North America Hot Fill Packaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

16.00 Billion

USD

21.56 Billion

2025

2033

USD

16.00 Billion

USD

21.56 Billion

2025

2033

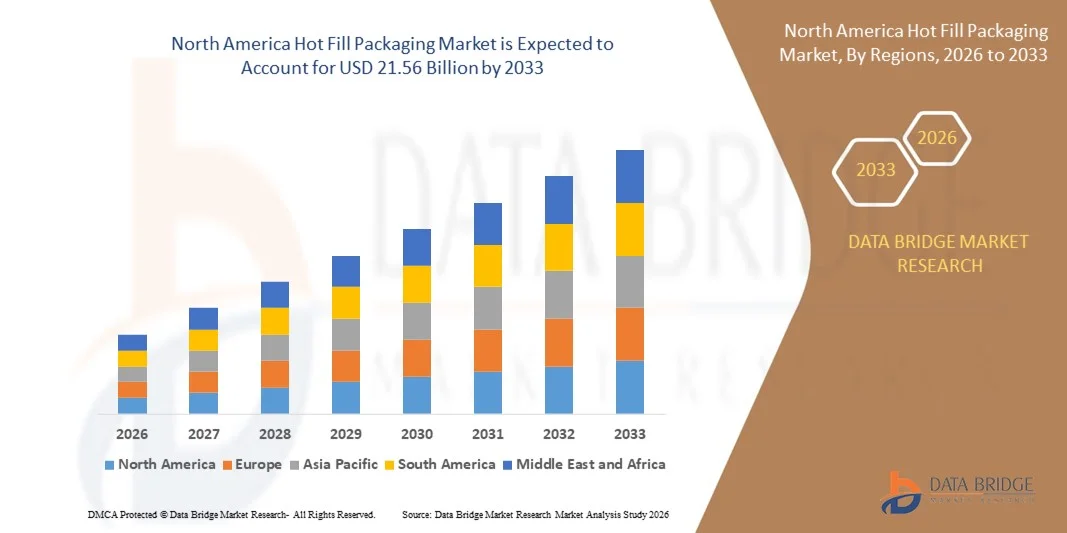

| 2026 –2033 | |

| USD 16.00 Billion | |

| USD 21.56 Billion | |

|

|

|

|

Segmentación del mercado de envases de llenado en caliente en Norteamérica, por tipo de producto (botellas, frascos, contenedores, bolsas, latas, tapas y cierres, entre otros), tipo de material (tereftalato de polietileno [PET], vidrio, polipropileno, entre otros), capa de envasado (primaria, secundaria y terciaria), capacidad (hasta 355 ml, 345 ml - 940 ml, 940 ml - 1,890 ml, más de 1,890 ml), tipo de máquina (manual y automática), usuario final (salsas y untables, jugos de frutas, jugos de verduras, mermeladas, mayonesa, agua saborizada, bebidas listas para beber, sopas, lácteos, néctares, entre otros), canal de distribución (presencial y en línea): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de envasado en caliente de América del Norte

- El tamaño del mercado de envases de llenado en caliente de América del Norte se valoró en USD 16.00 mil millones en 2025 y se espera que alcance los USD 21.56 mil millones para 2033 , con una CAGR de 3,80% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de bebidas, salsas y productos alimenticios líquidos estables con una vida útil más prolongada.

- La creciente preferencia por productos alimenticios y bebidas sin conservantes y mínimamente procesados está impulsando la adopción de soluciones de envasado en caliente.

Análisis del mercado de envases de llenado en caliente de América del Norte

- El mercado está impulsado por la capacidad del envasado en caliente para garantizar la seguridad del producto, la estabilidad microbiana y una vida útil más prolongada sin la necesidad de conservantes químicos.

- Además, los avances continuos en materiales de embalaje y contenedores livianos y resistentes al calor están mejorando el rendimiento, la sostenibilidad y la rentabilidad en toda la cadena de valor del embalaje de llenado en caliente.

- El mercado estadounidense de envasado en caliente representó la mayor participación en los ingresos en 2025, impulsado por la fuerte demanda de los fabricantes de bebidas, salsas y lácteos. Los productores adoptan cada vez más el envasado en caliente para garantizar la seguridad alimentaria, prolongar la vida útil y cumplir con las estrictas normas regulatorias.

- Se espera que Canadá sea testigo de la mayor tasa de crecimiento anual compuesta (CAGR) en el mercado de envasado en caliente de América del Norte debido a la creciente demanda de bebidas y salsas envasadas, la creciente preferencia por productos de vida útil prolongada y el aumento de las inversiones en soluciones de envasado sostenibles y reciclables.

- El segmento de botellas registró la mayor participación en ingresos del mercado en 2025, impulsado por su amplio uso en jugos de frutas, aguas saborizadas, salsas y bebidas listas para beber. Las botellas ofrecen un excelente sellado, facilidad de manejo y compatibilidad con procesos de llenado a alta temperatura. Su transparencia y flexibilidad de etiquetado también contribuyen a la imagen de marca y la visibilidad del producto. Además, la amplia disponibilidad y reciclabilidad de los formatos de botella siguen respaldando su dominio.

Alcance del informe y segmentación del mercado de envasado en caliente en América del Norte

|

Atributos |

Perspectivas clave del mercado de envasado en caliente en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de envasado en caliente en América del Norte

Creciente demanda de productos estables y sin conservantes

- El creciente enfoque en la seguridad alimentaria, la prolongación de la vida útil y las formulaciones sin conservantes está transformando significativamente el mercado de los envases de llenado en caliente. Los fabricantes están adoptando los envases de llenado en caliente para garantizar la estabilidad microbiana y la integridad del producto sin depender de conservantes químicos. Esta tendencia respalda su creciente uso en bebidas, salsas, bebidas lácteas y productos alimenticios líquidos, lo que fomenta la innovación en envases que equilibran la seguridad, el rendimiento y la sostenibilidad.

- La creciente preferencia de los consumidores por las bebidas listas para beber, las bebidas funcionales y los alimentos precocinados está acelerando la adopción de soluciones de envasado en caliente. Esta tecnología permite que los productos mantengan su frescura y calidad durante más tiempo, adaptándose a los estilos de vida ajetreados y a la creciente demanda de alimentos envasados. Esto ha impulsado a las empresas de alimentos y bebidas a ampliar sus carteras de productos de llenado en caliente e invertir en materiales de envasado avanzados.

- La sostenibilidad y las tendencias de etiquetado limpio influyen en la elección de envases, y los fabricantes se centran en materiales de envasado reciclables, ligeros y resistentes al calor, aptos para procesos de llenado en caliente. Estos factores ayudan a las marcas a cumplir con los requisitos normativos y las expectativas de los consumidores, a la vez que mejoran la eficiencia operativa. Los proveedores de envases priorizan los diseños y las certificaciones ecológicos para reforzar la diferenciación de la marca en un mercado competitivo.

- Por ejemplo, en 2024, varios fabricantes globales de bebidas y alimentos ampliaron sus líneas de envasado en caliente para jugos, salsas y bebidas funcionales con el fin de satisfacer la creciente demanda de productos estables y sin conservantes. Estos lanzamientos se centraron en mejorar las propiedades de barrera, los envases ligeros y la reciclabilidad, lo que reforzó el posicionamiento de la marca en torno a la seguridad y la sostenibilidad.

- Si bien la demanda de envases de llenado en caliente sigue en aumento, el crecimiento sostenido del mercado depende de los avances en la ciencia de los materiales, la producción rentable y el mantenimiento del rendimiento del envase a altas temperaturas. Los fabricantes están invirtiendo en I+D para mejorar la resistencia al calor, reducir el uso de material y optimizar la compatibilidad con las líneas de llenado automatizadas para impulsar su adopción a largo plazo.

Dinámica del mercado de envasado en caliente en América del Norte

Conductor

Creciente demanda de productos alimenticios y bebidas estables y convenientes

- El creciente consumo de bebidas y alimentos líquidos no perecederos es un factor clave para el mercado de los envases de llenado en caliente. Los fabricantes recurren cada vez más a estos envases para prolongar la vida útil de los productos, garantizar la seguridad alimentaria y reducir la dependencia de los conservantes. Esta tendencia impulsa una mayor adopción en jugos, alternativas lácteas, salsas y productos listos para consumir.

- La expansión de las aplicaciones en bebidas, condimentos, sopas y bebidas funcionales está contribuyendo al crecimiento del mercado. El envasado en caliente ayuda a preservar el sabor, la textura y la calidad nutricional, a la vez que cumple con las expectativas de etiquetado limpio. La creciente popularidad del consumo para llevar refuerza aún más la demanda de soluciones de envasado fiables y duraderas.

- Las empresas de alimentos y bebidas están promocionando sus productos envasados en caliente mediante la innovación, el desarrollo de marca y la modernización de los envases, priorizando la seguridad y la comodidad. Estos esfuerzos se ven respaldados por la demanda de alimentos y bebidas envasados de alta calidad por parte de los consumidores, lo que fomenta la colaboración entre proveedores de envases y fabricantes de productos para mejorar la eficiencia y reducir el impacto ambiental.

- Por ejemplo, en 2023, varias marcas globales de alimentos y bebidas incrementaron el uso de envases de llenado en caliente para jugos y salsas no perecederos, debido a la mayor demanda de productos sin conservantes y de larga duración. Las empresas destacaron la seguridad de los envases, la mayor vida útil y la sostenibilidad en sus campañas de marketing para aumentar la confianza del consumidor y la diferenciación de sus productos.

- A pesar de los fuertes impulsores de la demanda, la continua expansión del mercado depende de la optimización de los costos de producción, la mejora de la disponibilidad de materiales y la ampliación de las soluciones de envasado compatibles con el llenado en caliente. Las inversiones en tecnologías de fabricación avanzadas y el abastecimiento sostenible de materiales son fundamentales para satisfacer la creciente demanda mundial.

Restricción/Desafío

Altos costos de producción y limitaciones de materiales

- Los mayores costos de producción y de material asociados con el envasado en caliente siguen siendo un desafío clave, en particular debido a la necesidad de materiales resistentes al calor y procesos de fabricación especializados. Estos factores pueden incrementar los costos de envasado en comparación con las tecnologías de llenado alternativas, lo que limita su adopción entre los fabricantes sensibles a los costos.

- Las limitaciones en el rendimiento de los materiales también afectan el crecimiento del mercado, ya que los envases deben soportar altas temperaturas sin deformarse, manteniendo al mismo tiempo sus propiedades de barrera. La disponibilidad limitada de materiales rentables y reciclables, adecuados para aplicaciones de llenado en caliente, puede frenar la innovación y la adopción en ciertas categorías de productos.

- Los desafíos operativos, como el consumo energético, la inversión en equipos y la complejidad de los procesos, impactan aún más la expansión del mercado. Los sistemas de llenado en caliente requieren un control preciso de la temperatura y maquinaria especializada, lo que aumenta la inversión de capital y los requisitos de mantenimiento para los fabricantes.

- Por ejemplo, en 2024, varios productores de alimentos envasados informaron dificultades para adoptar el envasado en caliente debido al aumento de los costos de los materiales y a las actualizaciones de equipos necesarias para cumplir con los estándares de seguridad y rendimiento. Estos factores llevaron a algunos fabricantes a retrasar la transición al envasado o a limitar el lanzamiento de productos con tecnología de llenado en caliente.

- Para afrontar estos desafíos se requerirán avances en la ingeniería de materiales, sistemas de llenado energéticamente eficientes y procesos de producción rentables. La colaboración entre fabricantes de envases, proveedores de materiales y productores de alimentos será esencial para mejorar la asequibilidad, la escalabilidad y el crecimiento del mercado a largo plazo.

Alcance del mercado de envasado en caliente en América del Norte

El mercado de envasado en caliente de América del Norte está segmentado según el tipo de producto, el tipo de material, la capa de envasado, la capacidad, el tipo de máquina, el usuario final y el canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado norteamericano de envasado en caliente se segmenta en botellas, frascos, contenedores, bolsas, latas, tapas y cierres, entre otros. El segmento de botellas registró la mayor cuota de mercado en 2025, impulsado por su amplio uso en zumos de frutas, aguas saborizadas, salsas y bebidas listas para beber. Las botellas ofrecen un excelente sellado, facilidad de manejo y compatibilidad con procesos de llenado a alta temperatura. Su transparencia y flexibilidad de etiquetado también favorecen la imagen de marca y la visibilidad del producto. Además, la amplia disponibilidad y reciclabilidad de los formatos de botella siguen consolidando su dominio.

Se prevé que el segmento de las bolsas experimentará el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de envases ligeros y flexibles. Las bolsas de llenado en caliente reducen el uso de material y los costes de transporte en comparación con los formatos rígidos. Su comodidad, portabilidad y eficiencia de almacenamiento las hacen atractivas para el consumo individual y para llevar. La creciente preferencia por envases sostenibles y compactos acelera aún más su adopción.

- Por tipo de material

Según el tipo de material, el mercado norteamericano de envases de llenado en caliente se segmenta en tereftalato de polietileno (PET), vidrio, polipropileno y otros. El segmento de PET dominó el mercado en 2025 gracias a su ligereza, durabilidad y capacidad para soportar temperaturas de llenado en caliente. Los envases de PET ofrecen ventajas en cuanto a costos y facilitan operaciones de llenado a alta velocidad. Su reciclabilidad se alinea con las iniciativas de sostenibilidad de los fabricantes de alimentos y bebidas. Estas ventajas hacen del PET un material ampliamente preferido en múltiples aplicaciones.

Se prevé que el segmento del vidrio experimente el mayor crecimiento entre 2026 y 2033, gracias a sus excelentes propiedades de barrera y su aspecto premium. El vidrio se utiliza ampliamente para salsas, mermeladas y productos lácteos, donde la integridad del producto y la conservación del sabor son fundamentales. Su reutilización y reciclabilidad atraen a los consumidores con conciencia ambiental. Sin embargo, su mayor peso y el riesgo de rotura limitan ligeramente su adopción generalizada.

- Por capa de embalaje

Según la capa de envasado, el mercado norteamericano de envasado en caliente se segmenta en envases primarios, secundarios y terciarios. El segmento de envasado primario representó la mayor participación en los ingresos en 2025, ya que entra en contacto directo con alimentos y bebidas. Desempeña un papel fundamental en el mantenimiento de la higiene, la vida útil y la calidad del producto. Los envases primarios de llenado en caliente deben soportar altas temperaturas sin deformarse. La innovación continua en materiales y diseños está mejorando el rendimiento y la seguridad.

Se proyecta que el segmento de envases secundarios crecerá a un ritmo notable entre 2026 y 2033, impulsado por la creciente demanda de mayor protección y marca. El envase secundario facilita la manipulación, el almacenamiento y el transporte. Además, proporciona espacio adicional para el etiquetado y la información regulatoria. El creciente enfoque en diseños de envases listos para la venta minorista y fáciles de transportar está impulsando el crecimiento del segmento.

- Por capacidad

En función de la capacidad, el mercado norteamericano de envases de llenado en caliente se segmenta en hasta 12 oz, 13 oz–32 oz, 33 oz–64 oz y más de 64 oz. El segmento de 13 oz–32 oz mantuvo la mayor cuota de mercado en 2025 debido a su amplio uso en jugos, salsas y bebidas listas para beber. Este rango de tamaños ofrece un equilibrio entre comodidad y valor para los consumidores. Es adecuado tanto para el consumo doméstico como individual. Los fabricantes prefieren esta capacidad debido a la fuerte demanda de los consumidores y la eficiencia de la producción.

Se prevé que el segmento de 64 oz (más de 1,7 litros) experimente el mayor crecimiento entre 2026 y 2033, impulsado por la demanda de los operadores de servicios de alimentación y los compradores a granel. Los envases de mayor tamaño ofrecen rentabilidad y reducen el desperdicio de envases por unidad. Se utilizan habitualmente en restaurantes, servicios de catering y entornos institucionales. El creciente consumo de productos familiares y a granel impulsa el crecimiento del segmento.

- Por tipo de máquina

Según el tipo de máquina, el mercado norteamericano de envasado en caliente se segmenta en manual y automático. El segmento automático dominó el mercado en 2025 gracias a una mayor eficiencia y consistencia en la producción. Las máquinas automáticas facilitan la fabricación a gran escala con una mínima intervención de mano de obra. Además, reducen las tasas de error y mejoran los estándares de higiene. La creciente automatización en el procesamiento de alimentos y bebidas sigue impulsando la demanda.

Se prevé que el segmento manual crezca de forma sostenida entre 2026 y 2033, impulsado por su adopción entre los pequeños y medianos productores. Las máquinas manuales requieren una menor inversión de capital y son adecuadas para volúmenes de producción limitados. Ofrecen flexibilidad a los fabricantes de productos especializados y de nicho. El crecimiento de las pequeñas marcas de alimentos y las startups impulsa este segmento.

- Por el usuario final

En cuanto al usuario final, el mercado norteamericano de envasado en caliente se segmenta en salsas y untables, jugos de frutas, jugos de vegetales, mermeladas, mayonesa, aguas saborizadas, bebidas listas para beber, sopas, lácteos, néctares y otros. El segmento de jugos de frutas representó la mayor participación en los ingresos en 2025 debido al alto consumo de bebidas no perecederas. El envasado en caliente garantiza la seguridad y una mayor vida útil de los jugos. La fuerte demanda de los canales minoristas y de servicios de alimentación respalda el dominio del segmento. La preferencia de los consumidores por los jugos sin conservantes impulsa aún más su adopción.

The ready-to-drink beverages segment is expected to witness the fastest growth rate from 2026 to 2033. Rising consumption of functional and convenience beverages is boosting demand. Hot fill packaging supports flavor retention and long shelf life. Product innovation and expanding distribution channels are further contributing to growth.

- By Distribution Channel

On the basis of distribution channel, the North America hot fill packaging market is segmented into offline and online. The offline segment dominated the market in 2025 supported by strong relationships between manufacturers, distributors, and packaging suppliers. Bulk procurement and customized solutions are more accessible through offline channels. Physical distribution networks ensure reliable supply and after-sales support. This channel remains preferred for large-volume orders.

The online segment is projected to grow at the fastest rate from 2026 to 2033, driven by increasing digitalization of procurement processes. Online platforms offer ease of comparison, transparent pricing, and quick ordering. Small and mid-sized manufacturers increasingly prefer online sourcing for flexibility. Expansion of B2B e-commerce platforms is further supporting growth.

North America Hot Fill Packaging Market Regional Analysis

- U.S. hot fill packaging market accounted for the largest revenue share in 2025, driven by strong demand from beverage, sauce, and dairy manufacturers. Producers increasingly adopt hot fill packaging to ensure food safety, extend shelf life, and comply with stringent regulatory standards.

- Rising consumption of ready-to-drink beverages and packaged foods continues to support market dominance

- In addition, growing investments in automated filling systems and sustainable packaging materials are strengthening adoption

Canada Hot Fill Packaging Market Insight

The Canada hot fill packaging market is projected to grow at the fastest rate from 2026 to 2033, supported by increasing demand for packaged juices, sauces, and processed foods. Consumer preference for preservative-free and shelf-stable products is accelerating market expansion. The growth of local food manufacturing and export-oriented beverage production further contributes to demand. Moreover, rising focus on recyclable and eco-friendly packaging solutions supports sustained growth

North America Hot Fill Packaging Market Share

The North America hot fill packaging industry is primarily led by well-established companies, including:

- Amcor plc (U.S.)

- Berry Global Group, Inc. (U.S.)

- WestRock Company (U.S.)

- Graphic Packaging Holding Company (U.S.)

- Crown Holdings, Inc. (U.S.)

- Ball Corporation (U.S.)

- Silgan Holdings Inc. (U.S.)

- AptarGroup, Inc. (U.S.)

- Reynolds Group Holdings (U.S.)

- Owens-Illinois, Inc. (U.S.)

- Sonoco Products Company (U.S.)

- International Paper Company (U.S.)

- Sealed Air Corporation (U.S.)

- Pactiv Evergreen Inc. (U.S.)

- Winpak Ltd. (Canada)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.