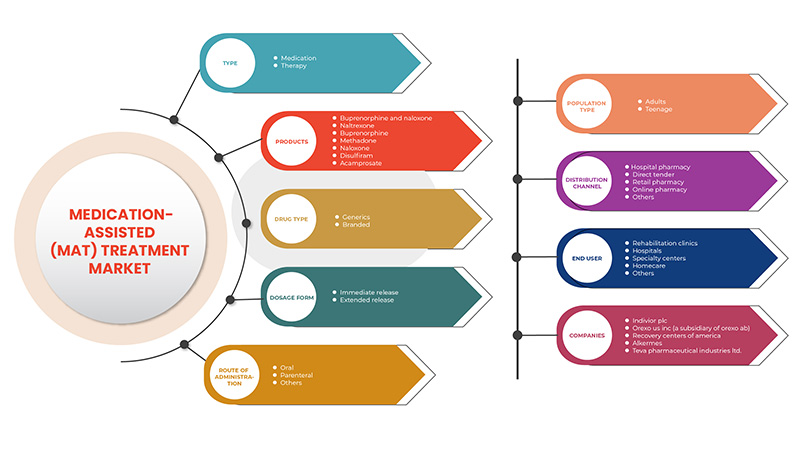

Mercado de tratamiento asistido por medicamentos (MAT) de América del Norte, por tipo (medicamentos y terapias), productos (buprenorfina y naloxona, naltrexona, buprenorfina, metadona, naloxona, disulfiram y acamprosato), tipo de fármaco ( genéricos y de marca), forma farmacéutica (liberación inmediata y liberación prolongada), vía de administración (oral, parenteral y otras), tipo de población (adultos y adolescentes), usuario final (clínicas de rehabilitación, hospitales, centros especializados, atención domiciliaria y otros), canal de distribución (farmacia hospitalaria, licitación directa, farmacia minorista, farmacia en línea y otros), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado

La Administración de Alimentos y Medicamentos (FDA) aprobó tres medicamentos clínicos: buprenorfina, metadona y naltrexona. El tratamiento asistido por medicamentos (MAT) se aplica para curar el trastorno por consumo de alcohol, los medicamentos para la dependencia de opioides y los medicamentos para la prevención de la sobredosis de opioides. El trastorno por consumo de alcohol (AUD) es una afección médica que se caracteriza por una capacidad deteriorada para dejar de consumir alcohol a pesar de las consecuencias sociales, laborales o de salud adversas. El acamprosato, el disulfiram y la naltrexona son los medicamentos más comunes que se usan para tratar el trastorno por consumo de alcohol (AUD). La medicación para la dependencia de opioides, el aumento de la adicción a los opioides entre los pacientes. La buprenorfina, la metadona y la naltrexona se usan para tratar los trastornos por consumo de opioides a opioides de acción corta como la heroína, la morfina y la codeína, así como opioides semisintéticos como la oxicodona y la hidrocodona. Estos medicamentos MAT son seguros durante meses, años o incluso toda la vida.

Definición de mercado

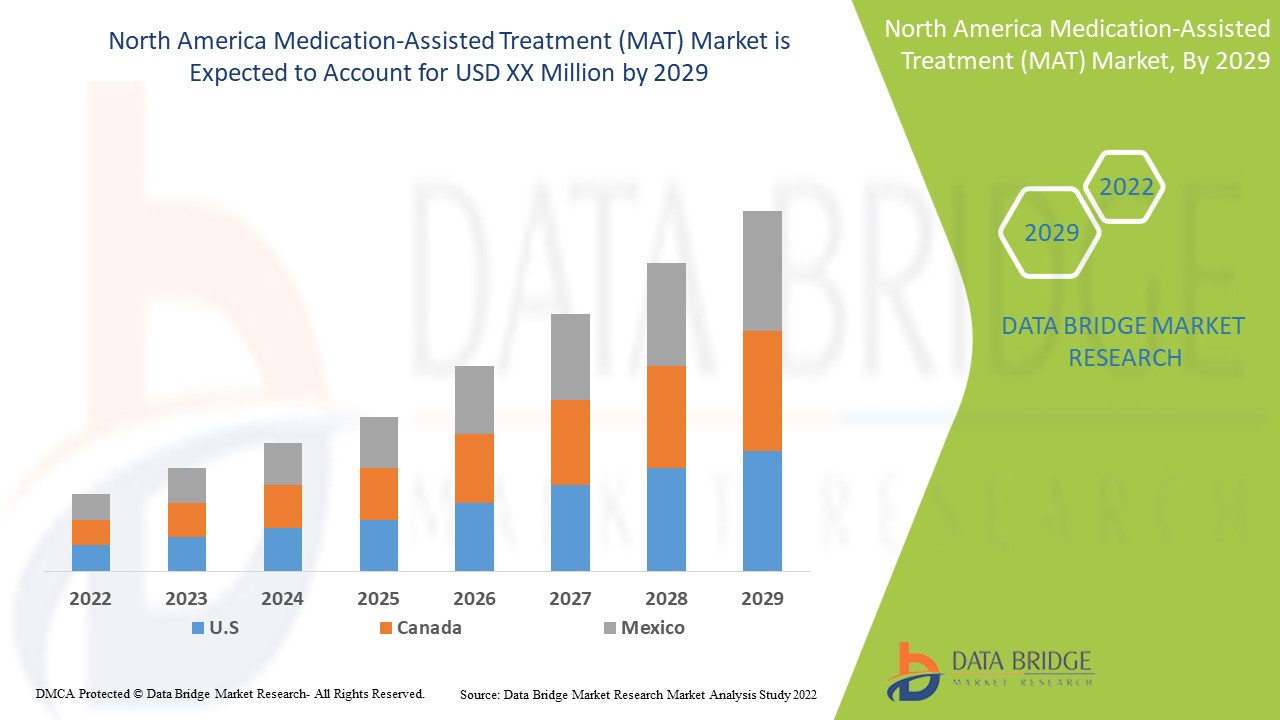

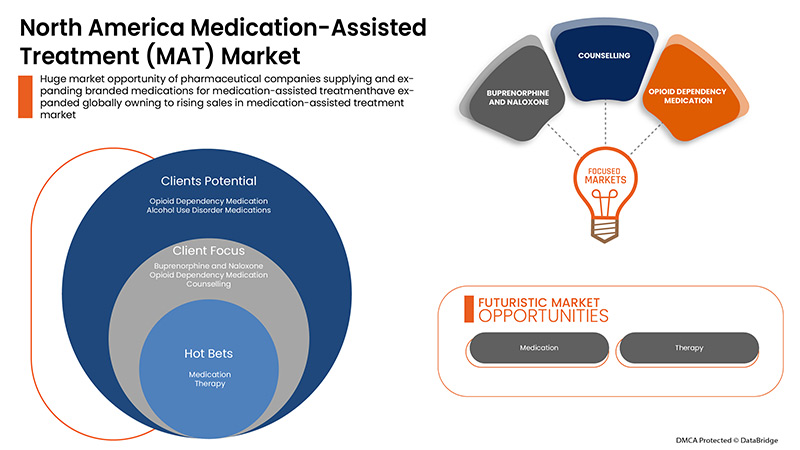

El tratamiento asistido por medicamentos (MAT) implica el uso de medicamentos, combinados con asesoramiento y terapias conductuales, para brindar un enfoque integral al paciente en el tratamiento de los trastornos por consumo de sustancias. En el caso de los medicamentos para la prevención de la sobredosis de opioides, la naloxona se utiliza para prevenir la sobredosis de opioides al revertir los efectos tóxicos de la sobredosis. Según la Organización Mundial de la Salud (OMS) y la Administración de Servicios de Abuso de Sustancias y Salud Mental (SAMHSA), la naloxona es uno de los muchos medicamentos que se consideran esenciales para el funcionamiento de un sistema de atención médica. El tratamiento asistido por medicamentos en América del Norte es de apoyo y tiene como objetivo reducir la gravedad de los síntomas. Data Bridge Market Research analiza que el mercado de tratamiento asistido por medicamentos (MAT) crecerá a una CAGR del 9,7 % entre 2022 y 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo (medicamento y terapia), productos (buprenorfina y naloxona, naltrexona, buprenorfina, metadona, naloxona, disulfiram y acamprosato), tipo de medicamento (genéricos y de marca), forma farmacéutica (liberación inmediata y liberación prolongada), vía de administración (oral, parenteral y otras), tipo de población (adultos y adolescentes), usuario final (clínicas de rehabilitación, hospitales, centros especializados, atención domiciliaria y otros), canal de distribución (farmacia hospitalaria, licitación directa, farmacia minorista, farmacia en línea y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

Indivior PLC, Orexo US Inc (una subsidiaria de Orexo AB), Recovery Centers of America, Alkermes, Sun Pharmaceutical Industries Ltd., Purdue Pharma LP, Taj Pharmaceuticals Limited, Lannett, Hikma Pharmaceuticals PLC, Pfizer Inc., Pinnacle Treatment Center, American Addiction Centers, Adamis Pharmaceuticals Corporation, Glenmark Pharmaceutical Inc., Viatris Inc., Mallinckrodt, Alvogen, VistaPharm, Inc., Teva Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Amneal Pharmaceuticals LLC, Titan Pharmaceuticals, Inc. |

Dinámica del mercado de tratamiento asistido por medicamentos (MAT) en América del Norte

Conductores

- El aumento de la incidencia de los trastornos por consumo de alcohol y opioides

El trastorno por consumo de alcohol (TCA) es una afección médica que se caracteriza por una capacidad deteriorada para detener o controlar el consumo de alcohol a pesar de las consecuencias sociales, laborales o de salud adversas. Abarca las afecciones que algunas personas denominan abuso de alcohol, dependencia del alcohol y adicción al alcohol. El tratamiento asistido con medicamentos (MAT) es el uso de medicamentos en combinación con asesoramiento y terapias conductuales para brindar un enfoque "integral" para el paciente en el tratamiento de los trastornos por consumo de sustancias. Los medicamentos utilizados en el MAT están aprobados por la Administración de Alimentos y Medicamentos (FDA), y los programas de MAT están impulsados clínicamente y diseñados para satisfacer las necesidades de cada paciente.

Por ejemplo,

- En 2022, los datos de la Región Europea de la Organización Mundial de la Salud (OMS) indicaron que el trastorno por consumo de alcohol causa 1 millón de muertes al año.

Como las empresas participan constantemente en actividades de investigación y desarrollo, el conocimiento sobre la incidencia de los trastornos por consumo de alcohol y opioides ayudaría a encontrar soluciones novedosas y eso ayudaría a establecer más colaboraciones y asociaciones con actores del mercado en países como Estados Unidos, Europa y la región de Asia y el Pacífico. Esto significa un aumento en las inversiones relacionadas con la investigación y el desarrollo para el inicio de medicamentos genéricos en el tratamiento asistido por medicamentos (MAT), lo que se espera que impulse el crecimiento del mercado.

- La financiación gubernamental para el tratamiento asistido por medicamentos (MAT)

A pesar de la eficacia demostrada de las farmacoterapias para tratar el consumo de opioides y los trastornos relacionados con el alcohol, se han observado limitaciones en la implementación de medicamentos para el tratamiento de las adicciones (MAT) por parte de programas de tratamiento especializados. Es necesario prestar especial atención a las fuentes específicas de financiación, la estructura organizativa y los recursos de personal, realizando una inversión a largo plazo que alinee el pago con los posibles beneficiarios futuros.

Por ejemplo,

- En enero de 2021, según el Registro Federal de Gobierno, las Subvenciones para la Iniciativa de Desarrollo Comunitario Rural (RCDI) proporcionaron fondos a organizaciones intermediarias que brindan asistencia financiera y técnica a los beneficiarios para ayudar a satisfacer las necesidades de sus comunidades en áreas rurales elegibles.

La financiación por parte del gobierno se traduciría en seguridad para el paciente y ahorro de costes. Además, los hospitales y las agencias de atención sanitaria administrarían este tratamiento a un precio más bajo gracias a la colaboración con las organizaciones gubernamentales. Por tanto, se espera que los avances en las actividades de investigación y desarrollo y la financiación por parte del gobierno impulsen el crecimiento del mercado.

Oportunidad

- Aumento del gasto sanitario

Además, el aumento de las actividades de investigación y desarrollo y el aumento de las inversiones por parte de organizaciones gubernamentales y privadas impulsarán nuevas oportunidades para la tasa de crecimiento del mercado.

Por ejemplo,

- En febrero de 2021, según el Índice de Precios de la Atención Sanitaria (HCPI), el presupuesto total de atención sanitaria de Estados Unidos había aumentado un 3,4%. El aumento de los estados de crecimiento indica que el gasto del gobierno federal disminuyó significativamente en el año anterior de USD 287.000 millones en 2020 a USD 170.000 millones en 2021.

El aumento del gasto sanitario también es beneficioso para el desarrollo económico y el crecimiento del sector sanitario. Además, el aumento de los ingresos disponibles de la población es un factor favorable. Se espera que todo lo anterior genere oportunidades lucrativas para el mercado de tratamientos asistidos con medicamentos (MAT).

Restricción/Desafío

- Efectos secundarios de los medicamentos utilizados en el tratamiento asistido por medicamentos (MAT)

El tratamiento asistido con medicamentos (MAT) implica el uso de medicamentos combinados con terapias conductuales y de asesoramiento para brindar un enfoque integral del paciente como parte de la estrategia de tratamiento. Por lo tanto, se espera que el alto costo actual muestre una tendencia descendente. El MAT es más eficaz para tratar los trastornos por consumo de alcohol y opioides. Sin embargo, se han informado efectos secundarios específicos.

Por ejemplo,

- La metadona y la buprenorfina, los medicamentos genéricos, son químicamente similares a los opioides, por lo que sus efectos secundarios también pueden ser similares. Estos pueden incluir estreñimiento, somnolencia y mareos. Algunas personas pueden experimentar efectos secundarios más graves.

Las complicaciones adversas notificadas provocarían una disminución de las ventas de medicamentos para la dependencia de opioides, lo que limitaría las ventas de los medicamentos. Además, afectaría a la fiabilidad de los fabricantes que participan en este mercado y, por lo tanto, se espera que frene el crecimiento del mercado.

El informe de mercado de tratamiento asistido por medicamentos (MAT) proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de tratamiento asistido por medicamentos (MAT), comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de la COVID-19 en el mercado de tratamientos asistidos con medicamentos (MAT)

Durante la pandemia, el tratamiento asistido con medicamentos reduce notablemente la mortalidad y la morbilidad de los pacientes con COVID-19. Se necesitan más estudios a gran escala para aprobar estos resultados. Se debe definir un protocolo para el tratamiento asistido con medicamentos en la infección por COVID-19 para lograr los mejores resultados clínicos posibles. Los ensayos clínicos se llevaron a cabo durante la COVID-19 Los servicios de medicación para el trastorno por consumo de opioides (MOUD) son clave para abordar la crisis de opioides, y la COVID-19 ha afectado significativamente la prestación de MOUD.

Desarrollo reciente

- En abril de 2021, Adamis Pharmaceuticals Corporation, junto con USWM, anunció el lanzamiento y la disponibilidad de un producto de naloxona inyectable de dosis alta ZIMHI para ayudar a combatir las muertes por sobredosis de opioides. Se espera que el lanzamiento aumente los ingresos del segmento de productos, lo que impulsará el crecimiento del mercado, y que ZIMHI esté disponible a un precio reducido para los socorristas y las organizaciones de salud comunitarias.

Alcance del mercado de tratamiento asistido por medicamentos (MAT) en América del Norte

El mercado de tratamientos asistidos por medicamentos (MAT) está segmentado en base a ocho segmentos: tipo, productos, tipo de fármaco y forma de dosificación, vía de administración, tipo de población, usuario final y canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Medicamento

- Terapia

Sobre la base del tipo, el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte se segmenta en medicamentos y terapias.

Productos

- Buprenorfina y naloxona

- Naltrexona

- Buprenorfina

- Metadona

- Naloxona

- Disulfiram

- Acamprosato

Sobre la base de los productos, el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte está segmentado en buprenorfina y naloxona, naltrexona, buprenorfina, metadona, naloxona, disulfiram y acamprosato.

Tipo de droga

- Genéricos

- De marca

Según el tipo de medicamento, el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte está segmentado en genéricos y de marca.

Forma de dosificación

- Publicación inmediata

- Versión extendida

Sobre la base de la forma de dosificación, el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte está segmentado en liberación inmediata y liberación prolongada.

Vía de administración

- Oral

- Parenteral

- Otros

Sobre la base de la vía de administración, el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte está segmentado en oral, parenteral y otros.

Tipo de población

- Adultos

- Joven

Según el tipo de población, el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte está segmentado en adultos y adolescentes.

Usuario final

- Clínicas de rehabilitación

- Hospitales

- Centros de especialidades

- Cuidado domiciliario

- Otros

Sobre la base del usuario final, el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte está segmentado en clínicas de rehabilitación, hospitales, centros especializados, atención domiciliaria y otros.

Canal de distribución

- Farmacia hospitalaria

- Licitación directa

- Farmacia minorista

- Farmacia en línea

- Otros

Sobre la base del canal de distribución, el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte está segmentado en farmacia hospitalaria, licitación directa, farmacia minorista, farmacia en línea y otras.

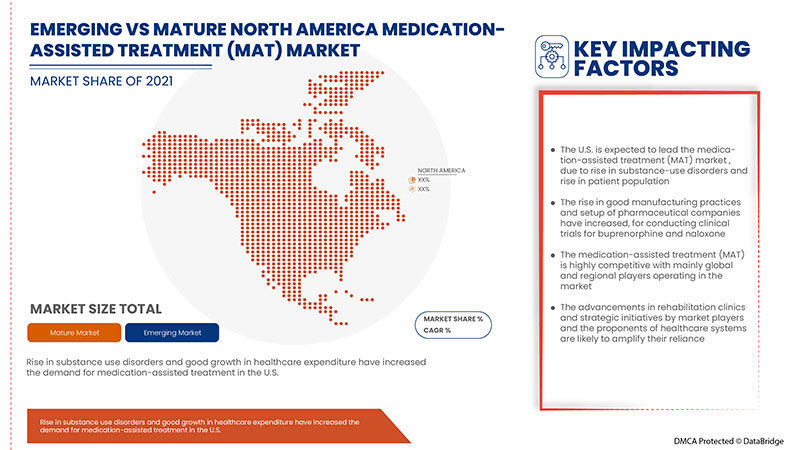

Análisis y perspectivas regionales del mercado de tratamiento asistido con medicamentos (MAT)

Se analiza el mercado de tratamiento asistido por medicamentos (MAT) de América del Norte y se proporcionan información y tendencias del tamaño del mercado por regiones, tipo de producto, tipo, aplicación, flujo de trabajo, usuario final y canal de distribución como se menciona anteriormente.

Los países cubiertos en el informe del mercado de tratamiento asistido por medicamentos (MAT) son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado debido al aumento de la dependencia de los opioides en los medicamentos, el gasto en atención médica y las compañías farmacéuticas.

La sección de países del informe también proporciona factores de impacto de mercados individuales y cambios en la regulación nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas de América del Norte y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los tratamientos asistidos con medicamentos (MAT)

The North America medication-assisted treatment (MAT) market competitive landscape provides details of a competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, the North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus on the medication-assisted (MAT) treatment market.

Some major players operating in the medication-assisted (MAT) treatment market are Indivior PLC, Orexo US Inc (a subsidiary of Orexo AB), Recovery Centers of America, Alkermes. Sun Pharmaceutical Industries Ltd., Purdue Pharma L.P., Taj Pharmaceuticals Limited, Lannett, Hikma Pharmaceuticals PLC, Pfizer Inc., Pinnacle Treatment Center, American Addiction Centers, Adamis Pharmaceuticals Corporation, Glenmark Pharmaceutical Inc. Viatris Inc., Mallinckrodt, Alvogen, VistaPharm, Inc., Amneal Pharmaceuticals LLC. Titan Pharmaceuticals, Inc.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 EPIDEMIOLOGY

4.2 PESTEL

4.3 PORTER'S FIVE FORCES MODEL

4.4 ANNUAL INCIDENCE OF SUBJECTS ENTERING MEDICATION-ASSISTED TREATMENT IN ALCOHOL, OPIOID USE DISORDER, AND OPIOID OVERDOSE PREVENTION (2021)

4.5 ANNUAL NUMBER OF TREATMENTS WITH CLONIDINE AND WITH LOFEXIDINE IN OPIOID USE DISORDER AND OPIOID OVERDOSE PREVENTION (2021)

4.6 ANNUAL INCIDENCE OF INDIVIDUALS RE-ENTERING MEDICATION-ASSISTED TREATMENT. FOR EXAMPLE, SOMEONE MAY DROP OUT OF TREATMENT AND RESTART TREATMENT LATER (2021)

4.7 ANNUAL USE OF NALTREXONE INJECTION AS PART OF TREATMENT FOR THE INITIAL WITHDRAWAL FROM OPIOIDS, AND ANNUAL MAINTENANCE THERAPY USING NALTREXONE INJECTION (2021)

4.8 PIPELINE ANALYSIS FOR MEDICATION-ASSISTED TREATMENT (MAT) MARKET

5 NORTH AMERICA MEDICATION-ASSISTED TREATMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN INCIDENCE OF ALCOHOL USE DISORDER AND OPIOID USE DISORDERS

6.1.2 THE FUNDING BY THE GOVERNMENT FOR MEDICATION-ASSISTED TREATMENT (MAT)

6.1.3 THE RISE IN THE POPULATION RECEIVING MEDICATION-ASSISTED TREATMENT (MAT) AND MEDICATION-ASSISTED AWARENESS PROGRAMMESMEDICATION-ASSISTED TREATMENT (MAT)

6.1.4 USE OF REIMBURSEMENT FOR MEDICATION-ASSISTED TREATMENT (MAT)

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS OF DRUGS USED IN MEDICATION-ASSISTED TREATMENT (MAT)

6.2.2 ETHICAL ISSUES RELATED TO USE OF MEDICATION-ASSISTED TREATMENTMEDICATION-ASSISTED TREATMENT (MAT)

6.2.3 RISE IN PRODUCT RECALLS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 THE LACK OF SKILLED PROFESSIONALS, REQUIRED FOR MEDICATION-ASSISTED TREATMENT

6.4.2 STRINGENT REGULATIONS

6.4.3 DISCONTINUATION OF MEDICATION-ASSISTED TREATMENT (MAT)

7 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 OPIOID DEPENDENCY MEDICATION

7.2.1.1 BUPRENORPHINE AND NALOXONE

7.2.1.2 BUPRENORPHINE

7.2.1.3 METHADONE

7.2.1.4 NALTREXONE

7.2.2 ALCOHOL USE DISORDER MEDICATIONS

7.2.2.1 NALTREXONE

7.2.2.2 DISULFIRAM

7.2.2.3 ACAMPROSATE

7.2.3 OPIOID OVERDOSE PREVENTION MEDICATION

7.2.3.1 NALOXONE

7.3 THERAPY

7.3.1 BEHAVIORAL THERAPY

7.3.2 EDUCATIONAL THERAPY

7.3.3 COUNSELLING

7.3.4 VOCATIONAL THERAPY

7.3.5 OTHERS

8 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 BUPRENORPHINE AND NALOXONE

8.3 NALTREXONE

8.4 BUPRENORPHINE

8.5 METHADONE

8.6 NALOXONE

8.7 DISULFIRAM

8.8 ACAMPROSATE

9 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE

9.1 OVERVIEW

9.2 GENERICS

9.3 BRANDED

9.3.1 SUBOXONE

9.3.2 VIVITROL

9.3.3 BUTRANS

9.3.4 ZUBSOLV

9.3.5 PROBUPHINE

9.3.6 OTHERS

10 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM

10.1 OVERVIEW

10.2 IMMEDIATE RELEASE

10.3 EXTENDED RELEASE

11 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.2.1 TABLET

11.2.2 SUBLINGUAL FILM

11.2.3 OTHERS

11.3 PARENTERAL

11.3.1 SOLUTION

11.3.2 SUSPENSION

11.4 OTHERS

12 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE

12.1 OVERVIEW

12.2 ADULTS

12.3 TEENAGE

13 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER

13.1 OVERVIEW

13.2 REHABILITATION CLINICS

13.3 HOSPITALS

13.4 SPECIALTY CENTERS

13.5 HOMECARE

13.6 OTHERS

14 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 HOSPITAL PHARMACY

14.3 DIRECT TENDER

14.4 RETAIL PHARMACY

14.5 ONLINE PHARMACY

14.6 OTHERS

15 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEVA PHARMACEUTICAL INDUSTRIES LTD. (2021)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 INDIVOR PLC (2021)

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VIATRIS INC (2021)

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 SUN PHARMACEUTICAL INDUSTRIES LTD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 ALKERMES (2021)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 PURDUE PHARMA L.P. (2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 PFIZER (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 GLENMARK PHARMACEUTICAL INC (2021)

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 DR. REDDY’S LABORATORIES LTD (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ALVOGEN (2021)

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 ADAMIS PHARMACEUTICALS CORPORATION (2021)

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 ACCORD HEALTHCARE (A SUBSIDIARY OF INTAS PHARMACEUTICALS)

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 AMNEAL PHARMACEUTICALS LLC (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 AMERICAN ADDICTION CENTERS (2021)

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 HIKMA PHARMACEUTICALS PLC (2021)

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 LANNETT (2021)

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 MALLINCKRODT (2021)

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 OREXO US INC (A SUBSIDIARY OF OREXO, INC) (2021)

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 PINNACLE TREATMENT CENTERS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 RECOVERY CENTERS OF AMERICA

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 TAJ PHARMACEUTICALS LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 TITAN PHARMACEUTICALS (2021)

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 VISTAPHARM, INC (A SUBSIDIARY OF VERTICE PHARMA, LLC. (2021))

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BUPRENORPHINE AND NALOXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA NALTREXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BUPRENORPHINE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA METHADONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA NALOXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DISULFIRAM IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ACAMPROSATE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA GENERICS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA IMMEDIATE RELEASE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA EXTENDED RELEASE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ADULTS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA TEENAGE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA REHABILITATION CLINICS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA HOSPITALS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SPECIALTY CENTERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HOMECARE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HOSPITAL PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA DIRECT TENDER IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 69 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 72 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 73 U.S. ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 75 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 U.S. MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 85 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 88 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 89 CANADA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 90 CANADA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 91 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 92 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 CANADA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MEXICO ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 101 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 104 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 105 MEXICO ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 106 MEXICO PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 107 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 109 MEXICO MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF ALCOHOL USE DISORDERS AND RISE IN PRODUCT APPROVALS IS EXPECTED TO DRIVE NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET FROM 2022 TO 2029

FIGURE 13 TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET

FIGURE 15 INCIDENCE OF ALCOHOL CONSUMPTION IN 2019

FIGURE 16 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, 2021

FIGURE 21 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 24 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, 2021

FIGURE 25 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, 2021

FIGURE 29 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 32 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 33 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 36 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, 2021

FIGURE 37 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, LIFELINE CURVE

FIGURE 40 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, 2021

FIGURE 41 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SNAPSHOT (2021)

FIGURE 49 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2021)

FIGURE 50 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE (2022-2029)

FIGURE 53 NORTH AMERICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.