Us Electrophysiology Equipment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

5.08 Billion

USD

9.60 Billion

2024

2032

USD

5.08 Billion

USD

9.60 Billion

2024

2032

| 2025 –2032 | |

| USD 5.08 Billion | |

| USD 9.60 Billion | |

|

|

|

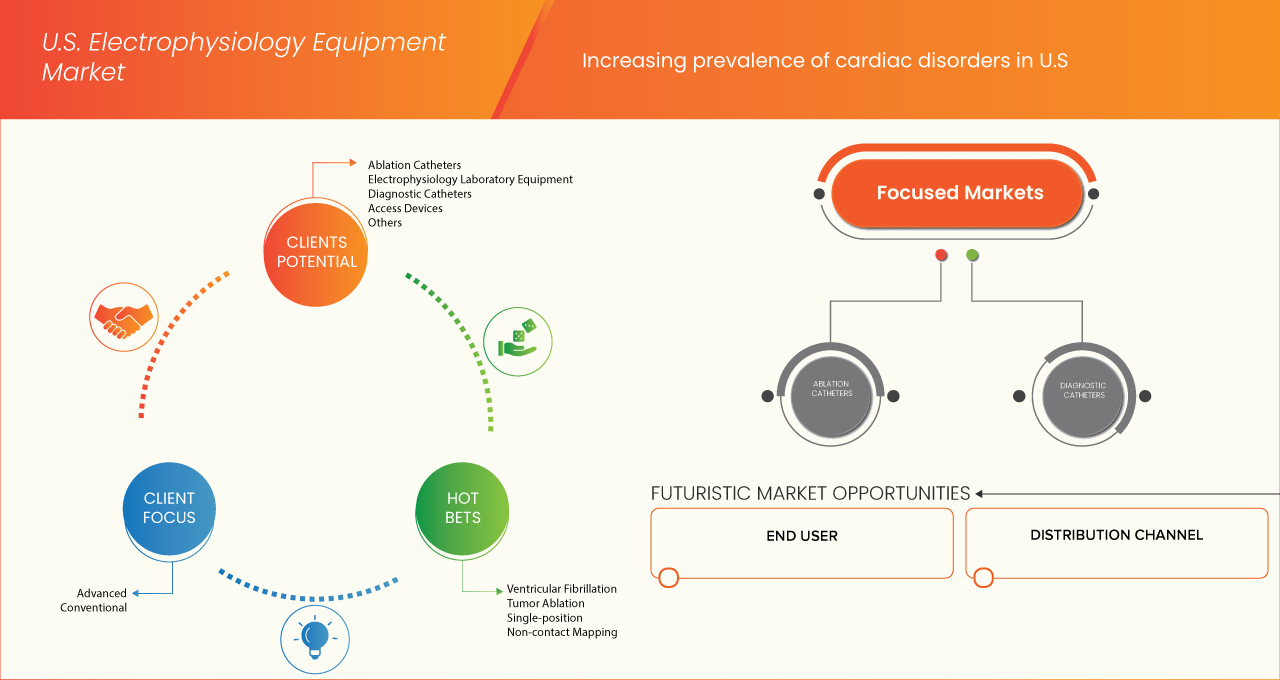

Mercado de equipos de electrofisiología de EE. UU., por tipo (catéteres de ablación, equipos de laboratorio de electrofisiología, catéteres de diagnóstico, dispositivos de acceso y otros), indicación (fibrilación auricular, aleteo auricular, taquicardia por reentrada del nódulo auriculoventricular (AVNRT), síndrome de Wolff-Parkinson-White (WPW) y otros), función (avanzada, convencional, crioablación y otros), procedimiento (fibrilación ventricular, ablación de tumores, mapeo sin contacto de posición única, mapeo electroanatómico multipunto para arritmias simples, venas varicosas y otros), usuario final (hospitales, centros quirúrgicos ambulatorios, centros de diagnóstico, laboratorios de cateterismo cardíaco, clínicas especializadas y otros), canal de distribución (licitación directa y ventas minoristas): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de equipos de electrofisiología en EE. UU.

La historia de los equipos de electrofisiología (EF) se remonta a mediados del siglo XX, cuando los avances en cardiología comenzaron a revelar la naturaleza eléctrica de la función cardíaca. Los desarrollos iniciales incluyeron monitores cardíacos básicos y los primeros marcapasos en la década de 1950, que allanaron el camino para dispositivos más sofisticados. En las décadas de 1960 y 1970 se introdujeron las máquinas de electrocardiografía (ECG) y la llegada de las técnicas de ablación con catéter, lo que permitió el tratamiento dirigido de las arritmias. A lo largo de los años, innovaciones como los sistemas de mapeo tridimensional, las técnicas de imágenes avanzadas y los sistemas de electrofisiología automatizados han mejorado significativamente la precisión y la seguridad de los procedimientos. A fines de la década de 1990 y principios de la década de 2000, la integración de la tecnología informática y una mejor comprensión de la anatomía cardíaca llevaron al desarrollo de laboratorios de EF de última generación equipados con sistemas especializados de mapeo y registro. Hoy en día, los equipos de electrofisiología continúan evolucionando, incorporando tecnologías avanzadas como inteligencia artificial y enfoques mínimamente invasivos, transformando así el manejo de las arritmias cardíacas y mejorando los resultados de los pacientes.

Tamaño del mercado de equipos de electrofisiología en EE. UU.

Se espera que el mercado estadounidense de equipos de electrofisiología alcance los 9.600 millones de dólares en 2032, desde los 5.080 millones de dólares en 2024, creciendo a una CAGR del 8,3% en el período de pronóstico de 2025 a 2032. Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Tendencias del mercado de equipos de electrofisiología en EE. UU.

“Aumento de la adopción de tecnologías avanzadas”

Una tendencia notable en el mercado de equipos de electrofisiología de EE. UU. es la creciente adopción de tecnologías avanzadas, como sistemas de mapeo 3D y catéteres de electrofisiología, impulsada por la creciente prevalencia de arritmias cardíacas y los avances en procedimientos mínimamente invasivos. Este cambio está impulsado en gran medida por la demanda de una mayor precisión diagnóstica y eficacia del tratamiento, lo que permite a los proveedores de atención médica ofrecer terapias personalizadas y específicas. Además, la integración de la inteligencia artificial y el aprendizaje automático dentro de estas tecnologías está mejorando el análisis de datos en tiempo real y los resultados de los procedimientos, lo que impulsa aún más el crecimiento del mercado. A medida que los centros de atención médica continúan invirtiendo en sistemas de electrofisiología de última generación, esta tendencia subraya un movimiento más amplio hacia soluciones de atención cardíaca más especializadas y tecnológicamente sofisticadas en el panorama de la atención médica de EE. UU.

Alcance del informe y segmentación del mercado de equipos de electrofisiología en EE. UU.

|

Atributos |

Perspectivas del mercado de equipos de electrofisiología de EE. UU. |

|

Segmentos cubiertos |

|

|

Actores clave del mercado |

Johnsons & Johnsons (EE. UU.), Abbott (EE. UU.), Medtronic (Irlanda), Boston Scientific Corporation (EE. UU.) y Koninklijke Philips NV (EE. UU.) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de equipos de electrofisiología de EE. UU.

El equipo de electrofisiología se refiere a un conjunto especializado de dispositivos e instrumentos médicos que se utilizan para diagnosticar y tratar las actividades eléctricas del corazón, en particular en relación con las arritmias y otros trastornos cardíacos. Esta categoría incluye herramientas como los catéteres de electrofisiología, que se insertan en el corazón para registrar señales eléctricas; los sistemas de mapeo, que visualizan la actividad eléctrica y ayudan a identificar áreas de conducción anormal; y los dispositivos de ablación, que se emplean para destruir o aislar el tejido problemático responsable de los ritmos cardíacos irregulares. Con los avances en la tecnología, el equipo de electrofisiología incorpora cada vez más funciones como el mapeo 3D, la navegación remota y el análisis de datos en tiempo real, lo que mejora la precisión y la eficacia de los procedimientos cardíacos.

Dinámica del mercado de equipos de electrofisiología en EE. UU.

Conductores

- Aumento de la prevalencia de trastornos cardíacos en EE. UU.

La creciente prevalencia de trastornos cardíacos en los EE. UU., especialmente arritmias como fibrilación auricular, bloqueo cardíaco y taquicardia ventricular, es un factor clave para el mercado de equipos de electrofisiología. Con el aumento de las tasas de afecciones relacionadas con el estilo de vida, como hipertensión, diabetes y obesidad, la incidencia de trastornos del ritmo cardíaco ha aumentado en los últimos años. Esta creciente carga sobre el sistema de atención médica requiere el uso de herramientas diagnósticas y terapéuticas avanzadas, como dispositivos de electrofisiología, para diagnosticar, monitorear y tratar eficazmente estas afecciones. A medida que más pacientes buscan tratamientos como la ablación con catéter y otros procedimientos de electrofisiología para controlar sus afecciones, aumenta la demanda de equipos de electrofisiología de alto rendimiento, lo que impulsa tanto la innovación como la adopción dentro del mercado. Este aumento en la demanda de opciones de tratamiento efectivas impulsa directamente el crecimiento del mercado, lo que hace que la creciente prevalencia de trastornos cardíacos sea un factor crucial para el sector de equipos de electrofisiología.

En octubre de 2024, según el artículo publicado por los Centros para el Control y la Prevención de Enfermedades, la enfermedad cardíaca coronaria (CHD), la afección cardíaca más común, se cobró 371.506 vidas en 2022. Aproximadamente 1 de cada 20 adultos mayores de 20 años se ven afectados por CHD, y 1 de cada 5 muertes relacionadas con enfermedades cardiovasculares ocurren en adultos menores de 65 años. Esta prevalencia alta y creciente de la enfermedad de las arterias coronarias impulsa significativamente la demanda de equipos de electrofisiología utilizados en el diagnóstico y el tratamiento, lo que impulsa el crecimiento del mercado.

- Infraestructura sanitaria mejorada

La expansión de los hospitales y las colaboraciones de los Centros Médicos Académicos (CMA) con hospitales comunitarios más pequeños son factores fundamentales que impulsan el mercado de equipos de electrofisiología de los EE. UU. A medida que los CMA y las grandes redes hospitalarias mejoran sus instalaciones e invierten en atención cardíaca especializada, establecen el estándar para el tratamiento avanzado, a menudo compartiendo tecnología y experiencia con hospitales comunitarios más pequeños. Estas colaboraciones garantizan un acceso más amplio a opciones de diagnóstico y tratamiento de vanguardia, incluidos los dispositivos de electrofisiología. La Ley de Atención Médica Asequible (ACA) ha facilitado aún más esta tendencia al ampliar el acceso a la atención médica, en particular para las poblaciones desatendidas. A medida que más pacientes obtienen acceso a la atención cardiovascular avanzada, aumenta la demanda de equipos de electrofisiología, lo que estimula el crecimiento del mercado y la innovación en el sector.

Por ejemplo-

En abril de 2024, según el artículo publicado por la American Heart Association, Inc., la ACA aborda la expansión de Medicaid que mejoró el acceso a la atención primaria y preventiva, lo que permitió un mejor diagnóstico y tratamiento de los factores de riesgo cardiometabólico y, al mismo tiempo, redujo los costos catastróficos de salud. También ha ayudado a reducir las disparidades raciales en el acceso a la atención médica. Este mejor acceso a la atención conduce a una mayor demanda de tratamientos cardiovasculares avanzados y herramientas de diagnóstico, lo que impulsa la adopción de equipos de electrofisiología en los centros de atención médica en todo Estados Unidos.

Oportunidades

- Número creciente de procedimientos de ablación con catéter

El creciente número de procedimientos de ablación con catéter crea oportunidades significativas para el mercado de equipos de electrofisiología de EE. UU. al aumentar la demanda de dispositivos diagnósticos y terapéuticos avanzados. La ablación con catéter, que se utiliza principalmente para tratar arritmias, como la fibrilación auricular y la taquicardia ventricular, es un procedimiento mínimamente invasivo que ofrece ventajas sobre los métodos tradicionales, como la administración de medicamentos o las intervenciones quirúrgicas. A medida que aumenta la conciencia sobre los beneficios de la ablación con catéter entre los pacientes y los proveedores de atención médica, y a medida que más centros de atención médica adoptan estas tecnologías, aumenta la demanda de equipos de electrofisiología, como catéteres, sistemas de mapeo y analizadores de electrofisiología. Esta tendencia se ve respaldada además por una población cada vez más envejecida, que es más propensa a sufrir enfermedades cardiovasculares que requieren tales intervenciones.

Por ejemplo,

En julio de 2023, según un artículo publicado por la Biblioteca Nacional de Medicina, la ablación con catéter es un campo en rápida evolución y ha demostrado ser una solución válida para muchos pacientes que sufren arritmias recurrentes. La ablación con catéter se utiliza ampliamente para muchas arritmias auriculares, el procedimiento también se asocia con una buena cantidad de complicaciones graves que incluyen muerte, estenosis de la vena pulmonar, perforación esofágica, bloqueo cardíaco que requiere un marcapasos, accidente cerebrovascular, lesión del nervio frénico y complicaciones del acceso vascular.

- Aumento de la financiación para la investigación cardiovascular

El aumento de la financiación de la investigación cardiovascular representa una oportunidad importante para el mercado estadounidense de equipos de electrofisiología, ya que acelera la innovación y facilita el desarrollo de tecnologías de última generación. A medida que las instituciones de investigación y las empresas privadas reciben más apoyo financiero, pueden asignar recursos a la exploración de nuevas técnicas electrofisiológicas y al avance del diseño de equipos. Esta financiación permite a los investigadores realizar estudios exhaustivos que pueden conducir al descubrimiento de nuevas modalidades terapéuticas, mejores diseños de catéteres, herramientas de mapeo sofisticadas y tecnologías de imagen mejoradas. En consecuencia, la introducción de estas innovaciones ayuda a satisfacer la creciente demanda de opciones de tratamiento eficaces y seguras para las arritmias cardíacas y otras afecciones cardiovasculares, lo que crea un entorno favorable para la expansión del mercado.

Además, el aumento de la financiación de la investigación cardiovascular suele dar lugar a una mayor colaboración entre diversos sectores, incluidas las instituciones académicas, los proveedores de atención sanitaria y las empresas biofarmacéuticas. Estas colaboraciones pueden permitir la rápida traducción de los resultados de las investigaciones a aplicaciones clínicas, lo que se traduce en mejoras aceleradas en los equipos de electrofisiología.

Restricciones/Desafíos

- Escasez de profesionales cualificados en Estados Unidos

La escasez de profesionales cualificados en el campo de la atención sanitaria es un reto crítico para el mercado estadounidense. Los procedimientos de electrofisiología, como la ablación por catéter y el mapeo cardíaco, requieren una formación altamente especializada y hay menos profesionales con la experiencia necesaria para realizar estas complejas intervenciones. A medida que aumenta la demanda de tratamientos de electrofisiología avanzada, los sistemas sanitarios se enfrentan a dificultades para formar y retener a profesionales cualificados, especialmente en zonas rurales o desatendidas. Esta escasez no solo limita la capacidad para realizar estos procedimientos, sino que también reduce la eficiencia del uso de equipos de electrofisiología de última generación. En consecuencia, el crecimiento del mercado se ve restringido, ya que los proveedores de atención sanitaria luchan por satisfacer la creciente demanda de estas soluciones avanzadas para el cuidado cardíaco.

Por ejemplo,

En octubre de 2024, según el artículo publicado por PRS Global, la escasez de tecnólogos médicos es significativa, ya que casi la mitad de los laboratorios médicos de EE. UU. informan que tienen dificultades para cubrir puestos y las tasas de vacantes alcanzan el 20% en algunas regiones (ASCLS, 2024). Esta escasez afecta el funcionamiento de los equipos de electrofisiología avanzados, ya que los profesionales capacitados son esenciales para realizar procedimientos complejos. La falta de personal capacitado limita el uso y la adopción efectivos de estas tecnologías, lo que actúa como un freno para el crecimiento del mercado.

- Alternativas a los procedimientos de electrofisiología

La competencia de los tratamientos alternativos supone una importante limitación para el mercado estadounidense de equipos de electrofisiología. A medida que se adoptan más terapias no invasivas, como los tratamientos farmacológicos, la cardioversión eléctrica y las intervenciones relacionadas con el estilo de vida, para tratar los trastornos del ritmo cardíaco, disminuye la demanda de procedimientos electrofisiológicos invasivos, como la ablación con catéter. Estas alternativas ofrecen opciones menos riesgosas y de menor costo, lo que limita la necesidad de dispositivos electrofisiológicos avanzados y frena el crecimiento del mercado.

Por ejemplo,

En mayo de 2024, según el artículo publicado por Heart Rhythm Society, la ablación con catéter, que incluye la ablación térmica y la ablación por campo pulsado (PFA), es una alternativa no farmacológica eficaz para tratar los trastornos del ritmo cardíaco. Al ser un procedimiento menos invasivo, compite con los tratamientos farmacológicos tradicionales y ofrece una opción viable para los pacientes que buscan menos medicamentos. La preferencia por la ablación con catéter en lugar de las terapias farmacológicas actuales limita la demanda de equipos de electrofisiología, lo que actúa como un freno para el crecimiento del mercado.

Alcance del mercado de equipos de electrofisiología en EE. UU.

El mercado está dividido en seis segmentos importantes según el tipo, la indicación, la función, el procedimiento, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Catéteres de ablación

- Ablación por radiofrecuencia

- Crioablación

- Ablación eléctrica

- Láser/Luz

- Ablación por ultrasonido

- Equipos de laboratorio de electrofisiología

- Sistemas de mapeo 3D

- Sistemas de registro de electrofisiología

- Sistemas de ecocardiografía intracardíaca (Ice)

- Sistemas de rayos X para electrofisiología

- Sistemas de dirección remota por electrofisiología

- Catéteres de diagnóstico

- Catéteres de diagnóstico avanzados

- Catéteres de diagnóstico convencionales

- Catéteres de diagnóstico por ultrasonido

- Dispositivos de acceso

- Vaina

- Introductor

- Dilatador/Aguja

- Kit de electrodos para pacientes

- Otros

- Otros

Indicación

- Fibrilación auricular

- Aleteo auricular

- Taquicardia por reentrada nodal auriculoventricular (Avnrt)

- Síndrome de Wolff-Parkinson-White (WPW)

- Otros

Función

- Avanzado

- Convencional

- Crioablación

- Otros

Procedimiento

- Fibrilación ventricular

- Ablación de tumores

- Mapeo sin contacto de posición única

- Mapeo electroanatómico multipunto para arritmias simples

- Varices

- Otros

Usuario final

- Hospitales

- Centros de cirugía ambulatoria

- Centros de diagnóstico

- Laboratorios de cateterismo cardíaco

- Clínicas de especialidades

- Otros

Canal de distribución

- Licitación directa

- Ventas al por menor

Cuota de mercado de equipos de electrofisiología en EE.UU.

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de equipos de electrofisiología de EE. UU. que operan en el mercado son:

- Johnsons & Johnsons (Estados Unidos)

- Abbott (Estados Unidos)

- Medtronic (Irlanda)

- Boston Scientific Corporation (Estados Unidos)

- Philips NV de Koninklijke (EE. UU.)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER FIVE FORCES

5 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF CARDIAC DISORDERS IN U.S.

6.1.2 IMPROVED HEALTHCARE INFRASTRUCTURE

6.1.3 INCREASE IN AGING POPULATION

6.2 RESTRAINTS

6.2.1 SHORTAGE OF SKILLED PROFESSIONALS IN U.S

6.2.2 ALTERNATIVES TO ELECTROPHYSIOLOGY PROCEDURES

6.3 OPPORTUNITIES

6.3.1 GROWING NUMBER OF CATHETER ABLATION PROCEDURES

6.3.2 INCREASED FUNDING FOR CARDIOVASCULAR RESEARCH

6.3.3 GROWING OF ARRHYTHMIA BURDEN

6.4 CHALLENGES

6.4.1 REGULATORY HURDLES INVOLVED IN THE APPROVALS OF THE PRODUCTS

6.4.2 HIGH COSTS OF THE EQUIPMENT

7 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 ABLATION CATHETERS

7.2.1 RADIOFREQUENCY ABLATION

7.2.2 CRYOABLATION

7.2.3 ELECTRICAL ABLATION

7.2.4 LASER/LIGHT

7.2.5 ULTRASOUND ABLATION

7.3 ELECTROPHYSIOLOGY LABORATORY EQUIPMENT

7.3.1 3D MAPPING SYSTEMS

7.3.2 ELECTROPHYSIOLOGY RECORDING SYSTEMS

7.3.3 INTRACARDIAC ECHOCARDIOGRAPHY (ICE) SYSTEMS

7.3.4 ELECTROPHYSIOLOGY X-RAY SYSTEMS

7.3.5 ELECTROPHYSIOLOGY REMOTE STEERING SYSTEMS

7.4 DIAGNOSTIC CATHETERS

7.4.1 ADVANCED DIAGNOSTIC CATHETERS

7.4.2 CONVENTIONAL DIAGNOSTIC CATHETERS

7.4.3 ULTRASOUND DIAGNOSTIC CATHETERS

7.5 ACCESS DEVICES

7.5.1 SHEATH

7.5.2 INTRODUCER

7.5.3 DILATOR/NEEDLE

7.5.4 PATIENT ELECTRODE KIT

7.5.5 OTHERS

7.6 OTHERS

8 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY PROCEDURE

8.1 OVERVIEW

8.2 VENTRICULAR FIBRILLATION

8.3 TUMOR ABLATION

8.4 SINGLE-POSITION NON-CONTACT MAPPING

8.5 MULTIPOINT ELECTROANATOMIC MAPPING FOR SIMPLE ARRHYTHMIAS

8.6 VARICOSE VEINS

8.7 OTHERS

9 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY INDICATION

9.1 OVERVIEW

9.2 ATRIAL FIBRILLATION

9.3 ATRIAL FLUTTER

9.4 ATRIOVENTRICULAR NODAL REENTRY TACHYCARDIA (AVNRT)

9.5 WOLFF-PARKINSON-WHITE SYNDROME (WPW)

9.6 OTHERS

10 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 ADVANCED

10.3 CONVENTIONAL

10.4 CRYOABLATION

10.5 OTHERS

11 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 AMBULATORY SURGICAL CENTERS

11.4 DIAGNOSTIC CENTERS

11.5 CARDIAC CATHETERIZATION LABORATORIES

11.6 SPECIALITY CLINICS

11.7 OTHERS

12 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 JOHNSON & JOHNSON SERVICES, INC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ABBOTT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 MEDTRONIC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 BOSTON SCIENTIFIC CORPORATION(2024)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 KONINKLIJKE PHILIPS N.V.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ANGIODYNAMICS

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ATRICURE, INC. (2024)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIOTRONIK SE & CO.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CATHVISION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATES

15.1 GENERAL ELECTRIC COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MICROPORT SCIENTIFIC CORPORATION

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 OLYMPUS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SIEMENS HEALTHCARE PRIVATE LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 STRYKER

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 TELEFLEX INCORPORATED

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 THERMEDICAL, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 2 U.S. ABLATION CATHETERS IN ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 3 U.S. ELECTROPHYSIOLOGY LABORATORY EQUIPMENT IN ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 4 U.S. DIAGNOSTIC CATHETERS IN ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 5 U.S. ACCESS DEVICES IN ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY PROCEDURE, 2018-2032 (USD MILLION)

TABLE 7 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY INDICATION, 2018-2032 (USD MILLION)

TABLE 8 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 9 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 10 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

Lista de figuras

FIGURE 1 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: SEGMENTATION

FIGURE 11 FIVE SEGMENTS COMPRISE THE U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET, BY TYPE

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING PREVALENCE OF CARDIAC DISORDERS IN U.S. IS DRIVING THE GROWTH OF THE U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET FROM 2025 TO 2032

FIGURE 15 THE ABLATION CATHETERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY TYPE, 2024

FIGURE 18 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY TYPE, 2025-2032 (USD MILLION)

FIGURE 19 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 20 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY PROCEDURE, 2024

FIGURE 22 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY PROCEDURE, 2025-2032 (USD MILLION)

FIGURE 23 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY PROCEDURE, CAGR (2025-2032)

FIGURE 24 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 25 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY INDICATION, 2024

FIGURE 26 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY INDICATION, 2025-2032 (USD MILLION)

FIGURE 27 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY INDICATION, CAGR (2025-2032)

FIGURE 28 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 29 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY FUNCTION, 2024

FIGURE 30 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY FUNCTION, 2025-2032 (USD MILLION)

FIGURE 31 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY FUNCTION, CAGR (2025-2032)

FIGURE 32 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 33 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY END USER, 2024

FIGURE 34 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 35 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 38 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 39 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 40 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 U.S. ELECTROPHYSIOLOGY EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.