North America Paint Protection Film Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

287.56 Million

USD

479.50 Million

2025

2033

USD

287.56 Million

USD

479.50 Million

2025

2033

| 2026 –2033 | |

| USD 287.56 Million | |

| USD 479.50 Million | |

|

|

|

|

Segmentación del mercado de películas protectoras de pintura en Norteamérica: por marca (protector transparente, máscara transparente, escudo invisible, protección contra impactos de rocas, envoltura transparente, película protectora contra rayones de automóviles y otras), material (poliuretano, vinilo, cloruro de polivinilo y otros), sistema (sistemas a base de agua y sistemas a base de solvente), acabado (mate, brillante y otros), aplicación (capó completo, borde delantero del capó, parachoques, paneles de guardabarros, espejos laterales pintados, cavidades de manijas de puertas, bordes de puertas, paneles inferiores, borde del maletero y otros), usuario final (automotriz, aeroespacial y defensa, eléctrico y electrónico, petróleo y gas y otros): tendencias y pronóstico de la industria hasta 2033.

Tamaño del mercado de películas protectoras de pintura en América del Norte

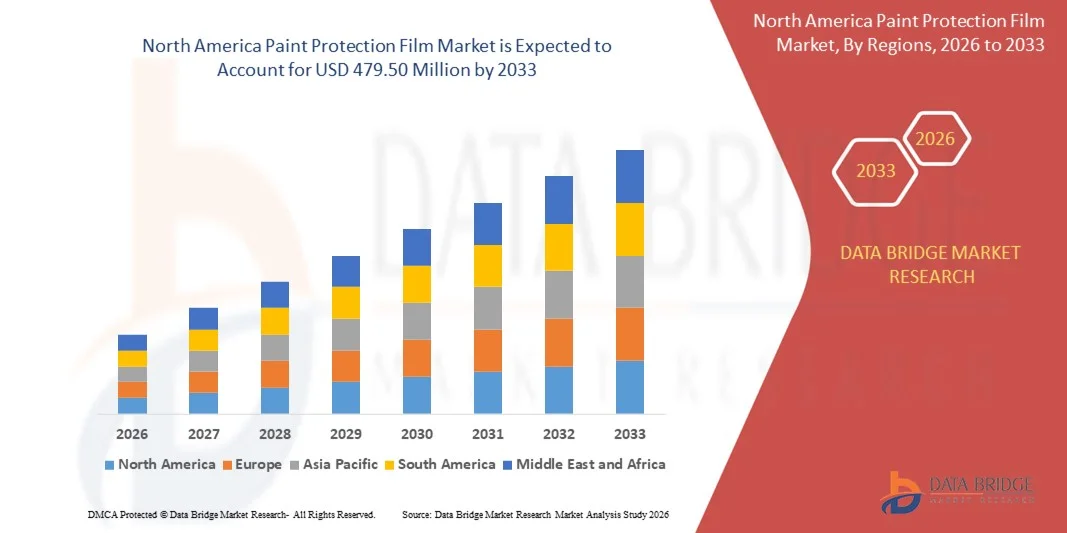

- El tamaño del mercado de películas protectoras de pintura de América del Norte se valoró en USD 287,56 millones en 2025 y se espera que alcance los USD 479,50 millones para 2033 , con una CAGR del 6,60 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de durabilidad de la superficie del vehículo, como una mejor resistencia a los arañazos, protección contra las manchas y retención del brillo a largo plazo.

- Aumento de la adopción por parte de fabricantes de equipos originales (OEM) de automóviles y aplicaciones de posventa para mejorar el valor de reventa del vehículo

Análisis del mercado de películas protectoras de pintura en América del Norte

- El mercado está experimentando una expansión constante debido al cambio hacia soluciones de cuidado de automóviles premium y avances tecnológicos como películas autorreparadoras.

- La creciente penetración de materiales basados en TPU, junto con la creciente conciencia de los recubrimientos protectores entre los propietarios de automóviles, continúa acelerando la adopción en el mercado.

- Estados Unidos dominó el mercado de películas protectoras de pintura de América del Norte con la mayor participación en los ingresos en 2025, impulsado por el aumento de la propiedad de vehículos, la creciente demanda de automóviles premium y de lujo y la creciente conciencia de la estética de los vehículos.

- Se espera que Canadá sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de películas de protección de pintura de América del Norte debido a la creciente conciencia de la estética de los vehículos, el aumento de las ventas de vehículos premium y de lujo y la creciente demanda de películas protectoras para el mercado de accesorios.

- El segmento Clear Bra obtuvo la mayor participación en ingresos del mercado en 2025, gracias a su consolidada presencia, su sólido reconocimiento de marca y sus películas duraderas de alta calidad. Los productos Clear Bra son ampliamente adoptados por propietarios de automóviles premium y centros de servicio por su protección duradera y su fácil instalación. Su robusto rendimiento, compatibilidad con diferentes superficies de vehículos y amplia disponibilidad los convierten en la opción preferida de usuarios comerciales y particulares.

Alcance del informe y segmentación del mercado de películas protectoras de pintura en América del Norte

|

Atributos |

Información clave del mercado de películas protectoras de pintura en Norteamérica |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Norteamérica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de películas protectoras de pintura en América del Norte

Creciente adopción de películas protectoras de pintura automotriz avanzadas

- El creciente énfasis en la estética del vehículo y el mantenimiento a largo plazo está impulsando la adopción de películas protectoras de pintura (PPF) en el sector automotriz. Estas películas proporcionan una barrera protectora contra arañazos, impactos de piedras, exposición a rayos UV y contaminantes ambientales, prolongando la vida útil del vehículo y preservando su valor de reventa. Los propietarios de vehículos reconocen cada vez más las PPF como una alternativa rentable a las frecuentes reparaciones y repintados.

- La creciente preferencia de los consumidores por los coches de alta gama y los vehículos de lujo está acelerando la demanda de láminas protectoras de pintura (PPF) de alta calidad, autorreparables y antiamarilleo. Los concesionarios y centros de servicio de automóviles están integrando la instalación de láminas en sus servicios posventa, lo que ofrece comodidad y aumenta las tasas de adopción. Esta tendencia se ve respaldada por la creciente concienciación de los consumidores sobre el impacto de los daños exteriores en el valor de reventa y la estética del vehículo.

- Los avances tecnológicos, como los recubrimientos nanocerámicos y las formulaciones adhesivas mejoradas, hacen que las láminas PPF modernas sean más fáciles de instalar, más duraderas y visualmente uniformes. Esto mejora la confianza del consumidor y facilita su aplicación rutinaria en vehículos nuevos y existentes. La innovación continua mejora la resistencia a los arañazos, las propiedades hidrofóbicas y la transparencia, haciendo que las películas sean casi invisibles a la vez que mantienen la protección.

- Por ejemplo, los propietarios de vehículos que aplicaron películas autoreparadoras y antiamarilleo informaron de menos arañazos y una reducción de los costes de mantenimiento durante el primer año, lo que demuestra los beneficios prácticos de las películas protectoras. Los proveedores de servicios han observado una mayor satisfacción del cliente y una mayor demanda de instalaciones repetidas, lo que demuestra la creciente confianza en las soluciones PPF.

- Si bien la adopción de PPF crece rápidamente, la expansión sostenida del mercado depende de la innovación de productos, instaladores cualificados y campañas de concienciación que destaquen los beneficios a largo plazo tanto para los consumidores como para los operadores de flotas. Educar a los usuarios finales sobre el mantenimiento adecuado, la vida útil de la película y las ventajas en cuanto a costos es esencial para una mayor aceptación.

Dinámica del mercado de películas protectoras de pintura en América del Norte

Conductor

Aumento de la propiedad de vehículos y mayor concienciación sobre la protección exterior del vehículo

- El aumento de las ventas mundiales de vehículos está animando a los consumidores a invertir en PPF para mantener la estética del vehículo y evitar su depreciación. Campañas de concienciación, marketing de influencers y ferias automotrices han destacado los beneficios de protección a largo plazo, impulsando la demanda de los consumidores. El enfoque preventivo ahora se considera una inversión, no un servicio opcional.

- Los operadores de flotas, incluidas las empresas de alquiler de vehículos y de viajes compartidos, están adoptando cada vez más el PPF para reducir los costos de reparación y mantener la apariencia de la flota, lo que refleja una transición de prácticas de mantenimiento reactivo a preventivo. Minimizar el tiempo de inactividad de los vehículos y reducir los gastos operativos son factores clave que impulsan su adopción en toda la flota.

- Las regulaciones gubernamentales y los incentivos de seguros que respaldan las medidas de protección vehicular incentivan aún más la adopción de películas protectoras. Las políticas orientadas al impacto ambiental, la reducción de reparaciones y el mantenimiento de los vehículos promueven indirectamente el uso de PPF. El cumplimiento de estas normas también motiva a los operadores comerciales y propietarios particulares a adoptar PPF.

- Por ejemplo, las empresas que utilizan PPF en varios vehículos observaron ahorros significativos en costos gracias a la menor necesidad de repintado y reparación, lo que resalta la ventaja económica de las películas protectoras. El mantenimiento preventivo con PPF se ha convertido en una estrategia eficaz para preservar la estética y la eficiencia operativa de los vehículos.

- Si bien la creciente concienciación y el aumento de la propiedad de vehículos son factores clave, la expansión del mercado depende de que los servicios de instalación sean más accesibles y de que se promuevan soluciones de PPF asequibles y duraderas. La colaboración entre fabricantes, distribuidores y proveedores de servicios es crucial para ampliar la adopción.

Restricción/Desafío

Alto costo de películas premium y disponibilidad limitada de instaladores calificados

- El alto precio de las PPF avanzadas, incluidas las películas autorreparables y nanocerámicas, sigue siendo un obstáculo importante para los consumidores individuales y los pequeños concesionarios. Los altos costos suelen restringir su adopción en los segmentos de automóviles de lujo o flotas comerciales. La sensibilidad al precio entre los compradores con presupuesto limitado limita una mayor penetración en el mercado.

- La disponibilidad limitada de instaladores capacitados capaces de aplicar películas sin defectos plantea otro desafío. Una instalación incorrecta puede provocar burbujas, desprendimiento o una menor efectividad de la película, lo que disuade a los usuarios potenciales. La necesidad de programas de capacitación certificados y mano de obra cualificada sigue siendo crucial para una calidad constante.

- En muchas regiones, el acceso a productos PPF genuinos y películas de reemplazo es irregular debido a limitaciones en la cadena de suministro, productos falsificados y obstáculos logísticos, lo que afecta la penetración general del mercado. Los consumidores suelen posponer las compras hasta que se disponga de productos confiables e instaladores cualificados.

- Por ejemplo, los propietarios de vehículos informaron retrasos en la adopción de PPF debido a preocupaciones sobre la calidad de la instalación y la durabilidad de la película, lo que destaca la importancia de las redes de servicios profesionales. El crecimiento del mercado está estrechamente vinculado a la mejora de la disponibilidad del servicio y la experiencia de los instaladores.

- Mientras continúa la innovación en la durabilidad de las películas y sus propiedades de autorreparación, abordar las barreras de costo y expandir las redes de instalación especializada son cruciales para liberar un mayor potencial de mercado. Los fabricantes y proveedores de servicios deben centrarse en soluciones escalables, asequibles y confiables para llegar a un público más amplio.

Alcance del mercado de películas protectoras de pintura en América del Norte

El mercado está segmentado en función de la marca, el material, el sistema, el acabado, la aplicación y el usuario final.

- Por marca

Según la marca, el mercado norteamericano de películas protectoras de pintura se segmenta en Clear Bra, Clear Mask, Invisible Shield, Rock Chip Protection, Clear Wrap, Car Scratch Protection Film y otros. El segmento Clear Bra tuvo la mayor participación en los ingresos del mercado en 2025, impulsado por su presencia establecida, un fuerte reconocimiento de marca y películas duraderas de alta calidad. Los productos Clear Bra son ampliamente adoptados por propietarios de automóviles premium y centros de servicio por su protección duradera y facilidad de instalación. Su robusto rendimiento, compatibilidad con diferentes superficies de vehículos y amplia disponibilidad los convierten en la opción preferida de usuarios comerciales e individuales

Se prevé que el segmento de Protectores Invisibles experimente el mayor crecimiento entre 2026 y 2033, debido a la creciente demanda de películas autorreparadoras y antiamarilleo que conservan la estética del vehículo con un mantenimiento mínimo. La creciente concienciación sobre las tecnologías de protección avanzadas y sus beneficios para reducir los costes de repintado y reparación está impulsando su adopción tanto entre los propietarios de vehículos de lujo como entre los operadores de flotas.

- Por material

En cuanto a materiales, el mercado norteamericano de películas protectoras de pintura se segmenta en poliuretano, vinilo, cloruro de polivinilo y otros. El segmento de poliuretano registró la mayor participación en los ingresos del mercado en 2025, gracias a su superior flexibilidad, resistencia al impacto y transparencia, lo que lo hace ideal tanto para vehículos de lujo como para el mercado general. Su resistencia a arañazos, piedras y exposición a los rayos UV garantiza una protección a largo plazo, manteniendo la apariencia del vehículo. Las películas de poliuretano también son compatibles con diversas técnicas de aplicación, lo que aumenta su adopción entre instaladores profesionales y proveedores de servicios.

Se prevé que el segmento del vinilo experimente el mayor crecimiento entre 2026 y 2033, impulsado por su rentabilidad, facilidad de aplicación y creciente uso en flotas de vehículos y servicios posventa. Su ligereza y versatilidad lo hacen atractivo tanto para pequeñas empresas como para particulares que buscan soluciones de protección asequibles.

- Por sistema

Según el sistema, el mercado norteamericano de películas de protección de pintura se segmenta en sistemas a base de agua y sistemas a base de solventes. El segmento de sistemas a base de agua tuvo la mayor participación en los ingresos del mercado en 2025 debido a su fórmula ecológica, bajas emisiones de COV y cumplimiento de las estrictas regulaciones ambientales de Norteamérica. Es ampliamente preferido por los proveedores de servicios y propietarios de vehículos que buscan una protección ambientalmente responsable pero duradera. Los sistemas a base de agua también simplifican la instalación y proporcionan un rendimiento constante en diferentes superficies del vehículo

Se prevé que el segmento de sistemas a base de solventes registre el mayor crecimiento entre 2026 y 2033, gracias a su mayor adhesión, durabilidad e idoneidad para recubrimientos de alto rendimiento en vehículos premium y deportivos. Los sistemas a base de solventes ofrecen una resistencia química superior, lo que los hace ideales para aplicaciones de alto estrés en vehículos comerciales y particulares.

- Por acabado

En función del acabado, el mercado norteamericano de películas protectoras de pintura se segmenta en acabado mate, acabado brillante y otros. El segmento de acabado brillante tuvo la mayor participación en los ingresos del mercado en 2025, impulsado por su adopción generalizada en vehículos premium, que ofrecen una apariencia elegante a la vez que brindan una protección robusta. Las películas brillantes son las preferidas para mejorar la estética del vehículo y mantener la claridad de la superficie a lo largo del tiempo, lo que contribuye a una alta satisfacción del consumidor. También son compatibles con tecnologías de autorreparación, lo que aumenta aún más su demanda

Se prevé que el segmento de acabados mate experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente preferencia de los consumidores por la estética personalizada y la creciente popularidad de los vehículos con acabado mate en Norteamérica. Las películas mate ofrecen un atractivo visual único a la vez que ofrecen una protección eficaz de las superficies, especialmente para vehículos de lujo y alta gama.

- Por aplicación

Según su aplicación, el mercado norteamericano de películas protectoras de pintura se segmenta en: capó completo, borde delantero del capó, parachoques, paneles de guardabarros, espejos laterales pintados, cavidades de manijas de puertas, bordes de puertas, paneles inferiores, borde del maletero y otros. El segmento de capó completo registró la mayor participación en ingresos del mercado en 2025, gracias a su amplia cobertura de protección y a la demanda entre los vehículos de alta gama. Las aplicaciones de capó completo ofrecen la máxima protección contra rayones, impactos de piedras y daños ambientales, lo que las hace esenciales para la conservación del vehículo.

Se prevé que los segmentos de paneles de guardabarros y parachoques experimenten el mayor crecimiento entre 2026 y 2033 debido a la frecuente exposición a escombros en la carretera y colisiones menores, lo que aumenta la necesidad de soluciones de protección localizadas. Estas áreas son particularmente propensas a sufrir daños, y las aplicaciones de PPF ayudan a reducir los costos de mantenimiento y a prolongar la vida útil del vehículo.

- Por usuario final

En función del usuario final, el mercado de películas protectoras de pintura de América del Norte se segmenta en Automotriz, Aeroespacial y Defensa, Eléctrico y Electrónico, Petróleo y Gas, y Otros. El segmento Automotriz tuvo la mayor participación en los ingresos del mercado en 2025, impulsado por el aumento de las ventas de vehículos, el creciente enfoque del consumidor en la estética y la creciente demanda de vehículos premium y de lujo en América del Norte. Los propietarios de automóviles invierten cada vez más en soluciones de protección para conservar el valor de reventa y reducir los costos de mantenimiento a largo plazo

Se prevé que el segmento Aeroespacial y de Defensa experimente el mayor crecimiento entre 2026 y 2033, impulsado por la adopción de PPF para la resistencia a la corrosión, la protección de superficies y el mantenimiento de equipos de alto valor. PPF proporciona protección duradera contra factores ambientales, rayones y desgaste operativo, lo cual es fundamental para activos aeroespaciales y de defensa sensibles y costosos.

Análisis regional del mercado de películas protectoras de pintura en América del Norte

- Estados Unidos dominó el mercado de películas protectoras de pintura de América del Norte con la mayor participación en los ingresos en 2025, impulsado por el aumento de la propiedad de vehículos, la creciente demanda de automóviles premium y de lujo y la creciente conciencia de la estética de los vehículos.

- Los propietarios de vehículos valoran mucho las películas con propiedades autorreparadoras, resistentes a rayones y antiamarilleo que protegen el exterior y al mismo tiempo mantienen el valor de reventa.

- La adopción generalizada está respaldada por redes de servicio automotrices bien establecidas, avances tecnológicos en materiales de película y una fuerte preferencia de los consumidores por el mantenimiento preventivo, lo que hace de PPF una solución estándar tanto para vehículos personales como comerciales.

Perspectiva del mercado de películas protectoras de pintura de Canadá

Se prevé que el mercado canadiense de películas protectoras de pintura experimente su mayor crecimiento entre 2026 y 2033, impulsado por el aumento de las ventas de vehículos, la creciente adopción de vehículos de lujo y premium, y la creciente concienciación sobre las soluciones de cuidado preventivo. Los propietarios de vehículos priorizan cada vez más las películas protectoras de pintura (PPF) para proteger contra arañazos, residuos de la carretera y factores ambientales. La expansión de los servicios profesionales de instalación, la disponibilidad de películas autorreparadoras avanzadas y la apuesta por soluciones ecológicas contribuyen aún más al rápido crecimiento del mercado en la región.

Cuota de mercado de películas protectoras de pintura en América del Norte

La industria de películas protectoras de pintura de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- 3M Company (EE. UU.)

- XPEL, Inc. (EE. UU.)

- Eastman Chemical / LLumar (EE. UU.)

- Avery Dennison Corporation (EE. UU.)

- Sharpline Converting, Inc. (EE. UU.)

- SWM International / ArgoGuard (EE. UU.)

- Reflek Technologies Corporation (EE. UU.)

- OPTICSHIELD (EE. UU.)

- ClearPro (EE. UU.)

- PremiumShield (EE. UU.)

Últimos avances en el mercado de películas protectoras de pintura en Norteamérica

- En febrero de 2024, XPEL, Inc., empresa estadounidense, lanzó varios productos nuevos para la protección de activos, incluyendo su primera película protectora de parabrisas y nuevas incorporaciones a su línea de cuidado de superficies, con el objetivo de ampliar su cartera de productos y mejorar las soluciones de protección para vehículos. Se espera que las nuevas ofertas, disponibles a nivel mundial en el tercer trimestre de 2024, fortalezcan la presencia de XPEL en el mercado e impulsen la demanda en Norteamérica y otros mercados internacionales.

- En mayo de 2024, Tint World Automotive Styling Centers, una red de franquicias con sede en EE. UU., se asoció con XPEL para ofrecer películas y recubrimientos protectores premium en múltiples aplicaciones. Esta colaboración busca mejorar la oferta de servicios, ampliar las capacidades globales de las franquicias y estimular la adopción de películas protectoras avanzadas en Norteamérica y los mercados internacionales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.