North America Sustainable Aviation Fuel Market, By Fuel Type (Bio Fuel, Hydrogen Fuel, and Power to Liquid Fuel), Manufacturing Technology (Hydroprocessed Fatty Acid Esters And Fatty Acids - Synthetic Paraffinic Kerosene (HEFA-SPK), Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK), Synthetic ISO-Paraffin From Fermented Hydroprocessed Sugar (HFS-SIP), Fischer Tropsch (FT) Synthetic Paraffinic Kerosene With Aromatics (FT-SPK/A), Alcohol To Jet SPK (ATJ-SPK) and Catalytic Hydrothermolysis Jet (CHJ)), Blending Capacity (Below 30 %, 30 % to 50 % and Above 50%), Blending Platform (Commercial Aviation, Military Aviation, Business & General Aviation, and Unmanned Aerial Vehicle) Industry Trends and Forecast to 2029.

North America Sustainable Aviation Fuel Market Analysis and Size

The aviation industry is keen on bringing down carbon footprints to achieve a sustainable environment and meet the stringent regulatory standards on emissions. Alternative solutions, such as improving aero-engine efficiency by design modifications, hybrid-electric and all-electric aircraft, renewable jet fuels, etc., are being adopted by various stakeholders of the aviation industry. However, out of these solutions, the adoption of sustainable aviation fuels such as E-fuels, synthetic fuels, green jet fuels, bio jet fuels, hydrogen fuels is one of the most feasible alternative solutions with respect to socio and economic benefits when compared to others, which contributes significantly to mitigating current and expected future environmental impacts of aviation.

Sustainable aviation fuels are a key component in meeting the aviation industry’s commitments to decouple increases in carbon emissions from traffic growth. Factors such as a rise in a number of airline passengers, growing disposable income, increase in air transportation, and increase in consumption of synthetic lubricants supplement the growth of the North America sustainable aviation fuel market. However, the lack of infrastructure act as a restraining factor for the market.

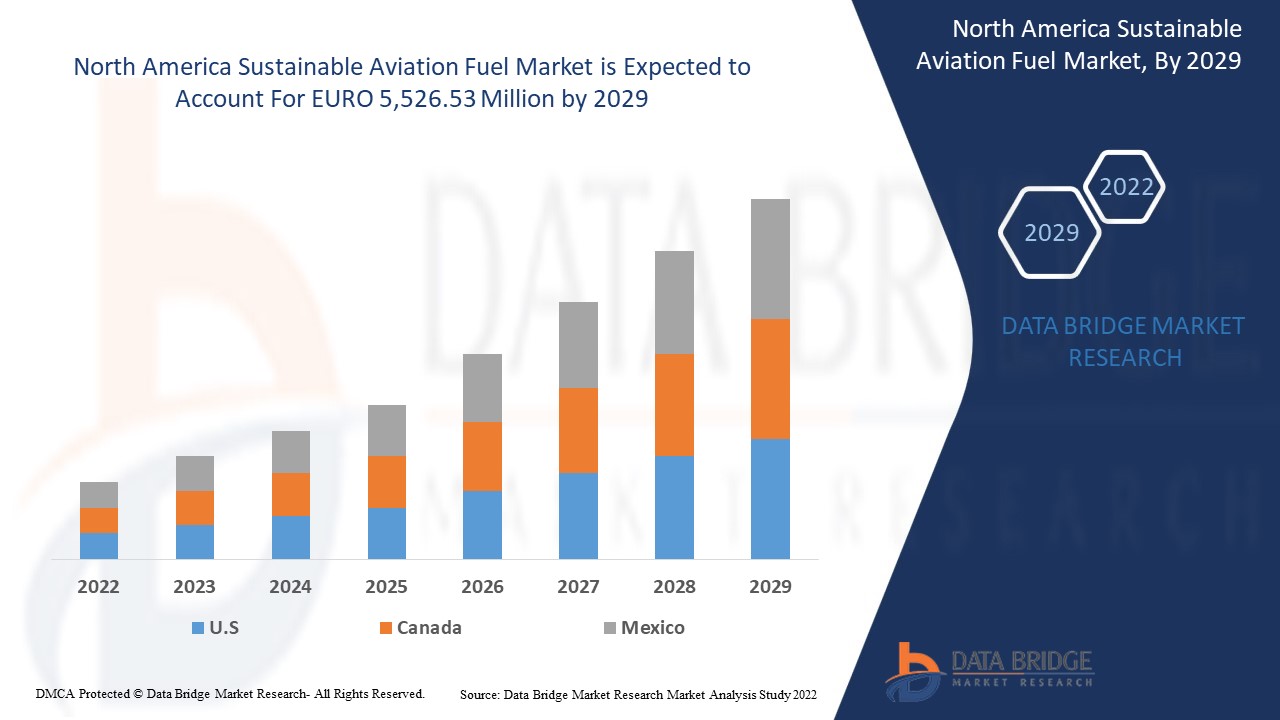

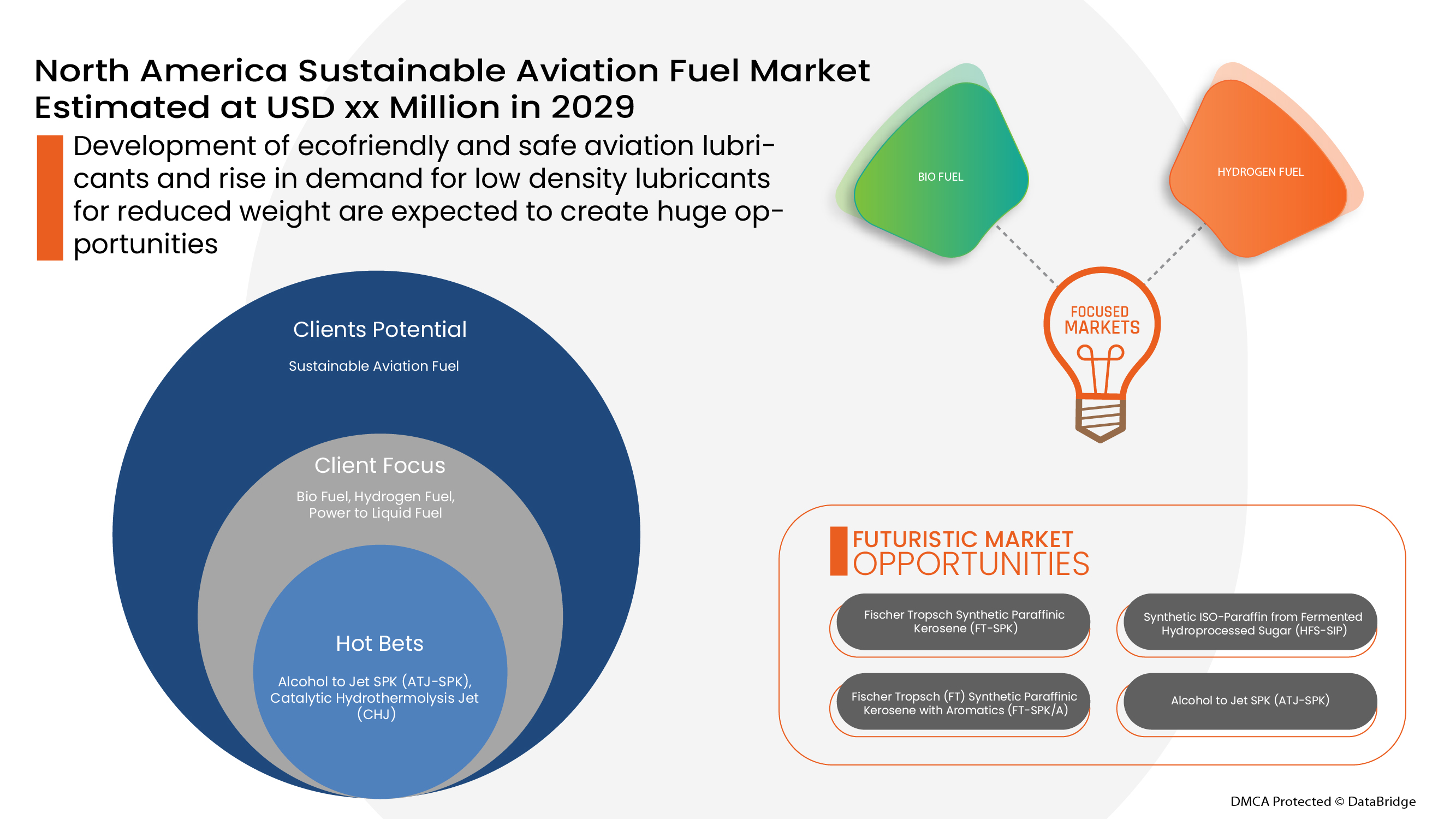

Data Bridge Market Research analyses that the Sustainable aviation fuel market is expected to reach the value of EURO 5,526.53 million by 2029, at a CAGR of 52.1% during the forecast period. “Bio Fuel" accounts for the largest technology segment in the Sustainable aviation fuel market due to rapid developments in technological pathways to commercialize the use of alternative jet fuel. The Sustainable aviation fuel market report also covers pricing analysis, patent analysis, and technological advancements in depth

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Ingresos en millones de euros, volúmenes en unidades, precios en euros |

|

Segmentos cubiertos |

Por tipo de combustible (biocombustible, combustible de hidrógeno y combustible líquido para energía), por tecnología de fabricación (ésteres de ácidos grasos hidroprocesados y ácidos grasos - queroseno parafínico sintético (Hefa-Spk), queroseno parafínico sintético Fischer Tropsch (FT-SPK), isoparafina sintética a partir de azúcar hidroprocesado fermentado (Hfs-Sip), queroseno parafínico sintético Fischer Tropsch (Ft) con aromáticos (FT-SPK/A), alcohol para jet Spk (ATJ-SPK) y jet de hidrotermólisis catalítica (CHJ)), por capacidad de mezcla (por debajo del 30 %, del 30 % al 50 % y por encima del 50 %), por plataforma de mezcla (aviación comercial, aviación militar, aviación general y de negocios, y vehículos aéreos no tripulados) |

|

Países cubiertos |

Estados Unidos, Canadá y México en América del Norte, |

|

Actores del mercado cubiertos |

Gevo, Fulcrum BioEnergy, Prometheus Fuels, World Energy, Avfuel Corporation, LanzaTech, Honeywell International Inc, Chevron Corporation, Exxon Mobil Corporation, Johnson Matthey, VIRENT, INC., HyPoint Inc., entre otros. |

Definición de mercado

El combustible de aviación sostenible es una forma única de combustible diseñado para su uso en aeronaves y, al mismo tiempo, aumentará el rendimiento de las aeronaves. Los combustibles de aviación sostenibles se derivan de materias primas sostenibles y podrían ser muy comparables en su composición química al combustible fósil estándar para aviones. Un aumento en la utilidad de los combustibles de aviación sostenibles genera una reducción de las emisiones de carbono en comparación con el combustible para aviones tradicional porque reemplaza el ciclo de vida del combustible.

La industria de la aviación está dispuesta a reducir la huella de carbono para lograr un entorno sostenible y cumplir con los estrictos requisitos regulatorios sobre emisiones. Además, la mejora del rendimiento de los motores de aviación mediante modificaciones de diseño, aviones híbridos eléctricos y totalmente eléctricos y combustibles renovables para aviones a reacción están siendo adoptados por numerosos actores de la industria de la aviación, pero la adopción de combustibles de aviación sostenibles se considera la solución de oportunidad más confiable y viable con respecto a las ventajas socioeconómicas en comparación con otras, lo que contribuye ampliamente a mitigar los impactos ambientales actuales y futuros previstos de la aviación.

Dinámica del mercado de combustibles de aviación sostenibles

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Necesidad creciente de reducir las emisiones de GEI en la industria de la aviación

Las emisiones de gases de efecto invernadero (GEI) causadas por el hombre amplifican el efecto invernadero, lo que provoca el cambio climático. El dióxido de carbono se emite principalmente a través de la combustión de combustibles fósiles como el carbón, el petróleo y el gas natural. Algunos de los mayores contaminadores son China y Rusia. Esta contaminación se debe principalmente a las corporaciones de carbón, petróleo y gas propiedad de la OPEP (Organización de Países Exportadores de Petróleo). Los niveles de dióxido de carbono en la atmósfera han aumentado alrededor de un 50% desde la época preindustrial debido a las emisiones causadas por el hombre.

Los contaminantes emitidos por los motores de los aviones son equivalentes a los emitidos por la combustión de combustibles fósiles. A mayor altitud, las emisiones de los aviones tienen una mayor concentración de contaminantes. Estas emisiones generan graves problemas ambientales, tanto en términos de su efecto en América del Norte como de su impacto en la calidad del aire local.

- Aumento del transporte aéreo y aumento del consumo de lubricantes sintéticos

Los viajes aéreos son un componente fundamental para el crecimiento económico y el desarrollo. A escala nacional, regional y mundial, los viajes aéreos fomentan la integración en la economía de América del Norte y ofrecen vínculos cruciales. Contribuyen al crecimiento del comercio, el turismo y las oportunidades de empleo. El sistema de aviación está evolucionando y seguirá evolucionando. Sin embargo, a largo plazo, será difícil que el sistema de transporte aéreo se adapte con la suficiente rapidez para satisfacer las necesidades cambiantes en términos de capacidad, impacto ambiental, satisfacción del consumidor, seguridad y protección, y al mismo tiempo mantener la viabilidad económica de los proveedores de servicios.

La pandemia de Covid-19, junto con el respaldo gubernamental y los descubrimientos tecnológicos, particularmente en el campo de la tecnología de combustibles, ha acelerado la transición de la industria de la aviación hacia el combustible de aviación sostenible (SAF). Si bien el uso de combustible de aviación sostenible (SAF) está en aumento, los lubricantes no sintéticos están en declive. Se espera que los lubricantes sintéticos y semisintéticos se beneficien de la transición porque la mayoría de las aeronaves emplean lubricantes de grado avanzado. Se prevé que el mercado mundial de combustible de aviación sostenible (SAF) esté impulsado por este factor.

- Aumento de la demanda de combustible de aviación sostenible por parte de las aerolíneas

El sector de la aviación está adoptando "medidas urgentes" para cumplir con el objetivo climático mundial, que incluye la reducción del crecimiento de los viajes aéreos y la rápida ampliación del uso de combustibles de aviación sostenibles (SAF). El propósito de los SAF es reciclar el carbono de la biomasa sostenible existente o los gases para convertirlo en combustible para aviones como reemplazo del combustible fósil refinado a partir del petróleo crudo. El sector de la aviación en su conjunto, así como las aerolíneas miembros de la IATA, están comprometidos con la consecución de objetivos agresivos de reducción de emisiones. Los SAF (combustibles de aviación sostenibles) se han destacado como un componente clave para alcanzar estos objetivos. Se necesitará el apoyo del gobierno para utilizar combustibles de aviación sostenibles para satisfacer los objetivos climáticos de la industria

A medida que los actores clave de la industria están reconociendo la necesidad de combustibles de aviación sostenibles (SAF), los proveedores de servicios han comenzado a adoptar varias alternativas de combustibles de aviación sostenibles (SAF) en varias aerolíneas, lo que se espera que impulse aún más el crecimiento de los combustibles de aviación sostenibles (SAF) de manera significativa.

- Disponibilidad insuficiente de materias primas y refinerías para satisfacer la demanda de producción sostenible de combustible para la aviación

Los combustibles de aviación sostenibles (SAF), que se fabrican a partir de materias primas de origen biológico, son una parte importante del plan para reducir la huella de carbono de la aviación. Técnicamente, es posible sustituir y mezclar los SAF con combustible para aviones; de hecho, la industria de la aviación ha estado utilizando SAF durante más de una década. Sin embargo, debido a las limitaciones de la oferta y la demanda, los niveles de consumo siguen siendo extremadamente bajos.

Los cultivos oleaginosos, los cultivos azucareros, las algas, el aceite usado y otros recursos biológicos y no biológicos son las materias primas que desempeñan un papel esencial en toda la cadena de producción de combustibles alternativos para la aviación, como los combustibles sintéticos, los e-fuels y los biocombustibles para aviones. La necesidad de combustible de aviación sostenible puede llegar a detenerse debido a la escasez de materias primas necesarias para su fabricación. Debido a la escasez de materias primas necesarias para su fabricación, la demanda de combustible de aviación sostenible puede detenerse. Además, las restricciones de las refinerías, que desempeñan un papel fundamental en la explotación óptima de estas materias primas, se suman al proceso total de fabricación de SAF. El bajo suministro de combustible también pone a prueba la capacidad de mezcla del combustible, lo que da como resultado una menor eficiencia.

Cuando aumenta la competencia del sector de la gasolina para carretera por materias primas que cumplan con los estándares de sostenibilidad, la disponibilidad de materias primas se convierte en un cuello de botella. Los costos de las materias primas son una parte significativa del costo de la gasolina para carretera, y la fluctuación de precios puede causar problemas de suministro para los productores de combustible. Por lo tanto, un recargo más alto por combustible por parte de un transportista está obstaculizando aún más el crecimiento del mercado hasta cierto punto.

- Fluctuaciones en los precios del petróleo crudo y contaminación de los lubricantes

La creciente competencia y la presión de los costos en América del Norte obligan a las empresas y las cadenas de suministro a descubrir potenciales de ahorro de costos no detectados. En particular, las interfaces con el mercado del petróleo crudo son un campo prometedor para la mejora. En el entorno empresarial actual, todas las organizaciones enfrentan cierto riesgo de fluctuación en el precio del petróleo crudo y los lubricantes. En la producción, los fabricantes pueden depender de una cantidad significativa de materias primas petroleras y, como resultado, pueden verse especialmente afectados por la volatilidad de los precios de los productos petrolíferos que adquieren directa e indirectamente a través de componentes y subconjuntos. Los mercados volátiles e inestables de América del Norte tienen amplias implicaciones para las organizaciones manufactureras. Desde el aumento de los costos de la energía hasta las fluctuaciones inesperadas en los costos de fabricación del petróleo crudo, los obstáculos imprevistos están desestabilizando las cadenas de suministro y dificultando que los fabricantes sigan generando ganancias. Como es cada vez más difícil asegurar el suministro de muchas materias primas, la volatilidad de los precios de las materias primas puede no ser solo un fenómeno temporal, y depende de los fabricantes absorber los costos adicionales, encontrar nuevas formas de mitigar los gastos o trasladar los aumentos de precios a los clientes que ya se muestran reacios a gastar. Dado que los precios se ven afectados por la contracción de los mercados de suministro, esta tendencia no muestra indicios de cambiar en el futuro cercano. Por lo tanto, el costo fluctuante del petróleo crudo y otros lubricantes actúa como una importante restricción para el mercado de combustible de aviación sostenible (SAF) de América del Norte.

Los fragmentos de carbón no suelen ser lo suficientemente duros ni lo suficientemente grandes como para provocar fallas en las bombas. Sin embargo, podrían ser lo suficientemente grandes como para bloquear filtros o boquillas diminutos. Otra causa de contaminación operativa es la presencia de arena, gravilla y partículas metálicas en el sistema de lubricación, lo que actúa como un factor limitante para el mercado de combustibles de aviación sostenibles (SAF) en América del Norte.

- Reducción de la huella de carbono debido a la baja capacidad de combustible de aviación sostenible

El combustible de aviación sostenible (SAF, por sus siglas en inglés) reduce las emisiones de carbono durante su vida útil en comparación con el combustible para aviones tradicional al que reemplaza. El aceite de cocina y otros aceites de desecho que no sean de palma de origen animal o vegetal son materias primas comunes, al igual que los desechos sólidos de hogares y empresas, como envases, papel, textiles y restos de comida que de otro modo se eliminarían en vertederos o se incinerarían. Los desechos forestales, como los desechos de madera, y los cultivos energéticos, como las plantas de crecimiento rápido y las algas, también son posibles fuentes.

Dependiendo de la materia prima sustentable utilizada, el proceso de producción y la cadena de suministro al aeropuerto, el SAF puede reducir las emisiones de carbono hasta en un 80% durante la vida útil del combustible en comparación con el combustible para aviones tradicional que reemplaza.

El SAF puede mezclarse hasta en un 50 % con combustible para aviones estándar y se somete a las mismas pruebas de calidad que el combustible para aviones tradicional. Luego, la mezcla se recertifica como Jet A o Jet A-1. Se puede manipular de la misma manera que el combustible para aviones estándar, por lo que no es necesario realizar cambios en la infraestructura de abastecimiento de combustible ni en las aeronaves que deseen utilizar SAF, lo que crea una oportunidad para el crecimiento del mercado de combustibles de aviación sostenibles de América del Norte.

- Desarrollo de lubricantes de aviación seguros y ecológicos

En el mundo actual, la industria de la aviación está en auge, lo que ha dado lugar a una mayor rivalidad entre los productores de combustible de aviación en todos los ámbitos. Se espera que las fuentes alternativas respetuosas con el medio ambiente para la producción a largo plazo de combustible de aviación tengan una influencia futura en el sector de combustible de aviación. El mercado de combustible de aviación sostenible ha crecido significativamente a lo largo de los años, debido a la creciente tendencia a utilizar combustibles avanzados en aviones de todo el mundo.

El cultivo de biomasa para la producción de combustible de aviación sostenible también permite a los agricultores ganar más dinero fuera de temporada al aportar materia prima a esta nueva industria, al tiempo que garantizan ventajas agrícolas como la reducción de la pérdida de nutrientes y la mejora de la calidad del suelo. De este modo, se crea una oportunidad para el crecimiento del mercado de combustible de aviación sostenible (SAF) en América del Norte.

- El alto costo del combustible de aviación sostenible aumenta el costo operativo de las aerolíneas

Los gastos de mano de obra y combustible son los dos gastos más importantes que afrontan las aerolíneas. A corto plazo, los gastos de mano de obra suelen ser estables, pero los precios del combustible fluctúan significativamente en función del precio del petróleo. El combustible es una parte importante del coste de funcionamiento de una aerolínea, ya que representa entre el 20 y el 30 % de los gastos totales. Los picos de precios del petróleo han sido algunos de los momentos más difíciles para las aerolíneas. Las aerolíneas pueden prepararse para un aumento gradual de los precios subiendo los precios de los billetes o reduciendo el número de vuelos, pero los aumentos inesperados de los precios hacen que muchas aerolíneas pierdan dinero.

El objetivo de utilizar combustible de aviación sostenible (SAF, por sus siglas en inglés) aumentará el costo del combustible este año, lo que dificultará aún más las cosas para las aerolíneas. Según la Asociación Internacional de Transporte Aéreo (IATA), la producción de SAF en América del Norte es de solo unos 100 millones de litros por año, o el 0,1 por ciento de todo el combustible de aviación utilizado. Por otro lado, varias aerolíneas se han comprometido a aumentar este porcentaje al 10 por ciento para 2030, un objetivo verdaderamente ambicioso.

Lamentablemente, debido al limitado volumen de fabricación, el costo también es elevado. La IATA estima que el costo del SAF es entre dos y cuatro veces mayor que el de los combustibles fósiles, mientras que una reciente divulgación de Air France-KLM sugirió que la disparidad de costos podría ser de entre cuatro y ocho veces mayor que la del queroseno.

La Asociación Internacional de Transporte Aéreo (IATA) y otros organismos han instado a los gobiernos a fomentar el desarrollo de combustibles de aviación sostenibles, pero en forma de estímulo económico. Esto allana el camino para el aumento de los precios de los combustibles de aviación sostenibles (SAF), lo que representa un desafío para el mercado de combustibles de aviación sostenibles de América del Norte.

Impacto posterior al COVID-19 en el mercado de combustibles de aviación sostenibles

La COVID-19 ha tenido un gran impacto en el mercado de combustibles sostenibles para la aviación, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a la producción de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de la producción y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas otras para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar los procesos.

El crecimiento del mercado de combustibles de aviación sostenibles está aumentando debido a la necesidad de reducir las emisiones de GEI en la industria de la aviación. Sin embargo, factores como la disponibilidad inadecuada de materias primas y refinerías para satisfacer la demanda de producción de combustibles de aviación sostenibles están restringiendo el crecimiento del mercado. El cierre de las instalaciones de producción durante la situación de pandemia ha tenido un impacto significativo en el mercado.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el combustible de aviación sostenible. Con esto, las empresas traerán controladores avanzados y precisos al mercado. Además, el uso de combustible de aviación sostenible por parte de las autoridades gubernamentales en el transporte aéreo ha impulsado el crecimiento del mercado.

Desarrollo reciente

- En marzo de 2022, Gevo y oneworld Alliance, una red de aerolíneas de clase mundial, anunciaron que algunos miembros de oneworld planean comprar hasta 200 millones de galones por año de combustible de aviación sostenible (“SAF”) de Gevo (el “Objetivo de compra de SAF de oneworld Alliance”). Se espera que la entrega del SAF comience en 2027, por un período de cinco años. Este acuerdo ayuda a mejorar los ingresos de la empresa.

- En diciembre de 2021, Fulcrum BioEnergy anunció que había completado la financiación provisional para su segundo proyecto de conversión de residuos en combustibles, que culminó con la emisión de USD 375 millones en Bonos de Ingresos por Mejora Ambiental (Bonos) por parte de la Autoridad Financiera de Indiana a través de la subsidiaria de propiedad absoluta de Fulcrum, Fulcrum Centerpoint, LLC (Centerpoint). Este desarrollo comercial ayuda a mejorar la presencia de la empresa en América del Norte.

Alcance del mercado de combustibles de aviación sostenibles en América del Norte

El mercado de combustibles de aviación sostenibles está segmentado en función del tipo de combustible, la tecnología de fabricación, la capacidad de mezcla y la plataforma de mezcla. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de combustible

- Biocombustible

- Combustible de hidrógeno

- Energía a partir de combustible líquido

Sobre la base del tipo de combustible, el mercado de combustible de aviación sostenible de América del Norte se segmenta en biocombustible, combustible de hidrógeno y energía a combustible líquido.

Tecnología de fabricación

- Ésteres de ácidos grasos hidroprocesados y ácidos grasos: queroseno parafínico sintético (HEFA-SPK)

- Queroseno parafínico sintético Fischer Tropsch (FT-SPK)

- Isoparafina sintética a partir de azúcar hidroprocesado fermentado (HFS-SIP)

- Queroseno parafínico sintético con aromáticos Fischer Tropsch (FT) (FT-SPK/A)

- Alcohol a chorro Spk (ATJ-SPK)

- Chorro de hidrotermólisis catalítica (CHJ)

Sobre la base de la tecnología de fabricación, el mercado de combustible de aviación sostenible de América del Norte se ha segmentado en ésteres de ácidos grasos hidroprocesados y ácidos grasos: queroseno parafínico sintético (HEFA-SPK), queroseno parafínico sintético de Fischer Tropsch (FT-SPK), isoparafina sintética de azúcar hidroprocesado fermentado (HFS-SIP), queroseno parafínico sintético de Fischer Tropsch (FT) con aromáticos (FT-SPK/A), alcohol a chorro SPK (ATJ-SPK) y chorro de hidrotermólisis catalítica (CHJ).

Capacidad de mezcla

- Por debajo del 30 %

- 30 % a 50 %

- Más del 50%

Sobre la base de la capacidad de mezcla, el mercado de combustible de aviación sostenible de América del Norte se ha segmentado en menos del 30 %, entre el 30 % y el 50 % y más del 50 %.

Plataforma de mezcla

- Aviación comercial

- Aviación militar

- Aviación comercial y general

- Vehículo aéreo no tripulado

Sobre la base de la plataforma de mezcla, el mercado de combustible de aviación sostenible de América del Norte se ha segmentado en aviación comercial, aviación militar, aviación comercial y general, y vehículos aéreos no tripulados.

Análisis y perspectivas regionales del mercado de combustibles de aviación sostenibles

Se analiza el mercado de combustible de aviación sostenible y se proporcionan información y tendencias del tamaño del mercado por país, tipo de combustible, tecnología de fabricación, capacidad de mezcla y plataforma de mezcla como se mencionó anteriormente.

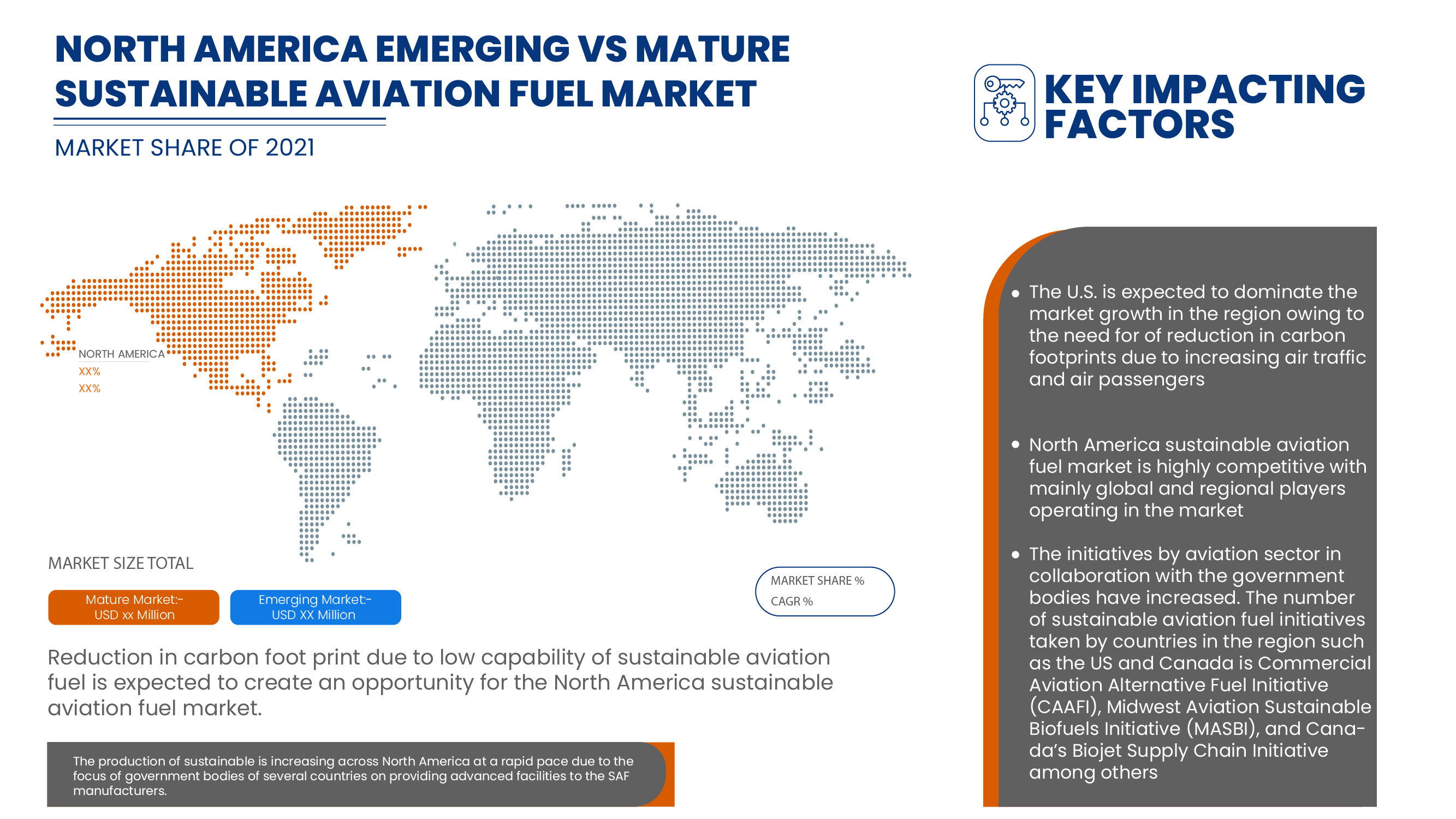

Los países cubiertos en el informe del mercado de combustible de aviación sostenible son Estados Unidos, Canadá y México en América del Norte.

Estados Unidos domina el mercado de combustibles de aviación sostenibles en América del Norte. Esto se debe a la reducción de la huella de carbono debido al aumento del tráfico aéreo y de los pasajeros. Los países de América del Norte, como Estados Unidos y Canadá, están poniendo en marcha diversas iniciativas para utilizar combustibles de aviación renovables. Además, las regulaciones e iniciativas de apoyo del gobierno están impulsando el mercado de combustibles de aviación sostenibles en Canadá.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de combustibles sostenibles para la aviación

El panorama competitivo del mercado de combustibles de aviación sostenibles proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de combustibles de aviación sostenibles.

Algunos de los principales actores que operan en el mercado de combustible de aviación sostenible son Gevo, Fulcrum BioEnergy, Prometheus Fuels, World Energy, Avfuel Corporation, LanzaTech, Honeywell International Inc, Chevron Corporation, Exxon Mobil Corporation, Johnson Matthey, VIRENT, INC., HyPoint Inc., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FUEL TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF FUTURE APPLICATIONS

4.2 ADVANCING SUSTAINABILITY WITHIN AVIATION

4.3 ORGANIZATIONS INVOLVED IN SUSTAINABLE AVIATION FUEL PROGRAMS

4.4 RESEARCH & INNOVATION ROADMAP FOR AVIATION HYDROGEN TECHNOLOGY

4.5 RECENT SUPPLY CONTRACTS BY SHELL

4.6 STANDARDS

4.6.1 OVERVIEW

4.6.2 INTERNATIONAL CIVIL AVIATION ORGANIZATION (ICAO)

4.6.3 INTERNATIONAL AIR TRANSPORT ASSOCIATION (IATA)

4.6.4 BUREAU OF CIVIL AVIATION SECURITY

4.6.5 FEDERAL AVIATION ADMINISTRATION

4.6.6 EUROPEAN UNION AVIATION SAFETY AGENCY (EASA)

4.6.7 CIVIL AVIATION ADMINISTRATION OF CHINA (CAAC)

4.6.8 UAE GENERAL CIVIL AVIATION AUTHORITY (GCAA)

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF SUSTAINABLE AVIATION FUEL MARKET

4.8 TECHNOLOGY TRENDS

4.8.1 OVERVIEW

4.8.2 HYDROTHERMAL LIQUEFACTION (HTL)

4.8.3 PYROLYSIS PATHWAYS OR PYROLYSIS-TO-JET (PTJ)

4.8.4 TECHNOLOGICAL MATURITY - FUEL READINESS LEVEL AND FEEDSTOCK READINESS LEVEL

4.9 IMPACT OF MEGATREND

4.1 INNOVATION AND PATENT ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY

5.1.2 INCREASE IN AIR TRANSPORTATION CONSUMPTION OF SYNTHETIC LUBRICANTS

5.1.3 INCREASE IN DEMAND FOR SUSTAINABLE AVIATION FUEL BY AIRLINES

5.1.4 INCREASE IN INVESTMENTS FOR THE GROWTH OF COMMERCIAL AIRCRAFTS

5.2 RESTRAINTS

5.2.1 INADEQUATE AVAILABILITY OF FEEDSTOCK AND REFINERIES TO MEET SUSTAINABLE AVIATION FUEL PRODUCTION DEMAND

5.2.2 FLUCTUATIONS IN CRUDE OIL PRICES AND CONTAMINATION OF LUBRICANTS

5.3 OPPORTUNITIES

5.3.1 REDUCTION IN CARBON FOOTPRINT DUE TO LOW CAPABILITY OF SUSTAINABLE AVIATION FUEL

5.3.2 DEVELOPMENT OF ECO-FRIENDLY AND SAFE AVIATION LUBRICANTS

5.3.3 RISE IN DEMAND FOR LOW-DENSITY LUBRICANTS FOR REDUCED WEIGHT

5.3.4 RISE IN SAFETY REGULATIONS FOR AIRCRAFTS

5.4 CHALLENGE

5.4.1 THE HIGH COST OF SUSTAINABLE AVIATION FUEL INCREASES THE OPERATING COST OF AIRLINES

6 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE

6.1 OVERVIEW

6.2 BIOFUEL

6.3 HYDROGEN FUEL

6.4 POWER TO LIQUID FUEL

7 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK)

7.3 FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK)

7.4 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP)

7.5 FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A)

7.6 ALCOHOL TO JET SPK (ATJ-SPK)

7.7 CATALYTIC HYDROTHERMOLYSIS JET (CHJ)

8 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY

8.1 OVERVIEW

8.2 BELOW 30%

8.3 30% TO 50%

8.4 ABOVE 50%

9 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM

9.1 OVERVIEW

9.2 COMMERCIAL AVIATION

9.2.1 BY TYPE

9.2.1.1 NARROW BODY AIRCRAFT

9.2.1.2 WIDE-BODY AIRCRAFT (WBA)

9.2.1.3 VERY LARGE AIRCRAFT (VLA)

9.2.1.4 REGIONAL TRANSPORT AIRCRAFT (RTA)

9.2.2 BY FUEL TYPE

9.2.2.1 BIOFUEL

9.2.2.2 HYDROGEN

9.2.2.3 POWER TO LIQUID FUEL

9.3 BUSINESS & GENERAL AVIATION

9.3.1 BIOFUEL

9.3.2 HYDROGEN

9.3.3 POWER TO LIQUID FUEL

9.4 MILITARY AVIATION

9.4.1 BIOFUEL

9.4.2 HYDROGEN

9.4.3 POWER TO LIQUID FUEL

9.5 UNMANNED AERIAL VEHICLE

9.5.1 BIOFUEL

9.5.2 HYDROGEN

9.5.3 POWER TO LIQUID FUEL

10 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 NESTE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 BP P.L.C.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 PREEM AB.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 CEPSA

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 CHEVRON CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AVFUEL CORPORATION

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ENI

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EXXON MOBIL CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FULCRUM BIOENERGY

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GEVO

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HONEYWELL INTERNATIONAL INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 HYPOINT INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOHNSON MATTHEY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 LANZATECH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PROMETHEUS FUELS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SKYNRG

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SASOL

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 TOTALENERGIES

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 VELOCYS

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 VIRENT, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 WORLD ENERGY

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 ZEROAVIA, INC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 2 NORTH AMERICA BIOFUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 NORTH AMERICA HYDROGEN IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 4 NORTH AMERICA POWER TO LIQUID FUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 5 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 6 NORTH AMERICA HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 7 NORTH AMERICA FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 NORTH AMERICA SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 9 NORTH AMERICA FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 10 NORTH AMERICA ALCOHOL TO JET SPK (ATJ-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 11 NORTH AMERICA CATALYTIC HYDROTHERMOLYSIS JET (CHJ) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 12 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 13 NORTH AMERICA BELOW 30% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 NORTH AMERICA 30% TO 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 NORTH AMERICA ABOVE 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 16 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 17 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 19 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 20 NORTH AMERICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 21 NORTH AMERICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 22 NORTH AMERICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 NORTH AMERICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 24 NORTH AMERICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 25 NORTH AMERICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 26 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 27 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 28 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 29 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 30 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 31 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 32 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 33 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 34 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 35 NORTH AMERICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 36 NORTH AMERICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 37 NORTH AMERICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 38 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 39 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 40 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 41 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 42 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 43 U.S. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 44 U.S. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 45 U.S. BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 46 U.S. MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 47 U.S. UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 48 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 49 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 50 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 51 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 52 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 53 CANADA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 54 CANADA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 55 CANADA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 56 CANADA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 57 CANADA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 58 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 59 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 60 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 61 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 62 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 63 MEXICO COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 64 MEXICO COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 65 MEXICO BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 66 MEXICO MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 67 MEXICO UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 10 THE INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 11 BIO FUEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 13 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET

FIGURE 15 NORTH AMERICA AIR TRANSPORT PASSENGER DEMAND

FIGURE 16 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY TECHNOLOGY, 2021

FIGURE 17 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY MANUFACTURING TECHNOLOGY, 2021

FIGURE 18 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING CAPACITY, 2021

FIGURE 19 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING PLATFORM, 2021

FIGURE 20 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY FUEL TYPE (2022-2029)

FIGURE 25 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.