Mercado de tarjetas de sonda de América del Norte, por tipo de sonda (tarjeta de sonda avanzada y tarjeta de sonda estándar), tipo de tecnología de fabricación ( MEMS , vertical, voladizo, epoxi, cuchilla , otros), tamaño de oblea (más de 12 pulgadas y menos de 12 pulgadas), tamaño de cabezal (más de 40 mm x 40 mm y menos de 40 mm x 40 mm), prueba (prueba de CC, prueba funcional y prueba de CA), material (tungsteno, laminado revestido de cobre (CCL), aluminio , otros), aplicación (WLCSP, SIP, chip invertido de señal mixta, analógico), tamaño del haz (más de 1,5 mil, menos de 1,5 mil), uso final (fundición, paramétrico, dispositivo lógico y de memoria, DRAM, sensor de imagen CMOS (CIS), Flash, otros), país (EE. UU., Canadá y México) Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado de tarjetas de prueba de América del Norte

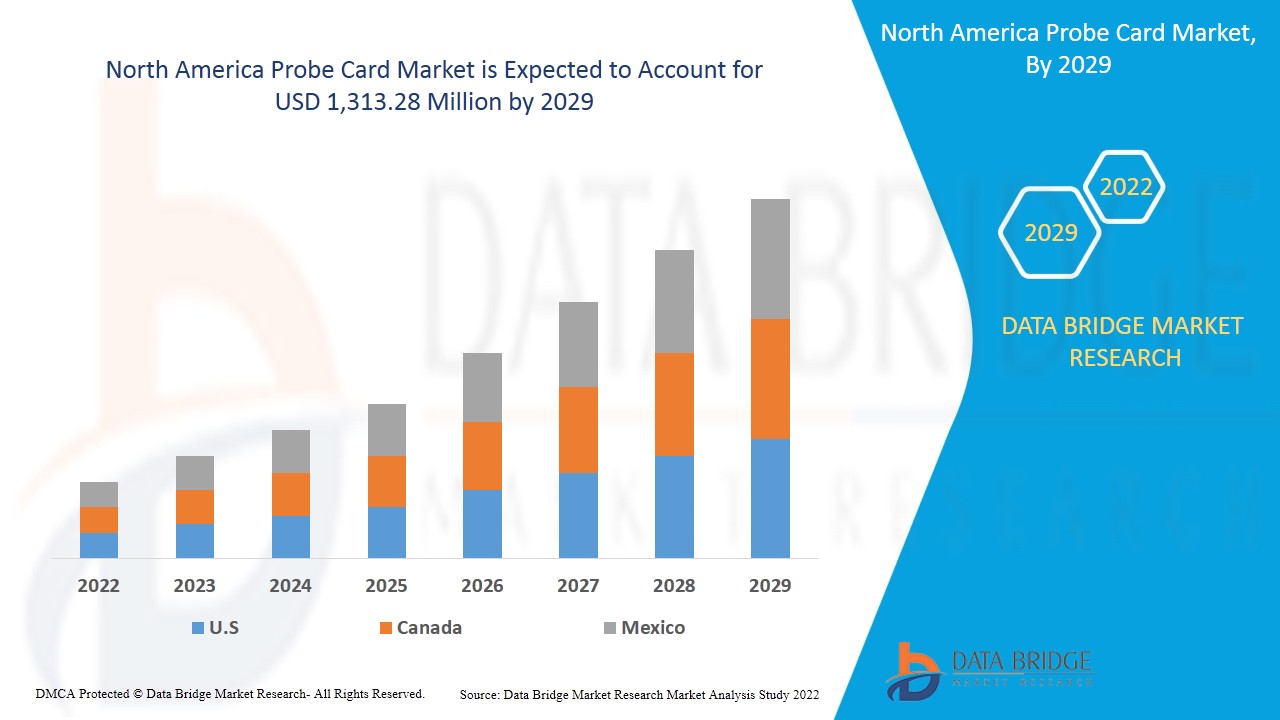

Se espera que el mercado de tarjetas de prueba de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 10,7% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 1.313,28 millones para 2029. Se espera que el uso creciente de circuitos integrados en dispositivos electrónicos impulse el mercado de tarjetas de prueba de América del Norte.

Una tarjeta de prueba es una interfaz que se utiliza para realizar una prueba de oblea para una oblea de semiconductores. Este proceso se utiliza para verificar la calidad de los circuitos integrados o la indexación semántica latente en el primer proceso de fabricación de semiconductores. Generalmente, la tarjeta de prueba está conectada eléctricamente a un probador y acoplada mecánicamente a un probador. La función principal de una tarjeta de prueba es proporcionar una ruta eléctrica entre el sistema de prueba y los circuitos en la oblea, donde se pueden probar los circuitos. Las partes principales incluidas en las tarjetas de prueba se denominan placas de circuito impreso (PCB) y algunas formas de elementos de contacto. Se consideran muchos elementos en una tarjeta de prueba, algunos son muy comunes de usar y otros tienen usos muy especiales.

El aumento de la demanda de pruebas electrónicas en la industria de semiconductores puede actuar como un factor impulsor del mercado de tarjetas de prueba de América del Norte. Se espera que la falta de conocimiento entre los consumidores sobre los beneficios de la solución de tarjetas de prueba suponga un desafío para el crecimiento del mercado. Sin embargo, se espera que el aumento de las asociaciones y colaboraciones estratégicas entre las organizaciones brinde oportunidades para el mercado de tarjetas de prueba de América del Norte. El alto costo asociado con la solución de tarjetas de prueba puede restringir el mercado.

El informe de mercado de tarjetas de prueba de América del Norte proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de tarjetas de prueba de América del Norte, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de tarjetas de prueba en América del Norte

El mercado de tarjetas de sonda de América del Norte está segmentado en función del tipo de sonda, el tipo de tecnología de fabricación, el tamaño de la oblea, el tamaño del cabezal, la prueba, el material, la aplicación, el tamaño del haz y el uso final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo de sonda, el mercado de tarjetas de sonda de América del Norte se segmenta en tarjetas de sonda avanzadas y tarjetas de sonda estándar. En 2022, se prevé que el segmento de tarjetas de sonda avanzadas domine el mercado porque proporciona una alta eficiencia en semiconductores de menor tamaño.

- Según el tipo de tecnología de fabricación, el mercado de tarjetas de sonda de América del Norte se segmenta en MEMS, verticales, en voladizo, epoxi, de cuchillas y otros. En 2022, se prevé que el segmento MEMS domine el mercado porque se adapta a los procesos de fabricación de alta densidad de menos de 14 nm.

- En función del tamaño de las obleas , el mercado de tarjetas de prueba de América del Norte se segmenta en más de 12 pulgadas y menos de 12 pulgadas. En 2022, se prevé que el segmento de más de 12 pulgadas domine el mercado porque permite un buen uso de las obleas semiconductoras y una alta velocidad de producción.

- En función del tamaño de la cabeza, el mercado de tarjetas de prueba de América del Norte se segmenta en más de 40 mm x 40 mm y menos de 40 mm x 40 mm. En 2022, se prevé que el segmento de más de 40 mm x 40 mm domine el mercado porque contiene diferentes variedades de industrias de semiconductores /LCD.

- En función de las pruebas, el mercado de tarjetas de prueba de América del Norte se segmenta en pruebas de CC, pruebas funcionales y pruebas de CA. En 2022, se prevé que el segmento de pruebas de CC domine el mercado porque la prueba de corriente continua ayuda a identificar la interrupción de la corriente en el circuito y a detectar la calidad en una etapa temprana.

- En función del material, el mercado de tarjetas de sonda de América del Norte se segmenta en tungsteno, laminado revestido de cobre (CCL), aluminio y otros. En 2022, se prevé que el segmento de tungsteno domine el mercado porque su alto punto de fusión y su estabilidad de forma extremadamente alta incluso en un entorno de temperatura muy alta lo hacen adecuado para las agujas de sonda.

- En función de la aplicación, el mercado de tarjetas de prueba de América del Norte se segmenta en WLCSP, SIP, chip invertido de señal mixta y analógico. En 2022, se prevé que el segmento WLCSP domine el mercado porque esta aplicación es útil en todo tipo de circuitos integrados como DRAM, lógica, sensor CMOS y otros.

- En función del tamaño del haz, el mercado de tarjetas de sonda de América del Norte se segmenta en más de 1,5 mil y menos de 1,5 mil. En 2022, se prevé que el segmento de más de 1,5 mil domine el mercado porque contiene un tamaño de característica mínimo que facilita el mantenimiento.

- En función del uso final, el mercado de tarjetas de prueba de América del Norte se segmenta en dispositivos de fundición, paramétricos, lógicos y de memoria, DRAM, sensores de imagen CMOS (CIS), flash y otros. En 2022, se prevé que el segmento de fundición domine el mercado con el aumento de la demanda de los sectores de la electrónica portátil y automotriz.

Análisis a nivel de país del mercado de tarjetas de prueba de América del Norte

El mercado de tarjetas de sonda de América del Norte está segmentado según el tipo de sonda, el tipo de tecnología de fabricación, el tamaño de la oblea, el tamaño del cabezal, la prueba, el material, la aplicación, el tamaño del haz y el uso final.

Los países incluidos en el informe sobre el mercado de tarjetas de prueba de América del Norte son Estados Unidos, Canadá y México. Se espera que Estados Unidos domine el mercado de tarjetas de prueba de América del Norte debido a la inversión de las industrias de semiconductores en los países después de la COVID-19.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

El aumento de la demanda de pruebas electrónicas en la industria de semiconductores está impulsando el crecimiento del mercado de tarjetas de prueba en América del Norte

El mercado de tarjetas de prueba de América del Norte también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de las tarjetas de prueba en América del Norte

El panorama competitivo del mercado de tarjetas de prueba de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de tarjetas de prueba de América del Norte.

Algunas de las principales empresas que se dedican a la tarjeta de prueba de América del Norte son FormFactor, FEINMETALL GmbH, RIKA DENSHI CO., LTD., TSE co,. Ltd., dynamic-test, STAr Technologies Inc., MICRONICS JAPAN CO., LTD., Translarity, SV Probe, MPI Corporation, Onto Innovation, JAPAN ELECTRONIC MATERIALS CORPORATION, WinWay Tech. Co., Ltd., Wentworth Labs, htt high tech grade GmbH, Technoprobe SpA, entre otras empresas nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosos contratos y acuerdos son iniciados también por empresas de todo el mundo, lo que acelera el mercado de tarjetas de prueba en América del Norte.

Por ejemplo,

- En diciembre de 2021, FormFactor puso en marcha una nueva planta de fabricación de tarjetas de prueba para obleas semiconductoras para su producción en California. La iniciativa se tomó para ampliar la capacidad de producción de tarjetas de prueba. El beneficio de la planta de producción ayudará a la empresa a satisfacer la creciente demanda de los clientes. El mercado tendrá una mayor cantidad de productos con características importantes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PROBE CARD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PROBE TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 THE MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN

4.1.1 MANUFACTURERS

4.1.2 CONSUMPTION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING USE OF INTEGRATED CIRCUITS IN ELECTRONIC DEVICES

5.1.2 SURGE IN DEMAND FOR ELECTRONIC TESTING IN THE SEMICONDUCTOR INDUSTRY

5.1.3 GROWING INVESTMENT IN MINIATURIZATION OF ELECTRONIC COMPONENT

5.1.4 RISING DEMAND FOR SEMICONDUCTORS PROBE CARDS IN AUTOMOBILE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH PROBE CARD SOLUTION

5.2.2 IMPACT OF METAL PRICES ON OVERALL COMPONENT PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC PARTNERSHIP AND COLLABORATION

5.3.2 RISING ADOPTION OF PROBE CARDS SOLUTION IN AUTOMOTIVE INDUSTRY

5.3.3 INCREASING USE OF SEMICONDUCTORS IN MILITARY AND DEFENSE SECTOR

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING BENEFITS OF PROBE CARD SOLUTION

5.4.2 DISRUPTION IN SUPPLY OF PROBE CARD

5.4.3 TECHNOLOGICAL ACCELERATION CREATES A CHALLENGING ENVIRONMENT FOR PROBE CARD SOLUTION

6 IMPACT ANALYSIS OF COVID-19 ON NORTH AMERICA PROBE CARD MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISIONS BY MANUFACTURERS AFTER COVID-19

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND AND SUPPLY CHAIN

6.5 CONCLUSION

7 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE

7.1 OVERVIEW

7.2 ADVANCED PROBE CARD

7.2.1 MEMS SP

7.2.2 VERTICAL PROBE

7.2.3 U-PROBE

7.2.4 SP-PROBE

7.2.5 OTHERS

7.3 STANDARD PROBE CARD

8 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE

8.1 OVERVIEW

8.2 MEMS

8.3 VERTICAL

8.4 CANTILEVER

8.5 EPOXY

8.6 BLADE

8.7 OTHERS

9 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE

9.1 OVERVIEW

9.2 MORE THAN 12 INCHES

9.3 LESS THAN 12 INCHES

10 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE

10.1 OVERVIEW

10.2 MORE THAN 40MM X 40MM

10.3 LESS THAN 40MM X 40MM

11 NORTH AMERICA PROBE CARD MARKET, BY TEST

11.1 OVERVIEW

11.2 DC TEST

11.3 FUNCTIONAL TEST

11.4 AC TEST

12 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL

12.1 OVERVIEW

12.2 TUNGSTEN

12.3 COPPER CLAD LAMINATED (CCL)

12.4 ALUMINUM

12.5 OTHERS

13 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 WLCSP

13.3 SIP

13.4 MIXED SIGNAL FLIP CHIP

13.5 ANALOG

14 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE

14.1 OVERVIEW

14.2 MORE THAN 1.5 MIL

14.3 LESS THAN 1.5 MIL

15 NORTH AMERICA PROBE CARD MARKET, BY END-USE

15.1 OVERVIEW

15.2 FOUNDRY

15.2.1 ADVANCED PROBE CARD

15.2.2 STANDARD PROBE CARD

15.3 PARAMETRIC

15.3.1 ADVANCED PROBE CARD

15.3.2 STANDARD PROBE CARD

15.4 LOGIC AND MEMORY DEVICE

15.4.1 ADVANCED PROBE CARD

15.4.2 STANDARD PROBE CARD

15.5 DRAM

15.5.1 ADVANCED PROBE CARD

15.5.2 STANDARD PROBE CARD

15.6 CMOS IMAGE SENSOR (CIS)

15.6.1 ADVANCED PROBE CARD

15.6.2 STANDARD PROBE CARD

15.7 FLASH

15.7.1 ADVANCED PROBE CARD

15.7.2 STANDARD PROBE CARD

15.8 OTHERS

16 NORTH AMERICA PROBE CARD MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA PROBE CARD MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 FORMFACTOR

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 TECHNOPROBE S.P.A.

19.2.1 COMPANY SNAPSHOT

19.2.2 COMPANY SHARE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 MICRONICS JAPAN CO., LTD.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 MPI CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIUS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 CHUNGHWA PRECISION TEST TECH.CO. LTD

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 FEINMETALL GMBH

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 HTT HIGH TECH TRADE GMBH

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 KOREA INSTRUMENT CO., LTD

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 JAPAN ELECTRONIC MATERIALS CORPORATION

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENT

19.1 MICROFRIEND

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 ONTO INNOVATION

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 SV PROBE

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 STAR TECHNOLOGIES INC.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 RIKA DENSHI CO., LTD.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TSE CO,. LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 TRANSLARITY

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 DYNAMIC-TEST

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 WILL TECHNOLOGY

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENTS

19.19 WENTWORTH LABS

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 WINWAY TECH. CO., LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STANDARD PROBE CARD IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEMS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA VERTICAL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CANTILEVER IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA EPOXY IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BLADE IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MORE THAN 12 INCHES IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LESS THAN 12 INCHES IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MORE THAN 40MM X 40MM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LESS THAN 40MM X 40MM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA DC TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FUNCTIONAL TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 21 NORTH AMERICA AC TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 22 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA TUNGSTEN IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA COPPER CLAD LAMINATED (CCL) IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 25 NORTH AMERICA ALUMINUM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 26 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 27 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA WLCSP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SIP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 30 NORTH AMERICA MIXED SIGNAL FLIP CHIP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 31 NORTH AMERICA ANALOG IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 32 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MORE THAN 1.5 MIL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA LESS THAN 1.5 MIL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA PROBE CARD MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 39 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 41 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 43 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 45 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 47 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 49 NORTH AMERICA PROBE CARD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.S. PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 71 U.S. PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 72 U.S. PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 73 U.S. PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 75 U.S. PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 76 U.S. FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 82 TABLE 132 CANADA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 86 CANADA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 87 CANADA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 88 CANADA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 CANADA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 CANADA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 91 CANADA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 92 CANADA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 93 CANADA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 95 CANADA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 105 MEXICO PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 MEXICO PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA PROBE CARD MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PROBE CARD MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PROBE CARD MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PROBE CARD MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PROBE CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PROBE CARD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PROBE CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PROBE CARD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PROBE CARD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA PROBE CARD MARKET: MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA PROBE CARD MARKET: SEGMENTATION

FIGURE 12 INCREASING USE OF INTEGRATED CIRCUITS IN ELECTRONIC DEVICES IS EXPECTED TO DRIVE THE NORTH AMERICA PROBE CARD MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE ADVANCED PROBE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PROBE CARD MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA PROBE CARD MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA PROBE CARD MARKET

FIGURE 16 NORTH AMERICA PROBE CARD MARKET: BY PROBE TYPE, 2021

FIGURE 17 NORTH AMERICA PROBE CARD MARKET: BY MANUFACTURING TECHNOLOGY TYPE, 2021

FIGURE 18 NORTH AMERICA PROBE CARD MARKET: BY WAFER SIZE, 2021

FIGURE 19 NORTH AMERICA PROBE CARD MARKET: BY HEAD SIZE, 2021

FIGURE 20 NORTH AMERICA PROBE CARD MARKET: BY TEST, 2021

FIGURE 21 NORTH AMERICA PROBE CARD MARKET: BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA PROBE CARD MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA PROBE CARD MARKET: BY BEAM SIZE, 2021

FIGURE 24 NORTH AMERICA PROBE CARD MARKET: BY END-USE, 2021

FIGURE 25 NORTH AMERICA PROBE CARD MARKET: SNAPSHOT (2021)

FIGURE 26 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2021)

FIGURE 27 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 NORTH AMERICA PROBE CARD MARKET: BY PROBE TYPE (2022-2029)

FIGURE 30 NORTH AMERICA PROBE CARD MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.