North America Medical Device Sterilization Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.05 Billion

USD

3.91 Billion

2024

2032

USD

2.05 Billion

USD

3.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.05 Billion | |

| USD 3.91 Billion | |

|

|

|

|

Segmentación del mercado de esterilización de dispositivos médicos en Norteamérica: por producto (instrumentos, reactivos y servicios), tecnología (esterilización térmica, esterilización por radiación ionizante, esterilización por filtración, esterilización química y por gases), usuario final (empresas farmacéuticas, hospitales, clínicas, laboratorios, instituciones académicas y de investigación, fabricantes de dispositivos médicos, etc.), canal de distribución (licitaciones directas, ventas minoristas y distribuidores externos): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de esterilización de dispositivos médicos en América del Norte

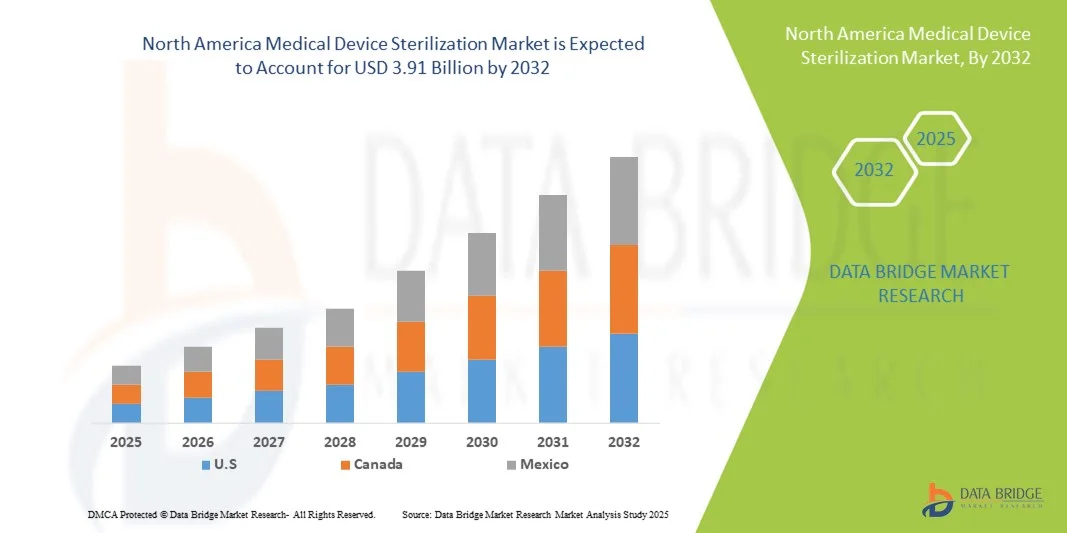

- El tamaño del mercado de esterilización de dispositivos médicos de América del Norte se valoró en USD 2.050 millones en 2024 y se espera que alcance los USD 3.910 millones para 2032 , con una CAGR del 8,40 % durante el período de pronóstico.

- El crecimiento del mercado se ve impulsado en gran medida por la creciente prevalencia de infecciones adquiridas en el hospital (IAH), el creciente número de procedimientos quirúrgicos y los avances en las tecnologías de esterilización, lo que genera una mayor demanda de dispositivos médicos estériles tanto en hospitales como en otros entornos de atención médica.

- Además, los crecientes requisitos regulatorios para el control de infecciones, junto con la creciente necesidad de procesos de esterilización seguros y eficientes, están consolidando la esterilización de dispositivos médicos como un componente crucial en la infraestructura sanitaria moderna. Estos factores convergentes están acelerando la adopción de soluciones de esterilización, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de esterilización de dispositivos médicos en América del Norte

- La esterilización de dispositivos médicos, que abarca métodos como la esterilización con vapor, gas y radiación para instrumentos quirúrgicos y equipos médicos, es cada vez más crítica en entornos de atención médica debido a los crecientes requisitos de control de infecciones, las preocupaciones por la seguridad de los pacientes y los estrictos estándares regulatorios en hospitales, clínicas y laboratorios.

- La creciente demanda de soluciones de esterilización se ve impulsada principalmente por la creciente prevalencia de infecciones adquiridas en el hospital (IAH), el creciente número de procedimientos quirúrgicos y los avances tecnológicos en equipos de esterilización que mejoran la eficiencia y la seguridad.

- Estados Unidos dominó el mercado de esterilización de dispositivos médicos de América del Norte con la mayor participación en los ingresos del 67,8 % en 2024, caracterizado por una infraestructura de atención médica avanzada, un alto gasto en atención médica y una fuerte presencia de actores clave de la industria.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de esterilización de dispositivos médicos de América del Norte durante el período de pronóstico debido al aumento de las inversiones en infraestructura de atención médica y la creciente conciencia sobre los protocolos de control de infecciones.

- El segmento de esterilización térmica dominó el mercado de esterilización de dispositivos médicos de América del Norte por tecnología con una participación de mercado del 39 % en 2024, impulsado por su confiabilidad comprobada, rentabilidad y aplicación generalizada en instrumentos médicos, reactivos y otros productos para el cuidado de la salud.

Alcance del informe y segmentación del mercado de esterilización de dispositivos médicos en América del Norte

|

Atributos |

Perspectivas clave del mercado de esterilización de dispositivos médicos en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de esterilización de dispositivos médicos en América del Norte

Avances en la esterilización a baja temperatura y basada en IoT

- Una tendencia significativa y en aceleración en el mercado de esterilización de dispositivos médicos de América del Norte es la adopción de tecnologías de esterilización a baja temperatura, como el plasma de peróxido de hidrógeno y el ozono, que reducen el daño a los instrumentos sensibles al calor y mantienen la esterilidad.

- Por ejemplo, los sistemas STERRAD NX utilizan esterilización con plasma de peróxido de hidrógeno a baja temperatura para instrumentos quirúrgicos delicados, lo que mejora la eficiencia operativa y la vida útil del dispositivo.

- La integración de esterilizadores con IoT permite la monitorización en tiempo real, el mantenimiento predictivo y la generación de informes automatizados, lo que proporciona un mejor control operativo y seguimiento del cumplimiento normativo. Por ejemplo, la plataforma SteriLog de Getinge integra los esterilizadores con los sistemas informáticos del hospital, lo que permite la gestión centralizada de los ciclos de esterilización, los registros de uso y los programas de mantenimiento.

- La tendencia de combinar la esterilización con el análisis de datos y el mantenimiento predictivo ayuda a los proveedores de atención médica a reducir el tiempo de inactividad y optimizar la asignación de recursos.

- Esta tendencia hacia una esterilización más inteligente, automatizada y a baja temperatura está cambiando las expectativas de seguridad y eficiencia en hospitales e instalaciones farmacéuticas.

- La demanda de sistemas de esterilización avanzados que combinen procesos de baja temperatura con conectividad IoT está creciendo rápidamente en hospitales, clínicas y unidades de fabricación farmacéutica, a medida que los proveedores de atención médica priorizan tanto la seguridad del paciente como la eficiencia operativa.

Dinámica del mercado de esterilización de dispositivos médicos en América del Norte

Conductor

Aumento de la demanda debido al aumento de los procedimientos quirúrgicos y el control de infecciones

- El creciente número de procedimientos quirúrgicos y la creciente incidencia de infecciones adquiridas en el hospital (IAH) son un factor importante que impulsa la mayor demanda de soluciones de esterilización avanzadas.

- Por ejemplo, en marzo de 2024, STERIS anunció una expansión de sus sistemas de esterilización automatizada en hospitales estadounidenses para abordar las crecientes cargas de trabajo quirúrgicas y los requisitos de control de infecciones.

- A medida que los centros de atención médica enfatizan la seguridad del paciente y el cumplimiento normativo, la esterilización de dispositivos médicos ofrece procesos confiables y validados para prevenir la contaminación cruzada y garantizar la esterilidad.

- Además, la adopción de esterilizadores avanzados que se integran con los sistemas informáticos del hospital permite una documentación, un seguimiento y una generación de informes fluidos, lo cual es esencial para el cumplimiento normativo.

- La mayor eficiencia operativa, la reducción del tiempo de inactividad de los instrumentos y los procedimientos de esterilización estandarizados son factores clave que impulsan la adopción de sistemas de esterilización modernos en hospitales, clínicas y unidades de fabricación farmacéutica.

- La creciente demanda de instrumental médico estéril en los laboratorios de producción e investigación farmacéutica está generando nuevas oportunidades de crecimiento para las tecnologías de esterilización. Por ejemplo, Midmark Corporation ha ampliado su oferta de esterilización para laboratorios biotecnológicos que producen medicamentos inyectables, cumpliendo con los requisitos de esterilidad y cumplimiento normativo.

- Las iniciativas gubernamentales de apoyo que promueven la seguridad de los pacientes y los estándares de control de infecciones en los EE. UU. están impulsando aún más el crecimiento del mercado.

Restricción/Desafío

Altos costos de los equipos y obstáculos para el cumplimiento normativo

- El costo inicial relativamente alto de los equipos de esterilización avanzados, junto con los gastos de mantenimiento constantes, plantea un desafío importante para una penetración más amplia en el mercado.

- Por ejemplo, los esterilizadores sofisticados de baja temperatura o los sistemas automatizados de STERIS o Getinge requieren una inversión de capital sustancial, lo que puede ser una barrera para los centros de atención médica más pequeños.

- El cumplimiento de las estrictas normas de esterilización de la FDA y los CDC de EE. UU. aumenta la complejidad operativa y requiere capacitación continua del personal, lo que agrava aún más el costo y dificulta su adopción. Por ejemplo, los hospitales deben mantener registros detallados de esterilización y adherirse a protocolos validados para cumplir con las auditorías regulatorias, lo que puede sobrecargar los recursos en centros más pequeños o con fondos insuficientes.

- La escasa concienciación y experiencia técnica de los pequeños proveedores de atención médica en el funcionamiento de sistemas de esterilización avanzados puede ralentizar la adopción. Por ejemplo, las clínicas pueden requerir capacitación externa o asistencia técnica para utilizar correctamente los esterilizadores Tuttnauer o Midmark, lo que aumenta la complejidad operativa.

- Los posibles tiempos de inactividad y las interrupciones durante la instalación o el mantenimiento de equipos de esterilización de alta gama también pueden obstaculizar la rápida adopción.

Alcance del mercado de esterilización de dispositivos médicos en América del Norte

El mercado está segmentado en función del producto, la tecnología, el usuario final y el canal de distribución.

- Por producto

Según el producto, el mercado se segmenta en instrumentos, reactivos y servicios. El segmento de instrumentos dominó el mercado con la mayor participación en los ingresos en 2024, impulsado por la alta demanda de instrumental quirúrgico esterilizado y herramientas de diagnóstico en hospitales, clínicas y laboratorios. Los hospitales y centros quirúrgicos priorizan la esterilización del instrumental para garantizar la seguridad del paciente y el cumplimiento de las estrictas normas regulatorias. El uso generalizado de instrumental reutilizable y el creciente número de procedimientos quirúrgicos contribuyen aún más al crecimiento del segmento. Los equipos de esterilización avanzados diseñados para instrumental, como los autoclaves automatizados y los esterilizadores de baja temperatura, también mejoran la eficiencia operativa. Además, el segmento se beneficia de la innovación continua en tecnologías de esterilización adaptadas a instrumental sensible. En general, el instrumental sigue siendo crucial debido a su papel directo en la atención al paciente y la prevención de infecciones.

Se prevé que el segmento de servicios experimente el mayor crecimiento entre 2025 y 2032, impulsado por las tendencias de externalización en centros sanitarios y empresas farmacéuticas. Los proveedores de servicios ofrecen esterilización como servicio, lo que reduce la necesidad de que hospitales y laboratorios inviertan grandes cantidades en equipos propios. Este segmento también se beneficia de estrictos requisitos de cumplimiento normativo, lo que convierte a los servicios de esterilización de terceros en una opción atractiva para centros más pequeños o aplicaciones especializadas. El auge de la industria biotecnológica y farmacéutica, donde los procesos estériles son cruciales, impulsa aún más la demanda de servicios profesionales de esterilización. Además, los proveedores de servicios suelen ofrecer soluciones integradas, que incluyen monitorización, documentación y validación, lo que mejora la eficiencia operativa. La comodidad, la rentabilidad y el acceso a tecnologías avanzadas contribuyen a la rápida adopción de los servicios de esterilización.

- Por tecnología

En función de la tecnología, el mercado se segmenta en esterilización térmica, esterilización por radiación ionizante, esterilización por filtración y esterilización por gases y productos químicos. El segmento de esterilización térmica dominó el mercado con la mayor participación en los ingresos, un 39%, en 2024, impulsado por su probada fiabilidad, rentabilidad y amplia aplicación en centros sanitarios. Los autoclaves de vapor y otros esterilizadores térmicos son los preferidos por su capacidad para esterilizar una amplia gama de instrumentos de forma eficiente. El método está bien establecido, validado y cuenta con un amplio respaldo regulatorio, lo que lo convierte en una opción preferida para hospitales y laboratorios. La alta tasa de adopción también se ve respaldada por las continuas mejoras tecnológicas en el diseño de autoclaves, la eficiencia energética y la monitorización de ciclos. Los profesionales sanitarios confían en la esterilización térmica por su simplicidad, reproducibilidad y eficacia duradera en la prevención de infecciones.

Se prevé que el segmento de esterilización por radiación ionizante experimente el mayor crecimiento entre 2025 y 2032, impulsado por su idoneidad para dispositivos médicos y productos farmacéuticos sensibles al calor. Los rayos gamma, los haces de electrones y los rayos X pueden esterilizar productos sin causar daños térmicos, lo cual es fundamental para los instrumentos médicos e implantes modernos. El sector farmacéutico recurre cada vez más a la esterilización por radiación para dispositivos de un solo uso, medicamentos inyectables y materiales de envasado. Su capacidad para proporcionar una esterilización uniforme a gran escala favorece su rápida adopción industrial. La creciente aprobación regulatoria y el conocimiento de los beneficios de la esterilización por radiación aceleran aún más su adopción. La precisión, la velocidad y la compatibilidad de este método con materiales sensibles lo convierten en un área clave de crecimiento en el mercado norteamericano.

- Por el usuario final

En función del usuario final, el mercado se segmenta en compañías farmacéuticas, hospitales, clínicas, laboratorios, institutos académicos y de investigación, fabricantes de dispositivos médicos, entre otros. El segmento hospitalario dominó el mercado con la mayor participación en ingresos en 2024, impulsado por el alto volumen de procedimientos quirúrgicos, la necesidad crítica de instrumental estéril y el cumplimiento de estrictos protocolos de control de infecciones. Los hospitales requieren soluciones de esterilización confiables para garantizar la seguridad del paciente, el cumplimiento normativo y la eficiencia operativa. El creciente número de procedimientos hospitalarios y cirugías mínimamente invasivas contribuye a una demanda sostenida. La integración de esterilizadores avanzados con los sistemas informáticos hospitalarios para la monitorización y la documentación también impulsa su adopción. Los hospitales siguen siendo el mayor usuario final debido al amplio uso de dispositivos e instrumental médico que requieren esterilización frecuente.

Se prevé que el segmento de las compañías farmacéuticas experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente producción de medicamentos estériles, productos biológicos y terapias inyectables. Los fabricantes farmacéuticos requieren soluciones de esterilización de alto volumen para reactivos, instrumental y líneas de producción. Las estrictas directrices de la FDA y la USP en materia de esterilidad, combinadas con la creciente externalización de servicios de esterilización, impulsan su adopción en el mercado. Tecnologías avanzadas como la esterilización a baja temperatura y por radiación son especialmente relevantes para productos sensibles. El aumento de las actividades de I+D en productos biológicos y medicamentos inyectables estériles también impulsa el crecimiento del segmento. La necesidad de cumplimiento normativo, seguridad y alto rendimiento convierte a las compañías farmacéuticas en un segmento de usuarios finales en rápido crecimiento.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en licitaciones directas, ventas minoristas y distribuidores externos. El segmento de licitaciones directas dominó el mercado con la mayor participación en los ingresos en 2024, impulsado por hospitales, clínicas y grandes compañías farmacéuticas que adquirieron equipos de esterilización directamente de los fabricantes. La compra directa garantiza el cumplimiento de las obligaciones contractuales, la garantía, el servicio y los acuerdos de mantenimiento. La adquisición a granel mediante licitaciones reduce los costos operativos y permite a los centros acceder a las tecnologías de esterilización más avanzadas. Los acuerdos de licitación directa también facilitan la integración con los sistemas informáticos y de flujo de trabajo existentes en hospitales o laboratorios. La preferencia por las licitaciones directas se ve reforzada por los contratos de servicio a largo plazo y las inversiones de alto valor.

Se prevé que el segmento de distribuidores externos experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de centros de salud, laboratorios y clínicas más pequeños que no pueden realizar grandes inversiones en compras directas. Los distribuidores ofrecen acceso flexible a equipos y consumibles de esterilización avanzados sin una inversión inicial significativa. Suelen ofrecer soporte de mantenimiento, instalación y capacitación, lo que facilita la adopción por parte de los usuarios finales. El crecimiento de centros de salud remotos y pequeños en Norteamérica impulsa aún más las ventas impulsadas por distribuidores. La disponibilidad de diversas marcas y tecnologías a través de distribuidores también aumenta la penetración en el mercado. La rentabilidad y la facilidad operativa convierten a los distribuidores externos en un canal de rápido crecimiento.

Análisis regional del mercado de esterilización de dispositivos médicos en América del Norte

- Estados Unidos dominó el mercado de esterilización de dispositivos médicos de América del Norte con la mayor participación en los ingresos del 67,8 % en 2024, caracterizado por una infraestructura de atención médica avanzada, un alto gasto en atención médica y una fuerte presencia de actores clave de la industria.

- Los proveedores de atención médica y las empresas farmacéuticas de la región priorizan la seguridad del paciente, el control de infecciones y el cumplimiento, lo que hace que las soluciones de esterilización sean fundamentales en hospitales, clínicas, laboratorios e instalaciones de fabricación.

- Esta adopción generalizada está respaldada además por una fuerte presencia de actores clave de la industria, un alto gasto en atención médica e inversiones continuas en tecnologías de esterilización avanzadas, lo que establece a los EE. UU. como el mercado líder para la esterilización de dispositivos médicos en América del Norte.

Análisis del mercado de esterilización de dispositivos médicos en EE. UU.

El mercado estadounidense de esterilización de dispositivos médicos captó la mayor participación en los ingresos, con un 67,8 %, en 2024 en Norteamérica, impulsado por la alta prevalencia de infecciones hospitalarias, el aumento de los procedimientos quirúrgicos y una infraestructura sanitaria avanzada. Los profesionales sanitarios priorizan la seguridad del paciente y el cumplimiento normativo, lo que hace que las soluciones de esterilización sean cruciales en hospitales, clínicas y laboratorios. La creciente demanda de sistemas de esterilización automatizados, de baja temperatura y con IoT impulsa aún más el mercado. Además, la presencia de actores clave del sector como STERIS, Getinge y Tuttnauer, junto con los continuos avances tecnológicos, contribuye significativamente a la expansión del mercado.

Análisis del mercado de esterilización de dispositivos médicos en Canadá

Se proyecta que el mercado canadiense de esterilización de dispositivos médicos se expandirá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado por el aumento de las inversiones en infraestructura sanitaria y la mayor concienciación sobre el control de infecciones. Hospitales, clínicas y compañías farmacéuticas están adoptando cada vez más sistemas de esterilización avanzados para cumplir con las normas regulatorias y garantizar la seguridad del paciente. El énfasis del gobierno en la calidad de la atención médica y los estrictos requisitos de cumplimiento impulsan el crecimiento del mercado. Además, la automatización y la integración del IoT en los esterilizadores están cobrando impulso, lo que permite una monitorización, documentación y mantenimiento predictivo eficientes en todos los centros sanitarios.

Análisis del mercado de esterilización de dispositivos médicos en México

Se prevé que el mercado mexicano de esterilización de dispositivos médicos crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por el aumento de centros de salud y el incremento de procedimientos quirúrgicos. La mayor concienciación sobre el control de infecciones y la seguridad del paciente anima a hospitales y clínicas a invertir en equipos de esterilización confiables. El crecimiento del mercado también se ve impulsado por las colaboraciones entre distribuidores locales y fabricantes globales de equipos de esterilización. Asimismo, la adopción de tecnologías de esterilización a baja temperatura y por radiación se está expandiendo, especialmente en hospitales privados y clínicas especializadas, para cumplir con los requisitos de eficiencia y cumplimiento normativo.

Cuota de mercado de esterilización de dispositivos médicos en América del Norte

La industria de esterilización de dispositivos médicos de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- STERIS (EE. UU.)

- Sterigenics US, LLC (EE. UU.)

- Sotera Health (EE. UU.)

- Getinge AB (Suecia)

- Cardinal Health (EE. UU.)

- 3M (EE. UU.)

- Midmark Corporation (EE. UU.)

- Merck KGaA, (Alemania)

- Dentsply Sirona (EE. UU.)

- MATACHANA (España)

- SciCan Ltd. (Canadá)

- MELAG Medizintechnik GmbH & Co. KG (Alemania)

- Grupo MMM (Alemania)

- ASP (EE. UU.)

- Tuttnauer USA Co. Ltd. (EE. UU.)

- Steelco SpA (Italia)

- Belimed AG (Suiza)

- Systec GmbH (Alemania)

- BMT USA, LLC (EE. UU.)

- Continental Equipment Company (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de esterilización de dispositivos médicos en América del Norte?

- En noviembre de 2024, la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) publicó una guía sobre la política de cumplimiento transitorio para los cambios en las instalaciones de esterilización con óxido de etileno para dispositivos de Clase III. Esta política describe el enfoque de la FDA para garantizar la seguridad continua del paciente y la disponibilidad de los dispositivos durante la implementación de nuevos métodos de esterilización o modificaciones en las instalaciones. La guía refleja el compromiso de la agencia de equilibrar el cumplimiento normativo con la necesidad de procesos de esterilización eficaces.

- En noviembre de 2024, Cosmed Group Inc., empresa de esterilización, se declaró en bancarrota (capítulo 11) tras numerosas demandas por lesiones, incluido cáncer, causadas por la exposición al óxido de etileno. La empresa enfrentó al menos 300 demandas y previamente había llegado a un acuerdo con la EPA por 1,5 millones de dólares en una investigación sobre emisiones de EtO en varias instalaciones. Este hecho pone de relieve los crecientes riesgos legales y financieros asociados a los métodos tradicionales de esterilización.

- En julio de 2024, Noxilizer, Inc. anunció una inversión de 30 millones de dólares para ampliar su plataforma de esterilización con dióxido de nitrógeno (NO₂). Esta tecnología ofrece una alternativa más segura y no cancerígena al EtO, respondiendo a la creciente presión regulatoria. La financiación apoyará la ampliación de los sistemas de esterilización con NO₂, con el objetivo de ofrecer una solución viable para la esterilización de dispositivos médicos sin los riesgos para la salud asociados al EtO.

- En abril de 2024, la planta de Servicios de Esterilización de Tennessee en Memphis, que utilizaba óxido de etileno para esterilizar equipos médicos, anunció su cierre debido a problemas con la extensión del contrato de arrendamiento. El cierre de la planta se considera una victoria para los grupos ambientalistas, ya que la planta había sido una fuente de problemas de salud relacionados con la exposición al EtO en las comunidades cercanas. Este cierre pone de relieve los desafíos y el escrutinio continuos que enfrentan las instalaciones que utilizan EtO para la esterilización.

- En marzo de 2024, la Agencia de Protección Ambiental de EE. UU. (EPA) aprobó una norma para reducir las emisiones de óxido de etileno (EtO) de las instalaciones de esterilización comercial en aproximadamente un 90 %. Esta decisión se debió al aumento del riesgo de cáncer asociado con la exposición prolongada al EtO. La nueva normativa exige que casi 90 instalaciones implementen controles de contaminación mejorados y análisis de la calidad del aire. Si bien esta medida busca proteger la salud pública, ha suscitado preocupación por posibles interrupciones en la cadena de suministro de dispositivos médicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.