North America Rigid Thermoform Plastic Packaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

207.80 million

USD

290.53 million

2022

2030

USD

207.80 million

USD

290.53 million

2022

2030

| 2023 –2030 | |

| USD 207.80 million | |

| USD 290.53 million | |

|

|

|

Mercado de envases de plástico termoformado rígido de América del Norte, por producto (polimetacrilato de metilo (PMMA), polímeros biodegradables, polietileno, acrilonitrilo butadieno estireno (ABS), cloruro de polivinilo (PVC), poliestireno de alto impacto, poliestireno, polipropileno (PP)), producto de envasado (botellas y frascos, bandejas, tarrinas, vasos, otros), proceso (conformado asistido por enchufe, termoformado de calibre grueso, termoformado de calibre fino, cierre a presión al vacío), proceso de fabricación (extrusión, moldeo por inyección, otros), aplicación (alimentos y bebidas, cuidado personal, médicos y sanitarios, electricidad y electrónica, automoción, construcción, bienes de consumo y electrodomésticos, otros), usuario final (alimentos y bebidas, cuidado personal, hogar, atención sanitaria, otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de envases de plástico termoformado rígido de América del Norte

Una de las principales tendencias en el sector de los envases de plástico rígido es el uso de materiales a base de fibra para el envasado, además de la agricultura, la medicina, el cuidado personal y los productos farmacéuticos. Las soluciones de envasado de plástico rígido se utilizan en diversos sectores industriales. Para crear estos componentes de envasado se utilizan técnicas como la extrusión, el moldeo por inyección, el moldeo por soplado, el termoformado y otras. Las botellas de plástico, por otro lado, se han convertido en un sustituto atractivo de las botellas de vidrio debido a sus atractivas cualidades, asequibilidad, ligereza, facilidad de producción y resistencia al impacto.

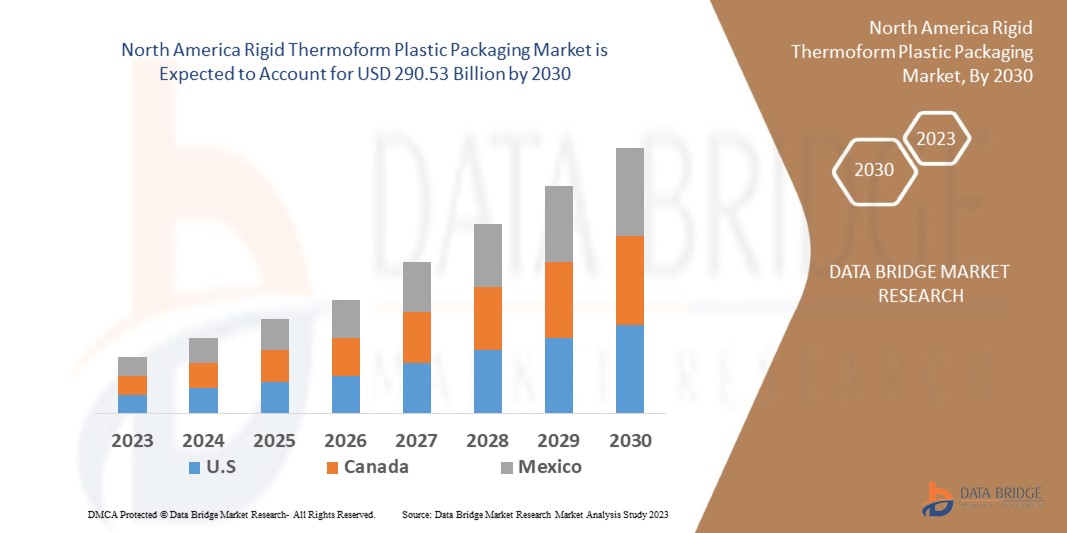

Data Bridge Market Research analiza que se espera que el mercado de envases de plástico termoformado rígido alcance los 290.530 millones de dólares en 2030, que fueron 207.800 millones de dólares en 2022, registrando una CAGR del 4,82% durante el período de pronóstico de 2023 a 2030. Además de la información sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis experto en profundidad, producción y capacidad por empresa representada geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis de déficit de la cadena de suministro y la demanda.

Alcance y segmentación del mercado de envases de plástico termoformado rígido de América del Norte

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en miles de millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Producto (Polimetilmetacrilato (PMMA), Polímeros biodegradables, Polietileno, Acrilonitrilo butadieno estireno (ABS), Cloruro de polivinilo (PVC), Poliestireno de alto impacto, Poliestireno, Polipropileno (PP)), Producto de embalaje (Botellas y tarros, Bandejas, Botes, Vasos, Otros), Proceso (Conformado asistido por tapón, Termoformado de calibre grueso, Termoformado de calibre fino, Cierre por vacío), Proceso de fabricación (Extrusión, Moldeo por inyección, Otros), Aplicación (Alimentos y bebidas, Cuidado personal, Medicina y atención sanitaria, Electricidad y electrónica, Automoción, Construcción, Bienes de consumo y electrodomésticos, Otros), Usuario final (Alimentos y bebidas, Cuidado personal, Hogar, Atención sanitaria, Otros) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

ALPLA (Austria), Amcor plc (Australia), DS Smith (Reino Unido), Klöckner Pentaplast (Alemania), Berry Global Inc. (EE. UU.), Pactiv Evergreen Inc. (EE. UU.), Sonoco Products Company (EE. UU.) |

|

Oportunidades de mercado |

|

Definición de mercado

El termoformado de plástico es un proceso de fabricación que implica calentar una lámina de plástico hasta que se vuelve flexible, moldearla en una forma específica y recortarla para crear un producto destinado a su envasado. Muchos tipos de envases, incluidas las bandejas de plástico tipo concha, los blísters y las películas para tapas, se fabrican mediante termoformado de calibre fino.

Los materiales plásticos como el polipropileno (PP), el polietileno de alta densidad (HDPE) y el polietileno (PET) se utilizan en envases de plástico rígido para el envasado de nuevas botellas y contenedores. Estos materiales son resistentes y ligeros. Las soluciones de envasado de polietileno y polipropileno se utilizan en diversas industrias, entre ellas la de alimentos y bebidas, la agricultura, la industria aeroespacial, la automoción y la medicina.

Dinámica del mercado de envases de plástico termoformado rígido en América del Norte

Conductores

• El reciclaje puede ayudar a reducir los desechos y la basura.

En todo el mundo ha habido mucho interés por la reutilización y el reciclaje de los materiales de embalaje. El reciclaje consiste en convertir la basura en un producto que se puede volver a utilizar. Las botellas de leche fabricadas con HDPE y PET se reciclan con frecuencia. El reciclaje de los envases de plástico rígido reduce la necesidad de materias primas, lo que reduce la contaminación del aire y del agua y las emisiones de gases de efecto invernadero. Con materiales reciclados, también se pueden controlar las emisiones de CO2. Los materiales de embalaje de plástico rígido han mostrado tasas de reciclaje significativas. Muchos gobiernos y partes interesadas comerciales han desarrollado planes para reducir los residuos plásticos mediante el reciclaje.

• Aumento de la demanda del sector sanitario

Su resistencia, limpieza, transparencia y ligereza hacen que el envase de plástico rígido proteja a los medicamentos de la contaminación. Es ideal para almacenar suministros médicos como agujas, comprimidos, jarabes, equipos quirúrgicos y otros artículos. Según las proyecciones, la demanda de envases de plástico rígido aumentará a nivel mundial a medida que se expanda la industria de la salud.

Oportunidades

- Creciente demanda de envases de plástico rígido en los sectores del cuidado personal y la cosmética

Para el envasado de productos de protección solar, cuidado de la piel, cuidado bucal, cuidado corporal, productos ornamentales y cuidado del cabello, la industria cosmética y de cuidado personal utiliza envases de plástico rígido. Esto permite que los productos se almacenen sin problemas y tengan una vida útil más larga. A medida que el mercado de cosméticos y cuidado personal emerge rápidamente en los países, también lo hace la demanda de envases de plástico rígido.

- Se espera que la expansión de las aplicaciones de poliestireno impulse el crecimiento

El poliestireno rígido y duro se utiliza en carcasas de televisores y ordenadores. El poliestireno también se utiliza en otros equipos porque proporciona el tipo de acabado y forma adecuados. El poliestireno se utiliza ampliamente en el envasado de productos alimentarios. Promueve la limpieza y la frescura de los alimentos. El poliestireno es económico de utilizar y, como es transparente, tiene un aspecto excelente, lo que resulta fundamental en el comercio minorista. Tanto el poliestireno de uso general (GPPS) como el poliestireno de alto impacto (HIP) son adecuados para el moldeo por inyección. Por tanto, las crecientes aplicaciones del poliestireno están impulsando el crecimiento.

- Se espera que las ventajas del termoformado aumenten la demanda de envases de plástico rígido.

El termoformado es una técnica de conformado de plástico que se utiliza para crear una amplia gama de bienes de consumo, ablandando una lámina de plástico sobre un molde y dejándola enfriar. Con la maquinaria adecuada, el termoformado puede producir cientos de piezas de plástico por hora, lo que lo convierte en una técnica de conformado ideal para producir piezas de plástico. La lámina de plástico fina que se utiliza para fabricar piezas de plástico de calibre fino se conoce como película de termoformado. Las ventajas del termoformado incluyen menores costos, mayor versatilidad, tiempos de entrega más rápidos y menos desperdicio. Los envases de plástico para productos de los sectores minorista, médico, de alimentos y bebidas y otros se crean mediante termoformado de calibre fino. Estas ventajas del termoformado están impulsando el crecimiento del mercado durante el período de pronóstico.

Restricciones/ Desafíos

- Las consecuencias medioambientales de los envases están frenando el crecimiento.

El polietileno de alta densidad (HDPE), el poliestireno expandido (EPS), el tereftalato de polietileno (PET) y el cloruro de polivinilo son los polímeros utilizados en la industria del embalaje (PVC). Muchas industrias utilizan embalajes de plástico rígido para conservar y almacenar productos envasados, como equipos industriales, alimentos y suministros médicos. El principal problema que presentan estos polímeros es la dificultad de reciclar, reutilizar y clasificar los residuos plásticos. Los materiales de embalaje de plástico pueden descomponerse en vertederos durante hasta mil años, contaminando el aire, la tierra y el agua. Además, a temperatura ambiente, los termoplásticos se ablandan y pierden resistencia mecánica cuando se exponen a la luz solar directa. Como resultado, los efectos ambientales negativos de los embalajes de plástico rígido limitarán el crecimiento del mercado.

Este informe de mercado de envases de plástico termoformado rígido proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de envases de plástico termoformado rígido, comuníquese con Data Bridge Market Research para obtener un informe de analistas; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias comienzan a sufrir. Los efectos previstos de la crisis económica sobre los precios y la accesibilidad de los productos se tienen en cuenta en los informes de conocimiento del mercado y los servicios de inteligencia que ofrece DBMR. Con esto, nuestros clientes pueden normalmente mantenerse un paso por delante de sus competidores, proyectar sus ventas e ingresos y estimar sus gastos de ganancias y pérdidas.

Acontecimientos recientes

- En 2021, Coexpan lanzó varias soluciones de envasado que utilizan sus bandejas monomateriales de PET o PP coexshield para aplicaciones de alimentos elaborados exclusivamente, afirmando que extienden la vida útil de 7 a 12 días. El centro de innovación y tecnología de coexpan tiene como objetivo reemplazar los complejos laminados de barrera media y alta por monomateriales de alta barrera que incluyen aditivos apropiados para el contacto con alimentos. El objetivo de la serie de libros es reducir el desperdicio de alimentos mediante los objetivos de desarrollo sostenible.

Alcance del mercado de envases de plástico termoformado rígido en América del Norte

El mercado de envases de plástico termoformado rígido está segmentado en función del producto, el envase, el proceso, el proceso de fabricación, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Polimetilmetacrilato (PMMA)

- Polímeros biodegradables

- Polietileno

- Acrilonitrilo butadieno estireno (ABS)

- Cloruro de polivinilo (PVC)

- Poliestireno de alto impacto

- Poliestireno

- Polipropileno (PP)

Embalaje

- Botellas y tarros

- Bandejas

- Tinas

- tazas

- Otros

Proceso

- Formación asistida por tapón

- Termoformado de calibre grueso

- Termoformado de calibre fino

- Cierre de presión al vacío

Proceso de fabricación

- Extrusión

- Moldeo por inyección

- Otros

Solicitud

- Alimentos y bebidas

- Cuidado personal

- Medicina y atención sanitaria

- Electricidad y electrónica

- Automotor

- Construcción

- Bienes de consumo y electrodomésticos

- Otros

Usuario final

- Alimentos y bebidas

- Cuidado personal

- Familiar

- Cuidado de la salud

- Otros

Análisis y perspectivas regionales del mercado de envases de plástico termoformado rígido de América del Norte

Se analiza el mercado de envases de plástico termoformado rígido de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, por producto, envase, proceso, proceso de fabricación, aplicación y usuario final, como se menciona anteriormente.

Los países cubiertos en el informe del mercado de envases de plástico termoformado rígido de América del Norte son Estados Unidos, Canadá y México.

Estados Unidos está dominando el mercado de envases de plástico termoformado rígido de América del Norte debido a las altas innovaciones y desarrollo en la fabricación de productos, creando una gran base de clientes para el mercado de envases de plástico termoformado rígido.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Puntos de datos como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por la investigación de mercado de Data Bridge también incluyen un análisis profundo de expertos, producción y capacidad por empresa representada geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de las tendencias de precios y análisis del déficit de la cadena de suministro y la demanda.

Análisis del panorama competitivo y de la cuota de mercado de envases de plástico termoformado rígido en América del Norte

The rigid thermoform plastic packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to rigid thermoform plastic packaging market.

Some of the major players operating in the rigid thermoform plastic packaging market are:

- ALPLA (Austria)

- Amcor plc (Australia)

- DS Smith (U.K.)

- Klöckner Pentaplast (Germany)

- Berry Global Inc.(U.S.)

- Pactiv Evergreen Inc.(U.S.)

- Sonoco Products Company (U.S.)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET

- LIMITATION

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- material type LIFE LINE CURVE

- MULTIVARIATE MODELING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET APPLICATION COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Increasing use of thermoformed packaging for the transportation for medical supplies in global pandemiC

- increasing consumption rate for thermoform packaging in the growing e-commerce industry

- advanceD property of secure seals in the thermoform packaging

- Increasing demand FOR packaged food among the working population

- Restraints

- Issues in the sorting and recycling of thermoformed plastic waste

- Vulnerable nature of raw material and machinery pricing

- Opportunity

- Advancements in the thermoformed blister packaging in the pharmaceutical sector

- CHALLENGES

- high rates of complexity in shapes and designs of thermoformed packaging in the developing nations

- Stringent Rules and regulations on plastics ban

- IMPACT OF COVID-19 ON THE North America Rigid Thermoform Plastic Packaging Market

- ANALYSIS ON IMPACT OF COVID-19 ON RIGID THERMOFORM PLASTIC PACKAGING market

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE RIGID THERMOFORM PLASTIC PACKAGING

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- North America rigid thermoform plastic packaging market, BY Material TYPE

- overview

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- OTHERS

- North America rigid thermoform plastic packaging market, BY Distribution Channel

- overview

- online

- offline

- North America rigid thermoform plastic packaging market, BY Application

- overview

- Containers

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- homecare

- Others

- Trays & Lids

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- Blister Pack

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- Clamshells

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- OTHERS

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Electronics

- Homecare

- Others

- North AMERICA rigid thermoform plastic packaging market, BY COUNTRY

- North America

- U.S.

- Canada

- Mexico

- NORTH AMERICA rigid thermoform plastic packaging Market: COMPANY landscape

- company share analysis: NORTH AMERICA

- MergerS & AcquisitionS

- EXPANSIONS

- new product developmentS

- SWOT

- company profiles

- WestRock Company

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Amcor plc

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Sonoco Products Company

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- WINPAK LTD.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- DS Smith

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATES

- COEXPAN

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Huhtamaki

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Fabri-Kal

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- D&W Fine Pack

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- EasyPak

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Constantia Flexibles

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Display Pack

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- Genpak, LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Pactiv LLC

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Placon

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Sabert Corporation

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATES

- questionnaire

- related reports

Lista de Tablas

TABLE 1 IMPORT DATA of Plates, sheets, film, foil and strip, of non-cellular plastics, not reinforced, laminated, supported or similarly combined with other materials, without backing, unworked or merely surface-worked or merely cut into squares or rectangles (excluding self-adhesive products, and floor, wall and ceiling coverings of heading (HS CODE- 3920) (USD Thousand)

TABLE 2 EXPORT data of Plates, sheets, film, foil and strip, of non-cellular plastics, not reinforced, laminated, supported or similarly combined with other materials, without backing, unworked or merely surface-worked or merely cut into squares or rectangles (excluding self-adhesive products, and floor, wall and ceiling coverings of heading (HS CODE- 3920) (USD Thousand)

TABLE 3 Thermoforming Machine Price (USD Dollar)

TABLE 4 Time taken for material to decompose in the environment (2015)

TABLE 5 demand brought on by Covid-19

TABLE 6 North America rigid thermoform plastic packaging market, BY material type, 2019-2028 (Million units)

TABLE 7 North America rigid thermoform plastic packaging market, BY material type, 2019-2028 (USD Million)

TABLE 8 North America rigid thermoform plastic packaging market, BY distribution Channel, 2019-2028 (USD Million)

TABLE 9 North America rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 10 North America containers in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 11 North America Trays & lids in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 12 North America Blister pack in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 13 North America Clamshells in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 14 North America others in rigid thermoform plastic packaging market, BY application, 2019-2028 (USD Million)

TABLE 15 North America rigid thermoform plastic packaging Market, By Country, 2019-2028 (million Units)

TABLE 16 North America rigid thermoform plastic packaging Market, By Country, 2019-2028 (USD Million)

TABLE 17 North America rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 18 North America rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 19 North America rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 20 North America rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 21 North America containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 22 North America Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 23 North America Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 24 North America Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 25 North America Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 26 U.S. rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 27 U.S. rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 28 U.S. rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 29 U.S. rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 30 U.S. containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 31 U.S. Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 32 U.S. Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 33 U.S. Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 34 U.S. Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 35 CANADA rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 36 CANADA rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 37 CANADA rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 38 CANADA rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 39 CANADA containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 40 CANADA Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 41 CANADA Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 42 CANADA Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 43 CANADA Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 44 MEXICO rigid thermoform plastic packaging Market, By material Type, 2019-2028 (million Units)

TABLE 45 MEXICO rigid thermoform plastic packaging Market, By Material Type, 2019-2028 (USD MILLION)

TABLE 46 MEXICO rigid thermoform plastic packaging Market, By distribution channel, 2019-2028 (USD Million)

TABLE 47 MEXICO rigid thermoform plastic packaging Market, By application, 2019-2028 (USD Million)

TABLE 48 MEXICO containers in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 49 MEXICO Trays & Lids in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 50 MEXICO Blister Pack in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 51 MEXICO Clamshells in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

TABLE 52 MEXICO Others in rigid thermoform plastic packaging Market, By Application, 2019-2028 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: segmentation

FIGURE 2 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: data triangulation

FIGURE 3 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: regionaL VS COUNTRY MARKET analysis

FIGURE 5 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: company research analysis

FIGURE 6 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: THE material type LIFE LINE CURVE

FIGURE 7 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 North America rigid thermoform plastic packaging Market: vendor share analysis

FIGURE 13 NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 14 Increasing use of thermoformed packaging for the transportation for medical supplies in global pandemic IS DRIVING THE North America rigid thermoform plastic packaging market in the forecast period of 2021 to 2028

FIGURE 15 Polyethylene Terephthalate (PET) SEGMENT is expected to account for the largest share of the NORTH AMERICA RIGID THERMOFORM PLASTIC PACKAGING MARKET in 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTs, OPPORTUNITy AND CHALLENGEs OF North America rigid thermoform plastic packaging MARKET

FIGURE 17 the U.S. Retail Sales via E-commerce in 2019 (USD million)

FIGURE 18 Revenue Earned By Couriers and Express delivery service In the U.S. (2012-2018) (USD million)

FIGURE 19 the U.S. internet Users (2011-2016)

FIGURE 20 North America rigid thermoform plastic packaging market: BY Material Type, 2020

FIGURE 21 North America rigid thermoform plastic packaging market: BY distribution Channel, 2020

FIGURE 22 North America rigid thermoform plastic packaging market: BY application, 2020

FIGURE 23 North America rigid thermoform plastic packaging MARKET: SNAPSHOT (2020)

FIGURE 24 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2020)

FIGURE 25 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2021 & 2028)

FIGURE 26 North America rigid thermoform plastic packaging MARKET: by COUNTRY (2020 & 2028)

FIGURE 27 North America rigid thermoform plastic packaging MARKET: by Material TYPE (2021-2028)

FIGURE 28 North America rigid thermoform plastic packaging Market: company share 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.