Mercado de sustitutos de huevo de origen vegetal en América del Norte, por tipo (sustituto de clara de huevo, sustituto de yema de huevo y sustituto de huevo completo), fuente (proteína de soja, proteína de guisante, linaza, semillas de chía, proteína de trigo, harina de algas, almidón de tapioca, almidón de patata, almidón de arrurruz, haba, frijol mungo y otros), goma utilizada (goma xantana, goma de celulosa, goma de tara, carragenina y otros), forma (polvo, líquido y otros), función (espesamiento, glaseado, aireación y viscosidad de la masa, elasticidad, estabilidad, retención de la estructura, glaseado y otros), naturaleza (OGM y no OGM), categoría (convencional, orgánico), aplicación (panadería, comida salada), país (EE. UU., México, Canadá) Tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado : mercado de sustitutos de huevo de origen vegetal en América del Norte

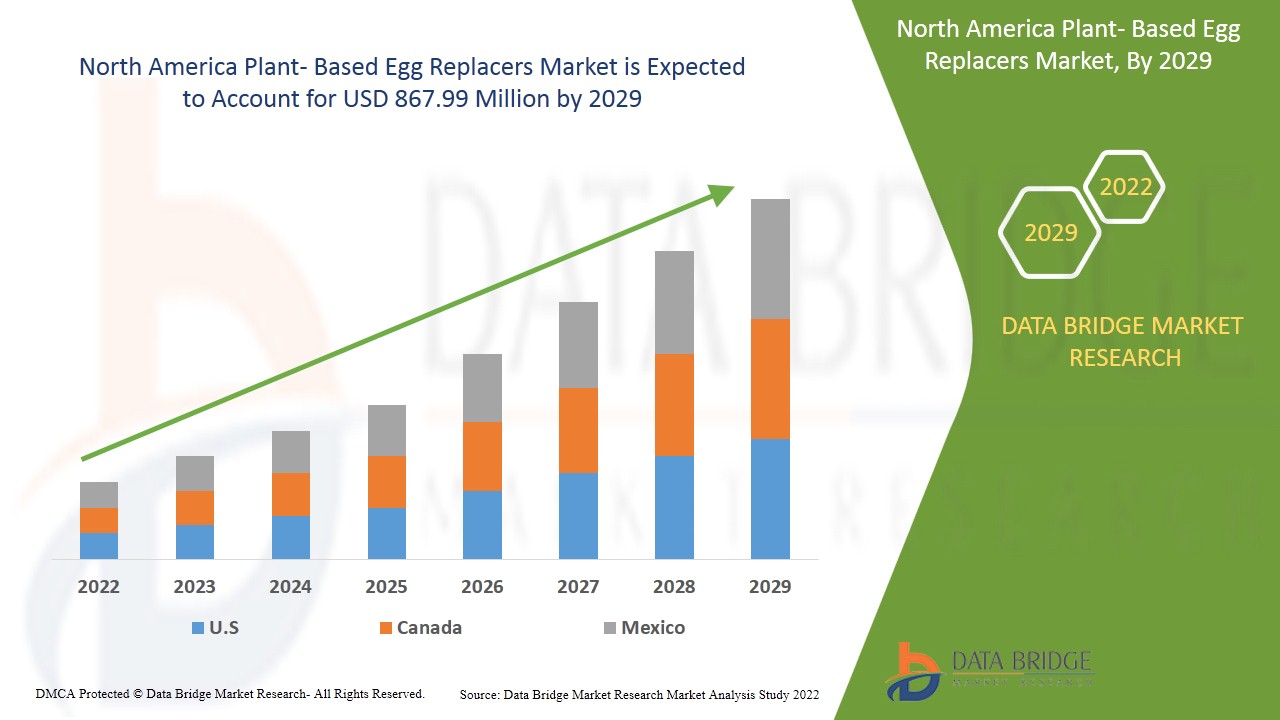

Se espera que el mercado de sustitutos de huevo de origen vegetal de América del Norte gane un crecimiento significativo en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,6% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 867,99 millones para 2029.

Los sustitutos de huevo de origen vegetal solo incluyen sustitutos de huevo de origen vegetal comerciales y solo aquellos productos que están etiquetados por los fabricantes como sustitutos de huevo de origen vegetal o productos para los cuales el sustituto de huevo figura como una de las aplicaciones en sus descripciones de producto. Se producen a partir de materias primas de origen vegetal, como aislados y concentrados de proteínas, almidones, legumbres, cereales y otros. Los sustitutos de huevo de origen vegetal replican casi toda la funcionalidad de los huevos convencionales. Los sustitutos de huevo de origen vegetal simplemente están destinados a proporcionar las propiedades aglutinantes necesarias para alimentos como pasteles, muffins y panqueques. Sirven para la estabilización, gelificación, emulsificación y otros. Los huevos de origen vegetal ofrecen varios beneficios para la salud, como que no tienen colesterol ni alérgenos y, por lo tanto, son los elegidos por los consumidores que padecen problemas de salud relacionados con el colesterol o que sufren alergia al huevo. Además, los huevos de origen vegetal ofrecen una alta seguridad alimentaria, ya que están hechos de materia prima de origen vegetal y, por lo tanto, reducen el riesgo de enfermedades transmitidas por los alimentos. Además, son ambientalmente sostenibles.

Los sustitutos de huevo de origen vegetal son ricos en calcio y vitamina B12 y contienen poca grasa y cero colesterol. Por lo tanto, son los preferidos por muchos consumidores por sus beneficios para la salud. Varios fabricantes ofrecen huevos de origen vegetal en diferentes envases y preparados a partir de diferentes fuentes vegetales, como cereales, legumbres, algas y otros. Además, la creciente demanda de sustitutos de huevo de origen vegetal entre los consumidores debido a sus beneficios para la salud, junto con la creciente tendencia de los alimentos de origen vegetal y los alimentos veganos, son los factores clave que impulsan el mercado de sustitutos de huevo de origen vegetal en América del Norte. Sin embargo, la falta de conocimiento sobre los alimentos de origen vegetal puede obstaculizar el crecimiento del mercado de sustitutos de huevo de origen vegetal.

- Además, se espera que el cambio de estilo de vida, los hábitos alimentarios de los consumidores y el aumento de la demanda de alimentos de origen vegetal creen enormes oportunidades para el mercado de sustitutos de huevo de origen vegetal de América del Norte. La interrupción de la cadena de suministro causada por la COVID-19 puede crear un desafío para el mercado de sustitutos de huevo de origen vegetal de América del Norte.

La demanda de sustitutos de huevo de origen vegetal está aumentando, por lo que los actores o empresas clave ahora están más centrados y participan en la expansión, innovación y lanzamientos de productos en el mercado de sustitutos de huevo de origen vegetal. Estas decisiones, en última instancia, están mejorando el crecimiento del mercado de sustitutos de huevo de origen vegetal de América del Norte. Varias empresas están tomando decisiones estratégicas, como la formación de acuerdos con centros de investigación para lanzar nuevos productos, para mejorar su participación de mercado. Como resultado, el mercado de sustitutos de huevo de origen vegetal está creciendo a un ritmo rápido. Por otro lado, las recientes innovaciones y lanzamientos de nuevos productos están creando nuevas oportunidades para el mercado. Sin embargo, la fácil disponibilidad de productos alternativos está actuando como un desafío para el mercado de sustitutos de huevo de origen vegetal de América del Norte.

El informe de mercado de sustitutos de huevo de origen vegetal de América del Norte proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de sustitutos de huevo de origen vegetal en América del Norte

El mercado de sustitutos de huevo de origen vegetal de América del Norte está segmentado en ocho segmentos notables según el tipo, la fuente, la goma utilizada, la forma, la función, la naturaleza, la categoría y la aplicación.

- En función del tipo de huevo de origen vegetal, el mercado de sustitutos de huevo de origen vegetal de América del Norte se segmenta en sustituto de huevo blanco, sustituto de yema de huevo y sustituto de huevo completo. En 2022, se espera que el segmento de sustitutos de huevo blanco domine el mercado debido a los beneficios para la salud de los sustitutos de huevo blanco. Además, el aumento de la población vegana impulsa el crecimiento del mercado.

- Según la fuente, el mercado de sustitutos de huevo de origen vegetal de América del Norte se segmenta en proteína de soja, proteína de guisante, linaza , semillas de chía, proteína de trigo , harina de algas, almidón de tapioca, almidón de patata, almidón de arrurruz, habas, frijol mungo y otros. En 2022, se espera que el segmento de proteína de soja domine el mercado de huevos de origen vegetal debido a la creciente demanda de proteína de soja para dar al huevo de origen vegetal una gran textura e imitar la textura de los huevos convencionales entre los fabricantes.

- En función de la goma utilizada, el mercado de sustitutos de huevo de origen vegetal de América del Norte se segmenta en goma xantana, goma de celulosa, goma de tara, carragenina y otras. En 2022, se espera que el segmento de la goma xantana domine el mercado debido a sus propiedades como espesante y estabilizadora. Por lo tanto, la creciente demanda de agentes espesantes en las industrias de panadería y confitería impulsa el crecimiento del mercado.

- En función de la forma, el mercado de sustitutos de huevo de origen vegetal de América del Norte se segmenta en polvo, líquido y otros. En 2022, el polvo ha dominado el mercado debido a factores como su facilidad de uso. Además, los precios del polvo son asequibles, lo que impulsa el crecimiento del mercado en el período de pronóstico.

- En función de su función, el mercado de sustitutos de huevo de origen vegetal de América del Norte se segmenta en espesamiento, glaseado, aireación y viscosidad de la masa, elasticidad, estabilidad, retención de la estructura y otros. En 2022, se espera que el segmento de estabilidad domine el mercado debido a su capacidad para mantener los alimentos frescos y mantener la calidad. Además, aumenta la preferencia de los consumidores por los sustitutos de huevo de origen vegetal que mantienen la estabilidad de los alimentos.

- En función de la naturaleza, el mercado de sustitutos de huevo de origen vegetal de América del Norte se segmenta en OGM y no OGM. En 2022, se espera que el segmento no OGM domine el mercado, ya que la mayoría de los consumidores demandan productos de origen vegetal no OGM debido a su asequibilidad y fácil disponibilidad.

- En función de la categoría, el mercado de sustitutos de huevo de origen vegetal de América del Norte se segmenta en orgánico y convencional. En 2022, se espera que el segmento convencional domine el mercado debido a su fácil disponibilidad y a su creciente demanda. Además, ofrece un mejor sabor y más sabores, lo que impulsa el crecimiento del mercado.

- En función de la aplicación, el mercado de sustitutos de huevo de origen vegetal de América del Norte se segmenta en panadería y alimentos salados. En 2022, se espera que el segmento de panadería domine el mercado debido a la creciente demanda de productos de panadería. Además, los consumidores demandan productos de panadería de origen vegetal y veganos que ayuden al mercado a crecer en los próximos años.

Análisis a nivel de país del mercado de sustitutos de huevo de origen vegetal

Se analiza el mercado de sustitutos de huevo de origen vegetal de América del Norte y se proporciona información sobre el tamaño del mercado según el país, el tipo, la fuente, la goma utilizada, la forma, la función, la naturaleza, la categoría y la aplicación.

- Sobre la base de la geografía, el mercado de sustitutos de huevo de origen vegetal de América del Norte está segmentado en EE. UU., México y Canadá.

- En América del Norte, se espera que EE. UU. crezca con la tasa de crecimiento más prometedora en el período de pronóstico de 2022 a 2029, ya que los principales industriales se están centrando en el desarrollo de productos veganos y de base vegetal para satisfacer las demandas de los consumidores.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Demanda creciente de sustitutos de huevo de origen vegetal

El mercado de sustitutos de huevo de origen vegetal de América del Norte también le proporciona un análisis detallado del mercado para el crecimiento de la industria en cada país con ventas, ventas de componentes e impacto de lanzamientos consistentes y cambios en los escenarios regulatorios con su apoyo al mercado. Los datos están disponibles para el período histórico de 2019 a 2029.

Análisis del panorama competitivo y de la cuota de mercado de los sustitutos de huevo de origen vegetal

El panorama competitivo del mercado de sustitutos de huevo de origen vegetal de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de sustitutos de huevo de origen vegetal de América del Norte.

Algunos de los principales actores que operan en el mercado de sustitutos de huevo de origen vegetal de América del Norte son DuPont, Alternative Foods, Ingredion, MGP, Kerry, Tate & Lyle, Corbion, Namaste Foods, J&K Ingredients, Inc., Fiberstar, Sunbloom Proteins GmbH, Fismer Lecithin, All American Foods, Ener-G Foods, Inc. y Bob's Red Mill Natural Foods.

Las empresas de todo el mundo también están iniciando diversos desarrollos de productos, lo que también está acelerando el crecimiento del mercado de sustitutos de huevo de origen vegetal.

Por ejemplo,

- En mayo de 2021, OsomeFood desarrolló y lanzó un huevo duro vegano entero elaborado a partir de micoproteína de hongos. El huevo se produce mediante fermentación y contiene muchos aminoácidos esenciales. Esto ayudó a la empresa a aumentar sus ingresos a medida que aumenta la demanda de sustitutos de huevo de origen vegetal.

Las asociaciones, las empresas conjuntas y otras estrategias mejoran la participación de mercado de la empresa con una mayor cobertura y presencia. También beneficia a las organizaciones mejorar su oferta de sustitutos de huevo de origen vegetal mediante una gama más amplia de tamaños.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 PLANT-BASED EGG TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGULATORY FRAMEWORK AND LABELLING, NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

6 SUPPLY CHAIN OF NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

6.1 RAW MATERIAL PROCUREMENT

6.2 MANUFACTURING AND DISTRIBUTION

6.3 MARKETING AND DISTRIBUTION

6.4 END USERS

7 VALUE CHAIN OF NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

8 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: NEW PRODUCT LAUNCHES

9 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, INDUSTRIAL INSIGHTS:

9.1 FUTURE PERSPECTIVE:

9.1.1 INCREASED USAGE OF PLANT-BASED EGGS IN VARIOUS APPLICATIONS:

9.2 CONCLUSION:

10 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS, NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

11 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: FACTORS INFLUENCING PURCHASE

11.1 GROWING CONSUMERS’ INTEREST IN PLANT-BASED DIETS

11.2 FOOD ALLERGIES

11.3 GROWING CONCERN REGARDING FOOD SAFETY

12 MARKET OVERVIEW

12.1 DRIVERS

12.1.1 RISING VEGETARIAN, VEGAN, AND FLEXITARIAN POPULATION

12.1.2 GROWING AWARENESS REGARDING VARIOUS HEALTH BENEFITS OF PLANT-BASED FOODS

12.1.3 INCREASE IN THE NUMBER OF PRODUCT LAUNCHES BY KEY PLAYERS FOR THE PLANT-BASED EGG REPLACERS PRODUCTS

12.1.4 ALLERGENS ASSOCIATED WITH CONVENTIONAL EGGS

12.2 RESTRAINTS

12.2.1 REGULATORY FRAMEWORK FOR LABELING

12.2.2 COMPLEXITY IN MANUFACTURING PROCESS OF PLANT-BASED EGG REPLACERS

12.3 OPPORTUNITIES

12.3.1 EASY AVAILABILITY OF RAW MATERIALS FOR THE PRODUCTS OF PLANT-BASED EGGS REPLACERS

12.3.2 SHIFT OF NORTH AMERICA CONSUMERS TOWARDS CLEAN LABEL AND PLANT-BASED PRODUCTS

12.4 CHALLENGES

12.4.1 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

13 IMPACT OF COVID-19 ON NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

13.1 IMPACT ON THE DEMAND OF PLANT-BASED EGG REPLACERS MARKET

13.2 IMPACT ON THE PRICE OF NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

13.3 IMPACT ON THE SUPPLY CHAIN OF THE NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

13.4 STRATEGIC INITIATIVES BY MANUFACTURERS

13.5 CONCLUSION

14 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY TYPE

14.1 OVERVIEW

14.2 WHITE EGG REPLACEMENT

14.2.1 POWDER

14.2.2 LIQUID

14.3 EGG YOLK REPLACEMENT

14.3.1 POWDER

14.3.2 LIQUID

14.4 COMPLETE EGG REPLACEMENT

14.4.1 POWDER

14.4.2 LIQUID

15 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY SOURCE

15.1 OVERVIEW

15.2 SOY PROTEIN

15.3 PEA PROTEIN

15.4 WHEAT PROTEIN

15.5 POTATO STARCH

15.6 TAPIOCA STARCH

15.7 ALGAL FLOUR

15.8 ARROWROOT STARCH

15.9 CHIA SEEDS

15.1 FLAXSEED

15.11 MUNG BEAN

15.12 FAVA BEAN

15.13 OTHERS

16 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION

16.1 OVERVIEW

16.2 BAKERY

16.2.1 BAKERY, BY APPLICATION

16.2.1.1 Cakes, Pastries & Truffle

16.2.1.2 Cookies & Crackers

16.2.1.3 pancakes

16.2.1.4 Brownies and Muffins

16.2.1.5 BREAD & ROLLS

16.2.1.6 Waffle

16.2.1.7 Biscuit

16.2.1.8 Tart & Pies

16.2.1.9 Croissants

16.2.1.10 Tortilla

16.2.1.11 others

16.2.2 BAKERY, BY EGG REPLACER TYPE

16.2.2.1 WHITE EGG REPLACEMENT

16.2.2.2 COMPLETE EGG REPLACEMENT

16.2.2.3 EGG YOLK REPLACEMENT

16.2.3 BAKERY, BY EGG REPLACER SOURCE

16.2.3.1 SOY PROTEIN

16.2.3.2 PEA PROTEIN

16.2.3.3 WHEAT PROTEIN

16.2.3.4 POTATO STARCH

16.2.3.5 TAPIOCA STARCH

16.2.3.6 ALGAL FLOUR

16.2.3.7 ARROWROOT STARCH

16.2.3.8 CHIA SEEDS

16.2.3.9 FLAXSEED

16.2.3.10 MUNG BEAN

16.2.3.11 FAVA BEAN

16.2.3.12 OTHERS

16.3 SAVORY FOOD

16.3.1 SAVORY, BY APPLICATION

16.3.1.1 Instant Noodles

16.3.1.2 Omelets

16.3.1.3 Scrambled Eggs

16.3.1.4 Pizza & Pasta

16.3.1.5 Snacks & Extruded Snacks

16.3.1.6 OTHERS

16.3.2 SAVORY, BY EGG REPLACER TYPE

16.3.2.1 WHITE EGG REPLACEMENT

16.3.2.2 COMPLETE EGG REPLACEMENT

16.3.2.3 EGG YOLK REPLACEMENT

16.3.3 SAVORY, BY EGG REPLACER SOURCE

16.3.3.1 SOY PROTEIN

16.3.3.2 PEA PROTEIN

16.3.3.3 WHEAT PROTEIN

16.3.3.4 POTATO STARCH

16.3.3.5 TAPIOCA STARCH

16.3.3.6 ALGAL FLOUR

16.3.3.7 ARROWROOT STARCH

16.3.3.8 CHIA SEEDS

16.3.3.9 FLAXSEED

16.3.3.10 MUNG BEAN

16.3.3.11 FAVA BEAN

16.3.3.12 OTHERS

17 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY FUNCTION

17.1 OVERVIEW

17.2 STABILITY

17.3 STRUCTURE RETENTION

17.4 THICKENING

17.5 AERATION AND BATTER VISCOSITY

17.6 ELASTICITY

17.7 GLAZING

17.8 OTHERS

18 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY GUM USED

18.1 OVERVIEW

18.2 XANTHAN GUM

18.3 CELLULOSE GUM

18.4 CARRAGEENAN

18.5 TARA GUM

18.6 OTHERS

19 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY FORM

19.1 OVERVIEW

19.2 POWDER

19.3 LIQUID

20 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY NATURE

20.1 OVERVIEW

20.2 NON GMO

20.3 GMO

21 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY CATEGORY

21.1 OVERVIEW

21.2 CONVENTIONAL

21.3 ORGANIC

22 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY REGION

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

23 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

24 SWOT ANALYSIS

25 COMPANY PROFILE

25.1 INGREDION

25.1.1 COMPANY SNAPSHOT

25.1.2 REVENUE ANALYSIS

25.1.3 COMPANY SHARE ANALYSIS

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENT

25.2 TATE & LYLE

25.2.1 COMPANY SNAPSHOT

25.2.2 REVENUE ANALYSIS

25.2.3 COMPANY SHARE ANALYSIS

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENT

25.3 KERRY

25.3.1 COMPANY SNAPSHOT

25.3.2 REVENUE ANALYSIS

25.3.3 COMPANY SHARE ANALYSIS

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENT

25.4 DUPONT

25.4.1 COMPANY SNAPSHOT

25.4.2 REVENUE ANALYSIS

25.4.3 COMPANY SHARE ANALYSIS

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENT

25.5 BOB’S RED MILL NATURAL FOODS

25.5.1 COMPANY SANPSHOT

25.5.2 COMPANY SHARE ANALYSIS

25.5.3 PRODUCT PORTFOLIO

25.5.4 RECENT DEVELOPMENTS

25.6 ALTERNATIVE FOODS

25.6.1 COMPANY SNAPSHOT

25.6.2 PRODUCT PORTFOLIO

25.6.3 RECENT DEVELOPMENTS

25.7 ALL AMERICAN FOODS

25.7.1 COMPANY SANPSHOT

25.7.2 PRODUCT PORTFOLIO

25.7.3 RECENT DEVELOPMENT

25.8 CORBION

25.8.1 COMPANY SNAPSHOT

25.8.2 REVENUE ANALYSIS

25.8.3 PRODUCT PORTFOLIO

25.8.4 RECENT DEVELOPMENT

25.9 ENER-G FOODS, INC.

25.9.1 COMPANY SNAPSHOT

25.9.2 PRODUCT PORTFOLIO

25.9.3 RECENT DEVELOPMENTS

25.1 FIBERSTAR

25.10.1 COMPANY SNAPSHOT

25.10.2 PRODUCT PORTFOLIO

25.10.3 RECENT DEVELOPMENT

25.11 FISMER LECITHIN

25.11.1 COMPANY SNAPSHOT

25.11.2 PRODUCT PORTFOLIO

25.11.3 RECENT DEVELOPMENT

25.12 J&K INGREDIENTS, INC.

25.12.1 COMPANY SNAPSHOT

25.12.2 PRODUCT PORTFOLIO

25.12.3 RECENT DEVELOPMENTS

25.13 MGP

25.13.1 COMPANY SNAPSHOT

25.13.2 REVENUE ANALYSIS

25.13.3 PRODUCT PORTFOLIO

25.13.4 RECENT DEVELOPMENT

25.14 NAMASTE FOODS

25.14.1 COMPANY SNAPSHOT

25.14.2 PRODUCT PORTFOLIO

25.14.3 RECENT DEVELOPMENTS

25.15 SUNBLOOM PROTEINS GMBH

25.15.1 COMPANY SNAPSHOT

25.15.2 PRODUCT PORTFOLIO

25.15.3 RECENT DEVELOPMENTS

26 QUESTIONNAIRE

27 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 3 NORTH AMERICA WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 6 NORTH AMERICA EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 9 NORTH AMERICA COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 12 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SOY PROTEIN IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PEA PROTEIN IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA WHEAT PROTEIN IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA POTATO STARCH IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA TAPIOCA STARCH IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ALGAL FLOUR IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ARROWROOT STARCH IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CHIA SEEDS IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FLAXSEED IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA MUNG BEAN IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA FAVA BEAN IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY CONFECTIONERY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA STABILITY IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA STRUCTURE RETENTION IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA THICKENING IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA AERATION AND BATTER VISCOSITY IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA ELASTICITY IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA GLAZING IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY GUM USED, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA XANTHAN GUM IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CELLULOSE GUM IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA CARRAGEENAN IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA TARA GUM IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA POWDER IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA LIQUID IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA NON- GMO IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA GMO IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA CONVENTIONAL IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA ORGANIC IN PLANT-BASED EGG REPLACERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 59 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 61 NORTH AMERICA WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 63 NORTH AMERICA EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 65 NORTH AMERICA COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 67 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY GUM USED, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 80 U.S. PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 82 U.S. WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 U.S. WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 84 U.S. EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 85 U.S. EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 86 U.S. COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 87 U.S. COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 88 U.S. PLANT-BASED EGG REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 89 U.S. PLANT-BASED EGG REPLACERS MARKET, BY GUM USED, 2020-2029 (USD MILLION)

TABLE 90 U.S. PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 91 U.S. PLANT-BASED EGG REPLACERS MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 92 U.S. PLANT-BASED EGG REPLACERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 93 U.S. PLANT-BASED EGG REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 94 U.S. PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 U.S. BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.S. BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 98 U.S. SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.S. SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.S. SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 101 CANADA PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 103 CANADA WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 104 CANADA WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 105 CANADA EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 106 CANADA EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 107 CANADA COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 108 CANADA COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 109 CANADA PLANT-BASED EGG REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 110 CANADA PLANT-BASED EGG REPLACERS MARKET, BY GUM USED, 2020-2029 (USD MILLION)

TABLE 111 CANADA PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 112 CANADA PLANT-BASED EGG REPLACERS MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 113 CANADA PLANT-BASED EGG REPLACERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 114 CANADA PLANT-BASED EGG REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 115 CANADA PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 CANADA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 CANADA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 118 CANADA BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 119 CANADA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 121 CANADA SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 124 MEXICO WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 125 MEXICO WHITE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 126 MEXICO EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 127 MEXICO EGG YOLK REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 128 MEXICO COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 129 MEXICO COMPLETE EGG REPLACEMENT IN PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (TONS)

TABLE 130 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY GUM USED, 2020-2029 (USD MILLION)

TABLE 132 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 133 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 134 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 136 MEXICO PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 MEXICO BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 MEXICO BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO BAKERY IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

TABLE 140 MEXICO SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 MEXICO SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGGS REPLACERS TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO SAVORY FOOD IN PLANT-BASED EGG REPLACERS MARKET, BY EGG REPLACER SOURCE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS REGARDING VARIOUS HEALTH BENEFITS OF PLANT-BASED FOODS IS EXPECTED TO DRIVE THE NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029.

FIGURE 12 FULL EGG SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN OF NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

FIGURE 14 VALUE CHAIN OF NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET

FIGURE 15 MARKET OVERVIEW SNAPSHOT

FIGURE 16 NORTH AMERICA PRODUCTION DATA FOR RAW MATERIALS (2016-2019)

FIGURE 17 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY TYPE, 2021

FIGURE 18 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY SOURCE, 2021

FIGURE 19 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY FUNCTION, 2021

FIGURE 21 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY GUM USED, 2021

FIGURE 22 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY FORM, 2021

FIGURE 23 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY NATURE, 2021

FIGURE 24 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET, BY CATEGORY, 2021

FIGURE 25 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: SNAPSHOT (2021)

FIGURE 26 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: BY COUNTRY (2021)

FIGURE 27 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: BY TYPE (2022 & 2029)

FIGURE 30 NORTH AMERICA PLANT-BASED EGG REPLACERS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.