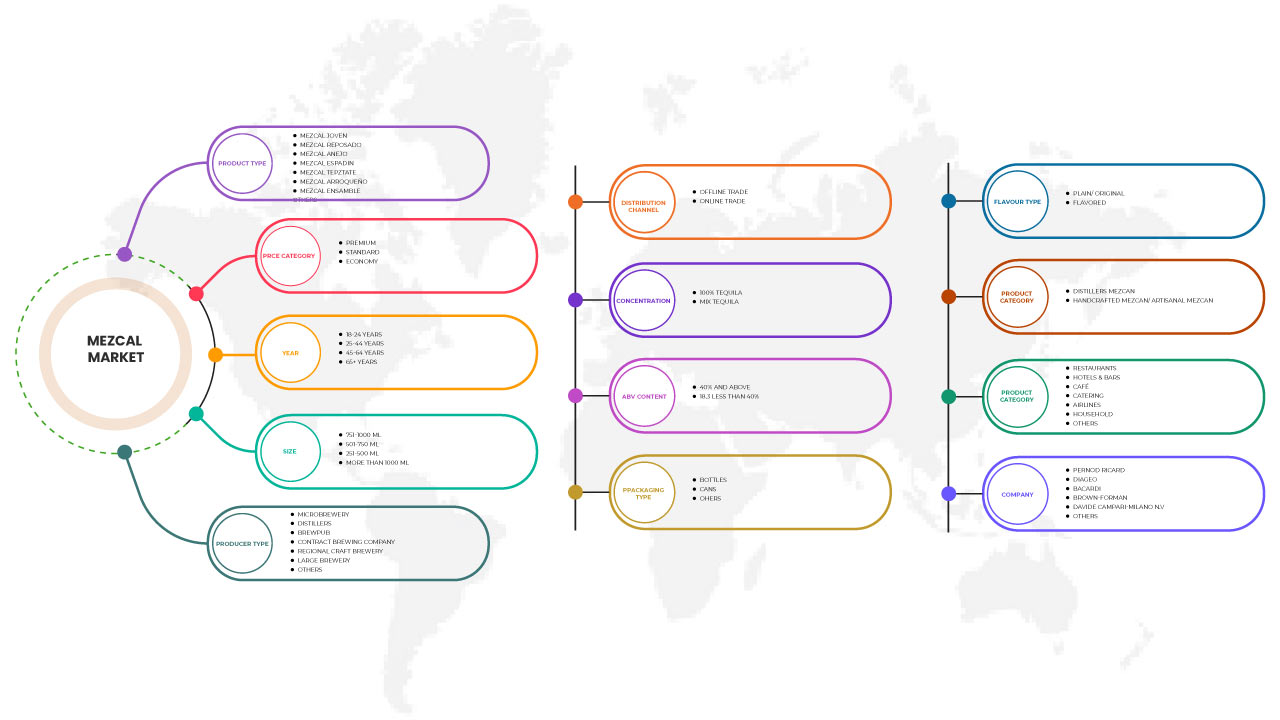

Mercado de mezcal en América del Norte, por tipo de producto (mezcal joven, mezcal reposado, mezcal añejo, mezcal espadín, mezcal tepztate, mezcal arroqueño, mezcal ensamble y otros), concentrado (tequila 100 % y tequila mixto), categoría de precio (premium, estándar y económico), contenido de alcohol (40 % o más y menos de 40 %), año (18-24, 25-44, 45-64, 65+), tipo de empaque (botella, latas y otros), tamaño (251-500 ml, 501-750 ml, 751-1000 ml y más de 100 ml), tipo de sabor (simple/original y saborizado), tipo de productor (microcervecería, destiladores, cervecerías artesanales, empresas cerveceras por contrato, cervecerías artesanales regionales, cervecerías grandes y otros), categoría de producto (destiladores de mezcal) y Mezcan Artesanal/Mezcan Artesanal), Usuario Final (Restaurantes, Hoteles y Bares, Cafés, Catering, Aerolíneas, Hogares y otros), Canal de Distribución (Comercio Offline y Comercio Online) - Tendencias de la Industria y Pronóstico hasta 2029.

Análisis y tamaño del mercado del mezcal en América del Norte

La creciente demanda de la bebida de mezcal por parte de los consumidores, las perspectivas positivas hacia las soluciones de envasado avanzadas e inteligentes y el aumento en el número de unidades de producción están impulsando la demanda del mercado del mezcal en el período de pronóstico. Sin embargo, se espera que los altos impuestos y aranceles y las estrictas normas y regulaciones obstaculicen el crecimiento del mercado del mezcal en el período de pronóstico.

La creciente iniciativa de las empresas para expandir sus negocios a nivel mundial conducirá al crecimiento del mercado.

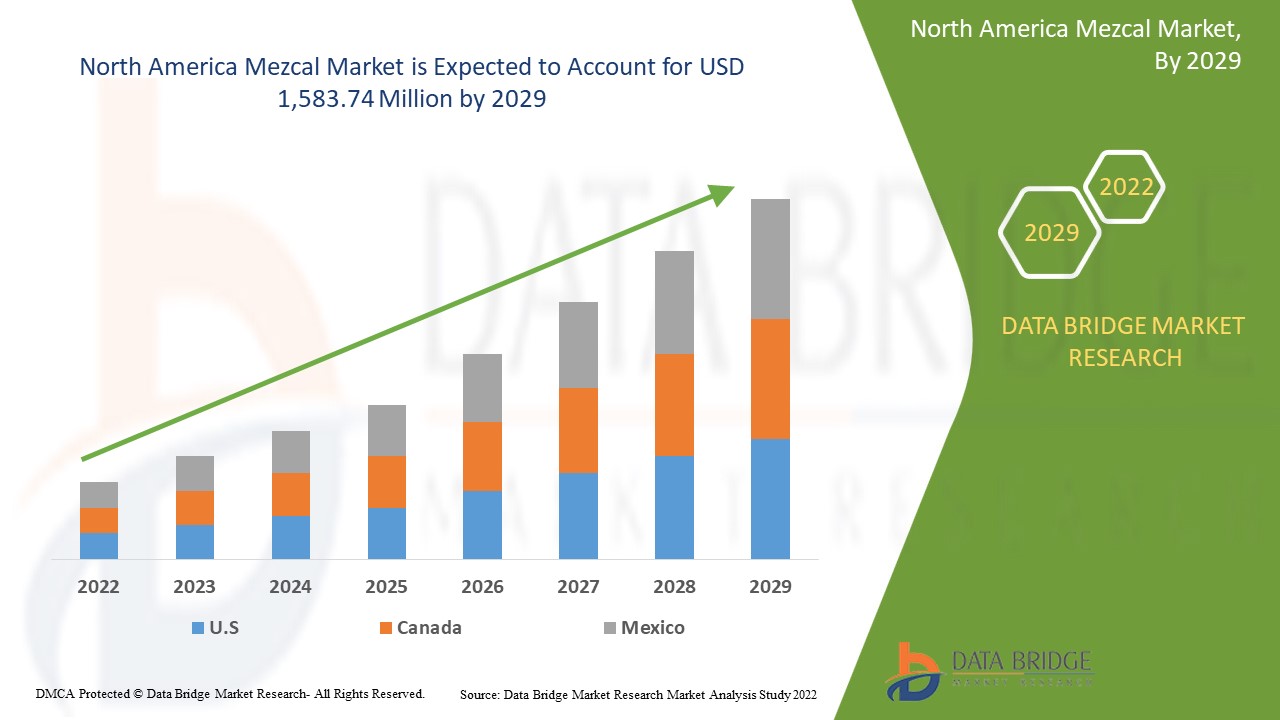

Data Bridge Market Research analiza que se espera que el mercado de mezcal de América del Norte alcance un valor de USD 1.583,74 millones para 2029, con una CAGR del 26,0% durante el período de pronóstico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Año histórico |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en millones de unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de producto (Mezcal Joven, Mezcal Reposado, Mezcal Añejo, Mezcal Espadín, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble y otros), Concentrado (100% Tequila y Tequila Mixto), Categoría de Precio (Premium, Estándar y Económico), Contenido de ABV (40% y más y menos de 40%), Año (18-24, 25-44, 45-64, 65+), Tipo de Empaque (Botella, Latas y Otros), Tamaño (251-500 ml, 501-750 ml, 751-1000 ml y más de 100 ml), Tipo de Sabor (Simple/Original y Saborizado), Tipo de Productor (Microcervecería, Destiladores, Brewpub, Compañía Cervecera Contratada, Cervecería Artesanal Regional, Cervecería Grande y Otros), Categoría de Producto (Destiladores Mezcan y Artesanales) Mezcan/Mezcan Artesanal), Usuario Final (Restaurantes, Hoteles y Bares, Cafés, Catering, Aerolíneas, Hogares y otros), Canal de Distribución (Comercio Offline y Comercio Online) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Davide Campari-Milano NV, BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown‑Forman, Diageo, Pernod Ricard, Rey Campero, Tequila & Mezcal Private Brands SA de CV, Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Empresa Importadora, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL Sombra , Pensador Mezcal, Ilegal Mezcal |

Definición de mercado

Mezcal es el nombre que se le da a las bebidas alcohólicas destiladas tradicionales que se elaboran en diversas zonas rurales de México, desde ciertos estados del norte hasta los del sur, cuyo náhuatl es mexcalli "agave cocido". Estas bebidas alcohólicas se elaboran a partir de los tallos cocidos de especies del género Agave, también conocidas como "maguey", que tienen azúcares fermentadas. Es una bebida destilada tradicional mexicana producida a partir de los jugos fermentados del núcleo cocido de la planta de agave.

Las diferentes especies de agave utilizadas, que tienen una amplia variedad de compuestos terpénicos, la capacidad de utilizar hojas de agave en la fermentación del mezcal, las variaciones en la etapa de maduración del agave, la cocción del agave que se puede hacer en agujeros en el suelo con madera encendida y piedras calentadas que producen furanos y volátiles ahumados y se retienen en el agave, y algunas hierbas u otros materiales naturales (como gusanos) pueden contribuir a las diferencias de sabor entre el mezcal.

Dinámica del mercado de Mazel

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores:

- DISPONIBILIDAD DE VARIEDAD DE SABORES EN MEZCAL

La calidad y autenticidad del mezcal son muy importantes debido al sabor alcohólico único de la bebida, que resulta de los compuestos volátiles y no volátiles, cuyos precursores directos provienen del propio agave crudo. Estos incluyen ácidos grasos , que van desde el cáprico al lignocérico, ácidos grasos libres, β-sitosterol y grupos de mono-, di- y triacilgliceroles, así como fructanos, el principal carbohidrato del agave. Debido a las temperaturas más altas y un pH más bajo en el proceso de cocción del agave, los fructanos podrían formar compuestos de Maillard, como furanos, piranos y cetonas.

Además, el parámetro importante que define la calidad de las bebidas de agave es el sistema de destilación utilizado. La composición del aroma del mezcal es extremadamente compleja. Las similitudes y diferencias entre las muestras de mezcal pueden atribuirse a las condiciones y las materias primas utilizadas, además del origen y la temporada de producción.

Por ejemplo,

- En todo México crecen diversas variedades de agave, y cada planta o maguey adopta el terroir del microclima en el que crece, lo que influye en el sabor del mezcal. Por ello, los aguardientes de agave más famosos de México son los mezcales, que pueden elaborarse a partir de cualquier especie de agave, lo que da como resultado una amplia variedad de sabores. La denominación de origen del mezcal incluye los estados de Oaxaca, Guerrero, Zacatecas, Guanajuato, Tamaulipas, San Luis Potosí, Durango y Michoacán.

- Según el escritor de bebidas espirituosas Chris Tunstall, las variedades más comunes de agave utilizadas para el mezcal son tobalá, tobaziche, tepeztate, arroqueño y espadín, que es el agave más común y representa hasta el 90% del mezcal. Los dos tipos de mezcal están hechos de 100% de agave y se mezclan con otros ingredientes, con aproximadamente un 80% de agave.

Debido a la disponibilidad de varios sabores en el mezcal, los consumidores lo prefieren sobre otros licores artesanales. Además, se espera que el creciente interés de los consumidores por los productos de origen ético y la tendencia a promover bebidas como la cerveza artesanal, los jugos prensados en frío y los batidos con ingredientes naturales como premium impulsen el crecimiento del mercado en el período de pronóstico.

- PERSPECTIVA POSITIVA HACIA SOLUCIONES DE EMBALAJE AVANZADAS E INTELIGENTES

La industria del envasado de vino está adoptando soluciones inteligentes y sostenibles para que los envases de los productos estén más orientados al consumidor y sean más respetuosos con el medio ambiente. La premiumización hace que una marca o un producto resulten más atractivos para los consumidores al destacar su calidad superior y su exclusividad en la categoría de bebidas a base de agave, lo que hace que una marca sea más atractiva y, por lo tanto, más cara. Esto puede deberse a nuevos envases, producción artesanal, ingredientes de mayor calidad, nuevos sabores y mensajes sociales y medioambientales.

Además, los envases impresos digitalmente ofrecen un considerable ahorro potencial en comparación con otros procesos de impresión y bajos costos de instalación. Los fabricantes pueden prescindir de pedidos al por mayor con grandes tiradas de impresión y almacenamiento de existencias. Las empresas de diseño de marcas populares prefieren botellas de vidrio para el envasado de mezcal. Los beneficios de la impresión digital son esenciales para el sector del envasado actual. La impresión digital es el proceso ideal para tiradas de impresión pequeñas y medianas y permite la creación de impresiones personalizadas para envases y expositores. Además, la mayor parte del mezcal disponible en línea se envasa en botellas de vidrio.

Por ejemplo,

- En abril de 2018, TagItWine, una nueva empresa productora de vino, lanzó una nueva aplicación para brindarles a los consumidores la información necesaria para realizar una compra de vino informada, con la esperanza de que el consumidor encuentre la bebida perfecta para su paladar único. Para usar esta aplicación, los consumidores simplemente deben escanear el código de barras de una botella. Luego, la aplicación ofrecerá los orígenes del vino, incluida la ubicación y la subregión del viñedo, el embotellador y el distribuidor. Los datos también ayudan a la aplicación a recopilar lo que se vende dentro de las tiendas para ayudar a las empresas a comprender mejor sus mercados objetivo.

Por lo tanto, debido a los lanzamientos y desarrollos de nuevos productos, se espera que un aumento en la demanda de envases avanzados e inteligentes actúe como impulsor del mercado de mezcal de América del Norte.

Oportunidad

- AUMENTO DE CLIENTES PARA PRODUCTOS DE MEZCAL

El rápido aumento de la conciencia pública sobre las ventajas para la salud de estos bienes y servicios es en gran medida responsable de la expansión del mercado. Otra razón importante que impulsa la expansión del mercado es la conciencia de las personas sobre sus preocupaciones por los problemas ambientales, las preocupaciones sobre esos problemas y los riesgos para la salud asociados con el consumo de sustancias químicas sucias e inorgánicas. Los productos orgánicos del mercado se utilizan para abordar problemas de salud.

Los cambios en los hábitos alimentarios y de estilo de vida de las personas en todo el mundo están presionando a los actores clave del mercado para que produzcan los mismos productos y desarrollen una base de clientes confiable y satisfecha durante el período de evaluación. La producción está en marcha y está aprovechando la creciente inversión en disponibilidad y lanzamientos de productos en el mercado mundial de manera brillante para aumentar la demanda de productos de mezcal durante el período de evaluación.

Restricciones/Desafíos

- LA CRECIENTE POPULARIDAD DEL CONSUMO DE BEBIDAS SALUDABLES Y SIN ALCOHOL

Una de las industrias que se está desarrollando con mayor rapidez es la de las bebidas, que implica la elaboración de diversas bebidas como el mezcal. Se prevé que la creciente conciencia de los consumidores sobre el uso de componentes naturales y orgánicos en los alimentos y las bebidas suponga un reto para la tasa de crecimiento de la industria del mezcal en el futuro.

Muchos alimentos y bebidas fermentadas contienen carbamato de etilo (EC), un carcinógeno genotóxico conocido. El carbamato de etilo no solo es cancerígeno, sino también un agente tóxico para el hígado en humanos. Además, el consumo de bebidas carbonatadas se ha relacionado con cálculos renales, todos ellos factores de riesgo de enfermedad renal crónica. El creciente número de enfermedades hepáticas y renales crónicas hace que los consumidores sean conscientes de la importancia de beber de forma saludable. Hoy en día, la gente prefiere más bebidas no alcohólicas debido a estas afecciones de salud.

Así, el aumento de las enfermedades crónicas está concienciando a los consumidores sobre el uso de bebidas no alcohólicas, y esto puede actuar como un desafío para el crecimiento del mercado.

Acontecimientos recientes

- En septiembre de 2022, Pernod Ricard anunció la creación de una nueva unidad de negocios como parte de su estrategia Transform & Accelerate para ampliar y expandir geográficamente su negocio directo al consumidor y B2B de nicho.

Alcance del mercado de Mazel en América del Norte

El mercado del mezcal en América del Norte está segmentado en base a doce segmentos notables, que se basan en el tipo de producto, concentrado, categoría de precio, contenido de alcohol, año, tipo de empaque, tamaño, tipo de sabor, tipo de productor, categoría de producto, usuario final y canal de distribución. El crecimiento entre estos segmentos lo ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Mezcal Joven

- Mezcal reposado

- Mezcal Añejo

- Mezcal Espadín

- Tepztate de mezcal

- Mezcal Arroqueño

- Ensamble de mezcal

- Otros

Sobre la base del tipo de producto, el mercado de mezcal de América del Norte se segmenta además en mezcal joven, mezcal reposado, mezcal añejo, mezcal espadín, mezcal tepztate, mezcal arroqueño, mezcal ensamble y otros.

Concentración

- 100% tequila

- Mezclar tequila

Sobre la base del concentrado, el mercado de mezcal de América del Norte está segmentado en tequila 100% y tequila mixto.

Categoría de precio

- De primera calidad

- Estándar

- Economía

Según la categoría de precio, el mercado de mezcal de América del Norte está segmentado en premium, estándar y económico.

Contenido ABV

- 40% y más

- Menos del 40%

Sobre la base del contenido de alcohol en volumen, el mercado de mezcal de América del Norte está segmentado en 40% y más y menos del 40%.

. Año

- 18-24 años

- 25-44 años

- 45-64 años

- 65+ años

Según el año, el mercado de mezcal de América del Norte se segmenta en 18-24 años, 25-44 años, 45-64 años y 65+ años.

Tipo de embalaje

- Botella

- Latas

- Otros

Según el tipo de empaque, el mercado de mezcal de América del Norte está segmentado en botellas, latas y otros.

Tamaño

- Menos de 250 ml

- 251-500 ml

- 501-750 ml

- 751-1000 ml

- Más de 1000 ml

En función del tamaño, el mercado de mezcal de América del Norte está segmentado en menos de 250 ml, 251-500 ml, 501-750 ml, 751-1000 ml, más de 1000 ml.

Tipo de sabor

- Sencillo/Original

- Sazonado

En función del sabor, el mercado de mezcal de América del Norte se segmenta en simple/original, con sabor

Tipo de productor

- Microcervecería

- Destiladores

- Cervecería

- Empresa cervecera por contrato

- Cervecería artesanal regional

- Gran cervecería

- Otros

Según el tipo de productor, el mercado de mezcal de América del Norte está segmentado en microcervecerías, destiladores, cervecerías, empresas cerveceras contratadas, cervecerías artesanales regionales, grandes cervecerías y otras.

Categoría de producto

- Destiladores Mezcan

- Mezcan artesanal/Mezcan artesanal

Sobre la base de la categoría de producto, el mercado de mezcal de América del Norte está segmentado en mezcan de destilería y mezcan artesanal/mezcan artesanal.

Usuario final

- Restaurantes

- Hoteles y bares

- Cafetería

- Abastecimiento

- Aerolíneas

- Familiar

- Otros

Sobre la base del usuario final, el mercado de mezcal de América del Norte está segmentado en restaurantes, hoteles, bares, cafés, servicios de catering, aerolíneas, hogares y otros.

Canal de distribución

- Comercio fuera de línea

- Comercio en línea

Sobre la base del canal de distribución, el mercado de mezcal de América del Norte está segmentado en comercio fuera de línea y comercio en línea.

Análisis y perspectivas regionales del mercado del mezcal en América del Norte

Se analiza el mercado de mezcal de América del Norte y se proporcionan información y tendencias sobre el tamaño del mercado por país, tipo de producto, concentrado, categoría de precio, contenido de ABV, año, tipo de empaque, tamaño, tipo de sabor, tipo de productor, categoría de producto, usuario final, canal de distribución como se menciona anteriormente.

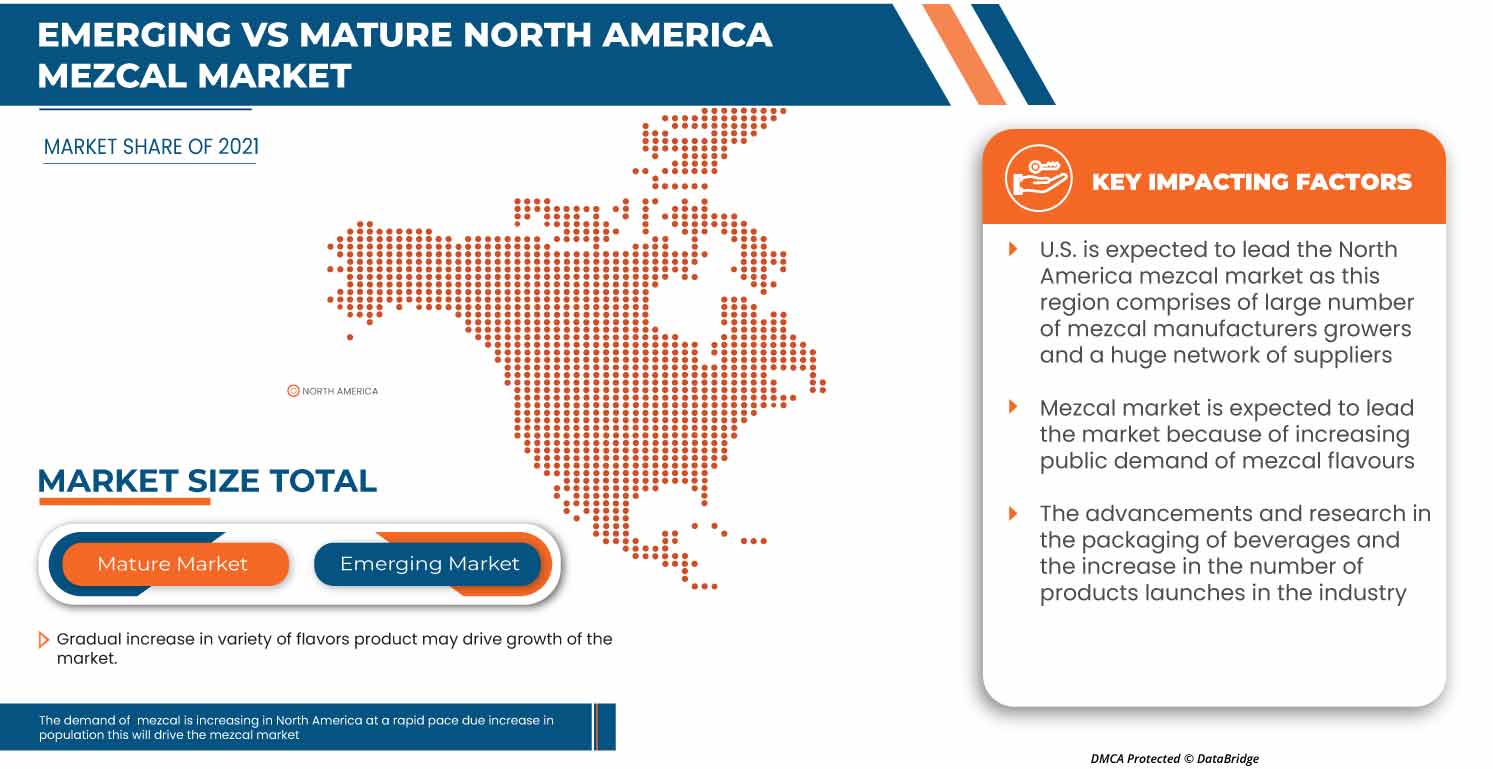

Los países cubiertos en el informe del mercado de mezcal de América del Norte son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado del mezcal debido a la perspectiva positiva hacia soluciones de envasado avanzadas e inteligentes.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y la participación de mercado del mezcal

El panorama competitivo del mercado del mezcal en América del Norte ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado del mezcal en América del Norte.

Las principales empresas que operan en el mercado del mezcal de América del Norte son Davide Campari-Milano NV, BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown‑Forman, Diageo, Pernod Ricard, Rey Campero, Tequila & Mezcal Private Brands SA de CV. , Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL Sombra, Pensador Mezcal, Ilegal Mezcal entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA MEZCAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGY OPTED BY MICROBREWERIES

4.1.1 CREATING CUSTOM PACKAGING

4.1.2 PROVIDING BUSINESS PERSPECTIVES

4.1.3 SOCIAL MEDIA USE

4.1.4 DESIGNING CUSTOMER LOYALTY INITIATIVES

4.1.5 GETTING INVOLVED WITH THE COMMUNITY

4.2 KEY TRENDS SCENARIO

4.2.1 PREMIUMISATION

4.2.2 VALUE FOR MONEY

4.2.3 HEALTH AND WELL BEING

4.2.4 CONSUMER AWARENESS

4.2.5 PRODUCT INNOVATION

4.2.6 AVAILABILITY OF LOCAL PRODUCTS

4.2.7 OTHERS

4.3 FACTORS INFLUENCING PURCHASE DECISION

4.4 KEY DEMOGRAPHIC CONSUMER BASE INCLUDE

4.5 PRICE ANALYSIS

4.6 PROMOTIONAL ACTIVITIES ADOPTED BY KEY MARKET PLAYERS

4.7 PRIVATE LABEL VS BRAND LABEL

4.8 TAXATION AND DUTY LEVIES

5 SUPPLY CHAIN OF NORTH AMERICA MEZCAL MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

5.5 LOGISTIC COST SCENARIO

5.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

6 NORTH AMERICA MEZCAL MARKET: SHOPPING BEHAVIOUR

6.1 RECOMMENDATIONS FROM FAMILY & FRIENDS

6.2 RESEARCH

6.3 IMPULSIVE

6.4 ADVERTISEMENT

6.4.1 TELEVISION ADVERTISEMENT

6.4.2 ONLINE ADVERTISEMENT

6.4.3 IN-STORE ADVERTISEMENT

7 NORTH AMERICA MEZCAL MARKET: REGULATIONS

7.1 REGULATION IN U.S

8 NORTH AMERICA MEZCAL MARKET, NEW PRODUCT LAUNCH STRATEGY

8.1 OVERVIEW

8.2 NUMBER OF PRODUCT LAUNCHES

8.2.1 LINE EXTENSION

8.2.2 NEW PACKAGING

8.2.3 RE-LAUNCHED

8.2.4 NEW FORMULATION

8.3 DIFFERENTIAL PRODUCT OFFERING

8.4 MEETING CONSUMER REQUIREMENT

8.5 PACKAGE DESIGNING

8.6 PRICING ANALYSIS

8.7 PRODUCT POSITIONING

8.8 CONCLUSION

9 NORTH AMERICA MEZCAL MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

9.1 OVERVIEW

9.2 SOCIAL FACTORS

9.3 CULTURAL FACTORS

9.4 PSYCHOLOGICAL FACTORS

9.5 PERSONAL FACTORS

9.6 ECONOMIC FACTORS

9.7 PRODUCT TRAITS

9.8 MARKET ATTRIBUTES

9.9 NORTH AMERICA CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

9.1 CONCLUSION

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

10.1.2 RISING TECHNOLOGICAL INNOVATIONS FOR SPIRIT PRODUCTION

10.1.3 POSITIVE OUTLOOK TOWARDS ADVANCED AND SMART PACKAGING SOLUTIONS

10.1.4 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS NORTH AMERICALY

10.2 RESTRAINTS

10.2.1 HEAVY TAXATION AND DUTIES

10.2.2 STRINGENT RULES AND REGULATIONS

10.3 OPPORTUNITIES

10.3.1 GROWING POPULARITY OF PREMIUM AND LUXURY BEVERAGES

10.3.2 INCREASING CUSTOMERS FOR MEZCAL PRODUCTS

10.3.3 INCREASED AVAILABILITY OF MEZCAL ON E-COMMERCE PLATFORMS

10.4 CHALLENGES

10.4.1 RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

10.4.2 HIGH COST OF MEZCAL

11 NORTH AMERICA MEZCAL MARKET, BY PRODUCT TYPE

11.1 OVERVIEW

11.2 MEZCAL ESPADIN

11.2.1 BY CONCENTRATION

11.2.1.1 100% TEQUILA

11.2.1.2 MIX TEQUILA

11.2.2 BY ABV CONTENT

11.2.2.1 40% AND ABOVE

11.2.2.2 LESS THAN 40%

11.3 MEZCAL JOVEN

11.3.1 BY CONCENTRATION

11.3.1.1 100% TEQUILA

11.3.1.2 MIX TEQUILA

11.3.2 BY ABV CONTENT

11.3.2.1 40% AND ABOVE

11.3.2.2 LESS THAN 40%

11.3.3 BY DISTILLATION

11.3.3.1 COPPER

11.3.3.2 STEEL

11.4 MEZCAL REPOSADO

11.4.1 BY CONCENTRATION

11.4.1.1 100% TEQUILA

11.4.1.2 MIX TEQUILA

11.4.2 BY ABV CONTENT

11.4.2.1 40% AND ABOVE

11.4.2.2 LESS THAN 40%

11.4.3 BY DISTILLATION

11.4.3.1 COPPER

11.4.3.2 STEEL

11.5 MEZCAL ANEJO

11.5.1 BY CONCENTRATION

11.5.1.1 100% TEQUILA

11.5.1.2 MIX TEQUILA

11.5.2 BY ABV CONTENT

11.5.2.1 40% AND ABOVE

11.5.2.2 LESS THAN 40%

11.5.3 BY DISTILLATION

11.5.3.1 COPPER

11.5.3.2 STEEL

11.6 MEZCAL ENSAMBLE

11.6.1 BY CONCENTRATION

11.6.1.1 100% TEQUILA

11.6.1.2 MIX TEQUILA

11.6.2 BY ABV CONTENT

11.6.2.1 40% AND ABOVE

11.6.2.2 LESS THAN 40%

11.7 MEZCAL ARROQUEÑO

11.7.1 BY CONCENTRATION

11.7.1.1 100% TEQUILA

11.7.1.2 MIX TEQUILA

11.7.2 BY ABV CONTENT

11.7.2.1 40% AND ABOVE

11.7.2.2 LESS THAN 40%

11.8 MEZCAL TEPEZTATE

11.8.1 BY CONCENTRATION

11.8.1.1 100% TEQUILA

11.8.1.2 MIX TEQUILA

11.8.2 BY ABV CONTENT

11.8.2.1 40% AND ABOVE

11.8.2.2 LESS THAN 40%

11.9 OTHERS

11.9.1 BY CONCENTRATION

11.9.1.1 100% TEQUILA

11.9.1.2 MIX TEQUILA

11.9.2 BY ABV CONTENT

11.9.2.1 40% AND ABOVE

11.9.2.2 LESS THAN 40%

12 NORTH AMERICA MEZCAL MARKET, BY CONCENTRATION

12.1 OVERVIEW

12.2 100% TEQUILA

12.3 MIX TEQUILA

13 NORTH AMERICA MEZCAL MARKET, BY PRICE CATEGORY

13.1 OVERVIEW

13.2 PREMIUM

13.3 STANDARD

13.4 ECONOMY

14 NORTH AMERICA MEZCAL MARKET, BY ABV CONTENT

14.1 OVERVIEW

14.2 40% AND ABOVE

14.3 LESS THAN 40%

15 NORTH AMERICA MEZCAL MARKET, BY YEAR

15.1 OVERVIEW

15.2 25-44

15.3 45-64

15.4 18-24

15.5 65+

16 NORTH AMERICA MEZCAL MARKET, BY PACKAGING TYPE

16.1 OVERVIEW

16.2 BOTTLE

16.3 CANS

16.4 OTHERS

17 NORTH AMERICA MEZCAL MARKET, BY SIZE

17.1 OVERVIEW

17.2 751-1000 ML

17.3 501-750 ML

17.4 251-500 ML

17.5 MORE THAN 1000 ML

18 NORTH AMERICA MEZCAL MARKET, BY FLAVOR TYPE

18.1 OVERVIEW

18.2 FLAVORED

18.2.1 CITRUS FRUITS

18.2.1.1 ORANGE

18.2.1.2 LEMON

18.2.1.3 GRAPE FRUIT

18.2.1.4 OTHERS

18.2.2 FLORALS

18.2.3 SMOKED

18.2.4 GREEN PEPPER

18.2.5 OTHERS

18.3 PLAIN/ORIGINAL

19 NORTH AMERICA MEZCAL MARKET, BY PRODUCER TYPE

19.1 OVERVIEW

19.2 MICROBREWERY

19.3 DISTILLERS

19.4 BREWPUB

19.5 REGIONAL CRAFT BREWERY

19.6 CONTRACT BREWING COMPANY

19.7 LARGE BREWERY

19.8 OTHERS

20 NORTH AMERICA MEZCAL MARKET, BY PRODUCT CATEGORY

20.1 OVERVIEW

20.2 DISTILLERS MEZCAL

20.3 HANDCRAFTED/ARTISANAL MEZCAL

21 NORTH AMERICA MEZCAL MARKET, BY END USE

21.1 OVERVIEW

21.2 HOTELS AND BARS

21.3 RESTAURANTS

21.3.1 RESTAURANTS, BY TYPE

21.3.1.1 CHAIN RESTAURANTS

21.3.1.2 INDEPENDENT

21.3.2 RESTAURANTS, BY SERVICE CATEGORY

21.3.2.1 FULL SERVICE RESTAURANTS

21.3.2.2 QUICK SERVICE RESTAURANTS

21.4 CAFE

21.5 AIRLINES

21.6 CATERING

21.7 HOUSEHOLD

21.8 OTHERS

22 NORTH AMERICA MEZCAL MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 OFFLINE TRADE

22.2.1 NON-STORE BASED RETAILERS

22.2.1.1 VENDING MACHINE

22.2.1.2 OTHERS

22.2.2 STORE BASED RETAILER

22.2.2.1 HYPERMARKET/SUPERMARKET

22.2.2.2 CONVENIENCE STORES

22.2.2.3 SPECIALTY STORES

22.2.2.4 GROCERY STORES

22.2.2.5 OTHERS

22.3 ONLINE TRADE

22.4 COMPANY OWNED WEBSITE

22.5 E-COMMERCE

23 NORTH AMERICA MEZCAL MARKET, BY REGION

23.1 OVERVIEW

23.1.1 U.S.

23.1.2 MEXICO

23.1.3 CANADA

24 NORTH AMERICA MEZCAL MARKET: COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

25 SWOT ANALYSIS

26 COMPANY PROFILE

26.1 PERNOD RICARD

26.1.1 COMPANY SNAPSHOT

26.1.2 REVENUE ANALYSIS

26.1.3 PRODUCT PORTFOLIO

26.1.4 RECENT DEVELOPMENT

26.2 DIAGEO

26.2.1 COMPANY SNAPSHOT

26.2.2 REVENUE ANALYSIS

26.2.3 PRODUCT PORTFOLIO

26.2.4 RECENT DEVELOPMENTS

26.3 BACARDI

26.3.1 COMPANY SNAPSHOT

26.3.2 PRODUCT PORTFOLIO

26.3.3 RECENT DEVELOPMENT

26.4 DAVIDE CAMPARI-MILANO N.V.

26.4.1 COMPANY SNAPSHOT

26.4.2 REVENUE ANALYSIS

26.4.3 PRODUCT PORTFOLIO

26.4.4 RECENT DEVELOPMENT

26.5 BROWN-FORMAN

26.5.1 COMPANY SNAPSHOT

26.5.2 REVENUE ANALYSIS

26.5.3 PRODUCT PORTFOLIO

26.5.4 RECENT DEVELOPMENT

26.6 BOZAL MEZCAL

26.6.1 COMPANY SNAPSHOT

26.6.2 PRODUCT PORTFOLIO

26.6.3 RECENT DEVELOPMENT

26.7 CRAFT DISTILLERS

26.7.1 COMPANY SNAPSHOT

26.7.2 PRODUCT PORTFOLIO

26.7.3 RECENT DEVELOPMENTS

26.8 DOS HOMBRES LLC.

26.8.1 COMPANY SNAPSHOT

26.8.2 PRODUCT PORTFOLIO

26.8.3 RECENT DEVELOPMENTS

26.9 DEL MAGUEY SINGLE VILLAGE MEZCAL

26.9.1 COMPANY SNAPSHOT

26.9.2 PRODUCT PORTFOLIO

26.9.3 RECENT DEVELOPMENTS

26.1 DESTILERÍA TLACOLULA

26.10.1 COMPANY SNAPSHOT

26.10.2 PRODUCT PORTFOLIO

26.10.3 RECENT DEVELOPMENT

26.11 EL SILENCIO HOLDINGS, INC.

26.11.1 COMPANY SNAPSHOT

26.11.2 PRODUCT PORTFOLIO

26.11.3 RECENT DEVELOPMENTS

26.12 FAMILIA CAMARENA

26.12.1 COMPANY SNAPSHOT

26.12.2 PRODUCT PORTFOLIO

26.12.3 RECENT DEVELOPMENTS

26.13 ILEGAL MEZCAL

26.13.1 COMPANY SNAPSHOT

26.13.2 PRODUCT PORTFOLIO

26.13.3 RECENT DEVELOPMENTS

26.14 KING CAMPERO

26.14.1 COMPANY SNAPSHOT

26.14.2 PRODUCT PORTFOLIO

26.14.3 RECENT DEVELOPMENTS

26.15 MADRE MEZCAL

26.15.1 COMPANY SNAPSHOT

26.15.2 PRODUCT PORTFOLIO

26.15.3 RECENT DEVELOPMENTS

26.16 MEZCAL SOMBRA

26.16.1 COMPANY SNAPSHOT

26.16.2 PRODUCT PORTFOLIO

26.16.3 RECENT DEVELOPMENT

26.17 PENSADOR MEZCAL

26.17.1 COMPANY SNAPSHOT

26.17.2 PRODUCT PORTFOLIO

26.17.3 RECENT DEVELOPMENTS

26.18 SAUZA TEQUILA IMPORT COMPANY

26.18.1 COMPANY SNAPSHOT

26.18.2 PRODUCT PORTFOLIO

26.18.3 RECENT DEVELOPMENTS

26.19 TEQUILA & MEZCAL PRIVATE BRANDS S.A. DE C.V.

26.19.1 COMPANY SNAPSHOT

26.19.2 PRODUCT PORTFOLIO

26.19.3 RECENT DEVELOPMENTS

26.2 WAHAKA MEZCAL

26.20.1 COMPANY SNAPSHOT

26.20.2 PRODUCT PORTFOLIO

26.20.3 RECENT DEVELOPMENT

27 QUESTIONNAIRE

28 RELATED REPORTS

Lista de Tablas

TABLE 1 THE FOLLOWING ARE THE DIFFERENT PRICES OF DIFFERENT BRANDS.

TABLE 2 NORTH AMERICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 4 NORTH AMERICA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 5 NORTH AMERICA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 8 NORTH AMERICA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 10 NORTH AMERICA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 11 NORTH AMERICA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 12 NORTH AMERICA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 13 NORTH AMERICA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 14 NORTH AMERICA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 15 NORTH AMERICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 16 NORTH AMERICA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 17 NORTH AMERICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 18 NORTH AMERICA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 19 NORTH AMERICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 20 NORTH AMERICA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 23 NORTH AMERICA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA MEZCAL MARKET: BY SIZE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 30 NORTH AMERICA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 31 NORTH AMERICA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 32 NORTH AMERICA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA MEZCAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 43 U.S. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 45 U.S. MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 46 U.S. MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 47 U.S. MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 48 U.S. MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 49 U.S. MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 50 U.S. MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 51 U.S. MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 53 U.S. MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 55 U.S. MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 56 U.S. MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 58 U.S. MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 59 U.S. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 60 U.S. MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 61 U.S. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 62 U.S. MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 63 U.S. OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 64 U.S. OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 65 U.S. MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 66 U.S. MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 67 U.S. MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 68 U.S. MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 69 U.S. MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 71 U.S. MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 U.S. MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 77 U.S. RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 79 U.S. MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 U.S. OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 U.S. NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 U.S. STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 U.S. ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 86 MEXICO MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 87 MEXICO MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 88 MEXICO MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 89 MEXICO MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 90 MEXICO MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 91 MEXICO MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 92 MEXICO MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 93 MEXICO MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 94 MEXICO MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 95 MEXICO MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 96 MEXICO MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 97 MEXICO MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 99 MEXICO MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 100 MEXICO MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 101 MEXICO MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 102 MEXICO MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 103 MEXICO MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 104 MEXICO OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 105 MEXICO OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 106 MEXICO MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 107 MEXICO MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 108 MEXICO MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 109 MEXICO MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 110 MEXICO MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 117 MEXICO MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 118 MEXICO RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 120 MEXICO MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 MEXICO OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 MEXICO NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 123 MEXICO STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 MEXICO ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 CANADA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 127 CANADA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 128 CANADA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 129 CANADA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 130 CANADA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 131 CANADA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 132 CANADA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 133 CANADA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 134 CANADA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 135 CANADA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 136 CANADA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 137 CANADA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 138 CANADA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 139 CANADA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 140 CANADA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 141 CANADA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 142 CANADA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 143 CANADA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 144 CANADA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 145 CANADA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 146 CANADA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 147 CANADA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 148 CANADA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 149 CANADA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 150 CANADA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 151 CANADA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 152 CANADA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 153 CANADA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 154 CANADA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 155 CANADA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 CANADA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 157 CANADA MEZCAL MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 158 CANADA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 159 CANADA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 CANADA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 161 CANADA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 162 CANADA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 163 CANADA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 CANADA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 165 CANADA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA MEZCAL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEZCAL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEZCAL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEZCAL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEZCAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEZCAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEZCAL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MEZCAL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA MEZCAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEZCAL MARKET: SEGMENTATION

FIGURE 11 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS NORTH AMERICALY AND INCREASING CONSUMER DEMAND FOR MEZCAL IS EXPECTED TO DRIVE THE NORTH AMERICA MEZCAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 MEZCAL ESPADIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEZCAL MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA MEZCAL MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEZCAL MARKET

FIGURE 15 NORTH AMERICA MEZCAL MARKET, BY PRODUCT TYPE

FIGURE 16 NORTH AMERICA MEZCAL MARKET: BY CONCENTRATION, 2021

FIGURE 17 NORTH AMERICA MEZCAL MARKET: BY PRICE CATEGORY, 2021

FIGURE 18 NORTH AMERICA MEZCAL MARKET: BY ABV CONTENT, 2021

FIGURE 19 NORTH AMERICA MEZCAL MARKET: BY YEAR, 2021

FIGURE 20 NORTH AMERICA MEZCAL MARKET: BY PACKAGING TYPE, 2021

FIGURE 21 NORTH AMERICA MEZCAL MARKET: BY SIZE, 2021

FIGURE 22 NORTH AMERICA MEZCAL MARKET: BY FLAVOR TYPE, 2021

FIGURE 23 NORTH AMERICA MEZCAL MARKET, BY PRODUCER TYPE

FIGURE 24 NORTH AMERICA MEZCAL MARKET, BY PRODUCT CATEGORY

FIGURE 25 NORTH AMERICA MEZCAL MARKET: BY END USE, 2021

FIGURE 26 NORTH AMERICA MEZCAL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 NORTH AMERICA MEZCAL MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA MEZCAL MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA MEZCAL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA MEZCAL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA MEZCAL MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 32 NORTH AMERICA MEZCAL MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.