Saudi Arabia Fleet Management Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

| 2024 –2031 | |

| USD 2.28 Million | |

| USD 4.58 Million | |

|

|

|

Saudi Arabia Fleet Management Market Segmentation, By Fleet Size (Small Fleets (Less than 100 Vehicles), Medium Fleets (100-500 Vehicles), Large and Enterprise Fleets (500+ Vehicles)), Business Type (Large Business and Small Business), Vehicle Type (Internal Combustion Engine and Electric Vehicle), Mode of Transportation (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), End User (Energy & Utilities, Automotive, Construction, Retail, Transportation & Logistics, Manufacturing, Government, Mining, Healthcare, Food & Beverages, Agriculture, and Others) - Industry Trends and Forecast to 2031

Fleet Management Market Analysis

The fleet management market in Saudi Arabia is growing due to economic diversification, increased logistics needs, and technological advancements. Government initiatives and rising e-commerce are driving demand for efficient fleet solutions. Key segments include software, hardware, and various vehicle types, with significant players both local and global. Challenges include high initial costs and infrastructure limitations. Future trends will focus on sustainability, smart technology integration, and increased investment.

Fleet Management Market Size

Saudi Arabia fleet management market size was volumed at 2.28 million units in 2023 and is projected to reach 4.58 million units by 2031, growing with a CAGR of 9.3% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Fleet Management Market Trend

“Growth in Integrated Transportation Solutions”

The growth in integrated transportation solutions, or Mobility as a Service (MaaS), is a significant trend in Saudi Arabia's fleet management market. This approach combines various transport modes such as public transit, ride-sharing, and logistics services into seamless, user-friendly platforms. The push for efficiency and convenience aligns with Saudi Arabia's Vision 2030, which emphasizes modernization and improved urban mobility. Companies are leveraging technology to create holistic solutions that enhance user experience and optimize resource allocation. This trend also facilitates better data sharing and collaboration among different transport providers. As e-commerce and urbanization continue to rise, integrated solutions will be crucial for meeting demand. Ultimately, this shift enhances operational efficiency and contributes to a more sustainable transportation ecosystem.

Report scope Fleet Management Market

|

Report Metric |

Fleet Management Details |

|

Segments Covered |

|

|

Countries Covered |

Saudi Arabia |

|

Key Market Players |

Oracle (U.S.), Fleetroot (U.A.E), SAP SE (Germany), Zain (Saudi Arabia), Detasad cloud (Saudi Arabia), ODOOTEC KSA (Saudi Arabia), LocoNav (U.S.), Electrical & Power Contracting Company (Saudi Arabia), Falcon Fleet Management (Saudi Arabia), and TUV SUD (Germany) among others |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Fleet Management Market Definition

The fleet management market refers to the systems and services used to manage a company's vehicle fleet, optimizing operations, cost efficiency, and safety. This market includes solutions like GPS tracking, telematics, fuel management, maintenance scheduling, and driver behavior monitoring. Fleet management aims to improve productivity, minimize operational costs, enhance vehicle utilization, and ensure regulatory compliance. It serves diverse industries, including transportation, logistics, construction, and retail, where vehicle fleets are essential for daily operations. With the growing need for data-driven insights, fleet management increasingly leverages IoT, AI, and cloud technologies to streamline operations and enhance decision-making.

Fleet Management Market Dynamics

Drivers

- Increase in Demand of the Logistic due to Ecommerce Industry

Fleet management is a practice that allows organizations to manage and coordinate delivery vehicles to achieve optimum efficiency and reduce costs. This practice is used to monitor and record couriers and delivery personnel. It requires a system of technologies that make it easier for the fleet manager to coordinate activities from fuel management to planning routes, and it can be easily managed using fleet management software. The rapid growth of e-commerce in Saudi Arabia has transformed consumer behavior, leading to a surge in demand for logistics services. As online shopping becomes more prevalent, businesses require reliable and efficient delivery systems to meet customer expectations for quick and accurate shipments. This escalating demand necessitates improved fleet management solutions to ensure timely deliveries and operational efficiency. The competitive landscape of e-commerce is prompting companies to invest in technology-driven fleet management systems. These systems enable businesses to optimize route planning, monitor vehicle performance, and manage inventory in real-time. By adopting advanced analytics and tracking technologies, logistics providers can enhance their service offerings, reduce operational costs, and ultimately boost customer satisfaction.

For instances,

- In 2024, according to the Agility index, Saudi Arabia's strong performance in Business Fundamentals (7.28) and Digital Readiness (6.02) on the Agility Emerging Markets Logistics Index creates a favorable environment for fleet management companies. This suggests a strong business environment, digital infrastructure, and government support for technological advancements. These factors can drive the adoption of advanced fleet management solutions and contribute to the growth of the fleet management market in Saudi Arabia

Rising Demand for the Improvement of Customer Services

Customers nowadays are smarter and have higher expectations than ever before. Customer satisfaction and happiness are one of the most important considerations for any company. Regardless of the business sector, unhappy customers will not stay for long, so it is important to keep them happy and make them feel valued. This is true for logistics and fleet management as well, where the retention of customers is key to long-term success. Improving customer services and satisfaction through improved fleet management performance is a key factor expected to boost market growth. In today's competitive market, businesses recognize the importance of customer satisfaction and use advanced technologies in fleet management solutions to optimize their operations and improve customer experiences. In a competitive marketplace, companies are investing in advanced fleet management technologies to optimize routes, reduce delivery times, and improve communication with customers. Features such as GPS tracking and automated notifications enable businesses to keep customers informed about their shipments, fostering trust and loyalty. By leveraging data analytics, companies can also anticipate customer needs and enhance service offerings based on insights gathered from fleet operations.

For instance,

- In March 2024, according to the article of Dialzara, companies in Saudi Arabia adopted AI chatbots to provide 24/7 customer support. This implementation allowed businesses to respond to customer inquiries more quickly and efficiently. As a result, customer satisfaction levels improved significantly across various industries.

Opportunities

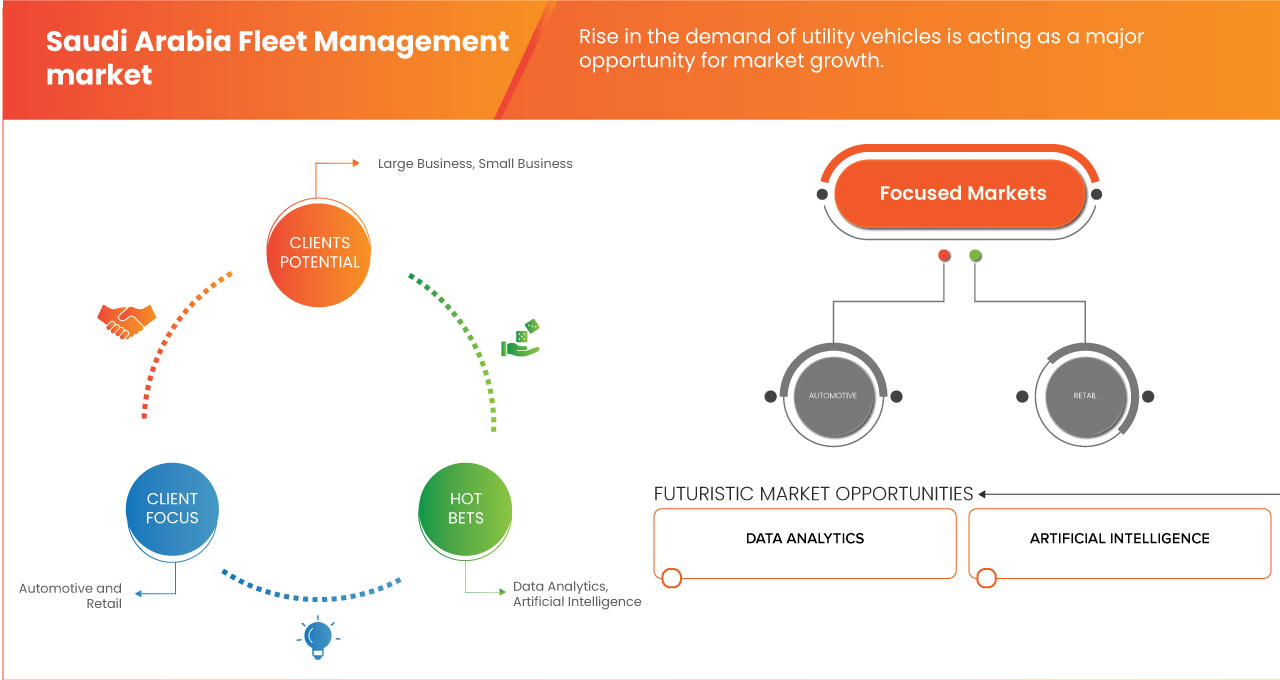

- Rising Demand for Utility Vehicles

Utility vehicles are vehicles designed and used for carrying goods or passengers. These vehicles include trucks, vans, buses, and other similar vehicles used for commercial purposes. The utility vehicle market is a crucial component of the Saudi Arabian automobile industry and has witnessed significant growth over the past decades the rise in demand for utility vehicles can be attributed to several factors, including the growth of the e-commerce industry, increasing urbanization, and the need for efficient transportation systems. As more and more businesses rely on utility vehicles for their transportation needs, the demand for fleet management services and software is also expected to increase. One of the reasons for the rise in demand for utility vehicles is the growth of the e-commerce industry. The demand for transportation services has increased with the increasing number of online shopping platforms. As a result, the use of utility vehicles has become more common, and fleet management has become more critical.

For instance,

- In September 2024, according to the article of Tata Motors International Business, Tata Motors highlighted innovations in their latest commercial vehicles, responding to the rising demand for utility vehicles in the Saudi Arabian market. As sectors such as construction and logistics expand, the need for versatile and efficient utility vehicles has become critical. These advancements support Saudi Arabia's economic diversification efforts, aligning with the Vision 2030 initiative to enhance infrastructure development.

Rising Trend of Urbanization

The rising trend of urbanization in Saudi Arabia presents a substantial opportunity for the fleet management market as more people migrate to cities and urban centers. This demographic shift increases the demand for efficient transportation solutions to support the growing population's needs. Urban areas require robust logistics systems to manage the distribution of goods and services, making effective fleet management essential for businesses operating in these environments. As cities expand, the complexity of urban logistics intensifies, necessitating advanced fleet management solutions that can navigate congested traffic and optimize delivery routes. The integration of technology, such as real-time tracking and route optimization software, allows fleet operators to respond quickly to the dynamic urban landscape. This capability not only enhances operational efficiency but also improves customer service by ensuring timely deliveries and efficient use of resources.

For instances,

- In December 2023, Careem expanded its partnership with Saudi Arabia Railways to enhance urban transportation solutions. This collaboration aimed to improve fleet management efficiency by integrating ride-hailing services with rail transit. As a result, customers benefited from more seamless and reliable transportation options in urban areas.

Restraints/ Challenges

- Accumulation of Huge Data Volume

Fleet management is more than just keeping up with the daily location and performance of vehicles; it also includes managing tools, parts, equipment, expenses, and employees. In some fleets, management responsibilities may be distributed to more than one person, increasing the need for communication and data transparency. Businesses with multiple locations, which perform in-house maintenance and repairs, where vehicles from any of their locations can be serviced, also have an increased need for data transparency and communication. Thus, fleet management enables the collection, management, and analysis of data. Data collection provides a historical look at your fleet operations. The more historical data accumulates, the better the overall fleet health and performance insights. A substantial buildup of historical data enables the calculation of future projections, helping with budgeting, vehicle replacement analyses, and more.

For instance,

- In September 2023, according to a blog published by Simply Fleet, the integration of telematics systems significantly increased the accumulation of huge data volumes for fleet management. Companies utilized this data to analyze vehicle performance, driver behavior, and operational efficiency. By leveraging these insights, fleet managers improved decision-making processes and enhanced overall fleet operations

Issues Related to Low Efficiency in Connectivity

The logistics and transport industry has undergone significant transformations with the introduction of digitization, big data, and connectivity. While these innovations have enhanced fleet management, the growing threat to connectivity efficiency is emerging as a major restraint for market growth. Connectivity plays a crucial role in providing fleet managers with a comprehensive overview of their entire fleet, enabling real-time communication with drivers, trucks, and trailers through automated processes. Telematics devices and connected software solutions have proven instrumental in promptly alerting fleet managers to minor vehicle issues, allowing for proactive maintenance, and addressing problems before they lead to breakdowns. Through telematics devices and connected software solutions, fleet problems can be alerted to minor vehicle issues as they arise, allowing them to address issues sooner and deal with problems before breakdowns occur. This gives the flexibility to make running repairs or scheduled maintenance in advance, which enables trucks to stay on the road more often, spending more time delivering goods.

For instance,

- In August 2022, according to LocoNav's article, fleet managers will increasingly be relying on GPS tracking for real-time vehicle visibility and operational efficiency. However, the rising availability of GPS jammers poses significant risks to fleet communication and security. Drivers may use these devices to conceal their locations, leading to unauthorized vehicle usage and challenges in theft recovery. This situation complicates logistics and can adversely affect service delivery in a rapidly growing market

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Fleet Management Market Scope

The market is segmented on the basis of fleet size, business type, vehicle type, mode of transport and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

Business Type

- Large Business Small Business

- Type

- Rental Car/Truck Company

- Moving Company

- Taxi Company

- Delivery Company

- Long Haul Semi-Truck Company

- Type

- Small Business

- Type

- Catering & Food Delivering Company

- Cleaning Service Company

- Electrician/Plumbing/Hvac Company

- Florist & Gift Delivery Business

- Landscaping Business

- Others

- Type

Vehicle Type

- Internal Combustion Engine

- Electric Vehicle

Mode of Transportation

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Type

- Trucks

- Trailers

- Forklifts

- Specialist Vehicles

- Type

End User

- Automotive

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Transportation & Logistics

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Retail

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Manufacturing

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Food & Beverages

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Energy & Utilities

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Mining

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Government

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Healthcare

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Agriculture

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Construction

- Fleet Size

- Small Fleets (1-100 Vehicles)

- Medium Fleets (101-200 Vehicles)

- Large & Enterprise Fleets (200+ Vehicles)

- Fleet Size

- Others

Fleet Management Market Share

Saudi Arabia fleet management market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on fleet management the market.

Fleet Management Market Players Operating in the Market Are:

- Oracle (U.S.)

- Fleetroot (U.A.E)

- SAP SE (Germany)

- Zain (Saudi Arabia)

- Detasad cloud (Saudi Arabia)

- ODOOTEC KSA (Saudi Arabia)

- LocoNav (U.S.)

- Electrical & Power Contracting Company (Saudi Arabia)

- Falcon Fleet Management (Saudi Arabia)

- TUV SUD (Germany)

Latest Development Fleet Management Market

- In April 2024, Zain launched a fully Saudi-made fleet management system, integrating local design and manufacturing with advanced cloud technology. This unveiled the product portfolio and provided a new segment for expanding businesses with local products.

- In January 2024, TÜV SÜD issued ISO/SAE 21434 certification for automotive cybersecurity to DENSO CORPORATION. This certification confirms that DENSO's vehicle components and systems meet international cybersecurity standards throughout their lifecycle. With this certification, DENSO can prove its commitment to secure development processes, enhancing trust and compliance in the automotive industry.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SAUDI ARABIA FLEET MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FLEET SIZE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR LOGISTICS DUE TO THE E-COMMERCE INDUSTRY

5.1.2 RISING DEMAND FOR THE IMPROVEMENT OF CUSTOMER SERVICES

5.1.3 RAPID ADOPTION OF FUEL MANAGEMENT SYSTEMS IN FLEETS

5.1.4 INCREASING DEMAND FOR FULL-SERVICE LEASING

5.2 RESTRAINTS

5.2.1 ISSUES RELATED TO LOW EFFICIENCY IN CONNECTIVITY

5.2.2 IMPROPER GUIDANCE FOR ENABLING THE ROUTE

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR UTILITY VEHICLES

5.3.2 RISING TREND OF URBANIZATION

5.3.3 INCREASING PARTNERSHIPS, ACQUISITIONS, AND COLLABORATIONS AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 ACCUMULATION OF HUGE DATA VOLUME

5.4.2 RISING CYBER THREATS RELATED TO FLEET MANAGEMENT SOFTWARE

6 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY FLEET SIZE

6.1 OVERVIEW

6.2 SMALL FLEETS (LESS THAN 100 VEHICLES)

6.3 MEDIUM FLEETS (100-500 VEHICLES)

6.4 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

7 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE

7.1 OVERVIEW

7.2 LARGE BUSINESS

7.2.1 LARGE BUSINESS, BY TYPE

7.2.1.1 RENTAL CAR/TRUCK COMPANY

7.2.1.2 DELIVERY COMPANY

7.2.1.3 TAXI COMPANY

7.2.1.4 MOVING COMPANY

7.2.1.5 LONG HAUL SEMI-TRUCK COMPANY

7.2.1.6 OTHERS

7.3 SMALL BUSINESS

7.3.1 SMALL BUSINESS, BY TYPE

7.3.1.1 CATERING & FOOD DELIVERING COMPANY

7.3.1.2 CLEANING SERVICE COMPANY

7.3.1.3 ELECTRICIAN/PLUMBING/HVAC COMPANY

7.3.1.4 FLORIST & GIFT DELIVERY BUSINESS

7.3.1.5 LANDSCAPING BUSINESS

7.3.1.6 OTHERS

8 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE

8.1 OVERVIEW

8.2 INTERNAL COMBUSTION ENGINE

8.3 ELECTRIC VEHICLE

9 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT

9.1 OVERVIEW

9.2 PASSENGER CARS

9.3 LIGHT COMMERCIAL VEHICLE

9.4 HEAVY COMMERCIAL VEHICLE

9.4.1 HEAVY COMMERCIAL VEHICLE, BY TYPE

9.4.1.1 TRUCKS

9.4.1.2 FORKLIFTS

9.4.1.3 TRAILERS

9.4.1.4 SPECIALIST VEHICLES

10 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY END-USER

10.1 OVERVIEW

10.2 ENERGY & UTILITIES

10.2.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.2.2 MEDIUM FLEETS (100-500 VEHICLES)

10.2.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.3 AUTOMOTIVE

10.3.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.3.2 MEDIUM FLEETS (100-500 VEHICLES)

10.3.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.4 CONSTRUCTION

10.4.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.4.2 MEDIUM FLEETS (100-500 VEHICLES)

10.4.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.5 RETAIL

10.5.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.5.2 MEDIUM FLEETS (100-500 VEHICLES)

10.5.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.6 TRANSPORTATION & LOGISTICS

10.6.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.6.2 MEDIUM FLEETS (100-500 VEHICLES)

10.6.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.7 MANUFACTURING

10.7.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.7.2 MEDIUM FLEETS (100-500 VEHICLES)

10.7.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.8 GOVERNMENT

10.8.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.8.2 MEDIUM FLEETS (100-500 VEHICLES)

10.8.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.9 MINING

10.9.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.9.2 MEDIUM FLEETS (100-500 VEHICLES)

10.9.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.1 HEALTHCARE

10.10.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.10.2 MEDIUM FLEETS (100-500 VEHICLES)

10.10.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.11 FOOD & BEVERAGES

10.11.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.11.2 MEDIUM FLEETS (100-500 VEHICLES)

10.11.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.12 AGRICULTURE

10.12.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.12.2 MEDIUM FLEETS (100-500 VEHICLES)

10.12.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

10.13 OTHERS

10.13.1 SMALL FLEETS (LESS THAN 100 VEHICLES)

10.13.2 MEDIUM FLEETS (100-500 VEHICLES)

10.13.3 LARGE AND ENTERPRISE FLEETS (500+ VEHICLES)

11 SAUDI ARABIA FLEET MANAGEMENT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ZAIN

13.1.1 COMPANY SNAPSHOT

13.1.2 SOLUTION PORTFOLIO

13.1.3 RECENT DEVELOPMENTS

13.2 TÜV SÜD

13.2.1 COMPANY SNAPSHOT

13.2.2 SERVICE PORTFOLIO

13.2.3 RECENT DEVELOPMENTS

13.3 SAP SE

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 ORACLE CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 FLEETROOT

13.5.1 COMPANY SNAPSHOT

13.5.2 SOLUTION PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 ARABITRA (PART OF ELECTRICAL & POWER CONTRACTING COMPANY)

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 DETASAD CLOUD.

13.7.1 COMPANY SNAPSHOT

13.7.2 SOLUTION PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 FALCON TRACKERS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 LOCONAV

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 ODOOTEC KSA

13.10.1 COMPANY SNAPSHOT

13.10.2 SOLUTION PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 UTILITY VEHICLES IMPORT DATA OF SAUDI ARABIA

TABLE 2 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS)

TABLE 3 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY BUSINESS TYPE, 2022-2031 (USD THOUSAND)

TABLE 4 SAUDI ARABIA LARGE BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2022-2031 (THOUSAND UNITS)

TABLE 5 SAUDI ARABIA SMALL BUSINESS IN FLEET MANAGEMENT MARKET, BY TYPE, 2022-2031 (THOUSAND UNITS)

TABLE 6 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY VEHICLE TYPE, 2022-2031 (THOUSAND UNITS)

TABLE 7 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY MODE OF TRANSPORT, 2022-2031 (USD THOUSAND)

TABLE 8 SAUDI ARABIA TRUCKS IN FLEET MANAGEMENT MARKET, BY TYPE, 2022-2031 (THOUSAND UNITS)

TABLE 9 SAUDI ARABIA FLEET MANAGEMENT MARKET, BY END USER, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 10 SAUDI ARABIA ENERGY & UTILITIES IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 11 SAUDI ARABIA AUTOMOTIVE IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 12 SAUDI ARABIA CONSTRUCTION IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 13 SAUDI ARABIA RETAIL IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 14 SAUDI ARABIA TRANSPORTATION & LOGISTICS IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 15 SAUDI ARABIA MANUFACTURING IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 16 SAUDI ARABIA GOVERNMENT IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 17 SAUDI ARABIA MINING IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 18 SAUDI ARABIA HEALTHCARE IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 19 SAUDI ARABIA FOOD & BEVERAGES IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 20 SAUDI ARABIA AGRICULTURE IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

TABLE 21 SAUDI ARABIA OTHERS IN FLEET MANAGEMENT MARKET, BY FLEET SIZE, 2022-2031 (THOUSAND UNITS UNITS)

Lista de figuras

FIGURE 1 SAUDI ARABIA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA FLEET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA FLEET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA FLEET MANAGEMENT MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA FLEET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA FLEET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA FLEET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SAUDI ARABIA FLEET MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 SAUDI ARABIA FLEET MANAGEMENT MARKET: MULTIVARIATE MODELING

FIGURE 10 SAUDI ARABIA FLEET MANAGEMENT MARKET: FLEET SIZE TIMELINE CURVE

FIGURE 11 SAUDI ARABIA FLEET MANAGEMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 12 SAUDI ARABIA FLEET MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 SAUDI ARABIA FLEET MANAGEMENT MARKET EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 THREE SEGMENTS COMPRISE THE SAUDI ARABIA FLEET MANAGEMENT MARKET, BY FLEET SIZE

FIGURE 16 INCREASE IN DEMAND OF THE LOGISTIC DUE TO E-COMMERCE INDUSTRY TO DRIVE THE SAUDI ARABIA FLEET MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 17 SMALL FLEETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA FLEET MANAGEMENT MARKET IN 2024 & 2031

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SAUDI ARABIA FLEET MANAGEMENT MARKET

FIGURE 19 SAUDI ARABIA E-COMMERCE REVENUE (2022-2024)

FIGURE 20 SAUDI ARABIA FLEET MANAGEMENT MARKET: BY FLEET SIZE, 2023

FIGURE 21 SAUDI ARABIA FLEET MANAGEMENT MARKET: BY BUSINESS TYPE, 2023

FIGURE 22 SAUDI ARABIA FLEET MANAGEMENT MARKET: BY VEHICLE TYPE, 2023

FIGURE 23 SAUDI ARABIA FLEET MANAGEMENT MARKET: BY MODE OF TRANSPORT, 2023

FIGURE 24 SAUDI ARABIA FLEET MANAGEMENT MARKET: BY END USER, 2023

FIGURE 25 SAUDI ARABIA FLEET MANAGEMENT MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.