Mercado de diagnóstico de trasplantes de América del Norte, por tipo de producto (instrumento de diagnóstico de trasplantes, software de diagnóstico de trasplantes, reactivo de diagnóstico de trasplantes), tecnología (ensayos moleculares basados en PCR, ensayos moleculares basados en secuenciación), tipo de trasplante (trasplante de órganos sólidos, trasplante de células madre, trasplante de tejidos blandos, trasplante de médula ósea, otros trasplantes), aplicación (aplicaciones de diagnóstico, aplicaciones de investigación), usuario final (laboratorios de investigación e institutos académicos, hospitales y centros de trasplantes, proveedores de servicios comerciales, otros), canal de distribución (licitación directa, ventas minoristas, otros) Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de diagnóstico de trasplantes en América del Norte

El diagnóstico de trasplantes es un procedimiento de diagnóstico que se suele dividir en procedimientos previos y posteriores al trasplante. Ayuda a analizar el estado de salud del paciente. Si esto se evita, la persona inmunodeprimida corre el riesgo de desarrollar una HAI o algo peor, lo que puede provocar la muerte. El procedimiento es una colaboración armoniosa entre los profesionales sanitarios y los expertos de laboratorio, lo que garantiza mejores resultados para el paciente. Además, es importante que haya una compatibilidad estrecha entre los marcadores HLA del donante y el receptor. Esto aumenta la probabilidad de supervivencia del injerto y minimiza las complicaciones graves del trasplante inmunológico. Es probable que la mayor prevalencia de enfermedades crónicas entre la población mundial impulse la expansión del mercado durante los años previstos. Además, el uso cada vez mayor de la terapia con células madre y de medicamentos personalizados está ganando popularidad. El uso de nuevas técnicas de diagnóstico ha mejorado los resultados médicos de los trasplantes de órganos. La tasa de rechazo de órganos se puede reducir haciendo coincidir la compatibilidad del donante y el receptor antes del trasplante.

Sin embargo, el alto costo de los procedimientos asociados con los instrumentos de diagnóstico por PCR y NGS es uno de los más significativos. Como resultado, el crecimiento del mercado puede verse obstaculizado a largo plazo. El costo del equipo médico es un elemento que puede suponer un desafío para los proveedores de dispositivos de diagnóstico de trasplantes críticos.

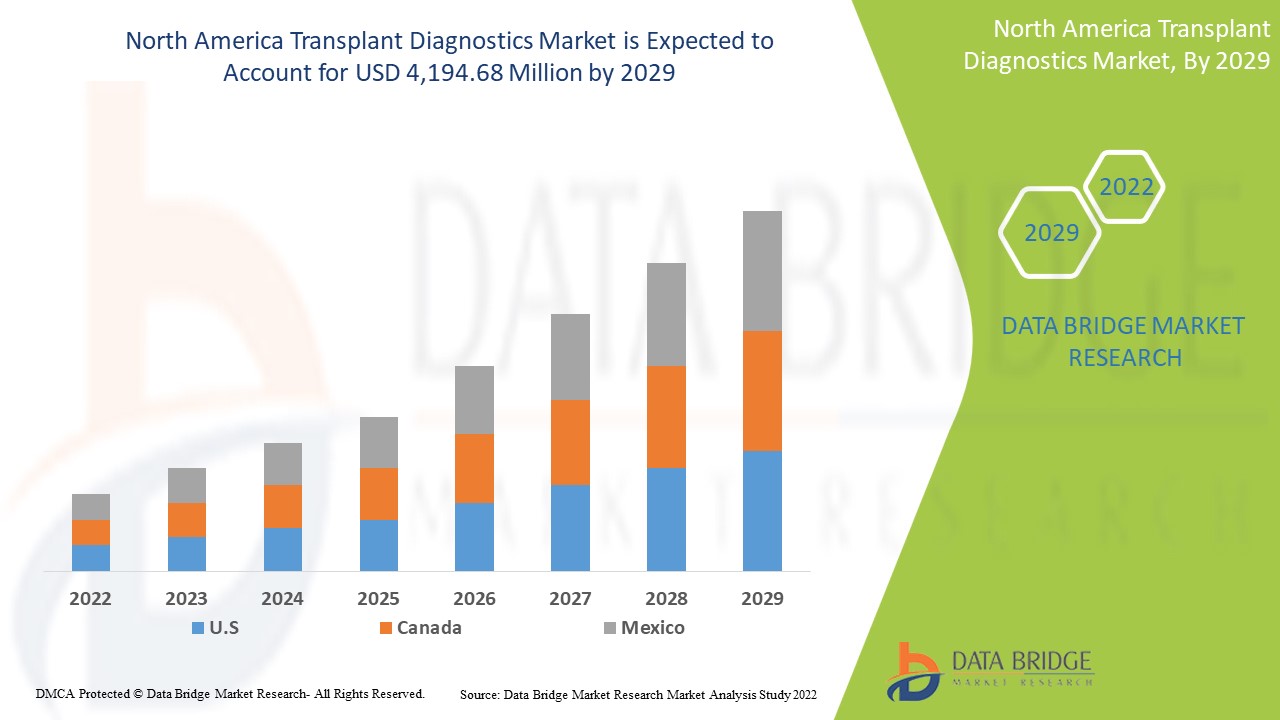

Data Bridge Market Research analiza que se espera que el mercado de diagnóstico de trasplantes de América del Norte alcance un valor de USD 4.194,68 millones para 2029, con una CAGR del 6,9 % durante el período de pronóstico. Este informe de mercado también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de producto (instrumento de diagnóstico de trasplantes, software de diagnóstico de trasplantes, reactivo de diagnóstico de trasplantes), tecnología ( ensayos moleculares basados en PCR , ensayos moleculares basados en secuenciación), tipo de trasplante (trasplante de órganos sólidos, trasplante de células madre, trasplante de tejidos blandos , trasplante de médula ósea , otros), aplicación (aplicaciones de diagnóstico, aplicaciones de investigación), usuario final (laboratorios de investigación e institutos académicos, hospitales y centros de trasplantes, proveedores de servicios comerciales, otros), canal de distribución (licitación directa, ventas minoristas y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Hologic, Inc., Biofortuna Limited, Takara Bio Inc., Abbott, Diagnóstica Longwood SL, Adaptive Biotechnologies, NanoString, Arquer Diagnostics Ltd, altona Diagnostics GmbH, ELITechGroup, DiaSorin SpA, Horiba Ltd, EUROFINS VIRACOR, CareDx Inc., Laboratory Corporation of America Holdings., Randox Laboratories Ltd., Thermo Fisher Scientific Inc., Preservation Solutions, Inc., TransMedics, Transonic, Stryker, Bio-Rad Laboratories, Inc., Zimmer Biomet, QIAGEN, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Illumina, Inc., Luminex Corporation (una filial de DiaSorin Company), IMMUCOR, entre otros. |

Definición de mercado

El diagnóstico de trasplantes es la inmunogenética y la histocompatibilidad de los trasplantes de órganos y células madre hematopoyéticas. Estos diagnósticos ayudan a los profesionales de la salud a determinar la compatibilidad entre los posibles receptores y los donantes de órganos. Estos se utilizan en varias disciplinas, como la inmunogenética, la patología y las enfermedades infecciosas, entre otras. El diagnóstico de trasplantes se utiliza para determinar si el donante y el receptor del órgano son compatibles antes o después del trasplante. Con la introducción del diagnóstico de trasplantes, se espera que la prevalencia de enfermedades que pueden causar insuficiencia orgánica, incluidas las pruebas de detección tanto previas como posteriores al trasplante, se dispare. El mercado ha atraído el interés de los profesionales de la salud debido a las muchas ventajas que ofrecen estas pruebas para verificar la idoneidad para un procedimiento de trasplante. El trasplante de órganos es una de las opciones de tratamiento más populares para muchos pacientes con enfermedad renal terminal en diálisis continua.

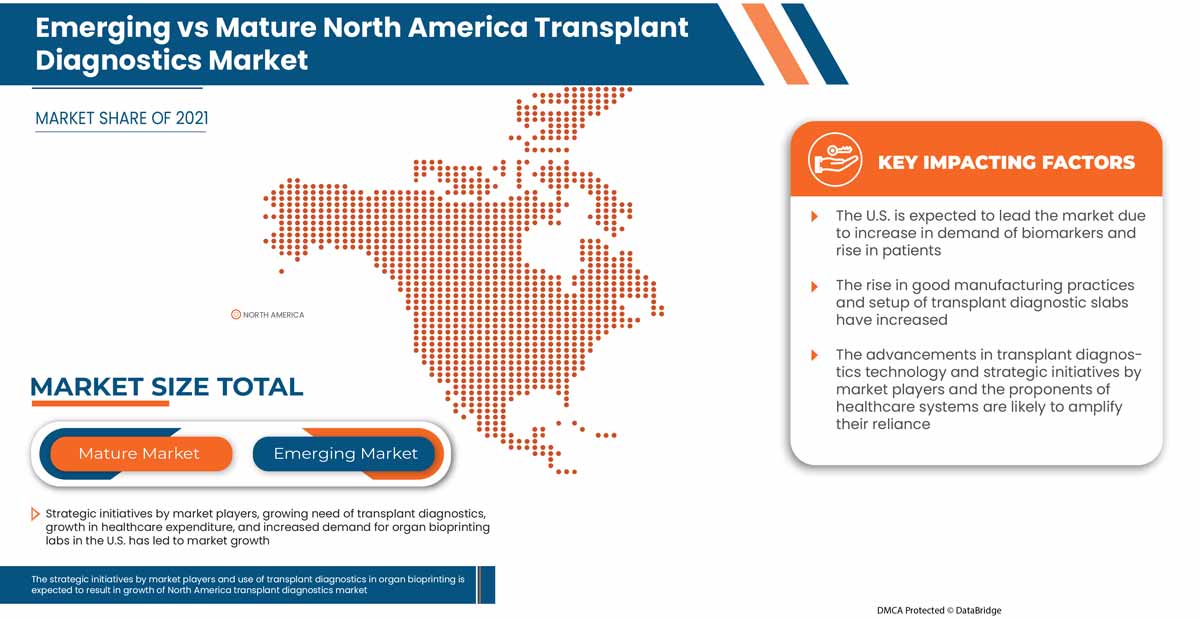

Además, es posible investigar el trasplante de órganos en casos que involucran el corazón, el hígado o la médula ósea. Aunque en muchos casos, existe una fuerte asociación entre la insuficiencia renal y el trasplante de hígado, incluida la enfermedad renal terminal. Los nuevos indicadores transcriptómicos, proteómicos y genómicos en el diagnóstico molecular pueden ayudar a adaptar mejor la terapia de trasplante y la detección temprana de eventos de rechazo. Además, las iniciativas estratégicas de los actores del mercado, los avances tecnológicos en el diagnóstico de trasplantes, la alta garantía de esterilidad y la creciente inversión en infraestructura de atención médica aumentan la demanda de diagnósticos de trasplantes.

Dinámica del mercado de diagnóstico de trasplantes en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento del número de procedimientos de trasplante

La demanda de trasplantes de órganos ha aumentado rápidamente en todo el mundo durante la última década debido a la mayor incidencia de insuficiencias de órganos vitales y a la mejora de los resultados posteriores al trasplante. La demanda de trasplantes de riñón, corazón, hígado y pulmones es muy alta. El consumo de alcohol, la falta de ejercicio y el abuso de drogas son las principales causas de insuficiencia orgánica. El número de trasplantes de donantes vivos se ha visto afectado por la pandemia de COVID-19, pero los trasplantes de donantes vivos han aumentado un 14,2 por ciento con respecto a 2020.

- Además, el trasplante de órganos mejora la supervivencia y la calidad de vida de los pacientes y tiene un importante impacto positivo en la salud pública y en la carga socioeconómica de la insuficiencia orgánica. La Unión Europea (UE) tiene un enfoque relativamente uniforme y estructurado en materia de trasplante de órganos, programas nacionales bien desarrollados, sistemas internacionales para facilitar el intercambio de órganos y políticas de intercambio bien definidas, lo que convierte a Europa en un líder en este campo.

Por lo tanto, se espera que el creciente número de procedimientos de trasplantes en todo el mundo y el aumento de trasplantes exitosos impulsen el mercado de diagnóstico de trasplantes en América del Norte.

- Aumento de los avances tecnológicos en el campo de los trasplantes

Las nuevas tecnologías están cambiando rápidamente los enfoques tradicionales del trasplante de órganos. Los principales desafíos en el trasplante de órganos son cómo identificar y, si es posible, eliminar la necesidad de inmunosupresión de por vida y cómo ampliar el grupo de donantes aptos para el trasplante humano. Los investigadores han desarrollado un sistema avanzado que permite prolongar el tiempo de transporte engañando a los órganos del donante para que piensen que todavía están dentro del cuerpo. Este sistema mantiene la sangre oxigenada fluyendo a través de los órganos para retrasar la muerte del tejido. Una máquina de perfusión normotérmica imita el cuerpo humano, asegurando un flujo sanguíneo constante al órgano. La máquina también puede administrar medicamentos u otros nutrientes para mantener el hígado en condiciones óptimas antes del trasplante.

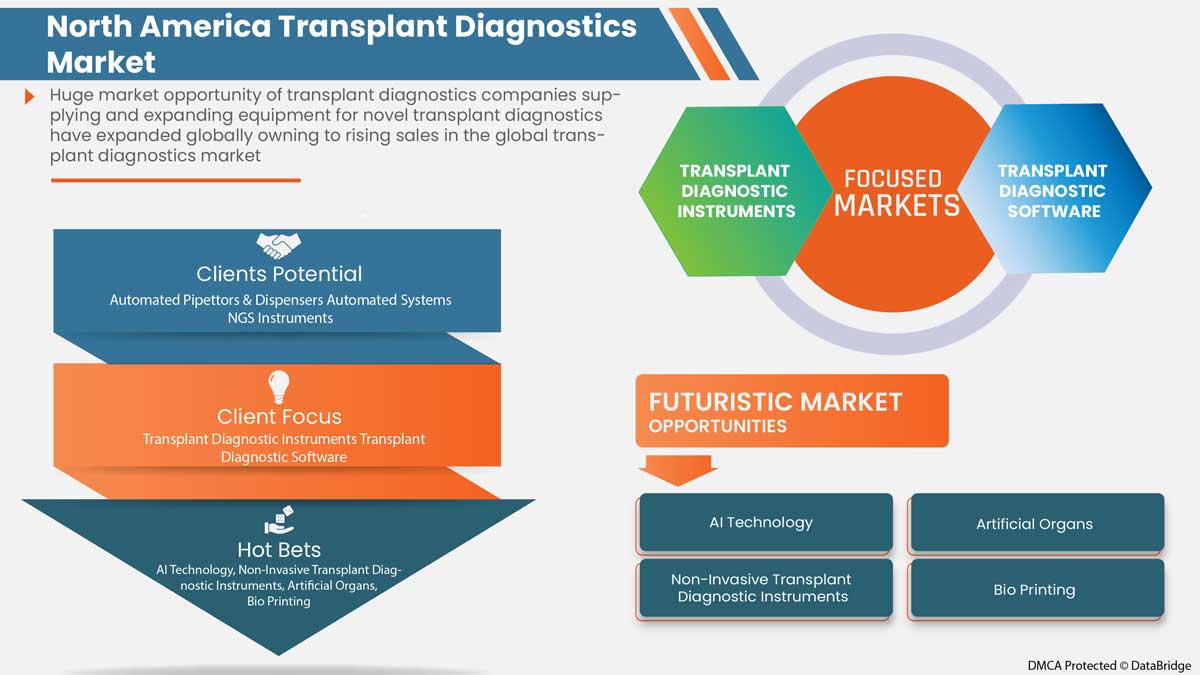

Además, las técnicas de producción de órganos bioartificiales son una gama de técnicas que permiten producir órganos humanos basados en principios biónicos. En los últimos diez años, se han logrado avances significativos en el desarrollo de diversas tecnologías de fabricación de órganos. En la última década, se han producido enormes avances en nuevas tecnologías, como la secuenciación de ARN de células individuales, la nanobiotecnología y la edición genética CRISPR-Cas9. Sin embargo, las aplicaciones creativas de estas nuevas y poderosas tecnologías para mejorar los trasplantes clínicos apenas han comenzado. Con estas herramientas, ahora existen buenas oportunidades para lograr grandes avances en la definición y la prestación de una atención optimizada e individualizada para todos los trasplantes de órganos.

Restricción

- Alto costo del trasplante de órganos

La terapia de trasplante de órganos emplea productos de tecnología muy avanzada. El desarrollo de estos productos implica una investigación y un desarrollo rigurosos por parte de los actores en desarrollo. Por lo tanto, el costo de los procedimientos y de los productos sigue siendo alto, lo que aumenta proporcionalmente el costo de las pruebas. Además, los trasplantes de órganos son caros porque requieren una gran cantidad de recursos e implican médicos bien pagados, transporte y medicamentos costosos.

- Además, también se han utilizado terapias desensibilizadoras para lograr el trasplante de un donante incompatible. Sin embargo, estos procedimientos son muy costosos y pueden estar asociados a complicaciones y peores resultados a largo plazo.

Por lo tanto, el alto costo del trasplante y del tratamiento con modalidades y productos tecnológicos avanzados actuará como un importante factor restrictivo para el crecimiento del mercado de diagnóstico de trasplantes en América del Norte.

Oportunidad

-

Iniciativas estratégicas de los actores del mercado

El aumento del mercado de diagnóstico de trasplantes en América del Norte aumenta la necesidad de ideas comerciales estratégicas. Incluye una asociación, expansión comercial y otros desarrollos. El aumento de la demanda de órganos de donantes está aumentando significativamente la demanda de kits de diagnóstico de trasplantes. Las estrategias planificadas permiten que los actores del mercado se alineen con las actividades funcionales de la organización para lograr los objetivos establecidos. Orienta las discusiones y la toma de decisiones de la empresa para determinar los requisitos de recursos y presupuesto para lograr los objetivos, aumentando así la eficiencia operativa.

Estas iniciativas estratégicas, como lanzamientos de productos, acuerdos y expansión comercial por parte de los principales actores del mercado, impulsarán el crecimiento del mercado y se espera que actúen como una oportunidad para el mercado de diagnóstico de trasplantes de América del Norte. Se espera que las iniciativas estratégicas ayuden al crecimiento y mejoren la cartera de productos de la empresa, lo que en última instancia conducirá a una mayor generación de ingresos. Por lo tanto, se puede esperar que estas iniciativas estratégicas de los actores del mercado sean una oportunidad que los ayude a impulsar el mercado de diagnóstico de trasplantes de América del Norte.

Desafío

- Desafíos éticos que se enfrentan durante el trasplante de órganos

El aumento de la incidencia de insuficiencia de órganos vitales y la falta de suministro de órganos ha creado una gran brecha entre la oferta y la demanda de órganos, lo que ha provocado largos tiempos de aprobación para recibir un órgano y un aumento de las muertes. Los acontecimientos, que ocurrieron en los años anteriores y continúan en el presente, han planteado muchos problemas éticos, morales y sociales en relación con el suministro, los métodos de asignación de órganos y el uso de donantes vivos como voluntarios, incluidos los menores de edad.

Falta de precisión en los informes, los órganos donados no pueden suministrarse y rápidamente se identifican procedimientos que no alivian el sufrimiento ni prolongan la vida.

Problemas como la falta de obtención de órganos, la aceptación religiosa, la muerte cerebral y los conceptos erróneos relacionados con la donación y el trasplante de órganos siguen presentes en muchos niveles éticos personales y comunitarios, incluso dentro de la comunidad médica. Los diversos aspectos de naturaleza ética, cultural y religiosa no deberían ser una barrera para el acto de donación y trasplante de órganos; todos estos son problemas que deben resolverse. Por lo tanto, se espera que los desafíos éticos que se enfrentan durante el trasplante de órganos desafíen el crecimiento del mercado.

Impacto posterior a la COVID-19 en el mercado de diagnóstico de trasplantes de América del Norte

El mercado de diagnóstico de trasplantes de América del Norte se ha visto gravemente afectado por la COVID-19. Las admisiones hospitalarias se limitaron a tratamientos no esenciales y las clínicas cerraron temporalmente durante la pandemia. La implementación del distanciamiento social, el bloqueo de la población y el acceso limitado a las clínicas han afectado enormemente al mercado. La desaceleración de los flujos de pacientes y las derivaciones también afectaron al crecimiento del mercado. Sin embargo, el mercado seguirá creciendo en el período posterior a la pandemia debido a la relajación de las restricciones impuestas anteriormente.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de I+D, lanzamientos de productos y asociaciones estratégicas para mejorar la tecnología y los resultados de las pruebas en el mercado de diagnóstico de trasplantes de América del Norte.

Acontecimientos recientes

- En julio de 2022, Horiba Medical lanzó un nuevo producto en su categoría de hematología Yumizen. El producto tiene características nuevas y avanzadas para satisfacer las necesidades de diversos requisitos clínicos y de laboratorio. Esto ha ayudado a la empresa a diversificar su oferta de productos.

- En enero de 2022, Hoffmann-La Roche Ltd presentó Cobas Infinity Edge, una plataforma de punto de atención basada en la nube y accesible. Con su tecnología avanzada, los profesionales de la salud pueden gestionar los datos de los pacientes. Esto ha ayudado a la empresa a diversificar su línea de productos.

Alcance del mercado de diagnóstico de trasplantes en América del Norte

El mercado de diagnóstico de trasplantes de América del Norte está segmentado por tipo de producto, tecnología, tipo de trasplante, aplicación, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Tipo de producto

- Instrumento de diagnóstico de trasplantes

- Software de diagnóstico de trasplantes

- Reactivo de diagnóstico de trasplantes

Sobre la base del tipo de producto, el mercado de diagnóstico de trasplantes de América del Norte está segmentado en instrumento de diagnóstico de trasplantes, software de diagnóstico de trasplantes y reactivo de diagnóstico de trasplantes.

Tecnología

- Ensayos moleculares basados en PCR

- Ensayos moleculares basados en secuenciación

Sobre la base de la tecnología, el mercado de diagnóstico de trasplantes de América del Norte está segmentado en ensayos moleculares basados en PCR y ensayos moleculares basados en secuenciación.

Tipo de trasplante

- Trasplante de órganos sólidos

- Trasplante de células madre

- Trasplante de tejidos blandos

- Trasplante de médula ósea

- Otros trasplantes

Según el tipo de trasplante, el mercado de diagnóstico de trasplantes de América del Norte está segmentado en trasplante de órganos sólidos, trasplante de células madre, trasplante de tejidos blandos, trasplante de médula ósea y otros trasplantes.

Solicitud

- Aplicaciones de diagnóstico

- Aplicaciones de investigación

Sobre la base de la aplicación, el mercado de diagnóstico de trasplantes de América del Norte está segmentado en aplicaciones de diagnóstico y aplicaciones de investigación.

Usuario final

- Laboratorios de investigación e institutos académicos

- Hospitales y centros de trasplantes

- Proveedores de servicios comerciales

- Otros

Sobre la base del usuario final, el mercado de diagnóstico de trasplantes de América del Norte está segmentado en laboratorios de investigación e institutos académicos, hospitales y centros de trasplantes, proveedores de servicios comerciales y otros.

Canal de distribución

- Licitación directa

- Ventas al por menor

- Otros

Sobre la base del canal de distribución, el mercado de diagnóstico de trasplantes de América del Norte está segmentado en licitación directa, ventas minoristas y otros.

Análisis y perspectivas regionales del mercado de diagnóstico de trasplantes en América del Norte

Se analiza el mercado de diagnóstico de trasplantes de América del Norte y se proporciona información sobre el tamaño del mercado por país, tipo de producto, tecnología, tipo de trasplante, aplicación, usuario final y canal de distribución.

Algunos países cubiertos por el mercado de diagnóstico de trasplantes de América del Norte son EE. UU., Canadá y México.

Se espera que Estados Unidos domine el mercado de diagnóstico de trasplantes de América del Norte debido a la presencia de actores clave del mercado en el mercado de consumo más grande con un PIB elevado.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de diagnóstico de trasplantes en América del Norte

North America transplant diagnostics market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus on the North America transplant diagnostics market.

Some of the major players operating in the North America transplant diagnostics market are Hologic, Inc., Biofortuna Limited, Takara Bio Inc., Abbott, Diagnóstica Longwood SL, Adaptive Biotechnologies, NanoString, Arquer Diagnostics Ltd, altona Diagnostics GmbH, ELITechGroup, DiaSorin S.p.A., Horiba Ltd, EUROFINS VIRACOR, CareDx Inc., Laboratory Corporation of America Holdings., Randox Laboratories Ltd., Thermo Fisher Scientific Inc., Preservation Solutions, Inc., TransMedics, Transonic, Stryker, Bio-Rad Laboratories, Inc., Zimmer Biomet, QIAGEN, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Illumina, Inc., Luminex Corporation (A subsidiary of DiaSorin Company), IMMUCOR, among others.

Research Methodology: North America Transplant Diagnostics Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include a Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 EPIDEMOLOGY

3.2 PESTEL_ANALYSIS

3.3 PORTER'S FIVE FORCE

3.4 TECHNOLOGICAL INNOVATIONS

4 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: REGULATIONS

5 KEY STRATEGIC INITIATIVES

6 INDUSTRIAL INSIGHTS:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING NUMBER OF TRANSPLANT PROCEDURES

7.1.2 INCREASE IN THE TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF TRANSPLANTS

7.1.3 RISING HEALTHCARE SPENDING

7.1.4 ADOPTION OF CROSS-MATCHING AND CHIMERISM TESTING DURING PRE- AND POST-TRANSPLANTATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF ORGAN TRANSPLANTATION

7.2.2 THE RISKS AND DIFFICULTIES OF ORGAN TRANSPLANTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.2 RISE IN PUBLIC, PRIVATE, AND GOVERNMENT FUNDING FOR ORGAN TRANSPLANTATION

7.3.3 SURGE IN AWARENESS ABOUT THE IMPORTANCE OF ORGAN TRANSPLANTATION

7.4 CHALLENGES

7.4.1 ETHICAL CHALLENGES FACED DURING ORGAN TRANSPLANTATION

7.4.2 LACK OF ORGAN DONORS OR GAP BETWEEN ORGAN DONORS AND ORGANS NEEDED ANNUALLY

8 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TRANSPLANT DIAGNOSTIC INSTRUMENTS

8.2.1 AUTOMATED PIPETTORS & DISPENSERS

8.2.2 AUTOMATED SYSTEMS

8.2.2.1 NUCLEIC ACID EXTRACTION SYSTEM

8.2.2.2 PCR SETUP

8.2.2.3 OTHERS

8.2.3 NGS INSTRUMENTS

8.2.4 READERS & ANALYZERS

8.2.5 TRANSPLANT DIAGNOSTIC KITS

8.2.5.1 ASPERGILLUS SPP KITS

8.2.5.2 P. JIROVECII KITS

8.2.5.3 CMV KITS

8.2.5.4 EBV KITS

8.2.5.5 BKV KITS

8.2.5.6 VZV KITS

8.2.5.7 HSV1 KITS

8.2.5.8 HSV2 KITS

8.2.5.9 PARVOVIRUS B19 KITS

8.2.5.10 ADENOVIRUS KITS

8.2.5.11 ENTEROVIRUS KITS

8.2.5.12 JCV KITS

8.2.5.13 HHV6 KITS

8.2.5.14 HHV7 KITS

8.2.5.15 HHV8 KITS

8.2.5.16 TOXOPLASMA GONDII KITS

8.2.5.17 HEPATITIS E KITS

8.2.5.18 OTHER KITS

8.2.6 OTHER KITS

8.3 TRANSPLANT DIAGNOSTIC SOFTWARE’S

8.3.1 DNA SOFTWARE

8.3.2 NGS SOFTWARE

8.3.3 DATA MANAGEMENT SOFTWARE

8.3.4 OTHER SOFTWARE’S

8.4 TRANSPLANT DIAGNOSTIC REAGENTS

8.4.1 MONOCLONAL ANTIBODIES

8.4.2 CYTOTOXIC CONTROLS

8.4.3 HUMAN SERUM

8.4.4 OTHER REAGENTS

9 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 PCR-BASED MOLECULAR ASSAYS

9.2.1 REAL TIME PCR

9.2.2 SEQUENCE-SPECIFIC PRIMER-PCR

9.2.3 SEQUENCE-SPECIFIC OLIGONUCLEOTIDE-PCR

9.2.4 RESTRICTION FRAGMENT LENGTH POLYMORPHISM (RFLP)

9.2.5 OTHER-PCR BASED MOLECULAR ASSAYS

9.3 SEQUENCING-BASED MOLECULAR ASSAYS

9.3.1 SANGER SEQUENCING

9.3.2 NEXT GENERATION SEQUENCING

9.3.3 OTHER SEQUENCING-BASED MOLECULAR ASSAYS.

10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE

10.1 OVERVIEW

10.2 SOLID ORGAN TRANSPLANTATION

10.2.1 KIDNEY TRANSPLANTATION

10.2.2 LIVER TRANSPLANTATION

10.2.3 HEART TRANSPLANTATION

10.2.4 LUNG TRANSPLANTATION

10.2.5 PANCREAS TRANSPLANTATION

10.2.6 OTHER ORGAN TRANSPLANTATIONS

10.3 STEM CELL TRANSPLANTATION

10.3.1 BONE MARROW TRANSPLANT (BMT)

10.3.2 PERIPHERAL BLOOD STEM CELL TRANSPLANT

10.3.3 CORD BLOOD TRANSPLANT

10.3.4 OTHER STEM CELL TRANSPLANTS

10.4 SOFT TISSUE TRANSPLANTATION

10.4.1 SKIN GRAFT

10.4.2 CARTILAGE TRANSPLANTATION

10.4.3 ADRENAL AUTOGRAFTING

10.4.4 OTHER SOFT TISSUE TRANSPLANTATION.

10.5 BONE MARROW TRANSPLANTATION

10.5.1 AUTOLOGOUS BONE MARROW TRANSPLANT

10.5.2 ALLOGENEIC BONE MARROW TRANSPLANT

10.5.3 UMBILICAL CORD BLOOD TRANSPLANT.

10.6 OTHERS

11 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIAGNOSTIC APPLICATIONS

11.2.1 TRANSPLANT DIAGNOSTIC INSTRUMENT

11.2.1.1 AUTOMATED PIPETTORS & DISPENSERS

11.2.1.2 AUTOMATED SYSTEMS

11.2.1.3 NGS INSTRUMENTS

11.2.1.4 READERS & ANALYZERS

11.2.1.5 TRANSPLANT DIAGNOSTIC KITS

11.2.1.6 OTHERS

11.2.2 TRANSPLANT DIAGNOSTIC SOFTWARE

11.2.2.1 DNA SOFTWARE

11.2.2.2 NGS SOFTWARE

11.2.2.3 DATA MANAGEMENT SOFTWARE

11.2.2.4 OTHER SOFTWARES

11.2.3 TRANSPLANT DIAGNOSTIC REAGENT

11.2.3.1 MONOCLONAL ANTIBODIES

11.2.3.2 CYTOTOXIC CONTROLS

11.2.3.3 HUMAN SERUM

11.2.3.4 OTHER REAGENTS

11.3 RESEARCH APPLICATIONS

11.3.1 TRANSPLANT DIAGNOSTIC INSTRUMENT

11.3.1.1 AUTOMATED PIPETTORS & DISPENSERS

11.3.1.2 AUTOMATED SYSTEMS

11.3.1.3 NGS INSTRUMENTS

11.3.1.4 READERS & ANALYZERS

11.3.1.5 TRANSPLANT DIAGNOSTIC KITS

11.3.1.6 OTHERS

11.3.2 TRANSPLANT DIAGNOSTIC SOFTWARE

11.3.2.1 DNA SOFTWARE

11.3.2.2 NGS SOFTWARE

11.3.2.3 DATA MANAGEMENT SOFTWARE

11.3.2.4 OTHER SOFTWARES

11.3.3 TRANSPLANT DIAGNOSTIC REAGENT

11.3.3.1 MONOCLONAL ANTIBODIES

11.3.3.2 CYTOTOXIC CONTROLS

11.3.3.3 HUMAN SERUM

11.3.3.4 OTHER REAGENTS

12 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS AND TRANSPLANT CENTERS

12.3 COMMERCIAL SERVICE PROVIDERS

12.4 RESEARCH LABORATORIES AND ACADEMIC INSTITUTES

12.5 OTHERS

13 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.4 OTHERS

14 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ABBOTT

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 F. HOFFMANN LA ROCHE LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TAKARA BIO INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 HOLOGIC, INC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ADAPTIVE BIOTECHNOLOGIES

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ALTONA DIAGNOSTICS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ARQUER DIAGNOSTICS LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 BAG DIAGNOSTICS GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOFORTUNA LIMITED

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 BIOMÉRIEUX

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 BIO-RAD LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 BIOTYPE GMBH

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 CAREDX INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 CLONIT SRL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 DIAGNOSTICA LONGWOOD SL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 DIASORIN S.P.A.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ELITECHGROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 EUROFINS VIRACOR

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 HORIBA LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 ILLUMINA, INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 IMMUCOR

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 LABORATORY CORPORATION OF AMERICA HOLDINGS.

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 LUMINEX CORPORATION. (A SUBSIDIARY OF DIASORIN)

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENT

17.25 NANOSTRING

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 PATHONOSTICS

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 PRESERVATION SOLUTIONS, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 QIAGEN

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENTS

17.29 RANDOX LABORATORIES LTD.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 STRYKER

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENT

17.31 TRANSMEDICS

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENTS

17.32 TRANSONIC.

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

17.33 ZIMMER BIOMET

17.33.1 COMPANY SNAPSHOT

17.33.2 REVENUE ANALYSIS

17.33.3 PRODUCT PORTFOLIO

17.33.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE’S IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE’S IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SEQUENCING-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SEQUENCING-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BONE MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BONE MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIAGNOSTIC APPLICATIONS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA DIAGNOSTIC APPLICATIONS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RESEARCH APPLICATIONS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA RESEARCH APPLICATIONS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HOSPITALS AND TRANSPLANT CENTERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA COMMERCIAL SERVICE PROVIDERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RESEARCH LABORATORIES AND ACADEMIC INSTITUTES IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT TENDER IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA RETAIL SALES IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 74 U.S. AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 75 U.S. AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 77 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 78 U.S. TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 79 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 80 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 82 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 83 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 86 U.S. TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 87 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 U.S. PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 89 U.S. SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.S. SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.S. DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.S. RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 109 CANADA AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 110 CANADA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 112 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 113 CANADA TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 114 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 115 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 117 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 118 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 121 CANADA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 122 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 CANADA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 124 CANADA SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 128 CANADA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 CANADA DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 135 CANADA RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 144 MEXICO AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 145 MEXICO AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 147 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 148 MEXICO TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 149 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 150 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 152 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 153 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 156 MEXICO TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 157 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 159 MEXICO SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 160 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 161 MEXICO SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 162 MEXICO STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 163 MEXICO SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 164 MEXICO BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 165 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 MEXICO DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 167 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 169 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 MEXICO RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF TRANSPLANT DIAGNOSTICS IS EXPECTED TO DRIVE THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET IN THE FORECAST PERIOD

FIGURE 12 TRANSPLANT DIAGNOSTIC INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET

FIGURE 14 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, 2021

FIGURE 19 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, 2021

FIGURE 23 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, 2021

FIGURE 31 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.