North America Radioimmunoassay Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

314.48 Million

USD

443.82 Million

2024

2032

USD

314.48 Million

USD

443.82 Million

2024

2032

| 2025 –2032 | |

| USD 314.48 Million | |

| USD 443.82 Million | |

|

|

|

|

Segmentación del mercado de radioinmunoensayos en Norteamérica, por tipo de producto (reactivos y kits de radioinmunoensayos y analizadores de radioinmunoensayos), aplicación (investigación científica y diagnóstico clínico), usuario final (hospitales, laboratorios de diagnóstico clínico, institutos académicos y de investigación, industria farmacéutica y biofarmacéutica, organizaciones de investigación por contrato, etc.), canal de distribución (licitación directa, ventas en línea, distribución a terceros, etc.): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de radioinmunoensayos en América del Norte

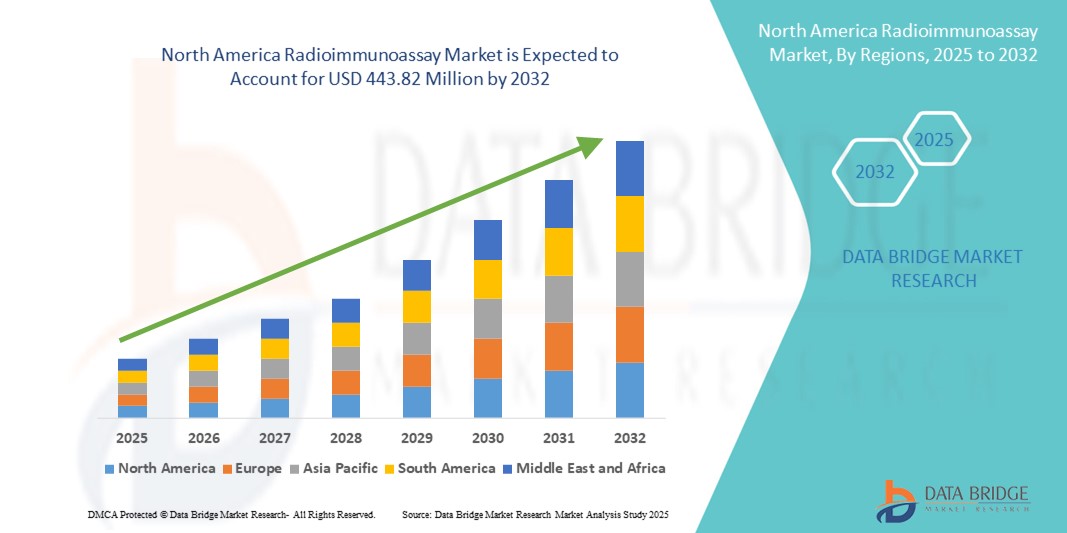

- El tamaño del mercado de radioinmunoensayo de América del Norte se valoró en USD 314,48 millones en 2024 y se espera que alcance los USD 443,82 millones para 2032 , con una CAGR del 4,4% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente prevalencia de enfermedades crónicas e infecciosas, junto con un enfoque creciente en técnicas de diagnóstico temprano y preciso, lo que impulsa la adopción del radioinmunoensayo en aplicaciones clínicas y de investigación.

- Además, los avances en la sensibilidad de los ensayos, la automatización y el desarrollo de reactivos están mejorando la precisión y la eficiencia, convirtiendo el radioinmunoanálisis en la opción preferida en los laboratorios. Estos factores convergentes están acelerando la adopción de soluciones de radioinmunoanálisis, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de radioinmunoensayos en América del Norte

- El radioinmunoensayo (RIA), una técnica de laboratorio altamente sensible para detectar y cuantificar hormonas, antígenos y otros biomarcadores , sigue siendo una herramienta esencial en el diagnóstico clínico, la investigación farmacéutica y los laboratorios académicos en América del Norte debido a su precisión, reproducibilidad y capacidad para medir analitos a nivel de trazas.

- La creciente demanda de radioinmunoensayos se ve impulsada principalmente por la creciente prevalencia de enfermedades crónicas como el cáncer y los trastornos endocrinos , la creciente necesidad de métodos de diagnóstico tempranos y precisos y el aumento de la financiación de la investigación en ciencias biomédicas.

- Estados Unidos dominó el mercado de radioinmunoensayo de América del Norte con la mayor participación en los ingresos del 47,9 % en 2024, caracterizado por una infraestructura de atención médica avanzada, sólidas capacidades de I+D y la presencia de fabricantes líderes de kits de diagnóstico, con una adopción fortalecida aún más por innovaciones en plataformas de ensayo automatizadas y reactivos de alta sensibilidad.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de radioinmunoensayo de América del Norte en la región durante el período de pronóstico debido al aumento de las inversiones en atención médica, la expansión de laboratorios de diagnóstico especializados y la creciente conciencia de las técnicas avanzadas de inmunoensayo en la práctica clínica.

- El segmento de reactivos y kits dominó el mercado de radioinmunoensayo de América del Norte con una participación de mercado del 75,26 % en 2024, impulsado por su uso repetido en pruebas de rutina y flujos de trabajo de investigación, lo que los convierte en el principal contribuyente de ingresos en todas las categorías de productos.

Alcance del informe y segmentación del mercado de radioinmunoensayo en América del Norte

|

Atributos |

Perspectivas clave del mercado de radioinmunoensayo en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de radioinmunoensayos en América del Norte

Automatización y desarrollo de ensayos de alta sensibilidad

- Una tendencia significativa y en auge en el mercado norteamericano de radioinmunoensayos (RIA) es la integración de tecnologías avanzadas de automatización y el desarrollo de kits de ensayo de alta sensibilidad para detectar niveles ultrabajos de hormonas, fármacos y biomarcadores. Este cambio está mejorando la precisión, el rendimiento y la eficiencia de las pruebas en los laboratorios clínicos y de investigación.

- Por ejemplo, Siemens Healthineers y Beckman Coulter han introducido analizadores de inmunoensayo automatizados capaces de ejecutar kits RIA con una mínima intervención manual, lo que reduce el error humano y mejora la reproducibilidad.

- La adopción de reactivos RIA de alta sensibilidad permite la detección temprana de trastornos endocrinos y cánceres mediante la identificación de concentraciones mínimas de biomarcadores, una capacidad cada vez más demandada en la medicina de precisión.

- La automatización también respalda la detección de alto rendimiento, lo que permite que los hospitales, laboratorios de diagnóstico y organizaciones de investigación por contrato procesen una mayor cantidad de muestras por día y mantengan la precisión.

- Además, la integración digital de las plataformas RIA automatizadas con los sistemas de gestión de información de laboratorio (LIMS) facilita el seguimiento centralizado de datos, el control de calidad y el cumplimiento normativo, agilizando las operaciones en redes de múltiples sitios.

- Esta tendencia hacia soluciones RIA automatizadas, de alta precisión y conectadas digitalmente está cambiando las expectativas de los usuarios, lo que impulsa a fabricantes como PerkinElmer y DIAsource ImmunoAssays a centrarse en plataformas innovadoras que combinan velocidad, precisión y flujos de trabajo simplificados.

- La demanda de soluciones RIA de alta sensibilidad y listas para la automatización está aumentando rápidamente entre las instituciones de atención médica y los centros de investigación de América del Norte, ya que priorizan la eficiencia operativa, la precisión del diagnóstico y el cumplimiento de estrictos estándares de calidad.

Dinámica del mercado de radioinmunoensayos en América del Norte

Conductor

La creciente prevalencia de trastornos crónicos y endocrinos impulsa la demanda de diagnóstico

- La creciente carga de enfermedades crónicas, en particular trastornos endocrinos como disfunción tiroidea, diabetes y problemas de salud reproductiva, está impulsando significativamente la demanda de pruebas RIA en América del Norte.

- Por ejemplo, la Asociación Estadounidense de Tiroides informa que más del 12% de la población de EE. UU. desarrollará una afección tiroidea durante su vida, lo que subraya la necesidad de realizar análisis hormonales sensibles.

- La confiabilidad comprobada del RIA en la detección de hormonas y antígenos de bajo nivel lo convierte en la opción preferida en el diagnóstico clínico y el monitoreo terapéutico, especialmente para afecciones que requieren una medición precisa del nivel hormonal.

- La expansión de las iniciativas de medicina personalizada y los programas de tratamiento de fertilidad amplifican aún más el uso de RIA en pruebas especializadas.

- Además, el aumento de la financiación de la investigación por parte de instituciones como los Institutos Nacionales de Salud (NIH) está fomentando la adopción de RIA en la I+D biomédica y farmacéutica.

- Se espera que la combinación de la creciente prevalencia de enfermedades, el énfasis en el diagnóstico temprano y la expansión de las aplicaciones de investigación mantengan una fuerte demanda de RIA en los próximos años.

Restricción/Desafío

Normativas sobre el manejo de radioisótopos y restricciones de disponibilidad

- Los estrictos requisitos reglamentarios para el manejo y la eliminación de materiales radiactivos plantean desafíos operativos y de cumplimiento para los laboratorios que utilizan tecnología RIA.

- Por ejemplo, las instalaciones deben cumplir con las directrices de la Comisión Reguladora Nuclear de Estados Unidos (NRC) o autoridades nacionales equivalentes en Canadá, lo que puede aumentar los costos operativos y los gastos administrativos.

- Las limitaciones en la disponibilidad de ciertos isótopos, las interrupciones de la cadena de suministro y la necesidad de una infraestructura especializada de almacenamiento y eliminación pueden obstaculizar su adopción generalizada, en particular entre laboratorios o instituciones de investigación más pequeños.

- Además, la competencia de alternativas de inmunoensayos no radiactivos, como los ensayos ELISA y de quimioluminiscencia, está creciendo debido a su menor carga regulatoria y flujos de trabajo más simples.

- Para abordar estos desafíos se requieren inversiones en tecnologías de manejo de isótopos más seguras, procesos de cumplimiento optimizados y educación sobre el valor diagnóstico único del RIA.

- Sin tales medidas, la complejidad regulatoria y las limitaciones operativas podrían desacelerar el crecimiento de la adopción del RIA a pesar de sus ventajas diagnósticas.

Alcance del mercado de radioinmunoensayo en América del Norte

El mercado está segmentado según el tipo de producto, la aplicación, el usuario final y el canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado norteamericano de radioinmunoensayo se segmenta en reactivos y kits de radioinmunoensayo y analizadores de radioinmunoensayo. El segmento de reactivos y kits dominó el mercado con la mayor participación en los ingresos, un 75,26 % en 2024, gracias a su papel esencial como consumibles en una amplia gama de pruebas diagnósticas y ensayos de investigación. Los laboratorios y hospitales requieren constantemente reactivos y kits nuevos para la cuantificación de hormonas, antígenos y biomarcadores, lo que garantiza ventas recurrentes y la estabilidad del mercado. Las innovaciones en la sensibilidad y especificidad de los ensayos, así como la expansión de las aplicaciones de los reactivos RIA, refuerzan aún más el dominio de este segmento.

Se prevé que el segmento de analizadores experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente adopción de plataformas de inmunoensayo automatizadas y de alto rendimiento. Estos analizadores mejoran la eficiencia del laboratorio al reducir la intervención manual, aumentar la precisión y permitir una integración fluida con los sistemas de gestión de información de laboratorio (LIMS), un factor muy valorado en entornos clínicos y de investigación.

- Por aplicación

En cuanto a su aplicación, el mercado norteamericano de radioinmunoensayos se segmenta en diagnóstico clínico e investigación científica. El segmento de diagnóstico clínico tuvo la mayor cuota de mercado en 2024, lo que refleja el uso generalizado del RIA para la detección y el seguimiento de trastornos endocrinos, cánceres, problemas de fertilidad y otras enfermedades crónicas. La creciente prevalencia de enfermedades y la demanda de diagnósticos tempranos y precisos impulsan el sólido crecimiento de este segmento.

Se prevé que el segmento de investigación científica registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la expansión de las actividades de I+D farmacéutica y biotecnológica. Esto incluye el desarrollo de fármacos, el descubrimiento de biomarcadores y la investigación biomédica básica, donde el RIA sigue siendo una herramienta valiosa gracias a su sensibilidad y fiabilidad.

- Por el usuario final

En cuanto al usuario final, el mercado norteamericano de radioinmunoensayos se segmenta en hospitales, laboratorios de diagnóstico clínico, institutos académicos y de investigación, industria farmacéutica y biofarmacéutica, organizaciones de investigación por contrato (CRO), entre otros. El segmento hospitalario dominó el mercado en 2024 debido al alto volumen de pruebas diagnósticas realizadas en estos entornos y al papel crucial del RIA en la gestión de la atención al paciente. Los laboratorios de diagnóstico clínico le siguen de cerca, ofreciendo servicios especializados y a gran escala de pruebas de inmunoensayo a hospitales y otros clientes. Los institutos académicos y de investigación también son usuarios importantes, aprovechando el RIA en diversas aplicaciones de investigación biomédica.

Se espera que la industria farmacéutica y biofarmacéutica, junto con las CRO, experimente la CAGR más rápida entre 2025 y 2032, impulsada por el aumento de ensayos clínicos y programas de desarrollo de fármacos que requieren ensayos de biomarcadores sensibles.

- Por canal de distribución

Según el canal de distribución, el mercado norteamericano de radioinmunoensayos se segmenta en licitación directa, ventas en línea, distribución a terceros y otros. El segmento de licitación directa tuvo la mayor participación en 2024, ya que los hospitales y los grandes laboratorios de diagnóstico prefieren adquirir reactivos, kits y analizadores directamente de los fabricantes o distribuidores autorizados para garantizar la autenticidad del producto, mejores precios y una entrega puntual. Los canales de distribución a terceros desempeñan un papel crucial para llegar a laboratorios e instituciones de investigación más pequeños que podrían no tener capacidad de adquisición directa.

Se espera que las ventas en línea experimenten la CAGR más rápida entre 2025 y 2032, impulsada por la creciente adopción digital, la facilidad para realizar pedidos y el acceso ampliado a una gama más amplia de productos, especialmente entre los usuarios finales más pequeños y las instalaciones de investigación emergentes.

Análisis regional del mercado de radioinmunoensayos en América del Norte

- Estados Unidos dominó el mercado de radioinmunoensayo de América del Norte con la mayor participación en los ingresos del 47,9 % en 2024, caracterizado por una infraestructura de atención médica avanzada, sólidas capacidades de I+D y la presencia de fabricantes líderes de kits de diagnóstico, con una adopción fortalecida aún más por innovaciones en plataformas de ensayo automatizadas y reactivos de alta sensibilidad.

- Los proveedores de atención médica y los centros de investigación de EE. UU. otorgan gran importancia a la precisión, la sensibilidad y la confiabilidad de las técnicas de radioinmunoensayo para detectar hormonas, marcadores tumorales y enfermedades infecciosas.

- Este dominio se ve reforzado aún más por la presencia de empresas de diagnóstico líderes, una financiación sólida para la investigación clínica, políticas de reembolso favorables y la creciente necesidad de soluciones de pruebas avanzadas para abordar la creciente carga de trastornos crónicos y endocrinos, lo que convierte a los EE. UU. en un centro central para la adopción de radioinmunoensayos en la región.

Perspectiva del mercado estadounidense de radioinmunoensayos

El mercado estadounidense de radioinmunoensayos representó la mayor participación en los ingresos de Norteamérica, con un 47,9 %, en 2024, gracias a una sólida red de laboratorios clínicos, hospitales e instituciones de investigación. Las altas tasas de cribado de enfermedades del país, el énfasis en la detección temprana y la sólida actividad de ensayos clínicos son factores clave que sustentan su dominio del mercado. Además, Estados Unidos se beneficia de una importante financiación para diagnósticos de precisión y tecnologías avanzadas de inmunoensayos. La creciente integración del radioinmunoensayo con sistemas automatizados e interpretación de datos basada en IA está mejorando la eficiencia y la precisión, consolidando aún más a Estados Unidos como el centro neurálgico de la innovación en radioinmunoensayos.

Análisis del mercado canadiense de radioinmunoensayos

Se proyecta que el mercado canadiense de radioinmunoensayos crecerá a una tasa de crecimiento anual compuesta (TCAC) constante durante el período de pronóstico, impulsado por el aumento de las inversiones en la modernización de la atención médica y la expansión de las redes de laboratorios de diagnóstico. La creciente incidencia de enfermedades crónicas, en particular la diabetes y los trastornos tiroideos, está impulsando la demanda de pruebas de inmunoensayo avanzadas. Las iniciativas gubernamentales en el ámbito de la atención médica y las colaboraciones de investigación con instituciones estadounidenses están acelerando la adopción de tecnología. Además, la transición hacia una atención médica centrada en el paciente y programas de cribado preventivo está fomentando un uso más amplio de los métodos de radioinmunoensayos en entornos clínicos y de investigación.

Perspectiva del mercado de radioinmunoensayo en México

Se espera que el mercado mexicano de radioinmunoensayos se expanda a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la creciente necesidad de herramientas de diagnóstico rentables y de alta precisión. La creciente concienciación sobre la detección temprana de enfermedades, junto con las mejoras en la infraestructura de laboratorio, está impulsando la penetración en el mercado. Las alianzas entre proveedores locales de diagnóstico y empresas internacionales de tecnología de análisis están facilitando el acceso a métodos de prueba avanzados. Además, los programas gubernamentales destinados a fortalecer los diagnósticos de salud pública están impulsando la adopción del radioinmunoensayo en hospitales, clínicas y laboratorios de investigación de todo el país.

Cuota de mercado de radioinmunoensayo en América del Norte

La industria de radioinmunoensayos de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- DiaSorin SpA (Italia)

- Medipan GmbH (Alemania)

- PerkinElmer (Estados Unidos)

- Siemens Healthineers AG (Alemania)

- Bio-Rad Laboratories, Inc. (EE. UU.)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Beckman Coulter, Inc. (EE. UU.)

- Abbott. (Estados Unidos)

- Ortho Clinical Diagnostics (EE. UU.)

- Randox Laboratories Ltd. (Reino Unido)

- Euroimmun AG (Alemania)

- Immunotech (Francia)

- Brahms GmbH (Alemania)

- BD (EE. UU.)

- Molecular Devices LLC (EE. UU.)

- Tecan Group Ltd. (Suiza)

- BIOMÉRIEUX (Francia)

- Agilent Technologies, Inc. (EE. UU.)

- Luminex Corporation (EE. UU.)

- GenWay Biotech Inc. (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de radioinmunoensayo en América del Norte?

- En enero de 2025, la Administración de Alimentos y Medicamentos de EE. UU. (FDA) otorgó la autorización 510(k) al inmunoensayo de quimioluminiscencia automatizado (ChLIA) de Euroimmun para la medición cuantitativa directa de los niveles de testosterona libre en suero o plasma. Este es el primer ensayo de este tipo autorizado por la FDA, que ofrece resultados rápidos en 48 minutos mediante las plataformas iSYS o i10, lo que mejora significativamente la velocidad y la fiabilidad del diagnóstico para afecciones hormonales como el hipogonadismo y el síndrome de ovario poliquístico (SOP).

- En enero de 2025, Medipan GmbH anunció una ampliación de la vida útil de varios de sus kits de radioinmunoensayo (RIA), incluyendo los kits SELco TSH Rapid, SELco Tg 1 Step y SELco Calcitonin. Mediante la optimización de sus procesos de fabricación, Medipan logró aumentar la vida útil de los kits en dos semanas adicionales. Esta mejora ofrece mayor flexibilidad y una mejor planificación de las pruebas diagnósticas, lo que refleja el compromiso de la empresa con la innovación continua de productos y las soluciones centradas en el cliente en el campo del diagnóstico.

- En mayo de 2023, Freenome, empresa biotecnológica privada con sede en EE. UU., adquirió Oncimmune Ltd, empresa británica líder en el desarrollo global de inmunodiagnóstico. La adquisición incorpora la prueba pulmonar EarlyCDT con marcado CE-IVD, la plataforma de perfilado de autoanticuerpos y la línea de I+D de Oncimmune a las capacidades de Freenome para la detección temprana del cáncer mediante multiómica. Esta expansión estratégica fortalece los activos de cribado clínico y comercial de Freenome para acelerar sus esfuerzos de detección de múltiples cánceres.

- En diciembre de 2022, Medipan GmbH lanzó SELco TRAb human 1 step, un radioinmunoensayo de alta sensibilidad diseñado para detectar anticuerpos contra el receptor de la hormona estimulante de la tiroides (TRAb). Este nuevo ensayo simplifica el proceso tradicional de análisis de dos pasos a uno solo, reduciendo el tiempo de incubación a tan solo 120 minutos. Esta innovación optimiza los flujos de trabajo del laboratorio, aumentando la eficiencia al reducir los plazos de entrega.

- En octubre de 2022, DiaSorin SpA completó la adquisición de Luminex Corporation, empresa estadounidense líder en tecnologías de diagnóstico multiplex y soluciones de análisis molecular. Esta estrategia busca fortalecer la presencia de DiaSorin en los mercados de diagnóstico molecular e investigación en ciencias de la vida. Se espera que la adquisición facilite el desarrollo de ensayos multiplataforma, incluyendo potencialmente aplicaciones de radioinmunoensayo para áreas específicas o tradicionales que requieren análisis ultrasensibles, como el análisis hormonal.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.