North America Internet Of Medical Things Iomt Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

62.50 Billion

USD

310.77 Billion

2025

2033

USD

62.50 Billion

USD

310.77 Billion

2025

2033

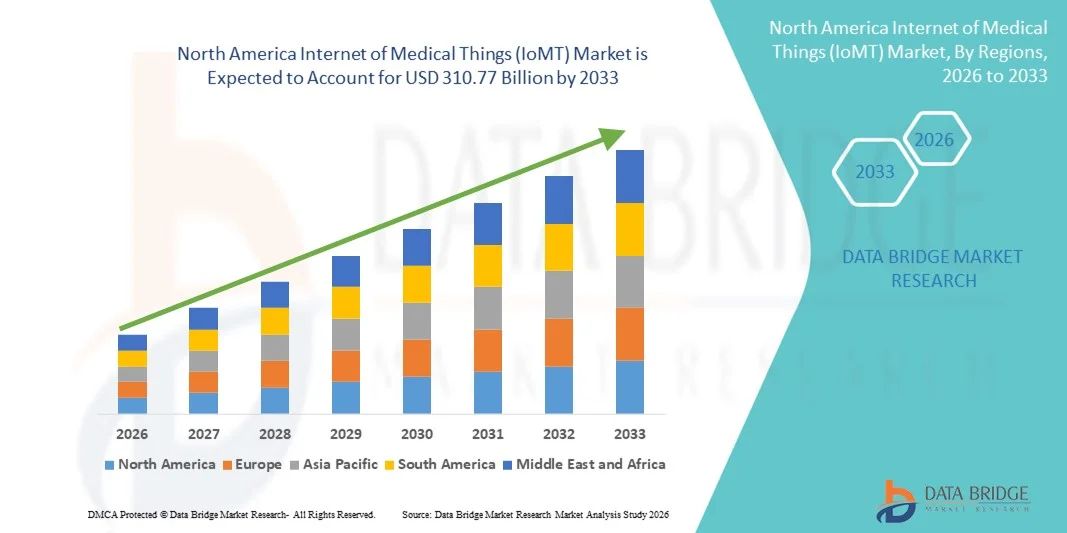

| 2026 –2033 | |

| USD 62.50 Billion | |

| USD 310.77 Billion | |

|

|

|

|

Segmentación del mercado de Internet de las cosas médicas (IoMT) en América del Norte por componente (hardware, software y servicios), plataforma (gestión de dispositivos, gestión de aplicaciones y gestión de la nube), modo de prestación del servicio (local y en la nube), dispositivos de conectividad (con cable e inalámbricos), aplicación (dispositivos corporales, proveedores de atención médica, dispositivos médicos de uso doméstico, comunidad y otros), usuario final (hospitales, clínicas, institutos de investigación y académicos, atención domiciliaria y otros): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de Internet de las cosas médicas (IoMT) en América del Norte

- El tamaño del mercado de Internet de las cosas médicas (IoMT) de América del Norte se valoró en USD 62,50 mil millones en 2025 y se espera que alcance los USD 310,77 mil millones para 2033 , con una CAGR del 22,2% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente adopción de dispositivos médicos conectados, soluciones de telesalud y sistemas de monitoreo remoto de pacientes , que están cada vez más integrados en redes hospitalarias y entornos de atención médica domiciliaria.

- Además, la creciente demanda de datos de pacientes en tiempo real, una mayor eficiencia operativa y mejores resultados sanitarios están posicionando las soluciones de IoMT como componentes esenciales del ecosistema sanitario digital. Estos factores están acelerando la implementación de dispositivos de IoMT en hospitales, clínicas y entornos de atención domiciliaria, impulsando así significativamente el crecimiento del mercado.

Análisis del mercado de Internet de las cosas médicas (IoMT) en América del Norte

- Los dispositivos IoMT, incluidos los dispositivos médicos conectados, los monitores de salud portátiles y los sistemas de monitoreo remoto de pacientes, son cada vez más esenciales en la atención médica moderna debido a su capacidad de proporcionar datos de pacientes en tiempo real, habilitar servicios de telesalud e integrarse perfectamente con la infraestructura de TI del hospital.

- La creciente adopción de IoMT está impulsada principalmente por la demanda de mejores resultados para los pacientes, eficiencia operativa y capacidades de atención médica remota, junto con las crecientes inversiones en tecnologías de salud digital por parte de hospitales y proveedores de atención médica.

- Estados Unidos dominó el mercado de Internet de las cosas médicas (IoMT) en América del Norte con la mayor participación en los ingresos del 86,2 % en 2025, respaldado por una infraestructura de atención médica avanzada, un alto gasto en TI de atención médica y la presencia de actores clave del mercado.

- Se espera que Canadá sea el país de más rápido crecimiento en el mercado de Internet de las cosas médicas (IoMT) de América del Norte durante el período de pronóstico, debido a la creciente adopción de dispositivos corporales y dispositivos médicos de uso doméstico, junto con iniciativas gubernamentales para expandir la infraestructura de atención médica digital y programas de monitoreo remoto de pacientes.

- El segmento de hardware dominó el mercado de Internet de las cosas médicas (IoMT) de América del Norte con una participación del 45,2 % en 2025, impulsado por la creciente implementación de sensores médicos, monitores portátiles y dispositivos de diagnóstico conectados en hospitales y entornos de atención domiciliaria.

Alcance del informe y segmentación del mercado de Internet de las cosas médicas (IoMT) en América del Norte

|

Atributos |

Perspectivas clave del mercado de Internet de las cosas médicas (IoMT) en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de Internet de las cosas médicas (IoMT) en América del Norte

Atención al paciente mejorada mediante dispositivos conectados e integración en la nube

- Una tendencia significativa y en aceleración en el mercado de Internet de las cosas médicas (IoMT) de América del Norte es la creciente integración de dispositivos médicos conectados con plataformas basadas en la nube y sistemas de TI de atención médica, lo que mejora significativamente el monitoreo de los pacientes y la coordinación de la atención.

- Por ejemplo, los monitores de glucosa portátiles ahora se sincronizan perfectamente con aplicaciones basadas en la nube, lo que permite a los proveedores de atención médica rastrear los niveles de azúcar en sangre de los pacientes en tiempo real y ajustar los planes de tratamiento de forma remota.

- La integración de IA en dispositivos IoMT permite el análisis predictivo para la detección temprana de anomalías, recomendaciones de salud personalizadas y alertas inteligentes basadas en la actividad del paciente. Por ejemplo, algunos monitores cardíacos portátiles utilizan IA para detectar arritmias y notificar automáticamente a los médicos.

- La integración perfecta de los dispositivos IoMT con los registros médicos electrónicos (EHR) y las plataformas de telesalud facilita la gestión centralizada de los pacientes, lo que permite a los médicos monitorear a varios pacientes desde un único panel y coordinar intervenciones de manera más eficiente.

- Esta tendencia hacia dispositivos médicos más inteligentes, basados en datos e interconectados está transformando las expectativas de la atención médica digital. En consecuencia, empresas como Philips y Medtronic están desarrollando dispositivos IoMT con IA que integran gestión en la nube, análisis predictivo y funciones de monitorización remota.

- La demanda de dispositivos IoMT con inteligencia artificial avanzada y capacidades en la nube está creciendo rápidamente en hospitales y entornos de atención domiciliaria, a medida que los proveedores de atención médica priorizan cada vez más la seguridad del paciente, la conveniencia y la eficiencia de la atención médica remota.

- Las aplicaciones de telesalud y salud móvil (mHealth) aprovechan cada vez más los dispositivos IoMT para la interacción continua con los pacientes, mejorando la adherencia a los planes de tratamiento y reduciendo las visitas al hospital. Por ejemplo, los tensiómetros portátiles pueden transmitir datos directamente a aplicaciones de salud móviles para monitorización y retroalimentación en tiempo real.

Dinámica del mercado de Internet de las cosas médicas (IoMT) en América del Norte

Conductor

Aumento de la demanda debido a enfermedades crónicas y monitorización remota de pacientes

- La creciente prevalencia de enfermedades crónicas y el envejecimiento de la población, junto con la adopción de soluciones de monitoreo remoto de pacientes, es un impulsor importante del mercado de Internet de las cosas médicas (IoMT) en América del Norte.

- Por ejemplo, en abril de 2025, Dexcom anunció un sistema CGM mejorado con integración en la nube para mejorar el control de la diabetes mediante el acceso a datos en tiempo real por parte de médicos y pacientes.

- Los dispositivos IoMT permiten la monitorización continua de los signos vitales, la detección temprana del deterioro de la salud y la intervención oportuna, lo que ofrece una ventaja convincente sobre la atención hospitalaria convencional.

- Además, las iniciativas gubernamentales que promueven la adopción de la telesalud y las políticas de reembolso para dispositivos de monitoreo remoto están apoyando el despliegue generalizado de soluciones de IoMT.

- La conveniencia del monitoreo remoto, las alertas en tiempo real y la información basada en datos para una atención personalizada es un factor clave que impulsa su adopción tanto en hospitales como en el sector de atención domiciliaria.

- La creciente disponibilidad de dispositivos IoMT fáciles de usar y la tendencia hacia modelos de atención centrados en el paciente contribuyen aún más al crecimiento sostenido del mercado.

- El aumento de las inversiones de capital riesgo y empresas de tecnología sanitaria está acelerando el desarrollo y la implementación de dispositivos innovadores de IoMT. Por ejemplo, empresas como Withings e iRhythm están ampliando sus carteras de productos con soluciones de monitorización basadas en la nube.

- La integración del análisis predictivo basado en IA en las plataformas de IoMT está mejorando la gestión de enfermedades crónicas, permitiendo a los profesionales sanitarios ajustar los tratamientos de forma proactiva. Por ejemplo, los wearables con IA pueden predecir eventos de insuficiencia cardíaca antes de que ocurran, lo que reduce los ingresos hospitalarios.

Restricción/Desafío

Preocupaciones sobre la privacidad de los datos y altos costos de implementación

- Las preocupaciones en torno a la privacidad de los datos y las vulnerabilidades de la ciberseguridad de los dispositivos médicos conectados plantean un desafío importante para la adopción más amplia de soluciones de IoMT.

- Por ejemplo, los informes de acceso no autorizado a datos de pacientes en sistemas de monitoreo remoto han hecho que algunos hospitales sean cautelosos a la hora de implementar ampliamente dispositivos conectados.

- Abordar estas preocupaciones de privacidad y seguridad a través de un cifrado sólido, protocolos de autenticación seguros y el cumplimiento de las regulaciones HIPAA es crucial para generar confianza entre los proveedores de atención médica y los pacientes.

- Además, el costo relativamente alto de los dispositivos IoMT avanzados, las plataformas de software y la infraestructura en la nube pueden obstaculizar su adopción, en particular para clínicas pequeñas y proveedores de atención domiciliaria con presupuesto limitado.

- Si bien los precios de los monitores y sensores portátiles básicos están disminuyendo gradualmente, las funciones premium como el análisis basado en IA o el monitoreo continuo de múltiples parámetros a menudo tienen un precio más alto, lo que limita su adopción.

- Superar estos desafíos mediante una ciberseguridad mejorada, el cumplimiento normativo y el desarrollo de soluciones de IoMT rentables será vital para el crecimiento sostenido en el mercado de IoMT de América del Norte.

- La escasa alfabetización digital entre el personal sanitario y los pacientes puede ralentizar la adopción, lo que requiere programas de formación e infraestructura de apoyo. Por ejemplo, los pacientes mayores pueden necesitar orientación para utilizar eficazmente los dispositivos de monitorización portátiles.

- Los desafíos de integración entre los sistemas informáticos hospitalarios heredados y las nuevas plataformas de Internet de las Cosas (IoMT) pueden limitar la implementación. Por ejemplo, algunos hospitales tienen dificultades para conectar sistemas de Historia Clínica Electrónica (HCE) antiguos con dispositivos de monitorización remota en la nube.

Alcance del mercado de Internet de las cosas médicas (IoMT) en América del Norte

El mercado está segmentado en función del componente, la plataforma, el modo de prestación del servicio, los dispositivos de conectividad , la aplicación y el usuario final.

- Por componente

En cuanto a los componentes, el mercado norteamericano de IoMT se segmenta en hardware, software y servicios. El segmento de hardware dominó el mercado con la mayor participación en ingresos, un 45,2 % en 2025, impulsado por la amplia implementación de sensores médicos, monitores portátiles y dispositivos de diagnóstico conectados en hospitales y centros de atención domiciliaria. La adopción de hardware se ve impulsada por la creciente necesidad de una monitorización precisa y continua de los signos vitales, la gestión de enfermedades crónicas y la atención remota al paciente. Los profesionales sanitarios priorizan los dispositivos de IoMT de alta calidad que pueden capturar y transmitir datos de los pacientes de forma fiable y en tiempo real. Además, los componentes de hardware suelen sentar las bases de soluciones de IoMT más amplias, como la integración con plataformas de software y sistemas de gestión en la nube. El creciente número de hospitales y centros de atención domiciliaria con IoMT en EE. UU. ha reforzado el dominio de este segmento.

Se prevé que el segmento de software experimente el mayor crecimiento durante el período de pronóstico, con una tasa de crecimiento anual compuesta (TCAC) del 19,8 % entre 2026 y 2033. Las soluciones de software para IoMT, como plataformas de gestión de dispositivos, aplicaciones de análisis y herramientas de monitorización basadas en IA, tienen una creciente demanda para procesar e interpretar grandes volúmenes de datos de pacientes. El auge de la adopción de la telesalud y las soluciones sanitarias en la nube está acelerando la implementación de sistemas de IoMT basados en software. El software también permite obtener información predictiva sobre la salud, diagnósticos remotos y la automatización del flujo de trabajo, esenciales para los profesionales sanitarios modernos. El aumento de la inversión en IA y análisis basados en aprendizaje automático está impulsando aún más el crecimiento del segmento de software.

- Por plataforma

En función de la plataforma, el mercado norteamericano de IoMT se segmenta en gestión de dispositivos, gestión de aplicaciones y gestión en la nube. El segmento de gestión en la nube dominó el mercado en 2025 gracias a su capacidad para almacenar, gestionar y analizar grandes volúmenes de datos de pacientes de forma segura. Las plataformas en la nube permiten a los profesionales sanitarios acceder remotamente a la información de los pacientes, integrar múltiples dispositivos y garantizar una interoperabilidad fluida entre hospitales y centros de atención domiciliaria. La escalabilidad y flexibilidad que ofrecen los sistemas de gestión en la nube los hacen ideales para gestionar diversos dispositivos de IoMT, lo que permite la monitorización en tiempo real y el análisis predictivo. Las plataformas en la nube también simplifican las actualizaciones, el cumplimiento de la seguridad y la integración con los sistemas de historiales clínicos electrónicos (HCE). Los hospitales y los profesionales de la atención domiciliaria están adoptando cada vez más soluciones en la nube para la gestión centralizada de los datos de los pacientes.

Se prevé que el segmento de Gestión de Dispositivos experimente el mayor crecimiento entre 2026 y 2033. Las plataformas de gestión de dispositivos facilitan la monitorización, la configuración y el mantenimiento de diversos dispositivos IoMT, garantizando un rendimiento y una seguridad óptimos. Con el creciente número de dispositivos médicos conectados en hospitales, clínicas y centros de atención domiciliaria, las soluciones de gestión de dispositivos son cruciales para la interoperabilidad y el control en tiempo real. Estas plataformas también ofrecen herramientas para la resolución remota de problemas, la actualización de firmware y la monitorización del cumplimiento normativo. La creciente adopción de ecosistemas sanitarios conectados y la necesidad de una administración eficiente de dispositivos impulsan la expansión de este segmento.

- Por modo de prestación del servicio

En cuanto a la prestación de servicios, el mercado norteamericano de IoMT se segmenta en local y en la nube. El segmento de la nube dominó en 2025 debido a la creciente preferencia por soluciones de atención médica escalables, accesibles remotamente y rentables. Las plataformas de IoMT basadas en la nube permiten a los profesionales de la salud acceder a los datos de los pacientes desde múltiples ubicaciones, facilitar las consultas de telesalud e integrar análisis para la toma de decisiones en tiempo real. La flexibilidad para gestionar numerosos dispositivos conectados de forma remota hace que la prestación en la nube sea ideal para hospitales y proveedores de atención domiciliaria. Además, los sistemas en la nube reducen los costos iniciales de infraestructura de TI y ofrecen capacidades de implementación rápida. Los profesionales de la salud en EE. UU. y Canadá recurren cada vez más a los servicios basados en la nube para la monitorización de pacientes y la eficiencia operativa.

Se espera que el segmento local experimente el mayor crecimiento durante el período de pronóstico, impulsado por hospitales e institutos de investigación que requieren un mayor control sobre los datos confidenciales de los pacientes. Las soluciones locales ofrecen mayor seguridad y cumplimiento con las estrictas regulaciones sanitarias, como la HIPAA. Son las preferidas por grandes hospitales y clínicas con equipos de TI internos capaces de gestionar la infraestructura. La capacidad de integrar sistemas heredados, personalizar software y mantener un control total sobre los datos está impulsando su adopción en centros de cuidados intensivos y médicos especializados. La implementación local también aborda los desafíos de latencia y conectividad, esenciales para ciertas aplicaciones de alta complejidad.

- Por dispositivos de conectividad

En cuanto a la conectividad, el mercado norteamericano de IoMT se segmenta en cableado e inalámbrico. El segmento inalámbrico dominó el mercado en 2025 debido a la creciente adopción de dispositivos portátiles, sensores inalámbricos y sistemas de monitorización remota de pacientes que requieren movilidad y flexibilidad. La conectividad inalámbrica permite la transmisión de datos vitales en tiempo real, reduce la complejidad de la instalación y facilita la integración con aplicaciones móviles y en la nube. Los hospitales y centros de atención domiciliaria prefieren las soluciones inalámbricas por su facilidad de implementación y la comodidad del paciente. La proliferación de Wi-Fi, Bluetooth y otras tecnologías inalámbricas de corto alcance fortalece aún más este segmento. Los dispositivos inalámbricos de IoMT también facilitan la monitorización continua de los pacientes sin restringir su movimiento.

Se espera que el segmento cableado experimente el mayor crecimiento durante el período de pronóstico, impulsado por dispositivos y equipos médicos especializados en entornos de cuidados críticos que requieren alta confiabilidad y conectividad estable. Los dispositivos cableados garantizan una pérdida mínima de datos, un suministro de energía constante y una reducción de interferencias, lo que los hace ideales para la monitorización intensiva en hospitales. Los profesionales de la salud priorizan las soluciones cableadas en quirófanos, unidades de cuidados intensivos y laboratorios de diagnóstico, donde el flujo de datos ininterrumpido es crucial. Este segmento también se ve respaldado por las continuas mejoras de infraestructura en los hospitales modernos.

- Por aplicación

En función de su aplicación, el mercado norteamericano de IoMT se segmenta en dispositivos corporales, proveedores de atención médica, dispositivos médicos de uso domiciliario, comunitarios y otros. El segmento de proveedores de atención médica dominó en 2025, impulsado por la adopción de soluciones de IoMT en hospitales, clínicas y centros de diagnóstico. Los dispositivos médicos conectados permiten a los proveedores de atención médica monitorear las constantes vitales de los pacientes, dar seguimiento a los resultados de los tratamientos y optimizar las operaciones de manera eficiente. Los hospitales utilizan las plataformas de IoMT para análisis en tiempo real, alertas predictivas e integración con historiales clínicos electrónicos. La necesidad de mejorar la seguridad del paciente, la automatización del flujo de trabajo y una atención médica rentable refuerza el dominio de este segmento. Los dispositivos de IoMT también mejoran la toma de decisiones clínicas y reducen los errores manuales en los flujos de trabajo de atención médica.

Se espera que el segmento de dispositivos corporales experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente adopción de monitores de salud portátiles, parches inteligentes y rastreadores de actividad física. Estos dispositivos permiten la monitorización continua de la frecuencia cardíaca, la presión arterial, los niveles de glucosa y otros parámetros de salud críticos fuera del ámbito clínico. La creciente tendencia a la monitorización remota de pacientes, el manejo de enfermedades crónicas y la atención médica preventiva está acelerando la implementación de dispositivos corporales. Además, la preferencia de los pacientes por soluciones de monitorización prácticas y no invasivas contribuye a una fuerte demanda. El análisis avanzado de IA y la integración en la nube mejoran aún más la funcionalidad de estos dispositivos.

- Por el usuario final

En función del usuario final, el mercado norteamericano de IoMT se segmenta en hospitales, clínicas, institutos de investigación y académicos, atención domiciliaria y otros. El segmento hospitalario dominó en 2025 debido a la implementación a gran escala de dispositivos de IoMT para la monitorización de pacientes hospitalizados, aplicaciones quirúrgicas y la gestión de cuidados críticos. Los hospitales requieren dispositivos conectados para monitorizar a múltiples pacientes simultáneamente, optimizar las operaciones y garantizar el cumplimiento de los estándares de atención médica. Esta adopción se debe al aumento del volumen de pacientes, la demanda de análisis en tiempo real y la integración con los sistemas informáticos hospitalarios. Los principales hospitales de EE. UU. y Canadá son pioneros en la adopción de soluciones de IoMT basadas en IA para mejorar la eficiencia y la seguridad del paciente. Los dispositivos de IoMT también mejoran las capacidades de telemedicina y consulta remota.

Se prevé que el segmento de atención domiciliaria experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente preferencia por la atención médica domiciliaria, el manejo de enfermedades crónicas y las soluciones de monitoreo remoto. Los usuarios de atención domiciliaria se benefician de dispositivos portátiles, sistemas de monitoreo conectados y plataformas en la nube para gestionar sus afecciones de salud de forma cómoda. Este crecimiento se ve respaldado por iniciativas gubernamentales de telesalud, la mayor concienciación de los pacientes y los avances tecnológicos en dispositivos portátiles de IoMT. Las soluciones de atención domiciliaria reducen las visitas al hospital, disminuyen los costos de atención médica y brindan monitoreo continuo a pacientes mayores y crónicos.

Análisis regional del mercado de Internet de las cosas médicas (IoMT) en América del Norte

- Estados Unidos dominó el mercado de Internet de las cosas médicas (IoMT) en América del Norte con la mayor participación en los ingresos del 86,2 % en 2025, respaldado por una infraestructura de atención médica avanzada, un alto gasto en TI de atención médica y la presencia de actores clave del mercado.

- Los proveedores de atención médica y los pacientes de la región valoran cada vez más el monitoreo en tiempo real, el análisis predictivo y las capacidades de atención remota al paciente que ofrecen las soluciones de IoMT, lo que mejora los resultados del tratamiento y la eficiencia operativa.

- Esta adopción generalizada está respaldada además por políticas gubernamentales favorables, marcos de reembolso para telesalud y monitoreo remoto, y un sólido ecosistema de hospitales, clínicas y proveedores de atención domiciliaria, lo que establece los dispositivos IoMT como herramientas esenciales en la prestación de atención médica moderna.

Perspectiva del mercado estadounidense de Internet de las cosas médicas (IoMT)

Estados Unidos captó la mayor participación en los ingresos, con un 86,2 %, en el mercado norteamericano del Internet de las Cosas Médicas (IoMT) en 2025, impulsado por la rápida adopción de dispositivos médicos conectados y soluciones de monitorización remota de pacientes. Los profesionales sanitarios priorizan cada vez más la monitorización de pacientes en tiempo real, el análisis predictivo y los servicios de telesalud para mejorar los resultados clínicos y la eficiencia operativa. La creciente demanda de diagnósticos basados en IA y plataformas de IoMT integradas en la nube impulsa aún más el mercado. Además, las políticas gubernamentales favorables, los marcos de reembolso y las sólidas inversiones en infraestructura de salud digital contribuyen significativamente a la expansión del mercado. La amplia presencia de importantes proveedores de soluciones de IoMT y startups innovadoras garantiza el desarrollo y la implementación continuos de soluciones avanzadas de monitorización y análisis.

Perspectivas del mercado de la Internet de las Cosas Médicas (IoMT) en Canadá

Canadá está experimentando un crecimiento constante en el mercado norteamericano del Internet de las Cosas Médicas (IoMT), impulsado por la creciente adopción de dispositivos de monitorización remota de pacientes y sensores médicos corporales. Las instituciones sanitarias priorizan la atención preventiva, el manejo de enfermedades crónicas y la integración de dispositivos IoMT con historias clínicas electrónicas (HCE) para optimizar la atención al paciente. El apoyo del gobierno canadiense a las iniciativas de telesalud y salud digital fomenta el uso de plataformas IoMT basadas en la nube. Además, la demanda de soluciones de atención domiciliaria y dispositivos portátiles de monitorización está aumentando debido al envejecimiento de la población y a un mayor enfoque en la atención médica centrada en el paciente. La integración de soluciones IoMT en hospitales y clínicas, junto con los avances tecnológicos, está acelerando la penetración en el mercado en todo el país.

Perspectiva del mercado del Internet de las Cosas Médicas (IoMT) en México

México se perfila como un mercado en crecimiento en el mercado norteamericano del Internet de las Cosas Médicas (IoMT), impulsado por la creciente concienciación sobre las tecnologías digitales de salud y el aumento de la inversión en infraestructura sanitaria. Hospitales y clínicas están adoptando gradualmente dispositivos de IoMT para monitorear las constantes vitales de los pacientes, gestionar enfermedades crónicas y optimizar los flujos de trabajo operativos. Las iniciativas gubernamentales que promueven la telemedicina y las soluciones de salud móvil están impulsando la adopción de plataformas de IoMT basadas en la nube. Además, la creciente prevalencia de enfermedades crónicas y la creciente demanda de servicios de atención médica a distancia están animando a los profesionales sanitarios a integrar dispositivos médicos conectados en la atención rutinaria. La creciente colaboración con proveedores de soluciones de IoMT y proveedores de tecnología está fortaleciendo aún más el potencial de crecimiento del mercado.

Cuota de mercado del Internet de las cosas médicas (IoMT) en América del Norte

La industria de Internet de las cosas médicas (IoMT) de América del Norte está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Medtronic (Irlanda)

- GE HealthCare (EE. UU.)

- Koninklijke Philips NV (Países Bajos)

- Cisco Systems, Inc. (EE. UU.)

- IBM Corporation (EE. UU.)

- Honeywell International Inc. (EE. UU.)

- Lenovo Group Ltd. (Hong Kong)

- Boston Scientific Corporation (EE. UU.)

- Siemens Healthineers AG (Alemania)

- BIOTRONIK SE & Co. KG (Alemania)

- Unison Healthcare Group (Taiwán)

- Cadi Scientific (Singapur)

- imedtac Co., Ltd (Taiwán)

- Meril Life Sciences (India)

- Omron Healthcare Co., Ltd (Japón)

- Corporación Terumo (Japón)

- CORPORACIÓN NIHON KOHDEN (Japón)

- Lepu Medical Technology Co., Ltd. (China)

- Accuster Technologies Pvt Ltd (India)

- iHealth Labs, Inc. (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado de Internet de las cosas médicas (IoMT) en América del Norte?

- En junio de 2025, Philips anunció una asociación multianual mejorada con Medtronic para ampliar el acceso a soluciones avanzadas de monitoreo de pacientes en el mercado de atención médica de América del Norte, integrando los sistemas de monitoreo de Philips con las tecnologías de Medtronic para agilizar la adquisición y respaldar el uso clínico de primera línea, reforzando la infraestructura de atención al paciente habilitada para IoMT.

- En abril de 2025, Medtronic anunció que presentó solicitudes 510(k) a la FDA de EE. UU. para una bomba de insulina interoperable que se integraría con sistemas de monitoreo continuo de glucosa (MCG), un desarrollo clave en soluciones de manejo de diabetes habilitadas para IoMT que podrían mejorar la conectividad y el monitoreo remoto de pacientes.

- En febrero de 2025, Etiometry obtuvo su décima autorización 510(k) de la FDA para una plataforma avanzada de datos de cuidados críticos que agrega datos continuos de múltiples dispositivos de IoMT a pie de cama en un panel de control unificado para el profesional clínico. Esta autorización mejora la monitorización remota y el análisis en tiempo real de pacientes críticos en unidades de cuidados intensivos de EE. UU., lo que marca un hito en las soluciones de datos de IoMT interoperables.

- En enero de 2025, la Administración de Alimentos y Medicamentos de EE. UU. (FDA) identificó graves vulnerabilidades de ciberseguridad en ciertos dispositivos de monitorización de pacientes conectados al IoMT, utilizados en hospitales y atención domiciliaria. La FDA advirtió que se podía acceder o manipular remotamente estos dispositivos, lo que podría comprometer tanto su funcionamiento como los datos confidenciales de los pacientes. Esto llevó a los centros sanitarios a implementar medidas de mitigación para proteger las redes del IoMT.

- En marzo de 2024, la Administración de Alimentos y Medicamentos de EE. UU. (FDA) autorizó el primer monitor continuo de glucosa (MCG) de venta libre, el sistema de biosensor de glucosa Dexcom Stelo, lo que permitió a los consumidores adultos adquirir y usar un dispositivo conectado de IoMT sin receta médica. Esta autorización marcó un cambio importante al hacer que la monitorización continua y en tiempo real de la salud fuera accesible directamente a los consumidores para obtener información más amplia sobre el bienestar y el cuidado de enfermedades crónicas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.