Mercado de RFID (identificación por radiofrecuencia) de América del Norte, oferta (hardware, software y servicios), conectividad (Bluetooth, banda ultra ancha y otros), tipo de material (plástico, metal, papel, vidrio y otros), usuario final (minorista/comercial, industrial, atención médica, bienes de consumo envasados, automotriz, aeroespacial, vigilancia y seguridad, logística y transporte, deportes, defensa, educación, ganado y vida silvestre y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de identificación por radiofrecuencia (RFID) en América del Norte

La tecnología RFID hace uso del campo electromagnético para detectar las etiquetas adheridas a los productos. Las etiquetas contienen información almacenada electrónicamente y pueden adherirse a los productos, animales y personas. Las etiquetas RFID se desarrollaron principalmente para reemplazar los códigos de barras en las cadenas de suministro. Las etiquetas RFID se pueden leer de forma inalámbrica y sin ninguna línea de visión. RFID es una tecnología inalámbrica de rápido crecimiento que ha ayudado a la industria textil y de la confección a ahorrar miles de millones de dólares al proporcionar datos precisos de diferentes artículos ubicados en cualquier momento. El crecimiento del mercado se ha visto impulsado en gran medida por el aumento de la instalación de sistemas RFID en las unidades de fabricación para mejorar la productividad. La creciente aceptación de las tarjetas de identidad electrónicas y las etiquetas RFID en las tarjetas inteligentes está impulsando el crecimiento del mercado de RFID (identificación por radiofrecuencia) en América del Norte.

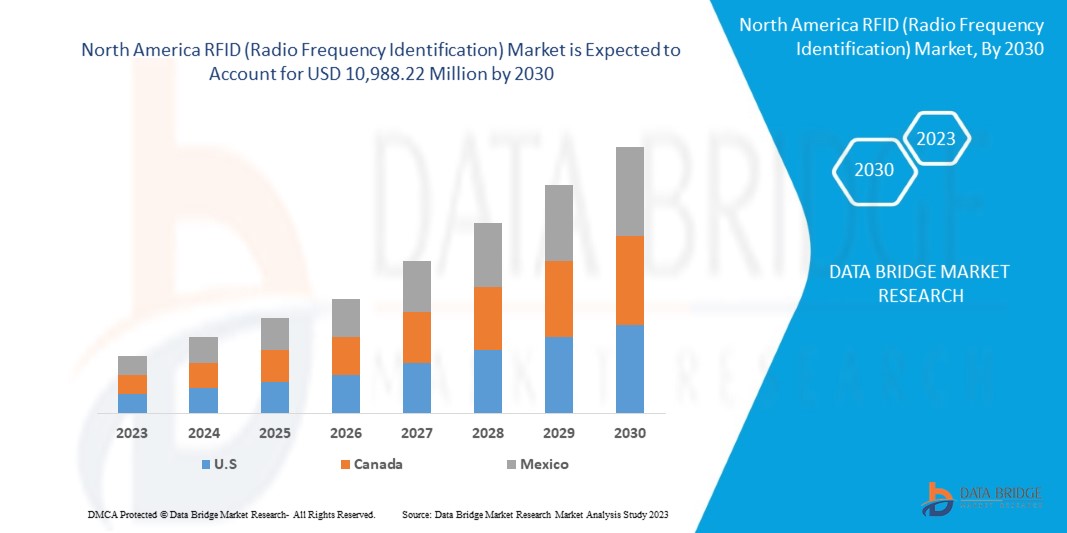

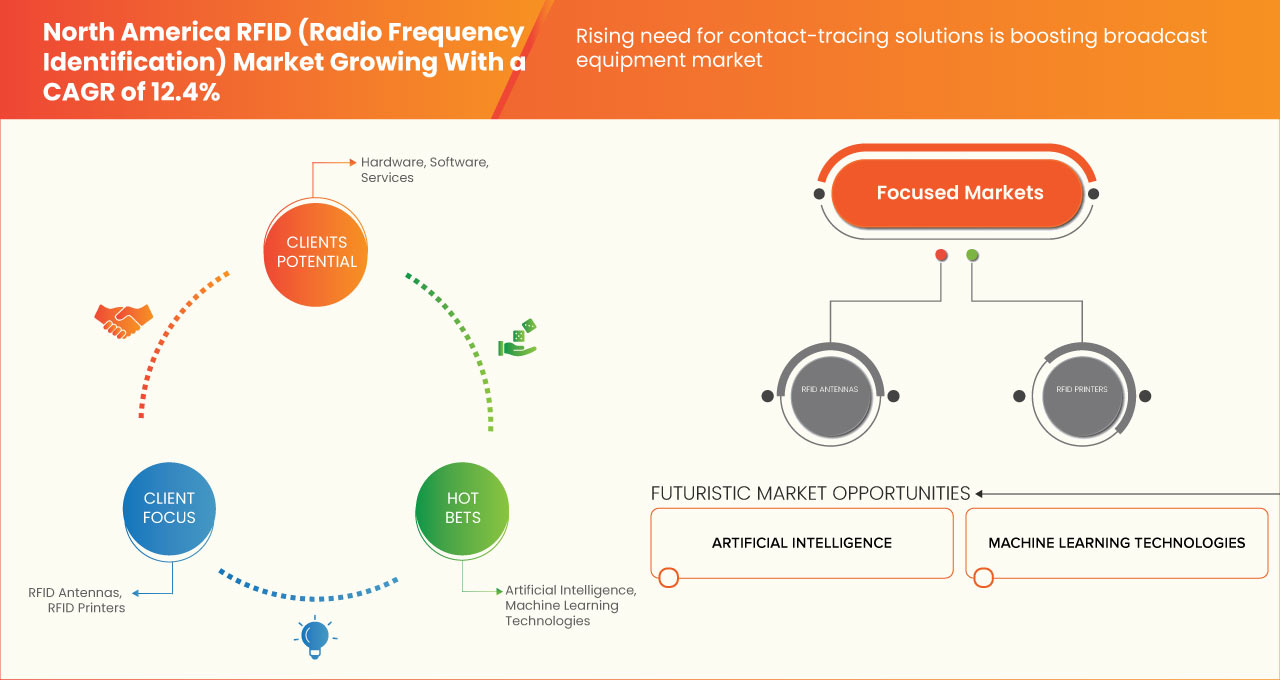

Data Bridge Market Research analiza que se espera que el mercado de RFID (identificación por radiofrecuencia) de América del Norte alcance un valor de USD 10 988,22 millones para 2030, con una CAGR del 12,4 % durante el período de pronóstico. El informe del mercado de RFID (identificación por radiofrecuencia) de América del Norte también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Oferta (hardware, software y servicios), conectividad (Bluetooth, banda ultra ancha y otros), tipo de material (plástico, metal, papel, vidrio y otros), usuario final (minorista/comercial, industrial, atención médica, bienes de consumo envasados, automotriz, aeroespacial, vigilancia y seguridad, logística y transporte, deportes, defensa, educación, ganado y vida silvestre y otros) |

|

País cubierto |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

CCL Industries, Honeywell International Inc., HL, Smart Label Solutions, Omnia Technologies, SES RFID GmbH, Invengo Technology Pte. Ltd., RFID4U, AVERY DENNISON CORPORATION, Jadak – A Novanta Company, Alien Technology, LLC, CoreRFID, Impinj, Inc., Nedap NV, NXP Semiconductors, Zebra Technologies Corp., Pepperl+Fuchs SE, SimplyRFID, Identiv, Inc., HID Global Corporation, parte de ASSA ABLOY, entre otros |

Definición de mercado

La identificación por radiofrecuencia (RFID) es parte de un sistema de seguimiento que utiliza códigos de barras inteligentes para identificar artículos mediante el uso de tecnología de radiofrecuencia. Las ondas de radio transmiten datos desde la etiqueta a un lector, y los datos recibidos se transmiten luego como información a un programa informático RFID. Las etiquetas RFID están equipadas con circuitos integrados y antenas que se pueden colocar en productos y envases. Las etiquetas RFID transfieren datos a través de ondas de radio, que los lectores RFID convierten para formar una forma más utilizable de datos que luego es analizada por el backend.

Dinámica del mercado de identificación por radiofrecuencia (RFID) en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

Aumenta la instalación de sistemas RFID en la industria manufacturera para mejorar la productividad

Los fabricantes siempre están buscando formas avanzadas de optimizar las operaciones y reducir los gastos. La tecnología de identificación por radiofrecuencia (RFID) puede optimizar la cadena de suministro al mejorar el flujo de material y el seguimiento de los daños. Una mayor automatización, combinada con la amplia disponibilidad de dispositivos inteligentes y redes inalámbricas asociadas como RFID, permite niveles de flexibilidad y eficiencia sin precedentes. La tecnología RFID se utiliza ampliamente en la fabricación, ya que proporciona numerosos beneficios, como un mejor seguimiento del producto, un estado más preciso del trabajo en proceso, menos errores de fabricación y un producto de mayor calidad. RFID permite ver en tiempo real el material y los activos, lo que es esencial para que el proceso de producción funcione sin problemas.

La creciente aceptación de las tarjetas de identidad electrónicas y las etiquetas RFID ubicadas en tarjetas inteligentes,

En febrero de 2023, la organización Security Technology Alliance publicó un informe detallado sobre las iniciativas de tarjetas inteligentes que han adoptado el gobierno y los institutos de Estados Unidos. En este informe, mencionaron que el gobierno federal de Estados Unidos lanzó programas de tarjetas inteligentes para regular las tarjetas inteligentes para las tarjetas de identificación de empleados y contratistas. También especifican tarjetas inteligentes para ciudadanos, trabajadores del transporte y personal de primera respuesta en los nuevos programas de identidad. Esta medida adoptada por el gobierno federal de Estados Unidos está impulsando la aceptación de las tarjetas de identidad electrónicas y las etiquetas RFID en las tarjetas inteligentes.

Oportunidad

Creciente necesidad de soluciones de rastreo de contactos

El rastreo de contactos es una parte importante y reconocida de cualquier estrategia para prevenir y monitorear el brote y la propagación de enfermedades infecciosas . La tecnología de identificación por radiofrecuencia (RFID) utiliza campos electromagnéticos para identificar y rastrear automáticamente las etiquetas adheridas a personas u objetos para crear un sistema de ubicación en tiempo real. El impacto de la COVID-19 revela la importancia de la trazabilidad y la estandarización para monitorear de manera efectiva a las personas, las cadenas de suministro y los activos en la industria de la salud. El brote de COVID-19 ha aumentado los riesgos que plantea el comercio mundial de productos farmacéuticos falsificados.

Restricción/Desafío

Altos costos de compra, instalación y mantenimiento.

La adopción de sistemas RFID en cualquier industria requiere inversiones elevadas, que incluyen el costo de compra de etiquetas RFID, lectores y software, y los costos asociados con los servicios de reemplazo y la electricidad. Las características adicionales, como la verificación continua de la precisión de los sistemas, la integración de IoT y los costos de capacitación, hacen que las soluciones RFID sean más costosas. Esto da como resultado una baja tasa de adopción de sistemas RFID. Las etiquetas RFID son de dos tipos: activas y pasivas; las etiquetas RFID pasivas tienen un costo bajo en comparación con las etiquetas RFID activas, pero la infraestructura de las etiquetas RFID pasivas es bastante cara.

Impacto posterior a la COVID-19 en el mercado de RFID (identificación por radiofrecuencia) de América del Norte

La COVID-19 afectó negativamente al mercado de RFID (identificación por radiofrecuencia) de América del Norte debido al cierre de la logística y el transporte global y la falta de pruebas para el sistema.

La pandemia de COVID-19 ha afectado al mercado de RFID (identificación por radiofrecuencia) de América del Norte de manera negativa. Sin embargo, la palabra RAIN se deriva de identificación por radiofrecuencia y actúa como un guiño para actuar como un vínculo entre RFID UHF y la nube. La nube ayuda a almacenar y administrar los datos que se pueden compartir a través de Internet. RAIN RFID es, por lo tanto, una tecnología inalámbrica que ayuda a conectar miles de millones de artículos cotidianos a Internet, lo que permite que varios consumidores identifiquen, localicen, autentiquen y utilicen cada artículo. Con la creciente automatización en varias industrias y el aumento del uso de equipos conectados, los fabricantes están desarrollando etiquetas RAIN RFID para ganar una mayor participación en el mercado, aumentando así el crecimiento del mercado.

Los actores del mercado están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología utilizada en los accesorios. Con esto, las empresas aportarán avances e innovación al mercado. Además, la financiación gubernamental para RFID ha impulsado el crecimiento del mercado.

Acontecimientos recientes

- En agosto de 2023, HL anunció que la empresa había lanzado un nuevo conector de alimentación industrial RFID UHF. Este paso ha permitido a la empresa aumentar su cartera de productos en el mercado de tecnología de identificación por radiofrecuencia de América del Norte y atender a una gama más amplia de consumidores en Europa y América del Norte.

- CCL Industries anunció que la empresa ha lanzado un nuevo sistema clínico para el sector sanitario. Este sistema contendrá una nueva capacidad digital para la próxima generación de etiquetado clínico. La empresa ha aumentado su dominio en el mercado de tecnología de identificación por radiofrecuencia de América del Norte a través de este lanzamiento.

Alcance del mercado de RFID (identificación por radiofrecuencia) en América del Norte

El mercado de identificación por radiofrecuencia (RFID) de América del Norte está segmentado en función de la oferta, la conectividad, el tipo de material y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

MERCADO DE RFID (IDENTIFICACIÓN POR RADIOFRECUENCIA) DE AMÉRICA DEL NORTE, AL OFRECER

- HARDWARE

- SOFTWARE

- SERVICIOS

En función de la oferta, el mercado está segmentado en hardware, software y servicios.

MERCADO DE RFID (IDENTIFICACIÓN POR RADIOFRECUENCIA) EN AMÉRICA DEL NORTE, POR CONECTIVIDAD

- BANDA BLUETOOTH

- BANDA ULTRA ANCHA

- OTROS

En base a la conectividad, el mercado se ha segmentado en bluetooth y banda ultra ancha, entre otros.

MERCADO DE IDENTIFICACIÓN POR RADIOFRECUENCIA (RFID) EN AMÉRICA DEL NORTE, POR TIPO DE MATERIAL

- PLÁSTICO

- METAL

- PAPEL

- VASO

- OTROS

Según el tipo de material, el mercado se ha segmentado en plástico, metal, papel, vidrio y otros.

MERCADO DE IDENTIFICACIÓN POR RADIOFRECUENCIA (RFID) EN AMÉRICA DEL NORTE, POR USUARIO FINAL

- VENTA MINORISTA/COMERCIAL

- INDUSTRIAL

- CUIDADO DE LA SALUD

- BIENES DE CONSUMO ENVASADOS

- AUTOMOTOR

- AEROESPACIAL

- VIGILANCIA Y SEGURIDAD

- LOGÍSTICA Y TRANSPORTE

- TECNOLOGÍA DE LA INFORMACIÓN (TI)

- DEPORTES

- DEFENSA

- FAUNA

- EDUCACIÓN

- GANADO

- OTROS

Sobre la base del usuario final, el mercado está segmentado en minorista/comercial, industrial, atención médica, bienes de consumo envasados, automotriz, aeroespacial, vigilancia y seguridad, logística y transporte, tecnología de la información (TI), deportes, defensa, vida silvestre, educación, ganadería y otros.

Análisis y perspectivas del país

Se analiza el mercado de identificación por radiofrecuencia (RFID) de América del Norte y se proporcionan información y tendencias sobre el tamaño del mercado por país, tipo, canal de distribución, demografía y rango de precios, como se mencionó anteriormente. Los países cubiertos en el informe del mercado de identificación por radiofrecuencia (RFID) de América del Norte son Estados Unidos, Canadá y México. Se espera que Estados Unidos domine el mercado, ya que el país tiene una creciente adopción de etiquetas RFID para la industria 4.0, IoT y fabricación inteligente en comparación con otras regiones. La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la tecnología RFID (identificación por radiofrecuencia) en América del Norte

El panorama competitivo del mercado de identificación por radiofrecuencia (RFID) en América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de identificación por radiofrecuencia (RFID) en América del Norte.

Algunos de los principales actores que operan en el mercado de RFID (identificación por radiofrecuencia) de América del Norte son CCL Industries, Honeywell International Inc., HL, Smart Label Solutions, Omnia Technologies, SES RFID GmbH, Invengo Technology Pte. Ltd., RFID4U, AVERY DENNISON CORPORATION, Jadak – A Novanta Company, Alien Technology, LLC, CoreRFID, Impinj, Inc., Nedap NV, NXP Semiconductors, Zebra Technologies Corp., Pepperl+Fuchs SE, SimplyRFID, Identiv, Inc., HID Global Corporation, parte de ASSA ABLOY, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE INSTALLATION OF RFID SYSTEMS IN THE MANUFACTURING INDUSTRY TO IMPROVE PRODUCTIVITY

5.1.2 RISE IN ACCEPTANCE OF ELECTRONIC IDENTITY CARDS AND RFID TAGS LOCATED IN SMART CARDS

5.1.3 INCREASE IN REGULATIONS AND GOVERNMENT INITIATIVES FOR VARIOUS INDUSTRIES

5.1.4 GROWTH IN THE USAGE OF RFID TAGS IN DIFFERENT INDUSTRIES

5.2 RESTRAINTS

5.2.1 HIGH PURCHASE, INSTALLATION, AND MAINTENANCE COSTS

5.2.2 CYBER ATTACKS AND DATA BREACHES WITH RFID

5.3 OPPORTUNITIES

5.3.1 RISE IN NEED FOR CONTACT-TRACING SOLUTIONS

5.3.2 INCREASE IN ADOPTION OF RFID TAGS FOR INDUSTRY 4.0, IOT, AND SMART MANUFACTURING

5.3.3 INCREASE IN DEVELOPMENTS IN RAIN RFID

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS ABOUT RFID SOLUTIONS AND EXPERT WORKFORCE

6 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 TAGS

6.2.1.1 BY PRODUCT TYPE

6.2.1.1.1 INLAY TAGS

6.2.1.1.2 COMPOSITE TAGS

6.2.1.1.3 CERAMIC TAGS

6.2.1.2 BY TYPE

6.2.1.2.1 PASSIVE TAGS

6.2.1.2.2 ACTIVE TAGS

6.2.1.2.3 BATTERY-ASSISTED PASSIVE (BAP) RFID TAGS

6.2.1.3 BY WAFER SIZE

6.2.1.3.1 300MM

6.2.1.3.2 200MM

6.2.1.3.3 OTHERS

6.2.1.4 BY FREQUENCY

6.2.1.4.1 LOW FREQUENCY

6.2.1.4.2 ULTRA-HIGH FREQUENCY

6.2.1.4.3 HIGH FREQUENCY

6.2.1.5 BY APPLICATION

6.2.1.5.1 RETAIL

6.2.1.5.2 ASSET MANAGEMENT

6.2.1.5.3 ACCESS CONTROL/ TICKETING

6.2.1.5.4 LOGISTICS

6.2.1.5.5 AIRLINES

6.2.1.5.6 HEALTHCARE

6.2.1.5.7 PEOPLE MANAGEMENT

6.2.1.5.8 EMBEDDED SYSTEMS

6.2.1.5.9 OTHERS

6.2.1.6 BY FORM FACTOR

6.2.1.6.1 CARD

6.2.1.6.2 IMPLANT

6.2.1.6.3 KEY FOB

6.2.1.6.4 LABEL

6.2.1.6.5 PLASTIC MOULDING

6.2.1.6.6 WRISTBAND

6.2.1.6.7 BUTTONS

6.2.1.6.8 BADGES

6.2.1.6.9 OTHERS

6.2.1.7 BY MATERIAL TYPE

6.2.1.7.1 PLASTIC

6.2.1.7.2 PAPER

6.2.1.7.3 GLASS

6.2.1.7.4 METAL

6.2.1.7.5 OTHERS

6.2.2 READERS

6.2.2.1 BY PRODUCT TYPE

6.2.2.1.1 FIXED RFID READERS

6.2.2.1.2 PORTABLE/HANDHELD RFID

6.2.2.1.2.1 HANDHELD TABLET READERS

6.2.2.1.2.2 HANDHELD PDA/EDA READERS

6.2.2.1.2.3 HANDHELD PISTOL GRIP READERS

6.2.2.1.3 USB RFID READERS

6.2.2.1.4 BLUETOOTH RFID READERS

6.2.2.1.5 RUGGED & VEHICLE MOUNTED RFID READERS

6.2.2.1.6 GPS RFID READERS

6.2.2.1.7 OTHERS

6.2.2.2 BY TECHNOLOGY

6.2.2.2.1 RAIN RFID READER

6.2.2.2.2 ANDROID RFID READER

6.2.2.2.3 IPHONE RFID READER

6.2.2.2.4 OTHER

6.2.2.3 BY FREQUENCY

6.2.2.3.1 LOW FREQUENCY READERS

6.2.2.3.2 ULTRA-HIGH FREQUENCY READERS

6.2.2.3.3 HIGH FREQUENCY READERS

6.2.2.4 BY APPLICATION

6.2.2.4.1 RETAIL

6.2.2.4.2 ASSET MANAGEMENT

6.2.2.4.3 ACCESS CONTROL/TICKETING

6.2.2.4.4 LOGISTICS

6.2.2.4.5 AIRLINES

6.2.2.4.6 HEALTHCARE

6.2.2.4.7 PEOPLE MANAGEMENT

6.2.2.4.8 EMBEDDED SYSTEMS

6.2.2.4.9 OTHERS

6.2.3 RFID ANTENNAS

6.2.4 RFID PRINTERS

6.2.4.1 DESKTOP PRINTER

6.2.4.2 MOBILE PRINTER

6.3 SOFTWARE

6.3.1 OPERATING SYSTEM

6.3.1.1 ANDROID

6.3.1.2 WINDOW

6.3.1.3 IOS

6.3.1.4 WEB

6.3.1.5 OTHERS

6.3.2 BY DEPLOYMENT

6.3.2.1 ON-PREMISE

6.3.2.2 CLOUD

6.3.3 BY APPLICATION

6.3.3.1 ACCESS CONTROL RFID SOFTWARE

6.3.3.2 ASSET TRACKING RFID SOFTWARE

6.3.3.3 PARKING CONTROL RFID SOFTWARE

6.3.3.4 PERSONAL TRACKING RFID SOFTWARE

6.3.3.5 AUTO-ID ENGINE

6.3.3.6 OTHERS

6.4 SERVICES

6.4.1 SYSTEM IMPLEMENTATION/MAINTENANCE

6.4.2 SYSTEM DESIGNING/DEVELOPMENT/TESTING

6.4.3 CONSULTING, SELECTION GUIDANCE

7 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY

7.1 OVERVIEW

7.2 BLUETOOTH

7.3 ULTRA WIDE BAND

7.4 OTHER

8 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PLASTIC

8.3 PAPER

8.4 GLASS

8.5 METAL

8.6 OTHERS

8.6.1 SILICON

8.6.2 CERAMIC

8.6.3 RUBBER

9 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER

9.1 OVERVIEW

9.2 RETAIL/COMMERCIAL

9.2.1 APPAREL

9.2.2 JEWELLER TRACKING

9.2.3 KIOSK

9.2.4 IT ASSET TRACKING

9.2.5 ADVERTISEMENT

9.2.6 LAUNDRY

9.2.7 OTHER

9.3 LOGISTICS AND TRANSPORTATION

9.4 SURVEILLANCE AND SECURITY

9.5 AUTOMOTIVE

9.6 INDUSTRIAL

9.7 AEROSPACE/AVIATION

9.7.1 BAGGAGE TRACKING

9.7.2 MATERIALS MANAGEMENT

9.7.3 FLY PARTS TRACKING

9.7.4 LIFETIME TRACEABILITY

9.7.5 MRO

9.7.6 OTHER

9.8 CONSUMER PACKAGE GOODS

9.9 HEALTHCARE

9.9.1 PATIENTS MANAGEMENT

9.9.2 WASTE MANAGEMENT

9.9.3 DRUGS MANAGEMENT

9.9.4 LABORATORY MANAGEMENT

9.9.5 EQUIPMENT MANAGEMENT

9.9.6 OTHER

9.1 LIVESTOCK & WILDLIFE

9.11 SPORTS

9.12 EDUCATION

9.13 DEFENSE

9.13.1 BORDER SECURITY

9.13.2 WEAPON MANAGEMENT TRACKING

9.13.3 SOLDIER MOVEMENT TRACKING

9.13.4 OTHER

9.14 OTHER

10 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILING

13.1 ZEBRA TECHNOLOGIES CORP.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 AVERY DENNISON CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 HONEYWELL INTERNATIONAL INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 CCL INDUSTRIES

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 IMPINJ, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALIEN TECHNOLOGY, LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 CORERFID

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 HID GLOBAL CORPORATION, PART OF ASSA ABLOY

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HL

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 IDENTIV, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 INVENGO TECHNOLOGY PTE. LTD.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 JADAK – A NOVANTA COMPANY

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 NEDAP N.V.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 NXP SEMICONDUCTORS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 OMNIA TECHNOLOGIES

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PEPPERL+FUCHS SE

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 RFID4U

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 SES RFID GMBH

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 SIMPLYRFID

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 SMART LABEL SOLUTION

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 3 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

TABLE 4 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 5 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2023-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2023-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2023-2030 (USD MILLION)

TABLE 9 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 12 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

TABLE 13 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2023-2030 (USD MILLION)

TABLE 14 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 15 NORTH AMERICA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 16 NORTH AMERICA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SERVICES IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2023-2030

TABLE 21 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY MATERIAL TYPE, 2023-2030

TABLE 22 NORTH AMERICA OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET: BY END USER, 2023-2030

TABLE 24 NORTH AMERICA RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 30 U.S. HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 34 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 35 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 37 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 41 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 42 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 43 U.S. RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 45 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 46 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 U.S. SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 49 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 U.S. RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 57 CANADA HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 61 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 62 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 64 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 68 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 69 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 CANADA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 72 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 73 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 CANADA SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 76 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 CANADA RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 84 MEXICO HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 89 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 91 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 95 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 96 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 99 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 100 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 MEXICO SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 103 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 106 MEXICO RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MEXICO AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 MEXICO HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 MEXICO DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SEGMENTATION

FIGURE 10 INCREASE IN THE INSTALLATION OF RFID SYSTEMS IN MANUFACTURING UNITS TO IMPROVE PRODUCTIVITY IS EXPECTED TO DRIVE THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET IN THE FORECAST PERIOD

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

FIGURE 13 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY OFFERING, 2022

FIGURE 14 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2022

FIGURE 15 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY MATERIAL TYPE, 2022

FIGURE 16 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET: BY END USER, 2022

FIGURE 17 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2022)

FIGURE 19 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY OFFERING (2023-2030)

FIGURE 22 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.