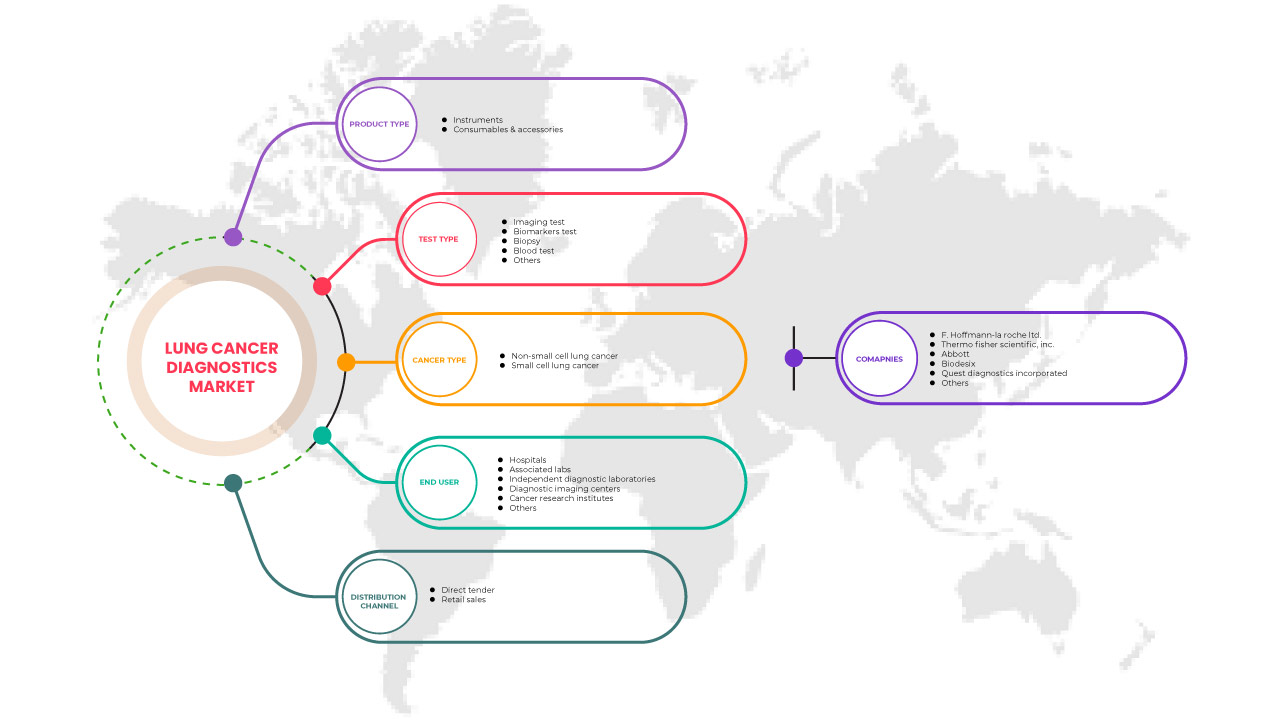

Mercado de diagnóstico de cáncer de pulmón de América del Norte, por tipo de producto (instrumentos, consumibles y accesorios), tipo de prueba (prueba de biomarcadores, prueba de imágenes, biopsia, análisis de sangre y otros), tipo de cáncer ( cáncer de pulmón de células no pequeñas , cáncer de pulmón de células pequeñas), usuario final (hospital, laboratorios asociados, laboratorios de diagnóstico independientes, centros de diagnóstico por imágenes, institutos de investigación del cáncer y otros), canal de distribución (licitación directa, ventas minoristas): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de diagnóstico de cáncer de pulmón en América del Norte

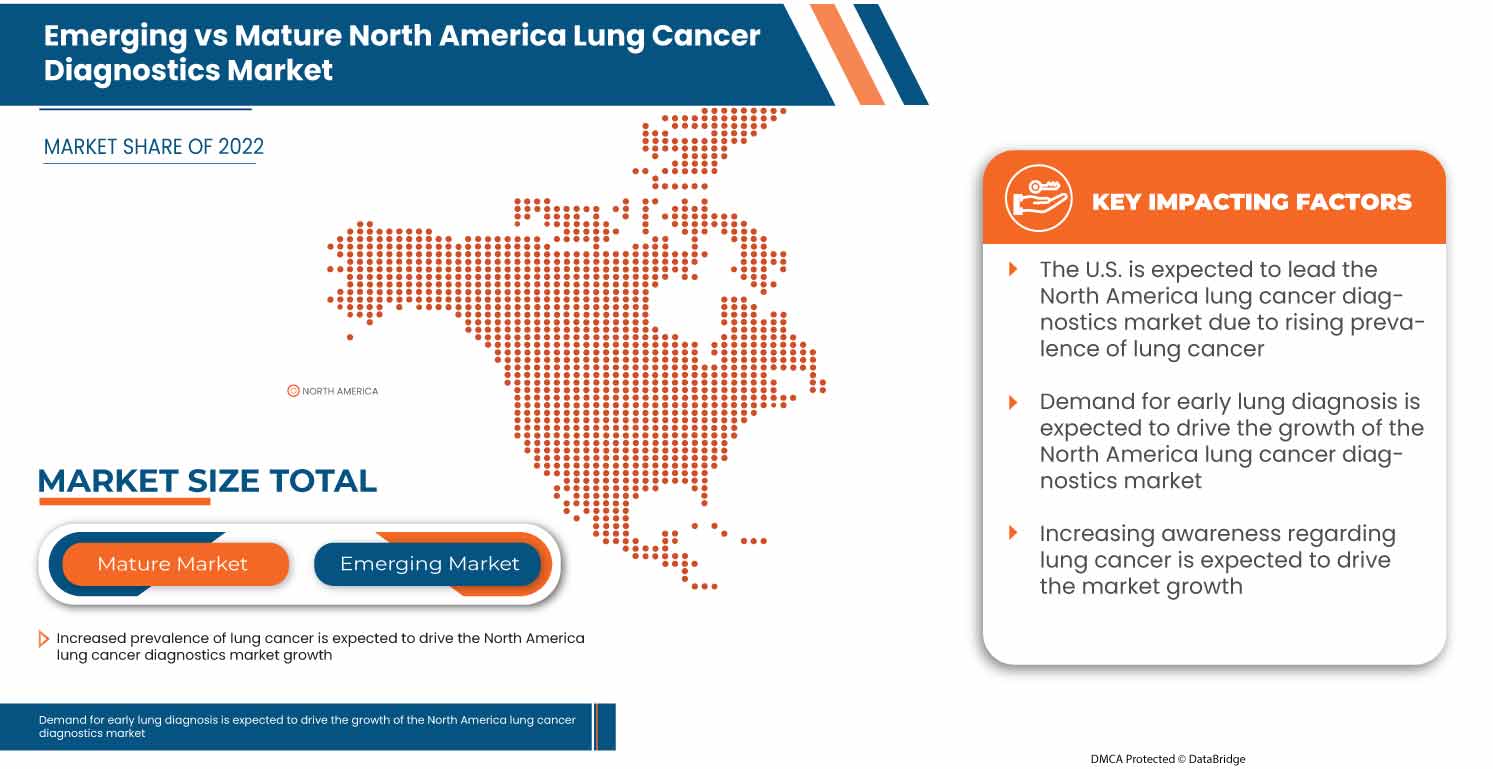

Se espera que el mercado de diagnóstico de cáncer de pulmón de América del Norte crezca en el año de pronóstico debido al aumento de los actores del mercado y la disponibilidad de servicios avanzados. Junto con esto, los fabricantes están involucrados en la actividad de I+D para lanzar nuevos servicios en el mercado. Se proyecta que el aumento de la investigación y el desarrollo del diagnóstico de cáncer de pulmón impulsará aún más el crecimiento del mercado. Sin embargo, las dificultades en las técnicas de detección del cáncer de pulmón podrían obstaculizar el crecimiento del mercado de diagnóstico de cáncer de pulmón de América del Norte en el período de pronóstico.

Se espera que el aumento del gasto sanitario en el diagnóstico y tratamiento del cáncer genere oportunidades para que el mercado mejore el tratamiento. Sin embargo, el alto coste de las pruebas y las estrictas normas y regulaciones para la aprobación y comercialización de productos de diagnóstico del cáncer pueden suponer un reto para el crecimiento del mercado.

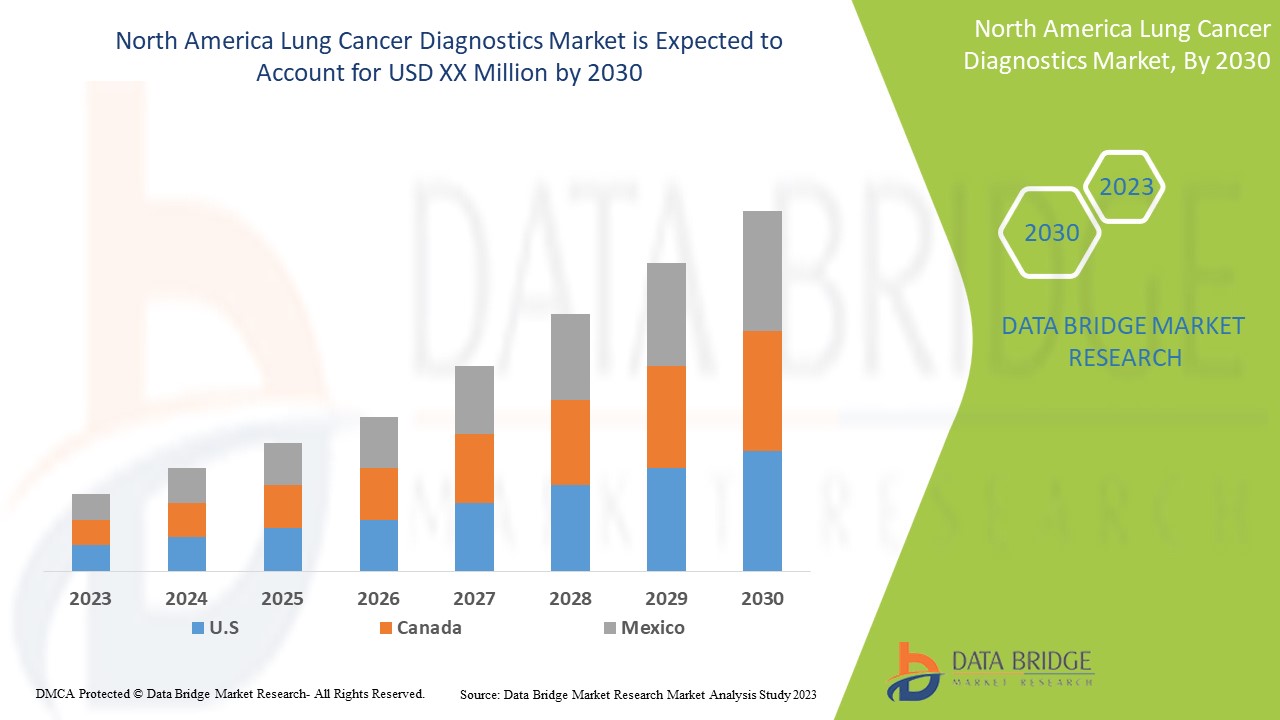

El mercado de diagnóstico de cáncer de pulmón de América del Norte es favorable y tiene como objetivo reducir la progresión de la enfermedad. Data Bridge Market Research analiza que el mercado de diagnóstico de cáncer de pulmón de América del Norte crecerá a una CAGR del 14,6 % durante el período de pronóstico de 2023 a 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Tipo de producto (instrumentos, consumibles y accesorios), tipo de prueba (prueba de biomarcadores, prueba de diagnóstico por imágenes, biopsia, análisis de sangre y otros), tipo de cáncer (cáncer de pulmón de células no pequeñas, cáncer de pulmón de células pequeñas), usuario final (hospital, laboratorios asociados, laboratorios de diagnóstico independientes, centros de diagnóstico por imágenes, institutos de investigación del cáncer y otros), canal de distribución (licitación directa, ventas minoristas) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Abbott, Quest Diagnostics Incorporated, Biodesix, Amoy Diagnostics Co., Ltd., Bio-Rad Laboratories, Inc., Biocartis, Boditech Med Inc., Danaher, Vela Diagnostics, DiaSorin SpA, Exact Sciences UK, Ltd. (una subsidiaria de Exact Science Corporation), 20/20 Gene Systems, Guardant Health, Inc., Inivata Ltd., LalPathLabs.com, LungLife AI, Inc., MedGenome, Myriad Genetics, Inc., NeoGenomics Laboratories, NanoString, Nanoentek, Oncocyte Corporation, PerkinElmer Inc., PlexBio, QIAGEN, Siemens Healthcare GmbH y Veracyte, Inc., entre otros. |

Definición de mercado

El cáncer comienza en los pulmones y se presenta con mayor frecuencia en personas que fuman. Los dos tipos principales de cáncer de pulmón son el cáncer de pulmón de células no pequeñas y el cáncer de pulmón de células pequeñas . Las causas del cáncer de pulmón incluyen el tabaquismo, el tabaquismo pasivo, la exposición a ciertas toxinas y los antecedentes familiares.

Los síntomas incluyen tos (a menudo con sangre), dolor en el pecho, sibilancia y pérdida de peso. Estos síntomas no suelen aparecer hasta que el cáncer está avanzado. Los tratamientos varían, pero pueden incluir cirugía, quimioterapia, radioterapia, terapia farmacológica dirigida e inmunoterapia.

Dinámica del mercado de diagnóstico del cáncer de pulmón en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

- Aumenta el diagnóstico precoz del cáncer de pulmón

El aprendizaje automático podría revolucionar el diagnóstico temprano del cáncer, ya que capacita a las computadoras para ver patrones en datos complejos. Las herramientas incluyen evaluaciones de datos de salud comunes, imágenes médicas , muestras de biopsia y análisis de sangre para ayudar en el diagnóstico temprano y la estratificación del riesgo. En muchos tipos de tumores, la probabilidad de recibir una terapia exitosa aumenta con un diagnóstico temprano del cáncer. Una estrategia importante es evaluar a los pacientes en riesgo que no presentan síntomas y responder de manera rápida y adecuada a aquellos que sí los presentan.

La probabilidad de tratar con éxito el cáncer aumenta considerablemente con la detección temprana. Los dos elementos de la detección temprana del cáncer son la detección y el diagnóstico temprano (o reducción del estadio). Mientras que la detección consiste en evaluar a individuos sanos para encontrar a aquellos que tienen cáncer antes de que aparezcan los síntomas, el diagnóstico temprano se centra en identificar a los pacientes sintomáticos lo antes posible.

- La detección de cánceres en etapa temprana a menudo está limitada por altos índices de falsos positivos y una baja sensibilidad

La creación de pruebas no invasivas que puedan identificar de forma rápida y fiable si una persona tiene un cáncer en fase inicial y en qué parte del cuerpo se encuentra es una de las áreas más prometedoras de la investigación sobre la prevención del cáncer. Y no sólo un cáncer, sino una variedad de cánceres. En este frente, se han logrado avances significativos en los últimos años. Actualmente se están desarrollando varias pruebas de detección temprana de múltiples cánceres (MCED, por sus siglas en inglés), diseñadas para detectar varios tipos de cáncer simultáneamente en individuos por lo demás sanos. Sin embargo, detectar el cáncer en fase inicial es un desafío, ya que presenta muchas barreras, como un alto índice de falsos positivos o una baja sensibilidad. Muchos casos de baja sensibilidad diagnóstica ponen en riesgo la vida del paciente. El alto índice de falsos positivos también es una de las causas de que el cáncer avance a etapas tardías o avanzadas.

Por lo tanto, la detección de cánceres en etapa temprana a menudo se ve limitada por altos índices de falsos positivos y, a veces, la baja sensibilidad puede actuar como un factor restrictivo importante para el crecimiento del mercado de diagnóstico de cáncer de pulmón en América del Norte.

- Aumento del gasto sanitario para el diagnóstico y tratamiento del cáncer

En todo el mundo, las actividades de investigación y desarrollo están aumentando debido al gasto público en salud con resultados económicos. Mientras que la industria de la salud ocupa el segundo lugar entre todas las industrias en lo que respecta a la cantidad gastada en atención médica. El aumento del gasto en atención médica puede dar como resultado una mejor provisión de oportunidades de investigación y desarrollo. Se prevé que aumente la demanda de diagnósticos de cáncer de pulmón. El aumento del gasto en atención médica para el tratamiento del cáncer también ayuda al paciente a recibir diagnósticos y tratamientos avanzados sin complicaciones para una recuperación rápida. El gasto en atención médica se compone de la combinación de pagos directos (personas que pagan por su atención), gasto gubernamental y fuentes. También incluye seguros médicos y actividades de organizaciones no gubernamentales. Este aumento del gasto en atención médica para el tratamiento del cáncer es una oportunidad para hacer crecer la demanda del mercado.

- Falta de profesionales cualificados y certificados

La necesidad de profesionales cualificados y certificados es un gran obstáculo para el diagnóstico del cáncer. La demanda de diagnósticos de cáncer ha aumentado debido al aumento de casos de cáncer en el mundo, pero la menor cantidad de profesionales cualificados presentes en los centros de diagnóstico está obstaculizando el crecimiento del mercado.

Los instrumentos, métodos y procedimientos para el diagnóstico del cáncer han avanzado, pero existen ciertas lagunas en la estandarización, la igualación y el conocimiento. Los técnicos enfrentan lagunas en la capacitación técnica relacionada con los problemas y adaptan métodos avanzados de manera segura para realizar procedimientos de manera eficiente. En el diagnóstico del cáncer, se necesitan profesionales capacitados para las actividades de desarrollo, validación, operación y resolución de problemas de métodos.

El diagnóstico de cáncer es un componente dinámico en la compleja época actual, que proporciona a los pacientes información esencial para diagnosticar, prevenir, tratar y controlar su enfermedad. La necesidad de personal capacitado es un gran problema para el mercado de diagnóstico de cáncer de pulmón de América del Norte. Debido a la falta de profesionales capacitados y certificados, los usuarios finales no pueden instalar productos avanzados para el diagnóstico de cáncer; esto puede desafiar el crecimiento del mercado de diagnóstico de cáncer de pulmón de América del Norte.

Impacto posterior a la COVID-19 en el mercado de diagnóstico del cáncer de pulmón en América del Norte

La elevada carga de COVID-19 en los sistemas sanitarios de todo el mundo ha suscitado inquietudes entre los oncólogos médicos sobre el impacto de COVID-19 en el diagnóstico y el tratamiento del cáncer de pulmón. Investigamos el impacto de COVID-19 en el diagnóstico y el tratamiento del cáncer de pulmón antes y después de la era de COVID-19 en este estudio de cohorte retrospectivo. Durante la pandemia, los nuevos diagnósticos de cáncer de pulmón disminuyeron un 34,7 % con estadios ligeramente más avanzados de la enfermedad, y hubo un aumento significativo de la radiocirugía como primer tratamiento definitivo y una disminución del tratamiento sistémico y la cirugía en comparación con la era anterior a COVID-19. En comparación con la época anterior a COVID-19, no hubo un retraso significativo en el inicio de la quimioterapia y la radioterapia durante la pandemia.

Sin embargo, durante la pandemia, hemos observado un retraso en la cirugía de cáncer de pulmón. La COVID-19 parece haber afectado significativamente a los diagnósticos y patrones de tratamiento de los pacientes con cáncer de pulmón en nuestro centro de cáncer de pulmón. A muchos oncólogos les preocupa que el número de pacientes con cáncer de pulmón recién diagnosticados aumente el próximo año. Esta investigación aún está en curso y se recopilará y analizará más información para comprender mejor el impacto general de la pandemia de COVID-19 en nuestra población de pacientes con cáncer de pulmón.

Acontecimientos recientes

- En octubre de 2022, Quest Diagnostics anunció un nuevo capítulo de la asociación con Decode Health. Esta asociación ha ayudado a la empresa a reducir el tiempo y los gastos necesarios para crear nuevas pruebas de diagnóstico y encontrar nuevos objetivos farmacológicos para varios tipos de cáncer, y ha aumentado la presencia de la empresa en América del Norte.

- En agosto de 2022, F. Hoffmann-La Roche Ltd. anunció el lanzamiento de un sistema Digital LightCycler, un sistema de PCR digital de última generación que ayuda a los investigadores clínicos a comprender mejor la naturaleza del cáncer, la enfermedad genética o la infección de un paciente. Este sistema está diseñado para laboratorios que realizan análisis de ADN y ARN de alta sensibilidad y precisión en oncología y enfermedades infecciosas.

Alcance del mercado de diagnóstico de cáncer de pulmón en América del Norte

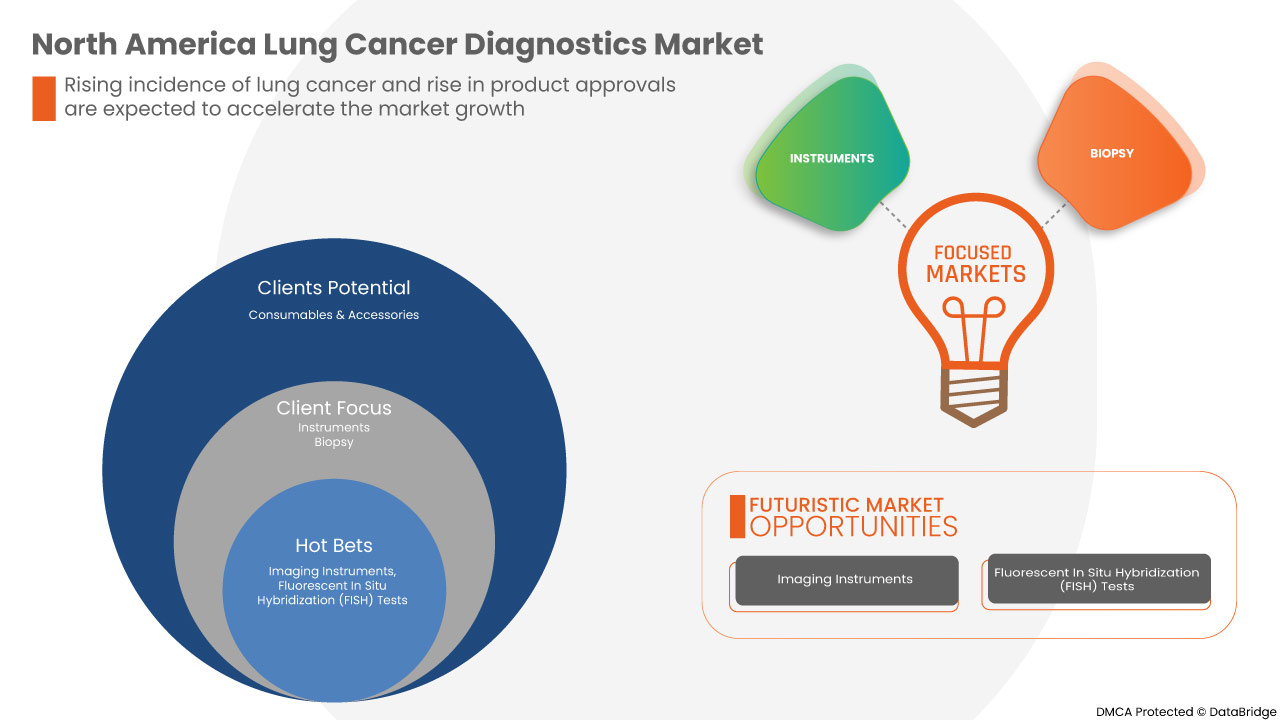

El mercado de diagnóstico de cáncer de pulmón de América del Norte se clasifica en cinco segmentos notables según el tipo de producto, el tipo de prueba, el tipo de cáncer, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Instrumentos

- Consumibles y accesorios

Según el tipo de producto, el mercado de diagnóstico de cáncer de pulmón de América del Norte está segmentado en instrumentos, consumibles y accesorios .

Tipo de prueba

- Pruebas de biomarcadores

- Prueba de imagen

- Biopsia

- Análisis de sangre

- Otros

Según el tipo de prueba, el mercado de diagnóstico de cáncer de pulmón de América del Norte está segmentado en pruebas de imágenes, pruebas de biomarcadores, biopsia, análisis de sangre y otros.

Tipo de cáncer

- Cáncer de pulmón de células no pequeñas

- Cáncer de pulmón de células pequeñas

Según el tipo de cáncer, el mercado de diagnóstico de cáncer de pulmón de América del Norte está segmentado en cáncer de pulmón de células no pequeñas y cáncer de pulmón de células pequeñas.

Usuario final

- Hospital

- Laboratorios asociados

- Laboratorios de diagnóstico independientes

- Centros de diagnóstico por imágenes

- Institutos de investigación del cáncer

- Otros

Sobre la base del usuario final, el mercado de diagnóstico de cáncer de pulmón de América del Norte está segmentado en hospitales, laboratorios asociados, laboratorios de diagnóstico independientes, centros de diagnóstico por imágenes, institutos de investigación del cáncer y otros.

Canal de distribución

- Licitación directa

- Ventas al por menor

Sobre la base del canal de distribución, el mercado de diagnóstico de cáncer de pulmón de América del Norte está segmentado en licitación directa y ventas minoristas.

Análisis y perspectivas regionales del mercado de diagnóstico de cáncer de pulmón en América del Norte

Se analiza el mercado de diagnóstico de cáncer de pulmón de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo de producto, tipo de prueba, tipo de cáncer, usuario final y canal de distribución, como se menciona anteriormente.

Algunos países cubiertos por el mercado de diagnóstico de cáncer de pulmón de América del Norte son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine la región de América del Norte debido a la conciencia exponencial sobre el diagnóstico del cáncer y los servicios de consultoría.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de diagnóstico del cáncer de pulmón en América del Norte

El panorama competitivo del mercado de diagnóstico de cáncer de pulmón de América del Norte proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de diagnóstico de cáncer de pulmón de América del Norte.

Algunos actores en el mercado de diagnóstico de cáncer de pulmón de América del Norte son F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Abbott, Quest Diagnostics Incorporated, Biodesix, Amoy Diagnostics Co., Ltd., Bio-Rad Laboratories, Inc., Biocartis, Boditech Med Inc., Danaher, Vela Diagnostics, DiaSorin SpA, Exact Sciences UK, Ltd. (una subsidiaria de Exact Science Corporation), 20/20 Gene Systems, Guardant Health, Inc., Inivata Ltd., LalPathLabs.com, LungLife AI, Inc., MedGenome, Myriad Genetics, Inc., NeoGenomics Laboratories, NanoString, Nanoentek, Oncocyte Corporation, PerkinElmer Inc., PlexBio, QIAGEN, Siemens Healthcare GmbH y Veracyte, Inc. entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS

5 EPIDERMIOLOGY

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 UNMET NEED FOR NON-INVASIVE, ACCURATE, AND RELIABLE DIAGNOSTIC TESTS FOR EARLIER CANCER DETECTION

7.1.2 INCREASING EARLY DIAGNOSIS OF LUNGS CANCER

7.1.3 INCREASING CASES OF LUNG CANCER

7.1.4 RISE IN PRODUCT APPROVALS

7.2 RESTRAINTS

7.2.1 POOR & LATE DIAGNOSIS OF LUNG CANCER

7.2.2 HIGH FALSE-POSITIVES AND POOR SENSITIVITY

7.3 OPPORTUNITIES

7.3.1 RISE IN HEALTHCARE EXPENDITURE FOR CANCER DIAGNOSIS AND TREATMENT

7.3.2 GOVERNMENT INITIATIVES TOWARD CANCER DIAGNOSTICS

7.3.3 RISING AWARENESS OF LUNG CANCER

7.4 CHALLENGES

7.4.1 STRINGENT REGULATORY FRAMEWORK FOR THE APPROVAL AND COMMERCIALIZATION OF CANCER DIAGNOSTIC PRODUCTS

7.4.2 INCREASED COST, SAFETY, AND CONVENIENCE ISSUES

7.4.3 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

8 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 IMAGING INSTRUMENTS

8.2.1.1 CT SYSTEMS

8.2.1.2 ULTRASOUND SYSTEMS

8.2.1.3 MRI SYSTEMS

8.2.1.4 OTHERS

8.2.2 BIOPSY INSTRUMENTS

8.2.2.1 NEEDLE BIOPSY

8.2.2.2 ENDOSCOPIC BIOPSY

8.2.2.3 CORE BIOPSY

8.2.2.4 OTHERS

8.2.3 PATHOLOGY-BASED INSTRUMENTS

8.2.3.1 SLIDE STAINING SYSTEMS

8.2.3.2 TISSUE PROCESSING SYSTEMS

8.2.3.3 CELL PROCESSORS

8.2.3.4 PCR INSTRUMENTS

8.2.3.5 OTHERS PATHOLOGY-BASED INSTRUMENTS

8.3 CONSUMABLES AND ACCESSORIES

8.3.1 KITS

8.3.1.1 DNA POLYMERASE KITS

8.3.1.2 NUCLEIC ACID ISOLATION KITS

8.3.1.3 PCR KITS

8.3.1.4 OTHERS

8.3.2 REAGENTS

8.3.2.1 ASSAYS

8.3.2.2 BUFFERS

8.3.2.3 PRIMERS

8.3.2.4 OTHERS

8.3.3 PROBES

8.3.4 OTHER CONSUMABLES

9 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE

9.1 OVERVIEW

9.2 IMAGING TEST

9.2.1 COMPUTED TOMOGRAPHY (CT) SCAN

9.2.2 POSITRON EMISSION TOMOGRAPHY (PET) SCAN

9.2.3 CHEST X-RAY

9.2.4 BONE SCAN

9.2.5 MRI

9.2.6 OTHERS

9.3 BIOMARKERS TEST

9.3.1 EGFR MUTATION TEST

9.3.2 KRAS MUTATION TEST

9.3.3 ALK TEST

9.3.4 HER2 TEST

9.3.5 OTHERS

9.4 BIOPSY

9.4.1 NEEDLE BIOPSY

9.4.2 BRONCHOSCOPY BIOPSY

9.4.3 CORE BIOPSY

9.4.4 OTHERS

9.5 BLOOD TEST

9.5.1 COMPLETE BLOOD COUNT (CBC)

9.5.2 BLOOD CHEMISTRY TESTS

9.5.3 OTHERS

9.6 OTHERS

10 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 NON-SMALL CELL LUNG CANCER

10.3 SMALL CELL LUNG CANCER

11 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITAL

11.3 ASSOCIATED LABS

11.4 INDEPENDENT DIAGNOSTIC LABORATORIES

11.5 DIAGNOSTIC IMAGING CENTERS

11.6 CANCER RESEARCH INSTITUTES

11.7 OTHERS

12 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 F. HOFFMANN-LA ROCHE LTD. (2022)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC. (2022)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ABBOTT (2022)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 QUEST DIAGNOSTICS INCORPORATED (2022)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 BIODESIX (2022)

16.5.1 COMPANY PROFILE

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AMOY DIAGNOSTICS CO., LTD. (2022)

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BIO-RAD LABORATORIES, INC. (2022)

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIOCARTIS (2022)

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 BODITECH MED INC.

16.9.1 COMPANY PROFILE

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DANAHER (2022)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 DIASORIN S.P.A. (2022)

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 EXACT SCIENCES UK, LTD. (SUBSIDIARY OF EXACT SCIENCE CORPORATION) (2022)

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 20/20 GENE SYSTEMS

16.13.1 COMPANY PROFILE

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GUARDANT HEALTH INC.

16.14.1 COMPANY PROFILE

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 INIVATA LTD.

16.15.1 COMPANY PROFILE

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 LALPATHLABS.COM (2022)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 LUNGLIFE AI, INC. (2022)

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MEDGENOME

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MYRIAD GENETICS, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 NEOGENOMICS LABORATORIES (2022)

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 NANOSTRING (2022)

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

16.22 NANOENTEK

16.22.1 COMPANY PROFILE

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 ONCOCYTE CORPORATION

16.23.1 COMPANY PROFILE

16.23.2 SERVICE PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 PERKINELMER INC

16.24.1 COMPANY PROFILE

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENTS

16.25 PLEXBIO

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 QIAGEN

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 SIEMENS HEALTHCARE GMBH

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENTS

16.28 VERACYTE, INC. (2022)

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 VELA DIAGNOSTICS

16.29.1 COMPANY PROFILE

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 DIFFERENT TYPES OF CANCER SCREENING TESTS FOR DIFFERENT TYPES OF CANCERS

TABLE 2 LUNG CANCER RATES

TABLE 3 APPROVED DIAGNOSTICS OF LUNGS CANCER

TABLE 4 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CONSUMABLES & ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA NON-SMALL CELL LUNG CANCER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SMALL CELL LUNG CANCER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HOSPITAL IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA ASSOCIATED LABS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA INDEPENDENT DIAGNOSTIC LABORATORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA DIAGNOSTIC IMAGING CENTERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA CANCER RESEARCH INSTITUTES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA DIRECT TENDER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA RETAIL SALES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 53 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 U.S. IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.S. CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.S. KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 U.S. REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 68 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 69 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 CANADA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 72 CANADA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 CANADA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 74 CANADA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 84 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 85 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 MEXICO INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 89 MEXICO BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 90 MEXICO CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 91 MEXICO KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 100 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LUNGS CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LUNG CANCER DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN THE AWARENESS ABOUT LUNG CANCER IS EXPECTED TO DRIVE THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET IN THE FORECAST PERIOD

FIGURE 12 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET

FIGURE 14 THE NORTH AMERICA MORTALITY RATE DUE TO CANCER

FIGURE 15 THE DATA GIVEN BELOW SHOWS THE INCREASING NORTH AMERICA CANCER RATE IN 2020

FIGURE 16 BARRIERS TO EARLY CANCER DIAGNOSIS AND TREATMENT

FIGURE 17 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022

FIGURE 18 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 19 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2022

FIGURE 22 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 23 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2022

FIGURE 26 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2023-2030 (USD MILLION)

FIGURE 27 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 30 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 31 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 34 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 35 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 36 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 38 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 39 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 40 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 41 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 42 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.