North America Left Ventricular Assist Device (LVAD) Market, By Product Type (Heart Pump, Controller, Batteries, and Wires), Therapy (Bridge-To-Transplant (BTT) Therapy, Destination Therapy, Bridge-To-Candidacy (BTC) Therapy, and Bridge-To-Recovery (BTR) Therapy), Age Group (Adult and Pediatric), Indication (Congestive Heart Failure, Congenital Heart Disease, Myocarditis, Cardiac Arrest, Familial Arrhythmias and Arrhythmic, Cardiomyopathies, Advanced Heart Failure, and Others), Generation (Second Generation Devices, Third Generation Devices, and First Generation Devices), Durability (Long-Term, Intermediate-Term, and Short-Term), Design (Axial and Centrifugal), Pulse Type (Nonpulsatile and Pulsatile), End User (Hospitals, Cardiac Cath Laboratories, Specialty Clinics, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others) - Industry Trends and Forecast to 2029.

North America Left Ventricular Assist Device (LVAD) Market Analysis and Size

A left ventricular assist device (LVAD) is a mechanical pump implanted in patients with heart failure. It helps the left bottom chamber of the heart (left ventricle) pump blood out of the ventricle to the aorta and the rest of the body. It is used for patients who have reached end-stage heart failure. The LVAD is surgically implanted, a battery-operated mechanical pump, which helps the left ventricle (main pumping chamber of the heart) pump blood to the rest of the body.

The occurrence of cardiovascular illnesses is growing at a rapid pace. It is estimated that advanced cardiovascular breakdown affects around 2.3% of North America's total population and is a severe socioeconomic burden. Further strong emphasis on R&D exercises aimed at the development of progressively enticing devices, as well as optimum government efforts, drive the left ventricular assist device (LVAD) market. Furthermore, the Canadian market is likely to benefit from low-intensity competition in the vendor landscape, making the country an attractive investment ground for firms looking to enter the sector of ventricular assist devices. The enormous pool of patients awaiting donor hearts for transplant gives commercial opportunities. However, there are dangers associated with the LVAD implant, and these hazards have an influence on market growth by acting as a restraining factor. Furthermore, the sector is currently confronted with a number of challenges, including barriers to DT adoption and safety concerns.

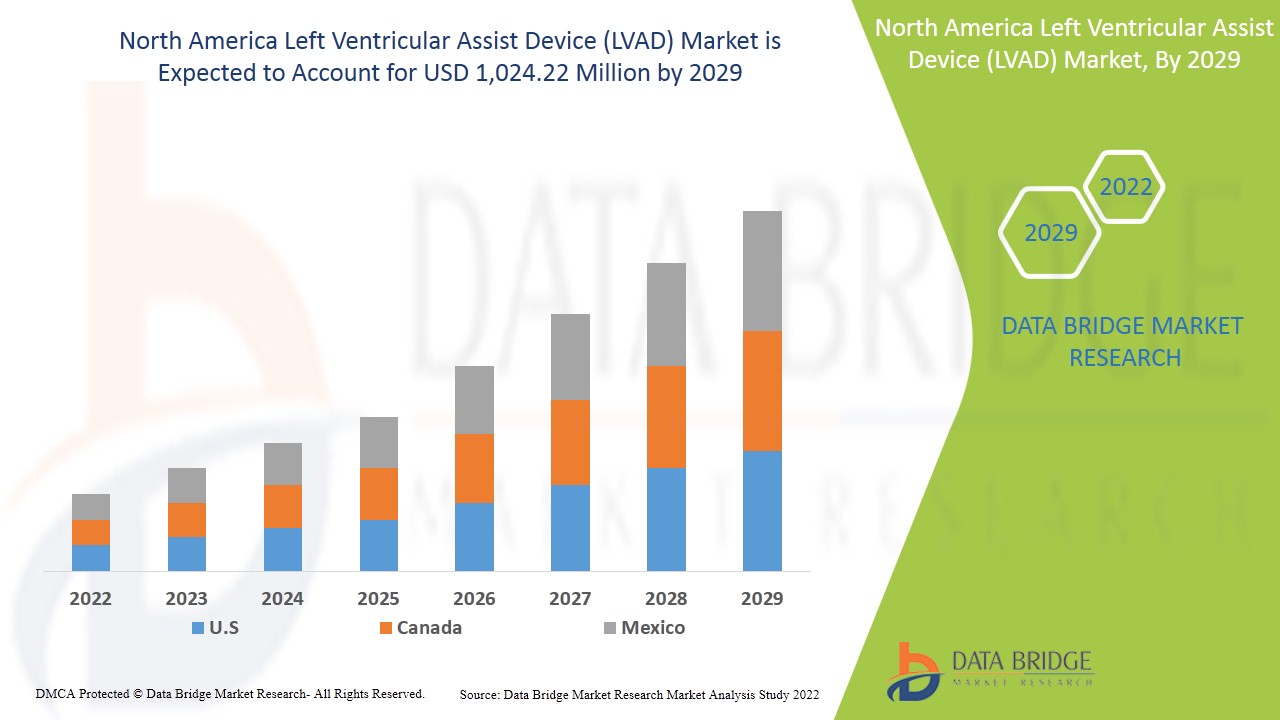

North America left ventricular assist device (LVAD) market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 9.5% in the forecast period of 2022 to 2029 and is expected to reach USD 1,024.22 million by 2029. Increasing technological advancements in the left ventricular assist device act as a driver for the left ventricular assist device (LVAD) market growth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Heart Pump, Controller, Batteries, and Wires), Therapy (Bridge-To-Transplant (BTT) Therapy, Destination Therapy, Bridge-To-Candidacy (BTC) Therapy, and Bridge-To-Recovery (BTR) Therapy), Age Group (Adult and Pediatric), Indication (Congestive Heart Failure, Congenital Heart Disease, Myocarditis, Cardiac Arrest, Familial Arrhythmias and Arrhythmic, Cardiomyopathies, Advanced Heart Failure, and Others), Generation (Second Generation Devices, Third Generation Devices, and First Generation Devices), Durability (Long-Term, Intermediate-Term, and Short-Term), Design (Axial and Centrifugal), Pulse Type (Nonpulsatile and Pulsatile), End User (Hospitals, Cardiac Cath Laboratories, Specialty Clinics, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

The major companies which are dealing in the market are ABIOMED, Abbott, Berlin Heart, Saft, Jarvik Heart, Inc., CorWave SA, and Evaheart, Inc., among others |

Market Definition

A left ventricular assist device (LVAD) is a mechanical pump implanted in patients with heart failure. It helps the left bottom chamber of the heart (left ventricle) pump blood out of the ventricle to the aorta and the rest of the body.

It is used for patients who have reached end-stage heart failure. The LVAD is surgically implanted, a battery-operated, mechanical pump, which helps the left ventricle (main pumping chamber of the heart) pump blood to the rest of the body. LVADs can be used as:

The high prevalence of cardiovascular diseases, increasing technological advancement, and rising healthcare expenditure are also propelling the growth of the North America left ventricular assist device (LVAD) market.

North America Left Ventricular Assist Device (LVAD) Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- INCREASING GERIATRIC POPULATION, ALONG WITH THE RISING PREVALENCE OF CARDIAC DISEASES

La prevalencia de enfermedades cardíacas también está aumentando con el crecimiento de la población geriátrica en América del Norte. Se estima que hay 40 millones de personas ciegas, la mayoría de ellas pertenecientes a la población de edad avanzada. Sin embargo, todos los estudios indican una alta prevalencia de enfermedades cardíacas en la población geriátrica. Con el aumento de la edad y la creciente prevalencia de trastornos cardíacos como la insuficiencia cardíaca en la población de edad avanzada, también están aumentando los tratamientos y medicamentos adecuados. Además, el crecimiento de la población ha aumentado la presión sobre el sistema de atención médica, por lo que la necesidad de atención, servicios y tecnologías está aumentando rápidamente. Por lo tanto, se espera que el aumento de la población geriátrica impulse el mercado de dispositivos de asistencia ventricular izquierda (LVAD) en América del Norte.

- PRESENCIA DE POLÍTICAS DE REEMBOLSO FAVORABLES

Los Centros de Servicios de Medicare y Medicaid (CMS) han publicado un memorando de decisión que liberaliza los criterios de cobertura de los dispositivos de asistencia ventricular (CMS, 2010). La política de los CMS elimina los criterios de tamaño corporal y flexibiliza las restricciones en torno a la duración requerida de la terapia médica fallida y el consumo máximo de oxígeno. De ahora en adelante, se espera que las políticas de reembolso favorables impulsen el mercado de dispositivos de asistencia ventricular izquierda (LVAD) en América del Norte en el año de pronóstico.

Oportunidades

- AUMENTO DEL GASTO EN SALUD

El gasto en atención sanitaria ha aumentado en América del Norte a medida que aumenta el ingreso disponible en los países. Además, para satisfacer las necesidades de la población, los organismos gubernamentales y las organizaciones de atención sanitaria están tomando iniciativas acelerando el gasto en atención sanitaria. El aumento del gasto en atención sanitaria ayuda simultáneamente a los centros sanitarios a mejorar sus instalaciones de tratamiento para diversas enfermedades cardiovasculares y a proporcionar tratamiento quirúrgico, ya que el trastorno ha sido muy frecuente en los últimos años.

El aumento del gasto sanitario ha dado una oportunidad al mercado al ofrecer más opciones de tratamiento, diagnósticos gratuitos y diferentes programas para promover el diagnóstico temprano. Además, el gasto sanitario del gobierno se centra en asignar recursos a estrategias para mejorar la gestión y los resultados de los pacientes con el fin de reducir la creciente carga económica.

El aumento del gasto en atención sanitaria también es beneficioso para el crecimiento económico y del sector sanitario, y es fructífero, sobre todo, porque afecta significativamente al desarrollo de dispositivos mejores y más avanzados para estas afecciones cardiológicas. Por lo tanto, el aumento del gasto en atención sanitaria es una oportunidad mayor para el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte.

Restricciones/Desafíos

- ALTO COSTO DE LA IMPLANTACIÓN Y TRATAMIENTO DEL DAVI

Los dispositivos de asistencia ventricular izquierda en pacientes con insuficiencia cardíaca no dependientes de inotrópicos mejoran la calidad de vida, pero aumentan sustancialmente los costos a lo largo de la vida debido a las frecuentes readmisiones y los costosos cuidados de seguimiento. Los dispositivos de asistencia ventricular izquierda también aumentan el empleo y la carrera profesional, lo que afecta las finanzas.

El alto costo de la implantación y el tratamiento de un dispositivo de asistencia ventricular izquierda (LVAD) supone una carga financiera y supone un desafío para el paciente. Además, el alto costo de la atención de seguimiento aumenta aún más la carga financiera del paciente, lo que frena el crecimiento del mercado.

Este informe de mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado.

Desarrollo reciente

- El 21 de diciembre de 2020, la Administración de Alimentos y Medicamentos de los EE. UU. (FDA) aprobó el etiquetado actualizado el 17 de diciembre para el dispositivo de asistencia ventricular izquierda (LVAD) HeartMate 3 de Abbott para su uso en pacientes pediátricos con insuficiencia cardíaca ventricular izquierda refractaria avanzada.

Alcance del mercado de dispositivos de asistencia ventricular izquierda (LVAD) en América del Norte

El mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte se clasifica en diez segmentos notables según el tipo de producto, la terapia, el grupo de edad, la indicación, la generación, la durabilidad, el diseño, el tipo de pulso, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

POR TIPO DE PRODUCTO

- BOMBA DE CORAZÓN

- CONTROLADOR

- BATERÍAS

- CABLES

Según el tipo de producto, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte se segmenta en bombas cardíacas, controladores, baterías y cables. Las baterías se segmentan además en recargables y no recargables.

POR TERAPIA

- Terapia puente al trasplante (BTT)

- Terapia de destino

- Terapia Puente a la Candidatura (BTC)

- Terapia Puente a la Recuperación (BTR)

Sobre la base de la terapia, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en terapia puente al trasplante (BTT), terapia de destino, terapia puente a la candidatura (BTC) y terapia puente a la recuperación (BTR).

POR GRUPO DE EDAD

- Adulto

- PEDIÁTRICO

Según el grupo de edad, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en adultos y pediátricos.

POR INDICACIÓN

- Insuficiencia cardíaca congestiva

- Enfermedad cardíaca congénita

- Miocarditis

- Paro cardiaco

- Arritmias familiares y arritmias

- Miocardiopatías

- Insuficiencia cardíaca avanzada

- Otros

Sobre la base de la indicación, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en insuficiencia cardíaca congestiva, enfermedad cardíaca congénita, miocarditis, paro cardíaco, arritmias familiares y miocardiopatías arrítmicas, insuficiencia cardíaca avanzada y otras.

POR GENERACIÓN

- Dispositivos de segunda generación

- Dispositivos de tercera generación

- Dispositivos de primera generación

Sobre la base de la generación, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en dispositivos de segunda generación, dispositivos de tercera generación y dispositivos de primera generación.

POR DURABILIDAD

- A largo plazo

- Plazo intermedio

- Corto plazo

Sobre la base de la durabilidad, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en largo plazo, mediano plazo y corto plazo.

A PROPÓSITO

- Axial

- Centrífugo

Sobre la base del diseño, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en axial y centrífugo.

POR TIPO DE PULSO

- No pulsátil

- Pulsátil

Sobre la base del tipo de pulso, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en pulsátil y no pulsátil.

POR USUARIO FINAL

- Hospitales

- Laboratorios de cateterismo cardíaco

- Clínicas de especialidades

- Otros

Sobre la base del usuario final, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en hospitales, clínicas especializadas, laboratorios de cateterismo cardíaco y otros.

POR CANAL DE DISTRIBUCIÓN

- LICITACIÓN DIRECTA

- VENTAS AL POR MENOR

- OTROS

Sobre la base del canal de distribución, el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte está segmentado en licitación directa, ventas minoristas y otros.

Análisis y perspectivas regionales del mercado de dispositivos de asistencia ventricular izquierda (LVAD) en América del Norte

Se analiza el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte y se proporcionan información y tendencias del tamaño del mercado por país, tipo de producto, terapia, grupo etario, indicación, generación, durabilidad, diseño, tipo de pulso, usuario final y canal de distribución como se menciona anteriormente.

El mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte incluye países como Estados Unidos, Canadá y México y se espera que crezca debido al aumento de casos de trastornos cardíacos y al crecimiento de la población geriátrica. El riesgo creciente de trastornos ventriculares también está impulsando el crecimiento del mercado.

Se espera que Estados Unidos domine el mercado de dispositivos de asistencia ventricular izquierda (LVAD) en América del Norte debido a la presencia de tecnología avanzada, la alta prevalencia de trastornos cardíacos y un sistema de atención médica establecido.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, epidemiología de enfermedades y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de otras marcas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta, se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los dispositivos de asistencia ventricular izquierda (LVAD)

El panorama competitivo del mercado de dispositivos de asistencia ventricular izquierda (LVAD) en América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en el país, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento del producto, la amplitud y la variedad del producto y el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas relacionado con el mercado de medicamentos para la osteoporosis.

Algunos de los principales actores que operan en el mercado de dispositivos de asistencia ventricular izquierda (LVAD) de América del Norte son ABIOMED, Abbott, Berlin Heart, Saft, Jarvik Heart, Inc., CorWave SA y Evaheart, Inc., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S

4.3 INDUSTRIAL INSIGHTS:

5 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: REGULATIONS

5.1 REGULATION IN U.S.

5.1.1 GUIDELINES-

5.2 REGULATION IN CANADA

5.2.1 GUIDELINES FOR THE MANUFACTURERS:

5.3 REGULATION IN MEXICO

5.3.1 GUIDELINES FOR THE MANUFACTURERS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING GERIATRIC POPULATION ALONG WITH RISING PREVALENCE OF CARDIAC DISEASES

6.1.2 PRESENCE OF FAVOURABLE REIMBURSEMENT POLICIES

6.1.3 CHANGING LIFESTYLE TRIGGERS THE DEVELOPMENT OF CARDIOVASCULAR DISEASES

6.2 RESTRAINTS

6.2.1 HIGH COST OF LVAD IMPLANTATION AND TREATMENT

6.2.2 COMPLICATIONS AND RISKS ASSOCIATED WITH LVAD

6.3 OPPORTUNITIES

6.3.1 INCREASE IN HEALTHCARE EXPENDITURE

6.3.2 INCREASE IN MINIMALLY INVASIVE PROCEDURE

6.3.3 INCREASING SHORTAGE OF ORGAN DONORS

6.3.4 TECHNOLOGICAL ADVANCEMENTS IN LEFT VENTRICULAR ASSIST DEVICES

6.4 CHALLENGES

6.4.1 ONGOING COVID-19

6.4.2 INCREASE IN PRODUCT RECALL

7 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 HEART PUMP

7.3 CONTROLLER

7.4 BATTERIES

7.4.1 RECHARGEABLE

7.4.2 NON-RECHARGEABLE

7.5 WIRES

8 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY

8.1 OVERVIEW

8.2 BRIDGE-TO-TRANSPLANT (BTT) THERAPY

8.2.1 HEART PUMP

8.2.2 CONTROLLER

8.2.3 BATTERIES

8.2.4 WIRES

8.3 DESTINATION THERAPY

8.3.1 HEART PUMP

8.3.2 CONTROLLER

8.3.3 BATTERIES

8.3.4 WIRES

8.4 BRIDGE-TO-CANDIDACY (BTC) THERAPY

8.4.1 HEART PUMP

8.4.2 CONTROLLER

8.4.3 BATTERIES

8.4.4 WIRES

8.5 BRIDGE-TO-RECOVERY (BTR) THERAPY

8.5.1 HEART PUMP

8.5.2 CONTROLLER

8.5.3 BATTERIES

8.5.4 WIRES

9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP

9.1 OVERVIEW

9.2 ADULT

9.2.1 19-39 YEARS

9.2.2 40-59 YEARS

9.2.3 60-79 YEARS

9.2.4 ABOVE 80 YEARS

9.3 PEDIATRIC

10 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION

10.1 OVERVIEW

10.2 SECOND GENERATION DEVICES

10.3 THIRD GENERATION DEVICES

10.4 FIRST GENERATION DEVICES

11 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN

11.1 OVERVIEW

11.2 AXIAL

11.3 CENTRIFUGAL

12 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION

12.1 OVERVIEW

12.2 CONGESTIVE HEART FAILURE

12.2.1 HEART PUMP

12.2.2 CONTROLLER

12.2.3 BATTERIES

12.2.4 WIRES

12.3 CONGENITAL HEART DISEASE

12.3.1 HEART PUMP

12.3.2 CONTROLLER

12.3.3 BATTERIES

12.3.4 WIRES

12.4 MYOCARDITIS

12.4.1 HEART PUMP

12.4.2 CONTROLLER

12.4.3 BATTERIES

12.4.4 WIRES

12.5 CARDIAC ARREST

12.5.1 HEART PUMP

12.5.2 CONTROLLER

12.5.3 BATTERIES

12.5.4 WIRES

12.6 FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES

12.6.1 HEART PUMP

12.6.2 CONTROLLER

12.6.3 BATTERIES

12.6.4 WIRES

12.7 ADVANCED HEART FAILURE

12.7.1 HEART PUMP

12.7.2 CONTROLLER

12.7.3 BATTERIES

12.7.4 WIRES

12.8 OTHERS

13 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY DURABILITY

13.1 OVERVIEW

13.2 LONG-TERM

13.3 INTERMEDIATE-TERM

13.4 SHORT-TERM

14 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY PULSE TYPE

14.1 OVERVIEW

14.2 NONPULSATILE

14.3 PULSATILE

15 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITAL

15.3 CARDIAC CATH LABORATORIES

15.4 SPECIALTY CLINICS

15.5 OTHERS

16 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY NORTH AMERICA

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 ABIOMED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.1.5.1 FDA APPROVAL

20.1.5.2 FDA APPROVAL

20.2 ABBOTT

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.2.5.1 SUPPLY INCREMENT

20.2.5.2 BREAK THROUGH DEVICE DESIGNATION

20.3 BERLIN HEART

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.3.4.1 PRODUCT APPROVAL

20.4 SAFT (A SUBSIDIARY OF TOTALENERGIES)

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENT

20.4.5.1 PARTNERSHIP

20.5 JARVIK HEART, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.5.4.1 FDA APPROVAL

20.6 CORWAVE SA

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.6.3.1 EXPANSION

20.7 EVAHEART, INC

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.7.3.1 PRODUCT TRIAL

21 QUESTIONNAIRE

22 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 26 U.S. BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 28 U.S. BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 29 U.S. DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 30 U.S. BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 31 U.S. BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 32 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 33 U.S. ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 34 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 35 U.S. CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 36 U.S. CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 37 U.S. MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 38 U.S. CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 U.S. ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 41 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 42 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 43 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 44 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 U.S. LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 49 CANADA BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 51 CANADA BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 52 CANADA DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 53 CANADA BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 54 CANADA BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 55 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 56 CANADA ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 57 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 CANADA CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 59 CANADA CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 63 CANADA ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 66 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 67 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 CANADA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 72 MEXICO BATTERIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 74 MEXICO BRIDGE-TO-TRANSPLANT (BTT) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 75 MEXICO DESTINATION THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 76 MEXICO BRIDGE-TO-CANDIDACY (BTC) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 77 MEXICO BRIDGE-TO-RECOVERY (BTR) THERAPY IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY THERAPY, 2020-2029 (USD MILLION)

TABLE 78 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ADULT IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO CONGESTIVE HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO CONGENITAL HEART DISEASE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO MYOCARDITIS IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 84 MEXICO CARDIAC ARREST IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO FAMILIAL ARRHYTHMIAS AND ARRHYTHMIC CARDIOMYOPATHIES IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 86 MEXICO ADVANCED HEART FAILURE IN LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 87 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY GENERATION, 2020-2029 (USD MILLION)

TABLE 88 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DURABILITY, 2020-2029 (USD MILLION)

TABLE 89 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 90 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY PULSE TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 MEXICO LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET:VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASE AND RISING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HEART PUMP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET

FIGURE 14 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, 2021

FIGURE 19 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, 2020-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY THERAPY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, 2021

FIGURE 23 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, 2020-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 26 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, 2021

FIGURE 27 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, 2020-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY GENERATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, 2021

FIGURE 31 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, 2020-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 34 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, 2021

FIGURE 35 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 38 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, 2021

FIGURE 39 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, 2020-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DURABILITY, LIFELINE CURVE

FIGURE 42 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, 2021

FIGURE 43 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, 2020-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY PULSE TYPE, LIFELINE CURVE

FIGURE 46 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, 2021

FIGURE 47 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 48 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 49 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 50 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 51 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 52 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 53 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 54 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: SNAPSHOT (2021)

FIGURE 55 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2021)

FIGURE 56 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 57 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 58 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 59 NORTH AMERICA LEFT VENTRICULAR ASSIST DEVICE (LVAD) MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.