Mercado de edificios prefabricados del sudeste y las Montañas Rocosas, por tipo de edificio (comercial e industrial), tamaño del edificio (edificios de pequeña escala (20 000 pies cuadrados - 50 000 pies cuadrados), edificios de mediana escala (50 001 pies cuadrados - 70 000 pies cuadrados), edificios de gran escala (más de 70 000 pies cuadrados)), material de construcción (acero, aluminio y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de edificios prefabricados del sudeste y las Montañas Rocosas

Se espera que la rentabilidad y la eficiencia en el tiempo impulsen el crecimiento del mercado de edificios prefabricados en el sureste y las Montañas Rocosas, un factor importante para este sector. Además, los avances en tecnología e innovaciones en diseño y materiales están impulsando el progreso en el sector de la construcción y se espera que impulsen el crecimiento del mercado. Sin embargo, se espera que el costo asociado con el transporte de módulos prefabricados suponga un desafío para el crecimiento del mercado, lo que se espera que lo restrinja.

Data Bridge Market Research analiza que se espera que el mercado de edificios prediseñados del sudeste y las Montañas Rocosas alcance un valor de USD 2.490,94 millones para 2030, con una CAGR del 8,4% durante el período de pronóstico 2023-2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Año histórico |

2021 (Personalizable 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Tipo de edificio (comercial e industrial), tamaño del edificio (edificios de pequeña escala (20 000 pies cuadrados - 50 000 pies cuadrados), edificios de mediana escala (50 001 pies cuadrados - 70 000 pies cuadrados), edificios de gran escala (más de 70 000 pies cuadrados)), material de construcción (acero, aluminio y otros) |

|

Países cubiertos |

Florida, Carolina del Norte, Georgia, Virginia, Tennessee, Carolina del Sur, Luisiana, Alabama, Misisipi y Virginia Occidental, Colorado, Utah, Montana, Wyoming, Idaho y Nuevo México. |

|

Actores del mercado cubiertos |

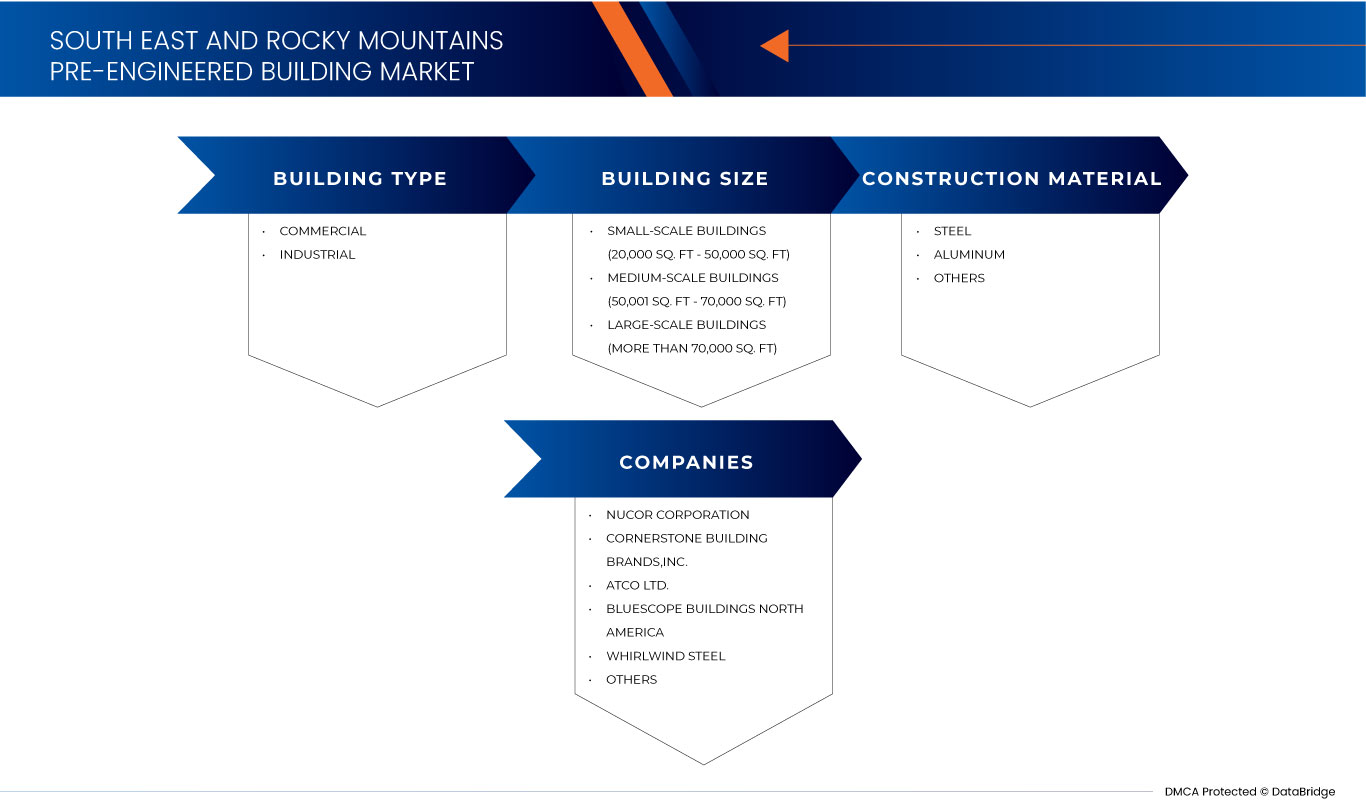

Nucor Corporation, Cornerstone Building Brands, Inc., ATCO LTD., Allied Builders, Stevens, Wollam Construction, JB STEEL, BlueScope Buildings North America, Mountain State Construction, AA Metal Buildings, Sunward Steel Buildings, Whirlwind Steel, CanAm Steel Buildings, Pluma Construction Systems Steel Buildings, Federal Steel Systems, DFB Buildings, Great Western Building Systems, Schulte Building Systems, Inc., Pacific Building Systems, entre otros. |

Definición de mercado

Los edificios prefabricados (PEB) son un tipo de solución de construcción que se caracteriza por el uso de componentes estructurales prefabricados y prediseñados. Estos componentes, que incluyen columnas, vigas, cerchas de techo, paneles de pared y otros elementos, se fabrican fuera del sitio en una fábrica o instalación de fabricación. Luego se transportan al sitio de construcción donde se ensamblan y se erigen para crear la estructura final del edificio.

Dinámica del mercado de edificios prefabricados en el sureste y las Montañas Rocosas

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- La rentabilidad y la eficiencia en el tiempo son factores cada vez más importantes en la industria de la construcción y están ganando prominencia como fuerzas impulsoras.

Se espera que la creciente importancia de las fuerzas impulsoras en el sector de la construcción, como la rentabilidad y el ahorro de tiempo, impulsen significativamente el crecimiento del mercado. Estas fuerzas están transformando la industria de la construcción al ofrecer soluciones prácticas para abordar los desafíos apremiantes de reducir costos y acelerar los plazos de los proyectos. Los edificios prediseñados ofrecen claras ventajas en términos de rentabilidad y ahorro de tiempo en comparación con los métodos de construcción tradicionales. Las estructuras prefabricadas se diseñan y fabrican fuera del sitio, lo que permite una planificación precisa y minimiza el desperdicio de material.

Esto se traduce en menores costos de construcción, ya que los constructores pueden comprar materiales al por mayor y agilizar el proceso de construcción. Además, los componentes prefabricados están diseñados para un montaje rápido, lo que reduce significativamente los requisitos de mano de obra en el lugar y los costos asociados. Por el contrario, los métodos de construcción tradicionales a menudo implican una planificación prolongada, fabricación a medida y una construcción compleja en el lugar, lo que puede generar mayores gastos debido a los plazos de proyecto prolongados y al trabajo intensivo en mano de obra. La naturaleza rentable de los edificios prefabricados, combinada con su proceso de construcción acelerado, los convierte en una opción atractiva para proyectos en los que las limitaciones de presupuesto y tiempo son consideraciones críticas.

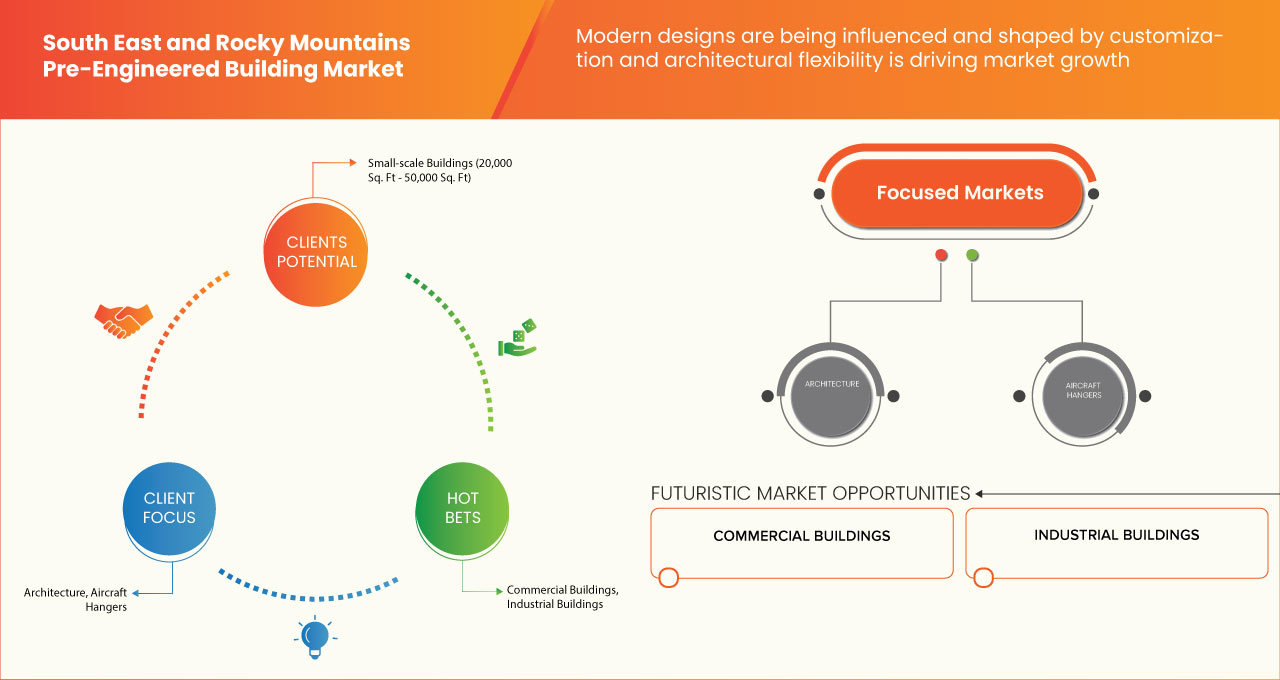

- Los diseños modernos están influenciados y moldeados por la personalización y la flexibilidad arquitectónica

La personalización y la versatilidad arquitectónica desempeñan un papel fundamental en la configuración de los diseños modernos y están preparadas para impulsar el crecimiento del mercado. Esta tendencia refleja un cambio fundamental en las preferencias de construcción, impulsado por factores como la estética, la funcionalidad y la rentabilidad.

La personalización de los edificios prefabricados permite a los arquitectos y constructores satisfacer las necesidades únicas de diversas industrias y negocios. Estas estructuras se pueden adaptar para adaptarse a funciones específicas y preferencias de diseño, lo que las hace muy adaptables para una amplia gama de aplicaciones. Por ejemplo, la región del sudeste a menudo requiere edificios que puedan soportar huracanes y alta humedad, mientras que la región de las Montañas Rocosas exige estructuras capaces de soportar grandes cargas de nieve. La personalización garantiza que los PEB puedan enfrentar estos variados desafíos climáticos y ambientales de manera efectiva. Además, la versatilidad arquitectónica juega un papel clave para satisfacer las demandas de diseño modernas. Los sistemas de construcción prefabricados han evolucionado para ofrecer una amplia gama de opciones estéticas, incluidos varios materiales de revestimiento, colores y acabados.

Esta versatilidad permite a los arquitectos y diseñadores crear estructuras visualmente atractivas que se alinean con la identidad de marca y la visión arquitectónica de sus clientes. Además, los edificios prefabricados pueden incorporar características arquitectónicas como grandes ventanales, tragaluces y entrepisos, mejorando aún más su atractivo estético y funcionalidad. La rentabilidad es otro factor crítico que impulsa la adopción de edificios prefabricados personalizables y arquitectónicamente versátiles. Los edificios prefabricados suelen dar como resultado plazos de proyecto más cortos y menores costos de mano de obra al agilizar el proceso de diseño y construcción. Además, la capacidad de personalizar los tamaños y las características de los edificios optimiza la utilización del espacio, lo que reduce los metros cuadrados desperdiciados y, en consecuencia, el costo general de la construcción.

- Los rápidos cambios en el desarrollo urbano y el crecimiento industrial están experimentando una rápida transformación

Se espera que la rápida transformación de la urbanización y la industrialización impulse el crecimiento del mercado. Varios factores contribuyen a esta importante influencia en el mercado.

El ritmo acelerado de urbanización en las regiones del sudeste y las Montañas Rocosas está generando una mayor demanda de infraestructura y espacios comerciales. Existe una creciente demanda de soluciones de construcción eficientes, económicas y rápidas a medida que las ciudades se expanden y las poblaciones aumentan. Los PEB ofrecen una solución ideal debido a su velocidad de construcción, versatilidad y asequibilidad. Las industrias que van desde la fabricación hasta el almacenamiento, la logística y los bienes raíces comerciales recurren cada vez más a los PEB para satisfacer sus necesidades de construcción. Se espera que esta tendencia impulse un crecimiento sustancial en el mercado. Además, la industrialización en estas regiones está fomentando el desarrollo de varias industrias, incluidas la fabricación, la energía y la logística. Estas industrias requieren espacios grandes y diseñados a medida que se puedan erigir rápidamente para acomodar sus operaciones. Los PEB son adecuados para tales fines, ya que se pueden adaptar para satisfacer requisitos industriales específicos, incluidos diseños de espacio libre para un espacio de piso sin obstrucciones y la capacidad de albergar maquinaria y equipo pesados. Se espera que la creciente industrialización aumente significativamente la demanda de PEB como instalaciones industriales.

Oportunidades

- Los avances tecnológicos y las innovaciones en diseño y materiales impulsan el progreso en el sector de la construcción

Los avances tecnológicos y las innovaciones en diseño y materiales están a punto de crear importantes oportunidades de crecimiento del mercado. Estos avances representan un cambio fundamental en la industria de la construcción y ofrecen una variedad de beneficios que atraen tanto a los constructores como a los clientes. Una oportunidad clave radica en la mejora de la eficiencia y la velocidad de la construcción mediante sistemas de construcción prediseñados. El software de diseño avanzado, la fabricación asistida por computadora (CAM) y el modelado de información de construcción (BIM) han revolucionado la forma en que se diseñan y fabrican los edificios prediseñados. Esto da como resultado plazos de proyecto más rápidos, menores costos de mano de obra y mayor precisión durante la construcción, lo que atrae a los desarrolladores y contratistas que buscan completar los proyectos de manera más rápida y rentable.

Las innovaciones en diseño también han ampliado las posibilidades arquitectónicas de los edificios prefabricados. Históricamente asociados con las estructuras utilitarias, los edificios prefabricados ahora incorporan opciones de diseño versátiles, lo que permite soluciones más estéticamente agradables y personalizadas. Este cambio amplía el atractivo del mercado, ya que los edificios prefabricados se convierten en una opción viable para una gama más amplia de aplicaciones, incluidos proyectos comerciales, industriales e incluso residenciales. En el sector comercial, incluyen almacenes para almacenamiento eficiente, espacios minoristas, edificios de oficinas modernos, salas de exposición e instalaciones recreativas. En entornos industriales, las estructuras prefabricadas albergan plantas de fabricación, centros de distribución, talleres, instalaciones agrícolas y unidades de almacenamiento en frío, optimizando los procesos de producción y almacenamiento.

Restricciones/ Desafíos

- Los costos asociados con el transporte de módulos prefabricados están sujetos a fluctuaciones

Los edificios prefabricados son una de las formas de construcción más rápidas y exclusivas, ya que la mayor parte de la construcción se realiza fuera del sitio. Luego, los módulos se transportan con cuidado y se ensamblan en el lugar. Los edificios prefabricados se están convirtiendo rápidamente en el método de construcción elegido en todo el mundo. Las personas de todo el mundo cambiaron a la construcción prefabricada debido a la rentabilidad, la construcción eficiente y la seguridad asociada con los trabajadores. El transporte de secciones de edificios modulares prefabricados requiere mucho espacio. La restricción en la fabricación y el transporte puede limitar el tamaño de las unidades modulares utilizadas para la construcción, lo que afecta los tamaños de habitación deseables. El cambio de los costos de transporte de los módulos prefabricados puede restringir significativamente el crecimiento del mercado.

- Escasez de mano de obra calificada

Los métodos de construcción de edificios prefabricados se están convirtiendo gradualmente en una alternativa deseable a los métodos tradicionales de construcción in situ, que ayudan a minimizar el trabajo in situ y maximizar el resultado y una entrega más rápida del proyecto. La principal ventaja de los edificios prefabricados sobre el método de construcción tradicional es la mejora de la calidad del producto construido, manteniendo y apoyando una construcción sostenible y más ecológica al reducir la generación de residuos.

El principal desafío que enfrenta el mercado es la falta de mano de obra calificada en la industria, lo que obstaculiza en gran medida el crecimiento del mercado. Una fuerza laboral no calificada afecta negativamente el desempeño del proyecto. El enfoque debe centrarse en mejorar y potenciar las habilidades laborales, ya que son muy exigentes en el sector de la construcción. El desempeño en cualquier industria es importante para lograr medidas que aseguren la sostenibilidad y la competitividad.

Acontecimientos recientes

- En agosto de 2023, Cornerstone Building Brands, Inc., el mayor fabricante de productos de construcción para exteriores de Norteamérica, adquirió MAC Metal Architectural, una empresa con sede en Saint-Hubert, Quebec, especializada en productos de revestimiento y techado de acero de alta gama para los mercados residenciales y comerciales de Norteamérica. Esta adquisición tiene como objetivo ampliar la cartera de productos para exteriores de Cornerstone Building Brands, en particular en el segmento de revestimiento y techado de metal, que está creciendo rápidamente, mejorando su presencia en el mercado y aprovechando su experiencia en fabricación. Se espera que la adquisición traiga beneficios a través de la expansión de márgenes, el aumento de la participación en el mercado y la eficiencia de la fabricación.

- En septiembre de 2023, ATCO LTD. publicó su Informe de sostenibilidad 2022, en el que destaca el desempeño ambiental, social y de gobernanza (ESG) de la empresa, incluidas estrategias, iniciativas, objetivos y métricas. El informe se centra en la transición a una energía baja en carbono; el cambio climático y la gestión ambiental; la fiabilidad y resiliencia operativa; las relaciones con la comunidad y los indígenas; la diversidad, la equidad y la inclusión; y la seguridad. Esto ayudará a la empresa a atraer una gran base de consumidores.

Alcance del mercado de edificios prefabricados en el sureste y las Montañas Rocosas

El mercado de edificios prefabricados del sudeste y las Montañas Rocosas se clasifica en tres segmentos notables por tipo de edificio, tamaño del edificio y material de construcción. El crecimiento entre estos segmentos lo ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de edificio

- Comercial

- Industrial

Según el tipo de edificio, el mercado se segmenta en comercial e industrial.

Tamaño del edificio

- Edificios de pequeña escala (entre 20 000 y 50 000 pies cuadrados)

- Edificios de tamaño mediano (50.001 pies cuadrados - 70.000 pies cuadrados)

- Edificios de gran tamaño (más de 70.000 pies cuadrados)

En función del tamaño del edificio, el mercado se segmenta en edificios de pequeña escala (20.000 pies cuadrados - 50.000 pies cuadrados), edificios de mediana escala (50.001 pies cuadrados - 70.000 pies cuadrados) y edificios de gran escala (más de 70.000 pies cuadrados).

Material de construcción

- Acero

- Aluminio

- Otros

Según el material de construcción, el mercado está segmentado en acero, aluminio y otros.

Análisis y perspectivas regionales del mercado de edificios prefabricados del sudeste y las Montañas Rocosas

El mercado de edificios prediseñados del sudeste y las Montañas Rocosas se clasifica en tres segmentos notables por tipo de edificio, tamaño del edificio y material de construcción.

Los estados cubiertos en el informe del mercado de edificios prediseñados del sudeste y las Montañas Rocosas son Florida, Carolina del Norte, Georgia, Virginia, Tennessee, Carolina del Sur, Luisiana, Alabama, Mississippi y Virginia Occidental, Colorado, Utah, Montana, Wyoming, Idaho y Nuevo México.

Se espera que el sudeste predomine debido a la presencia de actores clave del mercado en el mayor mercado de consumo con un alto PIB. Se espera que Florida crezca debido al aumento de la demanda de edificios prefabricados en el segmento comercial.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los edificios prefabricados en el sureste y las Montañas Rocosas

El panorama competitivo del mercado de edificios prefabricados del sudeste y las Montañas Rocosas proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de edificios prefabricados del sudeste y las Montañas Rocosas.

Algunos de los principales actores que operan en el sudeste y las montañas Rocosas en la construcción de edificios prediseñados son Nucor Corporation, Cornerstone Building Brands, Inc., ATCO LTD., Allied Builders, Stevens, Wollam Construction, JB STEEL, BlueScope Buildings North America, Mountain State Construction, AA Metal Buildings, Sunward Steel Buildings, Whirlwind Steel, CanAm Steel Buildings, Pluma Construction Systems Steel Buildings, Federal Steel Systems, DFB Buildings, Great Western Building Systems, Schulte Building Systems, Inc, Pacific Building Systems, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASINGLY BECOMING PIVOTAL FACTORS IN THE CONSTRUCTION INDUSTRY, COST-EFFECTIVENESS AND TIME EFFICIENCY ARE GAINING PROMINENCE AS DRIVING FORCES

5.1.2 MODERN DESIGNS ARE BEING INFLUENCED AND SHAPED BY CUSTOMIZATION AND ARCHITECTURAL FLEXIBILITY

5.1.3 SWIFT CHANGES IN URBAN DEVELOPMENT AND INDUSTRIAL GROWTH ARE UNDERGOING A RAPID TRANSFORMATION

5.2 RESTRAINT

5.2.1 THE COSTS ASSOCIATED WITH TRANSPORTING PREFABRICATED MODULES ARE SUBJECT TO FLUCTUATION

5.3 OPPORTUNITY

5.3.1 ADVANCES IN TECHNOLOGY AND INNOVATIONS IN DESIGN AND MATERIALS ARE DRIVING PROGRESS IN THE CONSTRUCTION SECTOR

5.4 CHALLENGE

5.4.1 A SCARCITY OF SKILLED WORKFORCE

6 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE

6.1 OVERVIEW

6.1.1 SMALL-SCALE BUILDINGS (20,000 SQ. FT - 50,000 SQ. FT)

6.1.2 MEDIUM-SCALE BUILDINGS (50,001 SQ. FT - 70,000 SQ. FT)

6.1.3 LARGE-SCALE BUILDINGS (MORE THAN 70,000 SQ. FT)

7 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE

7.1 OVERVIEW

7.2 INDUSTRIAL

7.2.1 INDUSTRIAL, BY TYPE

7.2.1.1 MANUFACTURING

7.2.1.1.1 MEDIUM-SCALE BUILDINGS (50,001 SQ. FT - 70,000 SQ. FT)

7.2.1.1.2 SMALL-SCALE BUILDINGS (20,000 SQ. FT - 50,000 SQ. FT))

7.2.1.1.3 LARGE-SCALE BUILDINGS (MORE THAN 70,000 SQ. FT)

7.2.1.2 HEAVY INDUSTRIES

7.2.1.3 PROCESSING

7.2.1.4 OTHERS

7.2.2 INDUSTRIAL, BY BUILDING SIZE

7.2.2.1 MEDIUM-SCALE BUILDINGS (50,001 SQ. FT - 70,000 SQ. FT)

7.2.2.2 SMALL-SCALE BUILDINGS (20,000 SQ. FT - 50,000 SQ. FT)

7.2.2.3 LARGE-SCALE BUILDINGS (MORE THAN 70,000 SQ. FT)

7.2.3 COMMERCIAL

7.2.4 WAREHOUSES

7.2.5 RETAIL

7.2.6 OFFICES

7.2.7 SHOWROOMS

7.2.8 OTHERS

8 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL

8.1 OVERVIEW

8.1.1 STEEL

8.1.2 ALUMINIUM

8.1.3 OTHERS

9 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY REGION

10 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: SOUTH EAST

10.2 COMPANY SHARE ANALYSIS: ROCKY MOUNTAINS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 NUCOR CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 CORNERSTONE BUILDING BRANDS, INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 ATCO LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 BLUESCOPE BUILDINGS NORTH AMERICA

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENTS

12.5 WHIRLWINDSTEEL

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENTS

12.6 AA METAL BUILDINGS

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIOS

12.6.3 RECENT DEVELOPMENTS

12.7 ALLIED BUILDERS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 CANAM STEEL BUILDINGS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 DFB BUILDINGS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 FEDERAL STEEL SYSTEMS

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 GREAT WESTERN BUILDING SYSTEMS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 JB STEEL

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 MOUNTAINS STATE CONSTRUCTION

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 PACIFIC BUILDING SYSTEMS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 PLUMA CONSTRUCTION SYSTEMS STEEL BUILDINGS

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 SCHULTE BUILDING SYSTEMS, INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENTS

12.17 STEVENS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 SUNWARD STEEL BUILDING

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 WOLLAM CONSTRUCTION

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 SOUTH EAST PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 2 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 3 SOUTH EAST PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 4 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 5 SOUTH EAST INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 SOUTH EAST MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 8 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 9 SOUTH EAST MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 10 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 11 SOUTH EAST COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 SOUTH EAST PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 14 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 15 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 SOUTH EAST PRE-ENGINEERED BUILDING MARKET, BY STATE, 2021-2030 (USD MILLION)

TABLE 17 FLORIDA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 18 FLORIDA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 FLORIDA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 20 FLORIDA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 21 FLORIDA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 FLORIDA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 23 FLORIDA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 24 NORTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH CAROLINA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH CAROLINA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 27 NORTH CAROLINA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 28 NORTH CAROLINA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 30 NORTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 31 GEORGIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 32 GEORGIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 GEORGIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 34 GEORGIA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 35 GEORGIA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 GEORGIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 37 GEORGIA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 38 VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 39 VIRGINIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 VIRGINIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 41 VIRGINIA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 42 VIRGINIA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 44 VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 45 TENNESSEE PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 46 TENNESSEE INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 TENNESSEE INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 48 TENNESSEE MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 49 TENNESSEE COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 TENNESSEE PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 51 TENNESSEE PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 52 SOUTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 53 SOUTH CAROLINA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SOUTH CAROLINA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 55 SOUTH CAROLINA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 56 SOUTH CAROLINA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 SOUTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 58 SOUTH CAROLINA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 59 LOUISIANA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 60 LOUISIANA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 LOUISIANA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 62 LOUISIANA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 63 LOUISIANA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 LOUISIANA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 65 LOUISIANA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 66 ALABAMA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 67 ALABAMA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 ALABAMA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 69 ALABAMA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 70 ALABAMA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 ALABAMA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 72 ALABAMA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 73 MISSISSIPPI PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 74 MISSISSIPPI INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 MISSISSIPPI INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 76 MISSISSIPPI MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 77 MISSISSIPPI COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 MISSISSIPPI PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 79 MISSISSIPPI PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 80 WEST VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 81 WEST VIRGINIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 WEST VIRGINIA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 83 WEST VIRGINIA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 84 WEST VIRGINIA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 WEST VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 86 WEST VIRGINIA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 87 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET, BY STATE, 2021-2030 (USD MILLION)

TABLE 88 COLORADO PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 89 COLORADO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 COLORADO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 91 COLORADO MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 92 COLORADO COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 COLORADO PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 94 COLORADO PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 95 UTAH PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 96 UTAH INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 UTAH INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 98 UTAH MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 99 UTAH COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 UTAH PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 101 UTAH PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 102 MONTANA PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 103 MONTANA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 MONTANA INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 105 MONTANA MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 106 MONTANA COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MONTANA PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 108 MONTANA PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 109 WYOMING PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 110 WYOMING INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 WYOMING INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 112 WYOMING MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 113 WYOMING COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 WYOMING PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 115 WYOMING PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 116 IDAHO PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 117 IDAHO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 IDAHO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 119 IDAHO MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 120 IDAHO COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 IDAHO PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 122 IDAHO PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

TABLE 123 NEW MEXICO PRE-ENGINEERED BUILDING MARKET, BY BUILDING TYPE, 2021-2030 (USD MILLION)

TABLE 124 NEW MEXICO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 NEW MEXICO INDUSTRIAL IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 126 NEW MEXICO MANUFACTURING IN PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 127 NEW MEXICO COMMERCIAL IN PRE-ENGINEERED BUILDING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 NEW MEXICO PRE-ENGINEERED BUILDING MARKET, BY BUILDING SIZE, 2021-2030 (USD MILLION)

TABLE 129 NEW MEXICO PRE-ENGINEERED BUILDING MARKET, BY CONSTRUCTION MATERIAL, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: SEGMENTATION

FIGURE 2 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: DATA TRIANGULATION

FIGURE 3 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: DROC ANALYSIS

FIGURE 4 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: REGIONAL VS STATE MARKET ANALYSIS

FIGURE 5 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: REGIONAL VS STATE MARKET ANALYSIS

FIGURE 6 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: MULTIVARIATE MODELLING

FIGURE 8 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: SEGMENTATION

FIGURE 11 INCREASINGLY BECOMING PIVOTAL FACTORS IN THE CONSTRUCTION INDUSTRY, COST-EFFECTIVENESS AND TIME EFFICIENCY ARE GAINING PROMINENCE IS EXPECTED TO DRIVE THE GROWTH OF THE SOUTH EAST PRE-ENGINEERED BUILDING MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 SWIFT CHANGES IN URBAN DEVELOPMENT AND INDUSTRIAL GROWTH ARE UNDERGOING A RAPID TRANSFORMATION IS EXPECTED TO DRIVE THE GROWTH OF THE ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 13 THE INDUSTRIAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SOUTH EAST PRE-ENGINEERED BUILDING MARKET IN 2023 AND 2030

FIGURE 14 THE INDUSTRIAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET IN 2023 AND 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SOUTH EAST AND ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET

FIGURE 16 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: BY BUILDING SIZE, 2022

FIGURE 17 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: BY BUILDING SIZE, 2022

FIGURE 18 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: BY BUILDING TYPE, 2022

FIGURE 19 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: BY BUILDING TYPE, 2022

FIGURE 20 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: BY CONSTRUCTION MATERIALS, 2022

FIGURE 21 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: BY CONSTRUCTION MATERIAL, 2022

FIGURE 22 SOUTH EAST PRE-ENGINEERED BUILDING MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 ROCKY MOUNTAINS PRE-ENGINEERED BUILDING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.