Mercado de desinfectantes de superficies de América del Norte, por composición (alcoholes, cloro, amonio cuaternario, aldehídos, peróxidos, biodesinfectantes), tipo ( líquido , aerosoles, toallitas), aplicación (desinfección de superficies, desinfección de instrumentos y otras aplicaciones), usuario final (hospitales, laboratorios de diagnóstico e investigación, empresas farmacéuticas y biotecnológicas, alimentos y bebidas y residenciales ), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado

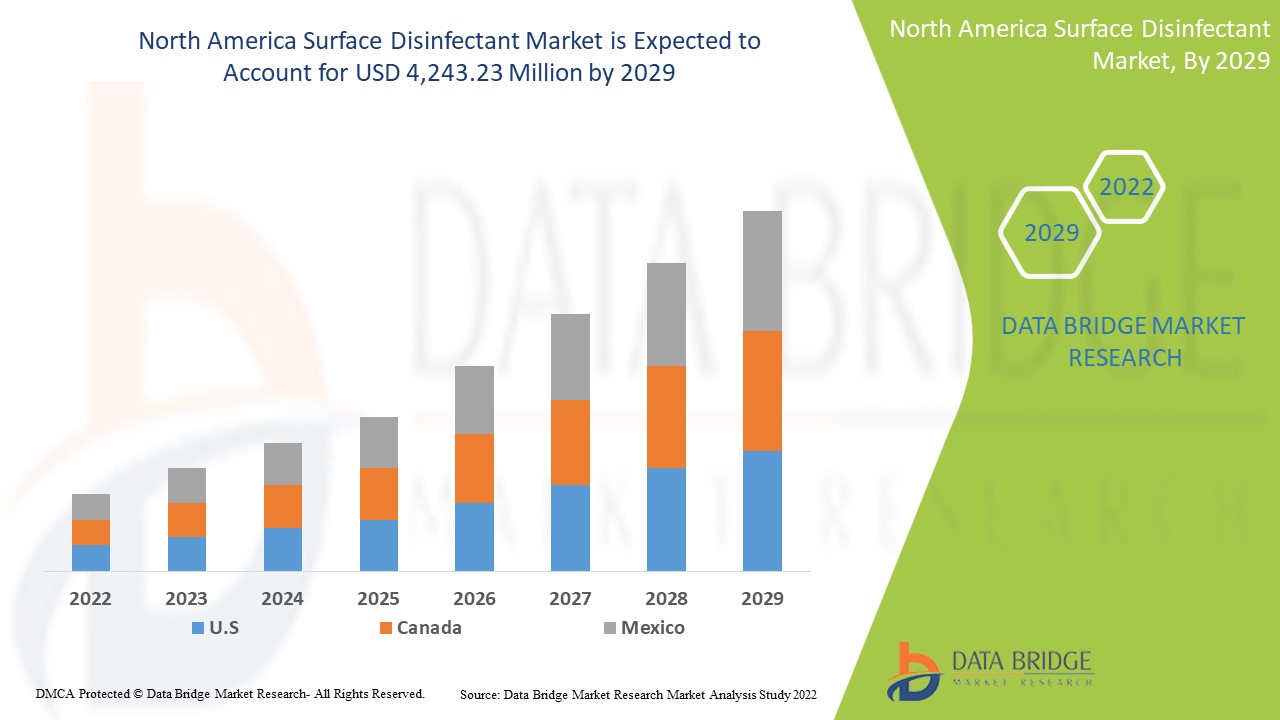

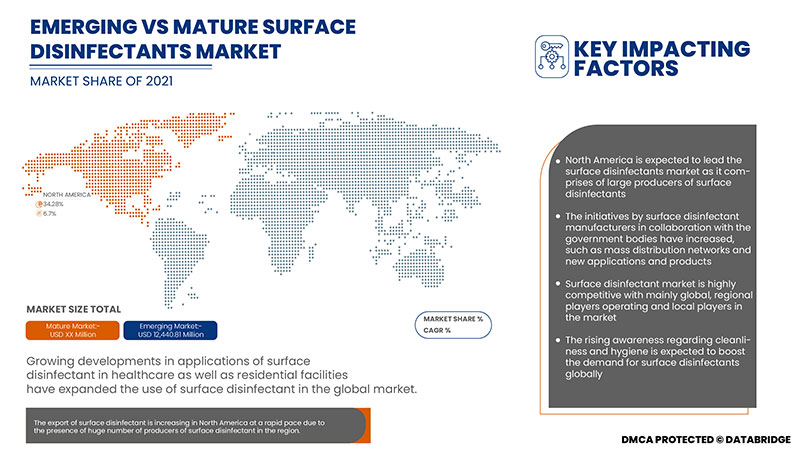

Se espera que el mercado de desinfectantes de superficies de América del Norte gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,7% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 4243,23 millones para 2029. El factor principal que impulsa el crecimiento del mercado de desinfectantes de superficies es la creciente demanda de los centros de atención médica, el aumento de la incidencia de trastornos crónicos, la creciente demanda de productos después de Covid-19 y el cambio de la preferencia de los consumidores hacia el uso de desinfectantes de base biológica y respetuosos con la naturaleza.

Los desinfectantes son antimicrobianos utilizados para matar bacterias dañinas, gérmenes y otros microorganismos presentes en diversas superficies y, por lo tanto, se utilizan más comúnmente para desinfectar pisos, baños, azulejos, muebles e instrumentos.

Un desinfectante de superficies es un compuesto químico que se utiliza para matar o inactivar microorganismos, generalmente en una superficie sólida . Estos desinfectantes se pueden encontrar en varios compuestos químicos y funcionan en varias vías para destruir microorganismos. Se pueden incorporar en diferentes formas, como líquidos, toallitas y aerosoles. El brote de COVID-19 aumentó significativamente la necesidad de prácticas de limpieza y desinfección de superficies . Se están tomando todas las medidas conocidas para frenar la propagación del virus mortal, incluida la desinfección y limpieza de superficies. Esto aumentó la demanda de desinfectantes de superficies a múltiples niveles.

El informe del mercado de desinfectantes de superficies de América del Norte proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de segmentos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volumen en kilogramos, precios en USD |

|

Segmentos cubiertos |

Por composición (alcoholes, cloro, amonio cuaternario, aldehídos, peróxidos, biodesinfectantes), tipo (líquido, aerosoles, toallitas), aplicación (desinfección de superficies, desinfección de instrumentos y otras aplicaciones), usuario final (hospitales, laboratorios de diagnóstico e investigación, empresas farmacéuticas y biotecnológicas, alimentos y bebidas y residenciales) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Español Los nombres comerciales incluyen: 3M, Ecolab, Gesco Healthcare Pvt. Ltd., Contec, Inc., BETCO, CARROLLCLEAN, Cetylite, Inc., GOJO Industries, Inc., Medalkan, Medline Industries, LP., Metrex Research, LLC., Spartan Chemical Company, Inc., RUHOF, ZEP Inc., KINNOS INC, PDI, Inc., Pal International, OXY PHARM, Reckitt Benckiser Group PLC., PurposeBuilt Brands, SC Johnson & Son Inc., Brulin, MEDIVATORS Inc., Pharmax Limited, Whiteley, Procter & Gamble, STERIS, The Clorox Company, PAUL HARTMANN AG y Diversey Holdings LTD. |

Definición de mercado

Se espera que la creciente demanda de los centros de atención médica, el aumento de los trastornos crónicos y el cambio en la preferencia de los consumidores hacia desinfectantes de base biológica y respetuosos con la naturaleza impulsen el crecimiento del mercado de desinfectantes de superficies de América del Norte. La creciente concienciación entre la población y el mayor enfoque en las iniciativas de investigación y desarrollo (I+D) brindarán oportunidades en el mercado de desinfectantes de superficies de América del Norte. Sin embargo, se prevé que los riesgos ambientales y para la salud asociados con los desinfectantes supongan un desafío para el crecimiento del mercado de desinfectantes de superficies.

Dinámica del mercado de desinfectantes de superficies en América del Norte

Conductores

- Demanda creciente de los centros de salud

Con el aumento del número de cirugías realizadas en los hospitales, se han utilizado cada vez más desinfectantes en los procedimientos quirúrgicos para evitar infecciones y brindar una atención de calidad al paciente y mantener la higiene. El uso creciente de desinfectantes para desinfectar diversas superficies, como instrumentos médicos reutilizables como endoscopios, la esterilización inadecuada del equipo médico y la desinfección de alto nivel insuficiente pueden provocar efectos adversos graves para los pacientes.

- Aumento de la incidencia de trastornos crónicos

Se espera que el aumento de la población de pacientes de edad avanzada cambie los sistemas de prestación y funcionamiento de los servicios de atención sanitaria y cree un mayor mercado para los desinfectantes de superficies, ya que la población de edad avanzada es propensa a contraer infecciones intrahospitalarias. Además, el aumento de enfermedades crónicas, como las enfermedades cardiovasculares y otras, requiere una estancia hospitalaria prolongada. Por lo tanto, hay un aumento en el número de casos de infecciones intrahospitalarias durante estas estancias.

- Aumento de la demanda de productos tras el brote de Covid-19

La pandemia ha trastocado todos los sistemas sanitarios del mundo debido a la creciente afluencia de pacientes en los hospitales. También se han creado varios hospitales temporales para hacer frente a la creciente incidencia de la enfermedad y controlarla. Por tanto, la propagación de la COVID-19 ha provocado un aumento de la demanda de productos de limpieza y desinfección debido a la creciente concienciación sobre la seguridad, la higiene y la salud. Por tanto, el aumento del gasto sanitario y el aumento del número de hospitales temporales también están impulsando la demanda de desinfectantes de superficies. Además, factores como la creciente demanda de camas de hospital y UCI y el creciente número de instalaciones de aislamiento han impulsado enormemente la demanda de desinfectantes de superficies.

- Cambio de preferencia de los consumidores hacia el uso de desinfectantes de origen biológico y respetuosos con la naturaleza

Los desinfectantes de superficies de origen biológico son cada vez más populares entre los consumidores debido a la creciente tendencia a utilizar productos respetuosos con el medio ambiente y productos que no tengan efectos tóxicos para la salud y el medio ambiente. Además, las estrictas regulaciones relativas al uso excesivo de productos químicos han impulsado el crecimiento de los desinfectantes de base biológica en los últimos años. Los desinfectantes de superficies de origen biológico también son muy eficaces. Ayudan a matar los gérmenes sin dejar residuos químicos tóxicos y eliminan los efectos nocivos para la piel, los ojos y el sistema respiratorio. Estos beneficios han atraído la atención de los consumidores hacia los productos desinfectantes de superficies de origen biológico. Además, el creciente interés de los fabricantes de desinfectantes de superficies por invertir en investigación y desarrollo para desarrollar nuevas fórmulas de origen biológico y aumentar el uso de desinfectantes de superficies de origen biológico como alternativa a los productos de base química también está impulsando el crecimiento del mercado.

Oportunidades

- Aumentar la concienciación de un gran porcentaje de la población

Las organizaciones gubernamentales y no gubernamentales, como la Organización Mundial de la Salud, también han puesto en marcha programas de concienciación y directrices para difundir entre los consumidores la conciencia sobre la salud y la higiene y el uso adecuado de los desinfectantes en sus respectivos lugares. Se espera que todo esto proporcione una serie de oportunidades para el crecimiento y el desarrollo del mercado de desinfectantes de superficies de América del Norte.

- Mayor atención a las iniciativas de investigación y desarrollo (I+D)

Los fabricantes del mercado de desinfectantes de superficies también están modernizando sus instalaciones de producción para satisfacer la mayor demanda de desinfectantes debido al brote del nuevo coronavirus, además de lanzar productos con nuevas fórmulas que eliminan eficazmente los gérmenes y las bacterias en diversas superficies. Por lo tanto, el creciente enfoque y desarrollo de iniciativas de investigación y desarrollo creará oportunidades para aprovechar el crecimiento del mercado de desinfectantes de superficies de América del Norte.

Restricciones/Desafíos

- Falta de comprensión sobre el uso de prácticas de desinfección estándar por parte de los usuarios finales

En los centros sanitarios y ambientales, la limpieza es una intervención compleja de prevención y control de infecciones que requiere un enfoque multidimensional. Esto incluye capacitación, monitoreo adecuado, auditorías y comentarios regulares, y la exhibición de procedimientos operativos estándar en áreas clave. La capacitación del personal de limpieza debe basarse en las políticas y procedimientos operativos estándar del centro sanitario y las pautas nacionales de la región.

- Disponibilidad de productos y tecnologías alternativas en el mercado

Algunas de las tecnologías para la desinfección incluyen la luz ultravioleta y el vapor. El vapor a alta temperatura, con baja humedad o el vapor seco no deja residuos ni películas químicas, lo que resulta muy eficaz y adecuado para muchas superficies. La luz ultravioleta C es adecuada para aplicaciones de desinfección específicas. Puede desinfectar salas médicas desocupadas y dispositivos electrónicos de alta tecnología, y puede utilizarse en el interior de conductos de aire para desinfectar el aire. Además, se han adoptado nuevas tecnologías de descontaminación automatizadas y sin contacto, como el peróxido de hidrógeno vaporizado y en aerosol, los dispositivos móviles que emiten luz ultravioleta (UV-C) continua y la luz de espectro estrecho de alta intensidad (405 nm). Estas tecnologías han demostrado una reducción de la contaminación bacteriana en las superficies. Por lo tanto, la disponibilidad de una amplia gama de productos y tecnologías alternativas a los desinfectantes de superficies en el mercado es el factor limitante para el crecimiento y, por lo tanto, restringe el desarrollo del mercado de desinfectantes de superficies de América del Norte.

- Riesgos ambientales y para la salud asociados con el uso de desinfectantes

Muchos desinfectantes de superficies se degradan lentamente o se biodegradan en sustancias químicas más tóxicas, persistentes y bioacumulables, lo que supone una amenaza para la vida acuática. Los ingredientes como el fósforo o el nitrógeno contribuyen a la carga de nutrientes en los cuerpos de agua, lo que provoca efectos adversos en la calidad del agua y la vida acuática presente en ellos. Además, los compuestos orgánicos volátiles (COV) de los productos de limpieza también pueden afectar a la calidad del aire interior y contribuir a la formación de smog en el aire exterior. Existen diversos efectos nocivos y peligros asociados a los desinfectantes de superficies, que actúan como un grave desafío para el crecimiento del mercado de desinfectantes de superficies de América del Norte en el futuro cercano.

- El precio más alto de los desinfectantes de superficies de base química en comparación con los desinfectantes de base biológica

Los desinfectantes de superficies a base de productos químicos ocupan una parte importante del mercado de desinfectantes de superficies de América del Norte debido a sus amplias aplicaciones en diversas instalaciones, como hospitales, clínicas, industrias y lugares públicos. Por lo tanto, sus altos precios afectarán negativamente al mercado y supondrán un desafío para el mercado de desinfectantes de superficies de América del Norte.

El COVID-19 tuvo un impacto mínimo en el mercado de desinfectantes de superficies de América del Norte

La COVID-19 afectó a varias industrias manufactureras en el año 2020-2021, ya que provocó el cierre de lugares de trabajo, la interrupción de las cadenas de suministro y las restricciones al transporte. Sin embargo, se notó un impacto significativo en el mercado de desinfectantes de superficies. Las operaciones y la cadena de suministro de desinfectantes de superficies, con múltiples instalaciones de fabricación, seguían funcionando en la región. Los proveedores de servicios continuaron ofreciendo desinfectantes de superficies siguiendo las medidas de saneamiento y seguridad en el escenario posterior a la COVID.

Desarrollo reciente

En mayo de 2022, BETCO lanzó dos nuevos módulos a pedido para ayudar a compartir información valiosa sobre la desinfección general y la desinfección específica de las instalaciones. Estos módulos cubren los desinfectantes que funcionan junto con los tipos de desinfectantes y cómo recomendar o seleccionar los desinfectantes más efectivos.

Alcance del mercado de desinfectantes de superficies en América del Norte

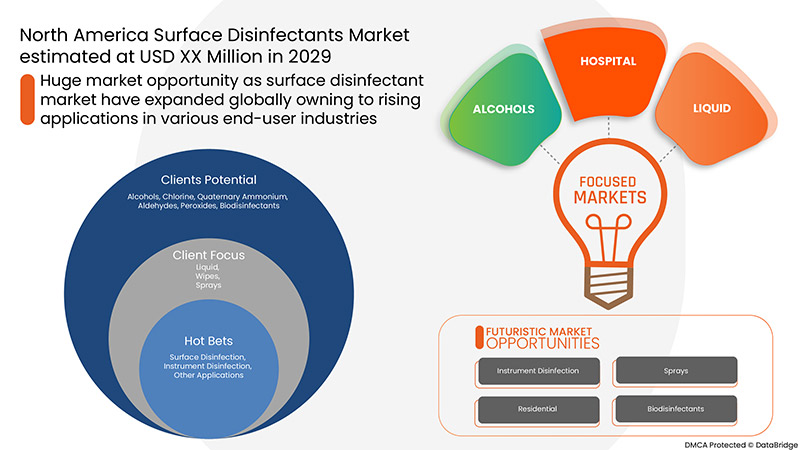

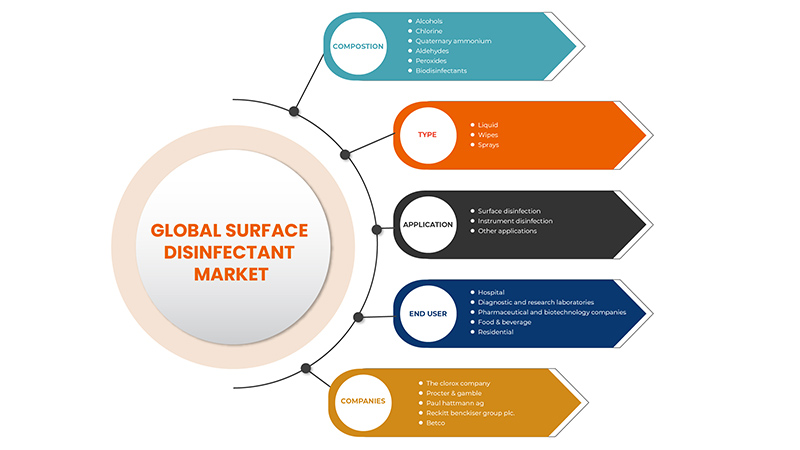

El mercado de desinfectantes de superficies de América del Norte se clasifica en función de la composición, el tipo, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento de la industria y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Composición

- Alcoholes

- Cloro

- Amonio cuaternario

- Aldehídos

- Peróxidos

- Biodesinfectantes

Según la composición, el mercado de desinfectantes de superficies de América del Norte se clasifica en seis segmentos: alcoholes, cloro, amonio cuaternario, aldehídos, peróxidos y biodesinfectantes.

Tipo

- Líquido

- Toallitas

- Aerosoles

Según el tipo, el mercado de desinfectantes de superficies de América del Norte se clasifica en tres segmentos: líquido, toallitas y aerosoles.

Solicitud

- Desinfección de superficies

- Desinfección de instrumentos

- Otras aplicaciones

Según la aplicación, el mercado de desinfectantes de superficies de América del Norte está segmentado en desinfección de superficies, desinfección de instrumentos y otras aplicaciones.

Usuario final

- Hospital

- Laboratorios de diagnóstico e investigación

- Empresas farmacéuticas y biotecnológicas

- Alimentos y bebidas

- Residencial

Según el usuario final, el mercado de desinfectantes de superficies de América del Norte está segmentado en hospitales, laboratorios de diagnóstico e investigación, empresas farmacéuticas y de biotecnología, alimentos y bebidas, y residenciales.

Análisis y perspectivas regionales del mercado de desinfectantes de superficies de América del Norte

El mercado de desinfectantes de superficies de América del Norte en la industria de la salud está segmentado según la composición, el tipo, la aplicación y el usuario final.

Los países del mercado de desinfectantes de superficies de América del Norte son Estados Unidos, Canadá y México.

Estados Unidos domina el mercado de desinfectantes de superficies de América del Norte en términos de participación de mercado e ingresos de mercado y seguirá manteniendo su dominio durante el período de pronóstico. Esto se debe al aumento de las visitas a hospitales y centros de diagnóstico.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos del análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias tecnológicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los desinfectantes de superficies en América del Norte

El panorama competitivo del mercado de desinfectantes de superficies de América del Norte proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de desinfectantes de superficies de América del Norte.

Algunos de los participantes destacados que operan en el mercado de desinfectantes de superficies de América del Norte son 3M, Ecolab, Gesco Healthcare Pvt. Ltd., Contec, Inc., BETCO, CARROLLCLEAN, Cetylite, Inc, GOJO Industries, Inc., Medalkan, Medline Industries, LP., Metrex Research, LLC., Spartan Chemical Company, Inc., RUHOF, ZEP Inc., KINNOS INC, PDI, Inc, Pal International, OXY PHARM, Reckitt Benckiser Group PLC., PurposeBuilt Brands, SC Johnson & Son Inc., Brulin, MEDIVATORS Inc, Pharmax Limited, Whiteley, Procter & Gamble, STERIS, The Clorox Company, PAUL HARTMANN AG y Diversey Holdings LTD.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, América del Norte frente a la región y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SURFACE DISINFECTANTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 COMPOSITION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 U.S SURFACE DISINFECTANT ANALYSIS

4.2 EPIDEMIOLOGY

4.2.1 INCIDENCE

4.2.2 TREATMENT RATE

4.2.3 MORTALITY RATE

4.2.4 PATIENT TREATMENT SUCCESS RATE

4.3 INDUSTRIAL INSIGHTS:

4.3.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.3.2 KEY PRICING STRATEGIES

4.3.2.1 PRICES OF RAW MATERIALS:

4.3.2.2 FLUCTUATION IN DEMAND AND SUPPLY

4.3.2.3 LEVELS OF DISINFECTION

4.3.3 QUALITY:

4.3.4 KEY CONSUMER ENROLLMENT STRATEGIES

4.3.5 INTERVIEWS WITH DISINFECTION PRODUCT MANUFACTURERS

4.3.6 INTERVIEWS WITH INFECTIOUS DISEASE SCIENTISTS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.5.1 THREAT OF NEW ENTRANTS:

4.5.2 THREAT OF SUBSTITUTES:

4.5.3 CUSTOMER BARGAINING POWER:

4.5.4 SUPPLIER BARGAINING POWER:

4.5.5 INTERNAL COMPETITION (RIVALRY):

5 NORTH AMERICA SURFACE DISINFECTANT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FROM HEALTHCARE FACILITIES

6.1.2 RISE IN OCCURRENCES OF CHRONIC DISORDERS

6.1.3 RISING PRODUCT DEMAND POST THE OUTBREAK OF COVID-19

6.1.4 SHIFTING CONSUMERS' PREFERENCE TOWARD USE OF BIO-BASED AND NATURE-FRIENDLY DISINFECTANTS

6.2 RESTRAINTS

6.2.1 LACK OF UNDERSTANDING REGARDING THE USE OF STANDARD DISINFECTION PRACTICES BY END-USERS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS AND TECHNOLOGIES IN THE MARKET

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS AMONG A LARGE PERCENTAGE OF POPULATION

6.3.2 INCREASING FOCUS ON RESEARCH AND DEVELOPMENT (R&D) INITIATIVES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL & HEALTH HAZARDS ASSOCIATED WITH THE USE OF DISINFECTANTS

6.4.2 HIGHER PRICE OF CHEMICAL-BASED SURFACE DISINFECTANTS COMPARED TO BIO-BASED DISINFECTANTS

7 NORTH AMERICA SURFACE DISINFECTANTS MARKET, COMPOSITION

7.1 OVERVIEW

7.2 ALCOHOLS

7.3 CHLORINE

7.4 QUATENARY AMMONIUM

7.5 ALDEHYDES

7.6 PEROXIDES

7.7 BIO DISINFECTANTS

8 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 LIQUID

8.3 WIPES

8.4 SPRAYS

9 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SURFACE DISINFECTION

9.3 INSTRUMENT DISINFECTION

9.4 OTHER APPLICATIONS

10 NORTH AMERICA SURFACE DISINFECTANTS MARKET, END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 DIAGNOSTIC AND RESEARCH LABORATORIES

10.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.5 FOOD & BEVERAGES

10.6 RESIDENTIAL

11 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA SURFACE DISINFECTANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.1.1 COLLABORATION

12.1.2 PRODUCT LAUNCHES

12.1.3 PARTNERSHIP

12.1.4 EVENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 THE CLOROX COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATE

14.2 PAUL HARTMANN AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 PROCTER & GAMBLE

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATE

14.4 DIVERSEY HOLDINGS LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 RECKITT BENCKISER GROUP PLC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 BETCO

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BRULIN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CARROLLCLEAN

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 CETYLITE, INC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONTEC, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 ECOLAB

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT UPDATES

14.12 GESCO HEALTHCARE PVT. LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATE

14.13 GOJO INDUSTRIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATE

14.14 KINNOS INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 MEDALKAN

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 MEDIVATORS, INC

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 MEDLINE INSUSTRIES, LP.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 METREX RESEARCH, LLC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 OXY PHARM

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 PAL INTERNATIONAL

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

14.21 PDI, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 PHARMAX LIMITED

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATES

14.23 PURPOSEBUILT BRANDS

14.23.1 COMPANY SNAPSHOT

14.23.2 RECENT UPDATE

14.24 RUHOF

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATE

14.25 S.C. JOHNSON & SON INC.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT UPDATES

14.26 SPARTAN CHEMICAL COMPANY, INC.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT UPDATES

14.27 STERIS

14.27.1 COMPANY SNAPSHOT

14.27.2 REVENUE ANALYSIS

14.27.3 PRODUCT PORTFOLIO

14.27.4 RECENT UPDATES

14.28 WHITELEY

14.28.1 COMPANY SNAPSHOT

14.28.2 PRODUCT PORTFOLIO

14.28.3 RECENT UPDATES

14.29 ZEP INC.

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT UPDATES

14.3 3M

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 PRODUCT PORTFOLIO

14.30.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF DISINFECTANTS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES; HS CODE – 380894 (USD THOUSAND)

TABLE 2 EXPORT DATA OF DISINFECTANTS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES; HS CODE – 380894 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ALCOHOLS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CHLORINE IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA QUATERNARY AMMONIUM IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ALDEHYDES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PEROXIDES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BIO DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 13 NORTH AMERICA LIQUID IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA WIPES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SPRAYS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SURFACE DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA INSTRUMENT DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHER APPLICATIONS IN SURFACE DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA HOSPITALS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA DIAGNOSTIC AND RESEARCH LABORATORIES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGIES COMPANIES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA FOOD & BEVERAGES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA RESIDENTIAL IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 30 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 U.S. SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 33 U.S. SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 35 U.S. SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 U.S. SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 CANADA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 38 CANADA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 CANADA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 40 CANADA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 CANADA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 MEXICO SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 43 MEXICO SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 45 MEXICO SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MEXICO SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SURFACE DISINFECTANTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SURFACE DISINFECTANTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SURFACE DISINFECTANTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SURFACE DISINFECTANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SURFACE DISINFECTANTS MARKET: COMPOSITION LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SURFACE DISINFECTANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SURFACE DISINFECTANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SURFACE DISINFECTANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SURFACE DISINFECTANTS MARKET: END USER COVERAGE GRID

FIGURE 11 NORTH AMERICA SURFACE DISINFECTANTS MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SURFACE DISINFECTANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA SURFACE DISINFECTANTS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 INCREASING DEMAND FROM HEALTH CARE FACILITIES IS EXPECTED TO DRIVE THE NORTH AMERICA SURFACE DISINFECTANTS MARKET IN THE FORECAST PERIOD

FIGURE 16 ALCOHOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SURFACE DISINFECTANTS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SURFACE DISINFECTANTS MARKET

FIGURE 18 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2021

FIGURE 19 NORTH AMERICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2021

FIGURE 20 NORTH AMERICA SURFACE DISINFECTANTS MARKET, APPLICATION, 2021

FIGURE 21 NORTH AMERICA SURFACE DISINFECTANTS MARKET, END USER, 2021

FIGURE 22 NORTH AMERICA SURFACE DISINFECTANTS MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA SURFACE DISINFECTANTS MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA SURFACE DISINFECTANTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA SURFACE DISINFECTANTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA SURFACE DISINFECTANTS MARKET: BY COMPOSITION (20212- 2029)

FIGURE 27 NORTH AMERICA SURFACE DISINFECTANT MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.