North America Minimally Invasive Surgery Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

25.78 Billion

USD

49.87 Billion

2025

2033

USD

25.78 Billion

USD

49.87 Billion

2025

2033

| 2026 –2033 | |

| USD 25.78 Billion | |

| USD 49.87 Billion | |

|

|

|

|

Segmentación del mercado de cirugía mínimamente invasiva en Norteamérica, por tipo de producto (dispositivos quirúrgicos, sistemas de monitorización y visualización, dispositivos de laparoscopia, equipos endoquirúrgicos y equipos electroquirúrgicos), aplicación (cirugía gastrointestinal, cirugía ginecológica, cirugía urológica, cirugía estética, cirugía torácica, cirugía vascular, cirugía ortopédica y de columna, cirugía bariátrica, cirugía de mama, cirugía cardíaca, cirugía de adrenalectomía, cirugía antirreflujo, cirugía oncológica, cirugía de colecistectomía, cirugía de colectomía, cirugía de colon y recto, cirugía de oído, nariz y garganta y cirugía de la obesidad), tecnología (cirugía transcatéter, cirugía laparoscópica, imágenes no visuales y robótica médica), usuarios finales (departamento de cirugía hospitalaria, pacientes de cirugía ambulatoria, consultorios grupales y cirujanos individuales): tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de cirugía mínimamente invasiva en América del Norte

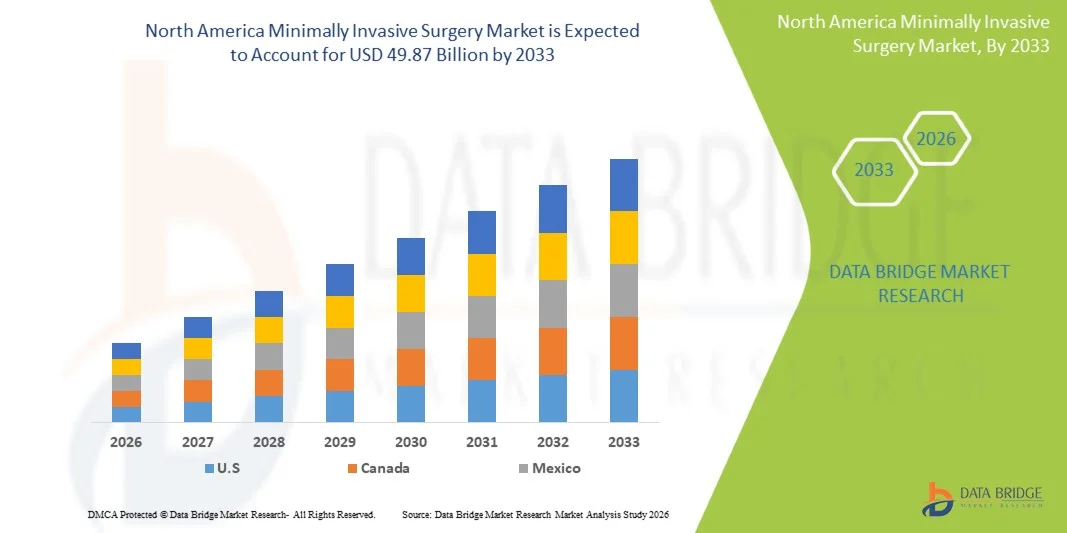

- El tamaño del mercado de cirugía mínimamente invasiva de América del Norte se valoró en USD 25,78 mil millones en 2025 y se espera que alcance los USD 49,87 mil millones para 2033 , con una CAGR del 8,60% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por los avances tecnológicos en instrumentos quirúrgicos , la creciente adopción de cirugías asistidas por robot y la creciente preferencia por procedimientos mínimamente invasivos debido al menor tiempo de recuperación y al menor riesgo de complicaciones.

- Además, la creciente concienciación de los pacientes, las políticas de reembolso favorables y la creciente demanda de procedimientos quirúrgicos ambulatorios contribuyen a la expansión de las cirugías mínimamente invasivas en hospitales y clínicas especializadas de la región. Estos factores, en conjunto, aceleran la adopción de soluciones MIS, impulsando así significativamente el crecimiento del sector.

Análisis del mercado de cirugía mínimamente invasiva en América del Norte

- La cirugía mínimamente invasiva en América del Norte, que abarca procedimientos realizados a través de pequeñas incisiones utilizando instrumentos especializados, endoscopios y sistemas robóticos, se está convirtiendo cada vez más en un estándar tanto en hospitales como en centros quirúrgicos ambulatorios debido a la recuperación más rápida del paciente, el menor riesgo de complicaciones y la mayor precisión quirúrgica.

- La creciente demanda de cirugía mínimamente invasiva está impulsada principalmente por los avances tecnológicos en robótica quirúrgica, dispositivos endoscópicos e instrumentos basados en energía, junto con la creciente conciencia de los pacientes y una creciente preferencia por procedimientos ambulatorios y en el mismo día.

- Estados Unidos dominó el mercado de cirugía mínimamente invasiva de América del Norte con la mayor participación en los ingresos del 78,7 % en 2025, caracterizado por la adopción temprana de tecnologías quirúrgicas avanzadas, un alto gasto en atención médica y una fuerte presencia de actores clave en dispositivos médicos, con procedimientos laparoscópicos y asistidos por robot que experimentaron un crecimiento sustancial, impulsados por innovaciones tanto de empresas médicas establecidas como de nuevas empresas centradas en herramientas quirúrgicas habilitadas por IA.

- Canadá está experimentando un crecimiento constante en el mercado de cirugía mínimamente invasiva en América del Norte, respaldado por el aumento de las inversiones en atención médica, las iniciativas gubernamentales que promueven los procedimientos mínimamente invasivos y la creciente preferencia de los pacientes por cirugías menos invasivas.

- El segmento de cirugía laparoscópica dominó el mercado de cirugía mínimamente invasiva de América del Norte con una participación de mercado del 45,9 % en 2025, impulsado por su eficacia clínica comprobada, rentabilidad y amplia aplicabilidad en procedimientos generales, ginecológicos y urológicos.

Alcance del informe y segmentación del mercado de cirugía mínimamente invasiva en América del Norte

|

Atributos |

Perspectivas clave del mercado de cirugía mínimamente invasiva en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de cirugía mínimamente invasiva en América del Norte

Creciente adopción de sistemas quirúrgicos asistidos por robot y basados en IA

- Una tendencia significativa y en aceleración en el mercado de cirugía mínimamente invasiva de América del Norte es la creciente adopción de sistemas quirúrgicos asistidos por robot y herramientas de planificación habilitadas por IA, que mejoran la precisión quirúrgica y la eficiencia de los procedimientos.

- Por ejemplo, el sistema quirúrgico da Vinci integra brazos robóticos con escala de movimiento asistida por IA, lo que permite a los cirujanos realizar procedimientos laparoscópicos complejos con mayor precisión y control.

- La integración de IA en MIS permite funciones como la planificación quirúrgica predictiva, la optimización de la trayectoria de los instrumentos y el análisis en tiempo real, lo que mejora los resultados del paciente y reduce el tiempo operatorio. Por ejemplo, algunas plataformas robóticas de Medtronic utilizan IA para proporcionar retroalimentación en tiempo real sobre la manipulación de tejidos y el posicionamiento de los instrumentos.

- La integración de MIS con imágenes digitales, sistemas de navegación y plataformas de IA facilita la planificación y el seguimiento quirúrgico centralizado, lo que permite flujos de trabajo coordinados en quirófanos.

- Esta tendencia hacia sistemas quirúrgicos inteligentes, precisos y tecnológicos está transformando radicalmente las expectativas de rendimiento hospitalario y atención al paciente. En consecuencia, empresas como Intuitive Surgical y Medtronic están desarrollando plataformas robóticas basadas en IA con visualización mejorada, retroalimentación háptica y automatización de procedimientos.

- La demanda de soluciones MIS asistidas por robot e integradas con IA está creciendo rápidamente en hospitales y centros quirúrgicos especializados, a medida que los proveedores de atención médica priorizan cada vez más la precisión, la eficiencia y la mejora de la recuperación del paciente.

- Las colaboraciones entre fabricantes de dispositivos médicos y desarrolladores de software para mejorar el flujo de trabajo de MIS e integrar análisis en tiempo real en los procedimientos quirúrgicos están acelerando aún más la innovación.

Dinámica del mercado de cirugía mínimamente invasiva en América del Norte

Conductor

“Creciente preferencia por procedimientos mínimamente invasivos y tecnologías quirúrgicas avanzadas”

- La creciente conciencia de los beneficios para los pacientes, como un menor tiempo de recuperación, menores riesgos de complicaciones y estadías hospitalarias más cortas, es un impulsor importante para la adopción de procedimientos MIS.

- Por ejemplo, en marzo de 2025, Intuitive Surgical informó una mayor adopción de sistemas da Vinci en los hospitales de EE. UU., lo que destaca la creciente demanda de cirugías asistidas por robot.

- Las crecientes inversiones en robótica quirúrgica, dispositivos endoscópicos avanzados e instrumentos basados en energía están permitiendo a los proveedores de atención médica ofrecer procedimientos MIS precisos y eficientes.

- Además, las políticas de reembolso favorables para procedimientos mínimamente invasivos y la creciente preferencia de los pacientes por las cirugías ambulatorias están haciendo que las soluciones MIS sean una opción preferida para hospitales y centros quirúrgicos.

- La creciente disponibilidad de herramientas de planificación basadas en IA, simuladores de capacitación y sistemas robóticos fáciles de usar impulsa aún más la adopción, lo que permite a los cirujanos ampliar sus capacidades y al mismo tiempo mejorar los resultados quirúrgicos.

- Las crecientes poblaciones geriátricas y la creciente prevalencia de enfermedades crónicas están impulsando la demanda de procedimientos MIS que reducen el trauma quirúrgico y mejoran la recuperación posoperatoria.

- La expansión de los programas de capacitación MIS y los centros de simulación para cirujanos está respaldando una adopción más rápida y una implementación más amplia en hospitales y clínicas especializadas.

Restricción/Desafío

“Altos costos y barreras para el cumplimiento normativo”

- La alta inversión inicial requerida para los sistemas MIS asistidos por robot e integrados con IA plantea un desafío importante para una penetración más amplia en el mercado, en particular para hospitales y clínicas más pequeños.

- Por ejemplo, los altos costos de las plataformas Da Vinci y Medtronic pueden retrasar su adopción en instalaciones con limitaciones presupuestarias a pesar de las claras ventajas clínicas.

- Los requisitos reglamentarios para la aprobación de dispositivos, la validación clínica y el cumplimiento de la seguridad agregan complejidad y tiempo de entrada al mercado para nuevas tecnologías MIS, lo que limita la rápida implementación.

- Además, la pronunciada curva de aprendizaje de los cirujanos y la necesidad de capacitación especializada pueden retrasar la adopción de plataformas MIS avanzadas.

- Superar estos desafíos mediante la optimización de costos, modelos de arrendamiento/alquiler, programas de capacitación de cirujanos y procesos regulatorios simplificados será crucial para el crecimiento sostenido en el mercado de cirugía mínimamente invasiva de América del Norte.

- El acceso limitado a sistemas MIS avanzados en hospitales rurales y de bajos recursos puede restringir el crecimiento del mercado a pesar de la creciente demanda general

- Las posibles fallas técnicas o complicaciones durante los procedimientos asistidos por robot pueden aumentar la indecisión entre los proveedores de atención médica, lo que enfatiza la necesidad de contar con servicios sólidos de soporte y mantenimiento.

Alcance del mercado de cirugía mínimamente invasiva en América del Norte

El mercado está segmentado según el tipo de producto, la aplicación, la tecnología y los usuarios finales.

- Por tipo de producto

Según el tipo de producto, el mercado norteamericano de cirugía mínimamente invasiva se segmenta en dispositivos quirúrgicos, sistemas de monitorización y visualización, dispositivos de laparoscopia, equipos endoquirúrgicos y equipos electroquirúrgicos. El segmento de Dispositivos Quirúrgicos dominó el mercado con la mayor participación en ingresos en 2025, impulsado por su amplio uso en múltiples procedimientos mínimamente invasivos, como cirugías laparoscópicas, torácicas y urológicas. Dispositivos quirúrgicos como trócares, pinzas de agarre y grapadoras son fundamentales para la manipulación precisa de tejidos y la eficiencia de los procedimientos. Los hospitales y centros quirúrgicos especializados priorizan los dispositivos quirúrgicos por su fiabilidad, eficacia clínica y compatibilidad con sistemas asistidos por robot. La demanda del mercado se ve respaldada además por las continuas innovaciones que mejoran la ergonomía y la funcionalidad. Además, los dispositivos quirúrgicos son esenciales para procedimientos MIS tanto rutinarios como complejos, lo que los convierte en un motor de ingresos clave para los fabricantes. Su integración con plataformas basadas en IA y sistemas robóticos mejora la precisión quirúrgica, impulsando su adopción en los centros sanitarios.

Se prevé que el segmento de Sistemas de Monitoreo y Visualización experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de endoscopia de alta definición, imágenes 3D y herramientas de monitoreo de pacientes en tiempo real. Estos sistemas brindan a los cirujanos una mejor visibilidad durante procedimientos complejos, mejorando la precisión y reduciendo las complicaciones. Los avances en la tecnología de imágenes y la integración de la realidad aumentada están expandiendo sus aplicaciones a cirugías gastrointestinales, ginecológicas y torácicas. Los hospitales dependen cada vez más de estos sistemas para respaldar los procedimientos asistidos por robot, proporcionando análisis en tiempo real y guía intraoperatoria. La creciente necesidad de soluciones mínimamente invasivas con menor riesgo operatorio impulsa aún más la demanda. Además, la integración con plataformas de IA permite obtener información predictiva y optimizar el flujo de trabajo, lo que hace que los sistemas de monitoreo y visualización sean indispensables en los quirófanos MIS modernos.

- Por aplicación

Sobre la base de la aplicación, el mercado de cirugía mínimamente invasiva de América del Norte está segmentado en cirugía gastrointestinal, cirugía ginecológica, cirugía urológica, cirugía estética, cirugía torácica, cirugía vascular, cirugía ortopédica y de columna, cirugía bariátrica, cirugía de mama , cirugía cardíaca, cirugía de adrenalectomía, cirugía antirreflujo, cirugía oncológica, cirugía de colecistectomía, cirugía de colectomía, cirugía de colon y recto, cirugía de oído, nariz y garganta, y cirugía de obesidad. El segmento de Cirugía Ginecológica dominó el mercado con la mayor participación en los ingresos en 2025, impulsado por la alta prevalencia de fibromas uterinos, endometriosis y trastornos ováricos que requieren intervención mínimamente invasiva. Los procedimientos laparoscópicos y asistidos por robot se han convertido en estándar en ginecología debido a una recuperación más rápida, cicatrices mínimas y hospitalización reducida. El segmento se beneficia de una fuerte adopción hospitalaria y políticas de reembolso favorables para procedimientos ambulatorios. Los cirujanos prefieren los enfoques MIS en ginecología por su precisión y menores tasas de complicaciones en comparación con las cirugías abiertas. Además, la concienciación de los pacientes y la demanda de opciones menos invasivas impulsan aún más su adopción. La innovación continua en instrumental quirúrgico ginecológico y sistemas de visualización refuerza su dominio en el mercado.

Se prevé que el segmento de Cirugía Bariátrica experimente el mayor crecimiento entre 2026 y 2033, impulsado por el aumento de las tasas de obesidad y la creciente demanda de cirugías para bajar de peso, como el bypass gástrico, la gastrectomía en manga y la banda gástrica ajustable. Hospitales y clínicas especializadas están ampliando sus programas bariátricos mínimamente invasivos para satisfacer la demanda de los pacientes. Los procedimientos asistidos por robot y laparoscópicos son los preferidos debido a la reducción de los tiempos de recuperación y los mejores resultados postoperatorios. Los avances tecnológicos en grapadoras e instrumental de energía mejoran la seguridad y la eficiencia de los procedimientos. El creciente énfasis en los procedimientos bariátricos ambulatorios también contribuye al crecimiento del segmento. Además, la preferencia de los pacientes por los enfoques mínimamente invasivos con menor trauma quirúrgico sigue impulsando la adopción en esta aplicación.

- Por tecnología

Sobre la base de la tecnología, el mercado de cirugía mínimamente invasiva de América del Norte está segmentado en cirugía transcatéter, cirugía laparoscópica, imágenes no visuales y robótica médica . El segmento de Cirugía Laparoscópica dominó el mercado con la mayor participación en los ingresos del 45,9% en 2025, impulsado por su uso establecido en procedimientos generales, urológicos, ginecológicos y gastrointestinales. La cirugía laparoscópica ofrece ventajas significativas, como incisiones más pequeñas, una recuperación más rápida y un menor riesgo de infección. Los hospitales adoptan ampliamente la laparoscopia debido a su eficacia clínica comprobada y su relación coste-eficacia en comparación con la cirugía abierta. La disponibilidad de instrumentos laparoscópicos avanzados, cámaras de alta definición y sistemas de guía habilitados para IA mejora aún más su adopción. Los cirujanos prefieren las técnicas laparoscópicas por su precisión, fiabilidad y versatilidad en múltiples procedimientos. Las continuas actualizaciones tecnológicas y la compatibilidad con sistemas robóticos fortalecen su dominio en el mercado.

Se prevé que el segmento de Robótica Médica experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente adopción de plataformas asistidas por robótica en hospitales y centros quirúrgicos especializados. La robótica mejora la precisión, reduce la fatiga del cirujano y permite realizar procedimientos complejos de forma mínimamente invasiva. La integración con sistemas de IA, imágenes y navegación permite una guía en tiempo real y mejores resultados quirúrgicos. Esta tendencia es especialmente fuerte en urología, ginecología y procedimientos cardíacos. La creciente inversión en plataformas robóticas y programas de formación impulsa su rápida adopción. Además, la demanda de los pacientes de tiempos de recuperación más cortos y enfoques mínimamente invasivos acelera el crecimiento de este segmento.

- Por los usuarios finales

En función de los usuarios finales, el mercado norteamericano de cirugía mínimamente invasiva se segmenta en departamentos quirúrgicos hospitalarios, pacientes de cirugía ambulatoria, consultorios grupales y cirujanos individuales. El segmento de Departamentos Quirúrgicos Hospitalarios dominó el mercado con la mayor participación en ingresos en 2025, impulsado por el alto volumen de procedimientos mínimamente invasivos realizados en entornos hospitalarios. Los hospitales invierten en dispositivos MIS avanzados, sistemas robóticos y plataformas de visualización para mejorar los resultados quirúrgicos y la eficiencia operativa. El segmento se beneficia de equipos quirúrgicos capacitados, infraestructura establecida y acceso a tecnologías especializadas. Además, la adopción hospitalaria se ve respaldada por políticas de reembolso y la preferencia de los pacientes por procedimientos mínimamente invasivos con una recuperación más rápida. Los hospitales también sirven como centros clave para ensayos clínicos y la adopción de nuevas innovaciones quirúrgicas, lo que refuerza su dominio. La colaboración continua entre hospitales y fabricantes de dispositivos médicos garantiza el acceso oportuno a soluciones MIS avanzadas.

Se prevé que el segmento de pacientes de cirugía ambulatoria experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de procedimientos ambulatorios y opciones mínimamente invasivas que reducen las estancias hospitalarias. Los centros de cirugía ambulatoria están cada vez más equipados con tecnologías laparoscópicas, robóticas y endoscópicas avanzadas. La creciente concienciación de los pacientes, la comodidad y el ahorro de costes impulsan la preferencia por los procedimientos ambulatorios de cirugía ambulatoria (MIS). La integración de soluciones de planificación y telemonitorización guiadas por IA mejora la seguridad del paciente y la eficiencia de los procedimientos. La expansión de los centros ambulatorios en zonas urbanas y semiurbanas impulsa aún más el crecimiento del segmento. Además, la cobertura de seguros y las políticas de reembolso favorables para los procedimientos ambulatorios aceleran la adopción por parte de los pacientes.

Análisis regional del mercado de cirugía mínimamente invasiva en América del Norte

- Estados Unidos dominó el mercado de cirugía mínimamente invasiva de América del Norte con la mayor participación en los ingresos del 78,7 % en 2025, caracterizado por la adopción temprana de tecnologías quirúrgicas avanzadas, un alto gasto en atención médica y una fuerte presencia de dispositivos médicos clave.

- Los hospitales y centros quirúrgicos de la región priorizan los sistemas quirúrgicos asistidos por robot, laparoscópicos y habilitados por IA debido a su eficacia clínica comprobada, tiempos de recuperación más rápidos y menor riesgo de complicaciones.

- Esta adopción generalizada está respaldada además por políticas de reembolso favorables, una amplia infraestructura de atención médica y la presencia de fabricantes líderes de dispositivos médicos, que establecen la cirugía mínimamente invasiva como un enfoque preferido en procedimientos quirúrgicos generales, ginecológicos, urológicos y especializados.

Perspectiva del mercado de cirugía mínimamente invasiva en EE. UU.

El mercado estadounidense de cirugía mínimamente invasiva captó la mayor participación en los ingresos, con un 78,7 %, en 2025, impulsado por la adopción temprana de tecnologías quirúrgicas avanzadas y la creciente preferencia de los pacientes por los procedimientos mínimamente invasivos. Los hospitales y centros de cirugía especializada están invirtiendo fuertemente en sistemas asistidos por robot, laparoscópicos y basados en IA para mejorar la precisión quirúrgica y reducir los tiempos de recuperación. La creciente tendencia a las cirugías ambulatorias y ambulatorias impulsa aún más el crecimiento del mercado. Además, la integración de la planificación asistida por IA y la monitorización en tiempo real en los procedimientos MIS está mejorando la eficiencia de los procedimientos. La creciente prevalencia de enfermedades crónicas y casos quirúrgicos complejos también impulsa la demanda. El apoyo gubernamental y las políticas de reembolso favorables fortalecen la adopción en los centros de salud.

Perspectiva del mercado canadiense de cirugía mínimamente invasiva

El mercado canadiense de cirugía mínimamente invasiva representó una participación de mercado del 15% en 2025, impulsado por el crecimiento de la infraestructura sanitaria y las iniciativas gubernamentales que apoyan los procedimientos mínimamente invasivos. Los hospitales implementan cada vez más sistemas laparoscópicos y asistidos por robot para mejorar los resultados quirúrgicos y reducir las estancias hospitalarias. La concienciación de los pacientes sobre la reducción de las complicaciones postoperatorias y una recuperación más rápida está impulsando aún más su adopción. El mercado se beneficia de los programas de formación avanzada para cirujanos y de la creciente inversión en tecnologías quirúrgicas asistidas por IA. Los hospitales públicos y privados están ampliando las capacidades de MIS en procedimientos gastrointestinales, urológicos y ginecológicos. La integración de los sistemas MIS con herramientas de imagenología digital y navegación es cada vez más frecuente en la práctica clínica.

Perspectiva del mercado de cirugía mínimamente invasiva en México

El mercado mexicano de cirugía mínimamente invasiva mantuvo una participación de mercado del 7% en 2025, impulsado por la adopción gradual de procedimientos mínimamente invasivos en hospitales privados y clínicas especializadas. El aumento del volumen quirúrgico y la concienciación sobre los beneficios para los pacientes, como la reducción de cicatrices y una recuperación más rápida, impulsan la demanda. Los hospitales están invirtiendo en dispositivos endoscópicos y laparoscópicos, mientras que se están introduciendo sistemas asistidos por robot en centros de salud urbanos. Las crecientes alianzas entre fabricantes de dispositivos médicos y proveedores de atención médica respaldan la implementación de tecnologías avanzadas de cirugía mínimamente invasiva (MIS). El mayor acceso a programas de capacitación para cirujanos y las políticas de salud favorables están impulsando aún más la adopción. Se espera que el mercado crezca de forma constante a medida que se expande la infraestructura de salud urbana y más pacientes buscan procedimientos ambulatorios de MIS.

Cuota de mercado de cirugía mínimamente invasiva en América del Norte

La industria de cirugía mínimamente invasiva de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Medtronic (Irlanda)

- Olympus Corporation (Japón)

- Siemens Healthineers AG (Alemania)

- GE Healthcare (EE. UU.)

- Abbott (EE. UU.)

- Intuitive Surgical (EE. UU.)

- Smith & Nephew (Reino Unido)

- Stryker (EE. UU.)

- Zimmer Biomet (EE. UU.)

- Boston Scientific Corporation (EE. UU.)

- Cook (EE.UU.)

- B. Braun SE (Alemania)

- Corporación CONMED (EE. UU.)

- Karl Storz SE & Co. KG (Alemania)

- Renishaw plc (Reino Unido)

- Distalmotion (Suiza)

- CMR Surgical (Reino Unido)

- Think Surgical (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de cirugía mínimamente invasiva en América del Norte?

- En octubre de 2025, Zimmer Biomet completó la adquisición de Monogram Technologies, agregando tecnologías quirúrgicas robóticas semiautónomas y totalmente autónomas (incluido un robot TKA basado en TC aprobado por la FDA) a su cartera de robótica y señalando una expansión estratégica en soluciones MIS impulsadas por IA.

- En julio de 2025, la plataforma Maestro de Moon Surgical, una solución robótica MIS con "IA física", recibió la autorización 510(k) de la FDA junto con una conectividad mejorada (Wi-Fi/5G) y conocimientos basados en la nube, lo que demuestra innovación en robótica MIS colaborativa y rentable.

- En mayo de 2025, Intuitive Surgical anunció la aprobación de la FDA para su sistema da Vinci Single Port para indicaciones mínimamente invasivas adicionales, ampliando las capacidades de procedimiento de la plataforma robótica y apoyando una adopción más amplia de la cirugía robótica de puerto único.

- En marzo de 2025, los cirujanos del Baylor St. Luke's Medical Center en Houston realizaron el primer trasplante de corazón totalmente robótico en los Estados Unidos, utilizando una técnica mínimamente invasiva con sistemas robóticos a través de pequeñas incisiones, reduciendo los riesgos de infección y el tiempo de recuperación en comparación con los procedimientos abiertos tradicionales.

- En marzo de 2024, el sistema quirúrgico robótico da Vinci 5 de Intuitive Surgical recibió la autorización 510(k) de la FDA de EE. UU., lo que marca un avance significativo del producto para cirugías mínimamente invasivas asistidas por robot multipuerto con precisión mejorada y nuevas funciones.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.