North Carolina South Carolina And Virginia Industrial Sugar And Sweeteners Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

366.03 Billion

USD

437.01 Billion

2024

2032

USD

366.03 Billion

USD

437.01 Billion

2024

2032

| 2025 –2032 | |

| USD 366.03 Billion | |

| USD 437.01 Billion | |

|

|

|

|

Segmentación del mercado de azúcar y edulcorantes industriales en Carolina del Norte, Carolina del Sur y Virginia: tipo (azúcar y edulcorantes naturales), presentación (líquido, cristalino y en polvo), origen (frutas, lácteos y vegetales), aplicación (panadería, confitería, postres congelados, alimentos procesados, fórmula infantil, bebidas, etc.): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia

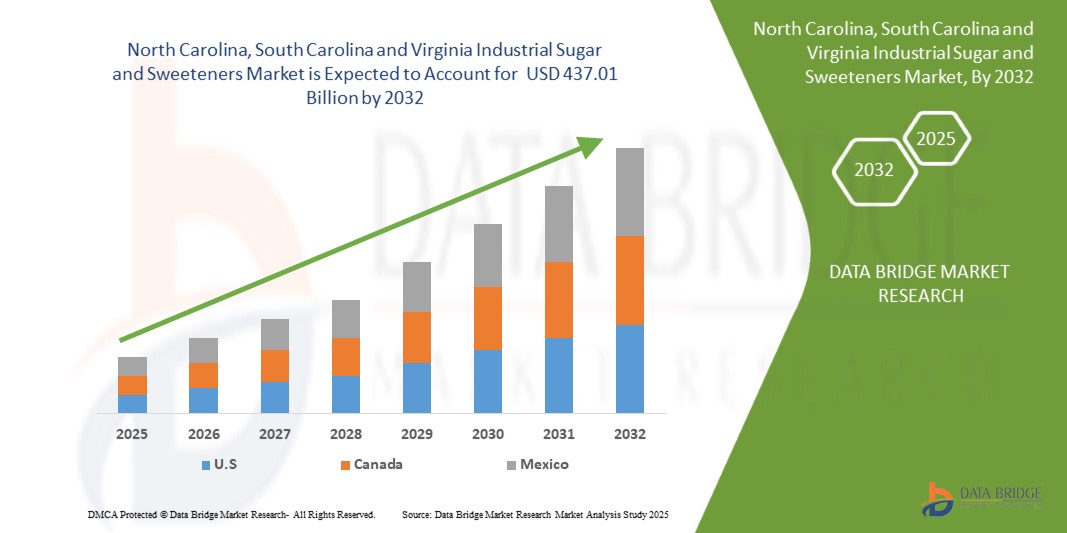

- El tamaño del mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia se valoró en USD 366,03 mil millones en 2024 y se espera que alcance los USD 437,01 mil millones para 2032 , con una CAGR de 2,24% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente preferencia de los consumidores por edulcorantes más saludables, bajos en calorías y naturales, sumado a una mayor concienciación sobre los efectos del consumo excesivo de azúcar en la salud. Los fabricantes están innovando con alternativas de azúcar de origen vegetal y natural, lo que permite la diversificación de productos en panadería, bebidas, confitería y alimentos procesados.

- Además, la creciente demanda de productos de etiqueta limpia y el respaldo regulatorio a los edulcorantes naturales están impulsando su adopción en los mercados globales. Estos factores convergentes están acelerando la adopción del azúcar y los edulcorantes industriales, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia

- El azúcar y los edulcorantes industriales abarcan una variedad de ingredientes naturales y sintéticos que se utilizan para aportar dulzor, textura y propiedades funcionales a alimentos y bebidas. Estos incluyen presentaciones líquidas, cristalinas y en polvo, provenientes de frutas, lácteos y plantas, y se utilizan en diversas aplicaciones como panadería, bebidas, confitería, postres congelados, fórmulas infantiles y alimentos procesados.

- La creciente demanda de azúcar y edulcorantes industriales se debe principalmente a la transición hacia dietas más saludables, la innovación en alternativas al azúcar y el creciente consumo de alimentos procesados y de conveniencia a nivel mundial. Los fabricantes adoptan cada vez más técnicas de procesamiento avanzadas para mejorar el sabor, la solubilidad y la funcionalidad, satisfaciendo así las necesidades cambiantes de los consumidores y la industria alimentaria.

- El segmento de azúcares naturales dominó el mercado con una participación del 62,5 % en 2024, debido a la creciente preferencia de los consumidores por ingredientes de etiqueta limpia y saludables. Los fabricantes están aprovechando los azúcares naturales para satisfacer la creciente demanda de productos con menos aditivos artificiales, y el respaldo regulatorio a los edulcorantes naturales impulsa aún más su adopción. Los azúcares naturales se utilizan ampliamente en panadería, repostería y bebidas debido a sus beneficios nutricionales percibidos, su versatilidad y su compatibilidad con los procesos de producción existentes. El segmento también se beneficia de fuertes inversiones en innovación de productos y de una mayor concienciación sobre los efectos negativos de los edulcorantes sintéticos en la salud, lo que refuerza su dominio del mercado.

Alcance del informe y segmentación del mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia

|

Atributos |

Perspectivas clave del mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de azúcar y edulcorantes industriales en Carolina del Norte, Carolina del Sur y Virginia

Industria de alimentos y bebidas en rápido crecimiento

- La sólida expansión de la industria de alimentos y bebidas es una tendencia clave que impulsa la demanda de azúcar y edulcorantes industriales. A medida que los consumidores optan cada vez más por productos alimenticios envasados, listos para consumir y funcionales, el azúcar y los edulcorantes son ingredientes esenciales para realzar el sabor, prolongar la vida útil y estabilizar las formulaciones en diversas categorías.

- Por ejemplo, Cargill Incorporated continúa ampliando su cartera de edulcorantes para satisfacer las necesidades de las empresas de bebidas y los fabricantes de confitería. De igual manera, Tate & Lyle ofrece una gama de azúcares tradicionales y edulcorantes especiales que satisfacen la creciente necesidad de equilibrio de sabor y control de calorías en diversos productos alimenticios y bebidas.

- El alto uso de azúcar industrial y edulcorantes en panadería, confitería, refrescos, lácteos y alimentos procesados subraya su papel como aditivos indispensables. Su capacidad para proporcionar un sabor, una textura y un volumen consistentes los convierte en parte integral de las necesidades de producción en masa de los fabricantes globales de alimentos.

- El auge de los mercados emergentes con poblaciones en rápida urbanización contribuye aún más a esta tendencia. El aumento de la renta disponible y los cambios en los hábitos alimentarios están impulsando el consumo de snacks, cereales para el desayuno, refrescos y alimentos congelados, lo que genera una mayor dependencia del azúcar y los edulcorantes.

- Los fabricantes también están diversificando su oferta para adaptarse a las cambiantes preferencias de los consumidores y a las presiones regulatorias. La creciente demanda de alternativas no nutritivas, como la stevia, los extractos de fruta del monje y los polioles, está transformando el mercado junto con el azúcar tradicional, garantizando la disponibilidad de soluciones tanto para el consumidor general como para el consumidor preocupado por su salud.

- En conclusión, el rápido crecimiento de la industria de alimentos y bebidas impulsa directamente la expansión del mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia. Esta tendencia confirma el papel esencial de estos ingredientes para garantizar el sabor, la calidad y la innovación en una amplia gama de aplicaciones alimentarias a nivel mundial.

Dinámica del mercado de azúcar y edulcorantes industriales en Carolina del Norte, Carolina del Sur y Virginia

Conductor

Aumento de la demanda de alimentos procesados envasados y productos especiales

- La creciente preferencia de los consumidores por los alimentos procesados envasados y los productos nutricionales especializados es un factor clave para el mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia. El ritmo de vida ajetreado y la creciente urbanización fomentan una mayor dependencia de los alimentos envasados de conveniencia, que dependen del azúcar y los edulcorantes para su sabor, estabilidad y conservación.

- Por ejemplo, Archer Daniels Midland (ADM) proporciona una amplia gama de azúcares y edulcorantes a importantes fabricantes de snacks y bebidas, lo que apoya la producción de alimentos envasados a gran escala. El desarrollo de productos de la empresa pone de relieve la estrecha relación entre los alimentos procesados y la demanda constante de edulcorantes.

- El azúcar y los edulcorantes industriales desempeñan un papel fundamental para mejorar el atractivo de los productos de panadería, confitería, bebidas carbonatadas, bebidas energéticas y cereales instantáneos. Productos especializados como batidos de proteínas, suplementos dietéticos y bebidas funcionales también dependen en gran medida de edulcorantes alternativos para equilibrar el sabor sin un consumo excesivo de calorías.

- La innovación continua en las categorías de alimentos envasados, incluyendo alimentos de origen vegetal, snacks fortificados y bebidas sin azúcar añadido, ha reforzado la necesidad de soluciones edulcorantes versátiles. Este impulso garantiza que el azúcar y los edulcorantes alternativos seguirán siendo parte integral de los procesos de I+D de las empresas globales de alimentos y bebidas.

- En conclusión, el aumento constante de la demanda de productos procesados y especiales consolida la industria del azúcar y los edulcorantes industriales como un eslabón vital para apoyar a diversos segmentos de consumidores. Este impulsor garantiza una expansión continua de la demanda en las categorías de alimentos tradicionales y emergentes a nivel mundial.

Restricción/Desafío

Riesgos para la salud del exceso de azúcar

- Uno de los desafíos más apremiantes para el mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia es la creciente concienciación sobre los riesgos para la salud asociados al consumo excesivo de azúcar. Las dietas ricas en azúcares refinados están estrechamente relacionadas con problemas de salud como la obesidad, la diabetes tipo 2, las enfermedades cardiovasculares y los problemas dentales, lo que genera una creciente resistencia entre los consumidores y los organismos reguladores.

- Por ejemplo, gobiernos de regiones como el Reino Unido y México han introducido impuestos al azúcar en las bebidas azucaradas para desincentivar el consumo excesivo y promover hábitos alimenticios más saludables. Grandes empresas de bebidas como Coca-Cola y PepsiCo han reducido el contenido de azúcar en varios productos para adaptarse a las políticas de salud pública y a las cambiantes expectativas de los consumidores.

- La transición hacia dietas saludables está afectando negativamente el consumo de alimentos procesados con alto contenido de azúcar, lo que resulta en una disminución de la demanda en ciertas categorías como refrescos y dulces tradicionales. Al mismo tiempo, los consumidores optan cada vez más por alternativas de edulcorantes naturales y bajos en calorías, lo que intensifica la presión competitiva sobre los fabricantes tradicionales de azúcar.

- Las restricciones regulatorias y los requisitos de etiquetado obligatorio también están creando desafíos para las empresas de alimentos y bebidas. La transparencia en la divulgación del contenido de azúcar y la preocupación de los consumidores por los azúcares ocultos en los alimentos envasados están transformando el comportamiento de compra y presionando a las empresas para que reformulen sus productos.

- Como resultado, los riesgos para la salud asociados con el consumo excesivo de azúcar siguen siendo un obstáculo importante para la industria. Superar este desafío dependerá de la innovación estratégica en tecnologías de reducción de azúcar, una mayor adopción de edulcorantes naturales y un equilibrio entre la demanda de sabor del consumidor y las consideraciones regulatorias y sanitarias.

Alcance del mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia

El mercado está segmentado según el tipo, la forma del producto, la fuente y la aplicación.

• Por tipo

Según el tipo, el mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia se segmenta en azúcar y edulcorantes naturales. El segmento de azúcar natural dominó la mayor cuota de mercado en ingresos, con un 62,5%, en 2024, impulsado por la creciente preferencia de los consumidores por ingredientes de etiqueta limpia y saludables. Los fabricantes están aprovechando los azúcares naturales para satisfacer la creciente demanda de productos con menos aditivos artificiales, y el respaldo regulatorio a los edulcorantes naturales impulsa aún más su adopción. Los azúcares naturales se utilizan ampliamente en panadería, confitería y bebidas debido a sus beneficios nutricionales percibidos, su versatilidad y su compatibilidad con los procesos de producción existentes. El segmento también se beneficia de fuertes inversiones en innovación de productos y de la creciente concienciación sobre los efectos negativos de los edulcorantes sintéticos en la salud, lo que refuerza su dominio del mercado.

Se prevé que el segmento de edulcorantes experimente su mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de alternativas bajas en calorías y aptas para diabéticos. Las innovaciones en edulcorantes naturales y de origen vegetal, junto con su integración en alimentos y bebidas funcionales, están impulsando su adopción. Los consumidores buscan cada vez más alternativas que aporten dulzor sin añadir calorías en exceso ni afectar los niveles de azúcar en sangre. El crecimiento del segmento se ve impulsado por la continua I+D en la mejora del sabor y la estabilidad de las formulaciones, lo que permite a los fabricantes sustituir los azúcares tradicionales sin comprometer la calidad del producto.

• Por forma de producto

Según la presentación del producto, el mercado de azúcares y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia se segmenta en líquido, cristalino y en polvo. El segmento cristalino obtuvo la mayor participación en los ingresos del mercado en 2024, gracias a su amplio uso en panadería, confitería y alimentos procesados. Los azúcares cristalinos ofrecen consistencia en el dulzor, facilidad de manejo y larga vida útil, lo que los hace ideales para aplicaciones industriales a gran escala. Los fabricantes también prefieren las formas cristalinas debido a su compatibilidad con equipos de procesamiento automatizado, lo que reduce los desafíos operativos. La fuerte demanda de los mercados tradicionales y emergentes, sumada a la creciente concienciación de los consumidores sobre las opciones de azúcar cristalino natural, ha reforzado el dominio de este segmento.

Se prevé que el segmento de líquidos experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por su creciente adopción en bebidas, salsas y alimentos procesados. Los azúcares y edulcorantes líquidos facilitan la mezcla, distribuyen uniformemente el dulzor y ofrecen una mejor solubilidad, lo que los hace muy atractivos para el uso industrial. La creciente demanda de bebidas listas para beber y bebidas funcionales, junto con las innovaciones en edulcorantes naturales líquidos, está impulsando el crecimiento. Además, los edulcorantes líquidos ayudan a los fabricantes a reducir el tiempo de procesamiento y los costos energéticos, lo que impulsa aún más su popularidad.

• Por fuente

Según el origen, el mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia se segmenta en frutas, lácteos y productos de origen vegetal. El segmento de origen vegetal dominó el mercado en 2024, impulsado por la creciente demanda de ingredientes veganos, sostenibles y saludables. Los edulcorantes de origen vegetal, como la stevia, el agave y el fruto del monje, gozan de gran popularidad por su origen natural, bajo índice glucémico y compatibilidad con diversas aplicaciones. Los fabricantes se están centrando en integrar ingredientes de origen vegetal en productos de panadería, repostería y bebidas para satisfacer la creciente tendencia de los consumidores hacia productos de etiqueta limpia y ambientalmente sostenibles. El crecimiento de este segmento se ve respaldado por las aprobaciones regulatorias y las fuertes inversiones en innovación de productos de origen vegetal.

Se prevé que el segmento de productos lácteos experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de edulcorantes funcionales y a base de lactosa en fórmulas infantiles, postres congelados y alimentos procesados especializados. Los azúcares lácteos aportan propiedades funcionales únicas, como el dorado, la retención de humedad y la mejora de la textura, lo que los hace muy adecuados para aplicaciones industriales. Los avances en las tecnologías de procesamiento de lácteos y la creciente preferencia de los consumidores por los ingredientes de origen natural contribuyen a la adopción acelerada del segmento.

• Por aplicación

Según su aplicación, el mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia se segmenta en panadería, confitería, postres congelados, alimentos procesados, fórmula infantil, bebidas y otros. El segmento de panadería dominó la mayor cuota de mercado en 2024, impulsado por la demanda constante de pan, pasteles y bollería. El azúcar y los edulcorantes industriales son fundamentales para mejorar la textura, el sabor y la vida útil de los productos de panadería, y los fabricantes prefieren cada vez más edulcorantes naturales y funcionales para satisfacer las demandas de los consumidores preocupados por la salud. Este segmento también se beneficia de la creciente urbanización, el aumento de la renta disponible y la expansión de las cadenas de panadería, que están acelerando la adopción de productos de azúcar y edulcorantes de alta calidad.

Se prevé que el segmento de bebidas experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el aumento del consumo de bebidas listas para beber, bebidas energéticas, aguas saborizadas y bebidas funcionales. Los fabricantes de bebidas incorporan cada vez más edulcorantes naturales y bajos en calorías para abordar las preocupaciones sobre la salud, manteniendo el sabor y el atractivo del producto. Las innovaciones en edulcorantes líquidos, la facilidad de formulación y la creciente demanda de alternativas al azúcar en bebidas frías y calientes son factores clave que impulsan el rápido crecimiento de este segmento.

Cuota de mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia

La industria del azúcar y los edulcorantes industriales está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- ADM (EE. UU.)

- Südzucker AG (Alemania)

- Cargill, Incorporated (EE. UU.)

- International Flavors & Fragrances Inc. (EE. UU.)

- Ingredion (EE. UU.)

- Wilmar International Ltd. (Singapur)

- Ingredientes naturales Layn (China)

- SweeGen, Inc., (EE. UU.)

- Imperial Sugar (EE. UU.)

- HOWTIAN (China)

- Pyure (Estados Unidos)

Últimos avances en el mercado de azúcar y edulcorantes industriales de Carolina del Norte, Carolina del Sur y Virginia

- En abril de 2024, Ingredion presentó una innovadora solución de stevia que superó a los productos de la competencia en las pruebas de sabor de los consumidores. Este nuevo edulcorante ofrece a los fabricantes de alimentos y bebidas una opción superior para la reducción de azúcar, lo que les permite satisfacer la creciente demanda de productos más saludables y con menos azúcar. Al mantener un sabor excelente y un perfil de etiqueta limpia, la innovación de Ingredion fortalece su posición en el mercado de edulcorantes naturales e impulsa el crecimiento de sus aplicaciones en panadería, bebidas y alimentos procesados. Este desarrollo refuerza la tendencia de la industria hacia ingredientes funcionales y saludables.

- En enero de 2024, Cargill Incorporated lanzó su edulcorante de stevia EverSweet, que aprovecha un proceso de fermentación patentado para mejorar el sabor y conservar su origen natural. Este avance aborda un desafío clave en el segmento de la stevia: el regusto amargo, lo que permite a los fabricantes ofrecer productos dulces con un sabor más limpio. Al mejorar la versatilidad del producto en aplicaciones de alimentos y bebidas, EverSweet posiciona a Cargill para capitalizar la creciente demanda de edulcorantes naturales bajos en calorías, ampliando aún más su influencia en el mercado.

- En agosto de 2024, ADM recibió el Premio al Liderazgo en Sostenibilidad 2024 otorgado por Business Intelligence Group. Este galardón destaca el compromiso estratégico de ADM con las prácticas e innovaciones sostenibles, consolidando su reputación como líder del mercado en la producción de azúcar y edulcorantes con responsabilidad ambiental y social. Es probable que este reconocimiento aumente el valor y la influencia de la marca ADM, especialmente entre los consumidores preocupados por la salud y la sostenibilidad, impulsando aún más la adopción de sus productos en los mercados globales.

- En abril de 2023, SweeGen, Inc. presentó los sabores Sweetensify, una nueva herramienta para fabricantes de alimentos y bebidas diseñada para crear productos más saludables y con menos azúcar. Impulsada por una novedosa tecnología de proteína dulce, que incluye brazeína y taumatina II, Sweetensify potencia y modula el dulzor para imitar el perfil de sabor del azúcar. Esta innovación amplía las oportunidades en el mercado de edulcorantes funcionales y naturales, permitiendo a los fabricantes desarrollar productos que satisfagan la demanda de los consumidores de opciones más saludables sin sacrificar el sabor.

- En marzo de 2022, Cargill Incorporated lanzó la plataforma EverSweet ClearFlo, una línea de edulcorantes a base de stevia diseñada para un sabor más limpio y una mayor versatilidad en aplicaciones de alimentos y bebidas. Mediante un proceso de fermentación patentado para optimizar los glicósidos de esteviol, la plataforma ofrece a los fabricantes una solución práctica para reducir el azúcar, manteniendo el dulzor y el atractivo del sabor. Este desarrollo consolidó la posición competitiva de Cargill en el mercado de edulcorantes naturales, respondiendo a la creciente tendencia global hacia productos bajos en calorías y saludables.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.