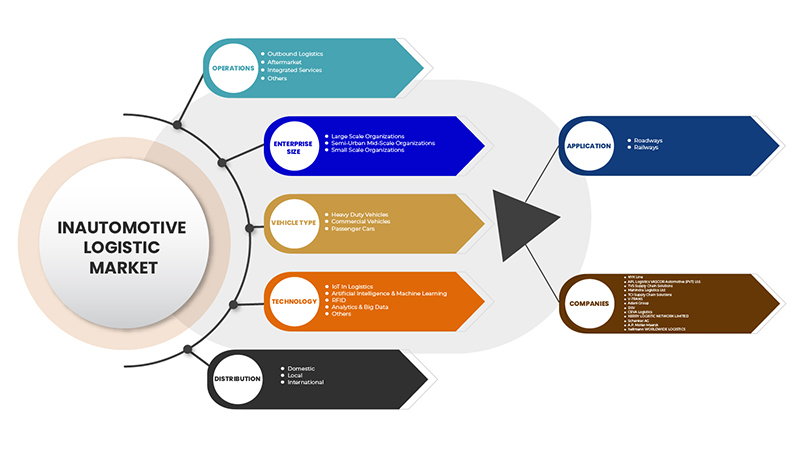

>Mercado logístico automotriz de Tailandia, por operaciones (logística de salida, posventa, servicios integrados y otros), tamaño de la empresa (organización a gran escala, organizaciones semiurbanas de escala media y organizaciones de pequeña escala), tipo de vehículo (vehículos pesados, vehículos comerciales y automóviles de pasajeros), tecnología (IoT en logística, inteligencia artificial y aprendizaje automático, RFIDanálisis y big data y otros), distribución (nacional, local e internacional), aplicación (carreteras y ferrocarriles), tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

Los proveedores de servicios intentaban continuamente encontrar formas de aumentar la precisión del trabajo, mejorar los servicios, la seguridad y trabajar con una tecnología en aumento. El requisito por estas razones se está satisfaciendo mediante la implementación de la logística automotriz, ya que se utilizan para proporcionar servicios mejorados, ininterrumpidos, gratuitos y oportunos en las operaciones industriales. La logística automotriz en varias industrias se está utilizando ampliamente debido a la creciente demanda de experiencia del cliente. Permite a las industrias mejorar sus operaciones y productividad. La logística automotriz ayuda a los usuarios finales al proporcionar mejores soluciones automatizadas sin interferencia humana y brindando una mejor experiencia de conducción. El mercado de logística automotriz de Tailandia está en una fase de rápido crecimiento debido a la creciente demanda de electrificación en vehículos que impulsa la demanda de logística automotriz. Las empresas incluso están lanzando nuevos productos para ganar una mayor participación de mercado.

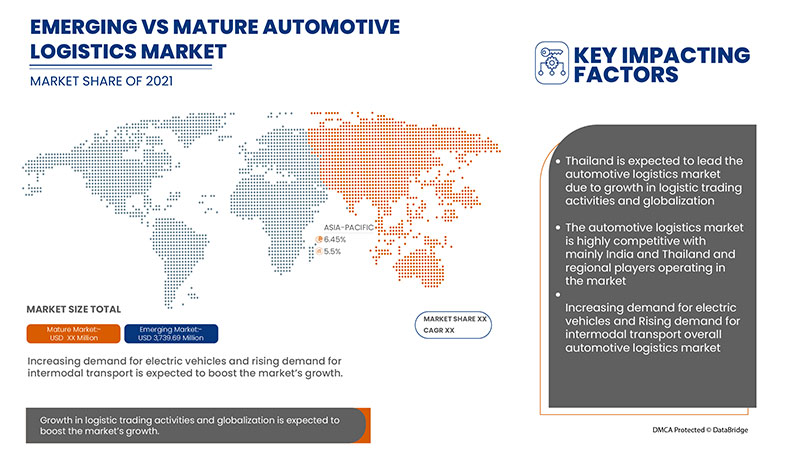

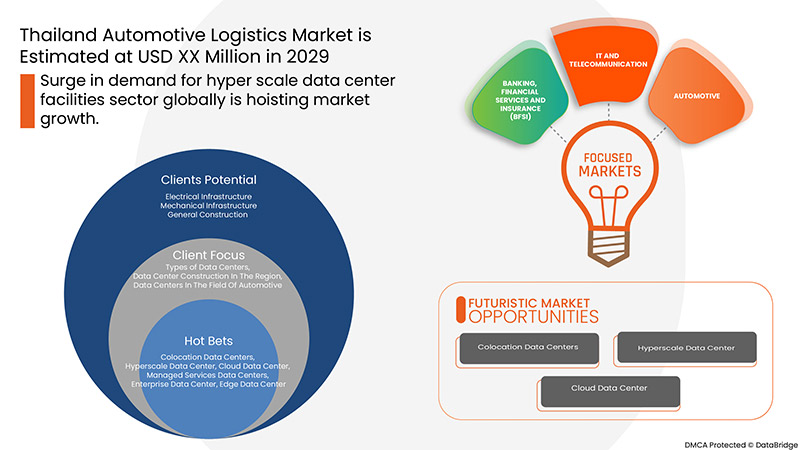

Data Bridge Market Research analiza que se espera que el mercado de logística automotriz alcance un valor de USD 3.739,69 millones para 2029, con una CAGR del 5,5 % durante el período de pronóstico. Outbound Logistics representa el segmento de oferta más grande en el mercado de logística automotriz. El servicio de Tailandia proporciona información precisa que se utiliza para desarrollar redes de IoT de alta precisión . El informe del mercado de logística automotriz también cubre análisis de precios, análisis de patentes y avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por operaciones (logística de salida, posventa, servicios integrados y otros), tamaño de la empresa (organización a gran escala, organizaciones semiurbanas de escala media y organizaciones a pequeña escala), tipo de vehículo (vehículos pesados, vehículos comerciales y automóviles de pasajeros), tecnología (IoT en logística, inteligencia artificial y aprendizaje automático, RFID, análisis y big data y otros), distribución (nacional, local e internacional), aplicación (carreteras y ferrocarriles) |

|

Países cubiertos |

Tailandia |

|

Actores del mercado cubiertos |

Entre ellas se encuentran: NYK Line, APL Logistics VASCOR Automotive (PVT) Ltd., TVS Supply Chain Solutions, Mahindra Logistics Ltd, TCI Supply Chain Solutions, V-TRANS, Adani Group, DSV, CEVA Logistics, KERRY LOGISTIC NETWORK LIMITED, Schenker AG, AP Moller-Maersk, hellmann WORLDWIDE LOGISTICS, entre otras. |

Definición de mercado

La logística automotriz es una red de distribución compleja y elevada en la que todas las etapas están bien conectadas. Todas las empresas de transporte en todo el mundo la consideran como el área más difícil y especializada. La mecanización y sofisticación de la cadena de suministro automotriz debe enriquecerse con la implementación de tecnologías logísticas modernas, lo que nos permite alcanzar nuestro objetivo de gestión de costos y mejora de la calidad, lo que da como resultado ventajas totales y una mayor efectividad general. Las actividades de planificación y gestión logística de la cadena de suministro automotriz están integradas desde la fuente de los componentes hasta el usuario final. La cadena de suministro automotriz utiliza una estructura organizativa, con proveedores de componentes automotrices y fabricantes de automóviles completos, concesionarios de automóviles en todos los niveles y consumidores finales, todos integrados en un sistema a través del flujo de información de retroalimentación y avance, el flujo de capital y los datos logísticos. Las actividades se relacionan con las operaciones de suministro de materias primas, componentes y otros suministros a las empresas de fabricación de automóviles. La entrega de materias primas y componentes desde los productores hasta el comienzo de la operación de fabricación de automóviles se conoce como logística de suministro automotriz. La logística de suministro automotriz puede ayudar a mantener la fabricación, el tránsito y la compra de automóviles en movimiento. Es necesario disminuir costos, aumentar ingresos en la cadena de suministro y mantener la gestión efectiva de las operaciones logísticas garantizando la disponibilidad de materiales.

Dinámica del mercado logístico automotriz

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Crecimiento de las actividades comerciales logísticas y globalización

La globalización puede definirse como la interdependencia de las economías, poblaciones y culturas del mundo unidas por el comercio transfronterizo de tecnología, bienes y otros. Hoy en día, la mayor parte de la economía del país depende en gran medida de la compra y venta de bienes en varios países. La región de Asia-Pacífico y América del Norte ha sido la principal protagonista del comercio mundial y tiene un alto volumen de flujo comercial que ha aumentado la necesidad de que los proveedores de servicios logísticos hagan que el flujo comercial sea más conveniente y rápido, impulsando así el crecimiento del mercado logístico para la región de Asia-Pacífico seguida de otras regiones.

- Creciente demanda de vehículos eléctricos

Los vehículos eléctricos (VE) están diseñados para ser una tecnología prometedora para lograr un transporte sostenible con cero emisiones de carbono, bajo nivel de ruido y alta eficiencia. Además, los vehículos eléctricos evolucionaron en el siglo XIX, pero debido a la falta de avances en la tecnología, los vehículos con motor de combustión interna tuvieron una gran demanda en comparación con los vehículos eléctricos. Durante el siglo XX, el avance tecnológico se impulsó año tras año y fue el resultado de desarrollos e innovaciones que ayudaron a remodelar los vehículos eléctricos.

- Aumento de los costes logísticos y de inventario

La logística tiene procedimientos operativos complejos debido al rápido crecimiento de las ventas, lo que hace que las operaciones de cumplimiento se subcontraten a un tercero logístico (3PL). Las dos variables importantes de las que depende el costo logístico son el tiempo y el volumen. La información sobre la logística en tránsito es importante para garantizar una mayor eficiencia y que cualquier organización o país logre economías de escala.

- Cambios en la preferencia de las empresas hacia la logística de salida

La logística de salida es el proceso que conecta a las empresas con sus clientes. El proceso permite a los productores trasladar sus productos a ubicaciones estratégicas. La figura describe el proceso involucrado en la logística de salida. La empresa compra el producto a los proveedores en el mercado y luego los productos se envían a los clientes.

Las empresas están cambiando su preferencia hacia la logística de salida porque tiene un proceso directo y menos complejo para la entrega de productos a los consumidores. La mayoría de las empresas prefieren la logística de salida porque la gestión y el almacenamiento del almacén de logística de salida están bien planificados según los requisitos. El inventario está bien administrado por los proveedores, el transporte y la entrega de último momento están bien planificados y gestionados.

- Creciente penetración de la nube, el big data y el Internet de las cosas (IoT) en los vehículos logísticos automotrices

La computación en la nube ha resultado ser una fuerza impulsora importante para la transformación digital en las industrias logísticas. No solo proporciona una agilidad incomparable, sino que también reduce los costos operativos y de gestión. Por ello, varios gobiernos y empresas están empezando a aprovechar esta tecnología y poco a poco está ganando popularidad en varios sectores verticales. El potencial se ha vuelto tan abierto que la noción de que la nube se limita únicamente a las funciones de TI ha cambiado por completo. Esto se integra aún más con otras tecnologías como la inteligencia artificial (IA), la IoT y la computación de borde, entre otras.

- Altos costos de transporte para el comercio internacional

La logística es la columna vertebral de cualquier economía y la industria logística en Tailandia está creciendo rápidamente. La logística se ha vuelto importante ya que puede conducir a una reducción en los costos operativos, mejorar el rendimiento de las entregas y aumentar los niveles de satisfacción del cliente. La logística que se comercializa a nivel internacional es importante para la gestión del flujo de productos de un lugar a otro.

Impacto posterior al COVID-19 en el mercado logístico automotriz

La COVID-19 ha tenido un gran impacto en el mercado logístico automotriz, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El crecimiento del mercado de la logística automotriz se debe a la llegada de los vehículos eléctricos en los últimos tiempos debido a la promoción por parte de muchas organizaciones gubernamentales del uso de vehículos eléctricos para reducir las emisiones. Sin embargo, el COVID-19 tuvo un efecto adverso en el mercado de la logística automotriz, ya que las operaciones de venta y logística de los vehículos en muchos países se detuvieron y la mayoría de las empresas cerraron sus operaciones temporalmente durante casi meses.

Además, después de la situación de pandemia, los consumidores no estaban dispuestos a comprar vehículos nuevos debido a la economía perturbada en muchos países, lo que afectó directamente las ventas y el crecimiento logístico del sector automotriz y tuvo como resultado un impacto en el crecimiento del mercado de logística automotriz.

Desarrollo reciente

- En marzo de 2022, CEVA Logistics anunció la asociación con Kodiak Robotics, Inc. Esta asociación ayudará a la empresa a desarrollar mejores soluciones logísticas, como entregas de carga autónomas, y diversificará la cartera de soluciones de la empresa y atraerá nuevos clientes.

En febrero de 2022, AP Moller – Maersk anunció la adquisición de la empresa piloto Freight Services. Esta adquisición ayudará a la empresa a ampliar la oferta logística integrada y permitirá el desarrollo de nuevos servicios, lo que aumenta las oportunidades de venta cruzada.

Alcance del mercado logístico de la industria automotriz en Tailandia

El mercado de logística automotriz está segmentado en función de las operaciones, el tamaño de la empresa, el tipo de vehículo, la tecnología, la distribución y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Operaciones

- Logística de salida

- Mercado de accesorios

- Servicios Integrados

- Otros

Sobre la base de la oferta, el mercado de logística automotriz de Tailandia está segmentado en logística de salida, posventa, servicios integrados y otros.

Tamaño de la empresa

- Organizaciones a gran escala

- Organizaciones de escala media semiurbanas

- Organizaciones de pequeña escala

Sobre la base del tamaño de la empresa, el mercado de logística automotriz de Tailandia se ha segmentado en organizaciones de gran escala, organizaciones semiurbanas de escala media y organizaciones de pequeña escala.

Tipo de vehículo

- Vehículos pesados

- Vehículos comerciales

- Automóviles de pasajeros

Sobre la base del tipo de vehículo, el mercado de logística automotriz de Tailandia se ha segmentado en vehículos pesados, vehículos comerciales y automóviles de pasajeros.

Tecnología

- IoT en la logística

- Inteligencia artificial y aprendizaje automático

- RFID

- Análisis y Big Data

- Otros

Sobre la base de la tecnología, el mercado de logística automotriz de Tailandia se ha segmentado en IoT en logística, inteligencia artificial y aprendizaje automático, RFID, análisis y big data, y otros.

Distribución

- Doméstico

- Local

- Internacional

Sobre la base de la distribución, el mercado logístico automotriz de Tailandia se ha segmentado en nacional, local e internacional.

Solicitud

- Carreteras

- Ferrocarriles

Sobre la base de la aplicación, el mercado de logística automotriz de Tailandia se ha segmentado en carreteras y ferrocarriles.

Análisis del panorama competitivo y la cuota de mercado de la logística automotriz

El panorama competitivo del mercado de logística automotriz ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Tailandia, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de logística automotriz.

Algunos de los principales actores que operan en el mercado de logística automotriz son NYK Line, APL Logistics VASCOR Automotive (PVT) Ltd., TVS Supply Chain Solutions, Mahindra Logistics Ltd, TCI Supply Chain Solutions, V-TRANS, Adani Group, DSV, CEVA Logistics, KERRY LOGISTIC NETWORK LIMITED, Schenker AG, AP Moller-Maersk y hellmann WORLDWIDE LOGISTICS, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THAILAND AUTOMOTIVE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OPEARTIONS TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TRENDS FOR FUTURE DOMESTIC SALES AND EXPORT NUMBER

4.1.1 RANKING, SHARE OF LOGISTICS COMPANIES (THAILAND)

4.2 MARKET FREIGHT RATE LEVEL TRANSITION FOR ROAD AND RAIL

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN LOGISTIC TRADING ACTIVITIES AND GLOBALIZATION

5.1.2 INCREASING DEMAND FOR ELECTRIC VEHICLES

5.1.3 RISING DEMAND FOR INTERMODAL TRANSPORT

5.2 RESTRAINTS

5.2.1 RISING LOGISTICS AND INVENTORY COST

5.2.2 POOR TRANSPORTATION INFRASTRUCTURE

5.3 OPPORTUNITIES

5.3.1 SHIFTING COMPANIES PREFERENCE TOWARD OUTBOUND LOGISTICS

5.3.2 INCREASING PENETRATION OF CLOUD, BIG DATA, AND INTERNET OF THING (IOT) IN THE AUTOMOTIVE LOGISTIC VEHICLES

5.3.3 INCREASING DEMAND FOR BLOCKCHAIN TECHNOLOGY IN LOGISTIC OPERATIONS

5.4 CHALLENGES

5.4.1 HIGH TRANSPORTATION COSTS FOR INTERNATIONAL TRADE

5.4.2 STRINGENT GOVERNMENT REGULATIONS FOR LOGISTICS

6 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS

6.1 OVERVIEW

6.2 OUTBOUND LOGISTICS

6.3 ORDER PROCESSING

6.4 PRODUCT PICKING & PACKING

6.5 SHIPMENT DISPATCH

6.6 AFTERMARKET

6.7 INTEGRATED SERVICES

6.8 OTHERS

7 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE

7.1 OVERVIEW

7.2 LARGE SCALE ORGANIZATIONS

7.3 SEMI-URBAN MID SCALE ORGANIZATIONS

7.4 SMALL SCALE ORGANIZATIONS

8 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE

8.1 OVERVIEW

8.2 HEAVY DUTY VEHICLES

8.3 PASSENGER CARS

9 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING

9.3 IOT IN LOGISTICS

9.4 ANALYTICS & BIG DATA

9.5 RFID

9.6 OTHERS

10 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION

10.1 OVERVIEW

10.2 DOMESTIC

10.3 LOCAL

10.4 INTERNATIONAL

11 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ROADWAYS

11.3 RAILWAYS

12 THAILAND

12.1 THAILAND

13 THAILAND AUTOMOTIVE LOGISTICS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: THAILAND

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 DSV

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ADANI GROUP

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 MAHINDRA LOGISTICS LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 NYK LINE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 CEVA LOGISTICS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 A.P. MOLLER - MAERSK

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 APL LOGISTICS VASCOR AUTOMOTIVE (PVT) LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 HELLMANN WORLDWIDE LOGISTICS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 KERRY LOGISTIC NETWORK LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 SCHENKER AG

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 TCI SUPPLY CHAIN SOLUTIONS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 TVS SUPPLY CHAIN SOLUTIONS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 V-TRANS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS, 2020-2029 (USD MILLION)

TABLE 2 THAILAND OUTBOUND LOGISTICS IN AUTOMOTIVE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 4 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 5 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION, 2020-2029 (USD MILLION)

TABLE 7 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS, 2020-2029 (USD MILLION)

TABLE 9 THAILAND OUTBOUND LOGISTICS IN AUTOMOTIVE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 11 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 12 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION, 2020-2029 (USD MILLION)

TABLE 14 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 THAILAND AUTOMOTIVE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 THAILAND AUTOMOTIVE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 THAILAND AUTOMOTIVE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 THAILAND AUTOMOTIVE LOGISTICS MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 THAILAND AUTOMOTIVE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THAILAND AUTOMOTIVE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 THAILAND AUTOMOTIVE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 THAILAND AUTOMOTIVE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 THAILAND AUTOMOTIVE LOGISTICS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 THAILAND AUTOMOTIVE LOGISTICS MARKET: SEGMENTATION

FIGURE 11 GROWTH IN LOGISTIC TRADING ACTIVITIES AND GLOBALIZATION IS EXPECTED TO DRIVE THAILAND AUTOMOTIVE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OPERATIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THAILAND AUTOMOTIVE LOGISTICS MARKET IN 2022 & 2029

FIGURE 13 AUTOMOTIVE SALES TREND IN INDIA

FIGURE 14 CAR SALES TREND OF THAILAND IN JANUARY MONTH

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THAILAND AUTOMOTIVE LOGISTICS MARKE

FIGURE 16 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY OPERATIONS, 2021

FIGURE 17 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 18 THAILAND AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE

FIGURE 19 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY TECHNOLOGY, 2021

FIGURE 20 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY DISTRIBUTION, 2021

FIGURE 21 THAILAND AUTOMOTIVE LOGISTICS MARKET: BY APPLICATION, 2021

FIGURE 22 THAILAND AUTOMOTIVE LOGISTICS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.