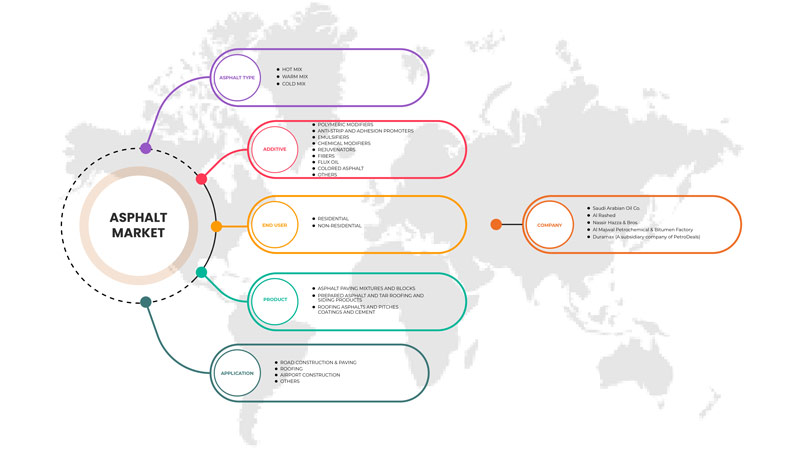

Mercado de asfalto de Arabia Saudita, por tipo de asfalto (mezcla en caliente, mezcla tibia y mezcla fría), producto (mezclas y bloques de asfalto para pavimentación, productos preparados de asfalto y alquitrán para techos y revestimientos, asfaltos y breas para techos, revestimientos y cemento), aditivo ( modificadores poliméricos , promotores anti-desprendimiento y de adhesión, emulsionantes , modificadores químicos, rejuvenecedores, fibras, aceite fundente, asfalto coloreado y otros), aplicación (construcción y pavimentación de carreteras, techado, construcción de aeropuertos y otros), usuario final (residencial y no residencial) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de asfalto de Arabia Saudita

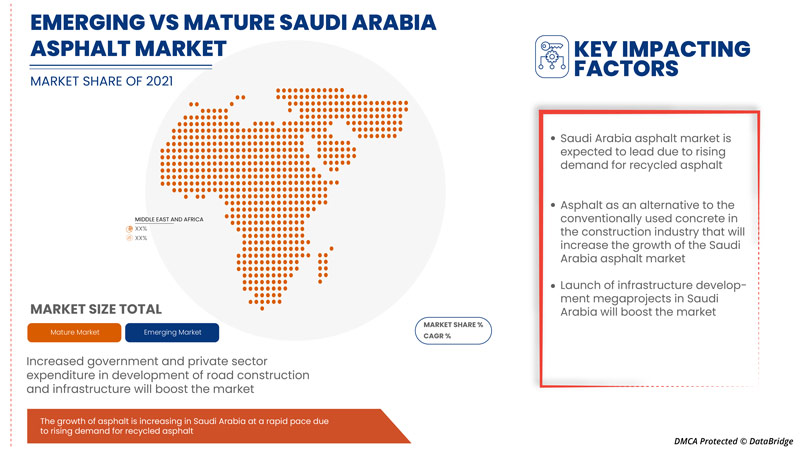

Se espera que la creciente demanda de asfalto reciclado y el aumento del gasto público y privado en construcción de carreteras y desarrollo de infraestructura impulsen la demanda del mercado de asfalto de Arabia Saudita. Sin embargo, el alto costo de maquinaria como las pavimentadoras de asfalto puede restringir aún más el crecimiento del mercado.

Este asfalto de Arabia Saudita se utiliza principalmente en la construcción de carreteras, áreas de estacionamiento y caminos de acceso, ya que une la piedra triturada y los agregados en superficies firmes y de concreto, como carreteras y aceras.

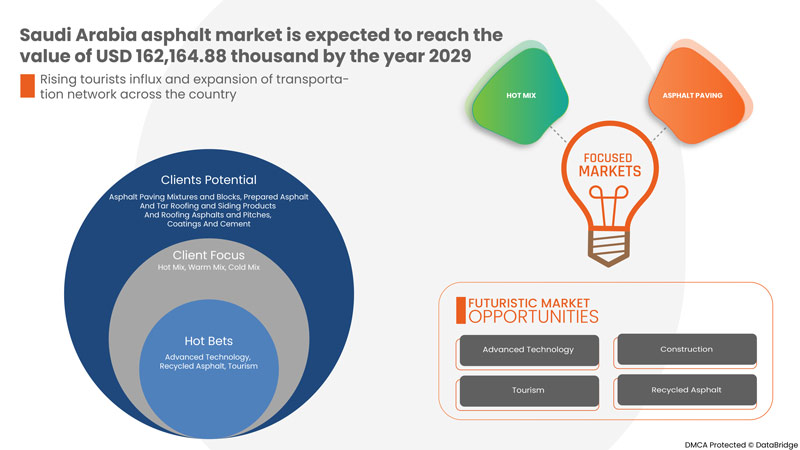

Data Bridge Market Research analiza que se espera que el mercado de asfalto de Arabia Saudita alcance un valor de USD 162.164,88 mil para el año 2029, a una CAGR del 3,9% durante el período de pronóstico. El segmento de mezcla en caliente representa el tipo de asfalto más destacado en el mercado respectivo, debido a la creciente demanda de asfalto reciclado. El informe de mercado elaborado por el equipo de Data Bridge Market Research incluye un análisis profundo de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y escenario de la cadena climática.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Por tipo de asfalto (mezcla en caliente, mezcla tibia y mezcla en frío), producto (mezclas y bloques de asfalto para pavimentación, productos preparados de asfalto y alquitrán para techos y revestimientos, asfaltos y breas para techos, revestimientos y cemento), aditivo (modificadores poliméricos, promotores antiadherentes y antidesprendimiento, emulsionantes, modificadores químicos, rejuvenecedores, fibras, aceite fundente, asfalto coloreado y otros), aplicación (construcción y pavimentación de carreteras, techado , construcción de aeropuertos y otros), usuario final (residencial y no residencial) |

|

País cubierto |

Arabia Saudita |

|

Actores del mercado cubiertos |

Fabricantes de asfalto y agregados Al-Azizia, fábrica de impermeabilización del Mar Rojo, Nassir Hazza & Bros., Saudi Arabian Oil Co., fábrica petroquímica y de betún Al Majwal, Duramax (una empresa subsidiaria de PetroDeals), Al Rashed, Passing Road Co., entre otros. |

Definición de mercado

El asfalto es un material aglutinante semisólido de color negro que se obtiene a partir de residuos de destilación de petróleo. El asfalto se fabrica a una temperatura promedio de 150 a 180 °C y es muy duradero y resistente a las grietas. Se utiliza principalmente en la construcción de carreteras, áreas de estacionamiento y caminos de acceso, ya que une la piedra triturada y los agregados en las superficies firmes y de hormigón, como carreteras y aceras. El asfalto colocado de manera uniforme ayuda a minimizar el consumo de combustible y las emisiones en los vehículos y aumenta la seguridad al proporcionar un mejor agarre a las ruedas.

Dinámica del mercado del asfalto en Arabia Saudita

- Creciente demanda de asfalto reciclado

El asfalto es reciclable. Es uno de los productos reciclados más utilizados en la industria de la construcción. La mezcla de asfalto reciclado también es más resistente, más duradera y resistente a la formación de surcos. Por lo tanto, el producto reciclado ofrece un rendimiento superior.

El asfalto reciclado es un asfalto reprocesado que contiene asfalto y agregados. El proceso de reciclaje del asfalto implica el fresado y redimensionamiento de los pavimentos de asfalto. La capa de asfalto se tritura y se extrae de la superficie existente, como carreteras o autopistas. Se realiza el fresado del asfalto, seguido de la pulverización y estabilización. La pulverización del asfalto se realiza para mezclar la capa de asfalto en subcapas. La estabilización implica mezclar alquitrán, agentes aglutinantes u otros materiales, aditivos y materiales impermeabilizantes con asfalto triturado.

- Aumento del gasto público y del sector privado en el desarrollo de la construcción de carreteras e infraestructuras

La rápida expansión del mercado del asfalto en Arabia Saudita se debe principalmente a la rápida expansión del sector de la construcción en todo el país. Existe una creciente demanda de los sectores residencial y comercial y un creciente conocimiento de diversos materiales, incluido el asfalto. La creciente urbanización, el aumento de las ciudades inteligentes, los edificios y otros proyectos de construcción urbana, junto con la expansión de los sectores de la construcción, son los principales factores impulsores del crecimiento del mercado del asfalto en Arabia Saudita.

- El asfalto como alternativa al hormigón convencional en la construcción

El asfalto puede utilizarse como material de elección y como una alternativa muy preferida al hormigón en la industria de la construcción debido a sus diversas propiedades. El asfalto tiene resistencia a la flexión y puede soportar diversas curvas y contorsiones antes de empezar a agrietarse o romperse. Esta es una de las razones por las que es un material muy buscado para proyectos que necesitan un material como este. El hormigón no tiene esta misma resistencia, lo que coloca al asfalto a la cabeza al comparar estos dos materiales.

- En diciembre de 2021, Saudi Aramco anunció que los precios internos de los productores de diésel y asfalto se revisarían anualmente de acuerdo con los procedimientos de gobernanza para ajustar los precios de los productos energéticos y del agua.

- En 2020, en Arabia Saudita, el precio promedio de exportación de betún y asfalto fue de USD 553 por tonelada 2020, lo que aumentó un 4,5% con respecto al año 2019.

Restricciones/Desafíos

- Volatilidad en los precios y el suministro de asfalto debido a la dependencia de la petroquímica

El mercado del asfalto sufre mucho por factores como la volatilidad de los precios de la energía y las materias primas y la fluctuación de la economía de la región. Este factor frena en gran medida la tasa de expansión del mercado. Existe una volatilidad significativa en los precios del asfalto, ya que es un producto petroquímico y las fluctuaciones en el precio del petróleo se reflejan en el precio del asfalto. La fluctuación de los precios de los petroquímicos da como resultado un suministro inconsistente de asfalto, lo que afecta los proyectos de construcción llevados a cabo por los gobiernos y los contratistas de carreteras, ya que es una materia prima primaria utilizada en la construcción de pavimentos de carreteras y autopistas. Además, los aditivos para asfalto están directamente relacionados con el mercado del asfalto. Por lo tanto, la volatilidad en los precios y la oferta de aditivos para asfalto también afecta al mercado. Esto también ha obligado a los actores clave que operan en el mercado a realizar cambios en sus productos de asfalto constantemente.

- Alto costo de maquinaria como pavimentadoras de asfalto

Las pavimentadoras de asfalto son máquinas que se utilizan o distribuyen y se colocan en superficies como puentes, autopistas y carreteras. Estas máquinas también se denominan terminadoras de asfalto. La compra, reutilización y alquiler de pavimentadoras de asfalto es una de las principales limitaciones en el mercado del asfalto de Arabia Saudita, ya que son muy caras y su mantenimiento también tiene un alto costo para los usuarios.

Además, poseer y poner en marcha una planta de asfalto es otra tarea importante y comprender el costo operativo relacionado con la misma es otra. Esto se debe a que la planta de mezcla de asfalto más básica puede comenzar con un precio tan bajo como USD 45.000. Puede llegar a USD 2-3 millones. El precio depende en gran medida de la capacidad de la planta de asfalto y el tipo de equipo utilizado. El factor de movilidad y los accesorios que se pueden agregar a la planta también afectan el costo. Hay dos tipos de plantas de asfalto, el tipo continuo y el tipo de lote. La planta de tipo lote tiene más funciones. Es más complicada que una planta de tambor y, por lo tanto, más costosa de poseer y operar.

El COVID-19 tuvo un impacto mínimo en el mercado del asfalto de Arabia Saudita

La COVID-19 afectó a varias industrias manufactureras en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y restricciones al transporte. Debido al confinamiento, el mercado del asfalto ha experimentado un impacto significativo en la importación y exportación de asfalto. La creciente demanda de productos de consumo aumentará el crecimiento del mercado del asfalto en Arabia Saudita.

Desarrollo reciente

- En abril de 2016, Saudi Arabian Oil Co. adjudicó un contrato EPC (ingeniería, adquisiciones y construcción) a la canadiense SNC-Lavalin para el proyecto de expansión de la producción de asfalto en la refinería de Ras Tanura. Este contrato ayudará a la empresa a ampliar sus instalaciones en todo el mundo.

Panorama del mercado del asfalto en Arabia Saudita

El mercado de asfalto de Arabia Saudita está segmentado en función del tipo de asfalto, el tipo de producto, la aplicación de aditivos y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por tipo de asfalto

- Mezcla caliente

- Mezcla caliente

- Mezcla fría

Sobre la base del tipo de asfalto, el mercado de asfalto de Arabia Saudita está segmentado en mezcla en caliente, mezcla tibia y mezcla fría.

Producto

- Mezclas y bloques asfálticos para pavimentación

- Productos para techos y revestimientos de asfalto y alquitrán preparados

- Asfaltos y cubiertas de asfalto

- Recubrimientos y Cemento

Sobre la base del producto, el mercado de asfalto de Arabia Saudita está segmentado en mezclas y bloques de asfalto para pavimentación, productos preparados de asfalto y alquitrán para techos y revestimientos, asfaltos y breas para techos, revestimientos y cemento.

Aditivo

- Modificadores poliméricos

- Promotores Anti-Tira y Adherencia

- Emulsionantes

- Modificadores químicos

- Rejuvenecedores

- Fibras

- Aceite fundente

- Asfalto coloreado

- Otros

Sobre la base de los aditivos, el mercado de asfalto de Arabia Saudita está segmentado en modificadores poliméricos , promotores antiadherentes y de adhesión, emulsionantes, modificadores químicos, rejuvenecedores, fibras, aceite fundente, asfalto coloreado y otros.

Solicitud

- Construcción de carreteras y pavimentación

- Techumbre

- Construcción de aeropuertos

- Otros

Sobre la base de la aplicación, el mercado de asfalto de Arabia Saudita está segmentado en construcción y pavimentación de carreteras, techado, construcción de aeropuertos, otros.

Usuario final

- Residencial

- No residencial

Sobre la base del usuario final, el mercado de asfalto de Arabia Saudita está segmentado en residencial y no residencial.

Análisis del panorama competitivo y la cuota de mercado del asfalto en Arabia Saudita

El panorama competitivo del mercado del asfalto de Arabia Saudita proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado del asfalto de Arabia Saudita.

Algunos de los principales actores que operan en el mercado de asfalto de Arabia Saudita son Al-Azizia Asphalt & Aggregates Manufacturers, Red Sea Waterproofing Factory, Nassir Hazza & Bros., Saudi Arabian Oil Co., Al Majwal Petrochemical & Bitumen Factory, Duramax (una empresa subsidiaria de PetroDeals), Al Rashed, Passing Road Co., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA ASPHALT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 ASPHALT TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 BRAND SHARE ANALYSIS

4.4 CLIMATE CHANGE SCENARIO AND SUSTAINABILITY

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 CONSUMER BEHAVIOR PATTERN FOR SAUDI ARABIA ASPHALT MARKET

4.6 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.7 PRODUCT ADOPTION SCENARIO

4.7.1 OVERVIEW

4.7.2 PRODUCT AWARENESS

4.7.3 PRODUCT INTEREST

4.7.4 PRODUCT EVALUATION

4.7.5 PRODUCT TRIAL

4.7.6 PRODUCT ADOPTION

4.7.7 CONCLUSION

4.8 SUPPLY CHAIN ANALYSIS

4.9 OVERVIEW

4.9.1 LOGISTIC COST SCENARIO

4.9.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 VENDOR SELECTION CRITERIA

5 CERTIFICATIONS AND REGULATIONS

6 COUNTRY ANALYSIS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR RECYCLED ASPHALT

7.1.2 INCREASED GOVERNMENT AND PRIVATE SECTOR EXPENDITURE IN THE DEVELOPMENT OF ROAD CONSTRUCTION AND INFRASTRUCTURE

7.1.3 ASPHALT AS AN ALTERNATIVE TO THE CONVENTIONALLY USED CONCRETE IN THE CONSTRUCTION INDUSTRY

7.2 RESTRAINTS

7.2.1 VOLATILITY IN THE PRICES AND SUPPLY OF ASPHALT DUE TO DEPENDENCE UPON PETROCHEMICAL

7.2.2 HEAVY COST OF MACHINERY SUCH AS ASPHALT PAVERS

7.3 OPPORTUNITIES

7.3.1 LAUNCH OF INFRASTRUCTURE DEVELOPMENT MEGAPROJECTS IN SAUDI ARABIA

7.3.2 RISING TOURISTS INFLUX AND EXPANSION OF TRANSPORTATION NETWORK ACROSS THE COUNTRY

7.4 CHALLENGE

7.4.1 LACK OF AWARENESS ABOUT ASPHALT ADDITIVES AMONG ROAD BUILDERS AND CONTRACTORS

8 SAUDI ARABIA ASPHALT MARKET, BY ASPHALT TYPE

8.1 OVERVIEW

8.2 HOT MIX

8.3 WARM MIX

8.4 COLD MIX

9 SAUDI ARABIA ASPHALT MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 ASPHALT PAVING MIXTURES AND BLOCKS

9.3 PREPARED ASPHALT AND TAR ROOFING AND SIDING PRODUCTS

9.4 ROOFING ASPHALTS AND PITCHES, COATINGS AND CEMENT

10 SAUDI ARABIA ASPHALT MARKET, BY ADDITIVE TYPE

10.1 OVERVIEW

10.2 POLYMERIC MODIFIERS

10.3 ANTI-STRIP AND ADHESION PROMOTERS

10.4 EMULSIFIERS

10.5 CHEMICAL MODIFIERS

10.6 REJUVENATORS

10.7 FIBERS

10.8 FLUX OIL

10.9 COLORED ASPHALT

10.1 OTHERS

10.10.1 RUBBER MODIFIERS

10.10.2 ORGANIC MATERIALS

11 SAUDI ARABIA ASPHALT MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ROAD CONSTRUCTION & PAVING

11.3 AIRPORT CONSTRUCTION

11.4 ROOFING

11.5 OTHERS

11.5.1 BRIDGES

11.5.2 PARKING LOTS

12 SAUDI ARABIA ASPHALT MARKET, BY END USER

12.1 OVERVIEW

12.2 NON-RESIDENTIAL

12.3 RESIDENTIAL

13 SAUDI ARABIA ASPHALT MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13.1.1 CONTRACT

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 SAUDI ARABIAN OIL CO.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATE

15.2 AL RASHED

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT UPDATE

15.3 NASSIR HAZZA & BROS.

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT UPDATE

15.4 AL MAJWAL PETROCHEMICAL & BITUMEN FACTORY

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT UPDATE

15.5 DURAMAX (A SUBSIDIARY COMPANY OF PETRODEALS)

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT UPDATE

15.6 RED SEA WATERPROOFING FACTORY

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AL-AZIZIA ASPHALT & AGGREGATES MANUFACTURERS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATE

15.8 PASSING ROAD CO.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF BITUMEN AND ASPHALT, NATURAL; BITUMINOUS OR OIL-SHALE AND TAR SANDS; ASPHALTITES AND ASPHALTIC; HS CODE – 2714 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BITUMEN AND ASPHALT, NATURAL; BITUMINOUS OR OIL-SHALE AND TAR SANDS; ASPHALTITES AND ASPHALTIC; HS CODE – 2714 (USD THOUSAND)

TABLE 3 CERTIFICATIONS AND REGULATIONS

TABLE 4 SAUDI ARABIA ASPHALT MARKET, BY ASPHALT TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 SAUDI ARABIA ASPHALT MARKET, BY ASPHALT TYPE, 2020-2029 (KILO TONS)

TABLE 6 SAUDI ARABIA ASPHALT MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 7 SAUDI ARABIA ASPHALT MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 8 SAUDI ARABIA ASPHALT MARKET, BY ADDITIVE TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 SAUDI ARABIA ASPHALT MARKET, BY ADDITIVE TYPE, 2020-2029 (KILO TONS)

TABLE 10 SAUDI ARABIA OTHERS IN ASPHALT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 SAUDI ARABIA OTHERS IN ASPHALT MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 12 SAUDI ARABIA ASPHALT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 13 SAUDI ARABIA ASPHALT MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 14 SAUDI ARABIA OTHERS IN ASPHALT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 SAUDI ARABIA OTHERS IN ASPHALT MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 16 SAUDI ARABIA ASPHALT MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 17 SAUDI ARABIA ASPHALT MARKET, BY END USER, 2020-2029 (KILO TONS)

Lista de figuras

FIGURE 1 SAUDI ARABIA ASPHALT MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA ASPHALT MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA ASPHALT MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA ASPHALT MARKET: SAUDI ARABIA MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA ASPHALT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA ASPHALT MARKET: THE ASPHALT TYPE LIFE LINE CURVE

FIGURE 7 SAUDI ARABIA ASPHALT MARKET: MULTIVARIATE MODELLING

FIGURE 8 SAUDI ARABIA ASPHALT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA ASPHALT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA ASPHALT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 SAUDI ARABIA ASPHALT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 SAUDI ARABIA ASPHALT MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SAUDI ARABIA ASPHALT MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FOR RECYCLED ASPHALT IS EXPECTED TO DRIVE SAUDI ARABIA ASPHALT MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 15 HOT MIX SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA ASPHALT MARKET IN 2022 & 2029

FIGURE 16 SAUDI ARABIA ASPHALT MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF SAUDI ARABIA ASPHALT MARKET

FIGURE 18 SAUDI ARABIA ASPHALT MARKET: BY ASPHALT TYPE, 2021

FIGURE 19 SAUDI ARABIA ASPHALT MARKET: BY PRODUCT, 2021

FIGURE 20 SAUDI ARABIA ASPHALT MARKET: BY ADDITIVE TYPE, 2021

FIGURE 21 SAUDI ARABIA ASPHALT MARKET: BY APPLICATION, 2021

FIGURE 22 SAUDI ARABIA ASPHALT MARKET: BY END USER, 2021

FIGURE 23 SAUDI ARABIA ASPHALT MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.