North America Potting And Encapsulating Compounds Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

804.00 Million

USD

1,108.83 Million

2025

2033

USD

804.00 Million

USD

1,108.83 Million

2025

2033

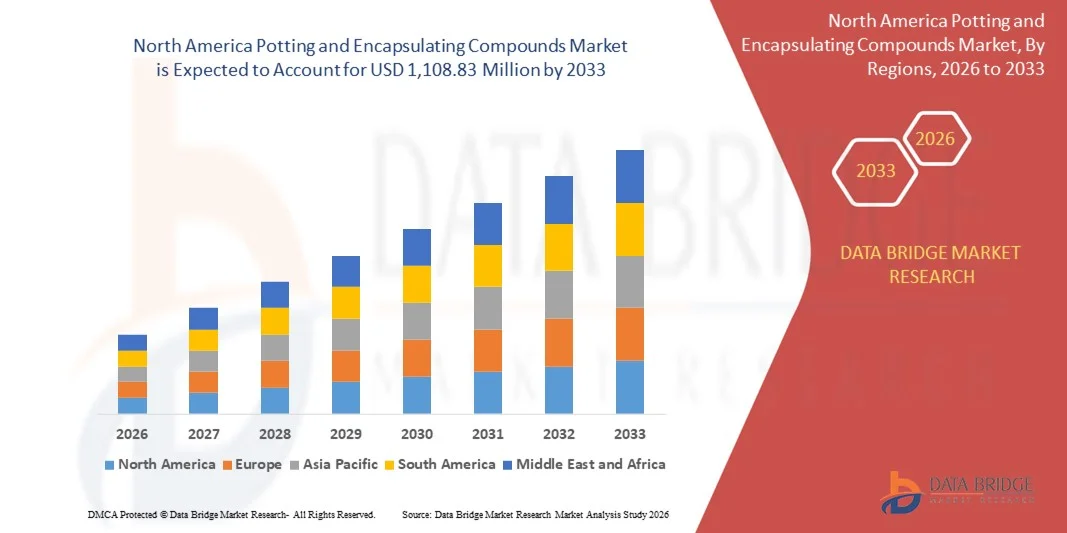

| 2026 –2033 | |

| USD 804.00 Million | |

| USD 1,108.83 Million | |

|

|

|

|

Segmentación del mercado de compuestos de encapsulado y encapsulado en Norteamérica por tipo (epoxi, poliuretano, silicona, poliéster, poliamida, poliolefina, etc.), tipo de sustrato (vidrio, metal, cerámica, etc.), función (aislamiento eléctrico, disipación térmica, protección contra la corrosión, resistencia a impactos, protección química, etc.), técnica de curado (curado a temperatura ambiente, curado a alta temperatura o térmico, y curado por UV), canal de distribución (en línea y fuera de línea), aplicación (electrónica y electricidad), usuario final (transporte, consumo, electrónica, energía, telecomunicaciones, atención médica, etc.): tendencias y pronóstico de la industria hasta 2033.

Tamaño del mercado de compuestos de encapsulamiento y encapsulamiento en América del Norte

- El tamaño del mercado de compuestos de encapsulado y encapsulado de América del Norte se valoró en USD 804,00 millones en 2025 y se espera que alcance los USD 1.108,83 millones para 2033 , con una CAGR del 4,10 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente demanda de componentes electrónicos fiables y duraderos en aplicaciones de electrónica de consumo, automotrices e industriales. Estos compuestos ofrecen una protección superior contra la humedad, el polvo, los productos químicos y el choque térmico, lo que prolonga la vida útil de los componentes electrónicos.

- Además, la creciente tendencia a la miniaturización y la creciente adopción de vehículos eléctricos (VE) están impulsando la necesidad de soluciones avanzadas de encapsulado y encapsulado para garantizar la seguridad y el rendimiento de los componentes en condiciones difíciles.

Análisis del mercado de compuestos de encapsulamiento y encapsulamiento en América del Norte

- El mercado de compuestos de encapsulado y encapsulado se está expandiendo de manera constante a medida que más industrias adoptan estos materiales para proteger componentes electrónicos sensibles de daños ambientales y estrés mecánico, asegurando una mayor confiabilidad y vida útil del producto.

- Los fabricantes se están centrando en el desarrollo de compuestos avanzados con estabilidad térmica mejorada y propiedades de aislamiento eléctrico para satisfacer los crecientes requisitos de los dispositivos electrónicos complejos, mejorando el rendimiento general y la seguridad.

- Estados Unidos dominó el mercado de compuestos de encapsulado y encapsulado, impulsado por la fuerte demanda de la electrónica automotriz, la electrónica de consumo y las aplicaciones aeroespaciales.

- Se espera que Canadá experimente la mayor tasa de crecimiento anual compuesta (TCAC) en el mercado norteamericano de compuestos de encapsulado y encapsulado, gracias a la expansión de los proyectos de energía renovable y al aumento de las inversiones en infraestructura para vehículos eléctricos. La creciente demanda de electrónica de potencia, sistemas de redes inteligentes y automatización industrial está impulsando la adopción de materiales de encapsulado y encapsulado.

- El segmento de epoxi domina con la mayor cuota de mercado, con un 38,5 % en 2025, gracias a su excelente adhesión, alta resistencia mecánica y resistencia química superior, lo que lo hace altamente confiable para la protección electrónica a largo plazo. Los compuestos epoxi se utilizan ampliamente en electrónica industrial, módulos de potencia y placas de circuitos, donde la durabilidad y la rigidez son cruciales. Su rentabilidad y facilidad de formulación refuerzan aún más su adopción en entornos de fabricación de alto volumen. Su alta resistencia a la humedad y la vibración también facilita su uso en condiciones de operación adversas.

Alcance del informe y segmentación del mercado de compuestos de encapsulamiento y encapsulamiento en América del Norte

|

Atributos |

Perspectivas clave del mercado de compuestos de encapsulado y encapsulado en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de compuestos de encapsulado y encapsulado en América del Norte

El auge de los compuestos para macetas ecológicos y sostenibles

- Existe una creciente tendencia hacia el desarrollo de compuestos de encapsulado y encapsulado ecológicos que minimizan el impacto ambiental y mantienen los estándares de rendimiento, a medida que los fabricantes buscan reducir las emisiones de carbono y cumplir con las normativas ambientales más estrictas. Estas soluciones se centran en reducir la toxicidad, mejorar la reciclabilidad y reducir el consumo de energía durante la producción, lo que las hace idóneas para la fabricación de productos electrónicos sostenibles. Además, los usuarios finales prefieren cada vez más materiales respetuosos con el medio ambiente sin comprometer la fiabilidad.

- Los fabricantes están invirtiendo en materiales de origen biológico y reciclables para abordar la creciente presión regulatoria y la demanda de productos electrónicos sostenibles por parte de los consumidores, especialmente en regiones con políticas ambientales estrictas. Estas inversiones respaldan los objetivos de sostenibilidad a largo plazo, a la vez que mejoran la reputación de la marca y el cumplimiento normativo. Además, la innovación en química verde permite un mejor rendimiento de los materiales, además de beneficios ambientales.

- Por ejemplo, Henkel presentó una nueva línea de encapsulantes de origen biológico destinada a reducir la huella de carbono en la fabricación de productos electrónicos, lo que contribuye a los objetivos de sostenibilidad en toda la cadena de valor de la electrónica. Estos productos ayudan a los fabricantes a reducir las emisiones durante su ciclo de vida, manteniendo al mismo tiempo las propiedades mecánicas y térmicas esenciales. Además, estas innovaciones fomentan una mayor adopción de materiales sostenibles en aplicaciones de alto rendimiento.

- Estos compuestos sostenibles ofrecen una protección térmica y eléctrica comparable, lo que ayuda a industrias como la automotriz y la electrónica de consumo a alinearse con las iniciativas ecológicas y los requisitos regulatorios. Garantizan un aislamiento eficaz, la disipación del calor y la protección de los componentes en condiciones de funcionamiento exigentes. Además, su rendimiento comparable al de los materiales convencionales reduce la resistencia a la transición hacia alternativas sostenibles.

Dinámica del mercado de compuestos de encapsulamiento y encapsulamiento en América del Norte

Conductor

Creciente demanda de protección de componentes electrónicos

- La demanda de compuestos de encapsulado y encapsulado se debe a la necesidad de proteger componentes electrónicos sensibles de la humedad, el polvo, los productos químicos y los impactos mecánicos en entornos hostiles. Estos materiales garantizan un rendimiento constante y previenen fallos prematuros de componentes críticos. Además, el aumento del uso de componentes electrónicos en entornos industriales y de exterior refuerza esta demanda.

- La creciente miniaturización y sofisticación de los dispositivos electrónicos en sectores como la automoción, la electrónica de consumo, la aeroespacial y las energías renovables hacen que la durabilidad y la fiabilidad sean cruciales. Los diseños compactos reducen el margen de fallo de los componentes, lo que requiere soluciones de protección avanzadas. Además, las mayores densidades de potencia aumentan la necesidad de un blindaje térmico y ambiental eficaz.

- Estos compuestos proporcionan aislamiento, gestión térmica y protección contra vibraciones y corrosión, mejorando el rendimiento y la vida útil del dispositivo. Ayudan a mantener la estabilidad eléctrica y reducen los requisitos de mantenimiento a lo largo del tiempo. Además, su mayor durabilidad permite ciclos de vida más largos y menores costos de reemplazo.

- Por ejemplo, los fabricantes de vehículos eléctricos utilizan ampliamente compuestos de encapsulado para proteger las baterías y los módulos de potencia de los cambios de temperatura y la entrada de humedad. Estos materiales mejoran la seguridad, la fiabilidad y la eficiencia operativa de los sistemas de propulsión eléctricos. Además, una protección robusta facilita una mayor adopción de vehículos eléctricos en diversas condiciones climáticas.

- El auge de los dispositivos IoT y la electrónica inteligente impulsa la adopción de materiales de encapsulado para garantizar un rendimiento seguro y duradero tanto en entornos industriales como en exteriores. Estos dispositivos suelen funcionar de forma continua y en ubicaciones remotas, lo que aumenta la necesidad de una protección fiable. Además, la amplia implementación de sensores aumenta la demanda de soluciones de encapsulado duraderas.

Restricción/Desafío

Altos costos de producción y de materias primas

- Un desafío importante para la adopción de compuestos de encapsulado y encapsulado es el alto costo de producción debido al alto costo de las materias primas, como resinas y rellenos de alta pureza. Estos materiales son esenciales para lograr las características de rendimiento deseadas, pero incrementan significativamente los costos del producto. Además, la disponibilidad limitada de materias primas especializadas puede limitar el suministro.

- Las fluctuaciones de precios causadas por problemas en la cadena de suministro y tensiones geopolíticas añaden incertidumbre a los costos de las materias primas, lo que impacta los gastos generales de fabricación. Esta volatilidad dificulta las estrategias de precios a largo plazo para los fabricantes. Además, la imprevisibilidad de los costos puede desincentivar la inversión en tecnologías avanzadas de encapsulado.

- La necesidad de precisión y un estricto control de calidad en la producción incrementa aún más los costos operativos, lo que hace que estos compuestos sean menos accesibles para aplicaciones con precios competitivos. A menudo se requieren equipos especializados y mano de obra cualificada para mantener la consistencia y el rendimiento. Además, el cumplimiento de las normas de la industria incrementa los gastos de pruebas y certificación.

- Por ejemplo, la demanda de componentes sostenibles y ecológicos incrementa los gastos debido a la investigación, el desarrollo y la búsqueda de alternativas más ecológicas, lo que puede resultar en precios más altos y una adopción más lenta en mercados con mayor conciencia de costos. El desarrollo de fórmulas de base biológica requiere una inversión significativa y ciclos de desarrollo más largos. Además, las limitadas economías de escala mantienen inicialmente los precios elevados de las soluciones sostenibles.

- Las pequeñas y medianas empresas a menudo tienen dificultades para afrontar estos costos, lo que limita su capacidad para utilizar materiales de encapsulado avanzados en sus productos. Las limitaciones presupuestarias pueden limitar la innovación y la adopción de soluciones de alto rendimiento. Además, las barreras de costo pueden obligar a las empresas más pequeñas a recurrir a alternativas de menor calidad.

Alcance del mercado de compuestos de encapsulamiento y encapsulamiento en América del Norte

El mercado de compuestos de encapsulamiento y encapsulamiento de América del Norte está segmentado según el tipo, el tipo de sustrato, la función, la técnica de curado, el canal de distribución, la aplicación y el usuario final.

- Por tipo

Según el tipo, el mercado norteamericano de compuestos de encapsulado y encapsulado se segmenta en epoxi, poliuretano, silicona, sistema de poliéster, poliamida, poliolefina y otros. El segmento de epoxi domina con la mayor cuota de mercado, con un 38,5 % en 2025, gracias a su excelente adhesión, alta resistencia mecánica y resistencia química superior, lo que lo hace altamente confiable para la protección electrónica a largo plazo. Los compuestos de epoxi se utilizan ampliamente en electrónica industrial, módulos de potencia y placas de circuitos, donde la durabilidad y la rigidez son fundamentales. Su rentabilidad y facilidad de formulación refuerzan aún más su adopción en entornos de fabricación de alto volumen. Su alta resistencia a la humedad y la vibración también facilita su uso en condiciones de operación adversas.

Se prevé que el segmento del silicona experimente el mayor crecimiento entre 2026 y 2033 gracias a su alta flexibilidad, sus excelentes propiedades dieléctricas y su resistencia a temperaturas extremas. Los materiales de silicona ofrecen un rendimiento fiable tanto en entornos de alta como de baja temperatura, lo que los hace adecuados para la electrónica automotriz, aeroespacial y de exteriores. Su capacidad para absorber la expansión térmica y la tensión mecánica mejora la fiabilidad de los componentes. La creciente demanda de sistemas electrónicos de alto rendimiento y larga duración está acelerando la adopción del silicona.

- Por tipo de sustrato

Según el tipo de sustrato, el mercado norteamericano de compuestos de encapsulado y encapsulado se segmenta en vidrio, metal, cerámica y otros. El segmento de sustratos metálicos representa la mayor cuota de mercado, con un 42,3 % en 2025, debido a su amplio uso en carcasas electrónicas, componentes de potencia y ensamblajes automotrices. Los compuestos de encapsulado proporcionan resistencia a la corrosión, amortiguación de vibraciones y aislamiento eléctrico para componentes metálicos. La alta compatibilidad de unión entre metales y encapsulantes facilita su uso industrial generalizado. El creciente uso de sustratos metálicos en la electrónica de potencia refuerza este dominio.

Se prevé que el segmento del vidrio experimente el mayor crecimiento entre 2026 y 2033, impulsado por su creciente uso en sensores ópticos, pantallas y dispositivos electrónicos avanzados. Los sustratos de vidrio ofrecen excelente aislamiento, transparencia y estabilidad química. La encapsulación mejora la durabilidad y protege los componentes sensibles de vidrio contra daños mecánicos. La creciente adopción de sensores inteligentes y sistemas de monitorización avanzados está impulsando la demanda.

- Por función

En función de su función, el mercado norteamericano de compuestos de encapsulado y encapsulado se segmenta en aislamiento eléctrico, disipación de calor, protección contra la corrosión, resistencia a impactos, protección química, entre otros. El aislamiento eléctrico dominará el mercado con una cuota de mercado del 44,1 % en 2025 debido a su papel fundamental en la prevención de cortocircuitos y fallos eléctricos. Estos compuestos garantizan el funcionamiento seguro de sistemas electrónicos de alta tensión y alta densidad. La creciente integración de la electrónica en diferentes industrias aumenta la necesidad de soluciones de aislamiento fiables. La seguridad operativa a largo plazo sigue siendo un factor clave para este segmento.

Se prevé que el segmento de disipación de calor experimente el mayor crecimiento entre 2026 y 2033, impulsado por el aumento de la densidad de potencia en los dispositivos electrónicos. Una gestión térmica eficaz es esencial en vehículos eléctricos, sistemas de energía renovable y electrónica de potencia. Los compuestos de encapsulado con conductividad térmica mejorada ayudan a mantener temperaturas de funcionamiento óptimas. Esto favorece una mayor vida útil de los componentes y una mayor eficiencia del sistema.

- Por técnica de curado

Según la técnica de curado, el mercado norteamericano de compuestos de encapsulado y encapsulado se segmenta en compuestos curados a temperatura ambiente, curados a alta temperatura o térmicamente, y curados por ultravioleta. Los compuestos curados a temperatura ambiente liderarán el mercado con una participación del 46,0 % en los ingresos en 2025 gracias a su facilidad de procesamiento y a su menor consumo energético. Estos materiales simplifican los flujos de trabajo de fabricación y reducen los costes operativos. Se utilizan ampliamente en entornos de producción de pequeña y mediana escala. Su compatibilidad con componentes sensibles impulsa aún más su adopción.

Se prevé que el segmento de compuestos curados por ultravioleta experimente el mayor crecimiento entre 2026 y 2033 gracias a su rápida velocidad de curado y alta eficiencia de producción. El curado UV permite un control preciso y ciclos más cortos en la fabricación automatizada. Estos compuestos contribuyen a procesos ecológicos al reducir el consumo energético. La creciente demanda de fabricación de productos electrónicos de alto rendimiento está acelerando su uso.

- Por canal de distribución

Según el canal de distribución, el mercado norteamericano de compuestos de encapsulado y encapsulado se divide en presencial y en línea. El segmento presencial representó el 71,5 % de los ingresos del mercado en 2025, respaldado por redes de proveedores consolidadas y contratos de adquisición a largo plazo. Los compradores industriales suelen preferir los canales presenciales para compras al por mayor y consultas técnicas. Las sólidas relaciones con los distribuidores garantizan un suministro constante y un servicio posventa. Este canal sigue siendo dominante en los sectores manufactureros tradicionales.

Se prevé que el segmento de distribución en línea experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente digitalización de los procesos de compra. Las plataformas en línea ofrecen mayor visibilidad de los productos, precios competitivos y pedidos más rápidos. Los pequeños y medianos fabricantes adoptan cada vez más el abastecimiento en línea por su comodidad. La mejora de la logística y los sistemas de pago digitales impulsan aún más el crecimiento.

- Por aplicación

En función de su aplicación, el mercado norteamericano de compuestos de encapsulado y encapsulado se segmenta en aplicaciones electrónicas y eléctricas. La aplicación electrónica domina el mercado con una cuota de mercado del 63,8 % en 2025, impulsada por la creciente demanda de electrónica de consumo, electrónica automotriz y dispositivos IoT. La miniaturización y la mayor complejidad de los circuitos requieren soluciones de protección avanzadas. Los compuestos de encapsulado mejoran la fiabilidad y el rendimiento de los componentes electrónicos sensibles. La rápida innovación en electrónica sigue impulsando la demanda.

Se prevé que el segmento de aplicaciones eléctricas experimente el mayor crecimiento entre 2026 y 2033, impulsado por la expansión de la infraestructura eléctrica global. Las crecientes inversiones en sistemas de transmisión, distribución y energías renovables aumentan la necesidad de materiales aislantes duraderos. Los compuestos de encapsulado protegen los cuadros de distribución, transformadores y sistemas de control. La mejora de la seguridad y la fiabilidad operativa siguen siendo factores clave de crecimiento.

- Por el usuario final

En función del usuario final, el mercado norteamericano de compuestos de encapsulado y encapsulado se clasifica en transporte, electrónica de consumo, energía, telecomunicaciones, salud y otros. El segmento de electrónica de consumo representará la mayor participación en los ingresos, con un 35,7 % en 2025, gracias a la adopción generalizada de teléfonos inteligentes, wearables y dispositivos domésticos inteligentes. Los altos volúmenes de producción y las frecuentes actualizaciones de productos mantienen una demanda constante. La protección contra la humedad y la tensión mecánica es fundamental para los dispositivos compactos. La innovación continua impulsa aún más el crecimiento del mercado.

Se prevé que el segmento de usuarios finales del transporte experimente el mayor crecimiento entre 2026 y 2033, impulsado por el aumento de la producción de vehículos eléctricos y las tendencias de electrificación. Los vehículos requieren materiales de encapsulado avanzados para sistemas de baterías, electrónica de potencia y sensores. Estos compuestos mejoran la seguridad, la estabilidad térmica y la durabilidad. El creciente interés en los vehículos autónomos y conectados acelera aún más su adopción.

Análisis regional del mercado de compuestos de encapsulamiento y encapsulamiento en América del Norte

- Estados Unidos dominó el mercado de compuestos de encapsulado y encapsulado, impulsado por la fuerte demanda de la electrónica automotriz, la electrónica de consumo y las aplicaciones aeroespaciales.

- La alta adopción de vehículos eléctricos, sistemas de energía renovable y automatización industrial avanzada aumenta significativamente la necesidad de soluciones de protección electrónica confiables.

- Este dominio se ve respaldado además por una sólida infraestructura de fabricación, un alto gasto en I+D y la adopción temprana de materiales avanzados en múltiples industrias de alto crecimiento.

Perspectiva del mercado canadiense de compuestos de encapsulado y encapsulado

Se prevé que el mercado canadiense de compuestos de encapsulado y encapsulado experimente su mayor crecimiento entre 2026 y 2033, impulsado por la expansión de proyectos de energía renovable e inversiones en vehículos eléctricos. La creciente demanda de electrónica de potencia e infraestructura de redes inteligentes está impulsando la adopción de materiales de encapsulado. El crecimiento de la automatización industrial y las telecomunicaciones contribuye aún más a la expansión del mercado. Además, la creciente atención a las tecnologías sostenibles y energéticamente eficientes está fortaleciendo las perspectivas de crecimiento a largo plazo.

Cuota de mercado de compuestos de encapsulado y encapsulado en América del Norte

La industria de compuestos de encapsulado y encapsulado de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• 3M Company (EE. UU.)

• Master Bond Inc. (EE.

UU.) • Dow Inc. ( EE. UU.)

• HB Fuller Company (EE. UU.)

• Parker Hannifin – Chomerics (EE. UU.)

•

Epoxies, Etc. (EE. UU.)

• Dymax Corporation (EE. UU.)

• Aremco Products Inc. (EE. UU.)

• Resin Designs LLC (EE. UU.) • LORD Corporation (EE. UU.)

• ITW Performance Polymers (EE. UU.)

• Ellsworth Adhesives (EE. UU.)

• Permabond LLC (EE. UU.)

• MG Chemicals (Canadá)

• Huntsman Advanced Materials Americas (EE. UU.)

Últimos avances en el mercado de compuestos de encapsulado y encapsulado en América del Norte

- En abril de 2021, Master Bond Inc. lanzó una nueva incorporación a su cartera de productos con la introducción de MasterSil 153AO, una silicona de dos componentes curada por adición con propiedades autoimprimantes. Este innovador compuesto ofrece aislamiento eléctrico y conductividad térmica, lo que lo hace ideal para proteger componentes electrónicos sensibles a la vez que gestiona eficientemente el calor. La estructura única del producto mejora la fiabilidad y el rendimiento del dispositivo en aplicaciones exigentes. Con la ampliación de su gama, Master Bond busca satisfacer la creciente demanda del mercado de materiales de protección avanzados, consolidando su posición en el sector de compuestos de encapsulado y encapsulado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.