Mercado de cal viva en América del Norte, por forma (trozos grandes, triturados o guijarros, molidos, pulverizados, peletizados y otros), producto (alto contenido de calcio, magnesio, dolomítico y otros), aplicación (metalurgia, materiales de construcción y edificación, tratamiento de agua, minería, productos químicos y otros), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado: mercado de cal viva en América del Norte

Análisis y perspectivas del mercado: mercado de cal viva en América del Norte

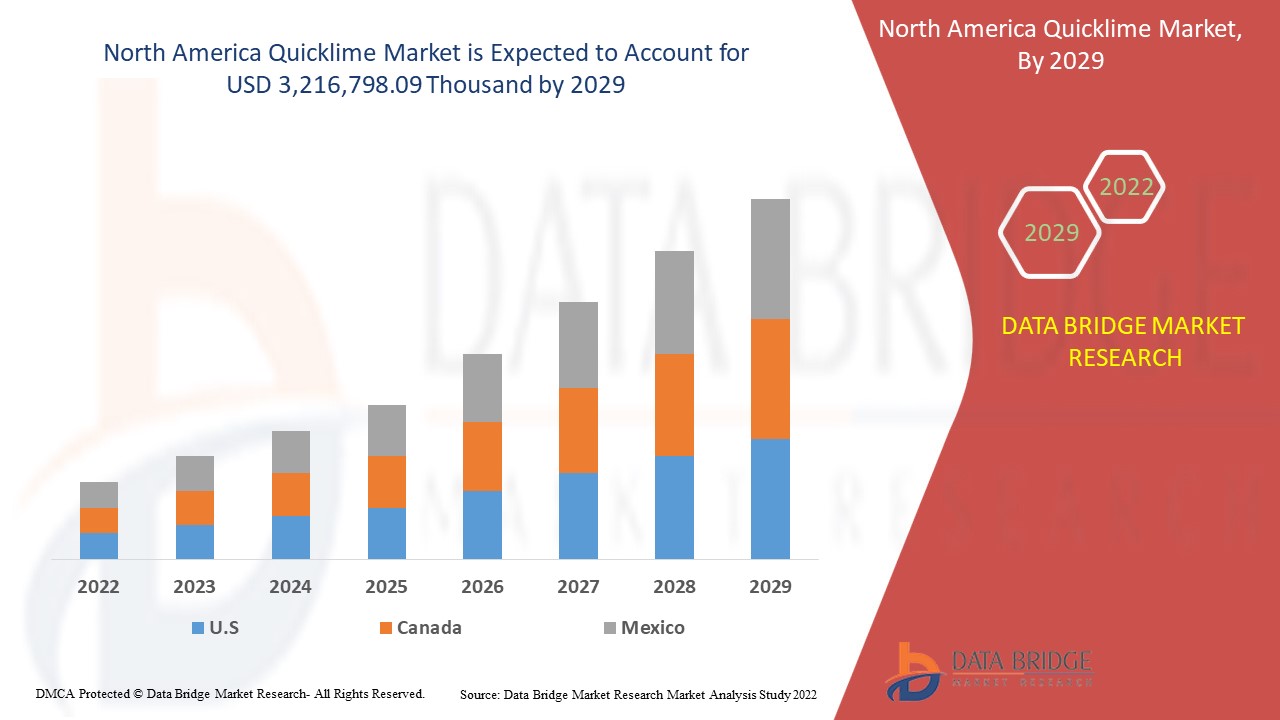

Se espera que el mercado de cal viva de América del Norte gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 4,0% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 3.216.798,09 mil para 2029.

La cal viva es un sólido blanco amorfo con un alto punto de fusión de 2600 grados Celsius. Forma cal apagada cuando interactúa con el agua. La cal viva tiene un alto contenido de calcio y dolomita, que se utilizan ampliamente como fundente para purificar el acero. Proporciona mortero y yeso duraderos y estabiliza el suelo. También mejora la calidad del agua, especialmente para ablandar el agua y eliminar el arsénico. La cal viva se puede aplicar en diversas aplicaciones, como materiales de construcción, metalurgia, productos químicos, minería, papel y producción de pulpa, entre otros.

Los principales factores que contribuyen al crecimiento del mercado de cal viva incluyen el uso creciente de carbonato de calcio precipitado y la alta adopción de cal viva en la industria de la construcción. Las principales restricciones que pueden afectar el crecimiento del mercado mundial de cal viva son la volatilidad de los precios de las materias primas de cal viva y el complicado proceso de producción de cal viva.

Entre las oportunidades asociadas con el mercado de la cal viva se encuentran la creciente demanda de hierro y acero de diferentes industrias y el aumento de las actividades mineras. Para satisfacer la creciente demanda de productos de cal viva en la construcción y el tratamiento del agua, algunas empresas están ampliando sus capacidades de producción y firmando acuerdos en diferentes regiones. Además, las estrictas regulaciones gubernamentales para la fabricación y comercialización de cal viva están desafiando el crecimiento del mercado.

El informe del mercado de cal viva de América del Norte proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de cal viva en América del Norte

Alcance y tamaño del mercado de cal viva en América del Norte

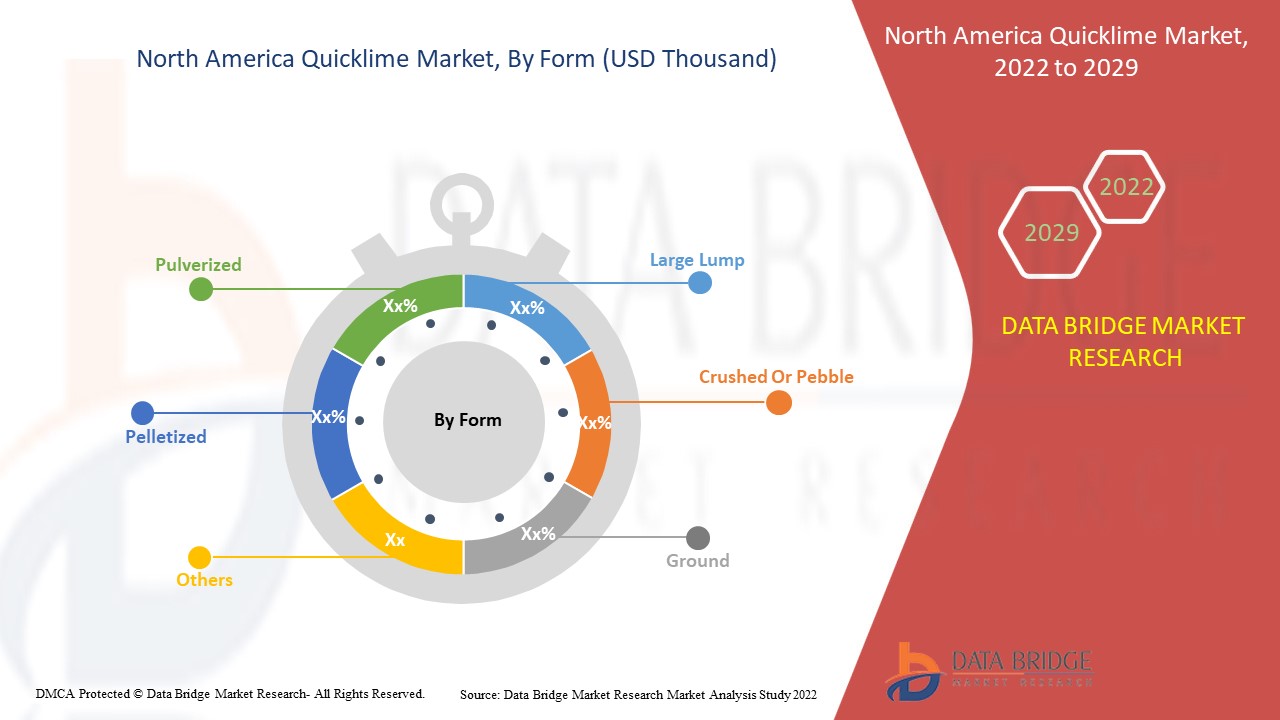

El mercado de cal viva de América del Norte se divide en tres segmentos importantes que se basan en la forma, el producto y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

- En función de la forma, el mercado de cal viva de América del Norte se segmenta en trozos grandes, triturados o en guijarros, molidos, pulverizados, granulados y otros. En 2022, se espera que el segmento triturado o en guijarros domine el mercado de cal viva de América del Norte, ya que se utiliza ampliamente en acero y otras áreas de fabricación industrial como agente fundente.

- En función del producto, el mercado de cal viva de América del Norte se segmenta en cal con alto contenido de calcio, magnesio, dolomítico y otros. En 2022, se espera que la cal con alto contenido de calcio domine el mercado, ya que es el material alcalino más eficaz para la desinfección y el tratamiento de olores.

- En función de la aplicación, el mercado de cal viva de América del Norte se segmenta en metalurgia, materiales de construcción, tratamiento de agua, minería, productos químicos y otros. En 2022, se espera que el segmento de materiales de construcción domine el mercado, ya que es un ingrediente importante en la fabricación de cemento.

Análisis a nivel de país del mercado de cal viva en América del Norte

El mercado de cal viva de América del Norte está segmentado en tres segmentos notables, que se basan en la forma, el producto y la aplicación.

Los países incluidos en el informe sobre el mercado de cal viva en América del Norte son Estados Unidos, Canadá y México. Estados Unidos domina el mercado de América del Norte debido a la alta adopción de cal viva en la industria de la construcción en la región.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Uso creciente de carbonato de calcio precipitado

La cal viva se utiliza como relleno en adhesivos y selladores en diversas industrias. Además, la cal viva se utiliza principalmente como un aditivo reológico importante en la fabricación de productos industriales de alto rendimiento. La cal viva en forma de carbonato de calcio precipitado también se utiliza como calcio en la dieta y se utiliza principalmente para productos líquidos donde es importante un tamaño de partícula muy pequeño. Muchos medicamentos y cosméticos contienen carbonato de calcio precipitado como material de base para tabletas o productos químicos de relleno, ungüentos y cremas.

La cal viva se utiliza habitualmente en pinturas y tintas como agente de relleno para aumentar la capacidad y la porosidad de los techos secos. Se utiliza como relleno fino y de control muy constante y ayuda a controlar las características de flujo y forma de los componentes finos. La cal viva también se puede suministrar recubierta con aditivos para mejorar el brillo y favorecer la adhesión en la industria papelera.

Además, el carbonato de calcio precipitado utilizado como cal viva hace que los productos sean más resistentes y se extrae de la piedra caliza , que se utiliza en diferentes revestimientos. Por este motivo, se espera que el uso creciente de carbonato de calcio precipitado actúe como un impulsor del mercado de cal viva de América del Norte.

Análisis del panorama competitivo y de la cuota de mercado de la cal viva

El panorama competitivo del mercado de cal viva de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los proyectos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en relación con el mercado de cal viva de América del Norte.

Algunos de los principales actores del mercado de cal viva en América del Norte son CARMEUSE, Graymont Limited, Cheney Lime & Cement Company, Lhoist Group, Mississippi Lime Company, Linwood Mining & Minerals Corporation, SMA Mineral AB, Pete Lien & Sons, Inc., Adelaide Brighton Cement Ltd., Boral, Nordkalk Corporation, United States Lime & Minerals, Inc., Cape Lime, Saudi Lime Industries Co., Emirates Lime Factory, Super Cement Manufacturing Company LLC, Valley Minerals LLC, CMI Company, Märker Gruppe, Kalkfabrik Netstal, Brenntag, Yoshizawa Lime Industry CO.,LTD. y Austin White Lime Company, Ltd., entre otros.

Por ejemplo,

- En julio de 2021, Lhoist North America y Maerz Ofenbau AG pusieron en marcha un nuevo horno de cal en Montevallo (EE. UU.). Lhoist North America ha ampliado su producción de cal viva dolomítica en Marble Falls (Texas), así como un nuevo horno de cal en sus instalaciones de New Braunfels (Texas). Con esta ampliación, la empresa puede aprovechar las áreas de mercado sin explotar.

- En junio de 2014, Graymont Limited anunció que había firmado un acuerdo con Holcim para adquirir los activos de Taylor's Lime de la empresa. Esta adquisición refleja la confianza de Graymont en las perspectivas de crecimiento a largo plazo de la economía de Nueva Zelanda y la región. Esta adquisición está sujeta a la obtención de todas las aprobaciones regulatorias habituales. El mercado de cal viva de América del Norte está segmentado en tres segmentos notables según la forma, el producto y la aplicación.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA QUICKLIME MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 OVERVIEW

4.1.2 LOGISTIC COST SCENARIO

4.1.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.2 CLIMATE CHANGE SCENARIO

4.2.1 ENVIRONMENTAL CONCERNS

4.2.2 INDUSTRY RESPONSE

4.2.3 GOVERNMENT’S ROLE

4.2.4 ANALYST RECOMMENDATION

4.3 IMPORT EXPORT SCENARIO

4.4 LIST OF BUYERS

4.5 VENDOR SELECTION CRITERIA

4.6 REGULATORY COVERAGE

4.7 PORTER'S FIVE FORCES:

4.7.1 THREAT OF NEW ENTRANTS:

4.7.2 THREAT OF SUBSTITUTES:

4.7.3 CUSTOMER BARGAINING POWER:

4.7.4 SUPPLIER BARGAINING POWER:

4.7.5 INDUSTRIAL RIVALRY:

4.8 PESTLE ANALYSIS

4.8.1 POLITICAL FACTORS:

4.8.2 ECONOMIC FACTORS:

4.8.3 SOCIAL FACTORS:

4.8.4 TECHNOLOGICAL FACTORS:

4.8.5 LEGAL FACTORS:

4.8.6 ENVIRONMENTAL FACTORS:

4.9 PRODUCTION AND CONSUMPTION ANALYSIS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.11 RAW MATERIAL PRODUCTION COVERAGE

4.12 PRICE ANALYSIS

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 ASIA-PACIFIC

5.3 NORTH AMERICA

5.4 EUROPE

5.5 SOUTH AMERICA

5.6 MIDDLE-EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USAGE OF PRECIPITATED CALCIUM CARBONATE

6.1.2 RISING MINING ACTIVITIES

6.1.3 INCREASE IN DEMAND FOR IRON AND STEEL FROM DIFFERENT INDUSTRIES

6.1.4 HIGH ADOPTION OF QUICKLIME IN BUILDING AND CONSTRUCTION INDUSTRY

6.2 RESTRAINTS

6.2.1 VOLATILITY IN THE PRICES OF QUICKLIME RAW MATERIALS

6.2.2 COMPLICATED PROCESS FOR PRODUCING QUICKLIME

6.3 OPPORTUNITIES

6.3.1 RAPID DEVELOPMENT IN WATER TREATMENT PROCESSES

6.3.2 RISING CONSTRUCTION ACTIVITIES IN EMERGING COUNTRIES

6.3.3 GROWING INDUSTRIAL MACHINERY PRODUCTION

6.4 CHALLENGES

6.4.1 STRICT GOVERNMENT REGULATIONS FOR QUICKLIME MANUFACTURING AND COMMERCIALIZING

6.4.2 GROWING IMPORTANCE OF QUICKLIME ALTERNATIVES SUCH AS LIMESTONE AND MAGNESIUM HYDROXIDE

7 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA QUICKLIME MARKET

7.1 AFTERMATH OF COVID-19 AND THE GOVERNMENT INITIATIVES TO BOOST THE MARKET

7.2 STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID-19 TO GET COMPETITIVE MARKET SHARE

7.3 PRICE IMPACT

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 NORTH AMERICA QUICKLIME MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 HIGH CALCIUM

8.3 MAGNESIUM

8.4 DOLOMITIC

8.5 OTHERS

9 NORTH AMERICA QUICKLIME MARKET, BY FORM

9.1 OVERVIEW

9.2 CRUSHED OR PEBBLE

9.3 LARGE LUMP

9.4 GROUND

9.5 PULVERIZED

9.6 PELLETIZED

9.7 OTHERS

10 NORTH AMERICA QUICKLIME MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BUILDING AND CONSTRUCTION MATERIAL

10.2.1 BUILDING AND CONSTRUCTION MATERIAL, BY PRODUCT

10.2.1.1 HIGH CALCIUM

10.2.1.2 MAGNESIUM

10.2.1.3 DOLOMITIC

10.2.1.4 OTHERS

10.3 CHEMICAL

10.3.1 CHEMICAL, BY PRODUCT

10.3.1.1 HIGH CALCIUM

10.3.1.2 MAGNESIUM

10.3.1.3 DOLOMITIC

10.3.1.4 OTHERS

10.4 WATER TREATMENT

10.4.1 WATER TREATMENT, BY PRODUCT

10.4.1.1 HIGH CALCIUM

10.4.1.2 MAGNESIUM

10.4.1.3 DOLOMITIC

10.4.1.4 OTHERS

10.5 METALLURGICAL

10.5.1 METALLURGICAL, BY PRODUCT

10.5.1.1 HIGH CALCIUM

10.5.1.2 MAGNESIUM

10.5.1.3 DOLOMITIC

10.5.1.4 OTHERS

10.6 MINING

10.6.1 MINING, BY PRODUCT

10.6.1.1 HIGH CALCIUM

10.6.1.2 MAGNESIUM

10.6.1.3 DOLOMITIC

10.6.1.4 OTHERS

10.7 OTHERS

10.7.1 OTHERS, BY PRODUCT

10.7.1.1 HIGH CALCIUM

10.7.1.2 MAGNESIUM

10.7.1.3 DOLOMITIC

10.7.1.4 OTHERS

11 NORTH AMERICA QUICKLIME MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA QUICKLIME MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 BORAL

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 BRENNTAG SE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATES

14.3 LHOIST GROUP

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT UPDATES

14.4 ADELAIDE BRIGHTON CEMENT LTD. (A SUBSIDIARY OF ADBRI LTD GROUP OF COMPANIES)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATE

14.5 CARMEUSE

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATE

14.6 GRAYMONT LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 NORDKALK CORPORATION

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 MISSISSIPPI LIME COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 YOSHIZAWA LIME FACTORY CO LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 AUSTIN WHITE LIME COMPANY, LTD

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 CAPE LIME (A SUBSIDIARY OF AFRIMAT)

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT UPDATE

14.12 CHENEY LIME & CEMENT COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATE

14.13 CMI COMPANY

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATE

14.14 EMIRATES LIME FACTORY

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATE

14.15 KALKFABRIK NETSTAL

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 LINWOOD MINING & MINERALS CORPORATION

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 MARKER GRUPPE

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATE

14.18 PETE LIEN & SONS, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATE

14.19 SAUDI LIME INDUSTRIES CO.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 SMA MINERAL AB

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

14.21 SUPER CEMENT MANUFACTURING CO. LLC (SCMC)

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATE

14.22 UNITED STATES LIME & MINERAL, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT UPDATE

14.23 VALLEY MINERALS LLC

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF QUICKLIMEHS CODE - 252210 (USD THOUSAND)

TABLE 2 EXPORT DATA OF QUICKLIME.; HS CODE - 252210 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 AVERAGE PRICE OF QUICKLIME PRODUCTS

TABLE 5 NORTH AMERICA QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA QUICKLIME MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 7 NORTH AMERICA HIGH CALCIUM IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA HIGH CALCIUM IN QUICKLIME MARKET, BY REGION, 2020-2029 (TONS)

TABLE 9 NORTH AMERICA MAGNESIUM IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA MAGNESIUM IN QUICKLIME MARKET, BY REGION, 2020-2029 (TONS)

TABLE 11 NORTH AMERICA DOLOMITIC IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA DOLOMITIC IN QUICKLIME MARKET, BY REGION, 2020-2029 (TONS)

TABLE 13 NORTH AMERICA OTHERS IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN QUICKLIME MARKET, BY REGION, 2020-2029 (TONS)

TABLE 15 NORTH AMERICA QUICKLIME MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA QUICKLIME MARKET, BY FORM, 2020-2029 (TONS)

TABLE 17 NORTH AMERICA CRUSHED OR PEBBLE IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA LARGE LUMP IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA GROUND IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA PULVERIZED IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA PELLETIZED IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA OTHERS IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA QUICKLIME MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA QUICKLIME MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 25 NORTH AMERICA BUILDING AND CONSTRUCTION MATERIAL IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA BUILDING AND CONSTRUCTION MATERIAL IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA CHEMICAL IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA CHEMICAL IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA WATER TREATMENT IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA WATER TREATMENT IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA METALLURGICAL IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA METALLURGICAL IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA MINING IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA MINING IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA OTHERS IN QUICKLIME MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA QUICKLIME MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA QUICKLIME MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 39 NORTH AMERICA PROTECTIVE COATING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA PROTECTIVE COATING MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 41 NORTH AMERICA PROTECTIVE COATING MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA PROTECTIVE COATING MARKET, BY FORM, 2020-2029 (TONS)

TABLE 43 NORTH AMERICA PROTECTIVE COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PROTECTIVE COATING MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 45 NORTH AMERICA BUILDING AND CONSTRUCTION MATERIALS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA CHEMICALS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA WATER TREATMENT IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA METALLURGICAL IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA MINING IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. QUICKLIME MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 53 U.S. QUICKLIME MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. QUICKLIME MARKET, BY FORM, 2020-2029 (TONS)

TABLE 55 U.S. QUICKLIME MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. QUICKLIME MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 57 U.S. BUILDING AND CONSTRUCTION MATERIALS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. CHEMICALS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 U.S. WATER TREATMENT IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 60 U.S. METALLURGICAL IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 U.S. MINING IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 62 U.S. OTHERS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA QUICKLIME MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 65 CANADA QUICKLIME MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA QUICKLIME MARKET, BY FORM, 2020-2029 (TONS)

TABLE 67 CANADA QUICKLIME MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 CANADA QUICKLIME MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 69 CANADA BUILDING AND CONSTRUCTION MATERIALS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 CANADA CHEMICALS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 CANADA WATER TREATMENT IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 CANADA METALLURGICAL IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 CANADA MINING IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 CANADA OTHERS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 76 MEXICO QUICKLIME MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 77 MEXICO QUICKLIME MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO QUICKLIME MARKET, BY FORM, 2020-2029 (TONS)

TABLE 79 MEXICO QUICKLIME MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 MEXICO QUICKLIME MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 81 MEXICO BUILDING AND CONSTRUCTION MATERIALS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 82 MEXICO CHEMICALS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 MEXICO WATER TREATMENT IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 84 MEXICO METALLURGICAL IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 MEXICO MINING IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 86 MEXICO OTHERS IN QUICKLIME MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA QUICKLIME MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA QUICKLIME MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA QUICKLIME MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA QUICKLIME MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA QUICKLIME MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA QUICKLIME MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA QUICKLIME MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA QUICKLIME MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA QUICKLIME MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA QUICKLIME MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA QUICKLIME MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA QUICKLIME MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA QUICKLIME MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA QUICKLIME MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASING DEMAND FOR IRON AND STEEL FROM DIFFERENT INDUSTRIES IS EXPECTED TO DRIVE THE NORTH AMERICA QUICKLIME MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 HIGH CALCIUM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA QUICKLIME MARKET IN 2022 & 2029

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 PRODUCTION AND CONSUMPTION ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA QUICKLIME MARKET

FIGURE 21 WORLD STEEL PRODUCTION IN 2015 AND 2016

FIGURE 22 INDIA CEMENT PRODUCTION (JUNE 2019 – APRIL 2020) (THOUSAND TONS)

FIGURE 23 NORTH AMERICA QUICKLIME MARKET, BY PRODUCT, (USD THOUSAND) (2021)

FIGURE 24 NORTH AMERICA QUICKLIME MARKET, BY FORM, (USD THOUSAND) (2021)

FIGURE 25 NORTH AMERICA QUICKLIME MARKET, BY APPLICATION (USD THOUSAND) (2021)

FIGURE 26 NORTH AMERICA PROTECTIVE COATING MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA PROTECTIVE COATING MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA PROTECTIVE COATING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA PROTECTIVE COATING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA PROTECTIVE COATING MARKET: BY PRODUCT (2022-2029)

FIGURE 31 NORTH AMERICA QUICKLIME MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.