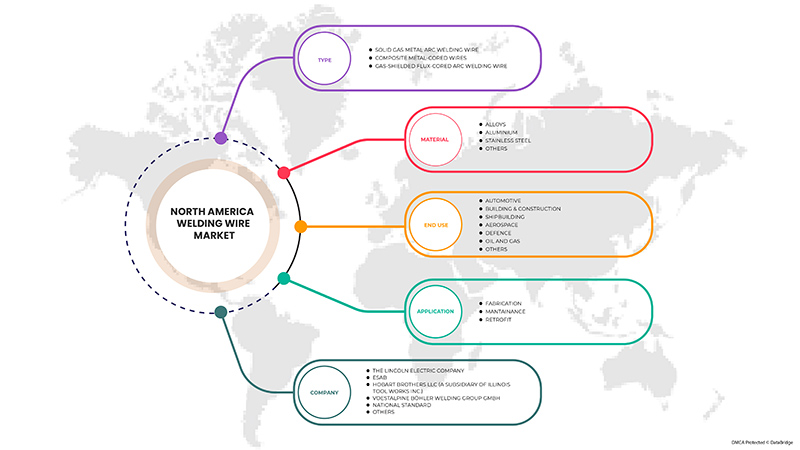

Mercado de alambres de soldadura de América del Norte, por tipo (alambre de soldadura por arco metálico con gas sólido, alambres compuestos con núcleo de metal y alambre de soldadura por arco con núcleo de fundente con protección de gas), material (aleaciones, acero inoxidable, aluminio y otros), aplicación (fabricación, mantenimiento y modernización), uso final (automotriz, construcción y edificación, aeroespacial, defensa, petróleo y gas, construcción naval y otros): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de alambres de soldadura de América del Norte

La soldadura se utiliza ampliamente en la industria automotriz para fabricar diversas piezas de vehículos. También se utilizan en la industria del transporte para unir rieles en proyectos ferroviarios o de metro, ya que las soldaduras proporcionan una unión sin costuras, robusta y duradera. Esto ha aumentado el uso de la soldadura como proceso de fabricación, aumentando así la demanda de alambres de soldadura. Se espera que el creciente número de refinerías y sistemas de suministro en la industria del petróleo y el gas y las instalaciones de tratamiento y suministro de agua impulsen el crecimiento del mercado de alambres de soldadura de América del Norte. La facilidad de uso y la buena resistencia de la unión actúan como un beneficio para los compradores potenciales. La disponibilidad de una amplia gama de alambres de soldadura en el mercado para varios tipos de soldadura se suma aún más al crecimiento del mercado de alambres de soldadura de América del Norte.

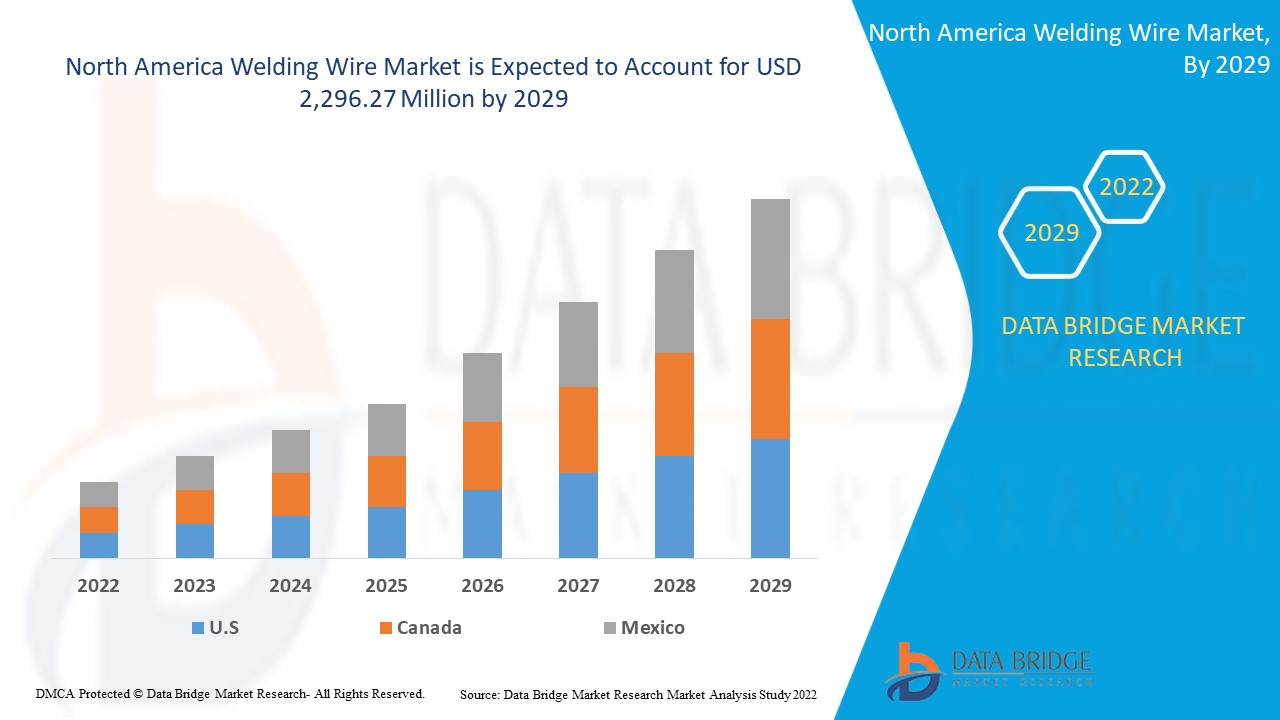

Data Bridge Market Research analiza que se espera que el mercado de alambres de soldadura de América del Norte alcance los 2296,27 millones de dólares en 2029, con una tasa de crecimiento anual compuesta (CAGR) del 2,7 % durante el período de pronóstico. El informe del mercado de alambres de soldadura también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en kilotoneladas, precios en USD |

|

Segmentos cubiertos |

Por tipo (alambre para soldadura por arco de metal con gas sólido, alambres con núcleo de metal compuesto y alambre para soldadura por arco con núcleo de fundente con protección de gas), material (aleaciones, acero inoxidable, aluminio y otros), aplicación (fabricación, mantenimiento y modernización), uso final (automotriz, construcción, aeroespacial, defensa, petróleo y gas, construcción naval y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Voestalpine Böhler Welding Group GmbH, The Lincoln Electric Company, Berkenhoff GmbH, Saarstahl AG, US Titanium Industry Inc., KOBE STEEL, LTD., ESAB, WeldWire, Venus Wire Industries Pvt. Ltd., National Standard, American Welding Products, Inc., LUVATA y Hobart Brothers LLC (una subsidiaria de Illinois Tool Works Inc.). |

Definición de mercado

Los alambres de soldadura, comúnmente denominados consumibles de soldadura, son varillas metálicas delgadas que se encienden cuando se aplica electricidad, creando un arco caliente que luego se utiliza para fusionar componentes metálicos. Los alambres de soldadura se funden al unir dos metales para servir como material de relleno , fortalecer la unión y, de ese modo, proteger la soldadura fundida de diversas contenciones atmosféricas. Dado que los alambres de soldadura son un producto consumible que tiene una gran demanda, se prevé que el mercado de alambres de soldadura crezca significativamente durante los años pronosticados.

Dinámica del mercado del alambre de soldadura

Esta sección trata sobre la comprensión de los impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos.

Conductores

- Aumento de las actividades de construcción e ingeniería en toda la región

Las industrias de la construcción y la ingeniería son responsables de crear todo tipo de estructuras con diferentes tamaños, niveles de complejidad y usos. ''La integridad estructural del armazón y la durabilidad de los componentes son las consideraciones más importantes en esta industria. Es por eso que la industria de la construcción emplea una gran cantidad de metales. Las tecnologías de soldadura se utilizan ampliamente en la construcción, principalmente para fabricar armazones metálicos estructuralmente sólidos mediante la fusión de varios componentes. También se utiliza para crear y mantener detalles no estructurales. Por lo tanto, el aumento de las actividades de construcción e ingeniería en toda la región está impulsando el crecimiento del mercado.

- Avances tecnológicos en consumibles y alambre de soldadura

En la actualidad, se utilizan múltiples alambres para aumentar la productividad en los diversos procesos de soldadura, lo que permite una velocidad de soldadura notablemente mayor para acero, acero inoxidable y aluminio. Otra nueva forma de mejorar la productividad es utilizar alambres de relleno dobles. Ambos alambres se pueden conectar a la misma unidad de potencia, lo que significa que comparten un arco familiar. Este método también se conoce como arco doble. Los procesos de dos alambres, como la soldadura en tándem y el alambre de soldadura doble, se clasifican en función de si se aplica un potencial común o dos separados al alambre. En los últimos años, la soldadura en tándem se ha establecido como un método de unión confiable en la soldadura de alto rendimiento. Satisface la demanda de soldadura mecanizada moderna, lo que aumenta la productividad. Estos avances tecnológicos están impulsando el crecimiento del mercado.

Oportunidad

- Aumento de las actividades de desarrollo y expansión empresarial por parte de las organizaciones

La expansión del negocio podría conectar a más personas con los productos y servicios de la empresa. Podrán convertir más clientes e impulsar sus ventas al expandir la base de clientes. Como resultado de esto, las ganancias pueden aumentar en el futuro. Los clientes son cruciales para el éxito de cualquier empresa, al igual que los miembros del equipo. Además, la empresa puede estar mejor posicionada para obtener la financiación necesaria si puede expandirse con éxito. Este capital puede ser un salvavidas para la empresa durante el proceso de expansión y, una vez que se haya producido la expansión, aún pueden confiar en él. Esto ayuda a generar conciencia y aumentar las ganancias de la organización y crea un margen para el crecimiento sostenible. Además, esto ayuda a la empresa a obtener reconocimiento en el mercado premium. Un número cada vez mayor de desarrollos comerciales y actividades de expansión por parte de las organizaciones están creando muchas oportunidades para los actores del mercado.

Restricción/Desafío

- Costos más elevados asociados con los alambres de soldadura y los consumibles

En el mundo actual, los fabricantes tienen muchas opciones para decidir el mejor proceso de soldadura y los consumibles que se utilizarán en una aplicación en particular. Hay que tener en cuenta muchas cuestiones, como la habilidad del soldador, el equipo, la disponibilidad de los consumibles, las cuestiones medioambientales y la economía del proceso. Al decidir la implementación de cualquier proceso de fabricación, los soldadores siempre buscan una solución viable con un proceso de bajo coste. Además, las actividades previas y posteriores a la soldadura, el flujo de productos, la gestión del inventario y el equipo afectan a la calidad, la productividad y la rentabilidad de las operaciones de soldadura. El metal de aportación es esencial, ya que puede crear costes de muchas formas que pueden no ser inmediatamente evidentes. Estos costes ocultos pueden generar una gran diferencia entre mantener una operación de soldadura rentable y competitiva y mantenerse al día con el resto de la industria.

- Aumento de los costes laborales en el proceso de soldadura

Los costes de mano de obra representan una parte importante de los costes totales de soldadura. Un soldador recibe una remuneración por hora y tiene una capacidad limitada para completar una cantidad determinada de componentes por hora. Por supuesto, esta cifra puede variar en función de la formación y la experiencia del soldador. Un soldador solo puede producir una cierta cantidad de material soldado durante el tiempo de trabajo asignado. Como se deben cumplir diversos requisitos para las operaciones de soldadura y los salarios por hora de los trabajadores aumentan día a día, los gastos de soldadura han aumentado naturalmente.

Impacto posterior al COVID-19 en el mercado de alambres de soldadura

El COVID-19 afectó significativamente el mercado de alambres de soldadura, ya que casi todos los países optaron por cerrar todas las instalaciones de producción, excepto aquellas dedicadas a producir bienes esenciales.

La pandemia de COVID-19 ha afectado al mercado de alambres de soldadura de manera negativa. Por lo tanto, el mercado ha tenido una tasa de crecimiento interanual estimada más baja en comparación con 2019 debido a la menor actividad en los sectores asociados con el mercado de alambres de soldadura. Sin embargo, el crecimiento ha sido alto desde que se abrió el mercado después de COVID-19 y se espera que haya un crecimiento considerable en el sector debido a la creciente demanda de las industrias automotriz, de construcción y edificación.

Los fabricantes y proveedores de soluciones están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el alambre de soldadura. Con esto, las empresas traerán tecnologías avanzadas al mercado. Además, las iniciativas gubernamentales para el uso de vehículos eléctricos han impulsado el crecimiento del mercado.

Acontecimientos recientes

- En noviembre de 2021, Hobart Brothers LLC presentó su nuevo alambre tubular con protección de gas llamado FabCO 91K2-M. Sin comprometer la calidad ni las propiedades mecánicas, estos nuevos alambres brindan a los operadores la flexibilidad de trabajar dentro de una gama más amplia de parámetros de soldadura. Esto mejorará la cartera de productos de la empresa.

- En octubre de 2019, voestalpine Böhler Welding Group GmbH inauguró su primera planta de fabricación en EE. UU. La producción local es un paso crucial para que voestalpine Böhler Welding amplíe aún más su línea de productos en EE. UU. Esto aumentará el alcance global de la empresa.

Alcance del mercado de alambres de soldadura en América del Norte

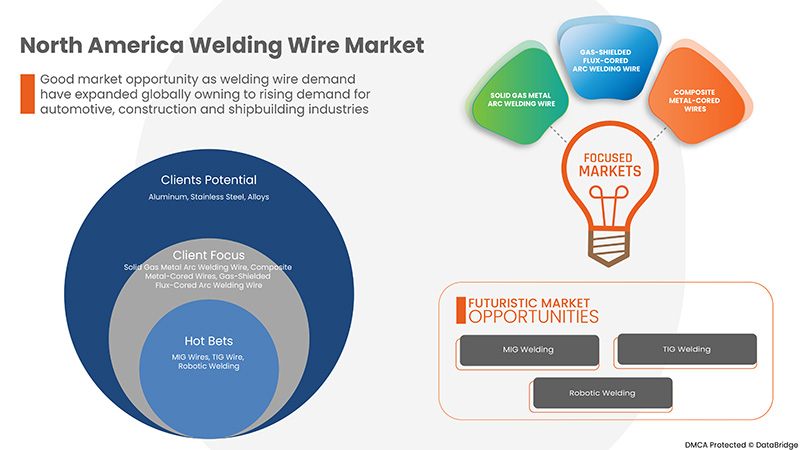

El mercado de alambre de soldadura está segmentado según el tipo, el material, la aplicación y el uso final.

El crecimiento entre estos segmentos le ayudará a analizar segmentos de crecimiento magros en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar aplicaciones de mercado centrales.

Tipo

- Alambre para soldadura por arco metálico con gas sólido

- Alambres compuestos con núcleo metálico

- Alambre de soldadura por arco con núcleo fundente y protección de gas

Según el tipo, el mercado de alambres de soldadura de América del Norte está segmentado en alambres de soldadura por arco metálico con gas sólido, alambres con núcleo metálico compuesto y alambres de soldadura por arco con núcleo fundente protegido con gas.

Material

- Aleaciones

- Acero inoxidable

- Aluminio

- Otros

Sobre la base del material, el mercado de alambre de soldadura de América del Norte se ha segmentado en aleaciones, acero inoxidable, aluminio y otros.

Solicitud

- Fabricación

- Reparación y mantenimiento

- Modernización

Sobre la base de la aplicación, el mercado de alambre de soldadura de América del Norte está segmentado en fabricación, reparación y mantenimiento y modernización.

Uso final

- Automotor

- Construcción y edificación

- Aeroespacial

- Defensa

- Petróleo y gas

- Construcción naval

- Otros

Sobre la base del uso final, el mercado de alambre de soldadura de América del Norte está segmentado en automotriz, construcción y edificación, aeroespacial, defensa, petróleo y gas, construcción naval y otros.

Análisis y perspectivas regionales del mercado de alambres de soldadura

Se analiza el mercado de alambre de soldadura y se proporcionan información y tendencias del tamaño del mercado por país, material, tipo, aplicación y uso final como se menciona anteriormente.

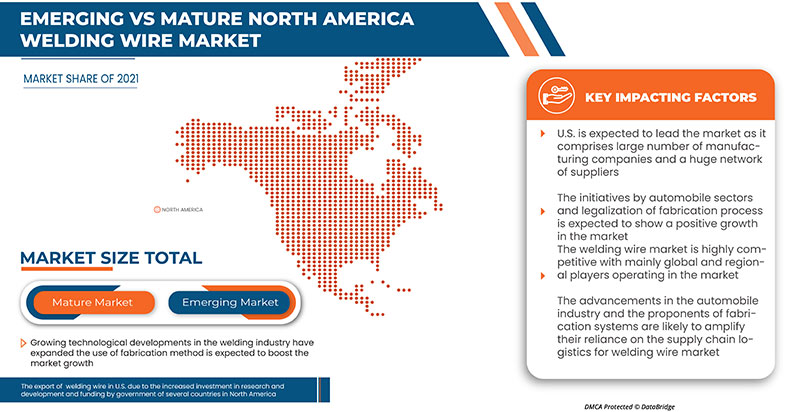

Los países incluidos en el informe sobre el mercado de alambres para soldadura son Estados Unidos, Canadá y México. Estados Unidos domina la región de América del Norte gracias a su infraestructura industrial desarrollada, iniciativas gubernamentales e inversiones en programas de capacitación en tecnología de soldadura.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del alambre de soldadura

El panorama competitivo del mercado de alambres para soldadura de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de alambres para soldadura.

Algunos de los principales actores que operan en el mercado de alambre de soldadura de América del Norte son voestalpine Böhler Welding Group GmbH, The Lincoln Electric Company, Berkenhoff GmbH, Saarstahl AG, US Titanium Industry Inc., KOBE STEEL, LTD., ESAB, WeldWire, Venus Wire Industries Pvt. Ltd., National Standard, American Welding Products, Inc., LUVATA y Hobart Brothers LLC (una subsidiaria de Illinois Tool Works Inc.), entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WELDING WIRE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END-USE COVERAGE GRID

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION-CONSUMPTION ANALYSIS

4.2 IMPORT-EXPORT SCENARIO

4.3 RAW MATERIAL PRODUCTION COVERAGE

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.5 PRICE ANALYSIS

4.6 LIST OF KEY BUYERS

4.7 PORTER'S FIVE FORCE ANALYSIS

4.8 VENDOR SELECTION CRITERIA

4.9 PESTEL ANALYSIS

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT'S ROLE

5.4 ANALYST RECOMMENDATION

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING CONSTRUCTION AND ENGINEERING ACTIVITIES ACROSS THE REGION

7.1.2 TECHNOLOGICAL ADVANCEMENTS IN CONSUMABLES AND WELDING WIRE

7.1.3 RISE IN DEMAND FOR VARIOUS WELDING WIRES IN THE AUTOMOTIVE INDUSTRY

7.2 RESTRAINTS

7.2.1 HIGHER COSTS ASSOCIATED WITH WELDING WIRES AND CONSUMABLES

7.2.2 EMISSION OF HARMFUL GASES WHILE PERFORMING WELDING OPERATIONS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN BUSINESS DEVELOPMENT AND EXPANSION ACTIVITIES BY ORGANIZATIONS

7.3.2 PENETRATION OF AUTOMATION IN VARIOUS WELDING PROCESS

7.3.3 GOVERNMENT INITIATIVES AND INVESTMENTS FOR WELDING PROFESSIONALS

7.4 CHALLENGES

7.4.1 LACK OF SKILLED WELDING PROFESSIONALS IN NORTH AMERICA

7.4.2 INCREASING LABOR COSTS IN THE WELDING PROCESS

8 NORTH AMERICA WELDING WIRE MARKET, BY TYPE

8.1 OVERVIEW

8.2 SOLID GAS METAL ARC WELDING WIRE

8.3 COMPOSITE METAL-CORED WIRES

8.4 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

9 NORTH AMERICA WELDING WIRE MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 ALUMINUM

9.3 STAINLESS STEEL

9.4 ALLOYS

9.5 OTHERS

10 NORTH AMERICA WELDING WIRE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FABRICATION

10.3 REPAIR & MAINTENANCE

10.4 RETROFIT

11 NORTH AMERICA WELDING WIRE MARKET, BY END-USE

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 SOLID GAS METAL ARC WELDING WIRE

11.2.2 COMPOSITE METAL-CORED WIRES

11.2.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.3 BUILDING & CONSTRUCTION

11.3.1 SOLID GAS METAL ARC WELDING WIRE

11.3.2 COMPOSITE METAL-CORED WIRES

11.3.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.4 SHIPBUILDING

11.4.1 SOLID GAS METAL ARC WELDING WIRE

11.4.2 COMPOSITE METAL-CORED WIRES

11.4.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.5 AEROSPACE

11.5.1 SOLID GAS METAL ARC WELDING WIRE

11.5.2 COMPOSITE METAL-CORED WIRES

11.5.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.6 DEFENCE

11.6.1 SOLID GAS METAL ARC WELDING WIRE

11.6.2 COMPOSITE METAL-CORED WIRES

11.6.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.7 OIL & GAS

11.7.1 SOLID GAS METAL ARC WELDING WIRE

11.7.2 COMPOSITE METAL-CORED WIRES

11.7.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

11.8 OTHERS

11.8.1 SOLID GAS METAL ARC WELDING WIRE

11.8.2 COMPOSITE METAL-CORED WIRES

11.8.3 GAS-SHIELDED FLUX-CORED ARC WELDING WIRE

12 NORTH AMERICA

12.1 U.S.

12.2 CANADA

12.3 MEXICO

13 NORTH AMERICA WELDING WIRE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 THE LINCOLN ELECTRIC COMPANY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 ESAB

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 HOBART BROTHERS LLC (A SUBSIDIARY OF ILLINOIS TOOL WORKS INC.)

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 VOESTALPINE BÖHLER WELDING GROUP GMBH

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 BRAND PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 NATIONAL STANDARD

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 VENUS WIRE INDUSTRIES PVT. LTD

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 SAARSTAHL AG (A SUBSIDIARY OF STAHL-HOLDING-SAAR (SHS) GROUP)

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AMERICAN WELDING PRODUCTS, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BERKENHOFF GMBH

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 KOBE STEEL, LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 U.S. TITANIUM INDUSTRY INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 WELDWIRE

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 EXPORTS OF WELDING WIRES FROM THE U.S.

TABLE 2 AVERAGE PRICE RANGE OF WELDING WIRES IN THE U.S.

TABLE 3 HEALTH EFFECTS OF HAZARDOUS FUMES DURING WELDING

TABLE 4 NORTH AMERICA WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA WELDING WIRE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 NORTH AMERICA WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 8 NORTH AMERICA WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 10 NORTH AMERICA WELDING WIRE MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA WELDING WIRE MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 12 NORTH AMERICA AUTOMOTIVE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA BUILDING & CONSTRUCTION IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SHIPBUILDING IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA AEROSPACE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DEFENCE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OIL & GAS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA WELDING WIRE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA WELDING WIRE MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 21 U.S. WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 U.S. WELDING WIRE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 23 U.S. WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 24 U.S. WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 25 U.S. WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 U.S. WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 27 U.S. WELDING WIRE MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 28 U.S. WELDING WIRE MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 29 U.S. AUTOMOTIVE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. BUILDING & CONSTRUCTION IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. SHIPBUILDING IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. AEROSPACE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. DEFENCE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. OIL & GAS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. OTHERS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 CANADA WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 CANADA WELDING WIRE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 38 CANADA WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 39 CANADA WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 40 CANADA WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 CANADA WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 42 CANADA WELDING WIRE MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 43 CANADA WELDING WIRE MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 44 CANADA AUTOMOTIVE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 CANADA BUILDING & CONSTRUCTION IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 CANADA SHIPBUILDING IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 CANADA AEROSPACE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA DEFENCE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA OIL & GAS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA OTHERS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 MEXICO WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MEXICO WELDING WIRE MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 53 MEXICO WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 54 MEXICO WELDING WIRE MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 55 MEXICO WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 MEXICO WELDING WIRE MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 57 MEXICO WELDING WIRE MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 MEXICO WELDING WIRE MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 59 MEXICO AUTOMOTIVE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO BUILDING & CONSTRUCTION IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO SHIPBUILDING IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO AEROSPACE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO DEFENCE IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO OIL & GAS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO OTHERS IN WELDING WIRE MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA WELDING WIRE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WELDING WIRE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WELDING WIRE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WELDING WIRE MARKET: REGIONAL VS. COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WELDING WIRE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WELDING WIRE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WELDING WIRE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WELDING WIRE MARKET: MARKET END-USE COVERAGE GRID

FIGURE 9 NORTH AMERICA WELDING WIRE MARKET: SEGMENTATION

FIGURE 10 INCREASE IN CONSTRUCTION AND ENGINEERING ACTIVITIES IS EXPECTED TO DRIVE THE NORTH AMERICA WELDING WIRE MARKET IN THE FORECAST PERIOD

FIGURE 11 SOLID GAS METAL ARC WELDING WIRE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WELDING WIRE MARKET IN 2022 & 2029

FIGURE 12 U.S. WELDING MATERIAL CONSUMPTION

FIGURE 13 IMPORTS OF WELDING WIRES IN THE U.S. (2011-2021)

FIGURE 14 PRODUCTION OF IRON ORE IN THE U.S.

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WELDING WIRE MARKET

FIGURE 16 NORTH AMERICA WELDING WIRE MARKET, BY TYPE, 2021 (USD MILLION)

FIGURE 17 NORTH AMERICA WELDING WIRE MARKET, BY MATERIAL, 2021 (USD MILLION)

FIGURE 18 NORTH AMERICA WELDING WIRE MARKET, BY APPLICATION, 2021 (USD MILLION)

FIGURE 19 NORTH AMERICA WELDING WIRE MARKET, BY END-USE, 2021 (USD MILLION)

FIGURE 20 NORTH AMERICA WELDING WIRE MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA WELDING WIRE MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA WELDING WIRE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA WELDING WIRE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA WELDING WIRE MARKET: BY TYPE (2022-2029)

FIGURE 25 NORTH AMERICA WELDING WIRE MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.