North America Medical Automation Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

35.34 Billion

USD

75.75 Billion

2025

2033

USD

35.34 Billion

USD

75.75 Billion

2025

2033

| 2026 –2033 | |

| USD 35.34 Billion | |

| USD 75.75 Billion | |

|

|

|

|

Segmentación del mercado de automatización médica en Norteamérica por componente (equipo, software y servicios), tipo (formulación y dispensación automatizadas de recetas, evaluación y monitorización automatizadas de la salud, imágenes y análisis automatizados, logística automatizada de la atención médica, seguimiento de recursos y personal, robótica médica y dispositivos quirúrgicos asistidos por computadora, procedimientos terapéuticos (no quirúrgicos) automatizados y análisis y pruebas de laboratorio automatizadas), aplicación (diagnóstico y monitorización, terapéutica, automatización de laboratorios y farmacias, logística y formación médica, entre otros), conectividad (cableada e inalámbrica), usuario final (hospitales, centros de diagnóstico, farmacias, laboratorios e institutos de investigación, atención domiciliaria, clínicas especializadas, centros de cirugía ambulatoria (ASCS), entre otros), canal de distribución (licitación directa, venta minorista, venta en línea, entre otros): tendencias y pronóstico del sector hasta 2033.

Tamaño del mercado de automatización médica en América del Norte

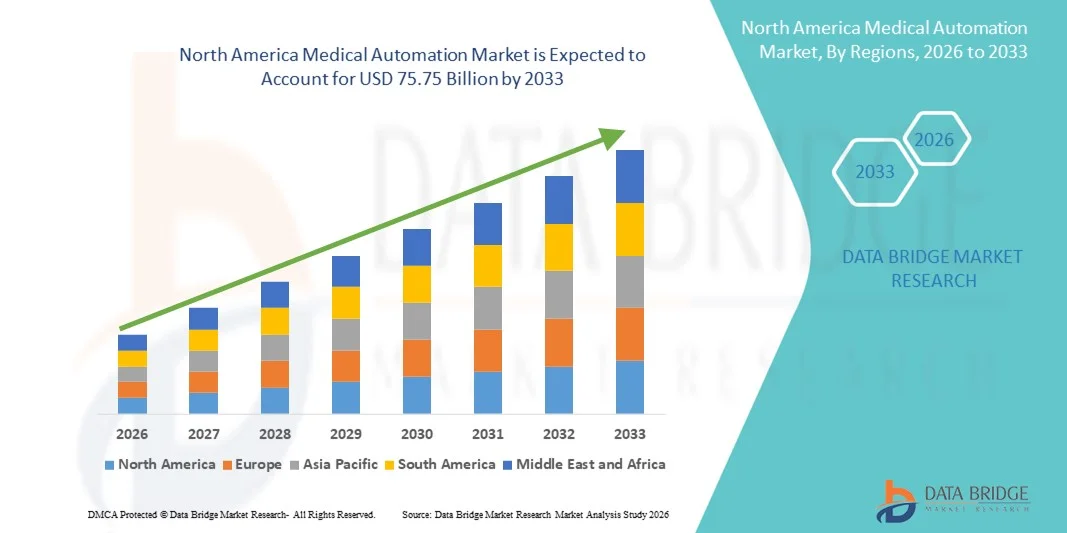

- El tamaño del mercado de automatización médica de América del Norte se valoró en USD 35,34 mil millones en 2025 y se espera que alcance los USD 75,75 mil millones para 2033 , con una CAGR del 10,00% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la rápida adopción de sistemas avanzados de TI para el cuidado de la salud, robótica e inteligencia artificial en hospitales y laboratorios de diagnóstico, lo que lleva a una mayor automatización de los flujos de trabajo clínicos, administrativos y operativos tanto en entornos hospitalarios como ambulatorios.

- Además, la creciente demanda de mayor eficiencia operativa, reducción de errores humanos, contención de costos y mayor seguridad del paciente está consolidando la automatización médica como un componente crucial de la atención médica moderna. Estos factores convergentes están acelerando la adopción de soluciones de automatización médica, impulsando así significativamente el crecimiento del sector.

Análisis del mercado de automatización médica en América del Norte

- La automatización médica, que abarca la robótica, el software impulsado por IA, los diagnósticos automatizados y las soluciones de flujo de trabajo digital, se está volviendo cada vez más esencial en hospitales, laboratorios e instalaciones ambulatorias a medida que los proveedores de atención médica buscan mejorar la eficiencia operativa, la precisión clínica y la seguridad del paciente.

- La creciente demanda de automatización médica está impulsada principalmente por el aumento del volumen de pacientes, la creciente presión para reducir los costos operativos, la escasez de profesionales de la salud capacitados y la rápida adopción de tecnologías de salud digital , IA y robótica en los procesos clínicos y administrativos.

- Estados Unidos dominó el mercado de automatización médica en América del Norte con la mayor participación en los ingresos de aproximadamente el 38,6 % en 2025, respaldado por una infraestructura de atención médica bien establecida, la adopción temprana de soluciones avanzadas de automatización de la atención médica, la implementación generalizada de diagnósticos habilitados por IA, cirugía robótica y automatización hospitalaria, junto con fuertes inversiones de empresas líderes en tecnología médica.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de automatización médica durante el período de pronóstico, con una CAGR sólida de 11.8%, impulsada por la creciente modernización de las instalaciones de atención médica, fuertes iniciativas gubernamentales que apoyan la digitalización de la atención médica, la creciente adopción de robótica médica y las crecientes inversiones en soluciones hospitalarias inteligentes por parte de actores nacionales e internacionales.

- El segmento cableado dominó el mercado con una participación en los ingresos de casi el 58,2 % en 2025, principalmente debido a su confiabilidad superior, transmisión de datos estable y rendimiento de baja latencia en entornos de atención médica críticos.

Alcance del informe y segmentación del mercado de automatización médica

|

Atributos |

Perspectivas clave del mercado de la automatización médica |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

• Siemens Healthineers (Alemania) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis en profundidad de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado de automatización médica en América del Norte

Creciente adopción de flujos de trabajo clínicos y de laboratorio automatizados

- Una tendencia significativa y en aceleración en el mercado global de automatización médica es la adopción generalizada de sistemas automatizados en hospitales, laboratorios de diagnóstico, instalaciones de fabricación farmacéutica y centros de atención ambulatoria para mejorar la eficiencia, la precisión y la seguridad del paciente.

- Por ejemplo, en 2024, Siemens Healthineers amplió la implementación de sus plataformas de automatización de laboratorio en América del Norte, América del Norte y Asia-Pacífico, respaldando diagnósticos de alto rendimiento y flujos de trabajo de pruebas estandarizados a escala global.

- Las soluciones de automatización médica se utilizan cada vez más para agilizar tareas clínicas y administrativas repetitivas, como la preparación de muestras, la dispensación de medicamentos, la monitorización de pacientes y la gestión de datos, lo que reduce significativamente la intervención manual y las tasas de error.

- La creciente demanda mundial de diagnósticos más rápidos, resultados clínicos consistentes y pruebas de gran volumen está acelerando la adopción de la automatización en los mercados de atención médica desarrollados y emergentes.

- Los avances en robótica, plataformas de software integradas y sistemas habilitados por sensores están permitiendo una coordinación perfecta entre diferentes funciones de atención médica, mejorando la continuidad del flujo de trabajo en entornos de atención complejos.

- Este cambio hacia sistemas de atención médica automatizados, escalables e interoperables está transformando fundamentalmente los modelos globales de prestación de atención médica y fortaleciendo el papel de la automatización médica en todo el mundo.

Dinámica del mercado de automatización médica en América del Norte

Conductor

Creciente demanda mundial de atención médica y requisitos de eficiencia operativa

- La creciente carga mundial de enfermedades crónicas, el envejecimiento de la población y el creciente volumen de pacientes son impulsores clave que respaldan el crecimiento del mercado mundial de automatización médica.

- Por ejemplo, en abril de 2025, Fresenius Medical Care anunció el lanzamiento global de soluciones automatizadas de gestión y monitoreo de tratamientos en sus clínicas de diálisis en múltiples regiones, con el objetivo de mejorar la consistencia de la atención y la eficiencia operativa.

- Los proveedores de atención médica en todo el mundo están adoptando cada vez más tecnologías de automatización para abordar la escasez de fuerza laboral, reducir los costos operativos y mejorar la consistencia en los procesos clínicos.

- La expansión de laboratorios centralizados, centros de fabricación farmacéutica e instalaciones de atención ambulatoria en regiones como Asia-Pacífico, América Latina y Medio Oriente está impulsando aún más la demanda de sistemas médicos automatizados.

- Además, las iniciativas globales de modernización de la atención médica y las inversiones en infraestructura digital y automatizada están acelerando la integración de soluciones de automatización en entornos de atención médica públicos y privados.

- Estos factores crean colectivamente un fuerte impulso para un crecimiento sostenido en el mercado global de automatización médica durante el período de pronóstico.

Restricción/Desafío

Altos costos de capital y complejidad de implementación

- La elevada inversión inicial requerida para los sistemas avanzados de automatización médica sigue siendo un gran desafío para los proveedores de atención médica, en particular en regiones con recursos limitados y sensibles a los costos.

- Por ejemplo, en 2024, varios hospitales en mercados emergentes de Asia y América Latina pospusieron proyectos de automatización de laboratorios a gran escala debido a limitaciones de financiamiento y desafíos de preparación de infraestructura, lo que pone de relieve las barreras de adopción relacionadas con los costos.

- La complejidad de la integración del sistema, incluida la compatibilidad con la infraestructura heredada existente y los sistemas de información hospitalaria, puede extender los plazos de implementación y aumentar los costos totales de propiedad.

- Además, desafíos como los requisitos de capacitación del personal, el rediseño del flujo de trabajo y las interrupciones operativas temporales durante la implementación pueden retrasar aún más la adopción.

- La variabilidad regulatoria entre países y regiones puede complicar la implementación de soluciones de automatización estandarizadas, aumentando los costos relacionados con el cumplimiento.

- Superar estas restricciones a través de un diseño de sistemas escalables, modelos de financiamiento flexibles y estrategias de implementación respaldadas por los proveedores será esencial para el crecimiento a largo plazo del mercado global de automatización médica.

Alcance del mercado de automatización médica en América del Norte

El mercado está segmentado según el componente, el tipo, la aplicación, la conectividad, el usuario final y el canal de distribución.

- Por componente

Según sus componentes, el mercado de la automatización médica se segmenta en equipos, software y servicios. El segmento de equipos dominó la mayor cuota de mercado en ingresos, con un 46,1 % aproximadamente, en 2025, impulsado por la amplia implementación de sistemas de hardware automatizados en hospitales, laboratorios de diagnóstico y clínicas especializadas. Equipos como sistemas de imágenes automatizadas, plataformas quirúrgicas robóticas, unidades de dispensación automatizadas y robots de laboratorio constituyen la columna vertebral de la infraestructura de automatización médica. Los hospitales siguen priorizando la inversión de capital en equipos de automatización para reducir los errores clínicos, mejorar la precisión de los procedimientos y gestionar el creciente volumen de pacientes. La fuerte demanda de los hospitales terciarios y los centros médicos académicos respalda este dominio. Las soluciones de equipos también se benefician de ciclos de reemplazo más largos y un alto valor de adquisición inicial. La integración de sensores con IA, robótica y controladores inteligentes impulsa aún más la adopción. Mercados desarrollados como EE. UU., Alemania, Japón y Francia lideran la implementación de equipos. Las continuas actualizaciones y la expansión de las instalaciones automatizadas mantienen el liderazgo en ingresos.

Se espera que el segmento de software experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 22,4 %, entre 2026 y 2033, debido a la rápida digitalización de los flujos de trabajo en el sector sanitario y a la creciente dependencia de la automatización basada en datos. Las plataformas de software permiten el control centralizado, la monitorización en tiempo real, el mantenimiento predictivo y el soporte de decisiones basado en IA en sistemas automatizados. La creciente adopción de soluciones basadas en la nube, algoritmos de IA y software interoperable integrado con historiales clínicos electrónicos acelera el crecimiento. Los proveedores de servicios sanitarios implementan cada vez más software de automatización para optimizar el uso de los equipos y reducir los costes operativos. Los modelos basados en suscripción y SaaS impulsan aún más la adopción. La expansión de la telesalud y el diagnóstico remoto también impulsa la demanda. Las economías emergentes están invirtiendo fuertemente en software de automatización debido a sus menores costes iniciales en comparación con el hardware. El énfasis regulatorio en la trazabilidad y el cumplimiento normativo también impulsa el crecimiento del software.

- Por tipo

Según el tipo, el mercado se segmenta en formulación y dispensación automatizada de recetas, evaluación y monitorización automatizadas de la salud, imágenes y análisis automatizados de imágenes, logística automatizada de la atención médica, seguimiento de recursos y personal, robótica médica y dispositivos quirúrgicos asistidos por computadora, procedimientos terapéuticos automatizados (no quirúrgicos) y pruebas y análisis de laboratorio automatizados. El segmento de imágenes y análisis automatizados de imágenes dominó la mayor cuota de mercado en ingresos de aproximadamente el 35,6 % en 2025, impulsado por la creciente demanda de imágenes diagnósticas rápidas, precisas y de gran volumen. La automatización mejora la eficiencia del flujo de trabajo en los departamentos de radiología y minimiza la variabilidad diagnóstica. Las herramientas de imágenes impulsadas por IA ayudan a los médicos en la detección temprana de enfermedades y la toma de decisiones clínicas. Su alta utilización en oncología, cardiología y neurología fortalece la adopción. Las grandes cadenas de diagnóstico y los hospitales dependen en gran medida de las imágenes automatizadas para gestionar el creciente volumen de escaneos. Las aprobaciones regulatorias de las soluciones de imágenes basadas en IA respaldan aún más el dominio. La integración con PACS y los sistemas informáticos del hospital aumenta el valor. Las regiones desarrolladas dominan la adopción debido a la infraestructura avanzada.

Se prevé que el segmento de Robótica Médica y Dispositivos Quirúrgicos Asistidos por Computadora registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 24,1 %, entre 2026 y 2033, impulsada por la creciente preferencia por las cirugías mínimamente invasivas y de precisión. Los sistemas robóticos mejoran la precisión quirúrgica, reducen la pérdida de sangre y acortan las estancias hospitalarias. El crecimiento de los programas de formación de cirujanos y la expansión de las indicaciones en ortopedia, urología, ginecología y neurocirugía impulsan su adopción. Avances tecnológicos como la navegación asistida por IA y las funciones autónomas aceleran el crecimiento. Los hospitales invierten en robótica para diferenciar sus servicios y mejorar los resultados. La expansión en los mercados de Asia-Pacífico y Oriente Medio impulsa aún más la TCAC. Las tendencias favorables en los reembolsos y la demanda de atención avanzada por parte de los pacientes refuerzan el impulso de crecimiento.

- Por aplicación

Según la aplicación, el mercado se segmenta en Diagnóstico y Monitoreo, Terapéutica, Automatización de Laboratorio y Farmacia, Logística y Capacitación Médica, y Otros. El segmento de Diagnóstico y Monitoreo representó la mayor participación en los ingresos del mercado, con aproximadamente el 41,3% en 2025, impulsado por la creciente prevalencia de enfermedades crónicas y la necesidad de monitoreo continuo de pacientes. Los sistemas de diagnóstico automatizados mejoran la precisión y reducen los tiempos de respuesta. Las soluciones de monitoreo remoto tuvieron una fuerte adopción después de la pandemia. Los hospitales implementan cada vez más diagnósticos automatizados para gestionar un alto volumen de pacientes. La integración con dispositivos portátiles y plataformas de IoT fortalece aún más su dominio. Las iniciativas gubernamentales que apoyan el diagnóstico digital también contribuyen. La automatización del diagnóstico sigue siendo fundamental para las estrategias de atención médica preventiva.

Se proyecta que el segmento de Automatización de Laboratorios y Farmacias registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 23,0 %, entre 2026 y 2033, impulsada por el aumento del volumen de pruebas y la demanda de dispensación de medicamentos sin errores. La automatización mejora la productividad del laboratorio, reduce los riesgos de contaminación y garantiza el cumplimiento normativo. La automatización de farmacias minimiza los errores de medicación y mejora el control de inventario. Su alta adopción en farmacias hospitalarias y laboratorios centralizados impulsa el crecimiento. La expansión de las instalaciones ambulatorias aumenta la demanda. El creciente énfasis en la medicina personalizada acelera aún más su adopción.

- Por conectividad

En función de la conectividad, el mercado se segmenta en cableado e inalámbrico. El segmento cableado dominó el mercado con una cuota de mercado cercana al 58,2% en 2025, principalmente gracias a su fiabilidad superior, transmisión de datos estable y rendimiento de baja latencia en entornos sanitarios críticos. La conectividad cableada es ampliamente preferida para los sistemas de automatización utilizados en quirófanos, unidades de cuidados intensivos (UCI), diagnóstico por imagen y automatización de laboratorios, donde el rendimiento ininterrumpido es esencial. Los hospitales dependen de las redes cableadas para garantizar un tiempo de funcionamiento constante del sistema y minimizar los riesgos de ciberseguridad asociados a la transferencia inalámbrica de datos. La infraestructura hospitalaria existente está diseñada principalmente en torno a la conectividad cableada, lo que reduce los costes de inversión adicionales. Los sistemas cableados también soportan altas cargas de datos generadas por sistemas de imagenología y robóticos. El cumplimiento normativo y los requisitos de protección de datos favorecen aún más las soluciones cableadas. Los grandes centros sanitarios priorizan la automatización cableada para aplicaciones de misión crítica. La durabilidad a largo plazo y el rendimiento predecible contribuyen a su continuo dominio.

Se espera que el segmento inalámbrico crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 21,2 %, entre 2026 y 2033, impulsada por la rápida expansión de dispositivos médicos con IoT y soluciones de monitorización remota de pacientes. La conectividad inalámbrica permite una mayor flexibilidad y movilidad tanto para profesionales sanitarios como para pacientes. La creciente adopción de la telesalud y la atención domiciliaria respalda firmemente la implementación de la automatización inalámbrica. Los sistemas inalámbricos reducen la complejidad de la instalación y permiten una expansión escalable entre centros. El crecimiento de los centros de cirugía ambulatoria y las clínicas ambulatorias acelera aún más la adopción. Los avances en la tecnología 5G mejoran significativamente el ancho de banda, la velocidad y la fiabilidad. La conectividad inalámbrica también es fundamental para los dispositivos portátiles y los sensores inteligentes. Las economías emergentes adoptan cada vez más sistemas inalámbricos debido a la reducción de los requisitos de infraestructura. La innovación continua fortalece las perspectivas de crecimiento a largo plazo.

- Por el usuario final

Según el usuario final, el mercado se segmenta en hospitales, centros de diagnóstico, farmacias, laboratorios e institutos de investigación, atención domiciliaria, clínicas especializadas, centros de cirugía ambulatoria (ASC) y otros. El segmento de hospitales dominó el mercado con una participación en los ingresos de aproximadamente el 49,4 % en 2025, impulsado por una amplia implementación de la automatización en múltiples departamentos. Los hospitales invierten fuertemente en diagnósticos automatizados, cirugía asistida por robot, automatización de farmacias y sistemas de monitoreo de pacientes para mejorar la eficiencia y los resultados de los pacientes. Los grandes volúmenes de pacientes requieren flujos de trabajo optimizados y una reducción del error humano. Los hospitales también se benefician de mayores presupuestos de capital y acceso a financiación gubernamental o privada. La integración de la automatización con los sistemas de información hospitalaria fortalece aún más la adopción. Los hospitales docentes y terciarios son pioneros en la adopción de tecnologías de automatización avanzadas. La presión regulatoria para mejorar la calidad de la atención respalda la inversión continua. Los hospitales también priorizan la automatización para abordar la escasez de personal. La planificación de infraestructura a largo plazo mantiene el liderazgo del mercado.

Se prevé que el segmento de atención domiciliaria experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 22,6 %, entre 2026 y 2033, impulsada por la creciente transición hacia una atención sanitaria descentralizada y centrada en el paciente. El creciente envejecimiento de la población y la creciente prevalencia de enfermedades crónicas impulsan significativamente la demanda de soluciones de automatización domiciliaria. Los dispositivos de monitorización automatizados permiten el seguimiento continuo del estado de salud del paciente. El diagnóstico remoto y la integración de la telesalud mejoran la accesibilidad a la atención. La automatización de la atención domiciliaria reduce los reingresos hospitalarios y los costes sanitarios generales. Los avances tecnológicos han dado lugar a dispositivos de automatización compactos, fáciles de usar y portátiles. La creciente preferencia de los pacientes por el tratamiento domiciliario impulsa aún más el crecimiento. La expansión de la conectividad inalámbrica mejora la viabilidad. Las políticas de reembolso favorables en las regiones desarrolladas aceleran su adopción. Los mercados emergentes también muestran un gran potencial de crecimiento para la automatización de la atención domiciliaria.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en Licitación Directa, Ventas Minoristas, Ventas en Línea y Otros. El segmento de Licitación Directa obtuvo la mayor participación en los ingresos, con aproximadamente el 53,7% en 2025, gracias a los contratos de adquisición a gran escala de hospitales, sistemas de salud gubernamentales e instituciones públicas. Las licitaciones directas permiten la compra a gran escala de equipos y sistemas de automatización de alto valor. Este canal garantiza una implementación estandarizada y el cumplimiento de los requisitos regulatorios. Los gobiernos y las grandes redes hospitalarias prefieren las licitaciones directas por su transparencia y rentabilidad. Los contratos de servicio y mantenimiento a largo plazo fortalecen aún más este canal. La licitación directa también facilita la personalización y la integración de sistemas. Sigue siendo dominante para las soluciones de automatización con alto consumo de capital. Las inversiones en salud pública sustentan firmemente la demanda.

Se espera que el segmento de ventas en línea registre la tasa de crecimiento anual compuesta (TCAC) más rápida, del 21,8 %, entre 2026 y 2033, impulsada por la creciente digitalización de los procesos de adquisición. Pequeñas clínicas, farmacias y proveedores de atención domiciliaria prefieren cada vez más las plataformas en línea para adquirir dispositivos de automatización. Las ventas en línea ofrecen mayor transparencia de precios y una mayor disponibilidad de productos. La facilidad para realizar pedidos y los plazos de entrega más rápidos impulsan la adopción. El crecimiento de las plataformas de comercio electrónico especializadas en dispositivos médicos impulsa la expansión. El software basado en suscripción y las herramientas de automatización modulares son ideales para la distribución en línea. La creciente penetración de internet en los mercados emergentes acelera aún más el crecimiento. Los canales en línea también facilitan la interacción directa entre el fabricante y el cliente. La innovación continua de las plataformas facilita la escalabilidad a largo plazo.

Análisis regional del mercado de automatización médica en América del Norte

- Se proyecta que el mercado de automatización médica de América del Norte se expandirá a una CAGR sustancial durante el período de pronóstico, impulsado principalmente por la creciente presión para mejorar la eficiencia de la atención médica, reducir los costos operativos y abordar la escasez de fuerza laboral en hospitales y centros de diagnóstico.

- El sólido marco regulatorio de la región que respalda la adopción de la salud digital, sumado a la creciente inversión en sistemas automatizados de laboratorio, cirugía asistida por robot y flujos de trabajo clínicos basados en IA, está acelerando el crecimiento del mercado. Los proveedores de atención médica en Norteamérica están adoptando cada vez más soluciones de automatización médica para mejorar la seguridad del paciente, optimizar la precisión de los diagnósticos y optimizar las operaciones hospitalarias.

- Se está observando un crecimiento en los centros de salud públicos y privados, con tecnologías de automatización que se integran tanto en los hospitales de nueva construcción como en las iniciativas de modernización de la infraestructura de salud existente.

Análisis del mercado de automatización médica en EE. UU.

El mercado estadounidense de automatización médica dominó el mercado norteamericano de automatización médica, con la mayor participación en ingresos, aproximadamente el 38,6 % en 2025. Esto se debió a una infraestructura sanitaria consolidada, la adopción temprana de soluciones avanzadas de automatización sanitaria, la implementación generalizada de diagnósticos basados en IA, cirugía robótica y automatización hospitalaria, junto con fuertes inversiones de empresas líderes en tecnología médica. El país continúa experimentando una rápida adopción de la robótica médica, los sistemas de laboratorio automatizados y los flujos de trabajo clínicos basados en IA, lo que fortalece el crecimiento general del mercado.

Análisis del mercado canadiense de automatización médica.

Se prevé que el mercado canadiense de automatización médica sea el de mayor crecimiento en Norteamérica durante el período de pronóstico, con una sólida tasa de crecimiento anual compuesta (TCAC) del 11,8 %, impulsada por la creciente modernización de los centros de salud, las sólidas iniciativas gubernamentales que apoyan la digitalización de la atención médica, la creciente adopción de la robótica médica y las crecientes inversiones en soluciones hospitalarias inteligentes por parte de actores nacionales e internacionales. Tanto los hospitales de nueva construcción como los ya existentes integran cada vez más soluciones de automatización para mejorar la atención al paciente, la eficiencia operativa y los resultados clínicos.

Cuota de mercado de automatización médica en América del Norte

La industria de la automatización médica está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• Siemens Healthineers (Alemania)

• GE Healthcare (EE. UU.)

• Philips Healthcare (Países Bajos)

• Abbott (EE. UU.)

• Roche Diagnostics (Suiza)

• Medtronic (Irlanda)

• BD (EE

. UU.) • Stryker Corporation (EE. UU.)

• Boston Scientific (EE. UU.)

• Olympus Corporation (Japón)

• Intuitive Surgical (EE. UU.)

• Danaher Corporation (EE. UU.)

• Thermo Fisher Scientific (EE. UU.)

• Agilent Technologies (EE. UU.)

• Johnson & Johnson (EE. UU.)

• Fresenius Medical Care (Alemania)

• Smith & Nephew (Reino Unido)

• Getinge AB (Suecia)

• Zimmer Biomet (EE. UU.)

• Omnicell (EE. UU.)

Últimos avances en el mercado de automatización médica en América del Norte

- En marzo de 2025, los Hospitales Prashanth de India inauguraron el Instituto de Cirugía Robótica junto con un sistema robótico quirúrgico específico para realizar cirugías mínimamente invasivas, lo que marcó una importante expansión de la automatización médica en la práctica clínica en el sur de Asia. El hospital destacó los beneficios del robot al reducir el tiempo de recuperación, la pérdida de sangre y la invasividad de los procedimientos, a la vez que facilita procedimientos de cirugía general, urología y ginecología, un hito en la adopción de la automatización a nivel regional.

- En abril de 2025, IMA Automation anunció el lanzamiento de su división IMA Med-Tech, centrada en líneas automatizadas de ensamblaje y empaquetado específicas para dispositivos médicos, como inyectores, inhaladores, plataformas de diagnóstico y dispositivos portátiles para el cuidado de la salud. Esta iniciativa refleja el impulso generalizado hacia la automatización en los procesos de fabricación y ensamblaje de dispositivos en toda la cadena de suministro del sector salud.

- En marzo de 2025, UiPath anunció un acuerdo de consultoría global con un importante proveedor de registros médicos electrónicos (EMR) para acelerar los servicios de automatización para organizaciones de atención médica en 16 países, facilitando una integración más fluida entre los EMR y los flujos de trabajo de automatización y expandiendo la presencia de herramientas de automatización en procesos clínicos y administrativos.

- En octubre de 2024, Microsoft lanzó un conjunto de nuevas herramientas de automatización e inteligencia artificial para el cuidado de la salud centradas en modelos de imágenes médicas, documentación clínica automatizada y asistencia al flujo de trabajo de enfermería, con el objetivo de reducir la carga administrativa y mejorar la prestación de atención a través de la automatización inteligente.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.