North America Photoacoustic Imaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

37.30 Billion

USD

136.44 Billion

2025

2033

USD

37.30 Billion

USD

136.44 Billion

2025

2033

| 2026 –2033 | |

| USD 37.30 Billion | |

| USD 136.44 Billion | |

|

|

|

|

Segmentación del mercado de imágenes fotoacústicas en Norteamérica por componente (hardware [componente y medio de sustancia], software y servicios), tipo (sistema de imágenes fotoacústicas, sistema de tomografía fotoacústica y computarizada), aplicación (preclínica y clínica), modalidad (portátil, independiente y portátil), plataforma (diodo láser pulsado, basado en LED, flash de xenón y otros), dimensión (2D y 3D), aplicación diagnóstica (oncología, hematología, dermatología, cardiología, neurología y otros), usuario final (centros de cirugía ambulatoria, laboratorios de investigación, hospitales y clínicas, centros de diagnóstico por imagen, empresas farmacéuticas y biotecnológicas y otros), canal de distribución (licitación directa, ventas minoristas, ventas en línea y otros) - Tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de imágenes fotoacústicas en América del Norte

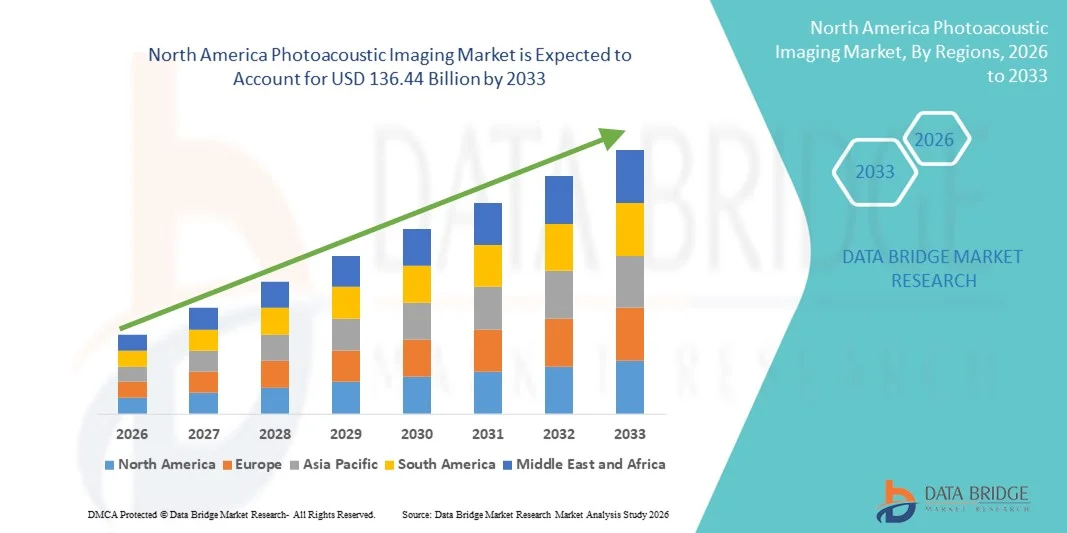

- El tamaño del mercado de imágenes fotoacústicas de América del Norte se valoró en USD 37.30 mil millones en 2024 y se espera que alcance los USD 136.44 mil millones para 2033 , con una CAGR del 17,60 % durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente adopción y los continuos avances tecnológicos en sistemas de diagnóstico e imagenología biomédica, en particular en el ámbito de las técnicas de imagenología no invasivas y en tiempo real. La imagenología fotoacústica, que combina modalidades ópticas y ultrasónicas, está ganando terreno gracias a su superior resolución, profundidad de penetración y capacidad para visualizar información estructural y funcional, lo que mejora la precisión diagnóstica en diversas aplicaciones médicas.

- Además, la creciente demanda de herramientas de diagnóstico más seguras, precisas y no ionizantes está posicionando la imagen fotoacústica como una alternativa de vanguardia a las técnicas de imagen convencionales como la resonancia magnética , la tomografía computarizada y la tomografía por emisión de positrones (PET). Estos factores convergentes están acelerando la adopción de soluciones de imagen fotoacústica en oncología, cardiología, neurología y dermatología, impulsando así significativamente la trayectoria de crecimiento del sector.

Análisis del mercado de imágenes fotoacústicas en América del Norte

- Las imágenes fotoacústicas, que aprovechan el efecto fotoacústico para proporcionar imágenes de alta resolución y alto contraste de tejidos biológicos, son un componente cada vez más vital de los sistemas de diagnóstico e investigación médica modernos, tanto en entornos clínicos como preclínicos, debido a su carácter no invasivo, su penetración profunda en los tejidos y sus capacidades de imágenes funcionales.

- La creciente demanda de imágenes fotoacústicas se debe principalmente a la creciente prevalencia de enfermedades crónicas, la creciente necesidad de un diagnóstico temprano y preciso y una creciente preferencia por modalidades de imágenes no ionizantes y no invasivas.

- Estados Unidos dominó el mercado de imágenes fotoacústicas con la mayor participación en los ingresos, un 41,2 % en 2024. Este liderazgo está respaldado por fuertes inversiones federales y privadas en infraestructura de atención médica avanzada, un ecosistema de investigación biomédica bien establecido, la adopción temprana de tecnologías innovadoras de diagnóstico por imágenes y la sólida presencia de actores líderes del mercado e instituciones de investigación académica en todo el país.

- Se espera que Canadá sea la región con mayor crecimiento en el mercado de imágenes fotoacústicas durante el período de pronóstico, con una tasa de crecimiento anual compuesta (TCAC) proyectada del 20,4 %. Este crecimiento se debe al aumento del gasto sanitario, la creciente prevalencia de enfermedades crónicas, la expansión de las actividades de investigación y desarrollo, el apoyo gubernamental a la innovación médica y la creciente adopción de soluciones de diagnóstico por imagen no invasivas y avanzadas en hospitales y centros de investigación.

- El segmento de hardware dominó el mercado con la mayor participación en los ingresos del 62,4 % en 2024, respaldado por la fuerte demanda de sistemas de imágenes avanzados, transductores y fuentes de luz utilizados en la investigación preclínica y clínica.

Alcance del informe y segmentación del mercado de imágenes fotoacústicas

|

Atributos |

Perspectivas clave del mercado de imágenes fotoacústicas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de imágenes fotoacústicas en América del Norte

Los avances tecnológicos impulsan la adopción clínica y la precisión de las imágenes

- Una tendencia significativa y en aceleración en el mercado global de imágenes fotoacústicas (PAI) es el avance continuo de los sistemas de imágenes híbridos que integran PAI con ultrasonido, tomografía de coherencia óptica (OCT) y otras modalidades para mejorar la precisión del diagnóstico clínico y la profundidad de la imagen.

- Por ejemplo, FUJIFILM VisualSonics ha presentado el sistema Vevo LAZR-X, que combina ultrasonido de alta frecuencia y fotoacústica, lo que permite a investigadores y médicos visualizar datos moleculares, funcionales y anatómicos simultáneamente. Esta integración multimodal mejora significativamente la caracterización tisular, especialmente en oncología e imágenes vasculares.

- La integración de fuentes láser sintonizables y algoritmos de desmezcla espectral en tiempo real ha mejorado la especificidad y la resolución de las imágenes fotoacústicas, lo que permite una mejor visualización de la hemoglobina, la melanina, los lípidos y otros cromóforos. Este avance es crucial para aplicaciones como la monitorización de la angiogénesis tumoral, la evaluación de la hipoxia y la imagenología metabólica.

- Se están desarrollando sondas de imagen avanzadas y agentes de contraste para identificar marcadores moleculares específicos, lo que permite la imagen fotoacústica molecular para la medicina personalizada. Por ejemplo, se están explorando agentes de contraste basados en nanopartículas, adaptados a biomarcadores de cáncer, para aumentar la sensibilidad de la detección de tumores mediante PAI.

- La miniaturización de los componentes de imagen permite el desarrollo de dispositivos fotoacústicos portátiles, especialmente prometedores para el diagnóstico en el punto de atención y la imagen intraoperatoria. Estos sistemas compactos ofrecen guía en tiempo real durante los procedimientos quirúrgicos, lo que podría mejorar los resultados en la resección tumoral y las cirugías vasculares.

- Este creciente énfasis en la innovación tecnológica y la integración clínica está transformando el panorama de la imagen fotoacústica. A medida que la industria avanza hacia una mayor adopción hospitalaria, empresas como iThera Medical, Seno Medical y TomoWave Laboratories están acelerando el desarrollo de productos y los ensayos clínicos para posicionar la PAI como una herramienta de imagen estándar en oncología, cardiología y dermatología.

Dinámica del mercado de imágenes fotoacústicas en América del Norte

Conductor

Necesidad creciente debido a la creciente demanda de imágenes no invasivas y detección temprana de enfermedades”

- La creciente demanda de herramientas de diagnóstico no invasivas y de alta resolución en entornos clínicos y de investigación es un impulsor importante para la creciente adopción de tecnologías de imágenes fotoacústicas (PAI) en diversos campos médicos.

- Por ejemplo, en marzo de 2024, FUJIFILM VisualSonics, Inc. anunció una nueva generación de su sistema Vevo LAZR-X, que incorpora capacidades mejoradas de imágenes multiespectrales para una mejor caracterización tumoral e imágenes vasculares. Se espera que innovaciones como estas impulsen el crecimiento del mercado de PAI durante el período de pronóstico.

- A medida que los sistemas de atención médica a nivel mundial cambian hacia la detección temprana de enfermedades y diagnósticos de precisión, la PAI ofrece una alternativa convincente a los métodos de imágenes tradicionales al combinar el contraste óptico con la penetración del ultrasonido, lo que permite la visualización detallada de los tejidos, la oxigenación de la sangre y los marcadores moleculares sin radiación ionizante.

- Además, la creciente prevalencia de enfermedades crónicas como el cáncer y los trastornos cardiovasculares ha intensificado la necesidad de imágenes funcionales en tiempo real, lo que impulsa la adopción de soluciones fotoacústicas tanto en hospitales como en institutos de investigación.

- La capacidad de la PAI para visualizar procesos biológicos como la angiogénesis, la hipoxia y la inflamación in vivo, sin necesidad de procedimientos invasivos, la posiciona como una herramienta predilecta en la investigación preclínica y el diagnóstico clínico. Se espera que la creciente concienciación y la validación clínica aceleren su integración en las prácticas rutinarias de imagenología en la atención médica.

Restricción/Desafío

Alto costo y adopción comercial limitada debido a la complejidad tecnológica

- A pesar de sus importantes ventajas clínicas y de investigación, el alto costo de los sistemas avanzados de imágenes fotoacústicas sigue siendo un obstáculo importante para su adopción generalizada. Estos sistemas requieren láseres de precisión, transductores y software especializado, lo que los encarece para muchas instituciones, especialmente en entornos de bajos recursos.

- Por ejemplo, muchas plataformas PAI de alto rendimiento que se utilizan actualmente en laboratorios de I+D académicos o farmacéuticos requieren inversiones de capital de seis cifras, lo que limita el acceso principalmente a grandes universidades o centros de investigación bien financiados.

- Además, la complejidad tecnológica de la PAI, incluyendo la necesidad de capacitación de los operadores, calibración precisa y mantenimiento, genera desafíos operativos que pueden desalentar su uso clínico. La curva de aprendizaje para interpretar datos multiespectrales e integrar la PAI en los flujos de trabajo clínicos dificulta aún más su adopción en hospitales o laboratorios de diagnóstico más pequeños.

- Además, si bien la PAI ha mostrado resultados prometedores en estudios iniciales, la falta de aprobación regulatoria generalizada y estandarización en entornos clínicos frena la expansión del mercado. La industria debe invertir en ensayos clínicos sólidos, alineamiento regulatorio y evidencia práctica para demostrar la eficacia y la rentabilidad de la tecnología en aplicaciones a gran escala.

Alcance del mercado de imágenes fotoacústicas en América del Norte

The market is segmented on the basis of component, type, application, modality, platform, dimension, diagnostic application, end user, and distribution channel.

- By Component

On the basis of component, the photoacoustic imaging market is segmented into hardware (component & substance medium), software and services. The hardware segment dominated the market with the largest revenue share of 62.4% in 2024, supported by the strong demand for advanced imaging systems, transducers, and light sources used in preclinical and clinical research. Hardware remains essential for signal generation, detection, and system integration, driving high investments from research institutions and hospitals. The growing focus on enhancing imaging depth, resolution, and speed is fueling continuous hardware upgrades. In addition, expanding applications in oncology, vascular imaging, and dermatology are driving the demand for sophisticated hardware solutions. Increasing adoption of multi-modal imaging systems further strengthens hardware dominance. The market is also witnessing significant funding and collaboration for developing next-generation photoacoustic devices. The hardware segment’s growth is further supported by rising demand for portable and compact systems. Overall, hardware continues to be the primary revenue contributor in the photoacoustic imaging market.

The software and services segment is expected to witness the fastest CAGR of 14.1% from 2026 to 2033, driven by the increasing need for advanced image processing, AI-based analytics, and cloud-based data management solutions. The growth is supported by the rising importance of real-time visualization and quantitative analysis for clinical decision-making. Software advancements are enhancing the accuracy of diagnostics and enabling better integration with other imaging modalities. The demand for software tools is rising across hospitals, diagnostic centers, and research labs to improve workflow efficiency. In addition, the expansion of AI and machine learning in image interpretation is driving software adoption. Services such as maintenance, training, and consulting are also gaining traction, contributing to overall growth. As clinical adoption expands, the need for regulatory-compliant software platforms increases. The software and services segment is poised to grow rapidly due to these technological and clinical trends.

- By Type

Según el tipo, el mercado de imágenes fotoacústicas se segmenta en sistemas de imágenes fotoacústicas y sistemas de tomografía computarizada fotoacústica. El segmento de sistemas de imágenes fotoacústicas dominó el mercado con la mayor participación en ingresos, con un 58,6%, en 2024, impulsado por su amplio uso en la investigación preclínica para el estudio de la vasculatura tumoral, la oxigenación y la imagen molecular. Los investigadores prefieren los sistemas PAI por su alto contraste y capacidad de generación de imágenes de alta resolución sin radiación ionizante. Este segmento se beneficia de una sólida adopción en instituciones académicas, I+D farmacéutica y laboratorios preclínicos. Su versatilidad en imágenes funcionales, estudios con animales pequeños y monitorización no invasiva contribuye a una demanda sostenida. El creciente enfoque en la investigación del cáncer y los estudios vasculares refuerza aún más el dominio del segmento. Además, los sistemas PAI se integran cada vez más con la ecografía y otras modalidades de imagen. La innovación continua en la miniaturización de sistemas y la mejora de los detectores también respaldan su liderazgo en el mercado. En general, el segmento de sistemas PAI sigue siendo el principal generador de ingresos gracias a su consolidada presencia y amplio uso.

Se proyecta que el segmento de sistemas de tomografía computarizada fotoacústica experimentará la tasa de crecimiento más rápida, del 12,4 %, entre 2026 y 2033, debido a su creciente papel en la obtención de imágenes de tejidos profundos y al aumento de ensayos clínicos centrados en oncología y enfermedades cardiovasculares. La profundidad de imagen avanzada y la capacidad de reconstrucción 3D están ganando terreno en la investigación traslacional y el potencial diagnóstico clínico. El aumento de los estudios de validación clínica para cáncer de mama, imágenes vasculares y dermatología impulsa el crecimiento. El segmento también se beneficia de las mejoras en los algoritmos de reconstrucción y la tecnología de detección. El creciente interés en el diagnóstico clínico no invasivo está impulsando la adopción de sistemas PACT en hospitales y centros de diagnóstico. La demanda de imágenes de alta profundidad en oncología y neurología impulsa el crecimiento del segmento. A medida que surgen más aprobaciones regulatorias y aplicaciones clínicas, se espera que el mercado de PACT se expanda significativamente.

- Por aplicación

Según su aplicación, el mercado de la imagen fotoacústica se segmenta en preclínico y clínico. El segmento preclínico obtuvo la mayor cuota de mercado en ingresos, con un 61,2%, en 2024, debido principalmente a su amplio uso en I+D académica y farmacéutica para evaluar la eficacia de fármacos, la biología tumoral y la investigación vascular. Los investigadores valoran la imagen fotoacústica por sus capacidades no invasivas y multimodales, especialmente en modelos animales pequeños. Los estudios preclínicos se benefician de la imagen en tiempo real y la visualización de alta resolución de cambios moleculares y funcionales. El segmento también se beneficia de una sólida financiación académica y de las colaboraciones entre universidades y empresas biotecnológicas. La creciente demanda de nuevos fármacos e investigación en medicina de precisión refuerza aún más el dominio del segmento. La presencia de una infraestructura de imagen preclínica consolidada en Norteamérica y Europa impulsa el crecimiento. En general, las aplicaciones preclínicas siguen siendo el principal motor de ingresos en el mercado de la imagen fotoacústica.

Se proyecta que el segmento clínico crecerá a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 13,8 %, entre 2026 y 2033, impulsado por el creciente interés en la aplicación de la imagen fotoacústica para el diagnóstico en humanos, en particular en la detección del cáncer de mama, la dermatología y los trastornos vasculares. A medida que más ensayos clínicos validen su eficacia, se espera que su uso clínico se expanda significativamente. La demanda de soluciones de imagen no invasivas con alto contraste y visualización en tiempo real está aumentando en hospitales y centros de diagnóstico. El creciente enfoque en la detección temprana de enfermedades y el tratamiento personalizado está impulsando su adopción clínica. Los avances en sistemas portátiles y de mano también están haciendo más viables las aplicaciones clínicas. Además, la integración con la ecografía y otras modalidades de imagen mejora la utilidad diagnóstica. El crecimiento del segmento también se ve respaldado por el aumento de las aprobaciones regulatorias y los estudios de validación clínica a nivel mundial.

- Por modalidad

Según la modalidad, el mercado se segmenta en portátiles, autónomos y de mano. El segmento autónomo dominó el mercado con la mayor cuota de mercado, un 54,9%, en 2024, impulsado por la alta adopción de sistemas a gran escala en instituciones de investigación y hospitales. Los sistemas autónomos ofrecen capacidades integrales de imagenología con detectores avanzados y láseres de alto rendimiento, lo que los hace ideales para aplicaciones preclínicas y clínicas. Este segmento se beneficia de la fuerte demanda en la investigación oncológica, los estudios vasculares y el desarrollo de fármacos. Su robusto rendimiento, precisión e integración con otras modalidades de imagenología contribuyen a su dominio del mercado. Además, los sistemas autónomos son los preferidos para flujos de trabajo de imagenología complejos y proyectos de investigación a largo plazo. Las inversiones en infraestructura y la disponibilidad de personal capacitado impulsan aún más este segmento.

Se espera que el segmento portátil registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 15,2 %, entre 2026 y 2033, debido a la creciente demanda de soluciones de imagenología compactas y móviles en entornos clínicos. Los sistemas portátiles están ganando popularidad gracias a su facilidad de transporte, rápida configuración y uso en diagnósticos en el punto de atención. El creciente interés en la monitorización a pie de cama y el diagnóstico ambulatorio está impulsando el crecimiento. Este segmento también se ve impulsado por los avances tecnológicos en láseres y detectores miniaturizados. A medida que los centros sanitarios adoptan la imagenología portátil para la detección y monitorización rápidas, se prevé un aumento de la demanda. La expansión de la telemedicina y la monitorización remota de pacientes está impulsando aún más la adopción de dispositivos fotoacústicos portátiles.

- Por plataforma

Según la plataforma, el mercado se segmenta en diodos láser pulsados, basados en LED, flash de xenón y otros. El segmento de diodos láser pulsados dominó el mercado con la mayor participación en ingresos, un 57,3 %, en 2024, gracias a su alta eficiencia energética y mayor profundidad de penetración. Los diodos láser pulsados ofrecen un rendimiento estable y una salida fiable, y se utilizan ampliamente en sistemas fotoacústicos preclínicos y clínicos. Este segmento se beneficia de la innovación continua y la reducción del coste de los láseres de diodo. Además, su compatibilidad con imágenes de alta resolución y su funcionamiento en múltiples longitudes de onda facilita diversas aplicaciones. Su fuerte adopción en la investigación oncológica y la imagen vascular fortalece aún más este segmento.

Se prevé que el segmento basado en LED crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 14,6 %, entre 2026 y 2033, impulsado por la creciente demanda de fuentes de luz compactas y rentables. Los sistemas basados en LED ofrecen un menor coste, un tamaño más reducido y una integración más sencilla, lo que los hace adecuados para dispositivos portátiles. Este crecimiento se sustenta en la expansión de las aplicaciones en dermatología e imagenología superficial. El desarrollo de matrices LED de alta potencia y la mejora de la salida de luz están impulsando aún más su adopción. Se prevé que el segmento gane impulso a medida que aumenten las aplicaciones clínicas y en el punto de atención.

- Por dimensión

On the basis of dimension, the market is segmented into 2D and 3D. The 2D segment dominated the market with the largest revenue share of 59.1% in 2024, supported by its widespread use in routine imaging applications due to easier implementation and lower operational complexity. 2D photoacoustic imaging is widely used in preclinical studies because it offers fast scanning and clear visualization of vascular structures, oxygenation levels, and functional changes in tissues. The cost-effectiveness of 2D systems makes them popular in academic labs and small research facilities. They also provide reliable imaging performance for superficial tissue analysis and small animal studies. Moreover, 2D systems are easier to integrate with ultrasound and other modalities, further increasing adoption. Training and workflow requirements are minimal compared to 3D systems, making them a preferred choice for early-stage research and routine diagnostics. Overall, 2D imaging remains the primary revenue contributor due to its established presence in both research and clinical environments.

The 3D segment is expected to grow at the fastest CAGR of 13.9% from 2026 to 2033, driven by rising demand for volumetric imaging and advanced reconstruction capabilities in clinical diagnostics and translational research. 3D photoacoustic imaging enables detailed visualization of tumor volumes, vascular networks, and organ structures, which is essential for accurate disease assessment and treatment planning. The growing number of clinical trials in oncology, cardiology, and neurology is pushing the adoption of 3D systems. Improvements in detector arrays, reconstruction algorithms, and computing power are enhancing 3D imaging quality and speed. As hospitals and diagnostic centers increasingly focus on precise disease mapping and real-time monitoring, 3D imaging becomes more valuable. The ability to provide deeper tissue visualization and better anatomical context is also encouraging wider adoption. Therefore, 3D imaging is expected to record strong growth during the forecast period.

- By Diagnostic Application

On the basis of diagnostic application, the market is segmented into oncology, hematology, dermatology, cardiology, neurology, and others. The oncology segment dominated the market with the largest revenue share of 45.8% in 2024, driven by strong demand for tumor imaging, monitoring treatment response, and evaluating tumor vasculature and oxygenation. Photoacoustic imaging provides high-contrast visualization of blood vessels and oxygen saturation, making it valuable for cancer research and diagnostics. The technology is increasingly used in preclinical and translational studies to monitor tumor growth and assess therapy effectiveness. Rising global cancer incidence and increasing investment in oncology research further support the segment’s dominance. In addition, the ability to combine photoacoustic imaging with ultrasound enhances its diagnostic value for tumor localization and characterization. Continuous innovation in contrast agents and multi-wavelength imaging is expanding applications in oncology. As a result, oncology remains the primary revenue driver in the photoacoustic imaging market.

The dermatology segment is expected to witness the fastest CAGR of 15.5% from 2026 to 2033, driven by the growing demand for non-invasive skin imaging and early detection of skin disorders such as melanoma and psoriasis. Photoacoustic imaging provides high-resolution visualization of skin layers and vascular structures, allowing clinicians to assess lesion depth, blood flow, and oxygenation without invasive biopsy. The rise in aesthetic and dermatology clinics adopting advanced imaging technologies is supporting market growth. In addition, the growing awareness of skin cancer screening and early diagnosis is fueling adoption. Technological advancements in handheld and portable devices are also making photoacoustic imaging more accessible for dermatology applications. The segment’s growth is further supported by increasing research on skin diseases and the development of specialized photoacoustic imaging systems for dermatology.

- By End User

On the basis of end-user, the market is segmented into ambulatory surgical centers, research laboratories, hospitals and clinics, diagnostic imaging centers, pharmaceutical and biotechnology companies, and others. The research laboratories segment dominated the market in 2024, owing to high demand for preclinical imaging tools, strong academic funding, and expanding research in functional and molecular imaging. Research institutions are increasingly adopting photoacoustic imaging systems to advance biomedical discovery, drug development, and translational research. The technology is widely used in small animal studies for tumor biology, vascular imaging, and drug efficacy evaluation. Moreover, collaborations between universities and biotech firms are fueling investments in PAI systems. The presence of well-established preclinical research infrastructure in North America and Europe also supports segment dominance. Overall, research laboratories continue to be the primary revenue contributor due to strong demand for high-end imaging tools.

The hospitals and clinics segment is forecasted to witness the highest CAGR of 14.7% from 2026 to 2033, supported by increasing adoption of innovative imaging modalities in clinical settings. Hospitals are increasingly investing in non-invasive and real-time imaging solutions for early disease detection and treatment monitoring. Growing emphasis on personalized medicine and precision diagnostics is encouraging integration of photoacoustic imaging into clinical workflows. The technology’s ability to provide functional and molecular information along with structural imaging makes it valuable for oncology, dermatology, and vascular disorders. In addition, improved clinical validation and regulatory approvals are boosting adoption. The rising demand for advanced diagnostic tools in emerging markets is also supporting growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, online sales, and others. The direct tender segment dominated the market with the largest revenue share of 52.6% in 2024, driven by institutional procurement of photoacoustic systems by hospitals, research labs, and government organizations. Direct tender procurement is preferred for large-scale purchases because it offers better pricing, long-term service contracts, and customized system configurations. This channel is especially popular in public healthcare systems and academic institutions that require high-end imaging equipment with full maintenance support. The presence of major imaging manufacturers and their strong distribution networks further supports direct tender dominance. In addition, tenders often include bundled services, installation, and training, which adds value for buyers.

Se espera que el segmento de ventas en línea registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 16,2 %, entre 2026 y 2033, gracias a la creciente digitalización, la adopción del comercio electrónico y un acceso más sencillo a accesorios de imagenología, software y dispositivos portátiles más pequeños. Las plataformas en línea ofrecen comodidad para la compra y una entrega rápida, especialmente para laboratorios de investigación y clínicas pequeñas. El crecimiento de las ventas en línea también se ve impulsado por la creciente demanda de compras remotas y la rápida sustitución de componentes. Además, la mayor confianza en las transacciones en línea y la mejora de la logística en los mercados emergentes impulsan el crecimiento de este segmento.

Análisis regional del mercado de imágenes fotoacústicas en América del Norte

- Se prevé que el mercado de imágenes fotoacústicas de América del Norte registre una fuerte CAGR del 14,8 % durante el período de pronóstico, y la región representará aproximadamente el 33,9 % de los ingresos globales en 2024.

- Este crecimiento está impulsado por un alto gasto en atención médica, una sólida financiación gubernamental y del sector privado para imágenes médicas avanzadas, la adopción temprana de tecnologías de diagnóstico innovadoras y un ecosistema de investigación bien establecido en los EE. UU. y Canadá.

- El aumento de las asociaciones público-privadas, las crecientes inversiones en investigación biomédica y la presencia de fabricantes líderes de tecnología de imágenes están mejorando el acceso a sistemas de imágenes fotoacústicas (PAI) avanzados y de alta calidad en toda la región.

Análisis del mercado estadounidense de imágenes fotoacústicas.

El mercado estadounidense de imágenes fotoacústicas dominó Norteamérica en 2024, representando aproximadamente el 41,2 % de los ingresos globales . Este liderazgo se sustenta en sólidas inversiones federales y privadas en infraestructura sanitaria, un sólido ecosistema de investigación biomédica, la adopción temprana de tecnologías de diagnóstico por imagen de vanguardia y la presencia de importantes actores del sector e instituciones de investigación académica. El alto uso de sistemas PAI tanto en el diagnóstico clínico como en la investigación preclínica impulsa aún más el crecimiento del mercado.

Análisis del mercado canadiense de imágenes fotoacústicas.

Se prevé que Canadá sea el país con mayor crecimiento en el mercado norteamericano de imágenes fotoacústicas durante el período de pronóstico, con una tasa de crecimiento anual compuesta (TCAC) del 20,4 % . Este crecimiento se debe al aumento del gasto sanitario, la expansión de las actividades de investigación y desarrollo, el apoyo gubernamental a la innovación médica y la creciente adopción de soluciones de diagnóstico por imagen no invasivas y avanzadas en hospitales, centros de diagnóstico e instituciones de investigación. El creciente énfasis en la detección temprana de enfermedades y la medicina de precisión impulsa aún más la adopción del mercado en el país.

Cuota de mercado de imágenes fotoacústicas en América del Norte

La industria de imágenes fotoacústicas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- PreXion Inc. (EE. UU.)

- iThera Medical GmbH (Alemania)

- PST Inc. (Corea del Sur)

- HÜBNER Photonics (Alemania)

- Láseres Litron (Reino Unido)

- FUJIFILM Visualsonics, Inc. (Canadá)

- Kibero (Suiza)

- InnoLas Laser GmbH (Alemania)

- QUANTEL LASER (Francia)

- GE HealthCare (EE. UU.)

- Ekspla (Lituania)

- TomoWave Laboratories, Inc. (EE. UU.)

- Aspectus GmbH (Alemania)

- Soluciones de luz natural (EE. UU.)

- ADVANTEST CORPORATION (Japón)

- illumiSonics Inc. (EE. UU.)

- OPOTEK LLC (EE. UU.)

- Seno Medical (EE. UU.)

- Vibronix, Inc. (EE. UU.)

Últimos avances en el mercado de imágenes fotoacústicas en América del Norte

- En abril de 2025 , los investigadores introdujeron el Factor de Sonoridad Acústica (ALF) , un nuevo parámetro de referencia diseñado para sondas fotoacústicas de moléculas pequeñas. El ALF permite predecir con precisión el rendimiento del colorante in vivo, acelerando el diseño de sondas y mejorando la calidad de la señal en el diagnóstico por imagen.

- En febrero y marzo de 2025 , los científicos de la Universidad Estatal de Wayne utilizaron PAI combinado con reconocimiento de patrones para revelar patrones de activación neuronal distintos en la corteza prefrontal durante el aprendizaje condicionado en ratas, lo que destaca el papel emergente de PAI en la investigación en neurociencia.

- En abril de 2025 , los investigadores de la Universidad de Duke publicaron hallazgos sobre el uso del factor de sonoridad acústica para evaluar y mejorar las sondas fotoacústicas de moléculas pequeñas, estableciendo un nuevo estándar para el diseño y la evaluación preclínica.

- En mayo de 2025 , un grupo conjunto A*STAR–NHG en Singapur presentó el primer ensayo en humanos que combina MSOT y segmentación basada en IA para imágenes de tumores en 3D (incluido el diagnóstico de carcinoma de células basales), demostrando una eficacia de alta resolución y potencial para guiar la planificación quirúrgica.

- En marzo de 2025 , Nature Reviews Bioengineering presentó un comentario titulado “Definir el nicho clínico para las imágenes fotoacústicas”, destacando su creciente relevancia terapéutica en oncología y diagnóstico cardiovascular, lo que subraya la adopción clínica acelerada.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.