North America Next Generation Anode Materials Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.59 Billion

USD

6.94 Billion

2025

2033

USD

2.59 Billion

USD

6.94 Billion

2025

2033

| 2026 –2033 | |

| USD 2.59 Billion | |

| USD 6.94 Billion | |

|

|

|

|

Mercado de materiales de ánodo de próxima generación de América del Norte, por material (mezclas de silicio/óxido de silicio, óxido de litio y titanio, fibra de silicio y carbono, grafeno de silicio, metal de litio y otros), aplicación (transporte, electricidad y electrónica, almacenamiento de energía y otros), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2028.

Análisis y perspectivas del mercado: mercado de materiales de ánodo de próxima generación en América del Norte

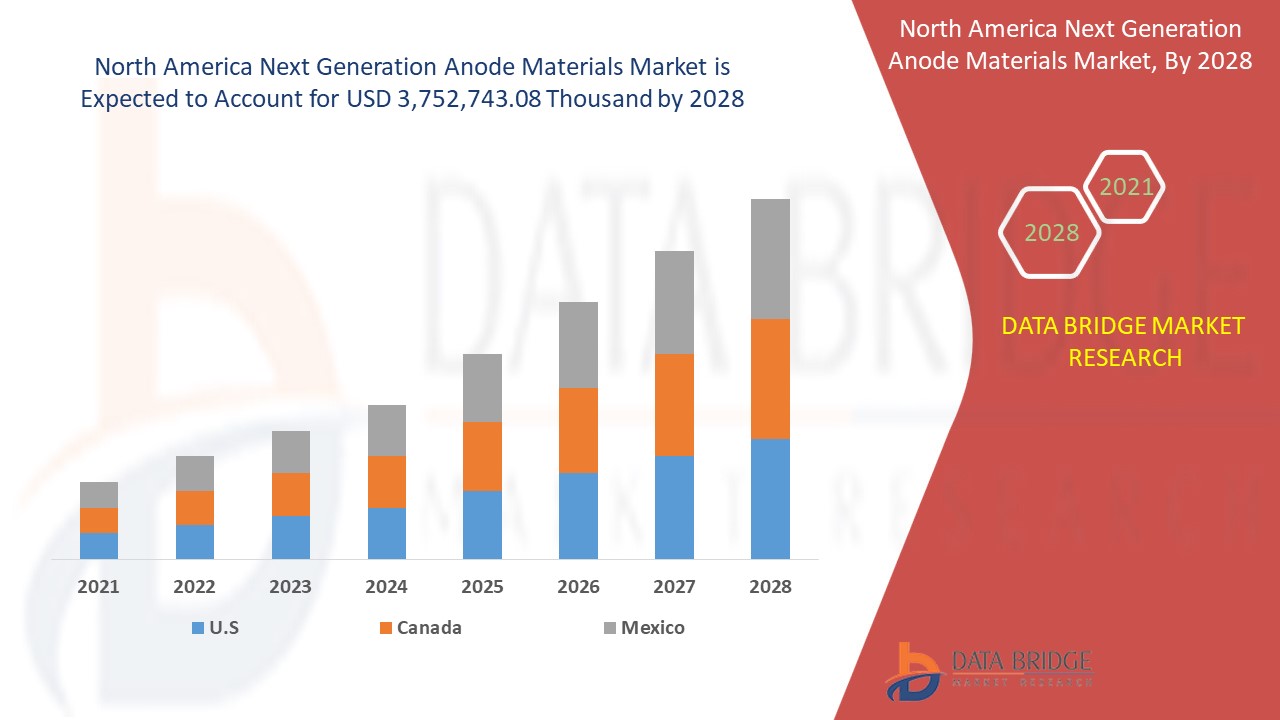

Se espera que el mercado de materiales de ánodo de próxima generación de América del Norte gane crecimiento de mercado en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 13,1% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 3.752.743,08 mil para 2028.

Los materiales del ánodo son los electrodos negativos de las baterías de iones de litio que funcionan en conjunto con los materiales del cátodo en una celda de iones de litio. Estos materiales del ánodo en las baterías de iones de litio funcionan como la horda, permitiendo la intercalación y desintercalación de iones de litio durante los ciclos de carga y descarga, y deben ser electroquímicamente activos hacia el proceso de oxidación deseado. Para ser adecuados para la fabricación de baterías de iones de litio, los materiales del ánodo deben poseer una excelente porosidad y deben ser buenos conductores de electricidad.

El aumento de la demanda de baterías de carga rápida ha tenido un impacto significativo en la expansión del mercado de materiales de ánodo de próxima generación. En consonancia con esto, el rápido aumento en el número de iniciativas de I+D para mejorar la química de las baterías y la demanda constante de baterías de iones de litio eficientes en vehículos eléctricos y otros dispositivos electrónicos de consumo , es un determinante clave que favorece el crecimiento del mercado de materiales de ánodo de próxima generación durante el período de pronóstico. Sin embargo, los diversos desafíos asociados con la producción de baterías de metal de litio y la incapacidad de producir grafeno de alta calidad a gran escala a bajo costo, pueden actuar como restricciones importantes en la tasa de crecimiento del mercado de materiales de ánodo de próxima generación.

El desarrollo de nuevos electrolitos para baterías de metal de litio puede actuar como una nueva vía de oportunidad para el mercado. Por el contrario, el rápido aumento y degradación de los ánodos de silicio podría desafiar el crecimiento del mercado de materiales para ánodos de próxima generación durante el período de pronóstico.

Este informe de mercado de materiales de ánodo de próxima generación proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de materiales para ánodos de próxima generación en América del Norte

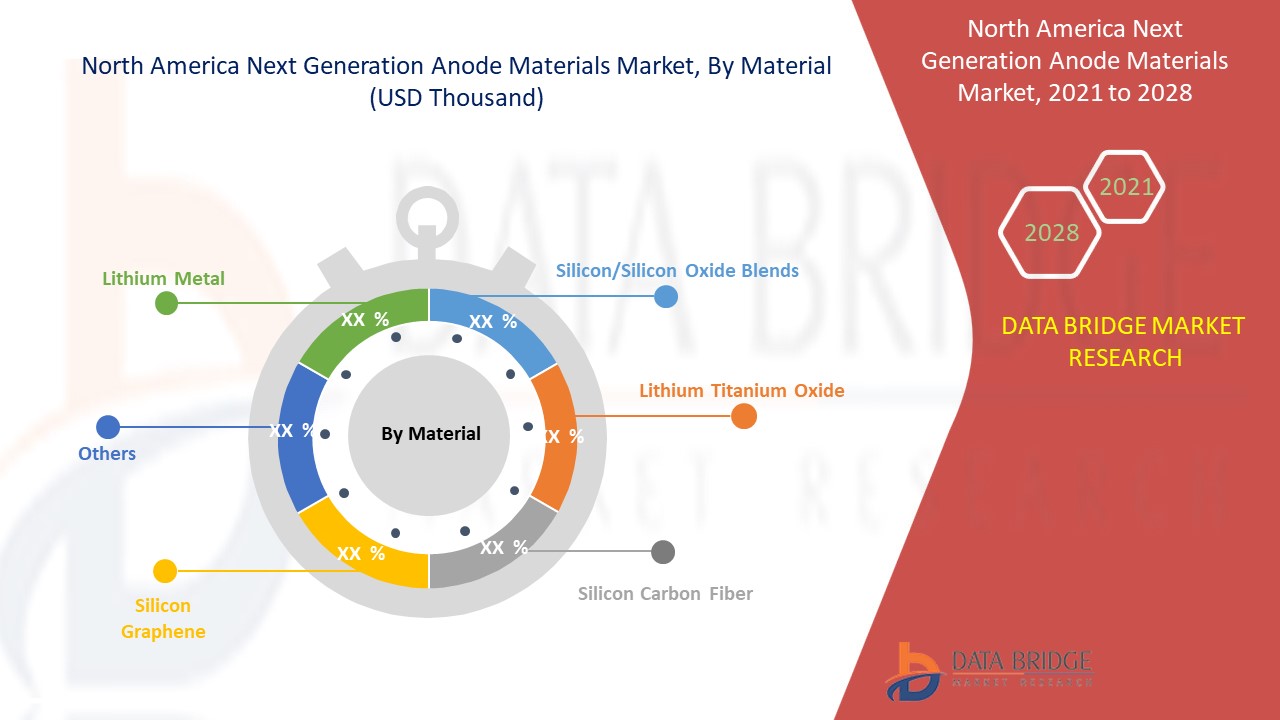

El mercado de materiales para ánodos de próxima generación de América del Norte está segmentado en dos segmentos notables, que se basan en el material y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función del material, el mercado de materiales para ánodos de próxima generación de América del Norte se segmenta en mezclas de silicio/óxido de silicio, óxido de litio y titanio, fibra de carbono de silicio, grafeno de silicio, litio metálico y otros. En 2021, en América del Norte, se espera que el segmento de mezclas de silicio/óxido de silicio domine el mercado, ya que las mezclas de silicio/óxido de silicio son muy ligeras y tienen un alto poder de resistencia, lo que aumenta su demanda en América del Norte.

- En función de la aplicación, el mercado de materiales de ánodo de próxima generación de América del Norte se segmenta en transporte, electricidad y electrónica, almacenamiento de energía y otros. Todos estos segmentos se subdividen a su vez en mezclas de silicio/óxido de silicio, óxido de litio y titanio, fibra de carbono de silicio, grafeno de silicio, litio metálico y otros. En 2021, se prevé que el transporte domine el mercado de materiales de ánodo de próxima generación de América del Norte, ya que los materiales de ánodo se utilizan principalmente en la producción de vehículos eléctricos, lo que aumenta su demanda en América del Norte.

Análisis a nivel de país del mercado de materiales para ánodos de próxima generación de América del Norte

El mercado de materiales de ánodo de próxima generación de América del Norte está segmentado en dos segmentos notables, que se basan en el material y la aplicación.

Los países incluidos en el informe sobre el mercado de materiales para ánodos de próxima generación de América del Norte son Estados Unidos, Canadá y México. Estados Unidos domina el mercado de América del Norte debido a la creciente popularidad de los vehículos eléctricos en la región.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Creciente necesidad de baterías de carga rápida

La carga rápida es una tecnología cada vez más común que permite cargar cualquier dispositivo en una fracción del tiempo que normalmente llevaría. Los cargadores con cable tradicionales no son los únicos que admiten una amplia gama de estándares y velocidades. La carga inalámbrica también está en auge, ofreciendo velocidades ultrarrápidas que superan las capacidades de carga por cable de la mayoría de los teléfonos. Las baterías de carga rápida tienen el potencial de revolucionar la adopción generalizada de vehículos eléctricos en la industria automotriz. La carga extremadamente rápida, con un tiempo de recarga objetivo de 15 minutos, está destinada a acelerar la adopción masiva de automóviles eléctricos, reducir las emisiones de gases de efecto invernadero y ofrecer una mejor seguridad energética al gobierno. Las baterías de iones de litio existentes utilizan grafito como un electrodo para impulsar los iones de litio hasta la carga de almacenamiento. Por lo tanto, se está desarrollando una emocionante competencia en todo el mundo para aumentar la cantidad y la potencia de las estaciones de carga rápida.

Además, los esfuerzos para mitigar los impactos del cambio climático y la contaminación del aire local han acelerado el desarrollo de automóviles eléctricos alimentados con baterías de iones de litio (Li-ion) en los últimos años, lo que resultó en una mayor demanda de baterías de carga rápida en la industria automotriz. Esto, a su vez, fomentó el crecimiento del mercado de materiales para ánodos de próxima generación en América del Norte.

Análisis del panorama competitivo y la cuota de mercado de los materiales de ánodo de próxima generación

El panorama competitivo del mercado de materiales de ánodo de próxima generación de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de materiales de ánodo de próxima generación de Asia-Pacífico.

Los principales actores del mercado involucrados en el mercado de materiales de ánodo de próxima generación de América del Norte son Amprius Technologies, Albemarle Corporation, Altairnano, California Lithium Battery, NANOGRAF CORPORATION, NEXEON LTD, Shanshan Technology, OneD BATTERY SCIENCES, pH Matter LLC, Sila Nanotechnologies Inc., Talga Group Ltd, JSR Corporation, SCT HK, Cuberg, Edgetech Industries LLC, Enevate Corporation, Enovix Corporation y Paraclete Energy, Inc. entre otros.

Por ejemplo,

- En julio de 2021, Talga Group Ltd inició una estrategia de crecimiento en los proyectos de grafito de Talga en Suecia con el objetivo de ampliar la base de recursos en medio de la creciente demanda de vehículos eléctricos y baterías. Esta expansión ha ayudado a la empresa a fortalecer su posición en América del Norte.

- En julio de 2021, JSR Corporation anunció la construcción de una nueva instalación de I+D, el centro de I+D de biociencia e informática de JSR (JSR BiRD), en King Skyfront, ciudad de Kawasaki, para aumentar la actividad de producción de su negocio de ciencias biológicas. La expansión ha ayudado a la empresa a crear nuevos negocios a través de las siguientes tres actividades:

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.