.1.1 FRUITS & VEGETABLES

9.3.1.1.1.2 BY TYPE

9.3.1.1.1.3 TOMATOES

9.3.1.1.1.4 WATERMELON

9.3.1.1.1.5 BANANAS

9.3.1.1.1.6 COCONUT

9.3.1.1.1.7 BASILS

9.3.1.1.1.8 CANNED FISH AND MEATS

9.3.1.1.1.9 CANNED FRUIT AND VEGETABLES

9.3.1.1.1.10 CONFECTIONERY PRODUCTS

9.3.1.1.1.11 CHOCOLATE AND CANDIES

9.3.1.2 OIL & PETROLEUM

9.3.1.3 CHEMICALS

9.3.1.4 OTHERS

9.4 REFRIGERATED (33°F AND 55°F)

9.4.1 BY PRODUCT TYPE

9.4.1.1 FOOD AND BEVERAGES

9.4.1.1.1 BY TYPE

9.4.1.1.1.1 FRUITS AND VEGETABLES

9.4.1.1.1.2 BY TYPE

9.4.1.1.1.3 ORANGES

9.4.1.1.1.4 APPLES

9.4.1.1.1.5 CUCUMBER

9.4.1.1.1.6 BEANS

9.4.1.1.1.7 KIWIS

9.4.1.1.1.8 EGGPLANT

9.4.1.1.1.9 GUAVAS

9.4.1.1.1.10 BLUEBERRIES

9.4.1.1.1.11 OTHERS

9.4.1.1.1.12 DAIRY PRODUCTS

9.4.1.1.1.13 MEAT

9.4.1.1.1.14 FISH

9.4.1.1.1.15 EGGS

9.4.1.1.1.16 OTHERS

9.4.1.2 CHEMICALS

9.4.1.3 BIO-PHARMACEUTICALS

9.4.1.3.1 BY TYPE

9.4.1.3.1.1 VACCINE

9.4.1.3.1.2 BLOOD BANKS

9.4.1.3.1.3 OTHERS

9.4.1.4 PLANTS AND FLOWERS

9.4.1.5 OTHERS

9.5 COLD/FROZEN (OF OR BELOW 32°F)

9.5.1 BY PRODUCT TYPE

9.5.1.1 POULTRY AND SEA FOOD

9.5.1.2 FRUITS AND VEGETABLES

9.5.1.2.1 BY TYPE

9.5.1.2.1.1 GRAPES

9.5.1.2.1.2 SWEET CORN

9.5.1.2.1.3 CABBAGE

9.5.1.2.1.4 CHERRIES

9.5.1.2.1.5 STRAWBERRIES

9.5.1.2.1.6 MUSHROOMS

9.5.1.2.1.7 LETTUCE

9.5.1.2.1.8 BROCCOLI

9.5.1.2.1.9 BRUSSELS SPROUTS

9.5.1.2.1.10 OTHERS

9.5.1.3 ARTWORK

9.5.1.4 OTHERS

10 SAUDI ARABIA WAREHOUSING MARKET, WMS TIER TYPE

10.1 OVERVIEW

10.2 BASIC WMS

10.3 INTERMEDIATE WMS

10.4 ADVANCED WMS

11 SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 HARDWARE/SYSTEM

11.2.1 PALLETS

11.2.1.1 SELECTIVE

11.2.1.2 DRIVE ION DRIVE

11.2.1.3 DOUBLE DEEP

11.2.1.4 CANTILEVER

11.2.1.5 OTHERS

11.2.2 CONVEYOR SYSTEM

11.2.2.1 ROLLER SYSTEM

11.2.2.2 BELT CONVEYORS

11.2.2.3 SLAT CONVEYORS

11.2.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

11.2.3.1 UNIT LOAD

11.2.3.2 MINILOAD

11.2.3.3 DEEP LANE

11.2.3.4 MAN ON BOARD

11.2.4 TRANSPORT SYSTEM

11.2.4.1 INDUSTRIAL TRUCKS

11.2.4.2 CRANES

11.2.5 AUTOMATED GUIDED VEHICLES (AGVS)

11.2.5.1 MATERIAL HANDLING

11.2.5.2 PICKING

11.2.5.3 SORTING

11.2.6 SORTATION SYSTEM

11.2.6.1 UNIT SORTER

11.2.6.1.1 POP UP WHEEL/ ROLLER/BELT SORTER

11.2.6.1.2 PIVOTING ARM SORTER

11.2.6.1.3 PUSH SORTER

11.2.6.2 CASE SORTER

11.2.6.2.1 TILT-TRAY & CROSS BELT SORTERS

11.2.6.2.2 PUSH TRAY SORTER

11.2.6.2.3 CASE & UNIT SORTERS

11.2.6.2.4 OTHERS

11.2.7 AUTONOMOUS MOBILE ROBOTICS

11.2.7.1 MATERIAL HANDLING

11.2.7.2 ORDER FULFILMENT

11.2.7.3 INVENTORY SCANNING

11.2.8 BARCODE SYSTEM

11.2.9 OTHERS

11.3 SOFTWARE

11.3.1.1 CLOUD

11.3.1.2 ON PREMISES

11.4 SERVICES

11.4.1.1 MANAGED SERVICES

11.4.1.2 PROFESSIONAL SERVICES

11.4.1.2.1 MAINTENANCE

11.4.1.2.2 INTEGRATION

11.4.1.2.3 TRAINING AND CONSULTING

11.4.1.2.4 TESTING

12 SAUDI ARABIA WAREHOUSING MARKET, BY END USER

12.1 OVERVIEW

12.2 FOOD AND BEVERAGES

12.2.1 NON PERISHABLE GOODS

12.2.2 COLD CHAIN LOGISTICS

12.2.2.1 HARDWARE/SYSTEM

12.2.2.1.1 PALLETS

12.2.2.1.2 CONVEYOR SYSTEM

12.2.2.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.2.2.1.4 TRANSPORT SYSTEM

12.2.2.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.2.2.1.6 SORTATION SYSTEM

12.2.2.1.7 AUTONOMOUS MOBILE ROBOTICS

12.2.2.1.8 BARCODE SYSTEM

12.2.2.1.9 OTHERS

12.2.2.2 SOFTWARE

12.2.2.3 SERVICES

12.3 TRANSPORTATION AND LOGISTICS

12.3.1 LAST MILE DELIVERY PROVIDER

12.3.2 THIRD PARTY LOGISTIC PROVIDER

12.3.2.1 LAND TRANSPORT

12.3.2.2 OCEAN FREIGHT

12.3.2.3 AIR FREIGHT

12.3.2.3.1 B2C

12.3.2.3.2 B2B

12.3.3 FREIGHT FORWARDER

12.3.3.1 HARDWARE/SYSTEM

12.3.3.1.1 PALLETS

12.3.3.1.2 CONVEYOR SYSTEM

12.3.3.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.3.3.1.4 TRANSPORT SYSTEM

12.3.3.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.3.3.1.6 SORTATION SYSTEM

12.3.3.1.7 AUTONOMOUS MOBILE ROBOTICS

12.3.3.1.8 BARCODE SYSTEM

12.3.3.1.9 OTHERS

12.3.3.2 SOFTWARE

12.3.3.3 SERVICES

12.4 RETAIL AND E-COMMERCE

12.4.1 E-COMMERCE

12.4.1.1 ONLINE MARKET PLACES

12.4.1.2 DIRECT TO CONSUMERS BRANDS

12.4.2 BRICK AND MOTOR

12.4.2.1 HARDWARE/SYSTEM

12.4.2.1.1 PALLETS

12.4.2.1.2 CONVEYOR SYSTEM

12.4.2.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.4.2.1.4 TRANSPORT SYSTEM

12.4.2.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.4.2.1.6 SORTATION SYSTEM

12.4.2.1.7 AUTONOMOUS MOBILE ROBOTICS

12.4.2.1.8 BARCODE SYSTEM

12.4.2.1.9 OTHERS

12.4.2.2 SOFTWARE

12.4.2.3 SERVICES

12.5 ENERGY AND UTILITIES

12.5.1 OIL AND GAS

12.5.2 UTILITIES

12.5.3 RENEWABLE ENERGY

12.5.4 MINING AND RESOURCES

12.5.4.1 HARDWARE/SYSTEM

12.5.4.1.1 PALLETS

12.5.4.1.2 CONVEYOR SYSTEM

12.5.4.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.5.4.1.4 TRANSPORT SYSTEM

12.5.4.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.5.4.1.6 SORTATION SYSTEM

12.5.4.1.7 AUTONOMOUS MOBILE ROBOTICS

12.5.4.1.8 BARCODE SYSTEM

12.5.4.1.9 OTHERS

12.5.4.2 SOFTWARE

12.5.4.3 SERVICES

12.6 CHEMICAL

12.6.1 HARDWARE/SYSTEM

12.6.1.1 PALLETS

12.6.1.2 CONVEYOR SYSTEM

12.6.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.6.1.4 TRANSPORT SYSTEM

12.6.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.6.1.6 SORTATION SYSTEM

12.6.1.7 AUTONOMOUS MOBILE ROBOTICS

12.6.1.8 BARCODE SYSTEM

12.6.1.9 OTHERS

12.6.2 SOFTWARE

12.6.3 SERVICES

12.7 AUTOMOTIVE

12.7.1 HARDWARE/SYSTEM

12.7.1.1 PALLETS

12.7.1.2 CONVEYOR SYSTEM

12.7.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.7.1.4 TRANSPORT SYSTEM

12.7.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.7.1.6 SORTATION SYSTEM

12.7.1.7 AUTONOMOUS MOBILE ROBOTICS

12.7.1.8 BARCODE SYSTEM

12.7.1.9 OTHERS

12.7.2 SOFTWARE

12.7.3 SERVICES

12.8 ELECTRICAL AND ELECTRONICS

12.8.1 HARDWARE/SYSTEM

12.8.1.1 PALLETS

12.8.1.2 CONVEYOR SYSTEM

12.8.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.8.1.4 TRANSPORT SYSTEM

12.8.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.8.1.6 SORTATION SYSTEM

12.8.1.7 AUTONOMOUS MOBILE ROBOTICS

12.8.1.8 BARCODE SYSTEM

12.8.1.9 OTHERS

12.8.2 SOFTWARE

12.8.3 SERVICES

12.9 HEALTHCARE

12.9.1 PHARMACEUTICAL

12.9.2 MEDICAL DEVICE

12.9.3 BIOTECH AND RESEARCH

12.9.4 OTHERS

12.1 COMPONENT

12.10.1 HARDWARE/SYSTEM

12.10.1.1 PALLETS

12.10.1.2 CONVEYOR SYSTEM

12.10.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.10.1.4 TRANSPORT SYSTEM

12.10.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.10.1.6 SORTATION SYSTEM

12.10.1.7 AUTONOMOUS MOBILE ROBOTICS

12.10.1.8 BARCODE SYSTEM

12.10.1.9 OTHERS

12.10.2 SOFTWARE

12.10.3 SERVICES

12.11 AGRICULTURE

12.11.1 HARDWARE/SYSTEM

12.11.1.1 PALLETS

12.11.1.2 CONVEYOR SYSTEM

12.11.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.11.1.4 TRANSPORT SYSTEM

12.11.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.11.1.6 SORTATION SYSTEM

12.11.1.7 AUTONOMOUS MOBILE ROBOTICS

12.11.1.8 BARCODE SYSTEM

12.11.1.9 OTHERS

12.11.2 SOFTWARE

12.11.3 SERVICES

12.12 OTHERS

13 SAUDI ARABIA WAREHOUSING MARKET, BY FUNCTION

13.1 OVERVIEW

13.2 INVENTORY CONTROL AND MANAGEMENT

13.2.1 BY TYPE

13.2.1.1 INVENTORY OPTIMIZATION

13.2.1.1.1 BY TYPE

13.2.1.1.1.1 SAFETY STOCK MANAGEMENT

13.2.1.1.1.2 DYNAMIC REORDERING

13.2.1.1.1.3 DEMAND SENSING

13.2.1.2 REAL TIME INVENTORY TRACKING

13.2.1.2.1 BY TYPE

13.2.1.2.1.1 RFID BASED TRACKING

13.2.1.2.1.2 BARCODE SCANNING

13.2.1.2.1.3 GPS BASED TRACKING

13.2.1.2.1.4 FIXED LOCATION

13.2.1.2.1.5 FLOATING (RANDOM) LOCATION

13.3 ORDER FULFILMENT

13.3.1 BY TYPE

13.3.1.1 PICKING AND PACKAGING AUTOMATION

13.3.1.1.1 BY TYPE

13.3.1.1.1.1 COBOTS

13.3.1.1.1.2 ROBOTS PICKERS

13.3.1.1.1.3 GOODS-TO-PERSON PICKING (GTP)

13.3.1.1.2 ORDER ROUTING AND OPTIMIZATION

13.3.1.1.2.1 MULTI CHANNEL ORDER MANAGEMENT

13.3.1.1.2.2 ROUTE PLANNING ALGORITHM

13.3.1.1.2.3 DYNAMIC SLOTTING

13.3.1.1.3 RECEIVING AND PUT AWAY

13.4 ASSET TRACKING

13.4.1 BY TYPE

13.4.1.1 PRODUCT AND PACKAGE TRACKING

13.4.1.1.1 BY TYPE

13.4.1.1.1.1 RFID TAGGING

13.4.1.1.1.2 SMART PACKAGING

13.4.1.1.1.3 BLOCK CHAIN BASED TRACKING

13.4.1.1.2 EQUIPMENT AND VEHICLE TRACKING

13.4.1.1.3 BY TYPE

13.4.1.1.3.1 GPS TRACKING

13.4.1.1.3.2 TELEMATICS

13.4.1.1.3.3 CONDITION MONITORING

13.5 SHIPPING

13.6 WORKFORCE AND TASK( PROCESS) MANAGEMENT

13.7 YARD AND DOCK MANAGEMENT

13.8 PREDICTIVE MAINTENANCE

13.8.1 BY TYPE

13.8.1.1 FAILURE MODE AND EFFECT ANALYSIS

13.8.1.2 SENSOR BASED

13.8.1.3 AI DRIVEN

13.9 OTHER

14 SAUDI ARABIA WAREHOUSING MARKET, BY CITY

14.1 SAUDI ARABIA

14.1.1 JEDDAH

14.1.2 RIYADH

14.1.3 DAMMAM

14.1.4 AL KHOBAR

14.1.5 REST OF SAUDI ARABIA

15 SAUDI ARABIA WAREHOUSING MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

16 SWOT ANALYSIS

17 COMPANY PROFILINGS

17.1 KUEHNE+NAGEL

17.1.1 COMPANY SNAPSHOT

17.1.2 SERVICES PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 CEVA LOGISTICS

17.2.1 COMPANY SNAPSHOT

17.2.2 SERVICES PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 YBA KANOO

17.3.1 COMPANY SNAPSHOT

17.3.2 SERVICE PORTFOLIO

17.3.3 RECENT DEVELOPMENTS

17.4 GAC

17.4.1 COMPANY SNAPSHOT

17.4.2 SERVICES PORTFOLIO

17.4.3 RECENT DEVELOPMENTS

17.5 TAMER LOGISTICS

17.5.1 COMPANY SNAPSHOT

17.5.2 SERVICES PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 AGILITY (A SUBSIDIARY OF DSV)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 SOLUTION PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AIDUK

17.7.1 COMPANY SNAPSHOT

17.7.2 SERVICES PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ALMAJDOUIE LOGISTICS

17.8.1 COMPANY SNAPSHOT

17.8.2 SERVICES PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ARAMEX

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 SERVICES PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 BAFCO

17.10.1 COMPANY SNAPSHOT

17.10.2 SERVICES PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BINZAGR

17.11.1 COMPANY SNAPSHOT

17.11.2 SERVICES PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 CAMELS PARTY LOGISTICS

17.12.1 COMPANY SNAPSHOT

17.12.2 SERVICES PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 DB SCHENKER (A SUBSIDIARY OF DEUTSCHE BAHN)

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 SERVICES PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 DHL

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 SOLUTION PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 FOURWINDS-KSA

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 HALA

17.16.1 COMPANY SNAPSHOT

17.16.2 SERVICES PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 LOGIPOINT

17.17.1 COMPANY SNAPSHOT

17.17.2 SERVICES PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LSC WAREHOUSING AND LOGISTICS SERVICES CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 SERVICES PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MLS

17.19.1 COMPANY SNAPSHOT

17.19.2 SOLUTION PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 S.A. TALKE LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 SERVICES PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SIGN LOGISTICS

17.21.1 COMPANY SNAPSHOT

17.21.2 SERVICES PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SMSA EXPRESS TRANSPORTATION COMPANY LTD.

17.22.1 COMPANY SNAPSHOT

17.22.2 SERVICES PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 TAKHZEEN

17.23.1 COMPANY SNAPSHOT

17.23.2 SERVICE PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 UNITED GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 WARED LOGISTICS

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 COMPARISON OF AUTOMATED WAREHOUSE AND TRADITIONAL WAREHOUSE

TABLE 3 SAUDI ARABIA WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 SAUDI ARABIA WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 5 SAUDI ARABIA WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 6 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 SAUDI ARABIA WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 10 SAUDI ARABIA AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 SAUDI ARABIA FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 SAUDI ARABIA AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 SAUDI ARABIA FOOD IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 SAUDI ARABIA FRUITS & VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 SAUDI ARABIA REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 SAUDI ARABIA FRUITS & VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 SAUDI ARABIA BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 SAUDI ARABIA COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 20 SAUDI ARABIA FRUITS AND VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 SAUDI ARABIA WAREHOUSING MARKET, BY WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 22 SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 23 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 SAUDI ARABIA PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 SAUDI ARABIA CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 SAUDI ARABIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 SAUDI ARABIA AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA WAREHOUSING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 42 SAUDI ARABIA THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 44 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 SAUDI ARABIA RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SAUDI ARABIA E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 SAUDI ARABIA RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 48 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 SAUDI ARABIA ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 SAUDI ARABIA ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 51 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 SAUDI ARABIA CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SAUDI ARABIA AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 57 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SAUDI ARABIA HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 SAUDI ARABIA HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 60 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 62 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 64 SAUDI ARABIA INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SAUDI ARABIA REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 68 SAUDI ARABIA ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 SAUDI ARABIA ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 SAUDI ARABIA PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 SAUDI ARABIA EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 SAUDI ARABIA PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 SAUDI ARABIA WAREHOUSING MARKET, BY CITY, 2021-2030 (USD MILLION)

TABLE 76 JEDDAH WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 77 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 JEDDAH PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 JEDDAH CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 JEDDAH AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 JEDDAH TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 JEDDAH AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 JEDDAH SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 JEDDAH UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 JEDDAH CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 JEDDAH AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 JEDDAH SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 JEDDAH SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 JEDDAH PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 BY FUNCTION

TABLE 91 JEDDAH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 JEDDAH INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 JEDDAH REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 JEDDAH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 95 JEDDAH ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 JEDDAH PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 JEDDAH ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 JEDDAH ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 JEDDAH PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 JEDDAH EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 JEDDAH PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 BY TYPE

TABLE 103 BY SIZE

TABLE 104 JEDDAH SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 JEDDAH MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 JEDDAH LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 JEDDAH AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 108 JEDDAH FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 JEDDAH AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 110 JEDDAH FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 111 JEDDAH FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 112 JEDDAH REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 113 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 114 JEDDAH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 115 JEDDAH BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 116 JEDDAH COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 117 JEDDAH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 118 JEDDAH WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 119 JEDDAH WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 120 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 122 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 JEDDAH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 JEDDAH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 125 JEDDAH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 126 JEDDAH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 127 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 JEDDAH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 JEDDAH E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 JEDDAH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 131 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 JEDDAH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 JEDDAH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 134 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 JEDDAH CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 136 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 JEDDAH AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 138 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 JEDDAH ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 140 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 JEDDAH HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 JEDDAH HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 143 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 JEDDAH AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 145 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 RIYADH WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 147 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 RIYADH PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 RIYADH CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 RIYADH AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 RIYADH TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 RIYADH AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 RIYADH SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 RIYADH UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 RIYADH CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 RIYADH AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 RIYADH SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 RIYADH SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 RIYADH PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 RIYADH WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 161 RIYADH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 RIYADH INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 RIYADH REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 RIYADH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 165 RIYADH ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 RIYADH PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 RIYADH ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 RIYADH ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 RIYADH PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 RIYADH EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 RIYADH PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 RIYADH WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 RIYADH WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 174 RIYADH SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 RIYADH MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 RIYADH LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 RIYADH WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 178 RIYADH WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 179 RIYADH AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 180 RIYADH FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 RIYADH AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 182 RIYADH FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 183 RIYADH FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 184 RIYADH REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 185 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 186 RIYADH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 187 RIYADH BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 188 RIYADH COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 189 RIYADH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 190 RIYADH WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 191 RIYADH WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 192 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 194 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 RIYADH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 RIYADH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 197 RIYADH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 198 RIYADH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 199 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 RIYADH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 RIYADH E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 RIYADH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 203 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 RIYADH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 RIYADH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 206 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 RIYADH CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 208 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 RIYADH AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 210 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 RIYADH ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 212 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 RIYADH HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 RIYADH HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 215 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 RIYADH AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 217 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 DAMMAM WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 219 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 DAMMAM PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 DAMMAM CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 DAMMAM AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 DAMMAM TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 DAMMAM AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 DAMMAM SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 DAMMAM UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 DAMMAM CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 DAMMAM AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 229 DAMMAM SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 DAMMAM SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 DAMMAM PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 DAMMAM WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 233 DAMMAM INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 DAMMAM INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 DAMMAM REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 DAMMAM INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 237 DAMMAM ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 DAMMAM PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 DAMMAM ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 DAMMAM ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 DAMMAM PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 DAMMAM EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 DAMMAM PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 DAMMAM WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 DAMMAM WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 246 DAMMAM SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 DAMMAM MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 DAMMAM LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 DAMMAM WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 250 DAMMAM WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 251 DAMMAM AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 252 DAMMAM FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 DAMMAM AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 254 DAMMAM FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 255 DAMMAM FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 256 DAMMAM REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 257 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 258 DAMMAM FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 259 DAMMAM BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 260 DAMMAM COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 261 DAMMAM FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 262 DAMMAM WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 263 DAMMAM WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 264 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 265 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 266 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 DAMMAM TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 DAMMAM THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 269 DAMMAM THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 270 DAMMAM TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 271 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 DAMMAM RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 DAMMAM E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 DAMMAM RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 275 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 DAMMAM ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 DAMMAM ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 278 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 279 DAMMAM CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 280 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 281 DAMMAM AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 282 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 283 DAMMAM ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 284 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 285 DAMMAM HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 286 DAMMAM HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 287 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 288 DAMMAM AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 289 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 AL KHOBAR WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 291 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 AL KHOBAR PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 AL KHOBAR CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 AL KHOBAR AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 295 AL KHOBAR TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 AL KHOBAR AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 AL KHOBAR SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 298 AL KHOBAR UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 299 AL KHOBAR CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 300 AL KHOBAR AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 301 AL KHOBAR SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 302 AL KHOBAR SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 303 AL KHOBAR PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 304 AL KHOBAR WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 305 AL KHOBAR INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 306 AL KHOBAR INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 307 AL KHOBAR REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 308 AL KHOBAR INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 309 AL KHOBAR ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 310 AL KHOBAR PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 311 AL KHOBAR ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 312 AL KHOBAR ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 313 AL KHOBAR PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 314 AL KHOBAR EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 315 AL KHOBAR PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 316 AL KHOBAR WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 317 AL KHOBAR WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 318 AL KHOBAR SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 319 AL KHOBAR MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 320 AL KHOBAR LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 321 AL KHOBAR MEDIUM WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 322 AL KHOBAR WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 323 AL KHOBAR AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 324 AL KHOBAR FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 AL KHOBAR AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 326 AL KHOBAR FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 327 AL KHOBAR FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 328 AL KHOBAR REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 329 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 330 AL KHOBAR FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 331 AL KHOBAR BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 332 AL KHOBAR COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 333 AL KHOBAR FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 334 AL KHOBAR WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 335 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 336 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 337 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 338 AL KHOBAR TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 339 AL KHOBAR THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 340 AL KHOBAR THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 341 AL KHOBAR TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 342 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 AL KHOBAR RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 344 AL KHOBAR E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 AL KHOBAR RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 346 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 AL KHOBAR ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 348 AL KHOBAR ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 349 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 350 AL KHOBAR CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 351 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 352 AL KHOBAR AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 353 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 354 AL KHOBAR ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 355 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 356 AL KHOBAR HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 357 AL KHOBAR HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 358 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 359 AL KHOBAR AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 360 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 361 REST OF SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 SAUDI ARABIA WAREHOUSING MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA WAREHOUSING MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA WAREHOUSING MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA WAREHOUSING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA WAREHOUSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA WAREHOUSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA WAREHOUSING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SAUDI ARABIA WAREHOUSING MARKET: END USER COVERAGE GRID ANALYSIS

FIGURE 9 SAUDI ARABIA WAREHOUSING MARKET: MULTIVARIATE MODELLING

FIGURE 10 SAUDI ARABIA WAREHOUSING MARKET: COMPONENT TIMELINE CURVE

FIGURE 11 SAUDI ARABIA WAREHOUSING MARKET: SEGMENTATION

FIGURE 12 GROWING E-COMMERCE MARKET IN SAUDI ARABIA IS EXPECTED TO DRIVE THE GROWTH OF THE SAUDI ARABIA WAREHOUSING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 HARDWARE/SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SAUDI ARABIA WAREHOUSING MARKET FROM 2023 TO 2030

FIGURE 14 VALUE CHAIN FOR SAUDI ARABIA WAREHOUSING MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SAUDI ARABIA WAREHOUSING MARKET

FIGURE 16 GROWING E-COMMERCE SECTOR IN SAUDI ARABIA

FIGURE 17 RISING E-COMMERCE SECTOR IN SAUDI ARABIA

FIGURE 18 COMPARISON OF E-COMMERCE SALES IN SAUDI ARABIA WITH OTHER COUNTRIES IN 2020

FIGURE 19 LAST-MILE GOODS DISTRIBUTION IN SAUDI ARABIA (NUMBER OF ORDERS IN MILLION) (2017-20)

FIGURE 20 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

FIGURE 21 IMPACT OF GEOPOLITICAL TENSIONS

FIGURE 22 SAUDI ARABIA WAREHOUSING MARKET: BY TYPE, 2022

FIGURE 23 SAUDI ARABIA WAREHOUSING MARKET: BY OWNERSHIP, 2022

FIGURE 24 SAUDI ARABIA WAREHOUSING MARKET: BY SIZE, 2022

FIGURE 25 SAUDI ARABIA WAREHOUSING MARKET: BY WAREHOUSING STORAGE NATURE, 2022

FIGURE 26 SAUDI ARABIA WAREHOUSING MARKET: WMS TIER TYPE, 2022

FIGURE 27 SAUDI ARABIA WAREHOUSING MARKET: COMPONENT, 2022

FIGURE 28 SAUDI ARABIA WAREHOUSING MARKET: BY END USER, 2022

FIGURE 29 SAUDI ARABIA WAREHOUSING MARKET: BY FUNCTION, 2022

FIGURE 30 SAUDI ARABIA WAREHOUSING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.