North America Interventional Cardiology Peripheral Vascular Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

9,596.92 Million

USD

3.27 Million

2022

2029

USD

9,596.92 Million

USD

3.27 Million

2022

2029

| 2023 –2029 | |

| USD 9,596.92 Million | |

| USD 3.27 Million | |

|

|

|

|

Mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos, por producto ( balones de angioplastia , stents, catéteres, stents para reparación de aneurismas endovasculares, filtros de vena cava inferior (VCI), dispositivos de modificación de placa, accesorios y dispositivos de alteración del flujo hemodinámico), tipo (convencional y estándar), procedimiento (intervención ilíaca, intervenciones femoropoplíteas, intervenciones tibiales (por debajo de la rodilla), angioplastia periférica, trombectomía arterial y aterectomía periférica), indicación ( enfermedad arterial periférica e intervención coronaria), grupo de edad (geriátrico, adultos y pediátrico), usuario final (hospitales, centros de cirugía ambulatoria , centros de enfermería, clínicas y otros), canal de distribución (licitación directa, distribuidores externos y otros), país (EE. UU., Canadá y México), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado: mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos

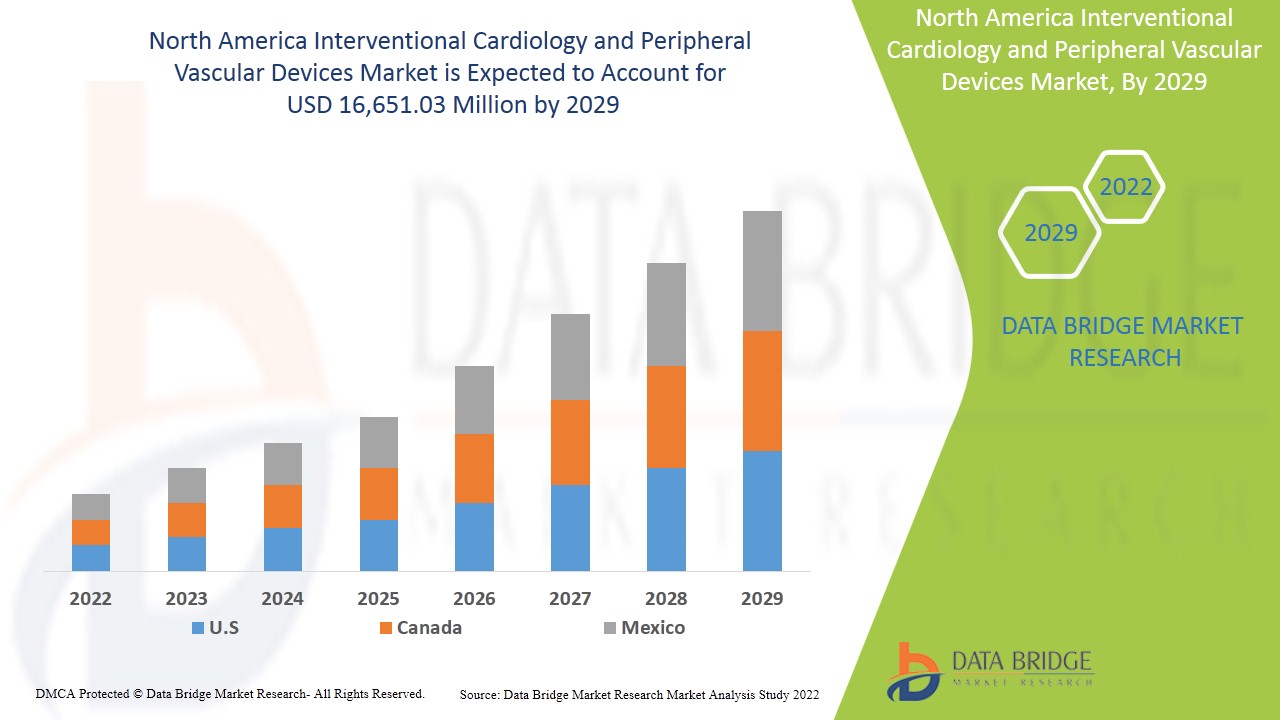

Se espera que el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos crezca durante el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 7,7 % durante el período de pronóstico de 2022 a 2029 y se espera que alcance los 16 651,03 millones de dólares en 2029, frente a los 9596,92 millones de dólares en 2021. El aumento de la prevalencia de enfermedades de las arterias coronarias , cardiopatías isquémicas y enfermedades vasculares, y el aumento de la concienciación sobre el tratamiento oportuno y el uso de los dispositivos probablemente sean los principales impulsores de la demanda del mercado durante el período de pronóstico.

El término cardiología intervencionista se refiere a un área de la medicina dentro de la subespecialidad de cardiología y dispositivos vasculares periféricos que utiliza técnicas diagnósticas mejoradas, convencionales y avanzadas, entre otras, para evaluar el flujo sanguíneo y la presión en las arterias coronarias y las cámaras cardíacas, así como procedimientos técnicos y medicamentos para tratar anomalías que afectan la función cardiovascular. La cardiología intervencionista y los dispositivos vasculares periféricos se utilizan porque estos dispositivos modifican el estilo de vida sedentario y reducen las complicaciones de las enfermedades cardíacas crónicas, como la enfermedad coronaria, la cardiopatía isquémica y las enfermedades vasculares.

La enfermedad coronaria es la principal causa de muerte en mujeres. El conocimiento sobre las enfermedades cardíacas y vasculares puede fomentar un estilo de vida saludable. Un conocimiento adecuado de los síntomas y sus factores de riesgo puede ayudar a reducir la exposición de la población a factores de riesgo modificables y contribuir a las estrategias de prevención y control. El conocimiento de los síntomas de las enfermedades cardiovasculares y vasculares se traduciría en un tratamiento oportuno.

Los factores que impulsan el crecimiento del mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos son la mayor prevalencia de enfermedades coronarias, cardiopatía isquémica y enfermedad vascular, la creciente concienciación sobre el tratamiento oportuno y el uso de estos dispositivos, los avances tecnológicos en cardiología y dispositivos vasculares periféricos, el mayor interés en la cirugía no invasiva y las favorables políticas de reembolso. Sin embargo, se prevé que los factores que frenarán el mercado sean el aumento del coste de los dispositivos, los riesgos observados durante su uso, el aumento de las retiradas de productos y la disponibilidad de tratamientos alternativos. Por otro lado, las iniciativas estratégicas de los actores del mercado, el aumento del gasto sanitario y de las actividades de investigación y desarrollo, y el crecimiento de la población geriátrica podrían representar una oportunidad para el crecimiento del mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos. La necesidad de expertos cualificados, la falta de infraestructura hospitalaria y la falta de aprobación regulatoria podrían plantear desafíos para este mercado.

El informe del mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos proporciona detalles sobre la cuota de mercado, nuevos desarrollos y análisis de la cartera de productos, así como del impacto de los actores del mercado nacional y local. Analiza las oportunidades en cuanto a nuevas oportunidades de negocio, cambios en la normativa del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas. Para comprender el análisis y el panorama del mercado, contáctenos para obtener un informe analítico. Nuestro equipo le ayudará a crear una solución que genere impacto en los ingresos para alcanzar su objetivo.

Alcance y tamaño del mercado de cardiología intervencionista y dispositivos vasculares periféricos en América del Norte

El mercado de cardiología intervencionista y dispositivos vasculares periféricos de América del Norte se clasifica en siete segmentos: producto, tipo, procedimiento, indicación, grupo etario, usuario final y canal de distribución.

- Según el producto, el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos se segmenta en balones de angioplastia, stents, catéteres, stents para la reparación de aneurismas endovasculares, filtros de vena cava inferior (VCI), dispositivos de modificación de placa, accesorios y dispositivos de alteración del flujo hemodinámico. En 2022, se prevé que el segmento de balones de angioplastia domine el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos debido al aumento de casos de enfermedades arteriales periféricas, el mayor riesgo de sedentarismo, los avances tecnológicos en balones de angioplastia y la existencia de políticas de reembolso en el sector sanitario estadounidense para el tratamiento de enfermedades cardíacas.

- Según el tipo, el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos se segmenta en convencional y estándar. En 2022, se prevé que el segmento convencional domine el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos debido a la creciente prevalencia de enfermedades cardiovasculares, como la enfermedad coronaria y la enfermedad de la arteria carótida, y a la disponibilidad y preferencia de los dispositivos de cardiología intervencionista y dispositivos vasculares periféricos convencionales por parte de médicos y cardiólogos que trabajan en hospitales de EE. UU. y Canadá.

- Según los procedimientos, el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos se segmenta en intervenciones ilíacas, femoropoplíteas, tibiales (por debajo de la rodilla), angioplastia periférica, trombectomía arterial y aterectomía periférica. En 2022, se prevé que el segmento de angioplastia periférica domine el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos gracias a los avances tecnológicos de la última década con dispositivos avanzados de angioplastia periférica.

- Según las indicaciones, el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos se segmenta en enfermedad arterial periférica e intervención coronaria. En 2022, se prevé que este segmento domine el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos debido al aumento de las enfermedades arteriales periféricas, el aumento de la población de edad avanzada y el incremento en las aprobaciones de productos.

- Según el grupo de edad, el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos se segmenta en geriátrico, adulto y pediátrico. En 2022, se prevé que el segmento geriátrico domine el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos. Son más vulnerables, con una inmunidad débil a diversos trastornos vasculares y la disponibilidad de políticas de reembolso, como Medicare, para el tratamiento de la población anciana a un costo mínimo en EE. UU.

- Según el usuario final, el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos se segmenta en hospitales, centros de cirugía ambulatoria, centros de enfermería, clínicas y otros. En 2022, se prevé que el segmento hospitalario domine el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos debido al aumento de enfermedades cardíacas crónicas, como la enfermedad coronaria y las enfermedades vasculares, el aumento de las cirugías, la disponibilidad de instalaciones hospitalarias avanzadas y la mayor concienciación sobre el tratamiento de las enfermedades cardíacas crónicas en los hospitales.

- Según el canal de distribución, el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos se segmenta en licitaciones directas, distribuidores externos y otros. En 2022, se prevé que el segmento de distribuidores externos domine el mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos debido a la creciente preferencia de los clientes, los bajos precios de adquisición y la reducción de costos.

Análisis del mercado de cardiología intervencionista y dispositivos vasculares periféricos en América del Norte

Se analiza el mercado de cardiología intervencionista y dispositivos vasculares periféricos de América del Norte y se proporciona información sobre el tamaño del mercado por producto, tipo, procedimiento, indicación, grupo etario, usuario final y canal de distribución.

Los países cubiertos en el informe del mercado de cardiología intervencionista y dispositivos vasculares periféricos de América del Norte son EE. UU., Canadá y México.

- En 2022, se espera que EE. UU. domine debido a la presencia del mayor mercado de consumo con un PIB elevado. Además, EE. UU. tiene el mayor gasto familiar del mundo y ofrece acuerdos comerciales con varios países, lo que lo convierte en el mayor mercado de productos de consumo, el aumento de la población de pacientes, la presencia de importantes actores del mercado y el mayor avance tecnológico en la región.

La sección de países del informe también describe los factores que impactan cada mercado y los cambios en la regulación nacional que impactan las tendencias actuales y futuras. Datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, las leyes regulatorias y los aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado en cada país. Asimismo, se considera la presencia y disponibilidad de las marcas norteamericanas, los desafíos que enfrentan debido a la alta o escasa competencia de las marcas locales y nacionales, y el impacto de los canales de venta, al proporcionar un análisis de pronóstico de los datos del país.

El potencial de crecimiento de la cardiología intervencionista y los dispositivos vasculares periféricos en las economías emergentes y las iniciativas estratégicas de los actores del mercado están creando nuevas oportunidades en el mercado de cardiología intervencionista y dispositivos vasculares periféricos de América del Norte.

El mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos también ofrece un análisis detallado del mercado para cada país, el crecimiento de cada sector, incluyendo las ventas de cardiología intervencionista y dispositivos vasculares periféricos, el impacto de los avances en este sector y los cambios en el panorama regulatorio que respaldan este mercado. Los datos están disponibles para el período histórico de 2019 a 2021.

Análisis del panorama competitivo y la cuota de mercado de cardiología intervencionista y dispositivos vasculares periféricos en América del Norte

El panorama competitivo del mercado norteamericano de cardiología intervencionista y dispositivos vasculares periféricos ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, plantas de producción, fortalezas y debilidades, lanzamiento de productos, líneas de ensayos clínicos, aprobaciones de productos, patentes, alcance y variedad de productos, dominio de aplicaciones y curva de vida tecnológica. Los datos anteriores se refieren únicamente al enfoque de la empresa en el mercado de cardiología intervencionista y dispositivos vasculares periféricos.

Algunas de las principales empresas que proporcionan dispositivos vasculares periféricos y de cardiología intervencionista son Medtronic, BD., Cordis., Abbott., Boston Scientific Corporation, Cook, Cardiovascular Systems, Inc., AngioDynamics., Edwards Lifesciences Corporation., Biosensors International Group, Ltd., OrbusNeich Medical Company Limited, Merit Medical Systems., Terumo Medical Corporation, B. Braun Melsungen AG, MicroPort Scientific Corporation, Lepu Medical Technology(Beijing)Co.,Ltd y Koninklijke Philips NV, entre otras.

Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Las iniciativas estratégicas de los actores del mercado junto con los nuevos avances tecnológicos para la cardiología intervencionista y los dispositivos vasculares periféricos de América del Norte están cerrando la brecha en el tratamiento de heridas crónicas.

Por ejemplo,

- En enero de 2022, OrbusNeich Medical Co. Ltd. anunció el lanzamiento de su nuevo producto "Scoreflex NC" y la obtención de la Aprobación Previa a la Comercialización (PMA) de la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA). Este producto es un catéter diseñado para su uso como catéter de dilatación en la porción estenótica de la estenosis de la arteria coronaria, ampliando así su oferta en el mercado.

La colaboración, las empresas conjuntas y otras estrategias por parte de los actores del mercado están mejorando el mercado de la empresa en el mercado de cardiología intervencionista y dispositivos vasculares periféricos, lo que también proporciona el beneficio para que la organización mejore su oferta para el mercado de cardiología intervencionista y dispositivos vasculares periféricos de América del Norte.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN PREVALENCE OF CHRONIC DISEASES, SUCH AS CORONARY ARTERY DISEASE, ISCHEMIC HEART DISEASE AND VASCULAR DISEASES

6.1.2 AWARENESS AMONG THE POPULATION ABOUT THE TREATMENT AND USE OF THE DEVICES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.1.4 FAVORABLE REIMBURSEMENT POLICIES

6.1.5 INCREASED INTEREST FOR MINIMALLY INVASIVE PROCEDURES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.2 RISKS OBSERVED WHILE USING INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.3 RISE IN PRODUCT RECALL

6.2.4 AVAILABILITY OF ALTERNATE TREATMENTS

6.3 OPPORTUNITIES

6.3.1 GROWING GERIATRIC POPULATION

6.3.2 RISING HEALTHCARE EXPENDITURE

6.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.4 INCREASING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 STRINGENT RULES & REGULATIONS

6.4.2 LACK OF HOSPITAL INFRASTRUCTURE

7 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS/ SERVICE PROVIDERS

7.5 CONCLUSION

8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ANGIOPLASTY BALLOONS

8.2.1 OLD/NORMAL BALLOONS

8.2.2 DRUG ELUTING BALLOONS

8.2.3 CUTTING AND SCORING BALLOONS

8.3 STENT

8.3.1 ANGIOPLASTY STENTS

8.3.2 CORONARY STENTS

8.3.2.1 BARE-METAL STENTS

8.3.2.2 DRUG-ELUTING STENTS (DES)

8.3.2.3 BIO ABSORBABLE STENTS

8.3.3 PERIPHERAL STENTS

8.3.4 OTHERS

8.4 CATHETERS

8.4.1 ANGIOGRAPHY CATHETERS

8.4.2 GUIDING CATHETERS

8.4.3 OTHERS

8.5 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

8.5.1 ABDOMINAL AORTIC ANEURYSM

8.5.2 THORACIC AORTIC ANEURYSM

8.6 INFERIOR VENA CAVA (IVC) FILTERS

8.6.1 RETRIEVABLE FILTERS

8.6.2 PERMANENT FILTERS

8.7 PLAQUE MODIFICATION DEVICES

8.7.1 THROMBECTOMY DEVICES

8.7.2 ATHERECTOMY DEVICES

8.8 HEMODYNAMIC FLOW ALTERATION DEVICES

8.8.1 EMBOLIC PROTECTION DEVICES

8.8.2 CHRONIC TOTAL OCCLUSION DEVICES

8.9 OTHERS AND ACCESSORIES

8.9.1 GUIDEWIRES

8.9.2 INTRODUCER SHEATHS

8.9.3 BALLOON INFLATION DEVICES

8.9.4 VASCULAR CLOSURE DEVICES

8.9.5 OTHERS

9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 CONVENTIONAL

9.2.1 STENTS

9.2.2 CATHETERS

9.2.3 GUIDEWIRES

9.2.4 VASCULAR CLOSURE DEVICES (VCD)

9.2.5 OTHERS

9.3 ADVANCED

9.3.1 BALLOON CATHETERS

9.3.2 STENT GRAFTS

10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 PERIPHERAL ANGIOPLASTY

10.2.1 ANGIOPLASTY BALLOONS

10.2.2 STENT

10.2.3 CATHETERS

10.2.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.2.5 INFERIOR VENA CAVA (IVC) FILTERS

10.2.6 PLAQUE MODIFICATION DEVICES

10.2.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.2.8 OTHERS AND ACCESSORIES

10.3 ILIAC INTERVENTION

10.3.1 ANGIOPLASTY BALLOONS

10.3.2 STENT

10.3.3 CATHETERS

10.3.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.3.5 INFERIOR VENA CAVA (IVC) FILTERS

10.3.6 PLAQUE MODIFICATION DEVICES

10.3.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.3.8 OTHERS AND ACCESSORIES

10.4 TIBIAL (BELOW-THE-KNEE) INTERVENTIONS

10.4.1 ANGIOPLASTY BALLOONS

10.4.2 STENT

10.4.3 CATHETERS

10.4.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.4.5 INFERIOR VENA CAVA (IVC) FILTERS

10.4.6 PLAQUE MODIFICATION DEVICES

10.4.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.4.8 OTHERS AND ACCESSORIES

10.5 ARTERIAL THROMBECTOMY

10.5.1 ANGIOPLASTY BALLOONS

10.5.2 STENT

10.5.3 CATHETERS

10.5.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.5.5 INFERIOR VENA CAVA (IVC) FILTERS

10.5.6 PLAQUE MODIFICATION DEVICES

10.5.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.5.8 OTHERS AND ACCESSORIES

10.6 PERIPHERAL ATHERECTOMY

10.6.1 ANGIOPLASTY BALLOONS

10.6.2 STENT

10.6.3 CATHETERS

10.6.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.6.5 INFERIOR VENA CAVA (IVC) FILTERS

10.6.6 PLAQUE MODIFICATION DEVICES

10.6.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.6.8 OTHERS AND ACCESSORIES

10.7 FEMOROPOPLITEAL INTERVENTIONS

10.7.1 ANGIOPLASTY BALLOONS

10.7.2 STENT

10.7.3 CATHETERS

10.7.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.7.5 INFERIOR VENA CAVA (IVC) FILTERS

10.7.6 PLAQUE MODIFICATION DEVICES

10.7.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.7.8 OTHERS AND ACCESSORIES

11 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION

11.1 OVERVIEW

11.2 PERIPHERAL ARTERIAL DISEASE

11.2.1 ATHEROSCLEROSIS

11.2.2 ABDOMINAL AORTIC ANEURYSM

11.2.3 LOWER EXTREMITY PERIPHERAL ARTERIAL DISEASE

11.2.4 SUPRA-INGUINAL ARTERIAL DISEASE

11.2.5 INFRA-INGUINAL ARTERIAL DISEASE

11.2.6 INFRA-POPLITEAL DISEASE

11.2.7 UPPER EXTREMITY OCCLUSIVE DISEASE

11.2.8 CAROTID ARTERY DISEASE

11.2.9 OTHERS

11.3 CORONARY INTERVENTION

11.3.1 ISCHEMIC HEART DISEASE

11.3.2 THORACIC AORTIC ANEURYSM

11.3.3 VALVE DISEASE

11.3.4 PERCUTANEOUS VALVE REPAIR OR REPLACEMENT

11.3.5 CONGENITAL HEART ABNORMALITIES

11.3.6 OTHERS

12 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 GERIATRIC

12.3 ADULTS

12.4 PEDIATRIC

13 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.2.1 PRIVATE

13.2.2 PUBLIC

13.3 AMBULATORY SURGICAL CENTERS

13.4 NURSING FACILITIES

13.5 CLINICS

13.6 OTHERS

14 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 THIRD PARTY DISTRIBUTORS

14.3 DIRECT TENDER

14.4 OTHERS

15 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY GEOGRAPHY

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 BOSTON SCIENTIFIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.1.6 ACQUSITION

18.2 CORDIS.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.2.6 PRODUCT LAUNCHES

18.3 ABBOTT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.3.6 PRODUCT LAUNCHES

18.4 BD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 TERUMO CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.5.6 PARTNERSHIP

18.5.7 PRODUCT LAUNCH

18.6 ANGIODYNAMICS.(2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 B. BRAUN MELSUNGEN AG (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 BIOSENSORS INTERNATIONAL GROUP, LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 CARDIOVASCULAR SYSTEMS, INC. (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 COOK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.10.4 EXPANSION

18.10.5 PRODUCT LAUNCHES

18.11 EDWARDS LIFESCIENCES CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 KONINKLIJKE PHILIPS N.V.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.12.5 PRODUCT UPDATES

18.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD. (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 MEDTRONIC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.14.5 COLLABORATION

18.14.6 PRODUCT LAUNCH

18.15 MERIT MEDICAL SYSTEM

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 MICROPORT SCIENTIFIC CORPORATION.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.16.4.1 PRODUCT APPROVALS

18.17 ORBUSNEICH MEDICAL COMPANY LIMITED

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.17.4 PRODUCT LAUNCH

18.18 SMT

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 TELEFLEX INCORPORATED.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.19.5 ACQUISITIONS

18.2 W. L. GORE & ASSOCIATES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STENT IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GERIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ADULTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PEDIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA NURSING FACILITIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CLINICS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DIRECT TENDER IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 U.S. ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.S. ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 U.S. INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.S. PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 99 U.S. ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 100 U.S. FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 102 U.S. PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 103 U.S. ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 104 U.S. PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 105 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 106 U.S. PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 U.S. CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 109 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 110 U.S. HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 CANADA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 CANADA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 CANADA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 CANADA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 CANADA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 CANADA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 126 CANADA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 127 CANADA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 128 CANADA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 130 CANADA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 131 CANADA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 132 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 133 CANADA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 134 CANADA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 135 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 136 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 CANADA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 MEXICO STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 144 MEXICO ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 MEXICO INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 MEXICO PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 MEXICO HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 148 MEXICO OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 MEXICO CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 153 MEXICO ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 156 MEXICO PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 157 MEXICO ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 159 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 160 MEXICO PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 161 MEXICO CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 162 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 163 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 MEXICO HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED PREVALENCE OF CHRONIC CARDIAC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN NON-INVASIVE SURGERIES AND PRODUCT APPPROVALS IS EXPECTED TO DRIVE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 TO 2029

FIGURE 13 PRODUCT SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

FIGURE 15 NORTH AMERICA PREVALENCE AND DISABILITY RATE OF ISCHEMIC HEART DISEASE (IHD) IN 2021

FIGURE 16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2021

FIGURE 17 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2021

FIGURE 25 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2021

FIGURE 29 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 33 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2021

FIGURE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SNAPSHOT (2021)

FIGURE 45 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021)

FIGURE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT (2021-2029)

FIGURE 49 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.