North America Handheld And Backpack Sprayers Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

408.71 Million

USD

574.47 Million

2024

2032

USD

408.71 Million

USD

574.47 Million

2024

2032

| 2025 –2032 | |

| USD 408.71 Million | |

| USD 574.47 Million | |

|

|

|

Segmentación del mercado de pulverizadores portátiles y de mochila de América del Norte, por tipo (pulverizador portátil y pulverizador de mochila), aplicación (agricultura, control de plagas, productores comerciales, jardinería, paisajismo, aplicaciones ganaderas, limpieza industrial y lavado de automóviles), usuario final (comercial, residencial e industrial), canal de distribución (fuera de línea y en línea) – Tendencias de la industria y pronóstico hasta 2032.

Análisis del mercado de pulverizadores portátiles y de mochila en América del Norte

Los pulverizadores de mano y de mochila son herramientas esenciales para una aplicación eficiente de pesticidas y herbicidas. Los pulverizadores de mano son livianos y portátiles, ideales para jardines pequeños o tratamientos específicos. Ofrecen facilidad de uso y una configuración rápida, pero pueden requerir recargas frecuentes para áreas más grandes.

Por el contrario, los pulverizadores tipo mochila están diseñados para un uso prolongado, cuentan con correas ajustables para mayor comodidad y tanques de mayor capacidad, lo que los hace adecuados para campos más grandes o aplicaciones comerciales. Permiten una cobertura más uniforme y reducen la fatiga del operador.

Tamaño del mercado de pulverizadores portátiles y de mochila en América del Norte

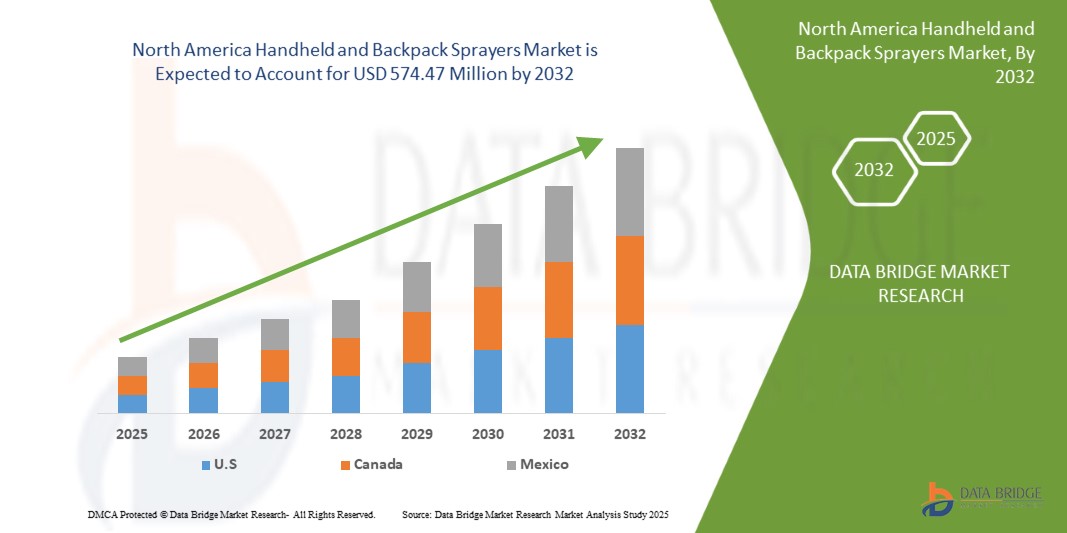

El tamaño del mercado de pulverizadores portátiles y de mochila de América del Norte se valoró en USD 408,71 millones en 2024 y se proyecta que alcance los USD 574,47 millones para 2032, con una CAGR del 4,35% durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Pulverizadores portátiles y de mochila: información clave del mercado |

|

Segmentación |

|

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores clave del mercado |

SOLO Kleinmotoren GmbH (Alemania), STIHL Incorporated (EE. UU.), Chapin International, Inc. (EE. UU.), THE FOUNTAINHEAD GROUP (EE. UU.), Berthoud (Francia), ECHO INCORPORATED (EE. UU.), Tomahawk Power (EE. UU.), Titan Tool Inc. (EE. UU.), Cardinal Sprayers (EE. UU.), Grupo Jacto (Brasil), PetraTools (EE. UU.), Maruyama US, Inc. (Japón) y HD Hudson (EE. UU.), entre otros. |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de pulverizadores portátiles y de mochila en América del Norte

“Aumenta la demanda de pulverizadores fáciles de usar”

Los sectores de la agricultura y la jardinería están siendo testigos de una creciente demanda de pulverizadores fáciles de usar, impulsada por la necesidad de un control eficaz y eficiente de las plagas y las malas hierbas. A medida que los consumidores priorizan la comodidad y la facilidad de uso, los fabricantes están innovando para producir diseños ligeros y ergonómicos que reducen la fatiga del operador. Características como las boquillas ajustables y los mecanismos de bombeo simples mejoran la facilidad de uso tanto para profesionales como para aficionados. Además, el cambio hacia prácticas sostenibles ha estimulado el interés en soluciones de pulverización ecológicas. Esta tendencia refleja un movimiento más amplio hacia la accesibilidad en las herramientas agrícolas, lo que permite a los usuarios lograr resultados óptimos con un mínimo esfuerzo y un impacto ambiental mínimo .

Definición del mercado de pulverizadores portátiles y de mochila

El mercado de pulverizadores portátiles y de mochila abarca dispositivos utilizados para la aplicación de pesticidas, herbicidas, fertilizantes y otros líquidos en entornos agrícolas, de jardinería e industriales. Los pulverizadores portátiles son compactos y portátiles, diseñados para aplicaciones a pequeña escala o específicas, mientras que los pulverizadores de mochila cuentan con tanques más grandes y diseños ergonómicos, lo que permite un uso prolongado en áreas más grandes. Este mercado está impulsado por la creciente necesidad de un control eficaz de las plagas y la creciente popularidad de la jardinería doméstica. Las innovaciones en el diseño, como las boquillas ajustables y los materiales livianos, mejoran la experiencia del usuario, lo que contribuye al crecimiento y la diversificación de este segmento dentro de la industria de herramientas agrícolas .

Dinámica del mercado de pulverizadores portátiles y de mochila

Conductores

- Aumento de la adopción de prácticas agrícolas avanzadas

El panorama agrícola de América del Norte está experimentando una transformación a medida que los agricultores adoptan cada vez más prácticas agrícolas avanzadas para mejorar la productividad y la sostenibilidad. Este cambio está influyendo significativamente en el mercado de pulverizadores portátiles y de mochila, ya que estas herramientas son esenciales para la implementación eficaz de estrategias modernas de gestión de plagas y protección de cultivos.

En un momento en que los agricultores se enfrentan al doble desafío de la creciente demanda de productos de alta calidad por parte de los consumidores y la necesidad de prácticas agrícolas sostenibles, la agricultura de precisión ha surgido como una solución clave. Tecnologías como la cartografía GPS y el análisis de datos permiten a los agricultores optimizar los insumos, incluidos el agua, los fertilizantes y los pesticidas. Los pulverizadores manuales y de mochila desempeñan un papel crucial en este proceso, ya que permiten una aplicación dirigida que minimiza el uso de productos químicos y maximiza la eficacia. Esta precisión no solo reduce los costos, sino que también disminuye el impacto ambiental, en consonancia con el creciente énfasis en las prácticas ecológicas.

Además, la creciente popularidad de las estrategias de manejo integrado de plagas (MIP) subraya la necesidad de contar con equipos de pulverización versátiles. El MIP se centra en la combinación de métodos de control biológico, cultural y químico para gestionar las plagas de forma sostenible. Los pulverizadores portátiles y de mochila son ideales para implementar el MIP, ya que brindan la flexibilidad de aplicar varios tratamientos en etapas de crecimiento específicas, lo que garantiza una alteración mínima de los organismos beneficiosos y del ecosistema .

La concienciación de los consumidores sobre la seguridad alimentaria y la sostenibilidad también está impulsando cambios en las prácticas agrícolas. A medida que los consumidores exigen transparencia y responsabilidad en la producción de alimentos, los agricultores están invirtiendo en tecnologías que satisfagan estas expectativas. Los pulverizadores portátiles y de mochila, equipados con funciones avanzadas como boquillas ajustables y patrones de pulverización mejorados, son herramientas esenciales que ayudan a los agricultores a cumplir con las normas de seguridad y, al mismo tiempo, mejoran el rendimiento de los cultivos.

Por ejemplo,

- En junio de 2020, una revista publicada en el International Journal of Food Science and Agriculture examinó el papel de las prácticas agrícolas sostenibles en la mejora de la seguridad alimentaria y la salud ambiental. Destacó estrategias como la diversificación de cultivos, la agricultura orgánica y el manejo integrado de plagas, haciendo hincapié en sus beneficios para promover la resiliencia frente al cambio climático, al tiempo que se garantiza un uso eficiente de los recursos y se mejora la productividad agrícola general.

Creciente popularidad de la jardinería, el paisajismo doméstico y la agricultura urbana

La creciente popularidad de la jardinería, el paisajismo doméstico y la agricultura urbana en América del Norte está influyendo significativamente en la demanda de pulverizadores portátiles y de mochila. A medida que las personas se involucran cada vez más en estas actividades, la necesidad de herramientas de control de plagas eficaces que sean fáciles de usar y eficientes se ha vuelto primordial.

La jardinería urbana ha ganado una notable popularidad a medida que más habitantes de las ciudades buscan cultivar sus propios alimentos y crear espacios verdes en áreas densamente pobladas. Este movimiento no es solo una tendencia; refleja un deseo más profundo de sostenibilidad, seguridad alimentaria y conexión con la naturaleza. Los huertos urbanos, ya sea en balcones, azoteas o en pequeños patios, a menudo priorizan las prácticas orgánicas, lo que lleva a una mayor dependencia de métodos específicos de control de plagas y enfermedades. Los pulverizadores de mano y de mochila son ideales para estos entornos, ya que permiten la aplicación precisa de fertilizantes, pesticidas y herbicidas en espacios reducidos, lo que garantiza un desperdicio mínimo y una máxima eficacia.

El paisajismo doméstico también desempeña un papel crucial en el crecimiento del mercado de pulverizadores. Los propietarios de viviendas invierten cada vez más en paisajismo para aumentar el valor de la propiedad y mejorar el atractivo exterior. Mantener céspedes y jardines saludables requiere un control eficaz de plagas, y los pulverizadores portátiles y de mochila son perfectos para estas tareas. Proporcionan la flexibilidad necesaria para aplicar tratamientos de manera uniforme y precisa, satisfaciendo las diversas necesidades de varias plantas.

La tendencia hacia prácticas de jardinería sostenibles amplifica aún más la demanda de soluciones de pulverización avanzadas. Los consumidores con conciencia ecológica están favoreciendo cada vez más los métodos de jardinería orgánicos, que requieren la aplicación precisa de pesticidas y fertilizantes naturales. Los pulverizadores de mano y de mochila equipados con boquillas ajustables y patrones de pulverización permiten una aplicación dirigida, minimizando el impacto en los insectos beneficiosos y el medio ambiente circundante.

Por ejemplo,

- En enero de 2023, un artículo publicado por MDPI destacó que la jardinería urbana está ganando atención por sus beneficios sociales y su potencial en la adaptación al cambio climático. A pesar de la investigación limitada sobre su papel en la seguridad alimentaria urbana, los huertos comunitarios y de huertos familiares ofrecen resiliencia frente a las amenazas climáticas.

Oportunidades

- Avances tecnológicos e innovaciones en la tecnología de pulverizadores

Los avances tecnológicos y las innovaciones en la tecnología de pulverizadores presentan una oportunidad sustancial en el mercado norteamericano de pulverizadores portátiles y de mochila. A medida que los sectores de la agricultura y la jardinería buscan cada vez más soluciones más eficientes, precisas y fáciles de usar, estos avances están impulsando el crecimiento del mercado y abriendo nuevas vías para el desarrollo.

Un área de desarrollo importante es la integración de tecnología inteligente en los pulverizadores. Al incorporar funciones sofisticadas como sensores, GPS y sistemas de control automatizados, los fabricantes pueden mejorar la precisión de los procesos de aplicación. Estas tecnologías inteligentes permiten realizar ajustes y un seguimiento en tiempo real, lo que reduce el desperdicio de productos químicos y mejora la eficiencia general. Esta capacidad es especialmente valiosa en un momento en que la industria se enfrenta a una creciente demanda de un uso más controlado y eficaz de los recursos, lo que es esencial para cumplir con las estrictas normas medioambientales y optimizar el rendimiento operativo.

Además, los pulverizadores que funcionan con batería se benefician de innovaciones que mejoran su eficiencia, como una mayor vida útil de la batería y capacidades de carga más rápidas. Estas mejoras abordan las preocupaciones habituales de los usuarios sobre la frecuencia de recarga y amplían la usabilidad de los pulverizadores, aumentando así su comodidad y eficacia para un uso prolongado.

La ergonomía y la comodidad del usuario también son una prioridad, con nuevos diseños que se centran en reducir la tensión física y mejorar la usabilidad general. Innovaciones como correas ajustables, materiales livianos y controles intuitivos contribuyen a una experiencia de usuario más cómoda, particularmente durante períodos prolongados de uso en tareas agrícolas o de jardinería. Este enfoque en el diseño ergonómico ayuda a abordar las demandas físicas que se imponen a los usuarios, mejorando su satisfacción general y su productividad.

Además, los avances en la tecnología de boquillas ofrecen más opciones para una aplicación precisa. Características como boquillas ajustables y patrones de rociado mejorados permiten a los usuarios adaptar la aplicación de productos químicos o fertilizantes a necesidades específicas. Este nivel de personalización mejora la eficiencia y la eficacia del proceso de aplicación, lo que permite una mejor gestión de los recursos y mejores resultados.

Por ejemplo,

- En octubre de 2022, según un artículo de Elsevier BV, los pulverizadores inteligentes equipados con GPS y tecnologías de sensores están mejorando la precisión en la agricultura. Permiten ajustes en tiempo real de los patrones de pulverización y las tasas de aplicación, lo que reduce el desperdicio y garantiza un uso preciso de los productos químicos. Estas innovaciones mejoran la eficiencia y ayudan a los agricultores a cumplir con las regulaciones ambientales de manera eficaz

Aumento de los incentivos y subsidios gubernamentales para los pequeños agricultores

El aumento de los incentivos y subsidios gubernamentales para los pequeños agricultores presenta importantes oportunidades en el sector agrícola. Estas ayudas financieras desempeñan un papel crucial a la hora de empoderar a los pequeños agricultores para que adopten tecnologías avanzadas, mejoren su productividad y contribuyan a prácticas agrícolas sostenibles. Al ofrecer subsidios, los gobiernos pretenden mejorar la viabilidad de las explotaciones agrícolas en pequeña escala, que suelen estar en desventaja debido a la limitación de recursos y acceso al capital.

Una oportunidad clave que surge de estos incentivos es la adopción de tecnologías agrícolas modernas. El apoyo gubernamental permite a los pequeños agricultores invertir en herramientas como pulverizadores manuales y de mochila, sistemas de riego y sensores de suelo que aumentan la eficiencia y el rendimiento. Por ejemplo, los subsidios pueden ayudar a los agricultores a pasar de los pulverizadores manuales a los que funcionan con baterías, lo que reduce los costos laborales y el impacto ambiental al minimizar el uso de combustibles fósiles. El acceso a estas tecnologías puede conducir a una aplicación más precisa de fertilizantes y pesticidas, lo que se traduce en una mejor salud de los cultivos y una reducción de los desechos.

Además, estos subsidios fomentan la sostenibilidad y el cuidado del medio ambiente. Muchos programas gubernamentales están diseñados para alentar la adopción de prácticas ecológicas, como la agricultura orgánica o la reducción del uso de productos químicos. Los pequeños agricultores pueden acceder a fondos para implementar técnicas sostenibles, como el uso de equipos alimentados con energía solar o la inversión en tecnologías de conservación del agua. Esto no solo mejora su productividad, sino que también los posiciona como contribuyentes clave a los esfuerzos de protección del medio ambiente, lo que es cada vez más importante a medida que los consumidores y los mercados priorizan la sostenibilidad.

Otra oportunidad importante es la posibilidad de mejorar el acceso a los mercados y el crecimiento de los ingresos. Al reducir la carga financiera que supone la compra de nuevos equipos y tecnologías, los subsidios permiten a los pequeños agricultores aumentar su producción y calidad, lo que a su vez les permite competir de manera más eficaz en mercados más grandes, tanto a nivel local como internacional. Además, el aumento de los rendimientos y la mejor calidad de los productos se traducen en mayores ingresos, lo que mejora la estabilidad económica de los pequeños agricultores y sus comunidades.

Por ejemplo,

- Según el USDA, el Programa de Desarrollo de Agricultores y Ganaderos Principiantes del USDA ofrece subvenciones a los pequeños agricultores para capacitación, asistencia técnica y desarrollo de infraestructura. Esto ayuda a reducir los costos iniciales, hace que la agricultura sea más accesible y mejora la sostenibilidad para los nuevos agricultores.

Restricciones/Desafíos

- Sensibilidad al precio para usuarios más pequeños o aficionados

La sensibilidad al precio entre los usuarios más pequeños o aficionados en el mercado de pulverizadores portátiles y de mochila de América del Norte es una consideración crucial que influye significativamente en las decisiones de compra. Estos usuarios, que a menudo se caracterizan por presupuestos limitados y necesidades específicas, tienden a priorizar la asequibilidad sobre las características avanzadas o las marcas premium. El mercado de estos pulverizadores está impulsado por un creciente interés en la jardinería, el cuidado del césped y el control de plagas, pero los aficionados suelen operar con restricciones financieras más estrictas en comparación con los usuarios comerciales. Como resultado, es más probable que comparen precios entre varias marcas, busquen ofertas o descuentos y se decanten por modelos de nivel de entrada que cumplan con sus requisitos básicos sin incurrir en costos sustanciales.

Además, la prevalencia de las compras en línea ha amplificado esta sensibilidad al precio, ya que los usuarios pueden acceder fácilmente a una gran cantidad de comparaciones de productos y reseñas de clientes, lo que les permite tomar decisiones informadas que enfatizan la relación calidad-precio. La disponibilidad de alternativas de bajo costo, incluidas opciones genéricas o de marcas desconocidas, exacerba aún más esta sensibilidad, lo que impulsa a las marcas establecidas a ajustar sus estrategias de precios o introducir líneas más económicas.

Las fluctuaciones económicas pueden afectar los ingresos disponibles, lo que aumenta aún más la importancia del precio en el proceso de toma de decisiones de estos consumidores. La demanda estacional también influye; durante las temporadas pico de jardinería o control de plagas, la sensibilidad al precio puede disminuir ligeramente, pero en general, los usuarios aficionados se mantienen atentos a sus gastos. En consecuencia, los fabricantes y minoristas deben considerar cuidadosamente las estrategias de precios que se alinean con las realidades financieras de este grupo demográfico y, al mismo tiempo, equilibrar la calidad y el rendimiento para capturar y retener este segmento de mercado. Comprender estas dinámicas es esencial para las partes interesadas que buscan satisfacer de manera eficaz las necesidades de los usuarios más pequeños dentro del panorama competitivo del mercado de pulverizadores portátiles y de mochila.

Por ejemplo,

- Northern Tool ofrece una variedad de pulverizadores de mochila en diferentes rangos de precios, diseñados para una aplicación eficiente y conveniente de pesticidas y herbicidas. Estos pulverizadores cuentan con boquillas ajustables, correas cómodas y una construcción duradera, lo que los hace ideales tanto para jardineros domésticos como profesionales. Su portabilidad permite a los usuarios cubrir áreas grandes con precisión fácilmente.

Aumento de los costes laborales en América del Norte

El aumento de los costos laborales en América del Norte presenta desafíos importantes para el mercado de pulverizadores portátiles y de mochila, lo que afecta tanto la producción como la eficiencia operativa. Estos desafíos se derivan del aumento de los salarios, los beneficios y los gastos asociados, que afectan tanto a los fabricantes como a los usuarios finales.

Una de las principales preocupaciones es el efecto directo de los salarios más altos sobre los costos de producción. A medida que aumentan los costos laborales, los fabricantes enfrentan mayores gastos de ensamblaje, prueba y empaquetado de los pulverizadores. Esto puede generar mayores costos generales de producción, que pueden trasladarse a los consumidores en forma de precios más altos para los pulverizadores manuales y de mochila. Para las empresas que operan con márgenes de ganancia reducidos, estos aumentos de costos pueden erosionar la rentabilidad y agotar los recursos financieros.

Además, el aumento de los costos laborales puede afectar la eficiencia operativa y la competitividad. Para gestionar estos costos, los fabricantes podrían tener que invertir en automatización y tecnologías avanzadas de fabricación. Si bien estas inversiones pueden mejorar la eficiencia a largo plazo, requieren un desembolso de capital sustancial y pueden no ser inmediatamente factibles para todas las empresas. Los fabricantes más pequeños, en particular, pueden tener dificultades para afrontar estas mejoras tecnológicas, lo que podría ponerlos en desventaja competitiva en comparación con los actores más grandes, que pueden absorber y gestionar mejor los costos crecientes.

El aumento de los costos laborales también afecta a la cadena de suministro en general. Los salarios más altos para los trabajadores de sectores relacionados, como la logística y la distribución, pueden generar mayores gastos de envío y manipulación. Esto puede elevar aún más el costo de entrega de los pulverizadores al mercado y afectar las estrategias de precios de los minoristas y distribuidores.

Además, el desafío se extiende a la contratación y retención de trabajadores calificados. A medida que aumentan los salarios, aumenta la necesidad de paquetes de remuneración competitivos, lo que puede tensar los presupuestos y afectar la estabilidad de la fuerza laboral. Las empresas deben equilibrar la necesidad de atraer y retener mano de obra calificada con las presiones de mantener la eficiencia de costos.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias comienzan a sufrir. Los efectos previstos de la crisis económica sobre los precios y la accesibilidad de los productos se tienen en cuenta en los informes de conocimiento del mercado y los servicios de inteligencia que ofrece DBMR. Con esto, nuestros clientes pueden normalmente mantenerse un paso por delante de sus competidores, proyectar sus ventas e ingresos y estimar sus gastos de ganancias y pérdidas.

Alcance del mercado de pulverizadores portátiles y de mochila en América del Norte

El mercado de pulverizadores portátiles y de mochila de América del Norte está segmentado en cuatro segmentos notables según el tipo, la aplicación, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por tipo

- Pulverizador de mano

- Pulverizador de mano, por tipo

- Pulverizadores manuales de mochila

- Pulverizadores de mochila a batería

- Pulverizador de mano, por categoría

- Gran capacidad (11 a 16 litros)

- Capacidad Mediana (5 a 10 Litros)

- Pequeña capacidad (1 a 5 litros)

- Pulverizador de mano, por tipo

- Pulverizador de mochila

- Pulverizadores de mochila, por tipo

- Pulverizadores manuales de mochila

- Pulverizadores de mochila a batería

- Pulverizadores de mochila por categoría

- Gran capacidad (16 a 18 litros)

- Capacidad Mediana (11 a 15 Litros)

- Pequeña capacidad (6 a 10 litros)

- Pulverizadores de mochila, por tipo

Por aplicación

- Agricultura

- Control de plagas

- Cultivadores comerciales

- Jardinería

- Paisajismo

- Aplicaciones para ganado

- Limpieza industrial

- Lavado de autos

Por el usuario final

- Comercial

- Residencial

- Industrial

Por canal de distribución

- Desconectado

- En línea

Análisis regional del mercado de pulverizadores portátiles y de mochila de América del Norte

Se analiza el mercado y se obtienen conocimientos y tendencias sobre el tamaño del mercado según el tipo, la aplicación, el usuario final y el canal de distribución.

Los países cubiertos en el mercado son Estados Unidos, Canadá y México.

Se espera que Estados Unidos domine el mercado debido a sus prácticas agrícolas avanzadas, la innovación y la fuerte demanda de soluciones eficientes para el control de plagas.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas arriba y aguas abajo, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de pulverizadores portátiles y de mochila en América del Norte

El panorama competitivo del mercado proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de pulverizadores portátiles y de mochila de América del Norte que operan en el mercado son:

- SOLO Kleinmotoren GmbH (Alemania)

- STIHL Incorporated (Estados Unidos)

- Chapin International, Inc. (Estados Unidos)

- EL GRUPO FOUNTAINHEAD (EE.UU.)

- Berthoud (Francia)

- ECHO INCORPORATED (EE.UU.)

- Tomahawk Power (Estados Unidos)

- Titan Tool Inc. (Estados Unidos)

- Pulverizadores Cardinal (EE. UU.)

- Grupo Jacto (Brasil)

- PetraTools (Estados Unidos)

- Maruyama US, Inc. (Japón)

- HD Hudson (Estados Unidos)

Últimos avances en el mercado de pulverizadores portátiles y de mochila en América del Norte

- En abril, ECHO Incorporated lanzó cuatro nuevos pulverizadores manuales de calidad comercial diseñados para una distribución eficiente de soluciones agrícolas y de limpieza. Estos pulverizadores, que se presentan en modelos de mano y de mochila, admiten desinfectantes, fungicidas y herbicidas, lo que satisface la creciente demanda de limpieza y control de plagas eficaces. HALO Trust mejorará la detección de minas terrestres

- En diciembre, ECHO Incorporated amplió sus operaciones con la compra de un almacén adicional de 103.000 pies cuadrados en un campus de 20 acres en Lake Zurich, Illinois, para satisfacer la creciente demanda de productos y mejorar la integración vertical. Mientras la empresa se prepara para su 50.º aniversario en 2022, este hito respalda las iniciativas en curso, como el moldeo por inyección interno y el ensamblaje automatizado, destinados a mejorar la eficiencia y el desarrollo de las habilidades de los empleados. El vicepresidente Ryan Ladley enfatizó la importancia de la integración vertical para responder a las necesidades de los clientes y fomentar el crecimiento profesional entre los empleados.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.