Mercado de envases de frutas de EE. UU., por tipo de fruta (plátano, manzana, bayas, uvas, naranja, frutas tropicales, granada y otras), tipo de material (plástico, papel, fibra moldeada/pulpa, madera y otros), tipo de producto ( embalaje rígido , embalaje flexible y otros), aplicación (venta minorista, transporte, servicios de alimentación y otros), canal de distribución (directo e indirecto), tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

El envasado de frutas y verduras es una práctica agrícola que implica llevar los cultivos frescos desde el campo hasta el cliente. Dado que todas las frutas y verduras son cultivos perecederos, la elección del envase adecuado para frutas y verduras es crucial para que los agricultores sobrevivan en el mercado. La función principal del envase es conservar las frutas y verduras para conservar su calidad y prolongar su vida útil.

El embalaje de frutas es muy beneficioso si se utiliza para un embalaje cómodo y flexible . Data Bridge Market Research analiza que se espera que el embalaje de frutas alcance el valor de USD 17.037,19 millones para el año 2029, a una CAGR del 1,8% durante el período de pronóstico. El plátano representa el segmento de tipo de fruta más destacado en el mercado respectivo debido al aumento del comercio electrónico, la mensajería y los servicios de entrega de frutas. El informe de mercado curado por el equipo de Data Bridge Market Research incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y escenario de la cadena climática.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en millones de unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de fruta (plátano, manzana, bayas, uvas, naranja, frutas tropicales, granada y otras), tipo de material (plástico, papel, fibra moldeada/pulpa, madera y otras), tipo de producto (embalaje rígido, embalaje flexible y otros), aplicación (venta minorista, transporte, servicios de alimentación y otros), canal de distribución (directo e indirecto) |

|

País cubierto |

A NOSOTROS |

|

Actores del mercado cubiertos |

Mondi, DS Smith, Amcor plc, Packaging Corporation of America, International Paper, Smurfit Kappa, Sealed Air, Sonoco Products Company, WestRock Company y Huhtamaki, entre otros. |

Definición de mercado

Las bolsas, contenedores y cajas de madera, plástico y papel, entre otros, son el material predominante para el envasado de frutas y verduras de consumo . Además de los costes de material muy bajos, las máquinas envasadoras automáticas reducen aún más los costes de envasado. Las bolsas de película son transparentes, lo que permite una fácil inspección del contenido, y aceptan fácilmente gráficos de alta calidad.

Marco regulatorio

- Según la Ley de Etiquetado y Empaquetado Justo de la FDA, las páginas web sobre Etiquetado de alimentos abordan los requisitos de etiquetado de los alimentos según la Ley Federal de Alimentos, Medicamentos y Cosméticos y sus modificaciones. El etiquetado de los alimentos es obligatorio para la mayoría de los alimentos preparados y crudos, incluidas las frutas y verduras. Esta ley emitió regulaciones que exigen que todos los "productos de consumo" se etiqueten para revelar el contenido neto, la identidad del producto y el nombre y el lugar de la empresa de los productos.

- Según la FDA (Administración de Alimentos y Medicamentos), todos los envases en los que se envasa cualquier producto de fruta deben estar sellados de manera que no se puedan abrir sin destruir el número de licencia y la marca de identificación especial del fabricante que se exhibirá en la parte superior o el cuello de la botella. Para las frutas enlatadas, se deben utilizar latas con tapa sanitaria hechas de tipos adecuados de hojalata, mientras que, para las frutas embotelladas, solo se deben utilizar botellas o frascos capaces de proporcionar un sello hermético. Las frutas confitadas y las cáscaras y las frutas secas se pueden envasar en bolsas de papel, cajas de cartón o madera, latas nuevas, botellas, frascos, aluminio y otros recipientes aprobados adecuados. Los productos de frutas y verduras también se pueden envasar en material de envasado aséptico y flexible que tenga una buena calidad de acuerdo con los estándares requeridos establecidos por el gobierno de los EE. UU.

Estas normas proporcionan calificación para la producción de envases de fruta, protocolos y pautas que garantizan un alto nivel de seguridad y certifican el material para su uso.

El COVID-19 tuvo un impacto mínimo en el mercado de envases de frutas de EE. UU.

La COVID-19 afectó a varias industrias manufactureras en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y las restricciones al transporte. Sin embargo, se notó un impacto significativo en el mercado de envases de frutas. Las operaciones y la cadena de suministro de envases de frutas, con múltiples instalaciones de fabricación, seguían funcionando en la región. Los proveedores de servicios continuaron ofreciendo envases de frutas siguiendo las medidas de saneamiento y seguridad en el escenario posterior a la COVID.

La dinámica del mercado de envases de frutas de EE. UU. incluye:

Factores impulsores y oportunidades que enfrenta la industria del mercado de envases de frutas en EE. UU.

- Creciente demanda de envases cómodos y flexibles

Las características de los envases flexibles hacen la vida más cómoda. Son fáciles de almacenar, de volver a sellar, de abrir, prolongan la vida útil del producto y son fáciles de transportar. El aumento de la renta disponible y la mejora del nivel de vida de los consumidores en los países en desarrollo son factores que contribuyen significativamente a la creciente demanda de alimentos envasados, incluidas las frutas, y esto está impulsando aún más la demanda de soluciones y materiales de envasado que sean más cómodos de usar. En conclusión, la creciente demanda de los principales minoristas de una vida útil más prolongada y de los consumidores de productos de conveniencia también están impulsando la demanda de envases flexibles y, por lo tanto, contribuyendo al crecimiento del mercado de envases de frutas de EE. UU.

- Aumento del comercio electrónico, la mensajería y los servicios de entrega de frutas

El comercio electrónico ha transformado la forma de hacer negocios en todo el mundo. Gran parte del crecimiento de la industria ha sido provocado por un aumento en la penetración de Internet y los teléfonos inteligentes. Además, los avances en la tecnología y el crecimiento de los mercados disponibles han facilitado la compra y venta de bienes a través de portales en línea. Los comerciantes y los servicios de entrega continúan siguiendo la demanda de los consumidores en las plataformas en línea, acudiendo al comercio electrónico en cantidades récord. Además, ha habido un aumento continuo en la demanda de necesidades de embalaje estandarizadas y configuraciones de entrega con humidificación aireada para una vida útil más prolongada durante el transporte de artículos perecederos como frutas y verduras. Esto, a su vez, aumenta la demanda de embalajes de frutas y, por lo tanto, impulsa el crecimiento del mercado de embalajes de frutas de EE. UU.

- Perspectiva positiva hacia soluciones de embalaje avanzadas e inteligentes

El objetivo de la tecnología de envasado inteligente es mantener la calidad del producto y prolongar su vida útil. El envasado activo responde a un evento desencadenante (como la exposición a la luz ultravioleta o una disminución de la presión) liberando o absorbiendo sustancias del producto envasado o del entorno que lo rodea. Por lo general, esto implica la incorporación de diferentes componentes, como eliminadores de humedad o gases o películas antimicrobianas, en el propio envase. Además, la adopción de tecnologías de envasado avanzadas está en aumento para ofrecer a los consumidores soluciones de envasado personalizadas. Esto, a su vez, aumenta la demanda de envases para frutas y, por lo tanto, crea una oportunidad para el mercado de envases para frutas de EE. UU.

Restricciones y desafíos que enfrenta el mercado de envases de frutas de EE. UU.

- Normas y regulaciones gubernamentales estrictas con respecto a los materiales de embalaje.

Las regulaciones impuestas por los gobiernos juegan un papel importante en la influencia del diseño de los envases para muchos fabricantes en el mercado. Existen varias regulaciones y políticas estrictas que deben cumplir los fabricantes de productos de embalaje. Las organizaciones gubernamentales regulan y monitorean los productos de embalaje de alimentos, medicamentos, cosméticos y el uso de materias primas, para proteger el medio ambiente y garantizar la seguridad y la confianza del consumidor. En conclusión, el aumento de las normas y regulaciones para la producción de productos de embalaje en todas las regiones ha afectado a la demanda de productos de embalaje. Esto, a su vez, disminuye la demanda de envases de frutas y, por lo tanto, restringe el crecimiento del mercado de envases de frutas de EE. UU.

- Gestionar los residuos de envases es difícil

Los envases de alimentos modernos ofrecen una forma de hacer que los alimentos sean seguros, fiables, estables y limpios. Lamentablemente, la mayoría de los envases de alimentos están diseñados para ser de un solo uso y no se reciclan. En cambio, se desechan y, a menudo, ensucian nuestros cursos de agua. Por lo tanto, este es un problema no solo para los seres humanos, sino también para toda la vida acuática. Los envases de alimentos también tienen otros impactos ambientales, incluido el aire y el suelo. En conclusión, la fabricación de envases de plástico es responsable de una cantidad significativa de emisiones de gases de efecto invernadero y, por lo tanto, afecta al aire del medio ambiente. Esto, a su vez, reduce la demanda de productos de envasado de frutas y, por lo tanto, desafía el crecimiento del mercado de envases de frutas de EE. UU.

Este informe sobre el mercado de envases de frutas de EE. UU. proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de rodenticidas, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Acontecimientos recientes

- En marzo de 2021, International Paper anunció la adquisición de dos plantas de cajas de cartón ondulado de última generación en España. Esto le permitió a la empresa reforzar sus capacidades en Madrid y Cataluña. Esto mejoró las soluciones de embalaje de la empresa en los segmentos industrial, de frutas y verduras frescas y de comercio electrónico.

- En marzo de 2021, Packaging Corporation of America anunció sus planes de lanzar proyectos trienales por valor de 440 millones de dólares para convertir de forma permanente una máquina de papel en su fábrica del condado de Clarke para producir cartón para embalajes de cartón ondulado. La empresa instalará una planta OCC para reciclar viejos contenedores de cartón ondulado y varias modificaciones de la fábrica de pulpa. Esto llevó al desarrollo de nuevos productos por parte de la empresa.

- En marzo de 2022, Amcor plc recibió tres premios 2022 Flexible Packaging Achievement Awards, en varias categorías de un número récord de inscriptos. Los premios han reconocido a Amcor por resolver desafíos complejos de los clientes, promover la sostenibilidad y elevar la contribución general de los envases flexibles.

Análisis y perspectivas regionales del mercado de envases de frutas de EE. UU.

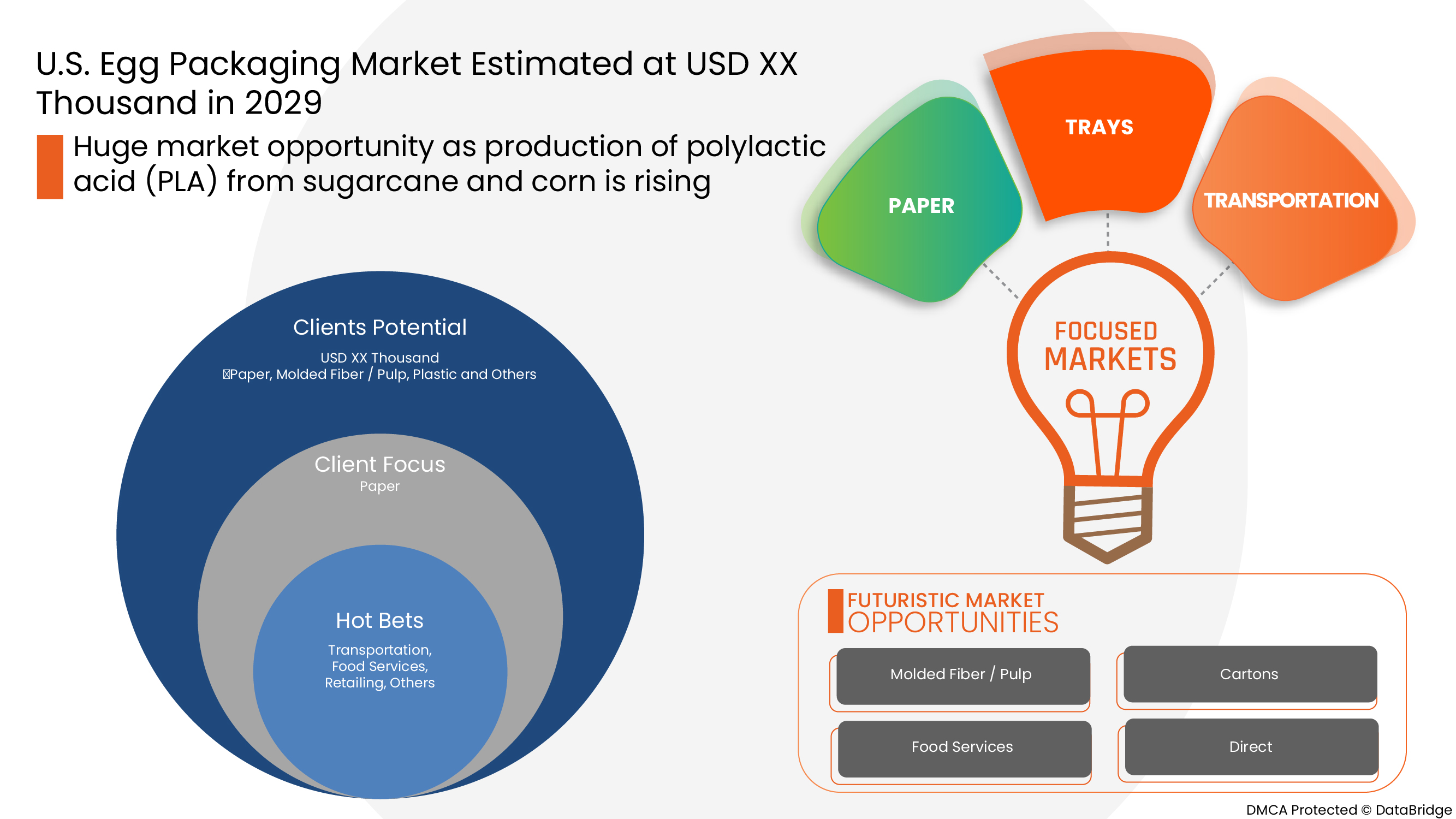

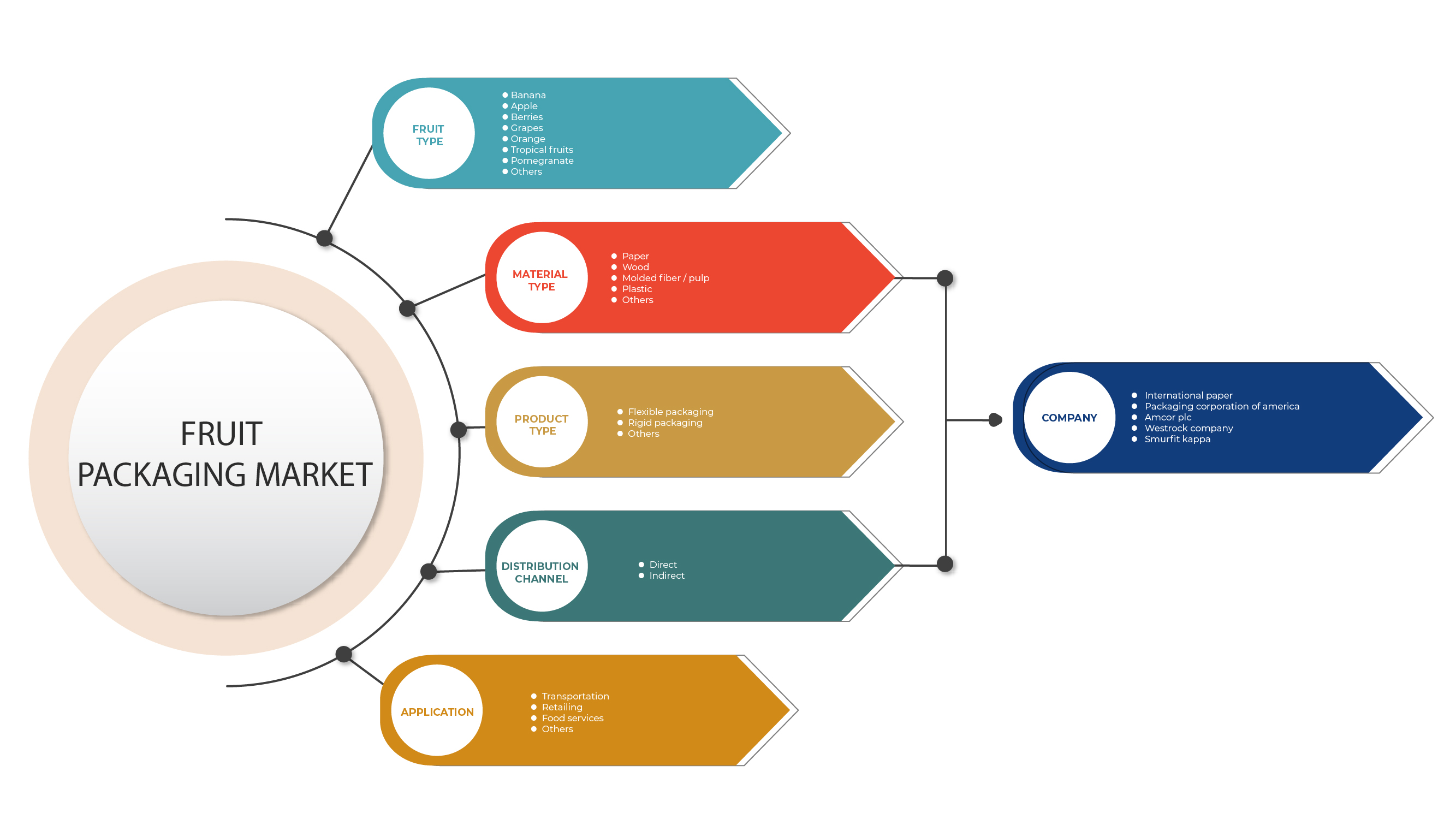

El mercado estadounidense de envases de frutas está segmentado en cinco segmentos notables que se basan en el tipo de fruta, el tipo de material, el tipo de producto, la aplicación y el canal de distribución.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, el análisis de las cinco fuerzas de Porter de las tendencias técnicas y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Alcance del mercado de envases de frutas en EE. UU.

El mercado estadounidense de envases de frutas está segmentado en función del tipo de fruta, el tipo de material, el tipo de producto, la aplicación y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de fruta

- Banana

- Manzana

- Bayas

- Uvas

- Naranja

- Frutas tropicales

- Granada

- Otros

Según el tipo de fruta, el mercado estadounidense de envases de frutas está segmentado en plátano, manzana, bayas, uvas, naranja, frutas tropicales, granadas y otros.

Tipo de material

- Papel

- Madera

- Fibra moldeada / Pulpa

- Plástico

- Otros

Según el tipo de material, el mercado estadounidense de envases de frutas está segmentado en plástico, papel, fibra/pulpa moldeada, madera y otros.

Tipo de producto

- Embalaje flexible

- Embalaje rígido

- Otros

Según el tipo de producto, el mercado estadounidense de envases de frutas está segmentado en envases rígidos, envases flexibles y otros.

Solicitud

- Transporte

- Venta al por menor

- Servicios de alimentación

- Otros

Sobre la base de la aplicación, el mercado estadounidense de envasado de frutas está segmentado en venta minorista, transporte, servicios de alimentación y otros.

Canal de distribución

- Directo

- Indirecto

Sobre la base del canal de distribución, el mercado estadounidense de envasado de frutas se segmenta en directo e indirecto.

Análisis del panorama competitivo y de la cuota de mercado de envases de frutas en EE. UU.

El panorama competitivo del mercado de envases de frutas de EE. UU. proporciona detalles sobre un competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de las empresas en relación con el mercado de envases de frutas de EE. UU.

Los actores que operan en el mercado estadounidense de envases de frutas son Mondi, DS Smith, Amcor plc, Packaging Corporation of America, International Paper, Smurfit Kappa, Sealed Air, Sonoco Products Company, WestRock Company y Huhtamaki, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. FRUIT PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.2 LABELING AND CLAIMS

4.3 REVENUE OF SUPPLIERS

4.4 SUPPLY CHAIN ANALYSIS:

4.5 VALUE CHAIN ANALYSIS:

4.6 MARKET SHARE OF MOLDED FIBER VS OTHER SUBSTRATES AND ITS PROJECTION

4.7 U.S. FRUIT PACKAGING MARKET, NEW PRODUCT LAUNCH STRATEGY

4.7.1 OVERVIEW

4.7.2 NUMBER OF PRODUCT LAUNCHES

4.7.2.1 LINE EXTENSION

4.7.2.2 NEW PACKAGING

4.7.2.3 RE-LAUNCHED

4.7.2.4 NEW FORMULATION

4.7.3 DIFFERENTIAL PRODUCT OFFERING

4.7.4 MEETING CONSUMER REQUIREMENT

4.7.5 PACKAGE DESIGNING

4.7.6 PRICING ANALYSIS

4.7.7 PRODUCT POSITIONING

4.7.8 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING

6.1.2 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PRODUCTS FOR FRUIT PACKAGING

6.1.3 RISING E-COMMERCE, COURIER, AND FRUIT DELIVERY SERVICES

6.1.4 GAINING POPULARITY OF FRUITS IN PREVENTING CHRONIC DISEASES

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT RULES AND REGULATIONS REGARDING PACKAGING MATERIALS

6.2.2 USE OF HARMFUL ADDITIVES FOR WATER/OIL RESISTANCE IN FOOD PACKAGING

6.3 OPPORTUNITIES

6.3.1 POSITIVE OUTLOOK TOWARD ADVANCED AND SMART PACKAGING SOLUTIONS

6.3.2 RISING DEMAND FOR MODIFIED ATMOSPHERE PACKAGING (MAP)

6.4 CHALLENGES

6.4.1 MANAGING PACKAGING WASTE IS DIFFICULT

6.4.2 MAINTAINING STANDARD QUALITY OF PACKAGING PRODUCT

7 U.S. FRUIT PACKAGING MARKET, BY FRUIT TYPE

7.1 OVERVIEW

7.2 BANANA

7.3 APPLE

7.4 BERRIES

7.4.1 STRAWBERRY

7.4.2 BLUEBERRY

7.4.3 RASPBERRY

7.4.4 BLACKBERRY

7.4.5 CRANBERRY

7.4.6 OTHERS

7.5 GRAPES

7.6 ORANGE

7.7 TROPICAL FRUITS

7.7.1 MANGO

7.7.2 PAPAYA

7.7.3 PASSION FRUIT

7.7.4 DRAGON FRUIT

7.7.5 JACKFRUIT

7.7.6 OTHERS

7.8 POMEGRANATE

7.9 OTHERS

8 U.S. FRUIT PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER

8.3 WOOD

8.4 MOLDED FIBER / PULP

8.4.1 CARDBOARD

8.4.2 RECYCLED PAPER

8.4.3 NATURAL FIBER

8.4.3.1 SUGARCANE

8.4.3.2 BAMBOO

8.4.3.3 WHEAT STRAW

8.4.3.4 OTHERS

8.4.4 OTHERS

8.5 PLASTIC

8.5.1 POLYETHYLENE TEREPHTHALATE

8.5.2 POLYPROPYLENE (PP)

8.5.3 POLY-VINYL CHLORIDE (PVC)

8.5.4 POLYSTYRENE

8.5.5 ETHYL VINYL ACETATE (EVA)

8.5.6 OTHERS

8.6 OTHERS

9 U.S. FRUIT PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FLEXIBLE PACKAGING

9.2.1 CORRUGATED

9.2.2 LAMINATED FOIL

9.2.3 OTHERS

9.3 RIGID PACKAGING

9.3.1 BOXBOARD

9.3.2 TRAYS

9.3.3 CONTAINERS

9.3.4 OTHERS

9.4 OTHERS

10 U.S. FRUIT PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TRANSPORTATION

10.2.1 TRANSPORTATION, BY MATERIAL TYPE

10.2.1.1 PAPER

10.2.1.2 WOOD

10.2.1.3 MOLDED FIBER / PULP

10.2.1.3.1 CARDBOARD

10.2.1.3.2 RECYCLED PAPER

10.2.1.3.3 NATURAL FIBER

10.2.1.3.3.1 SUGARCANE

10.2.1.3.3.2 BAMBOO

10.2.1.3.3.3 WHEAT STRAW

10.2.1.3.3.4 OTHERS

10.2.1.3.4 OTHERS

10.2.1.4 PLASTIC

10.2.1.4.1 POLYETHYLENE TEREPHTHALATE

10.2.1.4.2 POLYPROPYLENE (PP)

10.2.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.2.1.4.4 POLYSTYRENE

10.2.1.4.5 ETHYL VINYL ACETATE (EVA)

10.2.1.4.6 OTHERS

10.2.1.5 OTHERS

10.3 RETAILING

10.3.1 RETAILING, BY MATERIAL TYPE

10.3.1.1 PAPER

10.3.1.2 WOOD

10.3.1.3 MOLDED FIBER / PULP

10.3.1.3.1 CARDBOARD

10.3.1.3.2 RECYCLED PAPER

10.3.1.3.3 NATURAL FIBER

10.3.1.3.3.1 SUGARCANE

10.3.1.3.3.2 BAMBOO

10.3.1.3.3.3 WHEAT STRAW

10.3.1.3.3.4 OTHERS

10.3.1.3.4 OTHERS

10.3.1.4 PLASTIC

10.3.1.4.1 POLYETHYLENE TEREPHTHALATE

10.3.1.4.2 POLYPROPYLENE (PP)

10.3.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.3.1.4.4 POLYSTYRENE

10.3.1.4.5 ETHYL VINYL ACETATE (EVA)

10.3.1.4.6 OTHERS

10.3.1.5 OTHERS

10.4 FOOD SERVICES

10.4.1 FOOD SERVICES, BY MATERIAL TYPE

10.4.1.1 PAPER

10.4.1.2 WOOD

10.4.1.3 MOLDED FIBER / PULP

10.4.1.3.1 CARDBOARD

10.4.1.3.2 RECYCLED PAPER

10.4.1.3.3 NATURAL FIBER

10.4.1.3.3.1 SUGARCANE

10.4.1.3.3.2 BAMBOO

10.4.1.3.3.3 WHEAT STRAW

10.4.1.3.3.4 OTHERS

10.4.1.3.4 OTHERS

10.4.1.4 PLASTIC

10.4.1.4.1 POLYETHYLENE TEREPHTHALATE

10.4.1.4.2 POLYPROPYLENE (PP)

10.4.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.4.1.4.4 POLYSTYRENE

10.4.1.4.5 ETHYL VINYL ACETATE (EVA)

10.4.1.4.6 OTHERS

10.4.1.5 OTHERS

10.5 OTHERS

10.5.1 OTHERS, BY MATERIAL TYPE

10.5.1.1 PAPER

10.5.1.2 WOOD

10.5.1.3 MOLDED FIBER / PULP

10.5.1.3.1 CARDBOARD

10.5.1.3.2 RECYCLED PAPER

10.5.1.3.3 NATURAL FIBER

10.5.1.3.3.1 SUGARCANE

10.5.1.3.3.2 BAMBOO

10.5.1.3.3.3 WHEAT STRAW

10.5.1.3.3.4 OTHERS

10.5.1.3.4 OTHERS

10.5.1.4 PLASTIC

10.5.1.4.1 POLYETHYLENE TEREPHTHALATE

10.5.1.4.2 POLYPROPYLENE (PP)

10.5.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.5.1.4.4 POLYSTYRENE

10.5.1.4.5 ETHYL VINYL ACETATE (EVA)

10.5.1.4.6 OTHERS

10.5.1.5 OTHERS

11 U.S. FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 U.S. FRUIT PACKAGING MARKET, BY COUNTRY

12.1 U.S.

13 U.S. FRUIT PACKAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

13.1.1 MERGERS & ACQUISITIONS

13.1.2 EXPANSIONS

13.1.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 PACKAGING CORPORATION OF AMERICA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 AMCOR PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 WESTROCK COMPANY

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 SMURFIT KAPPA

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 DS SMITH

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 HUHTAMAKI

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 MONDI

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 SEALED AIR

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 SONOCO PRODUCTS COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD MILLION)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD MILLION)

TABLE 3 REVENUE OF SUPPLIERS (USD MILLION) (2021)

TABLE 4 MOLDED FIBER MARKET SHARE, BY MATERIAL TYPE (2022 AND 2029) (IN %)

TABLE 5 MOLDED FIBER MARKET SHARE, BY APPLICATIONS (2022 AND 2029) (IN %)

TABLE 6 U.S. FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (USD MILLION)

TABLE 7 U.S. FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (MILLION UNITS)

TABLE 8 U.S. BERRIES IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 U.S. TROPICAL FRUITS IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 U.S. FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 11 U.S. FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 12 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 15 U.S. FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.S. FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 17 U.S. FLEXIBLE PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 U.S. RIGID PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 U.S. FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 U.S. FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 21 U.S. TRANSPORTATION IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 23 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. RETAILING IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 26 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.S. FOOD SERVICES IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. OTHERS IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 U.S. FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 39 U.S. FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (MILLION UNITS)

TABLE 41 U.S. BERRIES IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. TROPICAL FRUITS IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 45 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE , 2020-2029 (USD MILLION)

TABLE 47 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 U.S. FLEXIBLE PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. RIGID PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 U.S. FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 54 U.S. TRANSPORTATION IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. RETAILING IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. FOOD SERVICES IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. OTHERS IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 U.S. FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

Lista de figuras

FIGURE 1 U.S. FRUIT PACKAGING MARKET: SEGMENTATION

FIGURE 2 U.S. FRUIT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 U.S. FRUIT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 U.S. FRUIT PACKAGING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. FRUIT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. FRUIT PACKAGING MARKET: MATERIAL TYPE LIFE LINE CURVE

FIGURE 7 U.S. FRUIT PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. FRUIT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. FRUIT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. FRUIT PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 11 U.S. FRUIT PACKAGING MARKET: CHALLENGE MATRIX

FIGURE 12 U.S. FRUIT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 U.S. FRUIT PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING IS DRIVING THE U.S. FRUIT PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 15 BANANA IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. FRUIT PACKAGING MARKET IN 2022 & 2029

FIGURE 16 U.S. FRUIT PACKAGING MARKET- SUPPLY CHAIN ANALYSIS

FIGURE 17 U.S. FRUIT PACKAGING MARKET- VALUE CHAIN ANALYSIS

FIGURE 18 U.S. FRUIT PACKAGING MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. FRUIT PACKAGING MARKET

FIGURE 20 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 21 WASTE GENERATION BY PACKAGING MATERIAL IN 2019 IN EUROPE

FIGURE 22 U.S. FRUIT PACKAGING MARKET: BY FRUIT TYPE, 2021

FIGURE 23 U.S. FRUIT PACKAGING MARKET: BY MATERIAL TYPE, 2021

FIGURE 24 U.S. FRUIT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 25 U.S. FRUIT PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 26 U.S. FRUIT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 U.S. FRUIT PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.