Mercado de bioestimulantes en Sudamérica, por ingredientes activos (a base de ácido, a base de extracto, enmiendas microbianas, hidrolizados de proteínas, vitaminas B, quitina, quitosano y otros), tipo de cultivo (frutas y verduras, cereales y granos, césped y plantas ornamentales, semillas oleaginosas y legumbres y otros cultivos), método de aplicación (tratamiento foliar, tratamiento del suelo y tratamiento de semillas), forma (líquido, seco), origen (bioestimulantes naturales y bioestimulantes biosintéticos), usuario final (agricultores, industrias agrícolas y relacionadas e institutos de investigación), canal de distribución (directo e indirecto), país (Brasil, Argentina, Colombia, Perú, Chile, Ecuador, Uruguay, Paraguay, resto de Sudamérica), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado de bioestimulantes en América del Sur

Se espera que el mercado de bioestimulantes gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 13,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los 1.447,76 millones para 2029.

Los bioestimulantes se desarrollan para ayudar a los agricultores a satisfacer la creciente demanda agrícola de forma sostenible. Los bioestimulantes aumentan el rendimiento de los cultivos y su valor, lo que afecta positivamente a la productividad agrícola. Los bioestimulantes agrícolas se componen de múltiples amalgamas de productos químicos , sustancias y microorganismos que se añaden a las plantas o suelos para aumentar el vigor, la producción, la sensibilidad a la presión abiótica y la calidad de los cultivos. Los bioestimulantes apoyan el crecimiento y la producción de cultivos durante todo el ciclo de vida del cultivo, desde la germinación de las semillas hasta la madurez de la planta, en una variedad de formas demostradas, incluida la regulación del metabolismo de la planta. Se desarrollan para que los agricultores satisfagan la demanda de una agricultura sostenible, incluida la calidad y el rendimiento mejorado de los cultivos, e incluso para que los consumidores satisfagan la demanda de productos orgánicos para hacer frente a los estándares de salud y seguridad. Por lo tanto, debido a esto, los inversores están cada vez más interesados en la categoría de bioestimulantes con respecto al potencial de crecimiento significativo.

Los principales factores que impulsan el crecimiento del mercado de bioestimulantes son la creciente adopción de productos orgánicos en la agricultura, la creciente necesidad de aumentar la producción agrícola para satisfacer el aumento de la presión demográfica y los rendimientos inestables en la agricultura debido al cambio climático. El aumento de la producción agrícola en América del Sur está creando oportunidades para el crecimiento del mercado. Los problemas de contaminación de la calidad de los bioestimulantes durante la fabricación y el transporte actúan como la principal restricción para el mercado de bioestimulantes.

Este informe de mercado de bioestimulantes proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de bioestimulantes en América del Sur

El mercado de bioestimulantes está segmentado en función de los ingredientes activos, el tipo de cultivo, el método de aplicación, la forma, el origen, el usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

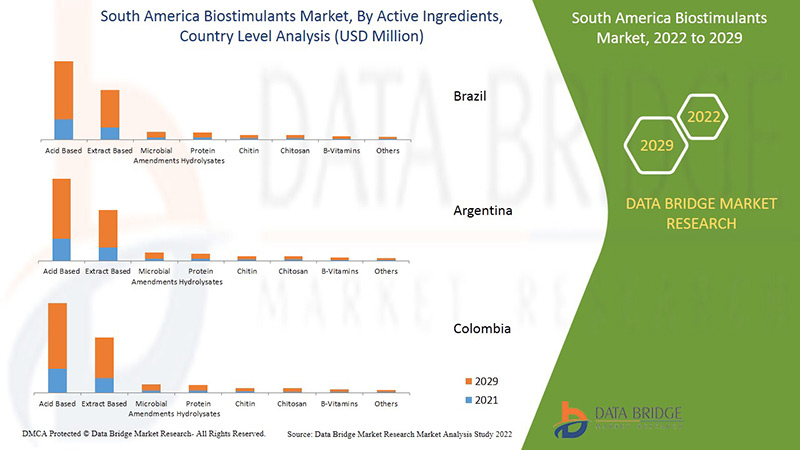

- Sobre la base de los ingredientes activos, el mercado de bioestimulantes de América del Sur se segmenta en base a ácidos, a base de extractos, enmiendas microbianas, hidrolizados de proteínas , vitaminas B, quitina, quitosano y otros. En 2022, se espera que el segmento basado en ácidos domine el mercado, ya que tiene componentes importantes, como ácido húmico, ácido fúlvico, y aumenta la productividad y el crecimiento de la planta. Junto con estos, mejora la fertilidad del suelo y muestra un efecto menos dañino en el ecosistema. El ácido húmico ayuda a las plantas manteniendo la disponibilidad de nutrientes, el intercambio de gases entre el suelo y la atmósfera y también mejora la fertilidad del suelo.

- Según el tipo de cultivo, el mercado de bioestimulantes de América del Sur se segmenta en frutas y verduras, cereales y granos, césped y plantas ornamentales, semillas oleaginosas y legumbres, y otros cultivos. En 2022, se espera que el segmento de frutas y verduras domine el mercado debido a su alta producción a nivel mundial. Los agricultores están produciendo más frutas y verduras para satisfacer la creciente demanda de los consumidores. Se ha observado que una alta producción de frutas y verduras necesitará más bioestimulantes con alto crecimiento y productividad, por lo que este sector está dominando el mercado.

- Según el método de aplicación, el mercado de bioestimulantes de América del Sur se segmenta en tratamiento foliar, tratamiento del suelo y tratamiento de semillas. En 2022, se espera que el segmento de tratamiento foliar domine el mercado, ya que es la aplicación preferida por los agricultores, ya que muestra un mayor efecto en las plantas. La aplicación foliar implica rociar bioestimulantes sobre las hojas, que se absorben fácilmente y muestran una alta productividad.

- En función de la forma, el mercado de bioestimulantes de América del Sur se segmenta en líquido y seco. El líquido se subdivide en concentrado en suspensión, concentrado líquido soluble y concentrado emulsionable. En 2022, se espera que el segmento líquido domine el mercado porque se absorbe fácilmente por las hojas y en el suelo para proporcionar un buen sistema de raíces, mejores tallos y desarrollo foliar para que el cultivo sea más capaz de soportar el estrés abiótico. Debido a los múltiples beneficios de los bioestimulantes líquidos, se ha observado que los productos en forma líquida son muy preferidos.

- En función del origen, el mercado de bioestimulantes de América del Sur se segmenta en bioestimulantes naturales y bioestimulantes biosintéticos. En 2022, se espera que el segmento de bioestimulantes naturales domine el mercado debido a su efecto nocivo mínimo en el ecosistema, ya que está compuesto de fuentes naturales como algas y plantas, microbios y otro material vegetal. Los bioestimulantes naturales mantienen la fertilidad del suelo y evitan su erosión. Sin embargo, el segmento sintético puede hacer crecer el mercado debido al uso de ciertos reguladores sintéticos que, en última instancia, ayudan al crecimiento de las plantas.

- En función del usuario final, el mercado de bioestimulantes de América del Sur está segmentado en agricultores, industrias agrícolas y relacionadas e institutos de investigación. En 2022, se espera que el segmento de agricultores domine el mercado, ya que los agricultores lo utilizan mucho en las granjas para aumentar el rendimiento y el crecimiento de los cultivos para satisfacer la creciente demanda de alimentos en el mercado. En los últimos tiempos, los agricultores se inclinan más por los bioestimulantes debido a sus beneficios, como la alta productividad, el crecimiento de las plantas y su menor daño a la naturaleza.

- En función del canal de distribución, el mercado de bioestimulantes de Sudamérica se segmenta en directo e indirecto. En 2022, se espera que el segmento directo domine el mercado porque la agricultura a gran escala, así como las industrias relacionadas, necesitan una gran cantidad de productos estimulantes para una alta productividad de los productos agrícolas, por lo que se ponen en contacto directamente con las empresas de fabricación de bioestimulantes y, por lo tanto, adquieren una mayor participación.

Análisis del mercado de bioestimulantes de América del Sur a nivel de país

Se analiza el mercado de bioestimulantes de América del Sur y se proporciona información sobre el tamaño del mercado por país, ingredientes activos, tipo de cultivo, método de aplicación, forma, origen, usuario final y canal de distribución.

Los países cubiertos en el informe del mercado de bioestimulantes de América del Sur son Brasil, Argentina, Colombia, Perú, Chile, Ecuador, Uruguay, Paraguay y el resto de América del Sur.

Brasil representó la mayor participación en el mercado de bioestimulantes debido a la presencia de un gran número de actores locales en la región. Argentina representa el segundo mercado más grande debido al creciente crecimiento de las tecnologías agrícolas en la región. Colombia ha sido testigo de un alto crecimiento en bioestimulantes debido a la gran cantidad de agricultores en la región.

La sección de países del informe de mercado de bioestimulantes también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, actos regulatorios y análisis de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Demanda creciente de bioestimulantes

El mercado de bioestimulantes de Sudamérica también le ofrece un análisis detallado del mercado de cada país, el crecimiento de la base instalada de diferentes tipos de productos, el impacto de la tecnología mediante curvas de línea de vida y cambios en los escenarios regulatorios y su impacto en el mercado de bioestimulantes. Los datos están disponibles para el año histórico 2012 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de los bioestimulantes

El panorama competitivo del mercado de bioestimulantes proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión del producto, el dominio de la aplicación y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de bioestimulantes.

Algunos de los principales actores que operan en el mercado de bioestimulantes de América del Sur son UPL, Lallemand Inc., Agrinos, Koppert Biological Systems, Syngenta, SICIT Group SpA, Isagro SpA, ILSA SpA, OMEX, Trade Corporation International, Bayer AG, Marrone Bio Innovations, Inc., SEIPASA, SA, Innovak Global, SA de CV, Stoller Group, Yara, BASF SE, Novozymes, Atlantica Agricola, Italpollina Spa, SummitAgro y otros.

Por ejemplo,

- En julio de 2020, Syngenta anunció una colaboración con el IICA (Instituto Interamericano de Cooperación para la Agricultura). De esta manera, la colaboración permitió implementar acciones orientadas a aumentar la productividad de los agricultores de manera sostenible y proteger la seguridad alimentaria en América Latina y el Caribe. Esto le permitió a la empresa implementar desarrollos científicos en protección de cultivos y mejoramiento de semillas en áreas rurales de América Latina y el Caribe junto con el IICA.

- En marzo de 2020, SICIT Group SpA y Syngenta anunciaron su colaboración para promover la agricultura sostenible mediante la firma de un contrato de suministro de bioestimulantes ISABION e HICURE. El acuerdo también hizo hincapié en el desarrollo de bioestimulantes a base de colágeno en un futuro próximo. Esto permitió a la empresa aumentar el acceso de los agricultores a soluciones innovadoras para la agricultura sostenible.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También brindan a la organización el beneficio de mejorar su oferta para el mercado de bioestimulantes mediante una gama de productos ampliada.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SOUTH AMERICA BIOSTIMULANTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 OFFERING TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES

4.2 CONSUMER TRENDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF ORGANIC PRODUCTS IN AGRICULTURE

5.1.2 RISING NEED FOR INCREASING AGRICULTURAL PRODUCTION TO MEET THE SURGE IN POPULATION PRESSURE

5.1.3 UNSTABLE YIELDS IN AGRICULTURE DUE TO CLIMATE CHANGES

5.1.4 GROWING EMPHASIS ON SUSTAINABLE FARMING

5.2 RESTRAINTS

5.2.1 BIOSTIMULANT QUALITY CONTAMINATION ISSUES DURING MANUFACTURING AND TRANSPORTATION

5.3 OPPORTUNITIES

5.3.1 INCREASING AGRICULTURAL PRODUCTION IN SOUTH AMERICA

5.3.2 SURGE IN ADOPTION OF MODERN FARMING TECHNOLOGIES FOR INCREASING CROP YIELD

5.4 CHALLENGES

5.4.1 REGIONAL INCONSISTENCY IN DEFINITION AND REGULATIONS CONCERNIGN BIOSTIMULANTS

5.4.2 DEMAND AMONG FARMERS FOR SUBSTITUTE PRODUCTS TO BIOSTIMULANTS

6 COVID-19 IMPACT ON SOUTH AMERICA BIOSTIMULANTS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 PRICE IMPACT

6.7 CONCLUSION

7 SOUTH AMERICA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS

7.1 OVERVIEW

7.2 ACID BASED

7.2.1 AMINO ACID

7.2.2 FULVIC ACID

7.2.3 HUMIC ACID

7.3 EXTRACT BASED

7.3.1 SEAWEED EXTRACTS

7.3.2 PLANT EXTRACT

7.3.3 FUNGAL EXTRACT

7.4 MICROBIAL AMENDMENTS

7.5 PROTEIN HYDROLYSATES

7.6 CHITIN

7.7 CHITOSAN

7.8 B-VITAMINS

7.9 OTHERS

8 SOUTH AMERICA BIOSTIMULANTS MARKET, BY CROP TYPE

8.1 OVERVIEW

8.2 FRUITS & VEGETABLES

8.3 CEREALS & GRAINS

8.4 OILSEEDS & PULSES

8.5 TURF & ORNAMENTALS

8.6 OTHER CROPS

9 SOUTH AMERICA BIOSTIMULANTS MARKET, BY APPLICATION METHOD

9.1 OVERVIEW

9.2 FOLIAR TREATMENT

9.3 SOIL TREATMENT

9.4 SEED TREATMENT

10 SOUTH AMERICA BIOSTIMULANTS MARKET, BY FORM

10.1 OVERVIEW

10.2 LIQUID

10.2.1 SOLUBLE LIQUID CONCENTRATE

10.2.2 EMULSIFIABLE CONCENTRATE

10.2.3 SUSPENSION CONCENTRATE

10.3 DRY

10.3.1 WETTABLE POWDER

10.3.2 DRY GRANULES

10.3.3 WATER DISPERSIBLE

11 SOUTH AMERICA BIOSTIMULANTS MARKET, BY ORIGIN

11.1 OVERVIEW

11.2 NATURAL BIOSTIMULANTS

11.3 BIOSYNTHETIC BIOSTIMULANTS

12 SOUTH AMERICA BIOSTIMULANTS MARKET, BY END USER

12.1 OVERVIEW

12.2 FARMERS

12.3 AGRI AND RELATED INDUSTRIES

12.4 RESEARCH INSTITUTES

13 SOUTH AMERICA BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 SOUTH AMERICA BIOSTIMULANTS MARKET, BY COUNTRY

14.1 BRAZIL

14.2 ARGENTINA

14.3 COLOMBIA

14.4 PERU

14.5 CHILE

14.6 ECUADOR

14.7 URUGUAY

14.8 PARAGUAY

14.9 REST OF SOUTH AMERICA

15 SOUTH AMERICA BIOSTIMULANTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: SOUTH AMERICA

16 SWOT ANALYSIS (TOP 5 COMPANIES)

16.1 UPL

16.2 BAYER AG

16.3 SYNGENTA

16.4 YARA

16.5 LALLEMAND INC.

17 COMPANY PROFILE

17.1 UPL

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 BAYER AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 SYNGENTA GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENTS

17.4 YARA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 LALLEMAND INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 AGRINOS

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ATLÁNTICA AGRÍCOLA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BASF SE

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 INNOVAK GLOBAL, SA DE CV

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ILSA S.P.A.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 ISAGRO S.P.A.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 ITALPOLLINA SPA

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 KOPPERT BIOLOGICAL SYSTEMS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 MARRONE BIO INNOVATIONS, INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 NOVOZYMES

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 OMEX

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 SEIPASA, S.A.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SICIT GROUP S.P.A.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 STOLLER GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SUMMITAGRO

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 TRADE CORPORATION INTERNATIONAL

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 SOUTH AMERICA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 2 SOUTH AMERICA ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 SOUTH AMERICA EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 SOUTH AMERICA BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 5 SOUTH AMERICA BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 6 SOUTH AMERICA BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 7 SOUTH AMERICA LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 SOUTH AMERICA DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 SOUTH AMERICA BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 10 SOUTH AMERICA BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 11 SOUTH AMERICA BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 12 SOUTH AMERICA BIOSTIMULANTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 13 BRAZIL BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 14 BRAZIL ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 BRAZIL EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 BRAZIL BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 17 BRAZIL BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 18 BRAZIL BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 19 BRAZIL LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 BRAZIL DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 BRAZIL BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 22 BRAZIL BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 BRAZIL BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 ARGENTINA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 25 ARGENTINA ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ARGENTINA EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 ARGENTINA BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 28 ARGENTINA BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 29 ARGENTINA BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 30 ARGENTINA LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 ARGENTINA DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ARGENTINA BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 33 ARGENTINA BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 ARGENTINA BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 COLOMBIA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 36 COLOMBIA ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 COLOMBIA EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 COLOMBIA BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 39 COLOMBIA BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 40 COLOMBIA BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 41 COLOMBIA LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 COLOMBIA DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 COLOMBIA BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 44 COLOMBIA BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 COLOMBIA BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 PERU BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 47 PERU ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 PERU EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 PERU BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 50 PERU BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 51 PERU BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 52 PERU LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 PERU DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 PERU BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 55 PERU BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 PERU BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 CHILE BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 58 CHILE ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CHILE EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHILE BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHILE BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 62 CHILE BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 63 CHILE LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CHILE DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHILE BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 66 CHILE BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 CHILE BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 ECUADOR BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 69 ECUADOR ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 ECUADOR EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 ECUADOR BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 72 ECUADOR BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 73 ECUADOR BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 74 ECUADOR LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ECUADOR DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ECUADOR BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 77 ECUADOR BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 ECUADOR BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 79 URUGUAY BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 80 URUGUAY ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 URUGUAY EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 URUGUAY BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 83 URUGUAY BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 84 URUGUAY BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 85 URUGUAY LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 URUGUAY DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 URUGUAY BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 88 URUGUAY BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 URUGUAY BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 90 PARAGUAY BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 91 PARAGUAY ACID BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 PARAGUAY EXTRACT BASED IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 PARAGUAY BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 94 PARAGUAY BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2020-2029 (USD MILLION)

TABLE 95 PARAGUAY BIOSTIMULANTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 PARAGUAY LIQUID IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 PARAGUAY DRY IN BIOSTIMULANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 PARAGUAY BIOSTIMULANTS MARKET, BY ORIGIN, 2020-2029 (USD MILLION)

TABLE 99 PARAGUAY BIOSTIMULANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 PARAGUAY BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 REST OF SOUTH AMERICA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 SOUTH AMERICA BIOSTIMULANTS MARKET: SEGMENTATION

FIGURE 2 SOUTH AMERICA BIOSTIMULANTS MARKET: DATA TRIANGULATION

FIGURE 3 SOUTH AMERICA BIOSTIMULANTS MARKET: DROC ANALYSIS

FIGURE 4 SOUTH AMERICA BIOSTIMULANTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SOUTH AMERICA BIOSTIMULANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SOUTH AMERICA BIOSTIMULANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SOUTH AMERICA BIOSTIMULANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SOUTH AMERICA BIOSTIMULANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 SOUTH AMERICA BIOSTIMULANTS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 SOUTH AMERICA BIOSTIMULANTS MARKET: SEGMENTATION

FIGURE 11 GROWING EMPHASIS ON SUSTAINABLE FARMING IS EXPECTED TO DRIVE SOUTH AMERICA BIOSTIMULANTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ACID BASED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SOUTH AMERICA BIOSTIMULANTS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF SOUTH AMERICA BIOSTIMULANTS MARKET

FIGURE 14 SOUTH AMERICA BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENTS, 2021

FIGURE 15 SOUTH AMERICA BIOSTIMULANTS MARKET, BY CROP TYPE, 2021

FIGURE 16 SOUTH AMERICA BIOSTIMULANTS MARKET, BY APPLICATION METHOD, 2021

FIGURE 17 SOUTH AMERICA BIOSTIMULANTS MARKET, BY FORM, 2021

FIGURE 18 SOUTH AMERICA BIOSTIMULANTS MARKET, BY ORIGIN, 2021

FIGURE 19 SOUTH AMERICA BIOSTIMULANTS MARKET, BY END USER, 2021

FIGURE 20 SOUTH AMERICA BIOSTIMULANTS MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 SOUTH AMERICA BIOSTIMULANTS MARKET: SNAPSHOT (2021)

FIGURE 22 SOUTH AMERICA BIOSTIMULANTS MARKET: BY COUNTRY (2021)

FIGURE 23 SOUTH AMERICA BIOSTIMULANTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 SOUTH AMERICA BIOSTIMULANTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 SOUTH AMERICA BIOSTIMULANTS MARKET: BY ACTIVE INGREDIENTS (2022-2029)

FIGURE 26 SOUTH AMERICA BIOSTIMULANTS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.