North America Preclinical Imaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.38 Billion

USD

2.32 Billion

2024

2032

USD

1.38 Billion

USD

2.32 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.32 Billion | |

|

|

|

|

Segmentación del mercado de imágenes preclínicas en Norteamérica, por producto (sistemas y servicios), reactivos (reactivos para imágenes ópticas preclínicas, reactivos para imágenes nucleares preclínicas, agentes de contraste para resonancia magnética preclínica, agentes de contraste para ultrasonido preclínico y agentes de contraste para tomografía computarizada preclínica), aplicación (investigación y desarrollo, descubrimiento de fármacos, biodistribución, detección de células cancerosas, biomarcadores y otros), usuario final (organización de investigación por contrato, empresas farmacéuticas y biotecnológicas, institutos de investigación académicos y gubernamentales, centros de diagnóstico y otros): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de imágenes preclínicas en América del Norte

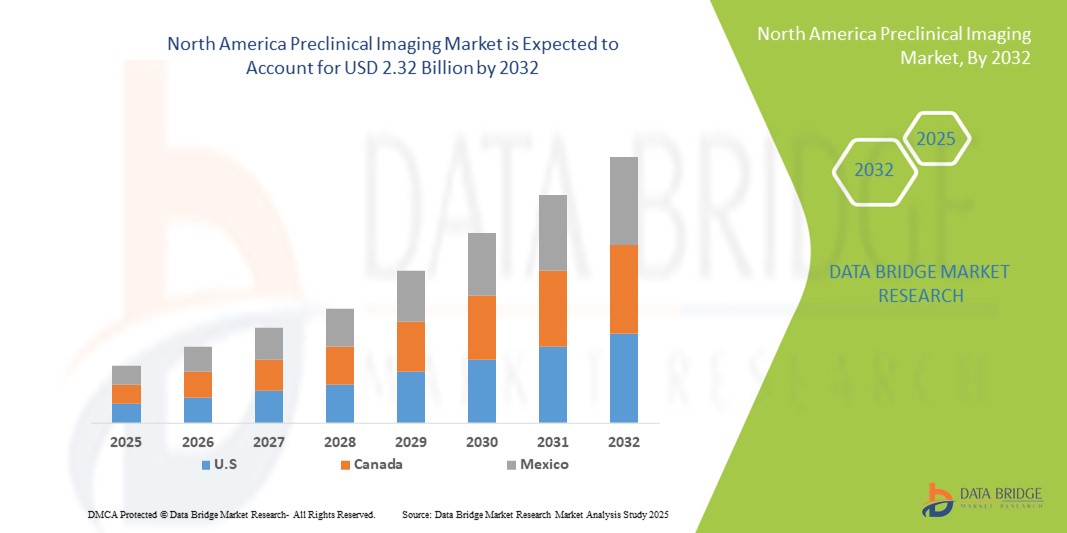

- El tamaño del mercado de imágenes preclínicas de América del Norte se valoró en USD 1.38 mil millones en 2024 y se espera que alcance los USD 2.32 mil millones para 2032 , con una CAGR del 6,70 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por el aumento de las inversiones en el descubrimiento y desarrollo de fármacos, junto con la creciente adopción de modalidades de imágenes avanzadas como la resonancia magnética , la PET, la tomografía computarizada y las imágenes ópticas para la investigación preclínica.

- Además, el creciente enfoque en la investigación traslacional, la medicina personalizada y las técnicas de imagen no invasivas para monitorizar la progresión de enfermedades en modelos animales está impulsando la demanda. Estos factores, en conjunto, están impulsando la adopción de soluciones de imagen preclínica, impulsando así significativamente el crecimiento del mercado.

Análisis del mercado de imágenes preclínicas en América del Norte

- Las imágenes preclínicas, que abarcan sistemas de imágenes avanzados como la resonancia magnética, la PET, la tomografía computarizada y las imágenes ópticas, son cada vez más vitales en el descubrimiento de fármacos modernos y la investigación traslacional debido a su capacidad de proporcionar información no invasiva y en tiempo real sobre la progresión de la enfermedad, la eficacia del tratamiento y los mecanismos biológicos en modelos animales.

- La creciente demanda de imágenes preclínicas se ve impulsada principalmente por las crecientes inversiones en investigación farmacéutica y biotecnológica , la creciente adopción de modalidades de imágenes avanzadas y la creciente necesidad de procesos de desarrollo de fármacos más rápidos y precisos.

- Estados Unidos dominó el mercado de imágenes preclínicas de América del Norte con la mayor participación en los ingresos del 82,5 % en 2024, caracterizado por altas inversiones en I+D, una fuerte presencia de fabricantes clave de equipos de imágenes y una adopción temprana de tecnologías de imágenes de vanguardia, con un crecimiento sustancial en las instalaciones de imágenes preclínicas en empresas farmacéuticas e institutos de investigación académica, impulsado por innovaciones en sistemas de imágenes multimodales y de resonancia magnética de alta resolución.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de imágenes preclínicas de América del Norte durante el período de pronóstico debido a la expansión de las inversiones en investigación de ciencias biológicas, el crecimiento de nuevas empresas de biotecnología y el creciente enfoque en la medicina traslacional y personalizada.

- El segmento de sistemas dominó el mercado de imágenes preclínicas con una participación de mercado del 49,5 % en 2024, impulsado por su papel esencial en la investigación y el descubrimiento de fármacos, las capacidades de imágenes de alta resolución y la amplia adopción en las instalaciones de investigación farmacéutica, biotecnológica y académica.

Alcance del informe y segmentación del mercado de imágenes preclínicas en América del Norte

|

Atributos |

Perspectivas clave del mercado de imágenes preclínicas en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de imágenes preclínicas en América del Norte

Avances en imágenes multimodales y mejoradas por IA

- Una tendencia significativa y en aceleración en el mercado de imágenes preclínicas de América del Norte es la creciente integración de sistemas de imágenes multimodales con software de análisis impulsado por IA, lo que permite una visualización más precisa y de alta resolución de los modelos de enfermedades y las respuestas al tratamiento.

- Por ejemplo, la combinación de plataformas de imágenes MRI-PET permite a los investigadores capturar simultáneamente datos anatómicos y funcionales, mejorando la calidad de los estudios preclínicos y acelerando los plazos de desarrollo de fármacos.

- La integración de IA en los sistemas de imagenología permite funciones como la detección automatizada de anomalías, el análisis predictivo de los resultados del tratamiento y la optimización de los protocolos de imagenología para un mayor rendimiento. Por ejemplo, algunos sistemas Vevo LAZR-X utilizan IA para mejorar la precisión de la reconstrucción de imágenes y proporcionar información predictiva para estudios longitudinales.

- La combinación perfecta de modalidades de imágenes con análisis de datos asistidos por IA facilita la gestión centralizada de los flujos de trabajo de imágenes, lo que permite a los investigadores analizar múltiples conjuntos de datos desde una única plataforma y obtener información completa sobre los procesos biológicos.

- Esta tendencia hacia soluciones de imagenología más inteligentes, automatizadas e integradas está transformando radicalmente las expectativas de eficiencia en la investigación preclínica. En consecuencia, empresas como Bruker y PerkinElmer están desarrollando sistemas de imagenología preclínica basados en IA con funciones como segmentación automatizada, modelado predictivo y resolución mejorada.

- La demanda de plataformas de imágenes preclínicas multimodales impulsadas por IA está creciendo rápidamente en las instalaciones de investigación farmacéutica y académica, a medida que las partes interesadas priorizan cada vez más la precisión, la velocidad y las capacidades de análisis integrales.

Dinámica del mercado de imágenes preclínicas en América del Norte

Conductor

Aumento de la demanda debido al aumento de las inversiones en I+D y las actividades de desarrollo de fármacos

- Las crecientes inversiones en I+D farmacéutica y biotecnológica, junto con la necesidad de un desarrollo de fármacos más rápido y preciso, son un impulsor importante de la mayor demanda de sistemas de imágenes preclínicas.

- Por ejemplo, en marzo de 2024, Bruker lanzó una nueva solución de imágenes MRI-PET de alto rendimiento diseñada para acelerar los estudios preclínicos de oncología y neurología, lo que indica una creciente adopción por parte de la industria de plataformas de imágenes avanzadas.

- A medida que los investigadores se centran en los estudios traslacionales y la medicina de precisión, las imágenes preclínicas proporcionan información fundamental sobre la eficacia de los medicamentos, la seguridad y la progresión de la enfermedad, lo que ofrece una ventaja convincente sobre los métodos de evaluación tradicionales.

- Además, la expansión de empresas emergentes de biotecnología y CRO en los EE. UU. está haciendo que las imágenes preclínicas sean una parte integral de la investigación en etapa inicial, brindando soluciones de imágenes escalables y estandarizadas en múltiples estudios.

- La capacidad de realizar estudios longitudinales no invasivos, monitorizar la expresión de biomarcadores e integrar datos de imágenes con análisis de IA son factores clave que impulsan su adopción en centros de investigación farmacéuticos y académicos. La tendencia hacia la imagenología preclínica de alto rendimiento y los flujos de trabajo automatizados contribuye aún más al crecimiento del mercado.

Restricción/Desafío

Altos costos y obstáculos para el cumplimiento normativo

- La preocupación por la elevada inversión de capital en sistemas de imagenología avanzados, sumada a los estrictos requisitos regulatorios y de validación, supone un reto significativo para una mayor penetración en el mercado. Dado que los equipos de imagenología preclínica requieren un funcionamiento especializado y el cumplimiento de las normas BPL/BPM, las pequeñas empresas biotecnológicas podrían enfrentarse a barreras para su adopción.

- Por ejemplo, la financiación limitada para empresas emergentes o instituciones académicas más pequeñas puede restringir el acceso a sistemas de imágenes por resonancia magnética, tomografía por emisión de positrones o multimodales de alta resolución, lo que ralentiza la aceptación general del mercado.

- Abordar estos desafíos mediante ofertas de sistemas modulares, opciones de arrendamiento flexibles y soporte regulatorio es crucial para una adopción más amplia. Empresas como PerkinElmer y MILabs priorizan las soluciones escalables y el cumplimiento normativo para generar confianza entre los compradores potenciales. Además, el mantenimiento continuo, las actualizaciones de software y la necesidad de personal capacitado aumentan los costos operativos para los usuarios, lo que dificulta la adopción en instalaciones más pequeñas.

- Si bien algunas empresas están introduciendo sistemas de imágenes de sobremesa o compactos y rentables, el precio de las plataformas multimodales de alta gama habilitadas con IA sigue siendo un obstáculo para su adopción generalizada, en particular para los laboratorios académicos y de biotecnología en etapa inicial.

- Superar estos desafíos a través de la optimización de costos, la orientación regulatoria y los programas de capacitación será vital para el crecimiento sostenido del mercado de imágenes preclínicas en América del Norte.

Alcance del mercado de imágenes preclínicas en América del Norte

El mercado está segmentado según el producto, los reactivos, la aplicación y el usuario final.

- Por producto

En cuanto a productos, el mercado norteamericano de imágenes preclínicas se segmenta en sistemas y servicios. El segmento de sistemas dominó el mercado con la mayor participación en ingresos, con un 49,5 % en 2024, impulsado por el papel esencial de plataformas de imágenes como la resonancia magnética, la tomografía por emisión de positrones (PET), la tomografía computarizada (TC) y los sistemas ópticos en el descubrimiento de fármacos y la investigación traslacional. Los sistemas proporcionan imágenes no invasivas de alta resolución, cruciales para monitorear la progresión de enfermedades y evaluar la eficacia de los tratamientos en modelos animales. La sólida adopción de estos sistemas por parte de compañías farmacéuticas, empresas biotecnológicas e institutos de investigación académica contribuye significativamente a los ingresos del mercado. Los sistemas también se ven favorecidos por su compatibilidad con análisis asistidos por IA y soluciones de imágenes multimodales, que mejoran la eficiencia de la investigación. Además, la financiación gubernamental y los incentivos a la I+D en EE. UU. impulsan aún más la adopción de sistemas.

Se prevé que el segmento de Servicios experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente externalización de estudios de imagen preclínica a organizaciones de investigación por contrato (CRO). Los servicios permiten a las pequeñas empresas biotecnológicas y a los laboratorios académicos acceder a capacidades avanzadas de imagenología sin una gran inversión de capital. El crecimiento se ve impulsado aún más por la demanda de soluciones integrales de imagenología, que incluyen análisis de datos, estudios longitudinales y optimización de protocolos de imagenología. La escalabilidad y flexibilidad de la oferta de servicios la hacen atractiva para las organizaciones que buscan un apoyo rentable a la investigación preclínica.

- Por reactivos

En cuanto a los reactivos, el mercado norteamericano de imágenes preclínicas se segmenta en agentes de contraste para resonancia magnética preclínica, reactivos para imágenes ópticas preclínicas, reactivos para imágenes nucleares preclínicas, agentes de contraste para ultrasonido preclínico y agentes de contraste para tomografía computarizada preclínica. El segmento de agentes de contraste para resonancia magnética preclínica dominó el mercado en 2024 debido al uso generalizado de sistemas de resonancia magnética en la investigación preclínica para imágenes anatómicas y funcionales de alta resolución. Los agentes de contraste para resonancia magnética mejoran la visibilidad de tejidos y órganos, lo que permite una evaluación detallada de la progresión de la enfermedad y los efectos terapéuticos. Los investigadores prefieren los agentes de contraste para resonancia magnética para estudios longitudinales no invasivos que reducen el uso de animales y proporcionan datos precisos. El segmento también se beneficia de las continuas mejoras tecnológicas y las aprobaciones regulatorias que amplían su aplicabilidad en la investigación oncológica, neurológica y cardiovascular. Su sólida adopción en instituciones de investigación farmacéutica y académica en EE. UU. garantiza un dominio constante del mercado.

Se prevé que el segmento de reactivos para imágenes ópticas preclínicas experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente demanda de monitorización no invasiva en tiempo real de procesos moleculares y celulares en modelos animales vivos. Los reactivos para imágenes ópticas se utilizan ampliamente en el descubrimiento de fármacos y estudios de biomarcadores gracias a su sensibilidad, rentabilidad y compatibilidad con plataformas de imágenes de alto rendimiento. Las innovaciones en sondas fluorescentes y reactivos bioluminiscentes mejoran aún más la calidad de las imágenes y la eficiencia de la investigación. Este crecimiento también se ve impulsado por el creciente enfoque en la investigación del cáncer, los estudios de biodistribución y el desarrollo de terapias dirigidas.

- Por aplicación

En función de su aplicación, el mercado norteamericano de imágenes preclínicas se segmenta en investigación y desarrollo, descubrimiento de fármacos, biodistribución, detección de células cancerosas, biomarcadores y otros. El segmento de descubrimiento de fármacos dominó el mercado en 2024, ya que las imágenes preclínicas son cruciales para evaluar la eficacia, la seguridad y la farmacocinética de los fármacos antes de los ensayos clínicos. Las imágenes de alta resolución proporcionan información sobre los efectos a nivel celular y tisular, lo que permite una toma de decisiones más rápida y precisa en los procesos de I+D. Las compañías farmacéuticas y las CRO dependen en gran medida de las imágenes preclínicas para reducir los fallos en las últimas etapas y acelerar el desarrollo de fármacos. Su adopción también se ve impulsada por el fomento regulatorio de los estudios no invasivos en animales, que optimizan el cumplimiento ético. La integración de la IA y las imágenes multimodales en los flujos de trabajo de descubrimiento de fármacos mejora la productividad y la precisión analítica.

Se espera que el segmento de Biomarcadores experimente el mayor crecimiento durante el período de pronóstico, impulsado por el creciente enfoque en la medicina de precisión y las terapias personalizadas. La detección de biomarcadores basada en imágenes permite a los investigadores rastrear la progresión de la enfermedad y la respuesta al tratamiento in vivo, lo que apoya la investigación traslacional. El crecimiento se ve impulsado aún más por el aumento de las colaboraciones entre empresas biotecnológicas e instituciones académicas para identificar nuevos biomarcadores en oncología, neurología e inmunología. El segmento también se beneficia de los avances tecnológicos en sondas de imagen de alta sensibilidad y el análisis de datos asistido por IA.

- Por el usuario final

En función del usuario final, el mercado norteamericano de imágenes preclínicas se segmenta en organizaciones de investigación por contrato (CROS), empresas farmacéuticas y biotecnológicas, institutos de investigación académicos y gubernamentales, centros de diagnóstico, entre otros. El segmento de empresas farmacéuticas y biotecnológicas dominó el mercado en 2024 debido a las importantes inversiones en investigación preclínica y a la necesidad de soluciones de imágenes de alto rendimiento para acelerar el desarrollo de fármacos. Estas empresas utilizan sistemas de imágenes y reactivos avanzados para evaluar la eficacia, la seguridad y la biodistribución de los fármacos. Este dominio se sustenta en la presencia de importantes centros de I+D farmacéuticos en EE. UU. y Canadá, así como en las alianzas con proveedores de soluciones de imágenes. La adopción de sistemas de imágenes multimodales y análisis mejorados con IA refuerza aún más su cuota de mercado.

Se prevé que el segmento de las CRO experimente el mayor crecimiento entre 2025 y 2032, ya que la externalización de la imagen preclínica permite a las pequeñas empresas biotecnológicas y a los laboratorios académicos acceder a capacidades avanzadas de imagen sin una gran inversión de capital. Las CRO ofrecen servicios escalables e integrales que incluyen imágenes, análisis de datos y soporte regulatorio. Este crecimiento se ve impulsado por la creciente demanda de soluciones de investigación preclínica flexibles y rentables, la expansión de las redes de CRO en EE. UU. y la creciente colaboración entre compañías farmacéuticas y proveedores de servicios especializados.

Análisis regional del mercado de imágenes preclínicas en América del Norte

- Estados Unidos dominó el mercado de imágenes preclínicas de América del Norte con la mayor participación en los ingresos del 82,5 % en 2024, caracterizado por altas inversiones en I+D y una fuerte presencia de fabricantes clave de equipos de imágenes.

- Los investigadores y las organizaciones de la región valoran mucho la precisión, las capacidades de alta resolución y la naturaleza no invasiva de los sistemas de imágenes preclínicas, que permiten un monitoreo eficiente de la progresión de la enfermedad, la eficacia de los medicamentos y la identificación de biomarcadores.

- Esta adopción generalizada está respaldada además por una sólida infraestructura de I+D, colaboraciones entre empresas de biotecnología e institutos de investigación académica y un enfoque creciente en la medicina traslacional y personalizada, estableciendo la imagen preclínica como un componente crítico de los flujos de trabajo de descubrimiento y desarrollo de fármacos modernos.

Perspectivas del mercado de imágenes preclínicas en EE. UU.

El mercado estadounidense de imágenes preclínicas captó la mayor participación en los ingresos en 2024 en Norteamérica, impulsado por importantes inversiones en I+D farmacéutica y biotecnológica, así como por la presencia de fabricantes líderes de equipos de imagen. Investigadores y organizaciones priorizan cada vez más los sistemas de imagen no invasivos de alta resolución para monitorizar la progresión de enfermedades, la eficacia de los fármacos y el descubrimiento de biomarcadores. La creciente adopción de imágenes multimodales y análisis asistidos por IA impulsa aún más el mercado. Además, las colaboraciones entre compañías farmacéuticas, empresas de biotecnología e instituciones académicas contribuyen significativamente a la expansión del mercado, en particular en la investigación oncológica, neurológica y cardiovascular.

Perspectivas del mercado de imágenes preclínicas en Canadá

Se proyecta que el mercado canadiense de imágenes preclínicas se expandirá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por el aumento de las inversiones gubernamentales y privadas en investigación en ciencias de la vida y biotecnología. El auge de las CRO y las startups biotecnológicas está impulsando la adopción, a la vez que aumenta la demanda de estudios de medicina traslacional y personalizada. Los institutos de investigación canadienses también están aprovechando los sistemas avanzados de imágenes para optimizar los procesos de descubrimiento de fármacos. La integración de la IA y el software de imágenes para mejorar la eficiencia y la precisión analítica está acelerando el crecimiento del mercado. Además, las colaboraciones con empresas farmacéuticas estadounidenses impulsan la transferencia de conocimiento y la adopción de tecnologías de imágenes de vanguardia.

Perspectiva del mercado de imágenes preclínicas en México

El mercado mexicano de imágenes preclínicas experimenta un crecimiento constante, impulsado por el aumento de las actividades de investigación farmacéutica y biotecnológica, así como por la expansión de institutos de investigación académicos y gubernamentales. La creciente inversión en I+D y las colaboraciones con compañías farmacéuticas estadounidenses y europeas impulsan la adopción de sistemas de imágenes avanzados. La creciente presencia de CRO que ofrecen servicios de imágenes preclínicas facilita el acceso a plataformas de resonancia magnética, tomografía por emisión de positrones (PET), tomografía computarizada (TC) y óptica de alta resolución. Las iniciativas gubernamentales que promueven la innovación biotecnológica y la investigación en ciencias de la vida impulsan aún más el mercado. El enfoque de México en mejorar la infraestructura de investigación y la capacitación de personal cualificado está impulsando la adopción de sistemas de imágenes preclínicas.

Cuota de mercado de imágenes preclínicas en América del Norte

La industria de imágenes preclínicas de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Bruker (EE. UU.)

- PerkinElmer (Estados Unidos)

- Trifoil Imaging LLC (EE. UU.)

- Mediso Ltd. (Hungría)

- MILabs BV (Países Bajos)

- MR Solutions (Reino Unido)

- Aspect Imaging Ltd. (Israel)

- VisualSonics Inc. (Canadá)

- LI-COR, Inc. (EE. UU.)

- FUJIFILM Holdings Corporation (Japón)

- Cubresa Inc. (Canadá)

- Scanco Medical AG (Suiza)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Rigaku Holdings Corporation (Japón)

- Agilent Technologies, Inc. (EE. UU.)

- Molecubes (Bélgica)

- Shanghai United Imaging Healthcare Co., LTD (China)

¿Cuáles son los desarrollos recientes en el mercado de imágenes preclínicas de América del Norte?

- En septiembre de 2025, Revvity estableció un Centro de Excelencia en Imagenología In Vivo en Carolina del Norte. Esta instalación busca desarrollar instrumentos de última generación, sistemas de imagenología óptica, tomografías computarizadas de rayos X, software de análisis de IA multimodal y sistemas de ultrasonido. Entre las principales innovaciones de Revvity disponibles actualmente en el centro se incluyen los sistemas de imagenología óptica IVIS, el sistema de microtomografía computarizada Quantum GX3, el sistema automatizado de ultrasonido preclínico Vega y el sistema de inyección guiada por imagen VivoJect para la administración dirigida de células y terapias.

- En agosto de 2025, United Imaging anunció la aprobación de la FDA para sus sistemas uMR Ultra y uOmniscan, lo que marca un avance significativo en la tecnología de imágenes preclínicas. Estos sistemas están diseñados para proporcionar imágenes de alta resolución, lo que mejora el estudio de los mecanismos de las enfermedades y las intervenciones terapéuticas en modelos animales pequeños.

- En mayo de 2025, United Imaging presentó sus tecnologías avanzadas de imagenología en la Reunión Científica Anual de la ISMRM en Honolulu. La compañía destacó su tecnología diferenciada, destacando las innovaciones en sistemas de resonancia magnética (RM). La participación de United Imaging resaltó su compromiso con el desarrollo de soluciones de imagenología para aplicaciones de investigación preclínica.

- En febrero de 2024, Bruker Corporation, empresa líder en instrumentos científicos, adquirió Spectral Instruments Imaging LLC. Esta adquisición tuvo como objetivo fortalecer la división de Imagenología Preclínica (PCI) de Bruker BioSpin mediante la expansión de su cartera de sistemas de imagenología óptica in vivo. Esta operación mejoró las capacidades de Bruker en la investigación de enfermedades y consolidó su posición en el competitivo mercado de la imagenología preclínica.

- En septiembre de 2023, Revvity, Inc., anteriormente conocida como PerkinElmer, presentó una serie de tecnologías de imagen preclínica de última generación diseñadas para acelerar los descubrimientos científicos. Esta expansión de la cartera incluyó los sistemas IVIS Spectrum 2 e IVIS SpectrumCT 2, que mejoran la imagen óptica in vivo con mayor sensibilidad y versatilidad.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.