Mercado de camas plegables en América del Norte, por operación (manual y automática), tipo (cama individual y cama doble), canal de distribución (en línea y fuera de línea), uso final (residencial y no residencial), país (EE. UU., Canadá y México), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado : mercado de camas abatibles en América del Norte

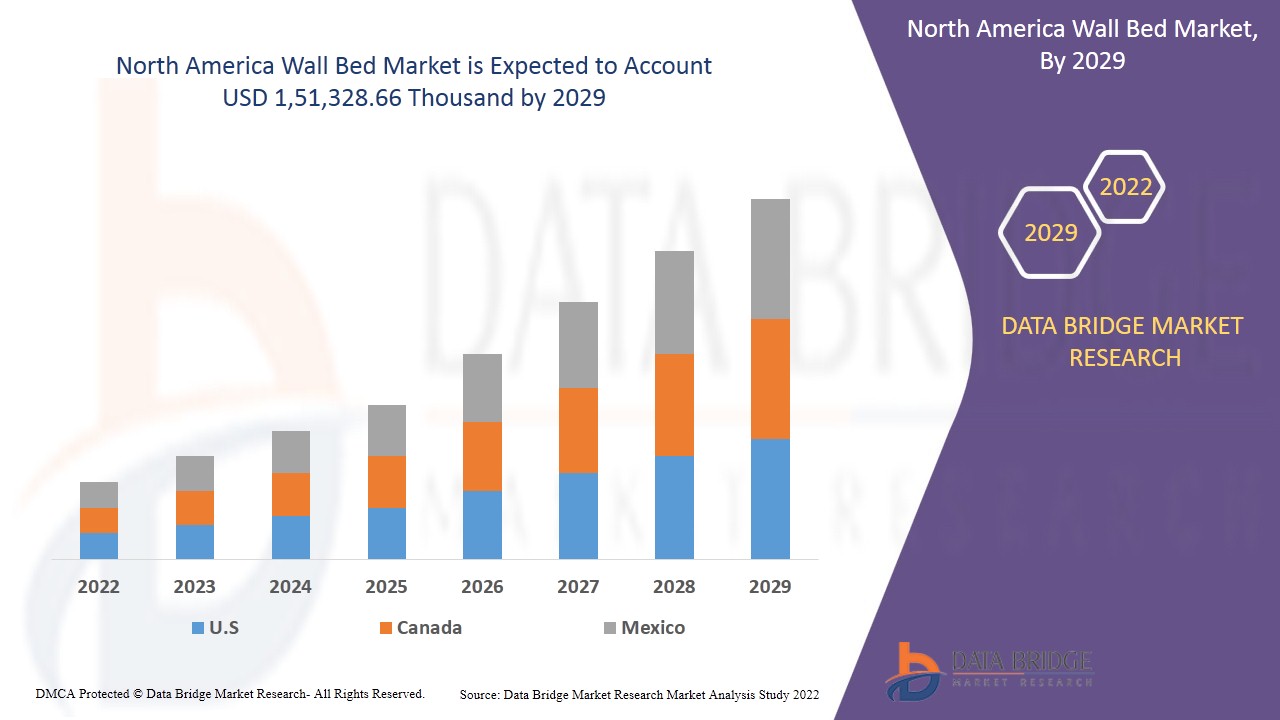

Se espera que el mercado de camas abatibles de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 3,7% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 1,51,328.66 mil para 2029. Se espera que el aumento de la población y el concepto generalizado de co-living impulsen el crecimiento del mercado de camas abatibles de América del Norte.

Las camas abatibles se utilizan para ahorrar espacio y son populares en lugares donde el espacio en el piso es limitado, como en casas pequeñas, departamentos, hoteles, casas móviles y residencias universitarias. En los últimos años, las unidades de camas abatibles han tenido opciones como iluminación, gabinetes de almacenamiento y componentes de oficina. La mayoría de las camas abatibles no tienen somieres. En cambio, el colchón generalmente se coloca sobre una plataforma o malla y se mantiene en su lugar para que no se hunda cuando está en posición cerrada. El colchón está sujeto al marco de la cama, a menudo con correas elásticas para mantener el colchón en su posición cuando la unidad está plegada en posición vertical.

Desde el primer modelo de cama abatible, se han creado otras variantes y diseños, entre los que se incluyen camas de montaje lateral, literas y soluciones que incluyen otras funciones como armarios de oficina y opciones de iluminación. Se están haciendo populares las camas abatibles con mesas o escritorios que se pliegan cuando se pliega la cama, y también hay modelos con sofás y soluciones de estanterías.

Se prevé que el aumento de la población y el concepto generalizado de convivencia impulsen el crecimiento del mercado de camas abatibles en América del Norte. Además, el aumento del nivel de vida y la concienciación sobre la decoración del hogar han impulsado el crecimiento del mercado de camas abatibles. Esto ha aumentado la demanda de camas abatibles debido a los espacios reducidos y al uso multipropósito de estas camas abatibles. Por otro lado, la principal restricción que puede obstaculizar el mercado de camas abatibles en América del Norte es el alto costo de las camas abatibles en comparación con las camas normales.

Se espera que el creciente uso de camas abatibles en la construcción de apartamentos tipo estudio genere oportunidades para el mercado de camas abatibles de América del Norte. Sin embargo, las camas abatibles no son adecuadas para personas que alquilan, lo que puede suponer un desafío para el crecimiento del mercado en el futuro cercano.

Este informe sobre el mercado de camas abatibles de América del Norte proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de nuevos segmentos de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de camas plegables en América del Norte

El mercado de camas abatibles de América del Norte está segmentado en función de la operación, el tipo, el canal de distribución y el uso final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función de su funcionamiento, el mercado de camas abatibles de América del Norte se segmenta en automático y manual. En 2022, se espera que el segmento automático domine el mercado de camas abatibles de América del Norte, ya que las camas abatibles operadas automáticamente son fáciles de plegar y desplegar, lo que probablemente impulsará la demanda en el año de pronóstico. Incluso a los niños y a las personas mayores les resulta cómodo utilizarlas sin la ayuda de nadie.

- En función del tipo, el mercado de camas abatibles de América del Norte se segmenta en camas individuales y camas dobles. En 2022, se espera que el segmento de camas individuales domine el mercado de camas abatibles de América del Norte, ya que ofrece la comodidad de dormir en la cama y sirve como almacenamiento o mesa cuando no se utiliza. Además, las camas individuales tienen una gran demanda entre las personas que viven en apartamentos tipo estudio que tienen menos espacio para muebles.

- En función del canal de distribución, el mercado de camas abatibles de América del Norte se segmenta en online y offline. En 2022, se espera que el segmento offline domine el mercado de camas abatibles de América del Norte, ya que muchas personas prefieren visitar tiendas y comprobar la calidad de las camas abatibles, y también las compras al por mayor se realizan offline en la mayoría de los casos. Se espera que esto ayude al crecimiento de este segmento en el período de pronóstico.

- En función del uso final, el mercado de camas abatibles de América del Norte se segmenta en residencial y no residencial. En 2022, se espera que el segmento residencial domine el mercado de camas abatibles de América del Norte. Estas camas ahorran mucho espacio que se puede utilizar como áreas de estar o áreas de juego para niños, lo que se espera que impulse su demanda en el período de pronóstico.

Análisis a nivel de país del mercado de camas abatibles de América del Norte

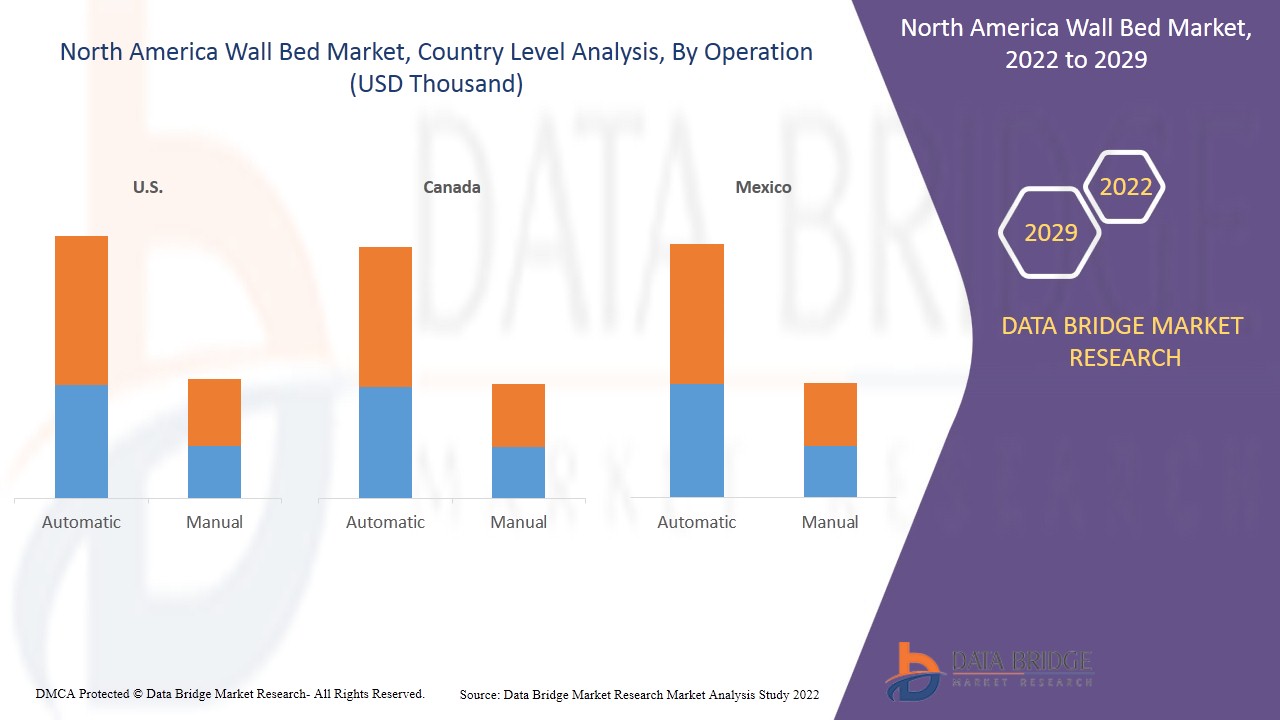

Se analiza el mercado de camas plegables de América del Norte y se proporciona información sobre el tamaño del mercado por país, operación, tipo, canal de distribución y uso final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de camas plegables de América del Norte son EE. UU., Canadá y México.

Se espera que Estados Unidos domine el mercado de camas abatibles de América del Norte debido a la alta demanda de los usuarios residenciales. Se espera que Canadá domine el mercado de camas abatibles de América del Norte debido al creciente nivel de vida y la conciencia de la decoración del hogar en esta región. Se espera que México domine el mercado de camas abatibles de América del Norte debido a la mejora del nivel de vida y el aumento de los ingresos disponibles y la urbanización en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Aumento de la población y generalización del concepto de convivencia

El mercado de camas abatibles de América del Norte también le proporciona un análisis detallado del mercado de cada país: el crecimiento de la base instalada de diferentes tipos de productos para el mercado de camas abatibles, el impacto de la tecnología que utiliza curvas de línea de vida y los cambios en las técnicas de producción, los escenarios regulatorios y su impacto en el mercado de camas abatibles. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de camas plegables en América del Norte

El panorama competitivo del mercado de camas abatibles de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los proyectos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en relación con el mercado de camas abatibles de América del Norte.

Algunos de los principales actores del mercado de camas abatibles de América del Norte son SICO Incorporated, Wilding Wallbeds, Wall Beds Manufacturing, Inc., Zoom Room Inc, BOFF Wall Beds, Twin Cities Closet Company, Wallbeds “n” more, Wallbeds & Closets North West, Bestar Modern Home and Office furniture, The Bedder Way Co., Murphy Wall Beds Hardware Inc., Modern Furniture and Interior Design, Superior Wall Beds, entre otros actores nacionales e internacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Por ejemplo,

- En enero de 2020, Bestar Modern Home and Office Furniture anunció su asociación de capital privado con MB Capital. Este desarrollo ha ayudado a la empresa a expandir su negocio.

- En enero de 2020, Bestar Modern Home and Office Furniture adquirió Bush Industries, un importante fabricante estadounidense de muebles de oficina y de artículos listos para usar para el hogar y la oficina. Este avance ha ayudado a la empresa a atraer más clientes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WALL BED MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 DEMOGRAPHIC ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING POPULATION AND WIDESPREAD CONCEPT OF CO-LIVING

5.1.2 GROWING INSTALLATION OF WALL BEDS IN THE HOSPITALITY INDUSTRY

5.1.3 INCREASING AWARENESS REGARDING HOME DÉCOR AND HOME FURNISHING

5.1.4 IMPROVED STANDARD OF LIVING COUPLED WITH RISING DISPOSABLE INCOME AND URBANIZATION

5.2 RESTRAINTS

5.2.1 HIGH COST OF WALL BEDS AS COMPARED TO NORMAL BEDS

5.2.2 AVAILABILITY OF MULTIPURPOSE SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING USE IN THE CONSTRUCTION OF STUDIO APARTMENTS

5.4 CHALLENGES

5.4.1 WALL BEDS ARE NOT SUITABLE FOR PEOPLE WHO ARE RENTING

5.4.2 WALL BEDS ARE NOT PORTABLE AND REQUIRE A WALL MOUNTING SYSTEM

6 IMPACT OF COVID 19 IMPACT ON THE NORTH AMERICA WALL BED MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA WALL BED MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE GLOBAL PACKAGING PRINITNG MARKET

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA WALL BED MARKET, BY OPERATION

7.1 OVERVIEW

7.2 AUTOMATIC

7.3 MANUAL

8 NORTH AMERICA WALL BED MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE BED

8.3 DOUBLE BED

9 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 OFFLINE

9.3 ONLINE

10 NORTH AMERICA WALL BED MARKET, BY END USE

10.1 OVERVIEW

10.2 RESIDENTIAL

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 NON-RESIDENTIAL

10.3.1 OFFLINE

10.3.2 ONLINE

11 NORTH AMERICA WALL BED MARKET, BY COUNTRY

11.1 U.S.

11.2 CANADA

11.3 MEXICO

12 NORTH AMERICA WALL BED MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 PARTNERSHIP & ACQUISITION

12.3 PRODUCT DEVELOPMENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 SICO INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT UPDATE

14.2 WILDING WALLBEDS

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT UPDATE

14.3 WALL BEDS MANUFACTURING, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT UPDATES

14.4 ZOOM ROOM INC

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT UPDATE

14.5 B.O.F.F. WALL BEDS

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATE

14.6 BESTAR MODERN HOME AND OFFICE FURNITURE

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 MODERN FURNITURE AND INTERIOR DESIGN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 MURPHY WALL BEDS HARDWARE INC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 SUPERIOR WALL BEDS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 THE BEDDER WAY CO

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 TWIN CITIES CLOSET COMPANY

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 WALLBEDS “N” MORE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 WALLBEDS & CLOSETS NORTH WEST

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF WOODEN FURNITURE FOR BEDROOMS; HS CODE - 940350 (USD THOUSAND)

TABLE 2 EXPORT DATA OF WOODEN FURNITURE FOR BEDROOMS; HS CODE - 940350 (USD THOUSAND)

TABLE 3 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 4 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA WALL BED MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA WALL BED MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 12 U.S. WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 13 U.S. WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 14 U.S. WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 15 U.S. WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 16 U.S. WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 17 U.S. RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 18 U.S. NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 19 CANADA WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 20 CANADA WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 21 CANADA WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 22 CANADA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 23 CANADA WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 24 CANADA RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 25 CANADA NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 26 MEXICO WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 27 MEXICO WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 28 MEXICO WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 29 MEXICO WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 30 MEXICO WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 31 MEXICO RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 32 MEXICO NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

Lista de figuras

FIGURE 1 NORTH AMERICA WALL BED MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WALL BED MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WALL BED MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WALL BED MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WALL BED MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WALL BED MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA WALL BED MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA WALL BED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA WALL BED MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA WALL BED MARKET: END USE COVERAGE GRID

FIGURE 11 NORTH AMERICA WALL BED MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA WALL BED MARKET: SEGMENTATION

FIGURE 13 RISING POPULATION AND WIDESPREAD CONCEPT OF CO-LIVING IS DRIVING NORTH AMERICA WALL BED MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 AUTOMATIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WALL BED MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WALL BED MARKET

FIGURE 16 NORTH AMERICA POPULATION GROWTH RATE

FIGURE 17 URBANIZATION IN DIFFERENT REGIONS

FIGURE 18 RENTER OCCUPIED HOUSING UNITS IN U.S. IN QUARTER 4 OF 2015 TO 2021

FIGURE 19 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2021

FIGURE 20 NORTH AMERICA WALL BED MARKET, BY TYPE, 2021

FIGURE 21 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 NORTH AMERICA WALL BED MARKET, BY END USE, 2021

FIGURE 23 CONSTRUCTION OF SINGLE UNIT IN NORTH AMERICAN CITIES, 2020

FIGURE 24 NORTH AMERICA WALL BED MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA WALL BED MARKET: BY OPERATION (2022-2029)

FIGURE 29 NORTH AMERICA WALL BED MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.